Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

It is an unfortunate reality that Indan household savings are locked in relatively unproductive assets such as real estate and gold. This is due to lack of trust (often justified) in Indian corporate and government sector including finance industry. This is common in other developing countries too where institutional trust is low. That implies the actual usable savings are even low for India. But the peculiarity of Indian savings does not mean household savings don't matter.

For any economy investment comes from savings . You can also generate investment form external borrowings or fiscal deficit but they all carry high risks. The rock solid , sustainable and safe investment comes from household savings. That is how China financed itself.

For any economy investment comes from savings . You can also generate investment form external borrowings or fiscal deficit but they all carry high risks. The rock solid , sustainable and safe investment comes from household savings. That is how China financed itself.

Re: Indian Economy News & Discussion - Nov 27 2017

In 1993-94, the household sector accounts for 81.8 % of gross domestic savings of the country.

(source: http://www.mospi.gov.in/136-saving-and-capital-formation )

In 2011-12, the household sector saved 20,037 billion rupees, and the gross domestic savings was 27,653 billion rupees.

(source: https://www.rbi.org.in/SCRIPTS/AnnualReportPublications.aspx?Id=1094 )

i.e., the household sector accounted for 72.5% of the gross domestic savings of the country.

As a result we must conclude that the sky was falling on the Indian economy between 1993-94 and 2011-12.

(source: http://www.mospi.gov.in/136-saving-and-capital-formation )

In 2011-12, the household sector saved 20,037 billion rupees, and the gross domestic savings was 27,653 billion rupees.

(source: https://www.rbi.org.in/SCRIPTS/AnnualReportPublications.aspx?Id=1094 )

i.e., the household sector accounted for 72.5% of the gross domestic savings of the country.

As a result we must conclude that the sky was falling on the Indian economy between 1993-94 and 2011-12.

Re: Indian Economy News & Discussion - Nov 27 2017

In any case, the latest annual data (2017) from the RBI, on savings as a fraction of gross national disposable income (GNDI) is here:

(PDF file) https://rbidocs.rbi.org.in/rdocs/Annual ... E43C72.PDF

For whatever reason, the 2017 report only goes up to 2015-16.

(PDF file) https://rbidocs.rbi.org.in/rdocs/Annual ... E43C72.PDF

For whatever reason, the 2017 report only goes up to 2015-16.

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.bloomberg.com/news/articles ... d-millions

Handyman Jobs Get a Leg Up as India Tackles Unemployment

Handyman Jobs Get a Leg Up as India Tackles Unemployment

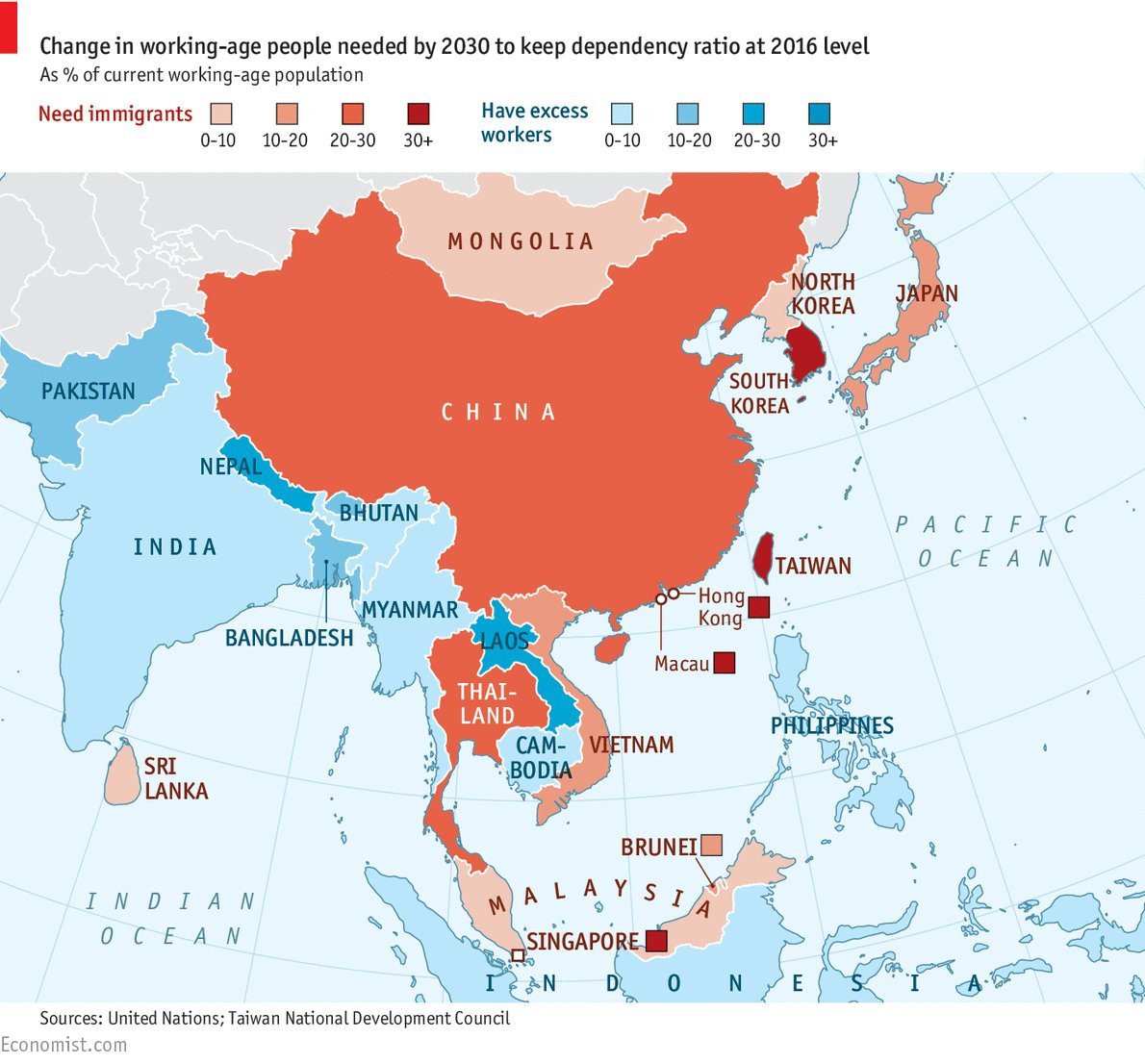

India is seeking to boost the aspirational value of jobs such as plumbing, carpentry and beautician to make more people employable in a market with one of the world’s largest working-age populations.

...

...

"‘How many of you have been to convocation ceremony of a vocational college?,’ Prime Minister Modi asked in one of the meetings. Not one had gone. ‘How will it become aspirational then?’, he asked," said Krishnan.

Barely 5 percent of its workforce has formal vocational skills, compared with 75 percent in Germany and 96 percent in South Korea.

Re: Indian Economy News & Discussion - Nov 27 2017

The important indicator you need to track is household savings in financial assets - these are from around 11% in 2001 to around 8% now. The three percent gap has been filled in by external borrowings, FDI and fiscal deficits. The consequence ? check the rupee value form 1993 to now and compare with yuan value.A_Gupta wrote:In 1993-94, the household sector accounts for 81.8 % of gross domestic savings of the country.

(source: http://www.mospi.gov.in/136-saving-and- ... -formation )

In 2011-12, the household sector saved 20,037 billion rupees, and the gross domestic savings was 27,653 billion rupees.

(source: https://www.rbi.org.in/SCRIPTS/AnnualRe ... px?Id=1094 )

i.e., the household sector accounted for 72.5% of the gross domestic savings of the country.

As a result we must conclude that the sky was falling on the Indian economy between 1993-94 and 2011-12.

Re: Indian Economy News & Discussion - Nov 27 2017

How do you draw that conclusion, I would love to know.kiranA wrote: The important indicator you need to track is household savings in financial assets - these are from around 11% in 2001 to around 8% now. The three percent gap has been filled in by external borrowings, FDI and fiscal deficits. The consequence ? check the rupee value form 1993 to now and compare with yuan value.

PS: e.g., eyeballing the charts at tradingeconomics.com

- the US Consumer Price Index at 2012 was around 228 and now it stands at 250. ( https://tradingeconomics.com/united-sta ... -index-cpi )

- the Indian Consumer Price Index at 2012 was 95 and is around 140 today.

( https://tradingeconomics.com/india/cons ... -index-cpi )

(their CPI data doesn't go much beyond this, and so I use 2012 instead of 2008).

- the USD to INR exchange rate in 2012 was around 52 INR to the USD

( https://tradingeconomics.com/india/currency )

So, in terms of CPI, today the USD has dropped to 228/250 of its value in 2012, but the rupee has dropped by 95/140 of its value in 2012, and so the current exchange rate should be 52 * 228/250 * 140/95 = 69.888

Wow! I didn't expect a simple CPI calculation to yield such a close match, when I started this.

So now, tie CPI to that 3% gap in savings in financial assets.

PPS: in any case, the gross financial savings of Indian households is at 10.x%, it is the net financial savings that is at ~8%. The Indian household debt to GDP curve is here: https://tradingeconomics.com/india/hous ... ebt-to-gdp. A simplified description is a linear fall from 11% to 9% 2008-2010, steady at 9% from 2010 into late 2014, and then a linear rise back to 11% to date. This varying level of debt (the difference of gross vs net financial savings) does not correlate with the value of the rupee.

Re: Indian Economy News & Discussion - Nov 27 2017

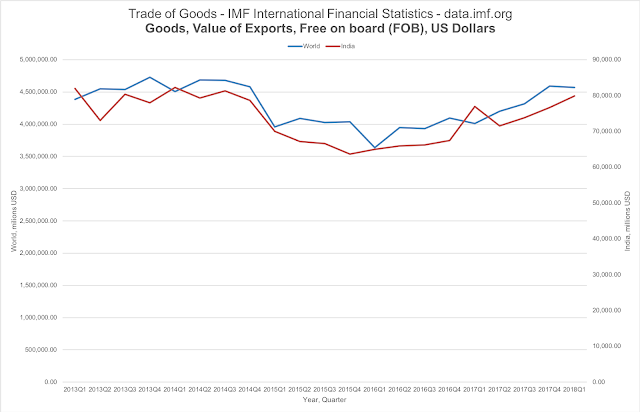

There was a world-wide slowdown in the trade of goods after 2013, and India was not immune to it. Here's a chart prepared from IMF data, the quarterly value of goods exported, in USD, value of goods at FOB, 2013 Q1 to 2018 Q1. (At this point in time, the IMF has monthly data till June 2018, so the full quarter is not available. I have the monthly data also charted at

http://answer2pakteahouse.blogspot.com/ ... -2013.html ).

Why is this important? Because the dip in exports is being made into a media+social media+political issue in India. So having information is good.

PS: notice the World y-axis is on the left, and the India y-axis, obviously to a different scale, is on the right.

http://answer2pakteahouse.blogspot.com/ ... -2013.html ).

Why is this important? Because the dip in exports is being made into a media+social media+political issue in India. So having information is good.

PS: notice the World y-axis is on the left, and the India y-axis, obviously to a different scale, is on the right.

Re: Indian Economy News & Discussion - Nov 27 2017

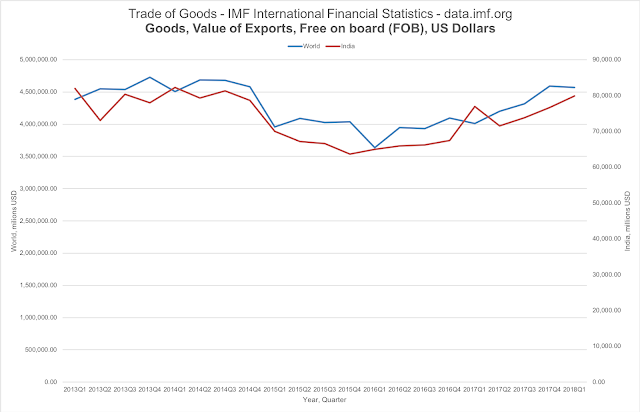

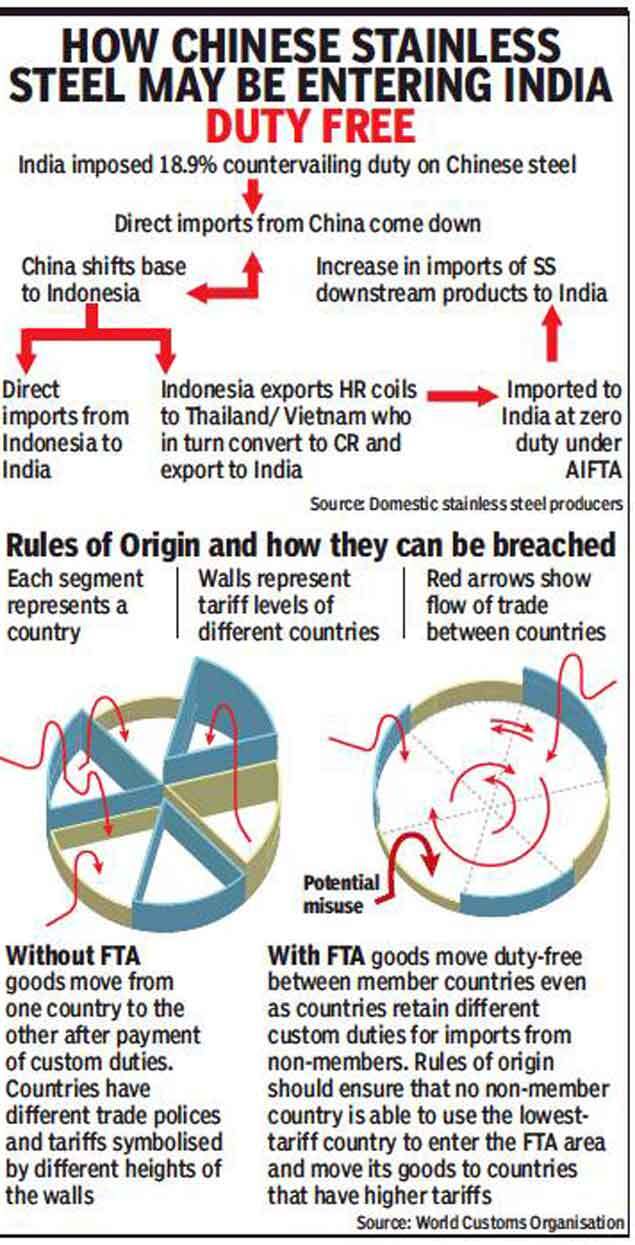

FTA misuse by China hitting us: Stainless steel industry

NEW DELHI: A surge in imports from China and countries with which India has signed free trade agreements (FTAs) is heaping misery on the domestic stainless steel manufacturers, prompting them to seek more permanent measures to stem inflows.

Given the scale of the problem, government has attempted several steps such as imposing anti-dumping duties, countervailing duties, quality control and anti-circumvention measures but the problem persists, say steel makers. ...........

New capacities in Indonesia riding on the back of Chinese investments also pose a threat to the domestic market.

Domestic manufacturers say the market for stainless steel is limited in Indonesia and the new capacity that is being added could be headed for India. The ongoing trade war between the US and China has also added an element of uncertainty. They are now demanding that steel should be excluded from FTAs that India has signed.

State-run SAIL is also confronting the challenge from a surge in imports and sources said the global trade spat has witnessed diversion of products in the mild steel segment.

Domestic players also say that the investment of nearly Rs 35,000 crore could be in jeopardy due to “dumping, subsidised imports and tariff benefits under FTAs.” The stainless steel sector also has a large chunk in the unorganised sector.

Trade experts said the problem is significant but doubted the theory that Chinese steel was being dumped through countries with whom India has FTAs as there are adequate rules of origin built in within FTA agreements.

Rules of origin are the criteria needed to determine the national source of a product, according to WTO definition. It says that their importance is derived from the fact that duties and restrictions in several cases depend upon the source of imports.

“The yuan has depreciated more than the rupee and the Chinese are past masters in manipulating the currency and that’s why the imports are going up,” said Biswajit Dhar, professor at the Jawaharlal Nehru University, when asked about the sharp surge in Chinese and other steel imports.

He said the government needs to adopt a medium term strategy to deal with the issue rather than resorting to short term measures such as imposing different duties. Dhar said the government should set up a forum to address the problems of the industry.

Chinese players also enjoy several advantages compared to Indian industry in terms of lower power, logistics and interest costs and access to better grade of coking coal, domestic steel players say.

Domestic players say that there should be no tariff concessions for China at least on steel and want the government to have a re-look at the FTAs with Korea and Japan.

They also want the government to accelerate the process of imposing anti-dumping duties, which now takes two years from filing the application to imposition of duty.

Re: Indian Economy News & Discussion - Nov 27 2017

Rural growth rate overtakes urban in India automobile sales

Uttar Pradesh, Bihar, Madhya Pradesh, West Bengal and Odisha have recorded higher growth in auto sales than Karnataka, Tamil Nadu and Maharashtra in the last two years

https://www.livemint.com/Auto/WXcqHRcxT ... sales.html

More accurately, less urbanized states show higher growth in auto sales than more urbanized states.

Uttar Pradesh, Bihar, Madhya Pradesh, West Bengal and Odisha have recorded higher growth in auto sales than Karnataka, Tamil Nadu and Maharashtra in the last two years

https://www.livemint.com/Auto/WXcqHRcxT ... sales.html

More accurately, less urbanized states show higher growth in auto sales than more urbanized states.

Re: Indian Economy News & Discussion - Nov 27 2017

More on household savings:

https://www.livemint.com/Politics/UZ0cQ ... mainl.html

Home » Politics

Household savings grow highest in 7 years, but it’s mainly in cash

Household financial savings as a percentage of gross national disposable income (GNDI) rose from 9.1% in 2016-17 to 11.1% in 2017-18, the highest in at least the last seven years

https://www.livemint.com/Politics/UZ0cQ ... mainl.html

Home » Politics

Household savings grow highest in 7 years, but it’s mainly in cash

Household financial savings as a percentage of gross national disposable income (GNDI) rose from 9.1% in 2016-17 to 11.1% in 2017-18, the highest in at least the last seven years

Re: Indian Economy News & Discussion - Nov 27 2017

Is it something I am missing here?A_Gupta wrote:Rural growth rate overtakes urban in India automobile sales

Uttar Pradesh, Bihar, Madhya Pradesh, West Bengal and Odisha have recorded higher growth in auto sales than Karnataka, Tamil Nadu and Maharashtra in the last two years

https://www.livemint.com/Auto/WXcqHRcxT ... sales.html

More accurately, less urbanized states show higher growth in auto sales than more urbanized states.

Isn't what moronic economists on left used to cry about? Bharat vs India... Rural vs Urban ... OMG OMG! We are doomed with income gap between these 2 Indias.

Why is no one acknowledging this? This means lesser migration to urban areas too

Why do they still talk about rural distress?

Shouldn't this help current Govt.?

OTOH ... Is urban populace unhappy at Govt. policies? Do they have genuine grouse?

Re: Indian Economy News & Discussion - Nov 27 2017

Chinis are doing exactly what I expected them to do. The trade war with US is also similar. They can bypass it by having it imported from another place. If Chinese companies have to export Chinese branded phone to US, they will assemble it in India, put made in india and send it to US to bypass the tarrifs.FTA misuse by China hitting us: Stainless steel industry

And the Chinese investment in our neighbors are exactly for that. We have FTA with Burma. The chinis can easily dump stuff under Made in Burma label.

The Belting & Roading adventure is exactly that. Third party exports.

Only way to deal with this. We need to scale. And ask every country having FTA with us for reciprocation deals. Make a law you cannot export more than 2 times what you import in to India.

Re: Indian Economy News & Discussion - Nov 27 2017

Free trade agreements have Rules of Origin clauses to deal with these. They just need to be kept up with the Chinese tactics.

Re: Indian Economy News & Discussion - Nov 27 2017

Protecting domestic industry by just raising import duties and working with FTA will only bring short term benefits, as the domestic industry will become complacent. It will not invest in R&D and improve the quality of their products. We have traveled this route of import substitution model in the past and the results were disastrous with high prices and low quality of products while exports fell leading to BOP crisis in 90's.nam wrote:Chinis are doing exactly what I expected them to do. The trade war with US is also similar. They can bypass it by having it imported from another place. If Chinese companies have to export Chinese branded phone to US, they will assemble it in India, put made in india and send it to US to bypass the tarrifs.FTA misuse by China hitting us: Stainless steel industry

And the Chinese investment in our neighbors are exactly for that. We have FTA with Burma. The chinis can easily dump stuff under Made in Burma label.

The Belting & Roading adventure is exactly that. Third party exports.

Only way to deal with this. We need to scale. And ask every country having FTA with us for reciprocation deals. Make a law you cannot export more than 2 times what you import in to India.

The correct path is to reduce their logistics, energy & labor costs also remove any legal hurdles that they face. This will make them globally competitive and we can then capture the international market vacated by china owing to their increasing labor cost.

Re: Indian Economy News & Discussion - Nov 27 2017

You need both to be honest. Some amount of protectionism and the govt getting out of the way and removing hurdles and encouraging domestic companies to grow organically and inorganically.

Re: Indian Economy News & Discussion - Nov 27 2017

Bad times for the economy.The RBI report on demon. shows it to have failed in its goal.Fuel prices rising daily like the plunging rupee.It is asinine for some babus to state that the rupee's fall is "not bad".The rupee's instability and almost daily drop is affecting exporters' ability to price their goods.It's lost over 10% this year and is Asia's worst performing currency.

Let me tell you that there is an acute shortage of skilled labour in the industrial workforce.The youth prefer "flexible" jobs at mall shops, fast food delivery wallahs instead of regular timed jobs which demand a higher level of responsibility from the workforce.Only yesterday an industrialist was describinv the situ to me.The NREGA dole was bad enough.Try getting a plumber or electrician these days.The collapse of the construction /real estate industry has seen a shortage of skilled labour in this sector.

I'm watching right now on a channel the plight of cab drivers stung v.hard bh the fuel price rise.

Jobs are becoming available only in the last menial level of the economy.What's happened to much of the EU states.Read this .morning's Ind.Exp. editorial.

Let me tell you that there is an acute shortage of skilled labour in the industrial workforce.The youth prefer "flexible" jobs at mall shops, fast food delivery wallahs instead of regular timed jobs which demand a higher level of responsibility from the workforce.Only yesterday an industrialist was describinv the situ to me.The NREGA dole was bad enough.Try getting a plumber or electrician these days.The collapse of the construction /real estate industry has seen a shortage of skilled labour in this sector.

I'm watching right now on a channel the plight of cab drivers stung v.hard bh the fuel price rise.

Jobs are becoming available only in the last menial level of the economy.What's happened to much of the EU states.Read this .morning's Ind.Exp. editorial.

Re: Indian Economy News & Discussion - Nov 27 2017

Feels like a political screed to me ... Take the following examples.Philip wrote:Bad times for the economy.The RBI report on demon. shows it to have failed in its goal.Fuel prices rising daily like the plunging rupee.It is asinine for some babus to state that the rupee's fall is "not bad".The rupee's instability and almost daily drop is affecting exporters' ability to price their goods.It's lost over 10% this year and is Asia's worst performing currency.

Let me tell you that there is an acute shortage of skilled labour in the industrial workforce.The youth prefer "flexible" jobs at mall shops, fast food delivery wallahs instead of regular timed jobs which demand a higher level of responsibility from the workforce.Only yesterday an industrialist was describinv the situ to me.The NREGA dole was bad enough.Try getting a plumber or electrician these days.The collapse of the construction /real estate industry has seen a shortage of skilled labour in this sector.

I'm watching right now on a channel the plight of cab drivers stung v.hard bh the fuel price rise.

Jobs are becoming available only in the last menial level of the economy.What's happened to much of the EU states.Read this .morning's Ind.Exp. editorial.

1. Quote "The rupee's instability and almost daily drop is affecting exporters' ability to price their goods. It's lost over 10% this year and is Asia's worst performing currency." Comment > Weren't we always told that devaluation increases export competitiveness and/or earnings? One just has to glance at the performance of the Software export industry and the stock price of the major software exporters over the last several months. One could go further and do a co-relation study say from 1990 between USD/INR rate and the Indian Software major's stock performance.

2. Quote "Try getting a plumber or electrician these days.The collapse of the construction /real estate industry has seen a shortage of skilled labour in this sector." Comment > Hell one would have expected an reverse to be true! Collapse in construction would have made a bunch of plumber and electrician jobless and increased the pool looking for new jobs?

Yes, economic is not so simple but I am only commenting on the logic given above which is exactly opposite to the "basic commonly understood" simplistic notions of just how the market forces work. Looks like "Logic manufacturing" to fit the narrative.

If one where to look beyond the "manufactured" narrative one might conclude ...

1. Exporters are not benefiting from a falling Rupee because maybe ... just maybe, the world trade is shrinking or at least not expanding like before in the current global protectionist environment. Perfectly logical and in sync with the original point raised.

2. The fact that it is getting harder by the day to find plumber and electrician who where put out of job by the "collapse of the construction /real estate" is because they are now gainfully employed in other industries/vocations. Again. perfectly logical and in sync with the original point raised.

Rather than trying to fit the data to the narrative and make one's logic convoluted to the point where it starts to contradict the "basic commonly understood" economic laws, one must look for "simpler but common sense" explanations.

See, I could come up with two simpler and common sense explanation of the two quoted phenomenon in about 15-20 minutes after I had read the original post not referring to google even once in the process. Hey, but that would then contradict the narrative that is sought to be portrayed.

Re: Indian Economy News & Discussion - Nov 27 2017

Are foreign investors going to take us seriously, after such fanciful estimates of project costs??

Andhra CM’s dream project which will cost more than India’s GDP, according to him

Andhra CM’s dream project which will cost more than India’s GDP, according to him

Andhra CM’s dream project which will cost more than India’s GDP, according to him

By Akshay Narang

August 31, 2018

In the recent past, Andhra Pradesh chief minister, Chandrababu Naidu has been trying hard to sell Amravati as an ideal capital city that he claims is going to be the pride of Andhra people and an engine of growth. It seems that TDP is trying to make electoral gains by hard selling Amravati and showcasing it as a world class city that is going to come up. In fact, municipal administration and urban development minister, Dr. Ponguru Narayana, who is considered quite close to chief minister Naidu and has been overseeing the construction of Amravati, himself admitted that Amravati will be on the top of poll agenda. This explains why Chandrababu Naidu has been pressing hard about the upcoming capital city even though it is still in the initial stages and not much is known about the details of the supposedly world class capital city.

However, this Tuesday, the Andhra Pradesh chief minister made a major blunder while speaking about Amravati. Addressing a gathering after listing the ‘Amravati bond’ on the Bombay Stock Exchange, he claimed that his government has envisioned an investment of US $ 2-4 trillion for developing Amravati, the greenfield capital city. Not only this, he further claimed that fund raising is not going to be a humungous task for his government because he has proper decision making and execution mechanism in place. He said, “Our infrastructure development plans need USD 2-4 trillion. Today the Centre is estimating only USD 1 trillion for infrastructure development. But for Amaravati, we do not see any problem in mobilising even USD 2-4 trillion.” Naidu added, “If there is no trust and no proper policy framework, there could be a problem (in raising funds). However, if we can do our work efficiently with proper execution, then there is no money constraint.” Then, he went on to claim credit for the success of Amravati Bond 2018 and suggested that this reflects investor confidence in his government and the development of Amravati.

It seems that in making exaggerated claims about Amravati, Naidu totally lost touch with ground realities. Take time to digest this, India is the sixth largest economy of the world and its total worth is US $ 2.6 trillion. However, Chandrababu Naidu wants US $ 2-4 trillion dollars for developing a single city. Even if the entire Indian economy, and mind it, we are talking about one of the largest economies in the world, came together even then it won’t be possible to meet the prospective requirements of Amravati that Naidu has in mind. This should have been enough embarrassment for Chandrababu Naidu and TDP. However, he did not stop here and also claimed that state economy should touch US $ 1 trillion by 2029. Currently, Andhra economy stands at US $ 130 billion and this is too mammoth a leap that he is proposing.

From this blunder it is clear that Naidu has got his priorities wrong. It does not seem that he is too serious about his claims and that is why he might be making such airy claims. This also raises serious and pertinent questions about the policy and execution mechanism that he was boasting about. It seems that his planners and those responsible for execution of the ambitious project to build the capital city of Amravati have got their numbers seriously wrong. Amravati at the most is only a poll agenda for the TDP and they are not at all serious about pursuing it in a reasonable manner.

Re: Indian Economy News & Discussion - Nov 27 2017

^Looks like he is confused between billion and trillion.

Re: Indian Economy News & Discussion - Nov 27 2017

Is there a particular reason that causes Q1 growth rate to be generally more than the growth rates of other quarters? (don't consider 2016 and 2017 coz of demonitization)

Re: Indian Economy News & Discussion - Nov 27 2017

I think he got confused between $ and Rs. Three trillion rupees would be around $40 billion. That is he has been saying all along but even that is too much and AP, without HYD, does not have that kind of money.Trikaal wrote:^Looks like he is confused between billion and trillion.

Re: Indian Economy News & Discussion - Nov 27 2017

Deleted

Last edited by Suraj on 01 Sep 2018 00:19, edited 1 time in total.

Reason: Please don't post such rhetoric here. Stick to the India-US thread to whine about politicians' actions

Reason: Please don't post such rhetoric here. Stick to the India-US thread to whine about politicians' actions

Re: Indian Economy News & Discussion - Nov 27 2017

Mod Note: I've cleaned up a bunch of noise. This thread isn't suited to such freewheeling political rhetoric.

Re: Indian Economy News & Discussion - Nov 27 2017

FY2018-19 First Quarter GDP data from CSO (pdf)

Basic Notes:

* 8.2% GDP growth in real terms, 13.8% in nominal terms.

* Gross fixed capital formation (investment/GDP) up to 31.6% from 31% in prior year

* Exports up from 19.5% to 20.1% YoY as component of GDP

* The strongest GVA drivers are manufacturing and construction.

* Manufacturing rebounded from -1.8% a year ago to 13.5% this quarter

* Construction improved from 1.8% to 8.7%

Basic Notes:

* 8.2% GDP growth in real terms, 13.8% in nominal terms.

* Gross fixed capital formation (investment/GDP) up to 31.6% from 31% in prior year

* Exports up from 19.5% to 20.1% YoY as component of GDP

* The strongest GVA drivers are manufacturing and construction.

* Manufacturing rebounded from -1.8% a year ago to 13.5% this quarter

* Construction improved from 1.8% to 8.7%

Re: Indian Economy News & Discussion - Nov 27 2017

Or Rupee vs. Dollar. 2-3 Trillion Rupees equals some 30-40 Billion USD. Plausible if it is a world class city built over 30 years. (sarc on) But then a billion here and a trillion their - who cares as long as people can dream about the loans they are getting and not the night mares about paying it back. (sarc off).Trikaal wrote:^Looks like he is confused between billion and trillion.

SaiP as much pointed out earlier then me on the confusion between rupees vs. dollars.

Re: Indian Economy News & Discussion - Nov 27 2017

The total money needed for Amaravathi doesn't need to be raised in one year, so I think this is a meaningless discussion here. If it is indeed 1T$ (which it very well could be in the grand scheme of things), it is also a fact that the city will take 20 years to fully build out, and for which the financing will run probably 30-50 years via bonds. By then we would certainly be a 10+T$ economy; so an outlay of $20B/year (or even better Rs20B/year) doesn't seem that outlandish to me.saip wrote:I think he got confused between $ and Rs. Three trillion rupees would be around $40 billion. That is he has been saying all along but even that is too much and AP, without HYD, does not have that kind of money.Trikaal wrote:^Looks like he is confused between billion and trillion.

Re: Indian Economy News & Discussion - Nov 27 2017

Per RBI data (via https://www.rbi.org.in/Scripts/BS_ViewWss.aspx )

India's foreign exchange reserves on

August 17: USD 400.8479 billion

August 24: USD 401.2933 billion

It is a little counter-intuitive that this happens when the INR is falling.

India's foreign exchange reserves on

August 17: USD 400.8479 billion

August 24: USD 401.2933 billion

It is a little counter-intuitive that this happens when the INR is falling.

Re: Indian Economy News & Discussion - Nov 27 2017

Thats cause RBI doesnt need to waste FX now. ought 85% higher quantities in July 18 ahead of Trump August deadline for 1st set of sanctions, previously we did not have capacity to store Oil, now with strategic reserves we have probably 90 days stock of Oil. However, seeing our Trade defecit numbers the peculators have decided to make a quick buck, burnign precious RBI reserves now will not be much benefit against these 5% forward traders.

We need to pay Iran for this OIl in October December 18 period. We will probably buy extra quantities of Oil for Strategic reserves in Aug 18 also. Sep 18 our Trade defect should be curbed as we would have build strategic safety by then. This data will be out by Oct 18 and Govt needing to pay Iran. That is the time they will intervene to lift the Rupee.

We need to pay Iran for this OIl in October December 18 period. We will probably buy extra quantities of Oil for Strategic reserves in Aug 18 also. Sep 18 our Trade defect should be curbed as we would have build strategic safety by then. This data will be out by Oct 18 and Govt needing to pay Iran. That is the time they will intervene to lift the Rupee.

Re: Indian Economy News & Discussion - Nov 27 2017

Deleted . Poster banned for a week for trolling.

Re: Indian Economy News & Discussion - Nov 27 2017

The gross fiscal deficit and CAD as a fraction of GDP have been falling since the NDA government took over.kiranA wrote: Which conclusion ? whether 3% gap was filled by FDI, fiscal deficit etc OR whether it led to rupee decline ? First one is pretty clear if one looks at rising FDI and generally high fiscal deficit run by Indian govt. Second thing is common sense - when a country runs a significant trade deficit, fiscal deficit, CAD, and has a significant net negative international investment position - it invariably correlates with losing currency value in international area.

If CPI included fuel prices, it would have changed that significantly, yes. But in any case, there is no arbitrage in CPI between US and India; one would have to construct the right trade weighted inflation index. So I don't expect CPIs to track the exchange rate except to within some percentage range (say +/- 5%). Obviously there is within-the-day fluctuations in the exchange rate, one can hardly explain those with CPI.Regarding your CPI calculation - now rupee is nearer to 71 - Did CPI change that drastically in last 2 weeks ?

Re: Indian Economy News & Discussion - Nov 27 2017

Q4 is the end off-the-shelf financial year. Companies usually present their performance after the end of Q4. So they do everything they can to save costs in that quarter including stopping recruitment.Trikaal wrote:Is there a particular reason that causes Q1 growth rate to be generally more than the growth rates of other quarters? (don't consider 2016 and 2017 coz of demonitization)

Q1 is new funds and spending generally shoots up.

Having said that many companies end their financial year along with the calendar year.

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.bloombergquint.com/business ... dline-ends

More Than 5.2 Crore Income Tax Returns Filed As Deadline Ends

More Than 5.2 Crore Income Tax Returns Filed As Deadline Ends

Over 5.29 crore income tax returns have been filed by taxpayers as the deadline ended today, signalling an increase of over 60 percent from the previous year.

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.fortuneindia.com/macro/fmcg ... sen/102336

FMCG sector to grow 12-13% in 2018: Nielsen

FMCG sector to grow 12-13% in 2018: Nielsen

India’s fast-moving consumer goods (FMCG) sector will grow 12-13% in calendar year 2018, says a report by market research firm Nielsen India.

The sector, according to Nielsen India, has weathered the storm of goods and services tax (GST) and demonetisation, and the trade dynamism caused by it has also settled down.

“Looking at the overall macro-economic scenario and the industry dynamics, the FMCG sector’s growth in calendar year 2018 to be around 12-13%, which is closer to the growth range witnessed in 2017,”said,” Sameer Shukla, executive director, Nielsen India.

The economic momentum is expected to gather pace through the second half of 2018, benefiting from a favourable economic and policy environment,” he added.

Re: Indian Economy News & Discussion - Nov 27 2017

https://timesofindia.indiatimes.com/bus ... 632329.cms

IPPB: India’s biggest bank in the making

Read more at:

http://timesofindia.indiatimes.com/arti ... aign=cppst

IPPB: India’s biggest bank in the making

Read more at:

http://timesofindia.indiatimes.com/arti ... aign=cppst

How it will function:

It will focus on providing banking and financial services to people in rural areas, by linking all the 1.55 lakh post office branches (that’s nearly 2.5 times the bank network) with India Post Payments Bank services by the end of 2018. Around 11,000 postmen both in rural and urban areas will provide doorstep banking services.

This will create the country’s largest banking network with a direct presence at the village level. IPPB has been allowed to link around 17 crore postal savings bank accounts with its accounts...

Re: Indian Economy News & Discussion - Nov 27 2017

India manufacturing PMI eases in August on softer domestic demand

Nikkei Manufacturing PMI fell to a three-month low of 51.7 from July’s 52.3, but continued to stay above the 50-mark which separates growth from contraction since July 2017

https://www.livemint.com/Industry/1AHVG ... tic-d.html

Nikkei Manufacturing PMI fell to a three-month low of 51.7 from July’s 52.3, but continued to stay above the 50-mark which separates growth from contraction since July 2017

https://www.livemint.com/Industry/1AHVG ... tic-d.html

“Indian manufacturers retained positive projections for output over the next 12 months, but the level of sentiment eased in August. Indeed, some of the key headwinds facing the economy include high global oil prices, monetary policy tightening, and capital outflows from emerging markets,” IHS Markit economist Aashna Dodhia said in a statement.

Re: Indian Economy News & Discussion - Nov 27 2017

My biggest issue with the monthly PMI blurbs are that they don't explain which of the 5 major factors resulted in the change in the index: new orders, inventory levels, production, supplier deliveries or employment. The specific permutation of changes may indicate a decrease in PMI, but may or may not herald any sort of significant change in economic momentum.

In comparison, data for IIP or core sector output for example, describes which of the contributors grew or fell in the month being reported.

In comparison, data for IIP or core sector output for example, describes which of the contributors grew or fell in the month being reported.

Re: Indian Economy News & Discussion - Nov 27 2017

Agreed. Most news sources do not provide this.Suraj wrote:My biggest issue with the monthly PMI blurbs are that they don't explain which of the 5 major factors resulted in the change in the index: new orders, inventory levels, production, supplier deliveries or employment. The specific permutation of changes may indicate a decrease in PMI, but may or may not herald any sort of significant change in economic momentum.

In comparison, data for IIP or core sector output for example, describes which of the contributors grew or fell in the month being reported.

https://www.business-standard.com/artic ... 206_1.html

New orders placed at Indian manufacturers rose for the tenth month in succession during August. Where an increase was reported, firms commented on strong market demand. Despite being solid, the rate of growth softened from the preceding month.

Orders from abroad rose for the tenth consecutive month during August. Moreover, the rate of expansion was marked and accelerated to the strongest since February.

Subsequently, pre-production stocks rose at a marginal and softer pace compared to the preceding month. Meanwhile, post-production inventories were depleted at a marked rate in August.

In response to sustained periods of expansion in output and new orders, firms were encouraged to raise their staffing levels during August. That said, job creation remained marginal and broadly similar to the previous survey period.

On the price front, Indian manufacturing companies continued to face higher input costs during August. There were reports that currency weakness contributed to higher raw material costs. Although sharp, input cost inflation moderated to the weakest since May.

As part of ongoing efforts to protect margins, Indian manufacturers raised their own selling prices for the thirteenth consecutive month in August. That said, the latest rise was marginal and the slowest since April.

Re: Indian Economy News & Discussion - Nov 27 2017

Great recent research work here, A_Gupta.