Indian Economy News & Discussion - Aug 26 2015

Re: Indian Economy News & Discussion - Aug 26 2015

Why do we need to get all RBI governors from US universities? Why can't we get them from our own IAS/IRS cadre?Marten wrote:Per PTI/ET: Professor in economics in a US university Viral V Acharya appointed as Deputy Governor of RBI

http://indianexpress.com/article/busine ... t-4448456/CV Starr professor of economics at the New York University Stern School of Business since 2008

Re: Indian Economy News & Discussion - Aug 26 2015

haven't retired baboo(n)s, judges and suchlike folks caused enough and more damage already??shyam wrote:Why do we need to get all RBI governors from US universities? Why can't we get them from our own IAS/IRS cadre?Marten wrote:Per PTI/ET: Professor in economics in a US university Viral V Acharya appointed as Deputy Governor of RBI

http://indianexpress.com/article/busine ... t-4448456/

they are all generalists with some amount of admin experience and nothing more.

or do you want to provide yet another safe haven for comfortable sinecures for such charlatans??

Re: Indian Economy News & Discussion - Aug 26 2015

I didn't suggest to put bad ones to that positions. There are many good ones among them whose loyalty is fully with India. People with dual interests may not be taking full interest of the country, rather just follow international standards.

-

putnanja

- BRF Oldie

- Posts: 4667

- Joined: 26 Mar 2002 12:31

- Location: searching for the next al-qaida #3

Re: Indian Economy News & Discussion - Aug 26 2015

Problem with IAS etc is that they are very hierarchical. GoI will find it difficult to place a 43-year old IAS officer as a RBI governor who is equivalent to minister of state in protocol! And there will be ugly turf wars which benefits none. Not that its impossible, but given how bureaucracy work, it can lead to ugly disputes.

Re: Indian Economy News & Discussion - Aug 26 2015

Just to avoid a local turf war it doesn't make sense to import a person who may have interest to repay his sponsors abroad, to such critical positions.

Re: Indian Economy News & Discussion - Aug 26 2015

Why an outsider even then. Don't we have anyone from any Indian university or other institutions? Are we saying we can not now produce an economist in India nowadays?

Re: Indian Economy News & Discussion - Aug 26 2015

I wonder what Su Swamy has to say about this.

Another question, what is Viral V Acharya's nationality?

Another question, what is Viral V Acharya's nationality?

Re: Indian Economy News & Discussion - Aug 26 2015

Viral V. Acharya is Indian, per the curriculum vitae posted here:

http://www.stern.nyu.edu/faculty/bio/viral-acharya

Also,

http://www.stern.nyu.edu/faculty/bio/viral-acharya

Also,

From the C.V.

Biography

Viral V. Acharya joined New York University Stern School of Business as a Professor of Finance in September 2008. Prior to joining NYU Stern, Professor Acharya was a Professor of Finance and Academic Director of the Private Equity Institute at the London Business School, a Research Affiliate of the Center for Economic Policy Research and an Academic Advisor to the Bank of England. He was appointed Senior Houblon-Normal Research Fellow at the Bank of England to conduct research on efficiency of the inter-bank lending markets for the summer of 2008.

Professor Acharya's research interests are in the regulation of banks and financial institutions, corporate finance, credit risk and valuation of corporate debt, and asset pricing with a focus on the effects of liquidity risk. He has published articles in the Journal of Finance, Journal of Financial Economics, Review of Financial Studies, Journal of Business, Rand Journal of Economics, Journal of Financial Intermediation, Journal of Money, Credit and Banking, and Financial Analysts Journal.

Professor Acharya has received numerous awards and recognition for his research. He received the Best Paper Award in Corporate Finance from the Journal of Financial Economics in 2000, Best Paper Award in Equity Trading at the Western Finance Association Meetings in 2003, Outstanding Referee Award for the Review of Financial Studies in 2003, the inaugural Lawrence G. Goldberg Prize for the Best Ph.D. in Financial Intermediation, Best Paper Award in Asset Pricing from the Journal of Financial Economics in 2005, and an inaugural Rising Star in Finance Award in 2008.

Professor Acharya earned a Bachelor of Technology in Computer Science and Engineering from the Indian Institute of Technology, Mumbai, and a Ph.D. in Finance from New York University Stern School of Business.

Ph.D. Finance, Stern School of Business, New York University, 1996 – 2001

• Dissertation - “Essays in Banking and Financial Institutions”

Ph.D. Computer Science (Incomplete), New York University, 1995 – 1996

B. Tech. in Computer Science and Engineering, IIT Bombay, 1991 – 1995

•President of India Gold Medalist for the highest GPA among 350 students.

•President of India Gold Medalist for the best academic and overall proficiency.

•Ranked 5th all over India at IIT Joint Entrance Exam, 1991.

Re: Indian Economy News & Discussion - Aug 26 2015

No wonder

References

•Professor Franklin Allen (1) 215 898-3629 allenf@wharton.upenn.edu

•Professor Peter DeMarzo (1) 650 736-1082 pdemarzo@stanford.edu

•Professor Darrell J Duffie (1) 650 723-1976 duffie@stanford.edu

•Professor Raghuram G. Rajan (1) 773 702-4437 raghuram.rajan@chicagogsb.edu

•Professor Hyun Song Shin (1) 609 258-4467 hsshin@princeton.edu

References

•Professor Franklin Allen (1) 215 898-3629 allenf@wharton.upenn.edu

•Professor Peter DeMarzo (1) 650 736-1082 pdemarzo@stanford.edu

•Professor Darrell J Duffie (1) 650 723-1976 duffie@stanford.edu

•Professor Raghuram G. Rajan (1) 773 702-4437 raghuram.rajan@chicagogsb.edu

•Professor Hyun Song Shin (1) 609 258-4467 hsshin@princeton.edu

Re: Indian Economy News & Discussion - Aug 26 2015

Via Bloomberg:

https://www.bloomberg.com/news/articles ... s-rbi-says

RBI’s Warning as Indian Banks’ Bad Loans Hit 14-Year High

https://www.bloomberg.com/news/articles ... s-rbi-says

RBI’s Warning as Indian Banks’ Bad Loans Hit 14-Year High

The industry’s gross bad-loan ratio jumped to 9.1 percent in September, from 7.8 percent in March, according to the Reserve Bank of India’s Financial Stability Report released Thursday. That’s the highest since the year ended March 2002. Stressed assets, including soured debt and restructured loans, rose to 12.3 percent of outstanding lending from 11.5 percent, the report showed.

Under a “macro stress test,” the gross non-performing loan ratio may rise even further by March 2017, the deadline set by the RBI for banks to clean up soured credit.

“The performance of the Indian banking sector remained subdued during 2015-16 amidst rising proportion of banks’ delinquent loans, consequent increase in provisioning and continued slowdown in credit growth,” the RBI said in the study, which is released every six months.

Earlier this year, the International Monetary Fund said India’s banking system was among the most vulnerable to profit declines as loan growth slowed and bad debts rose. According to the IMF, the ability of Indian companies to service debt is the lowest among 19 emerging-market nations it tracked.

Re: Indian Economy News & Discussion - Aug 26 2015

CNBC reports:

http://www.cnbc.com/2017/01/02/demoneti ... shows.html

"Demonetization cash crunch pushed Indian factory activity into contraction in December, survey shows"

http://www.cnbc.com/2017/01/02/demoneti ... shows.html

"Demonetization cash crunch pushed Indian factory activity into contraction in December, survey shows"

Indian factory activity plunged into contraction last month as a cash crunch following Prime Minister Narendra Modi's currency crackdown severely hurt output and demand, a survey found on Monday.

The Nikkei/Markit Manufacturing Purchasing Managers' Index fell to 49.6 in December from November's 52.3, its first reading below the 50 mark that separates growth from contraction since December 2015.

It was also the biggest month-on-month decline since November 2008, just after the collapse of Lehman Brothers triggered a financial crisis and brought on a global recession.

"Having held its ground in November following the unexpected withdrawal of 500 and 1,000 bank notes from circulation, India's manufacturing industry slid into contraction at the end of 2016," said Pollyanna De Lima, economist at survey compiler IHS Markit.

"Shortages of money in the economy steered output and new orders in the wrong direction, thereby interrupting a continuous sequence of growth that had been seen throughout 2016."

The output sub-index at 49.0 was its lowest this year, though the rate of contraction was only slight.

Re: Indian Economy News & Discussion - Aug 26 2015

There is one guy named Jayant Bhandari, a self proclaimed libertarian, who is writing trash about demonetization in international media. His opinions are recycled by many other international financial experts claiming the DeMo is an act of tyranny against the masses. He never reports that Modi popularity has increased to 81% and ordinary people are supporting it. Nor does he report the real issue of black money and fake money. This guys is either totally clue less (less likely), or has an agenda against Modi or he is telling what western economists want to hear so that he becomes popular among them (more likely).

Re: Indian Economy News & Discussion - Aug 26 2015

Yes, what a troll! E.g.,

http://goldnewsletter.com/podcast/jayan ... c-suicide/

"Beyond the self-inflicted economic crisis, Jayant Bhandari says India is becoming a police state. She is on a fast track to banana-republic status, before fragmentation into smaller political units"

http://goldnewsletter.com/podcast/jayan ... c-suicide/

"Beyond the self-inflicted economic crisis, Jayant Bhandari says India is becoming a police state. She is on a fast track to banana-republic status, before fragmentation into smaller political units"

Re: Indian Economy News & Discussion - Aug 26 2015

NaMo set to announce Universal Basic Income (UBI) to all adults in next budget.

Re: Indian Economy News & Discussion - Aug 26 2015

Bloomberg reports:

https://www.bloomberg.com/news/articles ... ces-sector

https://www.bloomberg.com/news/articles ... ces-sector

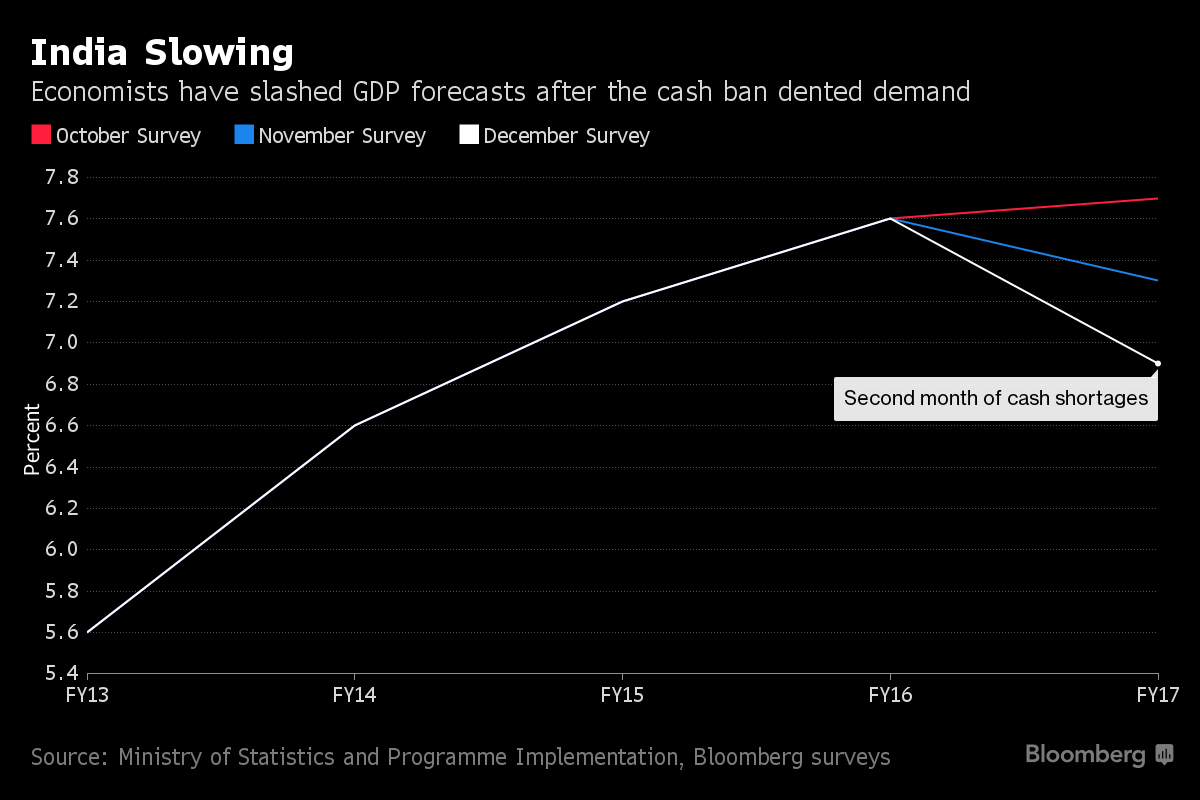

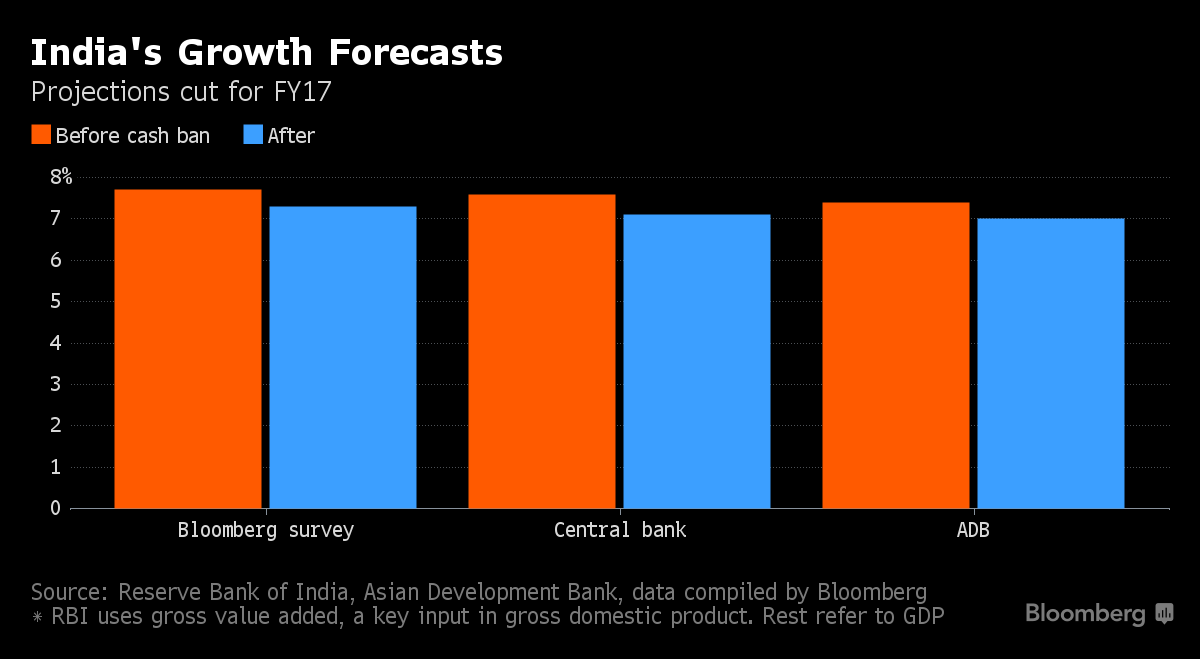

India’s dominant services sector is set to contract for a second straight month, adding to evidence that Prime Minister Narendra Modi’s surprise ban on cash will trigger a sharp slowdown in Asia’s No. 3 economy.

The Nikkei India Services Purchasing Managers’ Index was at 46.8 in December, a report showed on Wednesday, little changed from 46.7 a month earlier. A number below 50 indicates a contraction. The data follows a similar survey Monday, which showed the manufacturing sector will shrink for the first time in a year, dragging down the composite PMI to 47.6, the lowest since at least 2013.

The PMI data sets the tone for the government’s first growth estimate for the year through March, due Friday.

Re: Indian Economy News & Discussion - Aug 26 2015

Bloomberg presents this opinion:

https://www.bloomberg.com/news/articles ... ce-cs-says

https://www.bloomberg.com/news/articles ... ce-cs-says

Go long on the Indian rupee and ignore the noise over Prime Minister Narendra Modi’s surprise ban on cash. That's the advice from Credit Suisse AG to emerging-markets investors looking for bets to counter a strong dollar.

"We like the rupee as India has a very strong basic balance surplus, which affords a shield against the rising U.S. dollar and interest rates,'' Koon How Heng, senior FX investment strategist at Credit Suisse, said in an interview with Bloomberg TV on Tuesday. "A lot of people don't realize this because the attention is on demonetization."

...

...

...

India's basic surplus swelled to a record $30 billion in the 12-month period ended September as Modi's measures to attract foreign direct investments took hold, said Heng. That's a turnaround for a country struggling with "deep deficits'' of about $50 billion in 2012-2013, he said.

"EM countries with strong basic surpluses are better poised to withstand risks of capital outflows," he said....

Re: Indian Economy News & Discussion - Aug 26 2015

Ruchir Sharma, Prannoy Roy On The Elections And Economy In 2017

http://www.ndtv.com/india-news/live-ruc ... eststories

http://www.ndtv.com/india-news/live-ruc ... eststories

Re: Indian Economy News & Discussion - Aug 26 2015

Some of those graphs are quite interesting.Austin wrote:Ruchir Sharma, Prannoy Roy On The Elections And Economy In 2017

http://www.ndtv.com/india-news/live-ruc ... eststories

Re: Indian Economy News & Discussion - Aug 26 2015

----------------------------------------------------------------------------------------------------------------------------------------ramana wrote:NaMo set to announce Universal Basic Income (UBI) to all adults in next budget.

^^^^^^^^^^^^^^^^

Bad move

Hordes of Bangladeshis would enter India and be the first to avail of all these benefits

Re: Indian Economy News & Discussion - Aug 26 2015

The Int'l Spectator @spectatorindex

In 1991, the G7 countries made up 50.4% of world GDP.

In 2020, they are projected to make up 29%.

In 1991, the G7 countries made up 50.4% of world GDP.

In 2020, they are projected to make up 29%.

Re: Indian Economy News & Discussion - Aug 26 2015

It's not the government's job to build houses. It's their job to create the economic incentives that encourages private builders to build homes. The 2016 budget does contain significant new incentives to do this. However, builders bet significantly on the highest end of the market. With DeMo, there will be a recalibration of prices such that the entire market will move south in value. There's really nothing to support the RE valuations in some major cities. Upper-mid prices should be in the mid/mid-upper range, and other price bands should also fall correspondingly.

-------------------------------------------------------------------------------------------------------------------

^^^^^

This is in reply to Suraj's post in the de-mon thread

I would argue that it is the govts responsibility to execute this project , at best they can outsource the actual building to pvt contractors like L&T , Tatas, etc. But only the govt can be a large scale land aggregator to build entire townships that can populate lakhs of people and also benefit from economies of scale in sourcing raw mtls etc

No pvt sector developer would voluntarily enter low cost housing in its totality - at best they might be willing to build the homes and get paid for by the govt

The trend towards urbanisation is inexorable and only the govt can buiild entire NEW towns in a smart and planned way ( for a change ) and be a catalyst for this to happen

All Indian cities have grown in an organic , chaotic manner with zero planning input which leads to constant firefighting all the time even for basic services ( water / power / roads / sewage ) , even health and schooling are not available in good quality across all areas and are basically confined to the established central areas that leads to tremendous demand for these localities

The outer areas just mushroom with housing but there are no commensurate investments in schools / hospitals / parks -all things that enhance the quality of living standards

There are other good examples outside - ex Singapore - the successful HDB project that has made 90% of Singaporeans homeowners is a direct govt enterprise , while they have left the pvt housing / condos to pvt sector developers

Suraj - you are wondering why the RE prices are so high - which I too agree with , esp compared with other countries like Singapore , US , Aus etc

The reason is that land is scare within core city central areas and the FSI rules have been medieval to say the least

If you take Chennai , most of it is covered with 4 storey standardised apartments , while they could have relaxed FSI to Mumbai levels and helped develop 15-16 storey high rises that are the standard in Singapore

Even now , you can see that the prices of multi storeyed apts are slightly more reasonable ( even in central areas ) than the mid rise apts in same locality which are 25-30% more simply because the land costs have been amortised over more units

-------------------------------------------------------------------------------------------------------------------

^^^^^

This is in reply to Suraj's post in the de-mon thread

I would argue that it is the govts responsibility to execute this project , at best they can outsource the actual building to pvt contractors like L&T , Tatas, etc. But only the govt can be a large scale land aggregator to build entire townships that can populate lakhs of people and also benefit from economies of scale in sourcing raw mtls etc

No pvt sector developer would voluntarily enter low cost housing in its totality - at best they might be willing to build the homes and get paid for by the govt

The trend towards urbanisation is inexorable and only the govt can buiild entire NEW towns in a smart and planned way ( for a change ) and be a catalyst for this to happen

All Indian cities have grown in an organic , chaotic manner with zero planning input which leads to constant firefighting all the time even for basic services ( water / power / roads / sewage ) , even health and schooling are not available in good quality across all areas and are basically confined to the established central areas that leads to tremendous demand for these localities

The outer areas just mushroom with housing but there are no commensurate investments in schools / hospitals / parks -all things that enhance the quality of living standards

There are other good examples outside - ex Singapore - the successful HDB project that has made 90% of Singaporeans homeowners is a direct govt enterprise , while they have left the pvt housing / condos to pvt sector developers

Suraj - you are wondering why the RE prices are so high - which I too agree with , esp compared with other countries like Singapore , US , Aus etc

The reason is that land is scare within core city central areas and the FSI rules have been medieval to say the least

If you take Chennai , most of it is covered with 4 storey standardised apartments , while they could have relaxed FSI to Mumbai levels and helped develop 15-16 storey high rises that are the standard in Singapore

Even now , you can see that the prices of multi storeyed apts are slightly more reasonable ( even in central areas ) than the mid rise apts in same locality which are 25-30% more simply because the land costs have been amortised over more units

Re: Indian Economy News & Discussion - Aug 26 2015

this ruchir sharma seems to have a bug up his backside and continually likes to portray India in a bad light every time he comes on TV.Austin wrote:Ruchir Sharma, Prannoy Roy On The Elections And Economy In 2017

http://www.ndtv.com/india-news/live-ruc ... eststories

Re: Indian Economy News & Discussion - Aug 26 2015

That argument could be applied to anything arbitrarily. Govt should take over food production. Water distribution. Transportation... Pretty much Soviet model. Where does it end ?Schmidt wrote:I would argue that it is the govts responsibility to execute this project , at best they can outsource the actual building to pvt contractors like L&T , Tatas, etc. But only the govt can be a large scale land aggregator to build entire townships that can populate lakhs of people and also benefit from economies of scale in sourcing raw mtls etc

In general, the Government should be left to directly provide for basic public goods and services where private sector cannot do much. The basic idea of a public good/service is one that's accessible to all public needing it. A road for example. It's use is not restricted to one user. Each house on the other hand, is a significant capital investment that benefits only one family unit or whatever group is housed per unit. Only basic healthcare services like inoculation is agreed upon as something government can do, because there are immediate public benefits.

The Singapore HDB model is not without its faults. To start with, any Singapore example needs to be tempered by the fact that they're a tiny city state. It's not even subsidized housing for the poor as such. I've been there several times, and have extended family who've lived there for a few generations, since before there was a Republic of Singapore, and some of them live in HDB places. As a counter example, Germany has very low home ownership and largely rents. A large part of their urban infrastructure was bombed out too.

Also, this is not the right thread to discuss urban development and housing in greater detail. Please use the Urban Development and Public Policy thread, which I'd started long back.

-

KarthikSan

- BRFite

- Posts: 667

- Joined: 22 Jan 2008 21:16

- Location: Middle of Nowhere

Re: Indian Economy News & Discussion - Aug 26 2015

Yes. Zerohedge has been publishing a series of farticles by this guy. The libertarian problem with banks and fascination with gold comes from a US perspective. The Indian scenario is much different in that most banks are nationalized.shyam wrote:There is one guy named Jayant Bhandari, a self proclaimed libertarian, who is writing trash about demonetization in international media. His opinions are recycled by many other international financial experts claiming the DeMo is an act of tyranny against the masses. He never reports that Modi popularity has increased to 81% and ordinary people are supporting it. Nor does he report the real issue of black money and fake money. This guys is either totally clue less (less likely), or has an agenda against Modi or he is telling what western economists want to hear so that he becomes popular among them (more likely).

A cursory FB search of Jayant Bhandari's posts show that this guy is sitting in Singapore and commenting on day-to-day ground realities in India regarding demo. He also appears to be a closet AAPtard/Congressi IMHO. Let him have his 15m of fame.

Re: Indian Economy News & Discussion - Aug 26 2015

These so called experts have attention span of a day trader, few minutes. I predict the Indian economy will not only bounce later this year from this minor blip due to DM but also will post a growth of more than 8% in 2018 due to higher tax receipts and simply more money available to the govt for investment in infrastructure etc once again due to DM and going after black money.

Re: Indian Economy News & Discussion - Aug 26 2015

Equity Market Update - December 2016

Year 2016 turned out to be an eventful year. GST bill passage in parliament, appointment of new RBI governor, rate cuts, stable inflation and demonetization were key events. Globally, BREXIT, Donald Trump winning US Presidential elections, US rate hike etc made news.

A summary of key developments of 2016 is as follows:

Demonetization of Rs 500 and Rs 1000 notes

GST cleared, roll out in FY18 likely

Rules for speedy redressal of construction sector disputes in place. ~70,000 crores under arbitration currently

SUUTI stake sale commenced

Monetary policy committee (MPC) in place, Mr. Urjit Patel appointed as RBI governor

Merger of SBI and its associates announced, extension granted to SBI chairman

More consolidation of banks likely in FY18 & beyond

Large deleveraging deals like Essar-Roseneft, Jaiprakash Associates-Ultratech Cement, and Reliance Communication-Brookfield etc.

Donald Trump elected as US President

UK voted to leave European Union – BREXIT

Key Highlights of markets:

Mid-cap index outperformed the BSE Sensex for the third consecutive year

Though the S&P BSE SENSEX (‘SENSEX’) remained largely flat, sector divergence was high with role reversal in performance of many sectors (see table below)

Domestic MF inflows were higher than FII inflows for the second consecutive year. Insurance outflows continued for the fifth consecutive year

Developed markets indices like Dow Jones, NASDAQ, and FTSE etc outperformed emerging market indices like SENSEX, Shanghai etc.

During the year 2016, key commodities bounced back after a weak 2015, with crude up ~23% and steel and zinc up 96% and 60% respectively. All other major commodities also ended in green in year 2016.

FII’s invested $3.2bn in Indian equities in 2016 despite FII’s selling Indian equities worth $4.5bn in last 3 months. Inflows in domestic Equity mutual funds continue to be healthy. Inflows in 2016 till November have been ~Rs. 37,000 crs. including ~Rs 8,000 inflow in November.

Given the underperformance of equities, especially largecaps over nominal GDP over last several years, Market cap to GDP ratio is near decadal lows. In our opinion therefore, there is merit in increasing allocation to equities (for those with a medium to long term view).

Debt Market Update - December 2016

During the year 2016 there have been some notable events namely exit of Britain from European Union, US elections, demonetization in India, 50bps of rate cut by RBI and one more rate hike by the US Fed.

The yield on the 10-year benchmark Government bond ended the year at 6.52% down by 125 bps for the calendar year 2016. The yield on 10-year AAA Corporate Bonds ended the year at 7.58% as against 8.42% at end of 2015. Thus, corporate bond spreads ended the year at 96bps as against 51bps at the beginning of the year.

Demonetization has led to huge buildup of liquidity since 8th November 2016. About ~Rs1.84 lac crs of average liquidity net surplus has been placed with RBI since 8th November through various sources. Additionally, Rs 5.21 lac crs of cash management bills are outstanding as on end 2016. The overnight rate ended the year at 6.25% as against at 7.03% as on end 2015.

INR closed at 67.92 versus the USD in end 2016 as against 66.15 in end 2015. The net FII investment in equities & debt was an outflow of ~$ 6.4 billion in debt markets and inflow of $3.2 billion in equity markets. FII’s sold close to US$ 15.9 billion in Indian debt and equity markets in Q4 of 2016.

The annual rate of retail inflation, CPI remain range bound in 2016 with downward bias since August. The fall was largely on account of food inflation, which decelerated to 2.11% in November. Core inflation has been steadily falling since March 2014 and has been around 4.5-5% over the last one year now.

Outlook

Over the last few years HDFC AMC has consistently maintained that interest rates in India are headed lower. The impact of demonetization is also positive on key interest rate drivers: liquidity, fiscal deficit and inflation.

In our opinion there is still a downside bias to bond yields because of additional space with RBI for rate cuts, high real yields and continued fiscal consolidation. The upcoming Union Budget and the next credit policy review are key events to watch out.

However, admittedly the scope for further fall in interest rates is limited given the sharp fall from 8.8% to 6.5% in last 3 years. Investors should thus moderate future return expectations from fixed income funds.

Source for various data points: RBI Website, Bloomberg, Reuters and HDFC AMC Research.

Re: Indian Economy News & Discussion - Aug 26 2015

in 2015 it was announced and then cancelled that aadhar card would be mandatory for school kids, the goi seems to be starting a fresh push to give aadhar to all school kids to log the next generation fully into the record.

a govt official is visiting my childrens school next week and all who already have it asked to submit xerox. others will be able to apply through the school.

a govt official is visiting my childrens school next week and all who already have it asked to submit xerox. others will be able to apply through the school.

Re: Indian Economy News & Discussion - Aug 26 2015

^^ Aadhar is made mandatory in order to enroll for JEE main from this year onwards.

Re: Indian Economy News & Discussion - Aug 26 2015

X Posted on the Currency Demonetisation Thread

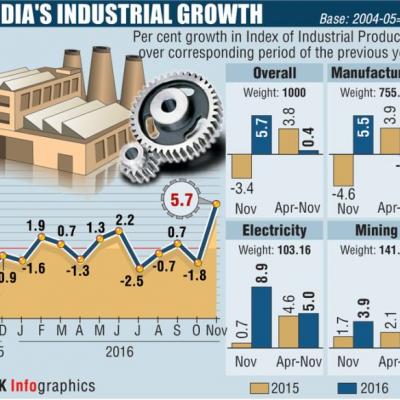

Contrary to fears of slowdown, factory output grows 5.7% in November

NEW DELHI: Industrial production in November grew by 5.7 per cent compared to a contraction of 3.4 per cent in the same month a year ago, contrary to expectations of a slowdown due to demonetisation.

Factory output measured in terms of Index of Industrial Production (IIP) got a push in November 2016 due to better performance of manufacturing, mining and electricity sectors coupled with larger offtake of capital goods, considered a barometer of investment.

Following demonetisation of Rs 1,000 and Rs 500 notes announced on November 8, 2016, it was feared that cash crunch will hit all sectors.

According to data released by the Central Statistics Office today, IIP for the month of October last year was revised slightly upwards to a contraction of 1.8 per cent from provisional estimates of (-) 1.9 per cent released last month.

As per the data, IIP growth during April-November period this fiscal remained almost flat at 0.4 per cent compared to 3.8 per cent a year ago.

Manufacturing sector, which constitutes over 75 per cent of the index, grew at 5.5 per cent in November compared to a decline in output by 4.6 per cent earlier.

However, during the April-November period the sector recorded a contraction of 0.3 per cent compared to a growth of 3.9 per cent.

Similarly, electricity generation grew at 8.9 per cent in November compared to a meagre 0.7 per cent a year ago. Mining output grew 3.9 per cent in November compared to 1.7 per cent same month a year ago.

Capital goods production increased by 15 per cent in November compared to a decline in production by 24.4 per cent earlier.

As per use-based classification, growth rates in November 2016 over November 2015 are 4.7 per cent in basic goods and 2.7 per cent in intermediate goods.

Consumer durables and consumer non-durables recorded growth of 9.8 per cent and 2.9 per cent respectively, with the overall growth in consumer goods being 5.6 per cent.

In terms of industries, 16 out of 22 industry groups in the manufacturing sector have shown growth during the month of November 2016 as compared to the corresponding month of the previous year.

Cheers

Contrary to fears of slowdown, factory output grows 5.7% in November

NEW DELHI: Industrial production in November grew by 5.7 per cent compared to a contraction of 3.4 per cent in the same month a year ago, contrary to expectations of a slowdown due to demonetisation.

Factory output measured in terms of Index of Industrial Production (IIP) got a push in November 2016 due to better performance of manufacturing, mining and electricity sectors coupled with larger offtake of capital goods, considered a barometer of investment.

Following demonetisation of Rs 1,000 and Rs 500 notes announced on November 8, 2016, it was feared that cash crunch will hit all sectors.

According to data released by the Central Statistics Office today, IIP for the month of October last year was revised slightly upwards to a contraction of 1.8 per cent from provisional estimates of (-) 1.9 per cent released last month.

As per the data, IIP growth during April-November period this fiscal remained almost flat at 0.4 per cent compared to 3.8 per cent a year ago.

Manufacturing sector, which constitutes over 75 per cent of the index, grew at 5.5 per cent in November compared to a decline in output by 4.6 per cent earlier.

However, during the April-November period the sector recorded a contraction of 0.3 per cent compared to a growth of 3.9 per cent.

Similarly, electricity generation grew at 8.9 per cent in November compared to a meagre 0.7 per cent a year ago. Mining output grew 3.9 per cent in November compared to 1.7 per cent same month a year ago.

Capital goods production increased by 15 per cent in November compared to a decline in production by 24.4 per cent earlier.

As per use-based classification, growth rates in November 2016 over November 2015 are 4.7 per cent in basic goods and 2.7 per cent in intermediate goods.

Consumer durables and consumer non-durables recorded growth of 9.8 per cent and 2.9 per cent respectively, with the overall growth in consumer goods being 5.6 per cent.

In terms of industries, 16 out of 22 industry groups in the manufacturing sector have shown growth during the month of November 2016 as compared to the corresponding month of the previous year.

Cheers

Re: Indian Economy News & Discussion - Aug 26 2015

http://timesofindia.indiatimes.com/indi ... 508354.cms

According to the data released by the Central Statistics Office (CSO), industrial output grew an annual 5.7% in November compared to a decline of 3.4% in the year earlier period. The sector had declined 1.8% in October. Growth in November was helped by the favourable base effect and the performance of manufacturing, capital goods and consumer durables sectors. Between April and November, industrial output growth rose 0.4% compared to 3.8% expansion in the year ago period, reflecting the sluggishness still persisting in the sector.

According to the data released by the Central Statistics Office (CSO), industrial output grew an annual 5.7% in November compared to a decline of 3.4% in the year earlier period. The sector had declined 1.8% in October. Growth in November was helped by the favourable base effect and the performance of manufacturing, capital goods and consumer durables sectors. Between April and November, industrial output growth rose 0.4% compared to 3.8% expansion in the year ago period, reflecting the sluggishness still persisting in the sector.

Re: Indian Economy News & Discussion - Aug 26 2015

^

that's a huge jump in IIP

that's a huge jump in IIP

-

abhishek_sharma

- BRF Oldie

- Posts: 9664

- Joined: 19 Nov 2009 03:27

Re: Indian Economy News & Discussion - Aug 26 2015

From ibtimes

Defence imports is another big fish but will take longer to tackle.

Crude oil, gold, electronics, palm oil. If India can curb imports of these in the next few years, rupee will be in a much better position.Gold imports dropped 48.49 percent to $1.95 billion from $3.80 billion in December 2015. In November, gold imports spurted 23.24 percent to $4.36 billion from $3.54 billion in November 2015 and $3.50 billion in October this year. The November spike was widely believed to be rise in gold purchases in the initial days of demonetisation.

Defence imports is another big fish but will take longer to tackle.

Re: Indian Economy News & Discussion - Aug 26 2015

I hope no such sweetheart deal is provided. India doesn't need Apple to move its assembly plant from China to India. There are plenty of screw-driver tech companies as it is, primarily in the defense sphere. The jobs that come with it are semi-skilled at best.abhishek_sharma wrote:Apple seeks 15-year custom duty holiday before setting up India unit

The govt on the other hand needs to reduce corporate taxes tothe low teens. It will provide incentives for the wider industries to move to India.

Re: Indian Economy News & Discussion - Aug 26 2015

The World Economic Forum publishes a Global Competitiveness Report. Let us remember all the caveats that go with such reports while looking at the info they provide. At a minimum, this has public relations value, and may help in attracting investment in India. Maximally, such reports might signal genuine improvements in the business climate in India.

* In the 2013-14 report (large PDF: http://www3.weforum.org/docs/WEF_Global ... 013-14.pdf ) India ranked 60th out of 148 countries listed (after ranking 59th in 2012-13).

* In 2014-15, India ranked 71st out of 144 countries listed (http://reports.weforum.org/global-compe ... /rankings/)

This downward trend has been reversed.

* In 2015-16, India ranked 55th out of 140 countries listed ( http://reports.weforum.org/global-compe ... -rankings/ )

* In 2016-17, India ranks 39th out of 138 countries listed (large PDF: http://www3.weforum.org/docs/GCR2016-20 ... _FINAL.pdf )

The countries ahead of India now are: Switzerland, Singapore, United States, Netherlands, Germany, Sweden, United Kingdom, Japan, Hong Kong, Finland, Norway, Denmark, New Zealand, Taiwan, Canada, United Arab Emirates, Belgium, Qatar, Austria, Luxembourg, France, Australia, Ireland, Israel, Malaysia, South Korea, Iceland, China, Saudi Arabia, Estonia, Czech Republic, Spain, Chile, Thailand, Lithuania, Poland, Azerbaijan and Kuwait.

- In BRICS, only China is ahead.

- India is now way ahead of the next rank in SAARC, Sri Lanka at 71st rank.

- With respect to ASEAN, India is behind Singapore, Malaysia and Thailand.

- With respect to the European Union, India is behind the leading economies, but ahead of some of the smaller ones.

Can India climb 10 places over the next year, and crack the top 30?

* In the 2013-14 report (large PDF: http://www3.weforum.org/docs/WEF_Global ... 013-14.pdf ) India ranked 60th out of 148 countries listed (after ranking 59th in 2012-13).

* In 2014-15, India ranked 71st out of 144 countries listed (http://reports.weforum.org/global-compe ... /rankings/)

This downward trend has been reversed.

* In 2015-16, India ranked 55th out of 140 countries listed ( http://reports.weforum.org/global-compe ... -rankings/ )

* In 2016-17, India ranks 39th out of 138 countries listed (large PDF: http://www3.weforum.org/docs/GCR2016-20 ... _FINAL.pdf )

The countries ahead of India now are: Switzerland, Singapore, United States, Netherlands, Germany, Sweden, United Kingdom, Japan, Hong Kong, Finland, Norway, Denmark, New Zealand, Taiwan, Canada, United Arab Emirates, Belgium, Qatar, Austria, Luxembourg, France, Australia, Ireland, Israel, Malaysia, South Korea, Iceland, China, Saudi Arabia, Estonia, Czech Republic, Spain, Chile, Thailand, Lithuania, Poland, Azerbaijan and Kuwait.

- In BRICS, only China is ahead.

- India is now way ahead of the next rank in SAARC, Sri Lanka at 71st rank.

- With respect to ASEAN, India is behind Singapore, Malaysia and Thailand.

- With respect to the European Union, India is behind the leading economies, but ahead of some of the smaller ones.

Can India climb 10 places over the next year, and crack the top 30?

Re: Indian Economy News & Discussion - Aug 26 2015

^^^^ from the same sources, the drags on India's competitiveness:

...financial market development is the pillar most dragging down India’s competitiveness compared to 10 years ago. Here the efforts of the Reserve Bank of India have increased transparency in the financial market and shed light on the large amounts of non-performing loans, previously not reported on the balance sheets of Indian banks. Banks have not yet found a way to sell these assets, and some need large recapitalizations.

The efficiency of the goods market has also deteriorated, resulting from India’s failure to address long-running problems such as varying goods and services tax (GST) levels within the country (this is set to finally change as of 2017 if the Central GST and Integrated GST Bills currently in Parliament are fully implemented).

Another area of concern is India’s stagnating performance on technological readiness, a pillar on which it scores one full point lower than any other. These three pillars will be key for India to prosper in its next stage of development, when it will no longer be possible to base its competitiveness on low-cost, abundant labor.

Higher education and training has also shown no improvement.

What areas should India prioritize today?

India has made significant progress on infrastructure, one of the pillars where it ranked worst. As the country closes the infrastructure gap, new priorities emerge.

The country’s biggest relative weakness today is in technological readiness, where initiatives such as Digital

India could lead to significant improvements in the next years.

India outperforms countries in the same stage of development, mostly those in sub-Saharan Africa, in all pillars except labor market efficiency.

Even on indicators where India has made progress, comparisons with other countries can be sobering: although

life expectancy has increased, for example, it is still low by global standards, with India ranking only 106th in the world; and while India almost halved infant mortality, other countries did even better, so it drops nine places this year to 115th. Huge challenges still lie ahead on India’s path to prosperity.

Re: Indian Economy News & Discussion - Aug 26 2015

A_Gupta wrote:^^^^ from the same sources, the drags on India's competitiveness:

...financial market development is the pillar most dragging down India’s competitiveness compared to 10 years ago. Here the efforts of the Reserve Bank of India have increased transparency in the financial market and shed light on the large amounts of non-performing loans, previously not reported on the balance sheets of Indian banks. Banks have not yet found a way to sell these assets, and some need large recapitalizations.

The efficiency of the goods market has also deteriorated, resulting from India’s failure to address long-running problems such as varying goods and services tax (GST) levels within the country (this is set to finally change as of 2017 if the Central GST and Integrated GST Bills currently in Parliament are fully implemented).

Another area of concern is India’s stagnating performance on technological readiness, a pillar on which it scores one full point lower than any other. These three pillars will be key for India to prosper in its next stage of development, when it will no longer be possible to base its competitiveness on low-cost, abundant labor.

Higher education and training has also shown no improvement.What areas should India prioritize today?

India has made significant progress on infrastructure, one of the pillars where it ranked worst. As the country closes the infrastructure gap, new priorities emerge.

The country’s biggest relative weakness today is in technological readiness, where initiatives such as Digital India could lead to significant improvements in the next years.

India outperforms countries in the same stage of development, mostly those in sub-Saharan Africa, in all pillars except labor market efficiency.

Even on indicators where India has made progress, comparisons with other countries can be sobering: although

life expectancy has increased, for example, it is still low by global standards, with India ranking only 106th in the world; and while India almost halved infant mortality, other countries did even better, so it drops nine places this year to 115th. Huge challenges still lie ahead on India’s path to prosperity.