Chart of the Day: The New Middle Kingdom Of Debt http://davidstockmanscontracorner.com/chart-of-the-d

WASHINGTON, Dec 13 - RIA Novosti, Ekaterina Sobol. The US suspects China of trying to build its economic world order bypassing international rules, US Secretary of State Rex Tillerson said in a speech at the Atlantic Council in Washington.

"China's policy -" one belt - one way "is a continuation of its economic development.Our policy is not to try to hinder China's economic development, but China's economic development in our understanding should work in the system of international economic norms, and" one belt is one way " seems to be trying to find its own rules and norms, "Tillerson said, commenting on China's creation of the Silk Road.

He added: "All countries in the region should have equal access to free trade."

Or rather it is trying to create an alternative to US rule.Austin wrote:The US suspects China of trying to create its own economic order

https://ria.ru/economy/20171213/1510787236.htmlWASHINGTON, Dec 13 - RIA Novosti, Ekaterina Sobol. The US suspects China of trying to build its economic world order bypassing international rules, US Secretary of State Rex Tillerson said in a speech at the Atlantic Council in Washington.

"China's policy -" one belt - one way "is a continuation of its economic development.Our policy is not to try to hinder China's economic development, but China's economic development in our understanding should work in the system of international economic norms, and" one belt is one way " seems to be trying to find its own rules and norms, "Tillerson said, commenting on China's creation of the Silk Road.

He added: "All countries in the region should have equal access to free trade."

Rishirishi wrote:Or rather it is trying to create an alternative to US rule.Austin wrote:The US suspects China of trying to create its own economic order

https://ria.ru/economy/20171213/1510787236.html

A giant lithium deposit found in Southwest China's Sichuan Province this year should reduce China's reliance on imports as energy experts called for protection of its exploitation and the creation of a strategic reserve.

A 519,500-ton lithium deposit was found this year at Keeryin Ore Concentration Area, Aba Tibetan and Qiang Autonomous Prefecture of Sichuan, the Institute of Multipurpose Utilization of Mineral Resources in Chengdu, Sichuan under China Geological Survey confirmed with the Global Times on Monday.

The outcrop ore bodies were 88 to 1,553 meters long and two to 35 meters wide and a massive ore deposit, the institute indicated in a notice on its website in November.

More than 2,000 tons of rubidium were also detected in the area.

The breakthrough suggests that Keeryin still has the potential for more mineral resources and could contribute to making Aba the "lithium valley" of China, the institute said.

"China is one of the biggest consumers of lithium, which is mainly used to make batteries for electric automobiles and bicycles," Lin Boqiang, director of the China Center for Energy Economics Research at Xiamen University, told the Global Times on Monday.

With new energy cars, lithium's value is obvious. A shortage of lithium could limit development of the industry, Lin noted.

China relies on imports for 80 percent of its cobalt and 70 percent of its lithium and nickel, the Xinhua News Agency reported in November.

"Apart from finding the deposit, the government should strengthen control of exploitation of the lithium mine and make a strategic reserve out of it," Lin said, noting that legislation is also necessary to protect such resources.

Global lithium demand will increase to 1 million tons in 2026 from 189,000 tons in 2016, mainly because of the battery industry, according to cbea.com, an energy-related news website under the China Industrial Association of Power Sources.

China's consumption of lithium in 2016 accounted for 47 percent of the world, cbea.com reported on Monday.

Chinese auto manufacturer Great Wall in September secured an agreement with Western Australian mining company Pilbara Minerals to ensure lithium supply for their electric car range, according to the Xinhua report.

Currently the Pilgangoora operation has a capacity of about 2 million tons of lithium a year, but the new deal should see the figure rise to more than 5 million tons.

He's probably aware of an imminent threat to China's financial stability, but would like to cover his ass, by blaming it on a black swan event.

Economic data fabrication has been an open secret in China for a long time. The local governments’ self-revelation of the problem is a positive move to getting the country’s economic data closer to reality. However, while many local governments have openly admitted to data fabrication in a high-profile manner, there are few actions being taken to hold those who cooked the books responsible. Authorities should trace back the data deception to find whoever is responsible for the scams, following the chain of data collection and report writing. The scammers should pay for what they did.

Data fabrication is extremely harmful. As key signals of the market, economic data serve as the foundation for macroeconomic decision-making. Watered-down data will hurt the efficiency of resources allocations and make the macro policies miss the targets. They also damage the local political ecology and will have a long-term impact on local development. The inflated figures may appear pleasing on the surface, but local people will suffer — each taxpayer in Liaoning, for instance, has to pay 1,000 yuan more each year to fill in the government’s fiscal gap because of exaggerated industrial output and fiscal revenue.

"The next area of challenge is going to be high tech," U.S. Commerce Secretary Wilbur Ross said at the World Economic Forum in Davos, Switzerland, on Wednesday.

Ross said that China has a "very clearly stated target of becoming the world leader with enormous market share, in most all of the new technologies you can name and spell."

Beijing has thrown its weight behind artificial intelligence, electric cars and computer chips in recent years, pumping in money to create industry champions with global clout.

"That is a direct threat, and that is a direct threat that is being implemented by the technology transfers, by disrespect for intellectual property rights, by commercial espionage, by all kinds of bad things," Ross said.

Western tech companies often complain that they have been shut out of China, where their designs are sometimes copied. Facebook (FB), Twitter (TWTR) and other social media platforms are banned, for example.

Silicon Valley has already raised concerns about Beijing's plans to dominate new technologies, warning they may give Chinese companies an unfair edge at home and abroad. Some analysts have called for the U.S. to ramp up spending on technology research in order to keep pace.

Trying to make most of Trump abandoning TPPA_Gupta wrote:https://www.bloomberg.com/news/articles ... mples-them

China Piles Up Free Trade Deals as Trump Abandons Them

https://twitter.com/tombschrader/status ... twterm%5E1USD1.2 billion in fraud at a single bank branch in western China. Everything is fine.

I think from time to time news like 'Massive corruption in China', 'Chinese NPAs are 30%', 'Chinese collapse will be anytime now' is actually encouraged by China to lull the west and others. Its like reassuring the west, especially America, that they are still the best and China is a long way from catching up with them.Prasad wrote:A thread on twitter about the stellar corruption in chinese bankshttps://twitter.com/tombschrader/status ... twterm%5E1USD1.2 billion in fraud at a single bank branch in western China. Everything is fine.

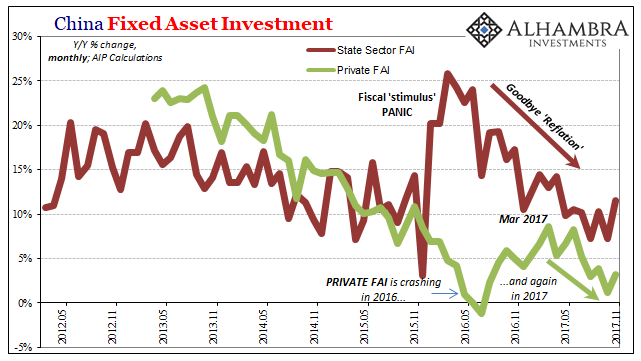

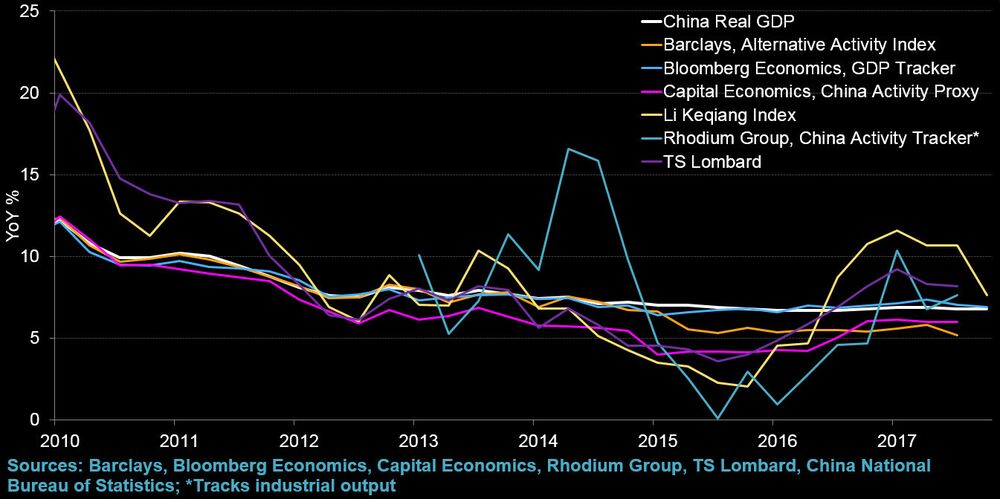

China’s growth rate in 2015 was probably overstated by “a couple of percentage points,” according to new data analysis by Bloomberg Economics.

Gross domestic product at the provincial level was consistently overstated between 2011 and 2015, calculations that cross-referenced energy consumption with output data show. But the exaggeration appears to have shrunk in 2016 as a method of inflating fiscal revenues was closed off.

Chinese data has long been dogged by concerns over fudging, with a recent spate of revisions to provincial growth and revenue data reviving questions about the reliability of national statistics.

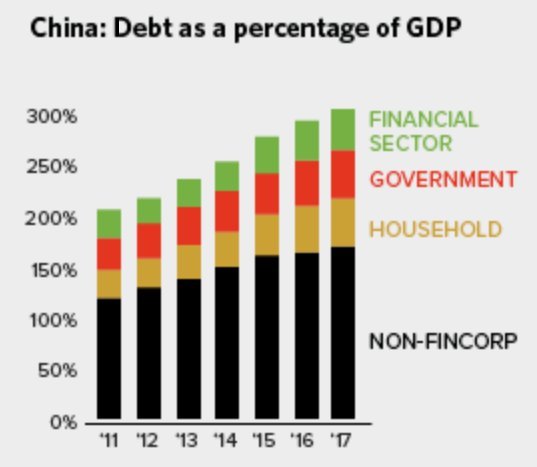

Data faking also raises questions about the country’s debt picture

What about data from 1988 till 2010?The provinces of Qinghai, Yunnan, Chongqing, Guizhou, and Shaanxi stood out as having both the most questionable growth data and the highest ratio of debt to GDP, according to the report.

My conclusion was that China by the early 2000s reached the sweet spot for its one-party state. Its economic reform was half-complete but had already delivered enough political benefits for it to retain legitimacy. It could use the growing economic resources to strengthen its repressive capacity to defend its political monopoly. It does not want to reform the economy further because doing so would also risk losing control over the economy and all the benefits it can generate for the party. So there is a hard limit to how far the party would push economic reform.

In a fully “marketized” economy—in the Chinese case that would mean very few state-owned enterprises—the Communist Party would have no real economic means to protect its political monopoly. But if the economy is not fully marketized, inefficiency will eventually doom economic growth. That’s why I applied the concept of “trapped transition”—the continuation of the status quo leading eventually to stagnation.

Frum: Has China now arrived at the “trap” you foresaw? Is it stuck? If yes, does any further economic progress remain possible, or will China now succumb to Japanese-like stagnation at a vastly below-Japanese level of prosperity?

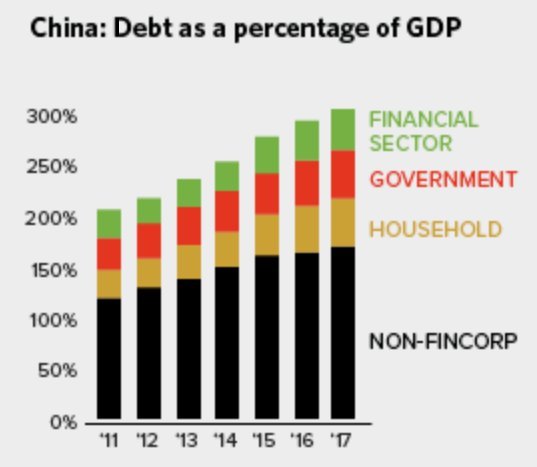

Pei: In terms of systemic or institutional change, China probably entered the trap a decade ago. Although China has maintained ostensibly reasonable growth rate, it has done so mainly by increasing debt or leverage. Future economic progress is doubtful without real and radical economic change, but what has happened in the last five years under Xi, who promised radical reforms but has not delivered on his promise, is discouraging. So the prospect of a Japanese-like stagnation is real. But because the party’s legitimacy depends on prosperity, such a scenario would be fatal to its survival.

Frum: If economic stagnation is fatal to regime survival—but the fuller reforms necessary to economic growth are regarded as unacceptable—what happens? In particular, does the regime turn to foreign adventurism as a new mode of legitimation? China’s foreign policy has become increasingly assertive over the past decade, to the point of provocation, even bellicosity. Is that the future to be faced?

Pei: Foreign adventurism in the context of declining economic performance is a distinctive possibility, but it is also very risky for the regime. If it succeeds, it will gain domestic legitimacy, but should it lose a war, it could lose power quickly. In the short to medium term, the Communist Party’s real strategy is to strengthen the security state, including the building of a powerful surveillance state.

The Chinese authorities will continue to gradually promote the internationalization of the yuan, including through the further opening of its financial market. This was stated at a press conference by the head of the People's Bank of China Zhou Xiaochuan, RIA Novosti reported .

"In the process of internationalization of the renminbi, sufficient measures have been taken that now allow the yuan to be used in trade and investment. In addition, the yuan was included in the SDR basket of currencies. The basic procedures have already been carried out, "said Zhou Xiaochuan.

According to him, it takes sufficient time for the participants of the world market to switch to yuan payments. But China will do everything to make the process of internationalization of the yuan. "We can not coerce anyone, decisions are made based on our own considerations," said the head of the People's Bank.

The IMF Executive Board decided in November 2015 to include the yuan in the SDR basket (special drawing rights) from October 1, 2016, which already includes the dollar, euro, pound sterling and yen.

In late 2015, the Central Bank of Russia included the Chinese yuan in the country's gold and currency reserves.

In 1978 when the country began to reform and open up, it accounted for less than 1% of global exports of goods. For the next 37 years, its share grew remorselessly, accelerating around the time of its entry into the World Trade Organisation in 2001. In socks, for example, China accounts for about 40% of world exports.

But in 2016 something unusual happened. China’s share of global merchandise exports slipped: from 13.9% to 13.5%, according to IMF data. That might have been a blip in a tumultuous year. But in the first 11 months of 2017 (the latest data available) its share fell again, to less than 13%.

Besides, China is losing market share not only to cheaper, younger countries like Vietnam. It is also ceding ground to greyer, costlier rivals like Japan, South Korea and Taiwan. The trio’s combined share of Asia’s exports rose by almost 1.2 percentage points from 2015 to 2017.

Pandurangharipanduranghari wrote:

Holee Sheet!

please could you also explain what happenedpanduranghari wrote:HIBOR is hong kong inter bank offer rate. Its the Money needed to settle overnight positions of banks. Also the interest rates which help sets mortgages and loans. End of the day bank positions covers everything from payroll, business loans, credit card payments and debits etc etc. Banks borrow (or lend out) from (or to) other banks for the short term at the HIBOR (like LIBOR) rate to cover shortfall in their balance sheet. At the end of the day assets=liabilities for a solvent entity. HIBOR is also used to fund Chinese projects which may are really under water. As funding runs out, the banks get desperate and only loan out at a higher interest rate.

Now look at the graph again. And this is just the beginning.