Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

Few things to ponder:

We must not confuse MFs being just Equity-linked, which are undoubtedly being impacted by this year's budget. But, they are still exempt from dividend-withholding tax, so should continue to be a viable avenue for long-term investors.

Debt MFs have long overtaken equity MFs. They also form the single biggest source of short/medium-term financing for corporates, NBFCs and (to smaller extent) banks. These MFs have always attracted LTCG. Investor has the choice to pay a low-rate or choose high-rate but with indexation. Eventually, Equity MFs could face a similar structure whereby providing decent real-returns (above inflation) even after tax.

Thirdly, life insurance unit-linked schemes now have a large share of the organised investing in capital markets. I am not aware of any impact of LTCG announcement on these schemes. Moreover, insurance sector has a far wider reach into smaller towns/cities.

ELSS schemes also will remain tax-exmpt.

All in all plenty of ways to access capital markets and potential to keep tax-liabilities small.

Worldwide, there's a bubble forming in equity markets. India is no exception. It is usually the small investor that has the most to lose when the bubble bursts. However much brokers may deny it, this kind of a move was expected.

We must not confuse MFs being just Equity-linked, which are undoubtedly being impacted by this year's budget. But, they are still exempt from dividend-withholding tax, so should continue to be a viable avenue for long-term investors.

Debt MFs have long overtaken equity MFs. They also form the single biggest source of short/medium-term financing for corporates, NBFCs and (to smaller extent) banks. These MFs have always attracted LTCG. Investor has the choice to pay a low-rate or choose high-rate but with indexation. Eventually, Equity MFs could face a similar structure whereby providing decent real-returns (above inflation) even after tax.

Thirdly, life insurance unit-linked schemes now have a large share of the organised investing in capital markets. I am not aware of any impact of LTCG announcement on these schemes. Moreover, insurance sector has a far wider reach into smaller towns/cities.

ELSS schemes also will remain tax-exmpt.

All in all plenty of ways to access capital markets and potential to keep tax-liabilities small.

Worldwide, there's a bubble forming in equity markets. India is no exception. It is usually the small investor that has the most to lose when the bubble bursts. However much brokers may deny it, this kind of a move was expected.

Last edited by JTull on 02 Feb 2018 16:52, edited 2 times in total.

Re: Indian Economy News & Discussion - Nov 27 2017

It would be good if there was tax exemption for longer-term holdings in ELSS and retirement funds such as >10 year window so that genuine savers are not impacted. 10% cut off ones retirement corpus can be a big blow.nam wrote: The recent increase in MF is not because lack of LTCG, but crash in real estate as a investment option. Investing in MF is much easier than the hassle of real estate and there is no other long term viable investment for a individual.

Re: Indian Economy News & Discussion - Nov 27 2017

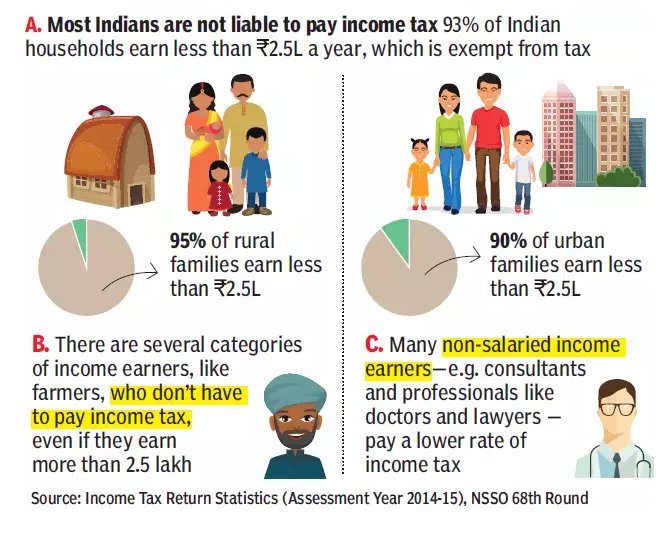

It could've been more imaginative.When GST has brought everyone into the tax bracket,and so few in the country still pay IT,they should've been rewarded with a drastic cut in personal IT,so that more would join paying moderate % of IT each year. The middle class is being squeezed and squeezed every year with no relief in sight.The rumours are that the next major decision is going to be inheritance tax.But where is all the tax collection going to? Who is it really benefiting? To me the massively inflated babudom is the chief beneficiary,as getting anything done in India,even for your basic services like water,electricity,etc. requires you to "know someone".Baksheesh is part of the informal tax that burdens the citizen even more.The number of (badly) unfinished infra projects are as numerous as the starts in the galaxy. I would dearly like to go to the next world tomorrow if I am assured that there are no taxes there!

PS:Alternative. Outsource running the country to the Chinese for a fee.We would gladly pay tax seeing how efficiently the Chins complete their projects!

PS:Alternative. Outsource running the country to the Chinese for a fee.We would gladly pay tax seeing how efficiently the Chins complete their projects!

Re: Indian Economy News & Discussion - Nov 27 2017

You mean like what the Pakis have done? Thanks, but no thanks.Philip wrote:PS:Alternative. Outsource running the country to the Chinese for a fee.We would gladly pay tax seeing how efficiently the Chins complete their projects!

Re: Indian Economy News & Discussion - Nov 27 2017

Well put.

1. There is a.perception that Givt. Is extracting 30% It and 28% GST. This is not true in case of GST but lot of businesses raised fees and call it is because of GST. Middle class bought this FUD. Govt. Showed did not put forward a coherent strategy to fight the perception or take action on scam businessmen.

2. We need to put money to good use very effectively. For example,.they have announced 2000 cr for healthcare initiative. Most of it will be wasted, corrupted and scammed at various levels. We have to use telemedicine etc t ok provide an effective solution. Unfortunately we rely on useless babus who will waste all the money and scam it.

3. People need to feel the action that this is benefiting them. There is the alienation of middle class man from Indian babudom. We have not reformed it and left people to the mercy of babus.

4. Taxation can be justified but wastage of that money is not fair.

1. There is a.perception that Givt. Is extracting 30% It and 28% GST. This is not true in case of GST but lot of businesses raised fees and call it is because of GST. Middle class bought this FUD. Govt. Showed did not put forward a coherent strategy to fight the perception or take action on scam businessmen.

2. We need to put money to good use very effectively. For example,.they have announced 2000 cr for healthcare initiative. Most of it will be wasted, corrupted and scammed at various levels. We have to use telemedicine etc t ok provide an effective solution. Unfortunately we rely on useless babus who will waste all the money and scam it.

3. People need to feel the action that this is benefiting them. There is the alienation of middle class man from Indian babudom. We have not reformed it and left people to the mercy of babus.

4. Taxation can be justified but wastage of that money is not fair.

Re: Indian Economy News & Discussion - Nov 27 2017

People randomly prattle on about 'perception', frequently having no idea what their problem is. Don't think so ? Then I challenge someone who says so to clearly list why they don't think actions taken don't constitute positive measures. They'll just weasel out saying 'but the perception is still there'.

This is pointless and selfish. When challenged, the person will be unable to clearly explain why actions are not positive, and will just whine and complain and expect detailed responses while they have nothing technically constructive to offer. People with such emotional considerations to the matter are requested not to post here, because most likely you're not posting about economics but politics.

The bottomline is that the problem has nothing to do with perception of non-performance of any Government policy. Rather, people wanted a tax cut of some form, didn't get it, and are pissed about it. Be honest about that, instead of waving hands about 'perception' etc to try to sound cool. Mostly, 'perception' is code for "*I* did not get a direct tax cut!"

This government has done more to reduce inefficiencies in public spending than several others, combined. They've been constantly trying to ensure that subsidy and benefit spending goes straight to the beneficiary's hand. PMJDY, MUDRA, a host of paid-for insurance cover programs, demonetisation, GST, linking benefits to a universal ID... just everything but demo and GST have saved tens of billions. E.g. just one of the items I listed has saved ~$10 billion in expenditure:

Savings due to DBT cross Rs.58000 crore

One of the last criticisms against this government is that it isn't doing enough to make the system more efficient. That's essentially been their main focus since day one. Making that the central argument against a budget is basically a case of ball rapping the pad right in front of middle stump. If you're unhappy you didn't get a certain tax cut, just say so and move on. No need to make it an elaborate 'perception of government inefficiency' misconstrued argument.

This is pointless and selfish. When challenged, the person will be unable to clearly explain why actions are not positive, and will just whine and complain and expect detailed responses while they have nothing technically constructive to offer. People with such emotional considerations to the matter are requested not to post here, because most likely you're not posting about economics but politics.

The bottomline is that the problem has nothing to do with perception of non-performance of any Government policy. Rather, people wanted a tax cut of some form, didn't get it, and are pissed about it. Be honest about that, instead of waving hands about 'perception' etc to try to sound cool. Mostly, 'perception' is code for "*I* did not get a direct tax cut!"

This government has done more to reduce inefficiencies in public spending than several others, combined. They've been constantly trying to ensure that subsidy and benefit spending goes straight to the beneficiary's hand. PMJDY, MUDRA, a host of paid-for insurance cover programs, demonetisation, GST, linking benefits to a universal ID... just everything but demo and GST have saved tens of billions. E.g. just one of the items I listed has saved ~$10 billion in expenditure:

Savings due to DBT cross Rs.58000 crore

One of the last criticisms against this government is that it isn't doing enough to make the system more efficient. That's essentially been their main focus since day one. Making that the central argument against a budget is basically a case of ball rapping the pad right in front of middle stump. If you're unhappy you didn't get a certain tax cut, just say so and move on. No need to make it an elaborate 'perception of government inefficiency' misconstrued argument.

Re: Indian Economy News & Discussion - Nov 27 2017

^^^^ Another way of putting it is as follows: you think the budget is broken? Ok, what would you rather cut so that you get your tax break?

Re: Indian Economy News & Discussion - Nov 27 2017

Deleted. Let's keep criticisms on point.

Last edited by Suraj on 02 Feb 2018 23:24, edited 2 times in total.

Reason: No need to get so political here. Doesn't really help the thread :)

Reason: No need to get so political here. Doesn't really help the thread :)

Re: Indian Economy News & Discussion - Nov 27 2017

Didn't want to get political, however the logic & reaction defied me!

Re: Indian Economy News & Discussion - Nov 27 2017

An interesting insight into GoI's thinking - rather than simply raise the exemption limit, they preferred to use the standard deduction. Technically the exemption limit *has* risen - it's not Rs.2.9 lakh and not Rs.2.5 lakh. This is because SD is Rs.40K. However you cannot get it without filing tax returns, and cannot use - potentially falsified - claims for exemptions. This fits with the government's general attitude of not trying to coerce public and cause evasion, but rather set up a framework where it's better to be honest than not:

Budget: Why FM chose standard deduction and not raised tax exemption limit

Cost estimate for Modicare:

Modicare: New health insurance plan may cost Centre, states $1.71 bn a year

Budget: Why FM chose standard deduction and not raised tax exemption limit

So much for "GoI is against middle class salaried people!!" when in reality they carefully made a choice that benefits people properly.Tax-free income for salaried class and pensioners has been raised to Rs 290,000 by way of a Rs 40,000 standard deduction and not by hiking exemption limit as the government wanted the benefit to accrue to honest taxpayers, Finance Secretary Hasmukh Adhia said on Friday.

The standard deduction, which replaces tax-free transport allowance of Rs 1,600 per month (Rs 19,200 a year) and medical expense reimbursement of Rs 15,000 per annum, will accrue automatically to salaried class and pensioners without the requirement of furnishing proof like medical bills that are in vogue now.

Finance Minister Arun Jaitley chose the standard deduction route rather than raising tax exemption limit as the government wanted the benefit to go to only salaried class who honestly pay their taxes, Adhia told PTI in an interview.

Raising I-T exemption limit would have benefited all taxpayers, including 18.8 million individual business taxpayers who pay a total of Rs 480 billion (Rs 48,000 crore) tax or an average of Rs 25,753 each.

This compares to 18.9 million salaried individuals paying total tax Rs 1.44 trillion or Rs 76,306 each.

Under the Income Tax Act, income up to Rs 250,000 is exempt from any tax. With the standard deduction, this limit would go up to Rs 290,000 for salaried class and pensioners from April 1.

"You don't have to file any bills for receiving tax-free medical allowance. You will get full Rs 40,000 benefit in medical and conveyance without the bill," Adhia said.

Currently salaried individuals has to provide bills to avail tax benefits for medical expenses up to Rs 15,000 under the I-T Act. However, for transport expenses, no bill is required to be produced.

Adhia said if the Income Tax exemption slab would have been increased from Rs 250,000, then the benefit would have reached the businesses and professionals as well and about 40 -50 lakh people would have gone out of tax net.

"We are targeting only salaried class which needs more exemption. Also, 40-50 lakh (four to five million) people go out of tax net the moment we increase the exemption. So our tax net expansion agenda is also not followed. Secondly, if we have to give any more benefits, it should go to the salaried class now," said Adhia, who is also the revenue secretary.

Cost estimate for Modicare:

Modicare: New health insurance plan may cost Centre, states $1.71 bn a year

Prime Minister Narendra Modi's ambitious plan to provide health insurance to 100 million poor families would require Rs 110 billion ($1.71 billion) in federal and state funding each year, a government official told Reuters.

The National Health Protection Scheme, dubbed "Modicare" and announced in Thursday's Budget 2018, would provide 100 million families, or about 500 million poor people, with a health cover of Rs 500,000 ($7,850) for free treatment of serious ailments.

The government has estimated the premium for insuring each family would be about Rs 1,100 ($17.15), said the government official with direct knowledge of the matter.

Re: Indian Economy News & Discussion - Nov 27 2017

It is not so much a crash in real estate, but a fall in speculative and cash heavy transactions. Total demand has fallen because speculators are out, so prices have fallen. This has been exacerbated by the need to liquidate unsold inventory (almost all the real estate ads in the front pages of our papers are barter deals, where the paper gets property in lieu of payment). This is the best time for first time buyers to buy a house.

Similarly, gold demand has reduced. Both factors have led to money going into mutual funds. Within mutual funds, returns from debt mutual funds have fallen, leading to a disproportionate investment in Equity MF's.

The markets had short up in the month preceding the budget and some kind of correction was inevitable. I made a fair bit, selling in the week before the budget and buying now !

Similarly, gold demand has reduced. Both factors have led to money going into mutual funds. Within mutual funds, returns from debt mutual funds have fallen, leading to a disproportionate investment in Equity MF's.

The markets had short up in the month preceding the budget and some kind of correction was inevitable. I made a fair bit, selling in the week before the budget and buying now !

Re: Indian Economy News & Discussion - Nov 27 2017

It may seem that the salaried class is being supported by such logic, however the fact of the matter is that there was no real benefit to the salaried class from it. The SD replaces existing exemptions that salaried people were availing, so the real difference is ~Rs 5K of which an even more measly amount would be actual tax savings. And for people with more than 5 lakh in income that 'saving' is more than nullified by the cess that has been added on, so tax outgo for many salaried people is actually higher.Suraj wrote: So much for "GoI is against middle class salaried people!!" when in reality they carefully made a choice that benefits people properly.

That logic might be seen as benefiting the salaried class in the echo chamber that the govt and diehard supporters are in, but most salaried people would see it as a sick joke.

Re: Indian Economy News & Discussion - Nov 27 2017

Got these numbers from net. Someone can correct me if wrong.

I want to understand how GoI is fleecing salaried class.

With 5% rate for 2.9 to 5 lakhs. That is max tax paid is 10500 per ann.

For a person earning 5 lakhs/40k per month,10.5k or around 900 per month is "fleecing"?

Re: Indian Economy News & Discussion - Nov 27 2017

The salaried class benefits in more ways than one. They get an effective exemption to Rs.2.9 lakh. If Rs.40000 is too small potatoes for you, well you are quite well off indeed. Even in US, $700 is a good number the middle class would notice.Bart S wrote:It may seem that the salaried class is being supported by such logic, however the fact of the matter is that there was no real benefit to the salaried class from it. The SD replaces existing exemptions that salaried people were availing, so the real difference is ~Rs 5K of which an even more measly amount would be actual tax savings. And for people with more than 5 lakh in income that 'saving' is more than nullified by the cess that has been added on, so tax outgo for many salaried people is actually higher.Suraj wrote: So much for "GoI is against middle class salaried people!!" when in reality they carefully made a choice that benefits people properly.

That logic might be seen as benefiting the salaried class in the echo chamber that the govt and diehard supporters are in, but most salaried people would see it as a sick joke.

It's instructive to read Mr.Adhia's comments better. He speaks of how GoI knows about a difference in behavior between salaried and professional individuals. They want to do two things a) Get people to file returns b) take away the scope for falsification of records. By keeping the limit the same but using SD to increase effective exemption limit, people have to file to claim it.

By removing the scope for falsification of records, it takes away the mindset of approaching tax returns with a plan to swindle or lie to get exemptions. The middle class salaried people are hard done by this, seeing that their taxes are paid 'by the book' but others simply make up documents. It builds societal cohesion and trust in public institutions when people don't approach any interaction with dread or desire to fool someone.

But you're cynical enough to just complain but have no specific statement as to what exactly you think would be a good action here (as yensoy mentioned earlier). I'm sure there are a class of people who just do not care beyond 'I want a bigger tax cut , dammit! This is a sick joke! JUST 40K!' Sure you can rant about that, but please find another place to do it in.

Re: Indian Economy News & Discussion - Nov 27 2017

What 40K? As I mentioned 40K replaces existing exemptions that the salaried class already have, of Rs 34,200 (if you have worked in India as a salaried employee, you would know that practically everyone is already claiming and using this exemption already). So the actual increase in tax exemption is about 5K, which is further nullified by cess for people in the >5L bracket. So for someone with <5L salary, the maximum extra take-home is Rs 500 over a year, for someone in higher brackets, it might be even more negligible. The only real difference is that people wont have to go through the charade of saving and submitting their medical bills at the end of the year. In terms of putting disposable income in the hands of the salaried class, it is not NEW exemptions, but really a bit of jugglery.Suraj wrote:The salaried class benefits in more ways than one. They get an effective exemption to Rs.2.9 lakh. If Rs.40000 is too small potatoes for you, well you are quite well off indeed. Even in US, $700 is a good number the middle class would notice.Bart S wrote:

It may seem that the salaried class is being supported by such logic, however the fact of the matter is that there was no real benefit to the salaried class from it. The SD replaces existing exemptions that salaried people were availing, so the real difference is ~Rs 5K of which an even more measly amount would be actual tax savings. And for people with more than 5 lakh in income that 'saving' is more than nullified by the cess that has been added on, so tax outgo for many salaried people is actually higher.

That logic might be seen as benefiting the salaried class in the echo chamber that the govt and diehard supporters are in, but most salaried people would see it as a sick joke.

Not sure what your logic here is, maybe you are playing off on the technicality of 'standard deduction' vs 'exemption' but to the average salaried person that distinction means absolutely nothing.

I did not ask for a higher tax cut anywhere in my post. Was just pointing out that the so-called benefit to the salaried class amounts to nothing in reality and nobody is fooled by it. Of course you can continue believing in whatever you want.Suraj wrote:

But you're cynical enough to just complain but have no specific statement as to what exactly you think would be a good action here (as yensoy mentioned earlier). I'm sure there are a class of people who just do not care beyond 'I want a bigger tax cut , dammit! This is a sick joke! JUST 40K!' Sure you can rant about that, but please find another place to do it in.

And there have already been plenty of constructive suggestions on relief to the salaried class, most of which are quite well known, such as increasing the limit on ELSS type savings - something that is good for the economy as well as the individual.

Re: Indian Economy News & Discussion - Nov 27 2017

If the governments desire to engender trust in the system by eliminating a motive for people to fudge receipts, does not matter to you, then that is fine. They can not satisfy everyone, and some people are simply too cynical to care about an improvement that takes away a reason to fool the system .

There are plenty of posters who have previously complained about others gaming the system while the salaried class has nothing to gain for being honest contributors.

These changes drive people to file , and take away a motive to lie in the return . Though you may not care at all, there are plenty who do . I’ve lost count of how many have whined here ‘what’s he point of being honest when I can easily lie and get the same or better deal ?’

One of the most corrosive causes of social discord is the honest person having to see that others can get the same thing as them by lying . They may still be getting largely the same thing (since the sum of exemptions is close to the SD) but the motive to lie disappears, and those who previously just don’t file, now have to.

There are plenty of posters who have previously complained about others gaming the system while the salaried class has nothing to gain for being honest contributors.

These changes drive people to file , and take away a motive to lie in the return . Though you may not care at all, there are plenty who do . I’ve lost count of how many have whined here ‘what’s he point of being honest when I can easily lie and get the same or better deal ?’

One of the most corrosive causes of social discord is the honest person having to see that others can get the same thing as them by lying . They may still be getting largely the same thing (since the sum of exemptions is close to the SD) but the motive to lie disappears, and those who previously just don’t file, now have to.

Re: Indian Economy News & Discussion - Nov 27 2017

By doing away deduction like medical bills and bringing them under SD, goi is slowly simplifying the tax structure for salaried class.

For example in UK, salaried class don't file returns. It is known they have only one source of earnings and no deduction to declare. I see this happening in India as well. GOI can raise the limits accordingly and do away filing for salaried class.

For example in UK, salaried class don't file returns. It is known they have only one source of earnings and no deduction to declare. I see this happening in India as well. GOI can raise the limits accordingly and do away filing for salaried class.

-

Mort Walker

- BRF Oldie

- Posts: 10040

- Joined: 31 May 2004 11:31

- Location: The rings around Uranus.

Re: Indian Economy News & Discussion - Nov 27 2017

The UK is a poor example to follow as their taxation rates of individuals is very high. A better model would be the US federal tax system, and even with its problems, it still IMHO a good central/federal income tax system.nam wrote:By doing away deduction like medical bills and bringing them under SD, goi is slowly simplifying the tax structure for salaried class.

For example in UK, salaried class don't file returns. It is known they have only one source of earnings and no deduction to declare. I see this happening in India as well. GOI can raise the limits accordingly and do away filing for salaried class.

Re: Indian Economy News & Discussion - Nov 27 2017

Mort, you have to do better than that. Just opining B is better than A, won't do. You can't be bothered to list either the reasons or the problems ?

Re: Indian Economy News & Discussion - Nov 27 2017

I wish they'd gotten rid of lunch coupons and increased standard deduction to account for it. I see Sodexo's used as alternative currency in super markets. And the company charges atrocious rates.

Regarding the LTCG, I'm not really concerned about the markets crashing. The PE was anyway getting to scary levels, and it coming down to saner levels is quite welcome. And we need not be scared of FII's getting scared. There is and will be a steady stream of domestic investment flowing due to EPF and NPS subscribers.

However, I wish they'd tweaked the time periods though - 1 year is "long term" for equities, while it is 3 years for bonds/debt funds. Looks inverted to me. Would have loved 1 year for bonds and 3 years for equities - all with indexation.

That said, I will be affected. I used to do asset rebalancing without tax consequences till now. And it was quite easy to get out of non-performing equity MFs.

I read somewhere that always resonated with me: taxes are the price we pay to live in a civilized society.

Regarding the LTCG, I'm not really concerned about the markets crashing. The PE was anyway getting to scary levels, and it coming down to saner levels is quite welcome. And we need not be scared of FII's getting scared. There is and will be a steady stream of domestic investment flowing due to EPF and NPS subscribers.

However, I wish they'd tweaked the time periods though - 1 year is "long term" for equities, while it is 3 years for bonds/debt funds. Looks inverted to me. Would have loved 1 year for bonds and 3 years for equities - all with indexation.

That said, I will be affected. I used to do asset rebalancing without tax consequences till now. And it was quite easy to get out of non-performing equity MFs.

I read somewhere that always resonated with me: taxes are the price we pay to live in a civilized society.

Re: Indian Economy News & Discussion - Nov 27 2017

I've made a great deal of money from equity mutual funds in the last 20 years and have absolutely no problem with LTCG. Neither, do the several funds managers and International investors I interact with. it was long expected, particularly after tax shelters like Mauritius were closed. I would have liked the holding periods for all asset classes to be uniform.

The lunch coupon thing is something that can be abolished. (I've run a supermarket chain where people used Sodexho as an alternate currency. Large companies can have a subsidised canteen facility that is not part of an employees salary. The company pays for it. Where a canteen is not possible, a company may give coupons (transferring tax in lieu of coupons is taxable).

The lunch coupon thing is something that can be abolished. (I've run a supermarket chain where people used Sodexho as an alternate currency. Large companies can have a subsidised canteen facility that is not part of an employees salary. The company pays for it. Where a canteen is not possible, a company may give coupons (transferring tax in lieu of coupons is taxable).

-

Mort Walker

- BRF Oldie

- Posts: 10040

- Joined: 31 May 2004 11:31

- Location: The rings around Uranus.

Re: Indian Economy News & Discussion - Nov 27 2017

I think I did. The UK personal income tax system is not a good model for India as it taxes personal incomes at very high percentage rates in comparison to the US.Suraj wrote:Mort, you have to do better than that. Just opining B is better than A, won't do. You can't be bothered to list either the reasons or the problems ?

Now, if I went in to details about overall tax burden for a comparison, then I would be accused of derailing the thread.

Re: Indian Economy News & Discussion - Nov 27 2017

The article itself mentions that travel allowance of 19200/- was allowed without bills as standard deduction. Then how come tax free income effectively went from 250000/- to 290000/-..? I never understood why people can miss such simple things and still get to write articles. Best case scenario, it has gone up from 270000/- to 290000/-. Also, an average family would easily end up spending 10000/- per year on medical expenses which are not covered by any insurance like OPD/dentist etc. So really speaking the benefits are only increased by 5000-10000/-. No amount of sugar-coating can change that fact. I understand GOI's intentions to keep people under tax-net and its alright that they didn't increase base tax-free income. IMO best way to give benefit to Salaried persons would be to hike 80c limit significantly. That not only gives personal benefits but also the savings help Nation. GOI needs to come up with better ways of utilising this increasing savings. Especially when they are trying to block usual ways in RE and gold. Flooding share market it not a very optimal use. I think proposed debt ETF is a good step in that direction. Maybe GOI can borrow from people through such ETF and money invested in these ETF can be separately given tax incentives under 80c.Suraj wrote:An interesting insight into GoI's thinking - rather than simply raise the exemption limit, they preferred to use the standard deduction. Technically the exemption limit *has* risen - it's not Rs.2.9 lakh and not Rs.2.5 lakh. This is because SD is Rs.40K. However you cannot get it without filing tax returns, and cannot use - potentially falsified - claims for exemptions. This fits with the government's general attitude of not trying to coerce public and cause evasion, but rather set up a framework where it's better to be honest than not:

Budget: Why FM chose standard deduction and not raised tax exemption limitTax-free income for salaried class and pensioners has been raised to Rs 290,000 by way of a Rs 40,000 standard deduction and not by hiking exemption limit as the government wanted the benefit to accrue to honest taxpayers, Finance Secretary Hasmukh Adhia said on Friday.

The standard deduction, which replaces tax-free transport allowance of Rs 1,600 per month (Rs 19,200 a year) and medical expense reimbursement of Rs 15,000 per annum, will accrue automatically to salaried class and pensioners without the requirement of furnishing proof like medical bills that are in vogue now.

Finance Minister Arun Jaitley chose the standard deduction route rather than raising tax exemption limit as the government wanted the benefit to go to only salaried class who honestly pay their taxes, Adhia told PTI in an interview.

Raising I-T exemption limit would have benefited all taxpayers, including 18.8 million individual business taxpayers who pay a total of Rs 480 billion (Rs 48,000 crore) tax or an average of Rs 25,753 each.

This compares to 18.9 million salaried individuals paying total tax Rs 1.44 trillion or Rs 76,306 each.

Under the Income Tax Act, income up to Rs 250,000 is exempt from any tax. With the standard deduction, this limit would go up to Rs 290,000 for salaried class and pensioners from April 1.

Interesting fact - Average salaried person pays 76000/- Tax while average self-employed person pays only 25000/-. Same number of tax payers, but three times more tax received from salaried persons.

Re: Indian Economy News & Discussion - Nov 27 2017

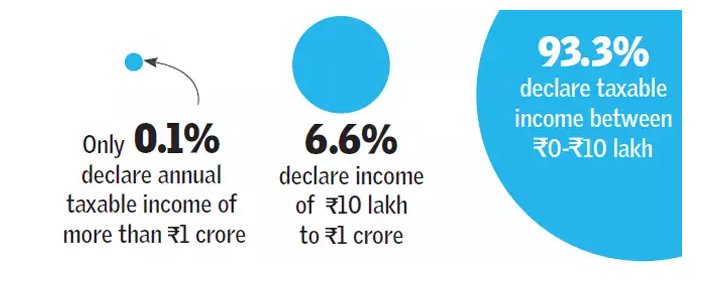

To pay 76k, average salary must be 8 lakhs without considering the various deduction!JayS wrote:

Interesting fact - Average salaried person pays 76000/- Tax while average self-employed person pays only 25000/-. Same number of tax payers, but three times more tax received from salaried persons.

Obvious that majority will be in the lower bracket (with 5 lakhs). Max they would pays 10.5k. To get a average of 76k, the upper bracket people must be paying disproportionate amount of taxes.

-

Rahulsidhu

- BRFite

- Posts: 165

- Joined: 22 Mar 2017 06:19

Re: Indian Economy News & Discussion - Nov 27 2017

Neelkanth Mishra, who in my opinion is one of the best analysts of the Indian economy, makes some points about the budget and govt. spending:

https://www.bloombergquint.com/union-bu ... ed-economy

* There seems to be a two-speed economy, where the well-off are doing well but there is distress in the rural and poor parts.

* It is incumbent on the govt. to support the latter, but it is not a trivial matter for the govt. to spend the money *productively*, given poor state capacity.

* So, an indirect way is to force food prices higher (via higher MSPs) which acts like a tax on the urban population and a transfer to the rural, food-producing parts.

* However, he thinks this would not make a huge impact, as there is a structural food surplus in the economy. There is some movement towards solving this issue (promoting exports, food processing etc.) but it will take time.

https://www.bloombergquint.com/union-bu ... ed-economy

* There seems to be a two-speed economy, where the well-off are doing well but there is distress in the rural and poor parts.

* It is incumbent on the govt. to support the latter, but it is not a trivial matter for the govt. to spend the money *productively*, given poor state capacity.

* So, an indirect way is to force food prices higher (via higher MSPs) which acts like a tax on the urban population and a transfer to the rural, food-producing parts.

* However, he thinks this would not make a huge impact, as there is a structural food surplus in the economy. There is some movement towards solving this issue (promoting exports, food processing etc.) but it will take time.

Re: Indian Economy News & Discussion - Nov 27 2017

Jetli says that in 4 out of 5 budgets that he has presented he has invariably given relief to the salaried class. I really don't know what brahmastra, these whiners expect. These are the buggers who mostly do not vote but without fail, come election day, bermuda clad + snazzy goggles on, wife + kids in tow, head out of the city in droves, for a holiday.JayS wrote:The article itself mentions that travel allowance of 19200/- was allowed without bills as standard deduction. Then how come tax free income effectively went from 250000/- to 290000/-..? I never understood why people can miss such simple things and still get to write articles. Best case scenario, it has gone up from 270000/- to 290000/-. Also, an average family would easily end up spending 10000/- per year on medical expenses which are not covered by any insurance like OPD/dentist etc. So really speaking the benefits are only increased by 5000-10000/-. No amount of sugar-coating can change that fact. I understand GOI's intentions to keep people under tax-net and its alright that they didn't increase base tax-free income. IMO best way to give benefit to Salaried persons would be to hike 80c limit significantly. That not only gives personal benefits but also the savings help Nation. GOI needs to come up with better ways of utilising this increasing savings. Especially when they are trying to block usual ways in RE and gold. Flooding share market it not a very optimal use. I think proposed debt ETF is a good step in that direction. Maybe GOI can borrow from people through such ETF and money invested in these ETF can be separately given tax incentives under 80c.Suraj wrote:An interesting insight into GoI's thinking - rather than simply raise the exemption limit, they preferred to use the standard deduction. Technically the exemption limit *has* risen - it's not Rs.2.9 lakh and not Rs.2.5 lakh. This is because SD is Rs.40K. However you cannot get it without filing tax returns, and cannot use - potentially falsified - claims for exemptions. This fits with the government's general attitude of not trying to coerce public and cause evasion, but rather set up a framework where it's better to be honest than not:

Budget: Why FM chose standard deduction and not raised tax exemption limit

Interesting fact - Average salaried person pays 76000/- Tax while average self-employed person pays only 25000/-. Same number of tax payers, but three times more tax received from salaried persons.

Its the bribed slum dwellers who vote and make all the difference in the absence of these pampered educated lot. Our corporator visits often and does what the entitled residents vociferously demand but come election day, the bleddy buggers will not stir out of their airconditioned homes to go vote for him.

Re: Indian Economy News & Discussion - Nov 27 2017

Personally, coming from a family with business, converting to a salaried person and trying to launch a start-up which has failed., I really find the whining of how much tax a salaried person pays more than a self-employed annoying.JayS wrote:Interesting fact - Average salaried person pays 76000/- Tax while average self-employed person pays only 25000/-. Same number of tax payers, but three times more tax received from salaried persons.

A self-employed person is basically an entrepreneur employing at least one. Several self-employed single person enterprises are actually run by two, the "housewife" runs the seed funding, accounting, inventory management, logistics as well. Talk to a pakoda seller and you will get an idea.

Running an enterprise has its risks. At one point my business employed several and at some point we had to run the family for a week on just Rs. 10. Yes, that is almost a cent per day. A Rs. 400/- contract at the end of the week was celebrated by few pieces of gur.

Indians have really lost the entrepreneur genes. This can be seen from the very fact that even a little subsidy to risk-taking is frowned upon.

I am disappointed with the budget since it has nothing for entrepreneurs. A farmer gets his loans written off. A salaried person gets PPF and on top of it guaranteed growth. Whatever little an entrepreneur gets, even a pakoda seller, as tax break is frowned upon! More needs to be done for the self-employed.

Here are some stories of entrepreneurs who could make their businesses grow:

Chandubhai Virani and his brothers started selling chips in a local cinema in Rajkot, and today their company Balaji Wafers has a 65% market share in five states, holding out against local and MNC competitors. They first tried the fertiliser business and then running a hostel, before settling on chips and snacks. Adherence to quality helped them get early customers, followed by importing Japanese machines and taking loans to grow their factory.

Hence this "debate" about tax breaks to self-employed is useless, particularly when without successes of self-employed, there would be no salaried section in the first place!Sriram Subramanya grew up in Pondicherry and started work in the auto ancillary business, with postings in Chennai and Bangalore and training in Germany. He later moved into the desktop publishing business, migrating from print designs to digital content. Sriram’s wife had to sell her jewellery at one stage to fund the growth of the company, Integra. A tight focus on quality, precision and business culture helped grow the company into one of the world’s Top 10 in publishing BPO. The company also won the Gender Inclusivity Award from NASSCOM.

Re: Indian Economy News & Discussion - Nov 27 2017

I merely pointed out an interesting fact. If you think that was to whine against self employed personals and the reply based on that, you are barking up the wrong tree my friend. FYI, I have worked in startup too, without salary for months, and when money was there it wasnt even enough to be taxable..LOLdisha wrote:Personally, coming from a family with business, converting to a salaried person and trying to launch a start-up which has failed., I really find the whining of how much tax a salaried person pays more than a self-employed annoying.JayS wrote:Interesting fact - Average salaried person pays 76000/- Tax while average self-employed person pays only 25000/-. Same number of tax payers, but three times more tax received from salaried persons.

A self-employed person is basically an entrepreneur employing at least one. Several self-employed single person enterprises are actually run by two, the "housewife" runs the seed funding, accounting, inventory management, logistics as well. Talk to a pakoda seller and you will get an idea.

Running an enterprise has its risks. At one point my business employed several and at some point we had to run the family for a week on just Rs. 10. Yes, that is almost a cent per day. A Rs. 400/- contract at the end of the week was celebrated by few pieces of gur.

Indians have really lost the entrepreneur genes. This can be seen from the very fact that even a little subsidy to risk-taking is frowned upon.

I am disappointed with the budget since it has nothing for entrepreneurs. A farmer gets his loans written off. A salaried person gets PPF and on top of it guaranteed growth. Whatever little an entrepreneur gets, even a pakoda seller, as tax break is frowned upon! More needs to be done for the self-employed.

Here are some stories of entrepreneurs who could make their businesses grow:

Chandubhai Virani and his brothers started selling chips in a local cinema in Rajkot, and today their company Balaji Wafers has a 65% market share in five states, holding out against local and MNC competitors. They first tried the fertiliser business and then running a hostel, before settling on chips and snacks. Adherence to quality helped them get early customers, followed by importing Japanese machines and taking loans to grow their factory.Hence this "debate" about tax breaks to self-employed is useless, particularly when without successes of self-employed, there would be no salaried section in the first place!Sriram Subramanya grew up in Pondicherry and started work in the auto ancillary business, with postings in Chennai and Bangalore and training in Germany. He later moved into the desktop publishing business, migrating from print designs to digital content. Sriram’s wife had to sell her jewellery at one stage to fund the growth of the company, Integra. A tight focus on quality, precision and business culture helped grow the company into one of the world’s Top 10 in publishing BPO. The company also won the Gender Inclusivity Award from NASSCOM.

Re: Indian Economy News & Discussion - Nov 27 2017

Hope thats not directed to me. But I agree mostly. A whole lot of educated fools in India only knows how to whine, but cannot do simple civic duties.chetak wrote:Jetli says that in 4 out of 5 budgets that he has presented he has invariably given relief to the salaried class. I really don't know what brahmastra, these whiners expect. These are the buggers who mostly do not vote but without fail, come election day, bermuda clad + snazzy goggles on, wife + kids in tow, head out of the city in droves, for a holiday.JayS wrote:

The article itself mentions that travel allowance of 19200/- was allowed without bills as standard deduction. Then how come tax free income effectively went from 250000/- to 290000/-..? I never understood why people can miss such simple things and still get to write articles. Best case scenario, it has gone up from 270000/- to 290000/-. Also, an average family would easily end up spending 10000/- per year on medical expenses which are not covered by any insurance like OPD/dentist etc. So really speaking the benefits are only increased by 5000-10000/-. No amount of sugar-coating can change that fact. I understand GOI's intentions to keep people under tax-net and its alright that they didn't increase base tax-free income. IMO best way to give benefit to Salaried persons would be to hike 80c limit significantly. That not only gives personal benefits but also the savings help Nation. GOI needs to come up with better ways of utilising this increasing savings. Especially when they are trying to block usual ways in RE and gold. Flooding share market it not a very optimal use. I think proposed debt ETF is a good step in that direction. Maybe GOI can borrow from people through such ETF and money invested in these ETF can be separately given tax incentives under 80c.

Interesting fact - Average salaried person pays 76000/- Tax while average self-employed person pays only 25000/-. Same number of tax payers, but three times more tax received from salaried persons.

Its the bribed slum dwellers who vote and make all the difference in the absence of these pampered educated lot. Our corporator visits often and does what the entitled residents vociferously demand but come election day, the bleddy buggers will not stir out of their airconditioned homes to go vote for him.

Re: Indian Economy News & Discussion - Nov 27 2017

Calm down.JayS wrote:Hope thats not directed to me. But I agree mostly. A whole lot of educated fools in India only knows how to whine, but cannot do simple civic duties.chetak wrote:

Jetli says that in 4 out of 5 budgets that he has presented he has invariably given relief to the salaried class. I really don't know what brahmastra, these whiners expect. These are the buggers who mostly do not vote but without fail, come election day, bermuda clad + snazzy goggles on, wife + kids in tow, head out of the city in droves, for a holiday.

Its the bribed slum dwellers who vote and make all the difference in the absence of these pampered educated lot. Our corporator visits often and does what the entitled residents vociferously demand but come election day, the bleddy buggers will not stir out of their airconditioned homes to go vote for him.

i don't know who or what you are. How can it be directed at you??

Your conclusion is unjustified.

Re: Indian Economy News & Discussion - Nov 27 2017

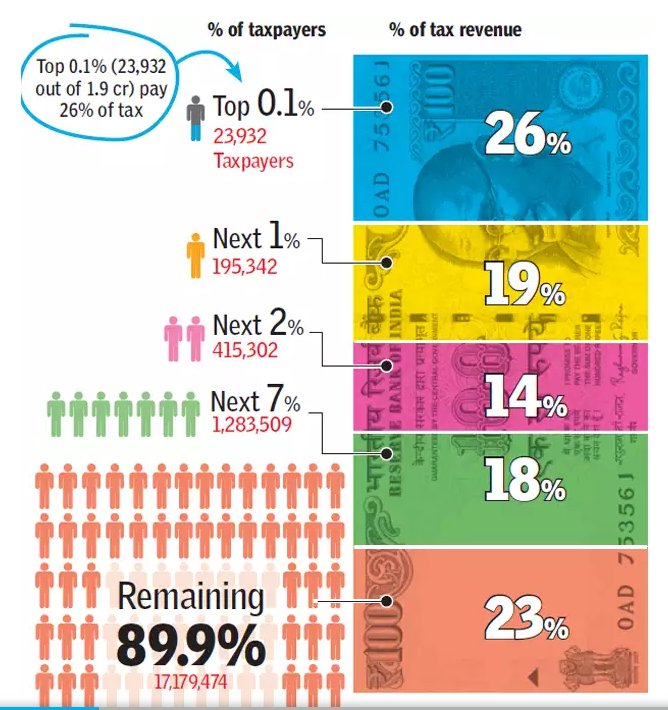

Almost exactly a year ago, I posted this summary of tax breakdown data I found (for fiscal year 2013-14 I believe - the newest I could find). Of course, at that time, the same "I didn't get a tax cut! Boo hoo!'" was going on . The data is instructive, mainly for the general breakdown of taxpayer subgroups and types. A lot will have changed due to much greater numbers now, plus GST:

link

link

Suraj wrote:Another piece of information, regarding the anger about few tax sops above 10L (or other brackets). Here's a breakdown of assessee count and returned income:

The 2-5L bracket constitutes 35% of taxpayers, but only 8.5% of revenue. GoI expect to make it up from the highest tax slabs. The other major middle class brackets: 5-10L constitutes <10% of assesses, and 10L-1CR are <5% of assessees, but the latter i particular accounts for almost half of taxes.

Now type of IT paid:

Among individuals, salary constitutes over half of declared income. Most of the rest comes from business income. LTCG/STCG are practically negligible, as are house/property income. This is unlike the US or other major developed economies where the income of the wealthy, who pay most of the income taxes, comes mostly from business income + capital gains. Here's US IT breakdown.

As the data above shows, it's not even the case that 'only 30 million people in India pay income tax'. In fact, that's the number of people filing returns. Out of that, half pay taxes. 50% of income tax is paid by the 13 lakh people with declared incomes of Rs.10L to 1CR . Another 16% is paid by the 33K people with incomes of 1-5CR, and only 2700 people clain incomes above 5CR. Do any of these numbers sound realistic ? Until more undeclared income is unearthed by DeMo and the >1CR brackets gain many more members - remember IT just sent notices to 18 lakh people for undeclared deposits of 4.17 lakh crore - GoI doesn't have a lot of hands to play. I hope DeMo changes the tax brackets to such an extent that they can easily provide a significant tax benefit to the upto 10L brackets.

Source: Making tax data public will facilitate policymaking and administration

Re: Indian Economy News & Discussion - Nov 27 2017

If you scratch the surface of anger and lying campaign, the real cause of anger is Real estate getting stuck in limbo.

99% of people have no idea on NPA/Bank crisis or Debt/Deficit or Forex. No one really cares if NE developed. It is their RE bubble that burst.

OTOH, Govt could have changed the game by increasing minimum tax base to 5 L or even 7.5 L. Could have helped a lot of young minds. Hope they have a good tax reform plan since they set up committee.

99% of people have no idea on NPA/Bank crisis or Debt/Deficit or Forex. No one really cares if NE developed. It is their RE bubble that burst.

OTOH, Govt could have changed the game by increasing minimum tax base to 5 L or even 7.5 L. Could have helped a lot of young minds. Hope they have a good tax reform plan since they set up committee.

Re: Indian Economy News & Discussion - Nov 27 2017

Deleted

Last edited by Suraj on 05 Feb 2018 06:42, edited 1 time in total.

Reason: Please take CTs elsewhere.

Reason: Please take CTs elsewhere.

Re: Indian Economy News & Discussion - Nov 27 2017

people don't to pay taxes, companies don't want to pay taxes, all want roads, water, power, security, fantastic infrastructure, free medical health schemes, increased pay and perks and what not.vijayk wrote:If you scratch the surface of anger and lying campaign, the real cause of anger is Real estate getting stuck in limbo.

99% of people have no idea on NPA/Bank crisis or Debt/Deficit or Forex. No one really cares if NE developed. It is their RE bubble that burst.

OTOH, Govt could have changed the game by increasing minimum tax base to 5 L or even 7.5 L. Could have helped a lot of young minds. Hope they have a good tax reform plan since they set up committee.

These very same people consider it beneath their dignity to stand in line at a polling booth and do their constitutional duty, maybe once or twice in a five year block.

Vote, strengthen the system, give someone, anyone, a clear majority and then ask for systemic changes.

Instead, every joker and his uncle want, nay demand hot, tasty, free, banna banna halwa delivered to their homes so that they can eat it as they please.

From where will Modi ever get the money to satisfy all this entitled greed??

Re: Indian Economy News & Discussion - Nov 27 2017

For every person worried about real estate stuck in limbo, there must be 10 others who are happy that they could finally afford something for themselves now.vijayk wrote:If you scratch the surface of anger and lying campaign, the real cause of anger is Real estate getting stuck in limbo.

Re: Indian Economy News & Discussion - Nov 27 2017

For most people who come to see a house/flat on the pretext of "renting", the real intention seems to be to buy the property but at dirt cheap prices which some moron has told them that is the way to go as owners are desperate to sell in this market.hanumadu wrote:For every person worried about real estate stuck in limbo, there must be 10 others who are happy that they could finally afford something for themselves now.vijayk wrote:If you scratch the surface of anger and lying campaign, the real cause of anger is Real estate getting stuck in limbo.

Re: Indian Economy News & Discussion - Nov 27 2017

Destruction of Realestate Ponzi scheme is the best thing that happened to India for a long time. Now people can at least dream of buying a house of their own.

As for as IT is concerned, my view is that tax payment is not an issue. The issue is non-payment of tax by many who have taxable income and cheat the system. This causes a lot of heartburn for salaried class. In respect of self-employed persons being critical etc., while I agree with that view it does not mean that they can be allowed to violate the tax laws with impunity. Either there should be some proper tax brakes, or they shall be forced to pay the tax as per law. If a large part of success mantra for self-employment is not paying IT as per law, then it is a terrible situation.

As for as IT is concerned, my view is that tax payment is not an issue. The issue is non-payment of tax by many who have taxable income and cheat the system. This causes a lot of heartburn for salaried class. In respect of self-employed persons being critical etc., while I agree with that view it does not mean that they can be allowed to violate the tax laws with impunity. Either there should be some proper tax brakes, or they shall be forced to pay the tax as per law. If a large part of success mantra for self-employment is not paying IT as per law, then it is a terrible situation.

Re: Indian Economy News & Discussion - Nov 27 2017

BAG1] BUDGET AT A GLANCE 2018-2019 http://www.indiabudget.gov.in/ub2018-19/bag/bag1.pdf

BAG2]Deficit Statistics http://www.indiabudget.gov.in/ub2018-19/bag/bag2.pdf

BAG3] TRANSFER OF RESOURCES TO STATES AND UNION TERRITORIES WITH LEGISLATURE

http://www.indiabudget.gov.in/ub2018-19/bag/bag3.pdf

BAG4] BUDGET PROFILE http://www.indiabudget.gov.in/ub2018-19/bag/bag4.pdf

BAG5] Receipts http://www.indiabudget.gov.in/ub2018-19/bag/bag5.pdf

BAG6] Expenditure of Government of India http://www.indiabudget.gov.in/ub2018-19/bag/bag6.pdf

BAG7] Outlay on Major Schemes http://www.indiabudget.gov.in/ub2018-19/bag/bag7.pdf

BAG2]Deficit Statistics http://www.indiabudget.gov.in/ub2018-19/bag/bag2.pdf

BAG3] TRANSFER OF RESOURCES TO STATES AND UNION TERRITORIES WITH LEGISLATURE

http://www.indiabudget.gov.in/ub2018-19/bag/bag3.pdf

BAG4] BUDGET PROFILE http://www.indiabudget.gov.in/ub2018-19/bag/bag4.pdf

BAG5] Receipts http://www.indiabudget.gov.in/ub2018-19/bag/bag5.pdf

BAG6] Expenditure of Government of India http://www.indiabudget.gov.in/ub2018-19/bag/bag6.pdf

BAG7] Outlay on Major Schemes http://www.indiabudget.gov.in/ub2018-19/bag/bag7.pdf

Re: Indian Economy News & Discussion - Nov 27 2017

I am really curious to know if young people earning 5lakhs find Rs 900 per month a burden? That is the max they pay.vijayk wrote: OTOH, Govt could have changed the game by increasing minimum tax base to 5 L or even 7.5 L. Could have helped a lot of young minds. Hope they have a good tax reform plan since they set up committee.

I presume this is the lot which does not think twice before getting the latest iphone.