OBOR, Chinese Strategy and Implications

Re: OBOR, Chinese Strategy and Implications

https://timesofindia.indiatimes.com/ind ... 146996.cms

"Although both countries back down, China has quietly resumed its activities in Doklam and neither Bhutan nor India has sought to dissuade it.

"Although both countries back down, China has quietly resumed its activities in Doklam and neither Bhutan nor India has sought to dissuade it.

Re: OBOR, Chinese Strategy and Implications

Hmm US trying to stoke fires, China has been on Doklam for some some time, but putting a road through our land to Jamperi ridge has been stopped.

Re: OBOR, Chinese Strategy and Implications

Quite so. Hell how did the Chinese build a road right up to the Indian post without any "activity" on the plateau?

India did not object to their "activities" till their road started to cross in-front of the Indian post. America seems to want to fight the Chinese to the last Indian.

India did not object to their "activities" till their road started to cross in-front of the Indian post. America seems to want to fight the Chinese to the last Indian.

Re: OBOR, Chinese Strategy and Implications

rather the US wants India to fight their war with their weapons that India pays for.. basically having the cake and eating it toopankajs wrote:Quite so. Hell, how did the Chinese build a road right up to the Indian post without any "activity" on the plateau?

India did not object to their "activities" till their road started to cross in front of the Indian post. America seems to want to fight the Chinese to the last Indian.

The whole of America vs China is getting polarized all around the world... there seems no middle ground; either you are with us or against us is the American motto. Rather the white supremacist America and oddly enough Russia against the rest .. its fits into Trump's detente with Putin (or is it )

And India is see-sawing in between, frankly on a very thin ledge that gets thinner every day; it would be a sad day if India has to go in for a coalition government in 2019

Re: OBOR, Chinese Strategy and Implications

http://www.asahi.com/ajw/articles/AJ201807310022.html

Payment due: Pacific islands in the red as debts to China mount

Payment due: Pacific islands in the red as debts to China mount

The initial roughly $65 million (7 billion yen) in Chinese lending now exceeds $115 million--almost one-third of Tonga's annual gross domestic product--as interest mounted and the government took out a second loan for road development across the country.

An onerous principal repayment schedule starts in September that will double Tonga's debt financing bill has left the government scrambling.

Tonga's precarious position is indicative of a wider debt-fueled hangover hitting small Pacific economies, stoking fears the region risks falling into financial distress and becoming more susceptible to diplomatic pressure from Beijing.

Re: OBOR, Chinese Strategy and Implications

One more wicket down and the list is getting longer by the day: Vanuatu, Djibouti, Maldives, Sri Lanka, Greece, Tonga, Pakistan (of course)pankajs wrote:http://www.asahi.com/ajw/articles/AJ201807310022.html

Payment due: Pacific islands in the red as debts to China mount

Re: OBOR, Chinese Strategy and Implications

Add Montenegro to that list.SSridhar wrote:One more wicket down and the list is getting longer by the day: Vanuatu, Djibouti, Maldives, Sri Lanka, Greece, Tonga, Pakistan (of course)pankajs wrote:http://www.asahi.com/ajw/articles/AJ201807310022.html

Payment due: Pacific islands in the red as debts to China mount

Re: OBOR, Chinese Strategy and Implications

^^^its not wicket down, it's no ball and free hit.

Re: OBOR, Chinese Strategy and Implications

A rare rebuke for Xi Jinping as China’s troubles pile up - NYT

Xu is one brave guy, He has hit all the raw nerves. His invocation of 'Heaven' in the end, so entrenched in Chinese psyche and has played a central role for 2500 years, is rather noteworthy.China’s top leader, Xi Jinping, seemed indomitable when lawmakers abolished a term limit on his power early this year. But months later, China has been struck by economic headwinds, a vaccine scandal and trade battles with Washington, emboldening critics in Beijing who are questioning Xi’s sweeping control.

Censorship and punishment have muted dissent in China since Xi came to power. So Xu Zhangrun, a law professor at Tsinghua University in Beijing, took a big risk last week when he delivered the fiercest denunciation yet from a Chinese academic of Xi’s hard-line policies, revival of communist orthodoxies and adulatory propaganda image.

“People nationwide, including the entire bureaucratic elite, feel once more lost in uncertainty about the direction of the country and about their own personal security, and the rising anxiety has spread into a degree of panic throughout society,” Xu wrote in an essay that appeared on the website of Unirule Institute of Economics, an independent think tank in Beijing that was recently forced out of its office.

“It’s very bold,” Jiang Hao, a researcher at the institute, said in an interview. “Many intellectuals might be thinking the same, but they don’t dare speak out.”

Xu urged Chinese lawmakers to reverse the vote in March that abolished a two-term limit on Xi’s tenure as president. That near-unanimous vote of the party-dominated legislature opened the way for Xi, in office since late 2012, to retain power for another decade or longer as president, Communist Party leader and chairman of the military.

The essay appeared as a burst of troubles has given a focus for criticisms of Xi’s strongman ways, and it has spread through Chinese social media, despite censors.

Other less damning criticisms, petitions and jibes about Xi’s policies have also spread, often shared through WeChat, a popular social media service. But this long, erudite jeremiad from a prestigious professor has carried more weight.

“Xu has written a challenge from the cultural heart of China to the political heart of the Communist Party,” said Geremie R. Barmé, an Australian scholar of China who is translating Xu’s essay. “Its content and culturally powerful style will resonate deeply throughout the Chinese party-state system, as well as in the society more broadly.”

Over recent months, China has been grappling with a growing trade dispute with the United States. Some Chinese foreign policy experts have suggested that the trade fights with the Trump administration could have been contained if Beijing had been more flexible and moved faster to douse triumphalist statements about its goals.

“China should adopt a lower profile in dealing with international issues,” Jia Qingguo, a professor of international relations at Peking University, said at a recent forum in Beijing. “Don’t create this atmosphere that we’re about to supplant the American model.”

Revelations about faulty vaccines given to hundreds of thousands of children have ignited public anger and protests, especially because the government promised to clean up after similar previous scandals.

On Tuesday, Xi convened a meeting of the Politburo — a 25-member party leadership council — that warned of economic tests while promising to keep growth steady.

The economy was sound but “faces some new issues and challenges, and the external environment has undergone clear changes,” the meeting concluded, according to an official summary from Xinhua, the state-run news agency.

The undercurrent of discontent does not pose any immediate threat to Xi’s hold on power. He and the Communist Party remain firmly in control. And many Chinese people endorse his tough campaign against corruption and his vows to build China into a great power that will not compromise over territorial disputes.

But party insiders and foreign experts said misgivings about Xi’s hard-line policies appeared to be building among intellectuals, liberal-minded former officials and middle-class people after the recent misfires. A former official who spoke on condition of anonymity said that many former colleagues had shared Xu’s essay.

Over time, he and others said, such criticism could coalesce into deeper disaffection that erodes Xi’s authority and gives other senior officials more courage to question his decisions.

“In recent weeks, the signs of a nascent pushback against Xi’s absolute power have started to emerge,” Richard McGregor, a former journalist in China who is now a senior fellow at the Lowy Institute in Sydney, Australia, wrote recently.

“The harder question then becomes what that actually means in practice,” McGregor said in emailed answers to questions. “If it means heightened infighting in elite politics, it might result in policy paralysis and instability, rather than just a freer and more open debate.”

In his essay, Xu challenged another political taboo, urging the government to overturn its condemnation of the pro-democracy, anti-corruption protests that erupted in Chinese cities in 1989 and ended after the Tiananmen Square crackdown. Next year is the 30th anniversary of that bloody upheaval and promises to be a tense time for the government.

“As things continue in this direction, the question arises whether reform and opening up will come to a halt and totalitarian rule will return,” Xu said in the essay, written in a densely classical style speckled with recondite phrases and historical allusions. “At this time, no other anxiety weighs most heavily on most people.”

Xu did not answer messages and phone calls, and he is listed as being a visiting scholar in Japan. He may face censure back in Beijing. Some opponents of Xi have been detained and imprisoned for online protests, but the authorities may act more cautiously against an academic from a major university.

Intellectuals and ex-officials skeptical of Xi’s agenda are also likely to seize on the 40th anniversary of a party meeting in 1978 that is now seen as inaugurating Deng Xiaoping’s era of “reform and opening up.”

Party leaders still revere Deng, even though Xi has jettisoned some of his pragmatic policies. But more liberal-minded former officials have also embraced Deng as an icon, casting him as a more moderate leader to highlight the swaggering overreach they say Xi has brought.

“Even though the reality is much more complex, Deng’s popular image often boils down to one word: reform,” said Julian Gewirtz, a scholar at the Weatherhead Center for International Affairs at Harvard University who is studying China’s changes in the 1980s.

“Today Xi is clearly parting ways with elements of what Deng supported, such as more open intellectual debate, greater separation of party and state, and ‘biding time’ in international relations,” he said. “And for critics of Xi, Deng may be a useful symbolic weapon because of his stature as a particular type of reformer.”

Some signs suggest that the trade tensions and domestic criticisms may have already prompted Xi’s government to cool the public tone. A series of articles in The People’s Daily scornfully mocked Chinese scholars and pundits who have claimed that China has surpassed the United States as a technological power and warned the news media to curb cocky boasting.

“It’s too soon to see if this type of criticism could constrain the leadership, but it is interesting that there has been some recalibration of the foreign policy rhetoric,” said Susan Shirk, the chairwoman of the 21st Century China Center at the University of California, San Diego, and a former deputy assistant secretary of state. That, she said, “suggests that there is some ability to self-correct, at least on the rhetorical level.”

Others see signs that the Communist Party has been cooling its glorification of Xi. In his essay, Xu said that the propaganda echoed the cult of personality that surrounded Mao Zedong, and he called for “slamming on the brakes.”

“The propaganda system has been put on the defensive for contributing to the cult and also messing up the messaging concerning the U.S.-China trade conflict,” said Dali Yang, a political scientist at the University of Chicago who studies Chinese politics.

But speculation shared among some of Xi’s critics in Beijing and on the internet that unhappy party officials and elders had forced a full-scale retreat from the adulation appears to be unfounded.

Xi’s name has appeared on the front page of the People’s Daily as often as ever; the frequency of appearances in July was not markedly down, according to counts made by Qian Gang, a media expert at the University of Hong Kong. As well, a party campaign to study Xi’s years as a youth in Liangjiahe Village in northwest China has continued to inspire rhapsodic reports.

Xu’s future may now become a test of whether Xi will display greater tolerance of criticism.

“I have said what I must and am in the hands of fate,” he wrote at the end of his essay. “Heaven will decide whether we rise or fall.”

Re: OBOR, Chinese Strategy and Implications

TK, that's from a batsman's PoV. The free hit still needs to be converted into a maximum. But, I am a bowler and I have already taken a wicket. It is in my bag.TKiran wrote:^^^its not wicket down, it's no ball and free hit.

OBOR, Chinese Strategy and Implications

X Posted on the Neutering & Defanging Chinese Threat (15-11-2017) Thread

After US announces big Indo-Pacific investment, Chinese media warns it against 'imperialism', 'power games'

NEW DELHI: Chinese language state media has been ramping up its rhetoric towards the US’s new India-Pacific technique saying “imperialism is deeply rooted in Western nations’ political pondering” so Washington higher watch out to “not interact in energy video games with (its) large funding” within the area.

In an editorial a day after the US introduced $113 million in new infrastructure initiatives within the Indo-Pacific area, the hardline Chinese language state-backed publication International Occasions, additionally crowed that this US funding would not in any respect have an effect on Beijing’s personal One Belt One Road (OBOR) initiatives within the geopolitically strategic area.

“Washington might hope to disrupt the Belt and Highway initiative, however it’s extremely unlikely the US’ $113 million funding initiative will collide with the Belt and Highway initiative,” mentioned an editorial within the International Occasions, which is run by Communist Get together of China (CPC) mouthpiece Folks’s Every day.

China’s media has additionally been concentrating on India – an enormous a part of the US’s Indo-Pacific imaginative and prescient – saying that for New Delhi, “any advantages from this technique could also be drastically outweighed by the prices” when it comes to improvement. So, India, too, must be cautious, mentioned the publication final week.

The US is after all pitching to counterbalance China’s OBOR initiatives, which Washington sees as making an attempt to swamp the area. In reality, the entire cause the US now refers back to the area as Indo-Pacific, reasonably than Asia-Pacific, is to undertaking its counter-front – with India, Japan and Australia – as equal to that of China’s juggernaut.

However what are the US and the West so fearful about, wonders the Chinese language editorial. That, it believes, has one thing to do with what it calls the West’s imperialist tendencies.

“What’s necessary is that China has not interfered in any nation’s politics nor sought to increase its sphere of affect. These nations take part within the initiative to increase their overseas cooperation. What are the US and different Western nations fearful about? The primary cause could also be that imperialism is deeply rooted in Western nations’ political pondering they usually perceive the period otherwise from rising nations,” the Chinese language editorial posits.

It mentioned that in areas aside from the West main powers are impartial from one another.

“The Shanghai Cooperation Group and BRICS are clearly extra equal than NATO and the G7. The consideration for rising nations is mutual improvement and cooperation, not conquest. The Belt and Highway’s unique intention was not an expedition, however for co-prosperity,” provides the editorial.

The Chinese media outlet, mentioned in one other article, that the US, like some other nation “is welcome” to spend money on the area.

“Any nation, the US included, is welcome to spend money on infrastructure initiatives within the Indo-Pacific area, however improvement applications needs to be vigilant to mounting strategic confrontation amongst Indo-Pacific nations,” it mentioned.

The article graciously mentioned that US funding within the Indo-Pacific area would afford US corporations extra alternatives even when it declines to work with China.

“Benign competitors will probably be conducive to improvement within the Indo-Pacific area, however we do not need any improvement program to evolve right into a strategic recreation amongst huge powers,” mentioned the editorial.

.Cheers

After US announces big Indo-Pacific investment, Chinese media warns it against 'imperialism', 'power games'

NEW DELHI: Chinese language state media has been ramping up its rhetoric towards the US’s new India-Pacific technique saying “imperialism is deeply rooted in Western nations’ political pondering” so Washington higher watch out to “not interact in energy video games with (its) large funding” within the area.

In an editorial a day after the US introduced $113 million in new infrastructure initiatives within the Indo-Pacific area, the hardline Chinese language state-backed publication International Occasions, additionally crowed that this US funding would not in any respect have an effect on Beijing’s personal One Belt One Road (OBOR) initiatives within the geopolitically strategic area.

“Washington might hope to disrupt the Belt and Highway initiative, however it’s extremely unlikely the US’ $113 million funding initiative will collide with the Belt and Highway initiative,” mentioned an editorial within the International Occasions, which is run by Communist Get together of China (CPC) mouthpiece Folks’s Every day.

China’s media has additionally been concentrating on India – an enormous a part of the US’s Indo-Pacific imaginative and prescient – saying that for New Delhi, “any advantages from this technique could also be drastically outweighed by the prices” when it comes to improvement. So, India, too, must be cautious, mentioned the publication final week.

The US is after all pitching to counterbalance China’s OBOR initiatives, which Washington sees as making an attempt to swamp the area. In reality, the entire cause the US now refers back to the area as Indo-Pacific, reasonably than Asia-Pacific, is to undertaking its counter-front – with India, Japan and Australia – as equal to that of China’s juggernaut.

However what are the US and the West so fearful about, wonders the Chinese language editorial. That, it believes, has one thing to do with what it calls the West’s imperialist tendencies.

“What’s necessary is that China has not interfered in any nation’s politics nor sought to increase its sphere of affect. These nations take part within the initiative to increase their overseas cooperation. What are the US and different Western nations fearful about? The primary cause could also be that imperialism is deeply rooted in Western nations’ political pondering they usually perceive the period otherwise from rising nations,” the Chinese language editorial posits.

It mentioned that in areas aside from the West main powers are impartial from one another.

“The Shanghai Cooperation Group and BRICS are clearly extra equal than NATO and the G7. The consideration for rising nations is mutual improvement and cooperation, not conquest. The Belt and Highway’s unique intention was not an expedition, however for co-prosperity,” provides the editorial.

The Chinese media outlet, mentioned in one other article, that the US, like some other nation “is welcome” to spend money on the area.

“Any nation, the US included, is welcome to spend money on infrastructure initiatives within the Indo-Pacific area, however improvement applications needs to be vigilant to mounting strategic confrontation amongst Indo-Pacific nations,” it mentioned.

The article graciously mentioned that US funding within the Indo-Pacific area would afford US corporations extra alternatives even when it declines to work with China.

“Benign competitors will probably be conducive to improvement within the Indo-Pacific area, however we do not need any improvement program to evolve right into a strategic recreation amongst huge powers,” mentioned the editorial.

.Cheers

Re: OBOR, Chinese Strategy and Implications

It's an umpire's point of view.

What is the use of beating a batsman outside off stump with your outswing, if the batsman is going to score a boundary off the back foot, with a classic square cut ala Gavaskar or gundappa Viswanath the very next ball?

SS sir, we have seen Sri Lanka, the first bankruptcy, what ultimately happened is they got land in IOR free of cost, Djibouti, Maldives, vanautu, etc, very easy to convert bebt into equity, China is happy with it's debt trap strategy is paying off, additionally IMF is giving money... It's all de javu... I don't see China losing any wickets.

Sometime back I gave analogy of how a hungry tiger (physically disabled) gets it's prey by showing బంగారు కడియం (golden leg ring) to it's prey. It's a classic trap, you can't come out of...

We must thank upa govt. for not getting trapped, and happy with multi lakh crores scams in India itself, certainly they didn't sell India to China. It's Modi's govt. and they are ready to open up for Chinese finance.

Sorry to bring in politics, but to emphasize the importance of not falling into trap I had to.

Even "chitragreeva" could not avoid the trap, though he knew about the trap.

What is the use of beating a batsman outside off stump with your outswing, if the batsman is going to score a boundary off the back foot, with a classic square cut ala Gavaskar or gundappa Viswanath the very next ball?

SS sir, we have seen Sri Lanka, the first bankruptcy, what ultimately happened is they got land in IOR free of cost, Djibouti, Maldives, vanautu, etc, very easy to convert bebt into equity, China is happy with it's debt trap strategy is paying off, additionally IMF is giving money... It's all de javu... I don't see China losing any wickets.

Sometime back I gave analogy of how a hungry tiger (physically disabled) gets it's prey by showing బంగారు కడియం (golden leg ring) to it's prey. It's a classic trap, you can't come out of...

We must thank upa govt. for not getting trapped, and happy with multi lakh crores scams in India itself, certainly they didn't sell India to China. It's Modi's govt. and they are ready to open up for Chinese finance.

Sorry to bring in politics, but to emphasize the importance of not falling into trap I had to.

Even "chitragreeva" could not avoid the trap, though he knew about the trap.

Re: OBOR, Chinese Strategy and Implications

Who said anything about China losing wickets? It is China taking wickets.TKiran wrote: . . .. I don't see China losing any wickets.

Re: OBOR, Chinese Strategy and Implications

^^^ now understand. (But pankajs must be very disappointed, he took wicket on a noball.  )

)

Re: OBOR, Chinese Strategy and Implications

Is this below climatic fact pushing the chinis to exploit other regions of the world in their search for farm lands?

Deadly heatwaves threaten China's northern breadbasket

https://phys.org/news/2018-08-deadly-he ... thern.html

Deadly heatwaves threaten China's northern breadbasket

The North China Plain, home to nearly 400 million people, could become a life-threatening inferno during future heat waves if climate change continues apace, researchers have warned.

Soaring temperatures combined with high humidity—made worse by the region's dense irrigation network—means the China's breadbasket faces "the greatest risk to human life from rising temperatures of any location on Earth," they said in a statement.

Megacities Beijing and Tianjin both fall within the densely populated plain, along with other major urban areas.

But it is tens of millions of farmers working outside that will be most at risk.

In China, heatwaves have become both more intense and more frequent since 1970, especially in the last 15 years.

Surprisingly, they found that the North China Plain's irrigation system adds about half a degree Celsius to future warming, under either scenario.

So, to prevent the han farmers from revolting and to continue food production on a mammoth scale to feed their population, the chinis are looking to expand their reach to otehr nations' farm lands by expanding their network of roads and sea ports and lanes. Hence, OBOR? Does that sound right?Unless drastic measures are taken to limit the greenhouse gas emissions warming the globe, "the North China Plain is likely to experience deadly heatwaves with wet bulb temperatures exceeding the threshold defining what Chinese farmers may tolerate," he added.

https://phys.org/news/2018-08-deadly-he ... thern.html

Re: OBOR, Chinese Strategy and Implications

TKiran wrote:It's bullshit theory propagated by DDM that China is eyeing Indian market through Nepal. ODOR is a geopolitical strategy by Han, with or without India.

X posted from the Economy thread

We have been entirely too soft on china and its shady ways of pushing cheap and shoddy goods into India by hook or by crook.

The costs of this deliberate economic aggression are approaching "enemy action" proportions.

No wonder these buggers are so repeatedly, desperately and adamantly pushing for India to accept the OBOR/CPEC routing through India.

In this part of the world, a major portion of their evil BRI/OBOR strategy is ONLY India centric.

We seem to have severely neglected our own supreme national interests in the vain hope of appeasing the greedy chinese.

Either we get an equitable deal or we get out by using very stringent anti dumping measures. Routing of chinese goods via third country quotas or using the other country specific agreements with India to push in chinese goods should result in either a ban or the return of the entire consignment back to the country of origin.

Inferior Vietnamese black pepper flooding the Indian market via the srilankan route is just one very recent example where Indian producers have been directly affected. This is one example of how countries route their goods via third countries that have "trade" agreements with India and the lankans are shameless and greedy enough to take advantage of India to permit this "trade", after taking their due "cuts".

So, it's NOT a bullshit theory propagated by DDM that China is eyeing Indian market through Nepal. They are coming at India from all possible directions and via all available countries.

With the exception of maybe the US, there is no other market where the chinese see so much potential for growth and very specifically, so little interest from the local govt to stop them.

We know how to bugger ourselves and the silence of multitudes of people who ought to know better but willfully keep their eyes closed is certainly not helping our national cause.

It is like the silence of the grave.

How Chinese goods are choking Indian industry and economy: The hard numbers

How Chinese goods are choking Indian industry and economy: The hard numbers

Parliamentary panel finds re-routing of Chinese goods through markets India has FTAs, under-invoicing to disturb trade balance, calls for product specific strategies

Abhishek Waghmare & Subhayan Chakraborty

New Delhi

July 28, 2018

India's trade policy must evolve.

“Chinese imports have thrown a spanner in the wheel of India’s economic progress per se, and the industrial sector in particular,” the parliamentary standing committee on commerce voiced in its report tabled last week.

Beginning with hard numbers that establishes its basic premise of huge and constantly growing Sino-Indian trade imbalance, the report dwells on the boiling debate on the market economy status to China, echoing a similar line of thought implicit in the US-initiated trade war.

Identifying the problem of costly capital in India vis-à-vis China, it suggests product specific strategies for improving the trade balance, underlining the accountability of pertinent institutions, including the Directorate General for Anti-Dumping and Allied Duties and the Risk Management Division of the Central Board of Indirect taxes and Customs.

The Committee found that Chinese manufacturers were re-routing their products through the markets of other countries that India has Free Trade Agreements (FTA) with. Straddling the South East Asia, underdeveloped members of ASEAN have served as hubs for Chinese exporters to circumvent anti-dumping and countervailing duties, it says.

It has recommended a relook at the Least Developed Countries (LDC) arrangements and joint verification/ certification mechanism with the partner countries.

The report has also expressed skepticism about India's ongoing negotiations with these nation and China, among others for the Regional Comprehensive Economic Partnership (RCEP) agreement.

It expressed hope that India might offer to reduce its tariffs by 74-86 per cent of all goods.

The unscrupulous imports from China are also on account of influx of under-invoiced Chinese goods, goods brought in through mis-declaration and outright smuggling, it says.

These illegalities have its share of adverse effect on domestic industry, the report declared. In April to December 2017-18, as many as 1,127 cases of smuggling have been registered by India, recovering more than Rs 5.4 billion worth of Chinese goods.

However, it also calls for measures such as encouraging people to buy Indian products, popularising ‘Swadeshi apnao’ (consume domestic goods) and generate positive public opinion about Indian goods, which, trade experts say, contribute little to revive domestic industry.

We look at the committee’s view from the perspective of data to understand the depth of the trade imbalance.

Sectors that have been impactedThe big picture

16.6%: Chinese share in India’s imports grew from 11.6 per cent in 2013-14 to 16.6 per cent in 2017-18. This came as a result of Chinese imports growing at a staggering 20 per cent in 2017-18, compared to 9 per cent growth four years ago. India exports grew by 9.8 per cent in 2017-18.

$50 bn: In a decade to 2017-18, India’s exports to China rose by $2.5 billion. In the same period, China’s imports in India rose by $50 billion. India registered a trade deficit of $157 billion in 2017-18.

5%: Chinese government gives an effective rebate of 17 per cent to its exporter companies.

This, the committee says, results in Chinese goods being 5-6 per cent cheaper than their Indian counterparts, making it lucrative for Indian importers.

9%: On account of costlier energy, finance and logistics, Indian goods are costlier by about 9 per cent in the global market. Chinese industry gets loans at 6 per cent, compared to 11-14 per cent in India. Logistics costs are 1 per cent of the business in China, compared to 3 per cent in India.

294: Of the 803 licenses provided by the Bureau of Indian Standards (BIS) to foreign manufacturers selling in India under the Foreign Manufacturer Certification Scheme (FMCS), 294 licenses for 55 products have been granted to Chinese manufacturers.

A similar scheme has also provided 9,274 registrations for information technology and electronics products. Of this, 5857, 0r 64 per cent, registrations have been granted to Chinese manufacturers.

8%: Despite the fact that 75-80 per cent of Chinese steel products are covered under anti-dumping duty, their imports have increased 8 per cent in 2017-18.

Industry Key number and how badly it hurts

Recommendations

Pharmaceuticals

1,200%: In the life-saving drugs category, the dependence on Chinese imports is as much as 90 per cent. As much as 75% of the APIs (Active Pharmaceutical Ingredients) used in the formulations of essential drugs in the National List of Essential Medicines (NLEM) are sourced from China.

China has increased the prices of bulk drugs 11-fold, or 1,200 per cent, during last two years.

Revive India’s fermentation based API capability.

Solar

90%: Chinese solar imports form 90% of the India’s market share directly or indirectly through their offshore companies across South East Asia. Further, its dumping prices in India are lower than that of the price at which they sell in Japan, Europe or the US.

Under the Special Incentive Package Scheme, no domestic manufacturer has got any capital subsidy till now.

Domestic industry must pursue innovation that will help in further reduction in price per unit.

Anti-dumping duty may be levied in a differential manner to facilitate level pegging for domestic industry.

Textile

35%: Cheap Chineseimports have resulted in 35 per cent closure of power looms in Surat and Bhiwandi, the report notes.

It fires a salvo at the GST structure, stating that taxing synthetic fibres at 18 per cent, yarns at 12 per cent and fabrics at 5 per cent has caused unintended benefit to China resulting in increased imports of fabric from there.

Need to look at the LDC arrangements wherein imports from LDCs are fully exempt.

Increase the customs duty on garment imports.

Modernize the power loom and handloom sector for mass production with quality.

Toys

85%: About 85-90 per cent of toy market space is commanded by Chinese products, the report says. It has affected 50 per cent of the domestic toy industry.

Low-priced Chinese toys are either mass-produced or are rejects from other countries and are diverted to Indian sub-continent/ Africa. Further, Chinese toys are toxic in high proportion, it says.

Issue quality control order (QCO) for toys and ensure toxic and cheap quality Chinese toys do not enter the country.

Import of finished toy products from China be banned

Bicycles

58%: Bicycle imports from China saw a rise of 58 per cent in volume and 47 per cent in value in April to October 2017 over the previous year.

Further, under-invoiced bicycles constitute 85% per cent of the total bicycle imports from China in 2017-18.

Apart from affecting bicycle manufacturers, it is gradually killing the unorganized industry of small bicycle parts manufacturers who provide employment to many skilled and unskilled workers.

Carry out detailed analysis of the customs data in order to unravel the modus operandi of the unscrupulous importers involved and curb the entry of under-valued Chinese bicycles into the country.

Source: Impact of Chinese Goods on Indian Industry, 145th report of Parliamentary standing committee on commerce

Re: OBOR, Chinese Strategy and Implications

TKiran your mental blind zone has gone far faàaaaaarrr beyond what a normal human being has. This is what blind zone does to an otherwise sane looking person.TKiran wrote:^^^ now understand. (But pankajs must be very disappointed, he took wicket on a noball.)

Just for starters, I was the one who posted the news which started this last thread. Why would I do that if I was ideological hanji?

Your comment only proves to others what I had guessed a long back. You have started wearing Chinese Red tinted glasses my friend unable to see, hear, think or analyze beyond ideology. Thank you AGAIN for making my point.

I pray for your recovery and good luck! And do let me know if you need help.

PS: Your previous post to this suggested that the demonetization [==Modi ==BJP] has indeed left a lasting impact on you so much so that you couldn't help bring politics to this thread! Yes I do recall the gist of your posts in that thread. Helps interpret your latest work.

Re: OBOR, Chinese Strategy and Implications

BTW, I had this though about a week back and TKiran and chetak ssars posts re-jogged my memory.

China has surplus capital and it seeks desperate and wider access to the Indian market. The logical thing would have been to directly invest in India but instead of doing that they are investing in our neighborhood. Why is that?

My theory is that the Chinese are trying to be clever. They are desperate but they don't want to commit to India because money sunk within India would give India a leverage with China. China realizes the risk of such a strategy more than most Indian do because they themselves have used similar leverage with Japan, Taiwan and SoKo once sufficient money was invested in China by these nations. Just check how much the American corporation invested in China are acting as its spokes with the current Admin or what the US was able to achieve with India via the IT industry during the Parliament Attack/ OP Prakram crisis.

So What is the Chinese strategy to not get into the same trap while reaping the benefits? Invest in India's neighbors and piggy back on their access to the Indian market. These countries are too weak to play hardball with China at a later date while still being able to act as a conduit to the Indian market.

That is the way to gain access to the Indian market while not providing India a leverage in the process. This is where Sri Lanka, Nepal, Bangladesh come in and to a lesser extent Maldives and Myanmar.

China has surplus capital and it seeks desperate and wider access to the Indian market. The logical thing would have been to directly invest in India but instead of doing that they are investing in our neighborhood. Why is that?

My theory is that the Chinese are trying to be clever. They are desperate but they don't want to commit to India because money sunk within India would give India a leverage with China. China realizes the risk of such a strategy more than most Indian do because they themselves have used similar leverage with Japan, Taiwan and SoKo once sufficient money was invested in China by these nations. Just check how much the American corporation invested in China are acting as its spokes with the current Admin or what the US was able to achieve with India via the IT industry during the Parliament Attack/ OP Prakram crisis.

So What is the Chinese strategy to not get into the same trap while reaping the benefits? Invest in India's neighbors and piggy back on their access to the Indian market. These countries are too weak to play hardball with China at a later date while still being able to act as a conduit to the Indian market.

That is the way to gain access to the Indian market while not providing India a leverage in the process. This is where Sri Lanka, Nepal, Bangladesh come in and to a lesser extent Maldives and Myanmar.

Re: OBOR, Chinese Strategy and Implications

Wrong. China is investing in our neighbourhood because it is investing everywhere that will take their money. There is little leverage that investments in BD, SL etc can provide, in fact our own companies are investing in these countries as well. Crony capitalism is well and alive in the smaller countries which are happy to cut deals with China. We are not, for reasons both of security and sound economics. We do have Chinese investments but in specific companies and specific industries, not a "let's build a grand vision high-tech city here" type of omnibus scheme which is the path to doom.pankajs wrote:China has surplus capital and it seeks desperate and wider access to the Indian market. The logical thing would have been to directly invest in India but instead of doing that they are investing in our neighborhood. Why is that?

...

That is the way to gain access to the Indian market while not providing India a leverage in the process. This is where Sri Lanka, Nepal, Bangladesh come in and to a lesser extent Maldives and Myanmar.

Re: OBOR, Chinese Strategy and Implications

The 2nd highlight is where you got it wrong. I was not talking of Chinese leverage on India directly or through SL, BD, etc but the Indian leverage on China IF China where to massively invest in India.yensoy wrote:Wrong. China is investing in our neighbourhood because it is investing everywhere that will take their money. There is little leverage that investments in BD, SL etc can provide, in fact our own companies are investing in these countries as well. Crony capitalism is well and alive in the smaller countries which are happy to cut deals with China. We are not, for reasons both of security and sound economics. We do have Chinese investments but in specific companies and specific industries, not a "let's build a grand vision high-tech city here" type of omnibus scheme which is the path to doom.pankajs wrote:China has surplus capital and it seeks desperate and wider access to the Indian market. The logical thing would have been to directly invest in India but instead of doing that they are investing in our neighborhood. Why is that?

...

That is the way to gain access to the Indian market while not providing India a leverage in the process. This is where Sri Lanka, Nepal, Bangladesh come in and to a lesser extent Maldives and Myanmar.

I did not intend my post to cover every scenario and reason. The 1st highlighted point is valid so are many others reasons why China is pumping money in SL, BD, etc. e.g. Surplus capacity at home that needs a market, Strategic long-term push into the IOR, etc. etc. Again, if you notice, I haven't covered their push into Eurasia or Latin America, etc.

Re: OBOR, Chinese Strategy and Implications

+++

Other than the mil (and laund grab) aspects that other posters talk about, "investing" is just the means to an end, not end itself. So what is the "end"? What prevents the new non-Indian e-Commerce giants in India from flooding Indian market with Made (or Assembled) In Cheen/BD/SL/PK/NEP etc. etc.

Walmart, Amazon may rope in Trump admin to counter Modi's nation-first ecommerce blueprint

Other than the mil (and laund grab) aspects that other posters talk about, "investing" is just the means to an end, not end itself. So what is the "end"? What prevents the new non-Indian e-Commerce giants in India from flooding Indian market with Made (or Assembled) In Cheen/BD/SL/PK/NEP etc. etc.

Walmart, Amazon may rope in Trump admin to counter Modi's nation-first ecommerce blueprint

Re: OBOR, Chinese Strategy and Implications

https://www.caixinglobal.com/2018-08-03 ... 11500.html

State-Owned Oil Giant Inks $871 Million in Persian Gulf Deals

State-Owned Oil Giant Inks $871 Million in Persian Gulf Deals

A subsidiary of state-owned crude oil giant China National Petroleum Corp. (CNPC) has inked two deals to develop oil storage and pipeline facilities in the Persian Gulf as China’s Belt and Road commitments in the region become more concrete.

China Petroleum Pipeline Engineering Co. Ltd. (CPPE) signed a deal with a subsidiary of state-owned Oman Oil Co. S.A.O.C. worth $321 million to build mooring, pipelines, water purification facilities and a sewage treatment plant at the country’s Raz Markaz crude-oil storage project, the CNPC announced in a filing with the Shanghai Stock Exchange on Wednesday.

OBOR, Chinese Strategy and Implications

X Posting on the Analyzing CPEC amd Terroristan Threads

This is an Eight Page Article and so just posting a Link.

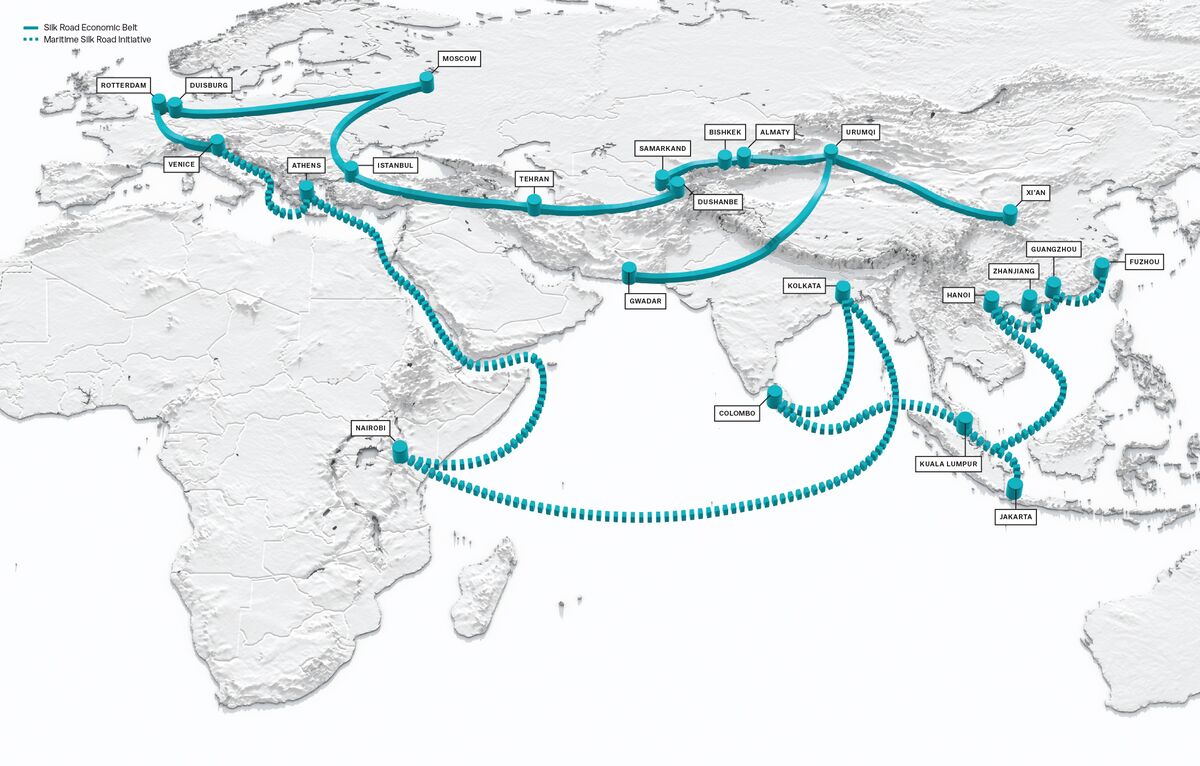

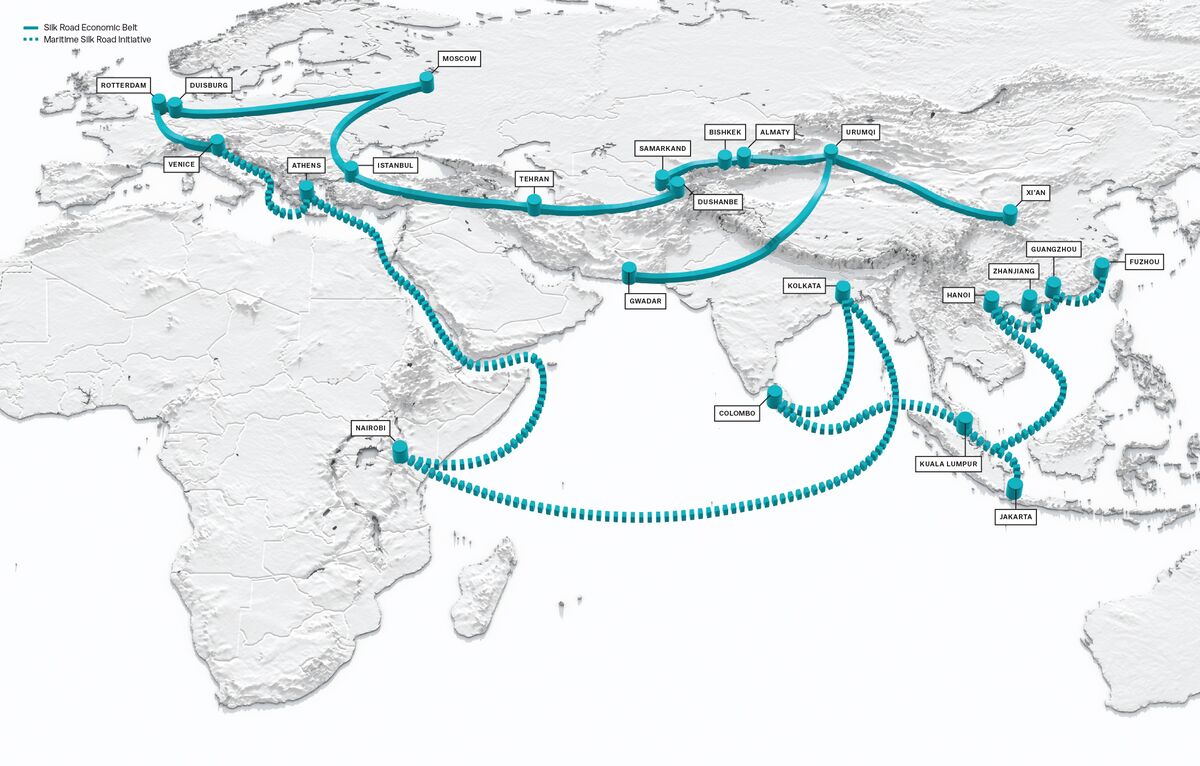

China’s Empire of Money Is Reshaping Global Trade

Xi Jinping’s new “Belt and Road” initiative is designed to promote economic development and extend China’s influence. Bloomberg Markets reports on the massive project’s impact along the Silk Road.

Cheers

This is an Eight Page Article and so just posting a Link.

China’s Empire of Money Is Reshaping Global Trade

Xi Jinping’s new “Belt and Road” initiative is designed to promote economic development and extend China’s influence. Bloomberg Markets reports on the massive project’s impact along the Silk Road.

China is building a very 21st century empire—one where trade and debt lead the way, not armadas and boots on the ground. If President Xi Jinping’s ambitions become a reality, Beijing will cement its position at the center of a new world economic order spanning more than half the globe. Already, China has extended its influence far beyond that of the Tang Dynasty’s golden age more than a millennium ago.

The most tangible manifestation of Xi’s designs is the new Silk Road he first proposed in 2013. The enterprise morphed into the “Belt and Road” initiative, a mix of foreign policy, economic strategy, and charm offensive that, nurtured by a torrent of Chinese money, is rebalancing global political and economic alliances.

Cheers

Re: OBOR, Chinese Strategy and Implications

chanakyaa wrote:+++

Other than the mil (and laund grab) aspects that other posters talk about, "investing" is just the means to an end, not end itself. So what is the "end"? What prevents the new non-Indian e-Commerce giants in India from flooding Indian market with Made (or Assembled) In Cheen/BD/SL/PK/NEP etc. etc.

Walmart, Amazon may rope in Trump admin to counter Modi's nation-first ecommerce blueprint

The entire business model of these companies involves dumping goods from China on the host country and they want a monopoly on it.

Years of that hollowed out US manufacturing and blew up it's trade deficit. That's despite printing the worlds reserve currency to cushion that disaster.

The purpose of having these large MNCs in India is to kick start manufacturing in the country - something small time Indian retailers cannot do.

But if all they offer are boats that arrive from China full of mechandise which then leave Indian ports empty, of what use are their "investments"

Re: OBOR, Chinese Strategy and Implications

https://macropolo.org/chinas-trade-war-tools/pankajs wrote:BTW, I had this though about a week back and TKiran and chetak ssars posts re-jogged my memory.

China has surplus capital and it seeks desperate and wider access to the Indian market. The logical thing would have been to directly invest in India but instead of doing that they are investing in our neighborhood. Why is that?

My theory is that the Chinese are trying to be clever. They are desperate but they don't want to commit to India because money sunk within India would give India a leverage with China. China realizes the risk of such a strategy more than most Indian do because they themselves have used similar leverage with Japan, Taiwan and SoKo once sufficient money was invested in China by these nations. Just check how much the American corporation invested in China are acting as its spokes with the current Admin or what the US was able to achieve with India via the IT industry during the Parliament Attack/ OP Prakram crisis.

China’s Trade War Tools and Their Effects on the US Economy

And againts Taiwan and recently against SoKo.Since the 1990s, American companies have entered the China market through direct investments or partnerships. Those US companies operating in China today (including their subsidiaries, joint ventures, and other business units) have achieved total annual revenue of $500 billion, annual profit of $31 billion, and hold over $600 billion in assets, according to BEA (see Figure 3). [Inside China and therefore leverage of the kind that I was referring too. It is one thing to close market to a country and quite another to seize assets.]

<snip>

Although unlikely, if tensions escalate into a full-blown trade war, and the Trump administration takes the nuclear option of taxing $450 billion of Chinese goods, Beijing will likely have little choice but to put a serious squeeze on these US companies. Beijing could employ an array of tactics, including promoting negative media coverage, manufacturing public outrage, ginning up economic nationalism, interrupting or even stopping operations altogether.

This may seem far-fetched at the moment but these sorts of scenarios have played out before - namely against Japan during the heated dispute over the Senkaku Islands in 2012. At the time, Chinese protestors broke into Japanese clothing stores, set cars on fire, and some Japanese automakers saw their sales in China plunge by nearly half. Now that foreign companies are already under more scrutiny, such a scenario could come to pass against US firms, depending on how far the trade war goes.

This kind of play is not new to the Chinese and therefore they are aware of such potential with other countries. This is what I was referring to.

BTW, just because that option is available does not mean that the Chinese will use it. Such a play with American companies will come at a tremendous cost which the Chinese will be very reluctant to pay. America is not Japan or SoKo or Taiwan and I don't mean it in Military sense. I will leave it to your imagination to figure out the cost.

Re: OBOR, Chinese Strategy and Implications

^^^ If the trade war gets to the point where the chinis think the US market is a lost cause then the $500B in sales by US firms in the chini market will be given to domestic companies by dictat.

Wall Street knows and had known for a long time that US firms profit far more from the chini trade than the chinese themselves. There are $700B in total sales from direct exports from the US and US firms in Cheen. Then there is the $400B out of the $500B exported to the US by American and allied companies assembling in the PRC. That is $1.1 trillion in trade by US companies. Profit-wise both the exports AND imports from the China trade goes mainly to Americans.

But the trade war really isn’t about trade. It is a war on Cheen’s technology sector which is on the edge of takeoff much like the US in the 1950s or Japan in the 1960s. That advancement is made possible by chini interaction with Amreeki and allied firms. Cut off that and hopefully you retain the tech lead.

Wall Street knows and had known for a long time that US firms profit far more from the chini trade than the chinese themselves. There are $700B in total sales from direct exports from the US and US firms in Cheen. Then there is the $400B out of the $500B exported to the US by American and allied companies assembling in the PRC. That is $1.1 trillion in trade by US companies. Profit-wise both the exports AND imports from the China trade goes mainly to Americans.

But the trade war really isn’t about trade. It is a war on Cheen’s technology sector which is on the edge of takeoff much like the US in the 1950s or Japan in the 1960s. That advancement is made possible by chini interaction with Amreeki and allied firms. Cut off that and hopefully you retain the tech lead.

Re: OBOR, Chinese Strategy and Implications

You got it saar!

At the current stage China still needs access to key American tech and cross-pollination to leap-frog in its journey to tech nirvana. If this was 10-20 years hence China would not hesitate to put the squeeze but today that would be a risky gambit and could easily backfire. Just check what the 1st, 2nd and 3rd largest Chinese imports are and see if one notices anything unusual.

We all saw the fate of ZTE. In ONE DAY a company goes from Hero to ZERO! America can still make it happen and in multiple sectors/companies and Chinese will need to account for that IF they choose to apply the local leverage.

Generally: The Chinese were coasting along nicely and with time would have taken their rightful place without much of a ripple. They got cocky a bit too early. Perhaps they should have waited another 10-20 years before they ditched the Deng dictum and bared their fangs. In a short period of time they have managed to ruffle feathers across the board and they are not ready for prime-time.

If this haste was a small mistake or a big one only time will tell.

At the current stage China still needs access to key American tech and cross-pollination to leap-frog in its journey to tech nirvana. If this was 10-20 years hence China would not hesitate to put the squeeze but today that would be a risky gambit and could easily backfire. Just check what the 1st, 2nd and 3rd largest Chinese imports are and see if one notices anything unusual.

We all saw the fate of ZTE. In ONE DAY a company goes from Hero to ZERO! America can still make it happen and in multiple sectors/companies and Chinese will need to account for that IF they choose to apply the local leverage.

Generally: The Chinese were coasting along nicely and with time would have taken their rightful place without much of a ripple. They got cocky a bit too early. Perhaps they should have waited another 10-20 years before they ditched the Deng dictum and bared their fangs. In a short period of time they have managed to ruffle feathers across the board and they are not ready for prime-time.

If this haste was a small mistake or a big one only time will tell.

Re: OBOR, Chinese Strategy and Implications

American corporations or for that matter, any foreign company doing trade in China never really made any profits so far... On the contrary, they lost their technology to chini locals.

Because the numbers make the stock markets go crazy, and the Chinese markets provide those numbers and the scale, initially which ever corporation made inroads into China, got huge speculative boost to their stock market prices. Gradually they started getting local competition because of technology thefts, but the stock markets don't see those changes, as it's based on speculation.

Take the example of GM or Chrysler etc, they show their sales in China as their own sales, whereas they are all joint ventures, usually the profits are eaten up by the local employees in the form of raises to their salary, then they use up the profits in gigantic 5 star hotel celebrations. Usually the profits are zero, but a million units sales is sexy for these companies, not the profits. See the last quarter results, the sales increased, profits have turned red. The reasons given are, more local competition, lesser profit margins, and higher operating costs and high taxes, just to fool the investors.

China has been doing this for far too long, bringing party members as board members in joint ventures etc, but the CEO's of the American corporations were plain greedy to show numbers, they knew the Chinese play perfectly well, and what Trump is doing is calling their bluff.

It's not going to hurt China, but the speculators in US.

Those speculators too are not powerful in US, but plain greedy. Trump is also not going to get hurt of his chances for a second term.

In a nutshell, American corporations have lost Chinese markets for ever. That too after burning their hands.

China has been a closed market despite pretentions to the contrary.

China is going to come out of this in flying colours as China has acquired great leverages around the world through its BRI initiative. It's a recent development, many analysts are still hesitant to acknowledge the success of BRI yet. Someone posted about a week back that the trade deficit with India is staggering 150 billion$, whereas I was thinking it was only 65 billion$.

For India trade has never been a strategic tool. India doesn't even have commercial IC engine technology, all companies including Maruti, Mahindra, Tata get their IC engines from Fiat or Isuzu.

Fiat makes huge profits from its trade with India, but that's still the good and dharmik way of Business, I genuinely want India to be like that only, but when the enemy China is taking advantage of Indian markets, we should stop all China trade even if it's routed through Nepal or BD or SL.

Because the numbers make the stock markets go crazy, and the Chinese markets provide those numbers and the scale, initially which ever corporation made inroads into China, got huge speculative boost to their stock market prices. Gradually they started getting local competition because of technology thefts, but the stock markets don't see those changes, as it's based on speculation.

Take the example of GM or Chrysler etc, they show their sales in China as their own sales, whereas they are all joint ventures, usually the profits are eaten up by the local employees in the form of raises to their salary, then they use up the profits in gigantic 5 star hotel celebrations. Usually the profits are zero, but a million units sales is sexy for these companies, not the profits. See the last quarter results, the sales increased, profits have turned red. The reasons given are, more local competition, lesser profit margins, and higher operating costs and high taxes, just to fool the investors.

China has been doing this for far too long, bringing party members as board members in joint ventures etc, but the CEO's of the American corporations were plain greedy to show numbers, they knew the Chinese play perfectly well, and what Trump is doing is calling their bluff.

It's not going to hurt China, but the speculators in US.

Those speculators too are not powerful in US, but plain greedy. Trump is also not going to get hurt of his chances for a second term.

In a nutshell, American corporations have lost Chinese markets for ever. That too after burning their hands.

China has been a closed market despite pretentions to the contrary.

China is going to come out of this in flying colours as China has acquired great leverages around the world through its BRI initiative. It's a recent development, many analysts are still hesitant to acknowledge the success of BRI yet. Someone posted about a week back that the trade deficit with India is staggering 150 billion$, whereas I was thinking it was only 65 billion$.

For India trade has never been a strategic tool. India doesn't even have commercial IC engine technology, all companies including Maruti, Mahindra, Tata get their IC engines from Fiat or Isuzu.

Fiat makes huge profits from its trade with India, but that's still the good and dharmik way of Business, I genuinely want India to be like that only, but when the enemy China is taking advantage of Indian markets, we should stop all China trade even if it's routed through Nepal or BD or SL.

Re: OBOR, Chinese Strategy and Implications

'No Cambodia left': how Chinese money is changing Sihanoukville

https://www.theguardian.com/cities/2018 ... anoukvilleHowever, the key complaint for many in Sihanoukville is that even though Chinese investment brings wealth, it is mainly kept within their own community. Chinese residents and visitors buy from Chinese businesses and visit Chinese restaurants and hotels, ensuring the trickle-down effect is minimal.

Re: OBOR, Chinese Strategy and Implications

https://www.ndtv.com/world-news/sri-lan ... bt-1894892

Sri Lanka Secures $1 Billion Loan From China, Amid Mounting Debt

Sri Lanka Secures $1 Billion Loan From China, Amid Mounting Debt

Colombo: Sri Lanka's central bank on Friday announced it had secured a $1 billion Chinese loan as the island, a key link in Beijing's ambitious Belt and Road initiative, develops closer relations with Asia's largest economy.

Central bank Governor Indrajit Coomaraswamy said that first half of the loan will be released later this month and the balance will be received in October.

"During consultations (with the Chinese over the loan) it was clear that they see us as a key strategic partner as far as the (Belt and Road) initiative is concerned, given our location," Coomaraswamy told reporters in Colombo. [Similar language as the rent seeking Bakis]

The eight-year loan by China Development Bank carries a 5.25 percent interest rate with a three year grace period.

Coomaraswamy said that the terms of Chinese loan were better than other international lenders and the country hopes to secure additional $200 to $250 million from China's domestic financial market by issuing "Panda bonds".

-

Ravi Karumanchiri

- BRFite

- Posts: 723

- Joined: 19 Oct 2009 06:40

- Location: www.ravikarumanchiri.com

- Contact:

Re: OBOR, Chinese Strategy and Implications

China’s Empire of Money Is Reshaping Global Trade

Xi Jinping’s new “Belt and Road” initiative is designed to promote economic development and extend China’s influence. Bloomberg Markets reports on the massive project’s impact along the Silk Road.

Xi Jinping’s new “Belt and Road” initiative is designed to promote economic development and extend China’s influence. Bloomberg Markets reports on the massive project’s impact along the Silk Road.

Re: OBOR, Chinese Strategy and Implications

Time will tell whether the OBOR is a giant white elephant scheme or a profitable enterprise.

So far they are losing money on it and these are supposed to be the boom times.

So far they are losing money on it and these are supposed to be the boom times.

Re: OBOR, Chinese Strategy and Implications

I might have choosen other threads to post this but for my comments of a few days back in this very thread and page.pankajs wrote:<snip>

Generally: The Chinese were coasting along nicely and with time would have taken their rightful place without much of a ripple. They got cocky a bit too early. Perhaps they should have waited another 10-20 years before they ditched the Deng dictum and bared their fangs. In a short period of time they have managed to ruffle feathers across the board and they are not ready for prime-time.

If this haste was a small mistake or a big one only time will tell.

https://asia.nikkei.com/Opinion/China-s-moment-of-truth

China's moment of truth [August 07, 2018]

https://www.scmp.com/comment/insight-op ... as-rise-soThe Chinese Communist Party (CCP) did not have to worry about elections, it was said. By contrast, Donald Trump's Republican Party would likely suffer from a backlash from voters hurt by Chinese retaliations.

Unfortunately for President Xi Jinping, such wisdom seems wrong. Even though Chinese trade retaliations against the U.S. have concentrated pain on the heart of Trumpland, the American farm belt in particular, the adverse impact on Trump is muted at best. Except for the faint complaints of a few Republicans, Trump's party has largely stuck by him. Indeed, the unfolding U.S.-China trade war has barely registered on America's political radar screen ahead of the fall mid-term elections.

But the story in China is entirely different. Its leaders may not have to run for office, but they are still held accountable by both public opinion and the fierce rivalry within the regime. The trade war with the U.S., to almost everybody's surprise, has triggered a heated but healthy debate on Chinese foreign and domestic policies under Xi's leadership.

On the surface, much of the debate revolves around the wisdom of responding in kind to Trump's trade war. Many in China are rightfully concerned that their country would end up much worse off in a full-blown war than the U.S. But underneath such economic worries is a comprehensive critique of President Xi's foreign policy since he assumed power in late 2012. Instead of blaming Trump solely for initiating the trade war, Xi's critics, both in society and within the party, attribute the trade war to the collapse of the foundations of U.S.-China relations caused by his expansive foreign policy in the last five years.

Directionally, they point to Xi's abandonment of Deng Xiaoping's grand strategy of "keeping international low profile" and "shying away from leadership" as the source of China's current external woes. In particular, Xi's signature foreign policy initiatives, such as the $1 trillion Belt and Road Initiative (BRI), island-building in the South China Sea, and strategic partnership with Russia, are now seen as too costly, ambitious, risky and confrontational. In hindsight, a growing consensus among Chinese elites is that the totality of these policies has fundamentally altered how the West in general, and the U.S. in particular, perceives China's rise. If the U.S. had an agnostic view on whether a powerful China constitutes a threat to its global leadership and interests, that has now changed entirely. The shift in Chinese grand strategy under Xi has clarified Washington's strategic thinking about China -- and directly led to the end of its long-standing engagement policy toward Beijing.

The realization that the trade war merely presages a long-term Sino-American strategic conflict appears to have shocked Chinese political and economic elites. It has finally dawned on them that the "golden age" of Chinese development is over. If Sino-American relations continue to spiral downward, the "China dream" championed by Xi would turn into a geopolitical nightmare. Notably, critics of Xi refer to the famous question Deng asked four decades ago: Why have America's friends grown rich but its enemies have grown poor? The implication is devastatingly clear -- by making China an adversary of the U.S., Beijing's current foreign policy risks dooming its economic future.

Beijing is right to see an opportunity for China’s rise. So what’s gone wrong? [08 August, 2018]

Hu let the dogs out!At the epicentre of public criticism has been China’s proactive foreign policy, crystallised in the Belt and Road Initiative and efforts to expand Chinese influence abroad, including China’s developmental paradigm. Western think tanks have called on their governments to contain China’s “sharp power”, which they say not only aims to appropriate the West’s technological crown jewels but also subvert Western nations. Washington and the European Union have listened.

In a recent essay, Luo Jianbo, the head of the China policy centre at the Central Party School, openly challenged China’s zeal to be the “saviour of the world”, arguing for a return to Deng Xiaoping’s “keep a low profile” strategy instead. China, Luo said, is still a developing country which needs to focus on domestic structural economic issues, deepen reform – and not spend strategic resources frivolously on sensational global undertakings.

More strikingly, Tsinghua University graduates wrote an open letter demanding that Hu Angang, director of the Institute for Contemporary China Studies, be sacked for having misled China’s senior leadership with his evaluation of the country’s “composite national power”, an indicator designed by political scientists to quantify a country’s aggregate economic, military, cultural and political strengths. Guided by Hu, the petitioners said, leaders had overestimated China’s strength and locked the country into an avoidable trade war with the United States.

Re: OBOR, Chinese Strategy and Implications

China's Leaders in Awe of Trump's "Creative Destruction" Agenda

Chinese leaders are apparently impressed by Trump's strategic and tactical brilliance in trying to rebuild international power structures in America's favor (aka. 'Creative Destruction')

https://www.ft.com/content/f83b20e4-8e6 ... 3b945e78cf

Chinese leaders are apparently impressed by Trump's strategic and tactical brilliance in trying to rebuild international power structures in America's favor (aka. 'Creative Destruction')

https://www.ft.com/content/f83b20e4-8e6 ... 3b945e78cf

Re: OBOR, Chinese Strategy and Implications

Financial Times: Chinese Officials “Awed” by Trump’s “Skill as a Strategist and Tactician”

Posted on July 26, 2018 by Yves Smith

A Financial Times article, The Chinese are wary of Donald Trump’s creative destruction, by Mark Leonard, director of the European Council on Foreign Relations, is so provocative, in terms of the contrast with Western perceptions of Trump, that I am quoting from it at some length.

According to Leonard, quite a few key players in China see Trump as having a coherent geopolitical agenda, with reducing China’s influence as a key objective, and that he is doing an effective job of implementation. From his Financial Times piece:

I have just spent a week in Beijing talking to officials and intellectuals, many of whom are awed by his [Trump’s] skill as a strategist and tactician…..

Few Chinese think that Mr Trump’s primary concern is to rebalance the bilateral trade deficit….They think the US president’s goal is nothing less than remaking the global order.

They think Mr Trump feels he is presiding over the relative decline of his great nation. It is not that the current order does not benefit the US. The problem is that it benefits others more in relative terms. To make things worse the US is investing billions of dollars and a fair amount of blood in supporting the very alliances and international institutions that are constraining America and facilitating China’s rise.

In Chinese eyes, Mr Trump’s response is a form of “creative destruction”. He is systematically destroying the existing institutions….as a first step towards renegotiating the world order on terms more favourable to Washington.

Once the order is destroyed, the Chinese elite believes, Mr Trump will move to stage two: renegotiating America’s relationship with other powers. Because the US is still the most powerful country in the world, it will be able to negotiate with other countries from a position of strength if it deals with them one at a time rather than through multilateral institutions that empower the weak at the expense of the strong.

My interlocutors….describe him as a master tactician, focusing on one issue at a time, and extracting as many concessions as he can. They speak of the skilful way Mr Trump has treated President Xi Jinping. “Look at how he handled North Korea,” one says. “He got Xi Jinping to agree to UN sanctions [half a dozen] times, creating an economic stranglehold on the country. China almost turned North Korea into a sworn enemy of the country.” But they also see him as a strategist, willing to declare a truce in each area when there are no more concessions to be had, and then start again with a new front.

For the Chinese, even Mr Trump’s sycophantic press conference with Vladimir Putin, the Russian president, in Helsinki had a strategic purpose. They see it as Henry Kissinger in reverse. In 1972, the US nudged China off the Soviet axis in order to put pressure on its real rival, the Soviet Union. Today Mr Trump is reaching out to Russia in order to isolate China.

In fact, Trump made clear on the campaign trail that he wanted to normalize relations with Russia because he saw China as the much bigger threat to US interests, and that the US could not afford to be taking them both on at the same time. He also regarded Russia as having more in common culturally with the US than China, and thus a more natural ally. Given the emphasis that Trump has placed on US trade deficits as a symbol of the US making deals that are to America’s disadvantage, by exporting US jobs,

However, even if the Chinese are right, and there is more method to Trump’s madness than his apparent erraticness would have you believe, there are still fatal flaws in his throwing bombs at international institutions.

As anyone who has done a renovation knows, the teardown in the easy part. Building is hard. And while the young Trump that pulled off the Grand Hyatt deal had a great deal of creativity and acumen, early successes appear to have gone to Trump’s head. He did manage to get out of the early 1990s real estate downturn in far better shape than most New York City developers by persuading lenders that his name was so critical to the value of his holdings that creditors needed to cut him some slack. But the older Trump has left a lot of money on the table, such as with The Apprentice, by not even knowing what norma were to press for greatly improved terms.

The fact that the half-life of membership on Trump’s senior team seems to be under a year does not bode well for establishing new frameworks, since they require consistency of thought and action. And the fact that Trump has foreign policy thugs operatives like John Bolton and Nikki Haley in important roles works against setting new foundations.

So even if the Chinese are right and Trump has been executing well on his master geopolitical plan, Trump is at best capable of delivering only on the easy, destructive part, and will leave his successors to clean up his mess.

Re: OBOR, Chinese Strategy and Implications

https://www.caixinglobal.com/2018-08-10 ... 13794.html

‘Belt and Road’ Drives Into Argentina with $2 Billion Contract

‘Belt and Road’ Drives Into Argentina with $2 Billion Contract

China State Construction Engineering Corp. (CSCEC) said it has won a $2.13 billion contract to build a major highway in Argentina, answering Beijing’s call for infrastructure specialists to export their skills to other developing markets.

The contract will see the Chinese company build the 538-kilometer (334 miles) highway over five years, using an engineering, procurement and construction arrangement that typically has a single contractor overseeing all the major responsibilities for such large projects, according to an announcement this week on the company’s website (link in Chinese). The contract includes 10 years to operate the project after its completion.

Re: OBOR, Chinese Strategy and Implications

https://www.scmagazine.com/fireeye-warn ... lfXj8CwKw1

FireEye warns China's Belt and Road Initiative will spark uptick in cyberespionage

Researchers speculate the project will spawn cyberespionage activity on regional governments along these trade routes and will likely include the emergence of new threat groups.

Researchers speculate the project will spawn cyberespionage activity on regional governments along these trade routes and will likely include the emergence of new threat groups.

FireEye researchers are cautioning Malaysian organizations to be on the lookout for elevated cyberespionage attacks that could result from recent political developments concerning China's Belt & Road Initiative.

The “One Belt, One Road” or "Belt and Road Initiative" (BRI) is an ambitious, multi-year, $1 trillion USD endeavor to build land and maritime trade routes across Asia and parts of Africa into Europe to project China's influence across the greater region, according to an internal FireEye report provided to SC Media.

Researchers speculate the project will spawn cyberespionage activity on regional governments along these trade routes and will likely include the emergence of new threat groups and nation-state actors considering the geopolitical interests that will be affected by the endeavor.

“Malaysia's new government has called for renegotiation of the terms of some Belt & Road projects, which is likely to generate some uncertainty in parties interested in the outcome of these projects and other regional developments,” Sandra Joyce, vice president and head of global intelligence operations at FireEye. “We expect espionage activity against Malaysian organizations will increase in an attempt to gain insight into current events,” said in a release prepared for the firm's customers.

Joyce added that Malaysian organizations both in the public and private sector should take steps to strategically manage their risk by understanding who their potential enemies are and how they would likely target them.

Researchers speculate threat actors may look to use announcements on BRI progress as a lure material for phishing attacks and other future intrusions and have already witnessed indication of cyberespionage activity in areas concerning the project is increasing from regional and unattributed actors.

Re: OBOR, Chinese Strategy and Implications

^^ Will be interesting to watch as China tries to trap Malaysia into unpayable OBOR debt with white elephant projects.

Maybe they will ask for the lease of a naval base..oops I mean maritime port in the Straits of Malacca for 99 years.

But how stupid are Malaysian politicians having signed on to such deals in the first place.

Maybe they will ask for the lease of a naval base..oops I mean maritime port in the Straits of Malacca for 99 years.

But how stupid are Malaysian politicians having signed on to such deals in the first place.

Re: OBOR, Chinese Strategy and Implications

Why do we expect these countries to be naive and stupid in regards to Cheen?Neshant wrote:^^ Will be interesting to watch as China tries to trap Malaysia into unpayable OBOR debt with white elephant projects.

Maybe they will ask for the lease of a naval base..oops I mean maritime port in the Straits of Malacca for 99 years.

But how stupid are Malaysian politicians having signed on to such deals in the first place.

Most Asian countries like Malaysia run trade and monetary surpluses with Cheen.

The chances are more than equal that they will take Cheen’s money and then ask for writeoffs if the PRC wants them to keep a neutral stance and not go over to Unkil completely.

Re: OBOR, Chinese Strategy and Implications

Somehow i doubt chinis are generous with their funds.

We are talking about billions of dollars - even if the chinis are handing the Malaysians a hugely inflated bill for so called obor infrastructure.

We are talking about billions of dollars - even if the chinis are handing the Malaysians a hugely inflated bill for so called obor infrastructure.