Pakistani Economic Stress Watch

-

prasannasimha

- Forum Moderator

- Posts: 1214

- Joined: 15 Aug 2016 00:22

Re: Pakistani Economic Stress Watch

fwiw about the oil reserve find

h[url]ttps://www.brecorder.com/2018/08/07/432829/fm- ... xxonmobil/[/url]

GENERAL NEWS

FM clarifies news item on ExxonMobil

Fawad MaqsoodAugust 7, 2018

ISLAMABAD: Caretaker Minister for Maritime Affairs and Foreign Affairs Abdullah Hussain Haroon on Tuesday clarified a news item published in a section of press, saying that his statement on oil drilling by ExxonMobil should be taken without implying any further meaning to it.

The Minister in a statement issued for press said ExxonMobil had purchased a block of Pakistan’s deep sea drilling rights off the Indus Delta for exploration.

“Their drilling is yet to start as depths are very intense but they are very hopeful of success in discovering a big cache of oil,” he said in a statement issued to press.

He added, “While the situation is not only good news and hopefully rewarding to Pakistan, anything further should not be added and may not be construed by my talk at FPCCI etc.”

A national daily in its August 4th publication had quoted Abdullah Haroon during his address at Federation of Pakistan Chambers of Commerce and Industry (FPCCI) as saying that ExxonMobil was close to hitting huge oil reserves near the Pak-Iran border, which could be even bigger than the Kuwaiti reserves.

Copyright APP (Associated Press of Pakistan), 2018

h[url]ttps://www.brecorder.com/2018/08/07/432829/fm- ... xxonmobil/[/url]

GENERAL NEWS

FM clarifies news item on ExxonMobil

Fawad MaqsoodAugust 7, 2018

ISLAMABAD: Caretaker Minister for Maritime Affairs and Foreign Affairs Abdullah Hussain Haroon on Tuesday clarified a news item published in a section of press, saying that his statement on oil drilling by ExxonMobil should be taken without implying any further meaning to it.

The Minister in a statement issued for press said ExxonMobil had purchased a block of Pakistan’s deep sea drilling rights off the Indus Delta for exploration.

“Their drilling is yet to start as depths are very intense but they are very hopeful of success in discovering a big cache of oil,” he said in a statement issued to press.

He added, “While the situation is not only good news and hopefully rewarding to Pakistan, anything further should not be added and may not be construed by my talk at FPCCI etc.”

A national daily in its August 4th publication had quoted Abdullah Haroon during his address at Federation of Pakistan Chambers of Commerce and Industry (FPCCI) as saying that ExxonMobil was close to hitting huge oil reserves near the Pak-Iran border, which could be even bigger than the Kuwaiti reserves.

Copyright APP (Associated Press of Pakistan), 2018

Re: Pakistani Economic Stress Watch

^In true Baki sense, to provide some "bositive news" and hence relief, the Maritime affairs minister released some pindi chana inspired gas.

And then how they backtrack!

The drilling that is yet to start is explorative drilling.

Assume that they find a huge cache and larger than Kuwait reserves. So what happens?

1. They will be among several nations already there awash in oil (Iran, Iraq, Kuwait, Arabia).

2. They will have to find external markets for their oil. Of course they can print money, and sell oil back to their awaam for free and free 24x7 electricity. And it will be land of ghee and honey, like Venezuela. Basically they have to trade. Their only market will be the gulf states (for agricultural produce) and central asian states (for minerals) and Cheen (for everything else).

Would the gulf state want another competitor producing the same produce? Already they have kept the oil prices up by production cuts. For example from 2014 till today, the WTI crude has seen 33% price drop. Opec basket has seen a bigger price drop. In general some 30% drop across the board. (https://oilprice.com/oil-price-charts)

So where will the investment to create drilling rigs come from? China?

And then how they backtrack!

They are so down the economic spiral that Exxon Mobil purchasing a block 230 Km offshore leads to jungjoo statements of "larger than Kuwait" find.The Minister in a statement issued for press said ExxonMobil had purchased a block of Pakistan’s deep sea drilling rights off the Indus Delta for exploration.

“Their drilling is yet to start as depths are very intense but they are very hopeful of success in discovering a big cache of oil,” he said in a statement issued to press.

He added, “While the situation is not only good news and hopefully rewarding to Pakistan, anything further should not be added and may not be construed by my talk at FPCCI etc.”

The drilling that is yet to start is explorative drilling.

Assume that they find a huge cache and larger than Kuwait reserves. So what happens?

1. They will be among several nations already there awash in oil (Iran, Iraq, Kuwait, Arabia).

2. They will have to find external markets for their oil. Of course they can print money, and sell oil back to their awaam for free and free 24x7 electricity. And it will be land of ghee and honey, like Venezuela. Basically they have to trade. Their only market will be the gulf states (for agricultural produce) and central asian states (for minerals) and Cheen (for everything else).

Would the gulf state want another competitor producing the same produce? Already they have kept the oil prices up by production cuts. For example from 2014 till today, the WTI crude has seen 33% price drop. Opec basket has seen a bigger price drop. In general some 30% drop across the board. (https://oilprice.com/oil-price-charts)

So where will the investment to create drilling rigs come from? China?

Pakistani Economic Stress Watch

TAKING ALMS FROM PETER TO PAY PAUL

Foreign loan disbursements slow down to $2.8b - Shahbaz Rana

ISLAMABAD: Foreign loan disbursements plunged by nearly two-thirds to just $2.8 billion in first eight months of the current fiscal year, suggesting that the government remained unable to remove bottlenecks that were hampering the release of funds for different projects.

The delay in finalisation of a bailout package with the International Monetary Fund (IMF) has also blocked policy loans in addition to forcing the government to postpone the issuance of Eurobonds.

The disbursement of $2.75 billion in loans from July to February of the current fiscal year did not include the emergency loans of $7 billion from Saudi Arabia, the United Arab Emirates (UAE) and China, showed official statistics.

Finance ministry’s spokesman Dr Khaqan Najeeb said on Friday the Saudi oil facility of $3 billion would become operational from April. He said the remaining $1 billion in loan from the UAE could also be disbursed next week.

Pakistan also expects $2.1 billion in Chinese commercial loan disbursement on upcoming Monday.

However, the loan disbursements from July through February were equal to only 31% of the original annual estimate of the finance ministry.

Owing to the low disbursements, the central bank’s gross foreign currency reserves have remained under pressure, standing at $8.8 billion even after arrival of $7 billion from three friendly countries. China gave $2 billion in loan in July last year followed by $3 billion that Pakistan got from Saudi Arabia and $2 billion from the UAE.

The financial assistance from these countries has been shown on central bank’s books.

The disbursements in July-February 2018-19 from international creditors were down $4.6 billion or 63% compared with the loans received in the same period of previous fiscal year. In July-February FY18, Pakistan had received $7.3 billion in loans on the back of $2.5 billion worth of sovereign bonds and $1.8 billion in commercial loans

Finance Minister Asad Umar has been trying to improve the situation including amending Public Procurement Regulatory Authority (PPRA) rules. However, the usual bureaucratic snags have not been removed so far.

The government is also trying to develop a mechanism for fast-track approval and implementation of foreign-funded projects. But so far the system has not improved.

Foreign loans are not sufficient to meet Pakistan’s growing financing needs and the slowdown has put pressure on the foreign currency reserves. Over the past few weeks, the central bank has also conducted open market operations to mop up dollars as part of its strategy to gradually let the rupee depreciate against the US dollar, said sources in the central bank.

Last week, Pakistan requested the Asian Development Bank (ADB) to approve $500 million in policy loan before June. But the lender may not pay heed until it gets a letter of comfort from the IMF.

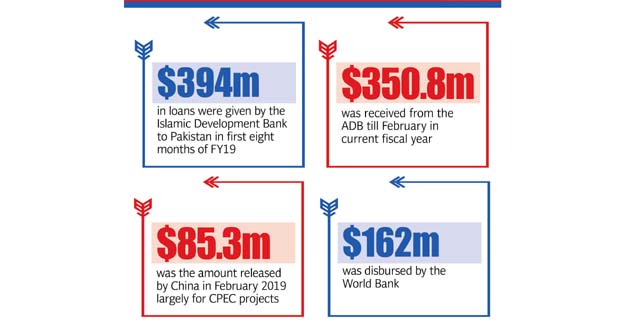

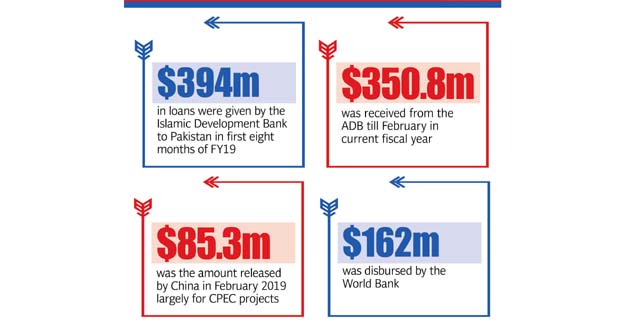

Beijing in February 2019 released $85.3 million, largely for China-Pakistan Economic Corridor (CPEC) projects, taking its contribution to $1.2 billion in the past eight months. The loans have largely been disbursed for the Sukkur-Multan motorway ($669 million) and Havelian-Thakot project of CPEC ($223 million). These two projects got 73% of the total Chinese financing in eight months.

PML-N demands foreign loans details

Chinese loans were equal to 44% of the total disbursements for Pakistan from July through February, according to the officials.

The country received $350.8 million from the ADB till February, far lower than the estimate. The World Bank disbursed only $162 million, down nearly 50% from disbursements in the previous fiscal year.

The Islamic Development Bank (IDB) disbursed an additional $91.4 million last month, which took its total loans for Pakistan to $394 million in eight months. IDB’s disbursements were down 57%.

Foreign loan disbursements drop to $2.2b in first half of FY19

The IDB has given these commercial loans for oil purchase from Saudi Arabia. So far, Pakistan has been promised three oil facilities worth $575 million for the current fiscal year.

Cheers

Foreign loan disbursements slow down to $2.8b - Shahbaz Rana

ISLAMABAD: Foreign loan disbursements plunged by nearly two-thirds to just $2.8 billion in first eight months of the current fiscal year, suggesting that the government remained unable to remove bottlenecks that were hampering the release of funds for different projects.

The delay in finalisation of a bailout package with the International Monetary Fund (IMF) has also blocked policy loans in addition to forcing the government to postpone the issuance of Eurobonds.

The disbursement of $2.75 billion in loans from July to February of the current fiscal year did not include the emergency loans of $7 billion from Saudi Arabia, the United Arab Emirates (UAE) and China, showed official statistics.

Finance ministry’s spokesman Dr Khaqan Najeeb said on Friday the Saudi oil facility of $3 billion would become operational from April. He said the remaining $1 billion in loan from the UAE could also be disbursed next week.

Pakistan also expects $2.1 billion in Chinese commercial loan disbursement on upcoming Monday.

However, the loan disbursements from July through February were equal to only 31% of the original annual estimate of the finance ministry.

Owing to the low disbursements, the central bank’s gross foreign currency reserves have remained under pressure, standing at $8.8 billion even after arrival of $7 billion from three friendly countries. China gave $2 billion in loan in July last year followed by $3 billion that Pakistan got from Saudi Arabia and $2 billion from the UAE.

The financial assistance from these countries has been shown on central bank’s books.

The disbursements in July-February 2018-19 from international creditors were down $4.6 billion or 63% compared with the loans received in the same period of previous fiscal year. In July-February FY18, Pakistan had received $7.3 billion in loans on the back of $2.5 billion worth of sovereign bonds and $1.8 billion in commercial loans

Finance Minister Asad Umar has been trying to improve the situation including amending Public Procurement Regulatory Authority (PPRA) rules. However, the usual bureaucratic snags have not been removed so far.

The government is also trying to develop a mechanism for fast-track approval and implementation of foreign-funded projects. But so far the system has not improved.

Foreign loans are not sufficient to meet Pakistan’s growing financing needs and the slowdown has put pressure on the foreign currency reserves. Over the past few weeks, the central bank has also conducted open market operations to mop up dollars as part of its strategy to gradually let the rupee depreciate against the US dollar, said sources in the central bank.

Last week, Pakistan requested the Asian Development Bank (ADB) to approve $500 million in policy loan before June. But the lender may not pay heed until it gets a letter of comfort from the IMF.

Beijing in February 2019 released $85.3 million, largely for China-Pakistan Economic Corridor (CPEC) projects, taking its contribution to $1.2 billion in the past eight months. The loans have largely been disbursed for the Sukkur-Multan motorway ($669 million) and Havelian-Thakot project of CPEC ($223 million). These two projects got 73% of the total Chinese financing in eight months.

PML-N demands foreign loans details

Chinese loans were equal to 44% of the total disbursements for Pakistan from July through February, according to the officials.

The country received $350.8 million from the ADB till February, far lower than the estimate. The World Bank disbursed only $162 million, down nearly 50% from disbursements in the previous fiscal year.

The Islamic Development Bank (IDB) disbursed an additional $91.4 million last month, which took its total loans for Pakistan to $394 million in eight months. IDB’s disbursements were down 57%.

Foreign loan disbursements drop to $2.2b in first half of FY19

The IDB has given these commercial loans for oil purchase from Saudi Arabia. So far, Pakistan has been promised three oil facilities worth $575 million for the current fiscal year.

Cheers

Pakistani Economic Stress Watch

X Posted on the Terroristan Thread

Rupee hits record low at 140.24 against US dollar

Rupee hits record low at 140.24 against US dollar

CheersKARACHI: In line with market expectations, the rupee hit a new record low at 140.24 to the US dollar in the inter-bank market on Friday on speculation that Pakistan had agreed with the International Monetary Fund (IMF) to let the currency depreciate ahead of obtaining a bailout.

Pakistani Economic Stress Watch

World Bank downgrades rating of Punjab project - Shahbaz Rana

CheersISLAMABAD: The World Bank has downgraded the rating of a $100 million project, which it is financing in Punjab to reduce poverty and joblessness, due to the provincial government’s failure to approve a spatial strategy.

Pakistani Economic Stress Watch

PTI govt required to pay Rs1 billion to oil pipeline company - Zafar Bhutta

ISLAMABAD: The shift in government’s policy which discourages the use of furnace oil in power plants is going to cost over Rs1 billion to the national exchequer.

The money will go to Asia Petroleum Limited (APL), which was incorporated in Pakistan on July 17, 1994 as it developed energy infrastructure for transporting furnace oil through its oil terminal and an underground oil pipeline connected to the 1,292-megawatt Hubco power plant in Balochistan.

APL signed a fuel transportation agreement with Pakistan State Oil (PSO) on May 13, 2004 for the supply of furnace oil to Hubco with annual guaranteed output of 1.5 million tons at an agreed tariff of $12.13 per ton for the first 19 years and $8.49 per ton till 2027. The agreement provides sovereign guarantee to pay for any shortfall in the guaranteed output.

Sources told The Express Tribune that APL through PSO had lodged an audited claim for the shortfall in guaranteed output with a cumulative value of Rs998 million for the period July 1, 2017 to December 31, 2018 besides expected claim of Rs884 million for the current financial year at the prevailing exchange rate. The claimed amount may further increase due to the applicable exchange rate at the time of actual payment to APL.

The main reason behind the shortfall was reduced furnace oil demand from the Power Division for the Hubco plant due to the shift in government’s policy towards increased consumption of cost-efficient fuels and other alternative sources rather than furnace oil.

Therefore, the shortfall will be paid by the government till the expiry of the agreement amounting to about $12.73 million per annum through budgetary allocation. In case of delay in making payment to APL, the late payment surcharge and exchange rate difference will also be payable by the government. Therefore, the Petroleum Division took up the matter with the Ministry of Finance.

APL told the Petroleum Division that following the halt to furnace oil supply through APL’s pipeline, the shortfall claims were generated and the company was facing financial and operational challenges. Therefore, in order to meet liquidity requirement of the business, the company was in the process of obtaining a financial facility from a bank. The Petroleum Division is seeking approval of the ECC for a supplementary grant to pay the money to APL.

Cheers

ISLAMABAD: The shift in government’s policy which discourages the use of furnace oil in power plants is going to cost over Rs1 billion to the national exchequer.

The money will go to Asia Petroleum Limited (APL), which was incorporated in Pakistan on July 17, 1994 as it developed energy infrastructure for transporting furnace oil through its oil terminal and an underground oil pipeline connected to the 1,292-megawatt Hubco power plant in Balochistan.

APL signed a fuel transportation agreement with Pakistan State Oil (PSO) on May 13, 2004 for the supply of furnace oil to Hubco with annual guaranteed output of 1.5 million tons at an agreed tariff of $12.13 per ton for the first 19 years and $8.49 per ton till 2027. The agreement provides sovereign guarantee to pay for any shortfall in the guaranteed output.

Sources told The Express Tribune that APL through PSO had lodged an audited claim for the shortfall in guaranteed output with a cumulative value of Rs998 million for the period July 1, 2017 to December 31, 2018 besides expected claim of Rs884 million for the current financial year at the prevailing exchange rate. The claimed amount may further increase due to the applicable exchange rate at the time of actual payment to APL.

The main reason behind the shortfall was reduced furnace oil demand from the Power Division for the Hubco plant due to the shift in government’s policy towards increased consumption of cost-efficient fuels and other alternative sources rather than furnace oil.

Therefore, the shortfall will be paid by the government till the expiry of the agreement amounting to about $12.73 million per annum through budgetary allocation. In case of delay in making payment to APL, the late payment surcharge and exchange rate difference will also be payable by the government. Therefore, the Petroleum Division took up the matter with the Ministry of Finance.

APL told the Petroleum Division that following the halt to furnace oil supply through APL’s pipeline, the shortfall claims were generated and the company was facing financial and operational challenges. Therefore, in order to meet liquidity requirement of the business, the company was in the process of obtaining a financial facility from a bank. The Petroleum Division is seeking approval of the ECC for a supplementary grant to pay the money to APL.

Cheers

Re: Pakistani Economic Stress Watch

Slow loan disbursement from foreign governments- paktribune

Not to mention all this will go for a toss if the FATF black listing occurs, then no money will come.

And to add to this

Please note this figure of 8.8 billion $ includes the double accounting of the domestic banks reserves of foreign exchange.

Some of the debts are hidden by using clever tactics such as holding corporation of circular debt.

And ofcourse it doesn't count the reimbursement to the exporters of the refunded tax amount.

The bakonomy is dekhonomoney. But you have to give credit to the foreskin fathers of still keeping up a good show.

Last week, Pakistan requested the Asian Development Bank (ADB) to approve $500 million in policy loan before June. But the lender may not pay heed until it gets a letter of comfort from the IMF.

The other lenders will not give money till World Bank does, the World Bank will not give till their very very tough conditions are met.Owing to the low disbursements, the central bank’s gross foreign currency reserves have remained under pressure, standing at $8.8 billion even after arrival of $7 billion from three friendly countries. China gave $2 billion in loan in July last year followed by $3 billion that Pakistan got from Saudi Arabia and $2 billion from the UAE.

Not to mention all this will go for a toss if the FATF black listing occurs, then no money will come.

And to add to this

Please note this figure of 8.8 billion $ includes the double accounting of the domestic banks reserves of foreign exchange.

Some of the debts are hidden by using clever tactics such as holding corporation of circular debt.

And ofcourse it doesn't count the reimbursement to the exporters of the refunded tax amount.

The bakonomy is dekhonomoney. But you have to give credit to the foreskin fathers of still keeping up a good show.

Re: Pakistani Economic Stress Watch

K Mehta wrote:Slow loan disbursement from foreign governments- paktribune

Last week, Pakistan requested the Asian Development Bank (ADB) to approve $500 million in policy loan before June. But the lender may not pay heed until it gets a letter of comfort from the IMF.

K Mehta Ji :Owing to the low disbursements, the central bank’s gross foreign currency reserves have remained under pressure, standing at $8.8 billion even after arrival of $7 billion from three friendly countries. China gave $2 billion in loan in July last year followed by $3 billion that Pakistan got from Saudi Arabia and $2 billion from the UAE. The other lenders will not give money till World Bank does, the World Bank will not give till their very very tough conditions are met.

Not to mention all this will go for a toss if the FATF black listing occurs, then no money will come.

And to add to this Please note this figure of 8.8 billion $ includes the double accounting of the domestic banks reserves of foreign exchange.

Some of the debts are hidden by using clever tactics such as holding corporation of circular debt.

And ofcourse it doesn't count the reimbursement to the exporters of the refunded tax amount.

The bakonomy is dekhonomoney. But you have to give credit to the foreskin fathers of still keeping up a good show.

Here is the Episode of "Terroristani Double Accounting"

By excluding $5.8 billion of short-term loans, the net usable reserves with the commercial banks stand at only $200 million. Out of $5.8 billion, $1.68 billion was obtained for one month, $2.46 billion for up to three months and $1.7 billion for up to one year, according to the SBP.

Cheers“This is clearly double counting of $5.8 billion. In principle, it should have excluded this sum from the commercial banks’ reserves,” said Dr Ashfaque Hasan Khan, former director general of Debt of Ministry of Finance.

Pakistani Economic Stress Watch

X Posted on the Terroristani Thread

Cheers

Cheers

Pakistani Economic Stress Watch

S&P BSE SENSEX

Index Current : 37,808.91 - Pt. Change : -355.70 - % Change : -0.93%

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,47,01,720.78 - $ 1 / Rs. 68.9625

Market Capitalization of BSE Listed Co. (U S $.) : 2,131.23 Billion

PSE

Index Current : 38128.66 - Pt. Change : -403.21 % - Change : -1.05% - $ 1 / Rs. 141.00

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 7,766,496,039,552

Market Capitalization of PSE Listed Co. (U S $.) : 55.08 Billion

B S E : P S E : : 38.69 : 1

Cheers

Index Current : 37,808.91 - Pt. Change : -355.70 - % Change : -0.93%

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,47,01,720.78 - $ 1 / Rs. 68.9625

Market Capitalization of BSE Listed Co. (U S $.) : 2,131.23 Billion

PSE

Index Current : 38128.66 - Pt. Change : -403.21 % - Change : -1.05% - $ 1 / Rs. 141.00

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 7,766,496,039,552

Market Capitalization of PSE Listed Co. (U S $.) : 55.08 Billion

B S E : P S E : : 38.69 : 1

Cheers

Re: Pakistani Economic Stress Watch

World Bank WITS database information on Pakistan

Essentially an exporter of primary and semifinished / low value add goods, and importer of high value goods and services.

Essentially an exporter of primary and semifinished / low value add goods, and importer of high value goods and services.

Pakistani Economic Stress Watch

S&P BSE SENSEX

Index Current : 38,233.41 - Pt. Change : +424.50 - % Change : +1.12%

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,48,37,723.20 - $ 1 / I Rs 68.9000

Market Capitalization of BSE Listed Co. (U S $.) : 2,153.52 Billion

P S E[/b]

Index Current : 38329.13 - Pt. Change : + 200.47 - % Change : + 0.53%

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 7,807,875,524,396 - $ 1 / Tr. Rs. 140

Market Capitalization of PSE Listed Co. (U S $.) : 55.77 Billion

B S E : P S E : : 38.61 : 1

Cheers

Index Current : 38,233.41 - Pt. Change : +424.50 - % Change : +1.12%

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,48,37,723.20 - $ 1 / I Rs 68.9000

Market Capitalization of BSE Listed Co. (U S $.) : 2,153.52 Billion

P S E[/b]

Index Current : 38329.13 - Pt. Change : + 200.47 - % Change : + 0.53%

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 7,807,875,524,396 - $ 1 / Tr. Rs. 140

Market Capitalization of PSE Listed Co. (U S $.) : 55.77 Billion

B S E : P S E : : 38.61 : 1

Cheers

Pakistani Economic Stress Watch

X Posted on the Terroristan Thread

State Bank slashes growth forecast, again - Shahid Iqbal

State Bank slashes growth forecast, again - Shahid Iqbal

KARACHI: Growth in the current fiscal year will “moderate significantly”, the State Bank of Pakistan (SBP) said in its second quarterly report released on Monday.

It is now projected to land in a range between 3.5 and 4 per cent, indicating sharp decline compared to 5.2pc growth in FY18 or the target of 6.2pc for the current fiscal year.

The sharp deceleration is already visible across the board, according to the report, and is attributable to slower growth in agriculture as well as “stabilisation measures taken to preserve macroeconomic stability.”

CheersIn the previous quarterly report the SBP had downgraded the growth forecast to a range between 4.0 and 4.5pc, significantly lower from the starting year target of 6.4pc. With the further downgrade the growth rate is approaching nearly half of what it was expected to be when the fiscal year began.

Re: Pakistani Economic Stress Watch

Thanks Peregine ji! Some reasons quoted points to mounting pressure on the economy:Peregrine wrote:X Posted on the Terroristan Thread

State Bank slashes growth forecast, again - Shahid IqbalKARACHI: Growth in the current fiscal year will “moderate significantly”, the State Bank of Pakistan (SBP) said in its second quarterly report released on Monday.It is now projected to land in a range between 3.5 and 4 per cent, indicating sharp decline compared to 5.2pc growth in FY18 or the target of 6.2pc for the current fiscal year.The sharp deceleration is already visible across the board, according to the report, and is attributable to slower growth in agriculture as well as “stabilisation measures taken to preserve macroeconomic stability.”CheersIn the previous quarterly report the SBP had downgraded the growth forecast to a range between 4.0 and 4.5pc, significantly lower from the starting year target of 6.4pc. With the further downgrade the growth rate is approaching nearly half of what it was expected to be when the fiscal year began.

..."This trend [rising private sector credit offtake] is largely due to the rising cost of imported inputs and higher energy prices on account of the rupee depreciation and liquidity constraints owing to a higher level of unsold inventories (in POL, steel, autos, fertilisers, electronics and sugar sectors) along with circular debt in the energy sector,” said the report.

But the SBP sees stalling growth, persistently high fiscal and current account deficits (despite sharp cuts in development spending and imports), and the highest inflation “in 17 consecutive quarters” with further inflationary pressures building. Tight monetary policy was constraining demand as well as investment, and the government’s debt profile shifting extensively to State Bank financing and “higher re-pricing risks” for the government as tenors on government debt grew ever shorter.....

In the agriculture sector, during the first half of FY19 there has been a broad-based decline in production of major kharif crops mainly due to water shortages. Cotton crop is affected the most as according to official estimates its production has remained short by 25pc from its target."

Pakistani Economic Stress Watch

X Posted on the Terroristan Thread

World Bank advises Pakistan to set currency free of state control - Salman Siddiqui

KARACHI : Following the International Monetary Fund (IMF), the World Bank (WB) has also suggested to Pakistan to leave its currency free from state control to let it find equilibrium against the dollar and other major currencies in a bid to help domestic economy grow to its true potential.

“The [rupee-dollar] exchange rate should be based on market system,” World Bank Group Country Director for Pakistan Patchamuthu Illangovan said while addressing at C100 Think Tank on Monday.

He added that state’s control over currency restricted export growth, resulting into partial consumption of the State Bank of Pakistan’s foreign currency reserves to finance international payments mainly on import and debt repayment counters and created balance of payment deficit.

“If you had retailed the 2005 market share of export globally (then) today you would have been exporting four times more than what you should be today,” he said, “Pakistan’s exports would have been worth over $108 billion today instead of around $25 billion in actual.”

Earlier, the IMF urged Pakistan to leave rupee free from the state’s control as a measure to help the economy flourish. To recall, Pakistan has been in talks with the international monetary institution to obtain a bailout for covering financing gaps on external front and fixing the faltering economy through structural reforms.

Giving reference to the World Bank’s recently launched report “Pakistan@100: Shaping The Future 2047”, Illangovan said the government has appreciated the anticipation which suggests Pakistani economy potential at $2 trillion by 2047, subject to controlling population growth rate and massive policy making and structural reforms. Patchamuthu Illangovan Sings "Glory Glory Hallelujah"

GDP growth at 30-35%

The country director further said Pakistan can achieve the projected economic potential much before 2047 if it removes gender inequality by encouraging women to pay their part in economic development.

“Pakistan’s economy has a potential to grow at 30-35% per annum if gender gap is narrowed close to equal,” he said. He, however, simultaneously urged private sector to equally play their important role in shaping Pakistan’s future.

“Targets (in the report) are achievable. Government cannot do it all alone as the private sector needs to come forward…create investment climate,” he said, adding Pakistan outperformed its regional peers till the 1960s.

Later on, however, the rate of investment in Pakistan fell to a historical low of about almost half of what other countries maintained in South Asia.

The World Bank country director further remarked Pakistan had done a remarkable job in promoting ease of doing business and poverty alleviation in recent years but it needs to further progress on these fronts. He urged parliamentarians to devise a policy to fight against water scarcity in the country.

Meanwhile, World Bank Group Chief Economist Hans Timmer said financial crisis comes after every 40 years at a global level and reshapes the world economy.

“The 2008 recession shifted economic power to the US while China is becoming a dominant player,” noted Timmer, urging nations, particularly Pakistan, to deploy technology for achieving economic growth.

KASBL CEO and Former Chairman Pakistan Stock Exchange Munir Kamal said Pakistan’s economy has lagged behind India, Bangladesh and Vietnam because they grew their exports through taking full advantage of economic growth in China.

He urged Pakistan to do the same through linking supplies to China from three under construction special economic zones which are part of the greater China-Pakistan Economic Corridor (CPEC).

Cheers

World Bank advises Pakistan to set currency free of state control - Salman Siddiqui

KARACHI : Following the International Monetary Fund (IMF), the World Bank (WB) has also suggested to Pakistan to leave its currency free from state control to let it find equilibrium against the dollar and other major currencies in a bid to help domestic economy grow to its true potential.

“The [rupee-dollar] exchange rate should be based on market system,” World Bank Group Country Director for Pakistan Patchamuthu Illangovan said while addressing at C100 Think Tank on Monday.

He added that state’s control over currency restricted export growth, resulting into partial consumption of the State Bank of Pakistan’s foreign currency reserves to finance international payments mainly on import and debt repayment counters and created balance of payment deficit.

“If you had retailed the 2005 market share of export globally (then) today you would have been exporting four times more than what you should be today,” he said, “Pakistan’s exports would have been worth over $108 billion today instead of around $25 billion in actual.”

Earlier, the IMF urged Pakistan to leave rupee free from the state’s control as a measure to help the economy flourish. To recall, Pakistan has been in talks with the international monetary institution to obtain a bailout for covering financing gaps on external front and fixing the faltering economy through structural reforms.

Giving reference to the World Bank’s recently launched report “Pakistan@100: Shaping The Future 2047”, Illangovan said the government has appreciated the anticipation which suggests Pakistani economy potential at $2 trillion by 2047, subject to controlling population growth rate and massive policy making and structural reforms. Patchamuthu Illangovan Sings "Glory Glory Hallelujah"

GDP growth at 30-35%

The country director further said Pakistan can achieve the projected economic potential much before 2047 if it removes gender inequality by encouraging women to pay their part in economic development.

“Pakistan’s economy has a potential to grow at 30-35% per annum if gender gap is narrowed close to equal,” he said. He, however, simultaneously urged private sector to equally play their important role in shaping Pakistan’s future.

“Targets (in the report) are achievable. Government cannot do it all alone as the private sector needs to come forward…create investment climate,” he said, adding Pakistan outperformed its regional peers till the 1960s.

Later on, however, the rate of investment in Pakistan fell to a historical low of about almost half of what other countries maintained in South Asia.

The World Bank country director further remarked Pakistan had done a remarkable job in promoting ease of doing business and poverty alleviation in recent years but it needs to further progress on these fronts. He urged parliamentarians to devise a policy to fight against water scarcity in the country.

Meanwhile, World Bank Group Chief Economist Hans Timmer said financial crisis comes after every 40 years at a global level and reshapes the world economy.

“The 2008 recession shifted economic power to the US while China is becoming a dominant player,” noted Timmer, urging nations, particularly Pakistan, to deploy technology for achieving economic growth.

KASBL CEO and Former Chairman Pakistan Stock Exchange Munir Kamal said Pakistan’s economy has lagged behind India, Bangladesh and Vietnam because they grew their exports through taking full advantage of economic growth in China.

He urged Pakistan to do the same through linking supplies to China from three under construction special economic zones which are part of the greater China-Pakistan Economic Corridor (CPEC).

Cheers

Re: Pakistani Economic Stress Watch

A considerable amount of blame for the pakis current predicament rests on Ishaq Dar keeping the PKR artificially overvalued by burning through their forex reserves all for H&D reasons. A gradual decline in the PKR's value would not have hurt them as much as the later sets of drastic drops that hit them eventually.

I hope someone convinces IK and Asad Umar that they need to keep the PKR value high or their personal H&D will nosedive and people will fondly remember how 1 USD cost "only" PKR 100 during the time of NS. Further efforts to keep it overvalued will ensure that whatever money they get from the IMF bailout will again be frittered away and they will be back at IMF's doors a few years down the line. Letting the PKR slide to its true level will help them in the long run. IK needs to be reminded that he will be rapidly thrown out of power long before the benefits are apparent.

I hope someone convinces IK and Asad Umar that they need to keep the PKR value high or their personal H&D will nosedive and people will fondly remember how 1 USD cost "only" PKR 100 during the time of NS. Further efforts to keep it overvalued will ensure that whatever money they get from the IMF bailout will again be frittered away and they will be back at IMF's doors a few years down the line. Letting the PKR slide to its true level will help them in the long run. IK needs to be reminded that he will be rapidly thrown out of power long before the benefits are apparent.

Re: Pakistani Economic Stress Watch

nachiket Ji :nachiket wrote:A considerable amount of blame for the pakis current predicament rests on Ishaq Dar keeping the PKR artificially overvalued by burning through their forex reserves all for H&D reasons. A gradual decline in the PKR's value would not have hurt them as much as the later sets of drastic drops that hit them eventually.

I hope someone convinces IK and Asad Umar that they need to keep the PKR value high or their personal H&D will nosedive and people will fondly remember how 1 USD cost "only" PKR 100 during the time of NS. Further efforts to keep it overvalued will ensure that whatever money they get from the IMF bailout will again be frittered away and they will be back at IMF's doors a few years down the line. Letting the PKR slide to its true level will help them in the long run. IK needs to be reminded that he will be rapidly thrown out of power long before the benefits are apparent.

Dar keeping the PKR artificially overvalued was to keep the Terroristani Elite happy so that they paid less in Terroristani Currency for the Imported Goods.

This massive Devaluation of their Rupee - about 50% - in One and a Half to Two Years i.e. the IMF suggested rate of Tr. Rupee being Devalued to 150 per US$ is similar to the IMF forcing India to Devalue the Indian Rupee from 4.76 to 7.50 to the US$ i.e.in 1966 or so - in ONE DAY - will cause a huge Inflationary Spiral - even though it has taken over 18 Months to drop from around the Rate of 97 to 150.

One should keep checking the Terroristani Rupee Rate in Pakistan's Debt and Liabilities Profile Provisional (In Billion Rupees) wherein the GDP is Tr. Rs. 38,474.0 Billion at an Average Rate of Rupees 134.3221 to the US Dollar.

Cheers

Re: Pakistani Economic Stress Watch

An 'anal'yst on paki tv program says internal pak government communique to Sui Northern and Sui Southern Gas company has said all commercial activities to be planned with Pak Rupee valuation at 180 to the American dollar during pak fiscal year 2019-2020 (Starts in July 2019). The gas companies has asked for immediate increase of 41% (on top of the more then 100% increase so far) on gas charges to be levied on public. AOA and soosai mubarak soon by aam abdul all over pakistan  .

.

Pakistani Economic Stress Watch

X Posted on the Terroristan Thread

Soup onullah! L'évacuation du matin a frappé le ventilateur!

Pakistan’s financing needs may hit $50b in next 2 years - Shahbaz Rana

ISLAMABAD: Pakistan’s gross financing needs in the next two years could hit a minimum $50 billion and it will have to get short-term debt rolled over besides securing new loans to meet external obligations, said Shahid Kardar, former governor of the central bank on Tuesday.

He stated this while speaking at an event organised by the embassy of Switzerland in Islamabad, which discussed the challenges faced by Pakistan’s economy and the way forward.

Kardar said the International Monetary Fund’s (IMF) financing envelope would not be that big to meet the external financing needs.

As per Pakistan’s entitlement, it can secure a net $6 billion from the IMF after excluding outstanding liabilities, said the former central bank governor.

Even the $50 billion financing requirement, on an average of $25 billion a year, seems very conservative given the external sector challenges being faced today. This requirement is worked out on the assumption of a single-digit current account deficit in dollar terms.

Pakistan remains firm, IMF changes its stance: Umar

It seems that due to the huge external financing requirement, Pakistan’s reliance on the club of friendly countries will continue in coming years or else it will be in trouble.

The government would have to contract nearly $35 billion in the next over two years to meet the financing needs, said Kardar.

Pakistan’s external debt and liabilities have already crossed $100 billion. The amount that will have to be rolled over or rescheduled into long-term loans will be over $15 billion in just two years.

Pakistan’s gross official foreign currency reserves of $10.6 billion have primarily been built on borrowed foreign funds. So far, the government has secured $9.2 billion in emergency loans from China, Saudi Arabia and the United Arab Emirates. Only China gave $4.2 billion since July last year.

IMF asks Pakistan to take decisive actions

The government is contracting expensive commercial loans at a time when it has much cheaper longer-maturity debt available from the World Bank, Asian Development Bank and IMF. However, loans from these countries are pegged with structural reforms, which are often painful and politically unpopular.

Kardar said it seemed that the IMF had frontloaded conditions for the under-discussion programme, which may create serious problems for the government. He was of the view that due to the prevailing macroeconomic conditions, poverty in the country could go up in the next two years.

He said the nature of problems suggested that it would require four years to address the structural issues but the IMF wanted to do most of it upfront, which could be problematic.

Finance Minister Asad Umar said on Monday the IMF had budged from its hard position, hoping that an agreement could be signed by the third week of next month.

Like the finance minister, Kardar also criticised past IMF policies, saying the IMF had failed in its own areas of core competence like taxation. It was on the IMF watch when Pakistan ended up distorting the tax structure including introduction of the concept of higher tax rates for non-filers of tax returns. Ah So! - Of course it is not the Fault of the Stupid Terroristanis!

Umar also blamed the IMF for the current economic mess as the macroeconomic situation could not improve despite signing 21 programmes with the fund.

Kardar said due to the serious nature of structural issues, the average annual growth rate for the next two to three years could be 3%, which would not be sufficient to create adequate job opportunities.

Independent economists have time and again said Pakistan needs to grow at a pace of 8% to absorb the additional 40 million youth, who will enter the labour force over the next 35 years.

Pakistan requires an increase in its investment and savings ratios to create an enabling environment for the creation of jobs. However, low tax revenues have restrained the government’s ability to enhance public investment.

Kardar said this year, the tax-to-GDP ratio may fall below last year’s level of 13% as the Federal Board of Revenue struggled to enhance its collection.

“The federal government also needs to get its act together by curtailing expenditures in areas which fall in the provincial domain,” said Kardar. He also sought a review of the independent power producers (IPPs) policy, which had given undue benefits to the producers at the expense of electricity consumers.

He said the IPPs had been given massive concessions and high rates of return at a time when global prices were going down.

Kardar also struck a positive note, saying the foreign direct investment may pick up due to a semblance of political stability. But foreign investors will only follow a boom that has to be created by domestic investors.

Cheers

Soup onullah! L'évacuation du matin a frappé le ventilateur!

Pakistan’s financing needs may hit $50b in next 2 years - Shahbaz Rana

ISLAMABAD: Pakistan’s gross financing needs in the next two years could hit a minimum $50 billion and it will have to get short-term debt rolled over besides securing new loans to meet external obligations, said Shahid Kardar, former governor of the central bank on Tuesday.

He stated this while speaking at an event organised by the embassy of Switzerland in Islamabad, which discussed the challenges faced by Pakistan’s economy and the way forward.

Kardar said the International Monetary Fund’s (IMF) financing envelope would not be that big to meet the external financing needs.

As per Pakistan’s entitlement, it can secure a net $6 billion from the IMF after excluding outstanding liabilities, said the former central bank governor.

Even the $50 billion financing requirement, on an average of $25 billion a year, seems very conservative given the external sector challenges being faced today. This requirement is worked out on the assumption of a single-digit current account deficit in dollar terms.

Pakistan remains firm, IMF changes its stance: Umar

It seems that due to the huge external financing requirement, Pakistan’s reliance on the club of friendly countries will continue in coming years or else it will be in trouble.

The government would have to contract nearly $35 billion in the next over two years to meet the financing needs, said Kardar.

Pakistan’s external debt and liabilities have already crossed $100 billion. The amount that will have to be rolled over or rescheduled into long-term loans will be over $15 billion in just two years.

Pakistan’s gross official foreign currency reserves of $10.6 billion have primarily been built on borrowed foreign funds. So far, the government has secured $9.2 billion in emergency loans from China, Saudi Arabia and the United Arab Emirates. Only China gave $4.2 billion since July last year.

IMF asks Pakistan to take decisive actions

The government is contracting expensive commercial loans at a time when it has much cheaper longer-maturity debt available from the World Bank, Asian Development Bank and IMF. However, loans from these countries are pegged with structural reforms, which are often painful and politically unpopular.

Kardar said it seemed that the IMF had frontloaded conditions for the under-discussion programme, which may create serious problems for the government. He was of the view that due to the prevailing macroeconomic conditions, poverty in the country could go up in the next two years.

He said the nature of problems suggested that it would require four years to address the structural issues but the IMF wanted to do most of it upfront, which could be problematic.

Finance Minister Asad Umar said on Monday the IMF had budged from its hard position, hoping that an agreement could be signed by the third week of next month.

Like the finance minister, Kardar also criticised past IMF policies, saying the IMF had failed in its own areas of core competence like taxation. It was on the IMF watch when Pakistan ended up distorting the tax structure including introduction of the concept of higher tax rates for non-filers of tax returns. Ah So! - Of course it is not the Fault of the Stupid Terroristanis!

Umar also blamed the IMF for the current economic mess as the macroeconomic situation could not improve despite signing 21 programmes with the fund.

Kardar said due to the serious nature of structural issues, the average annual growth rate for the next two to three years could be 3%, which would not be sufficient to create adequate job opportunities.

Independent economists have time and again said Pakistan needs to grow at a pace of 8% to absorb the additional 40 million youth, who will enter the labour force over the next 35 years.

Pakistan requires an increase in its investment and savings ratios to create an enabling environment for the creation of jobs. However, low tax revenues have restrained the government’s ability to enhance public investment.

Kardar said this year, the tax-to-GDP ratio may fall below last year’s level of 13% as the Federal Board of Revenue struggled to enhance its collection.

“The federal government also needs to get its act together by curtailing expenditures in areas which fall in the provincial domain,” said Kardar. He also sought a review of the independent power producers (IPPs) policy, which had given undue benefits to the producers at the expense of electricity consumers.

He said the IPPs had been given massive concessions and high rates of return at a time when global prices were going down.

Kardar also struck a positive note, saying the foreign direct investment may pick up due to a semblance of political stability. But foreign investors will only follow a boom that has to be created by domestic investors.

Cheers

Re: Pakistani Economic Stress Watch

The Mohammadden Terrorism Fomenting Islamic Republic of Pakistan is heading towards getting turfed out of the MSCI Emerging Market Index :

Pakistan’s Emerging-Market Status Just Got Into Big Trouble

Pakistan’s Emerging-Market Status Just Got Into Big Trouble

Pakistani Economic Stress Watch

S&P BSE SENSEX

Index Current : 38,545.72 - Pt. Change : +412.84 - % Change : +1.08%

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,49,83,159.64 - $ 1 / INR 69.3650

Market Capitalization of BSE Listed Co. (U S $.) : 2,160.05 Billion

P S E

Index Current : 38,552.95 - Pt. Change : -412.06 - % Change : -1.06% - $ 1 / Rs Tr 141.00

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 7,837,891,322,889

Market Capitalization of PSE Listed Co. (U S $.) : 55.59 Billion

B S E : P S E : : 38.86 : 1

Cheers

Index Current : 38,545.72 - Pt. Change : +412.84 - % Change : +1.08%

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,49,83,159.64 - $ 1 / INR 69.3650

Market Capitalization of BSE Listed Co. (U S $.) : 2,160.05 Billion

P S E

Index Current : 38,552.95 - Pt. Change : -412.06 - % Change : -1.06% - $ 1 / Rs Tr 141.00

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 7,837,891,322,889

Market Capitalization of PSE Listed Co. (U S $.) : 55.59 Billion

B S E : P S E : : 38.86 : 1

Cheers

Pakistani Economic Stress Watch

X Posted on the Terroristan Thread

Experts reject claim of major oil, gas discovery - Khalid Mustafa

ISLAMABAD: The Petroleum Division authorities are clueless as to why Prime Minister Imran Khan time and again announces that Pakistan is going to discover the biggest oil and gas reserves in the country’s deep sea, as drilling up to the required depth of 5,500 meters will complete by the end of April.

The Kekra-1 well, G Block has been drilled to a depth of 3,700 meters so far. In a second interaction with the media persons on Monday, Imran again reiterated that Pakistan was going to have a massive oil and gas discovery without knowing the repercussions of his announcements on the stock exchange businesses.

However, till Saturday last, dated January 9, the well was drilled at a depth of 3,700 meters which is far away from the target of 5500 meters.

So it is too much early to claim a major discovery. A top official said he did not know who was briefing the premier at this stage that a major discovery was on the cards. In kekra-1 well, he said, earlier the well was drilled to a depth of 4,900 meters when a high pressure was felt causing huge mud loss and because of unsafe operation the well was plugged. Then the first side tracking started and when it reached down to 3100 meters, then it again met failure which is why the hole was also blocked and now the second side tracking is underway owing to which the well is drilled by 3,700 meter and the target of 5500 meters is still 1,800 meters away, a top relevant official told this reporter quoting the data of ENI — the lead operator of the well. ENI, an Italian company, is operator of the Kekra well-1. Exxon Mobile, OGDCL and Pakistan Petroleum Limited (PPL) are the sleeping partners of the joint venture.

The spud drilling activities at Kekra-1 well was kicked off with $75-80 million by joint venture with 25 percent share each.

He said there were two types of pressure kicks; one’s called the water pressure kick and the other gas pressure kick. The official said the well at the depth of 4,800 meters was plugged because of kick pressure owing to which drilling activities had to be halted on account of huge mud loss. And after pause of some days, from one side, first side tracking process initiated and when drilling reached a depth of 3100 meters it met failure and the first side tracking had also be stopped and now the second side tracking is going on owing to which the drilling has reached the depth of 3,700 meters as of today. However, when contacted Mr Irtiza Sayyed, CEO ExxonMobile, said he was travelling and it was better to ask the ENI which was lead operation of Kekra-1.

ENI country representative Kamran Mian showed his inability to respond to any question saying under protocol he was no allowed to speak about any information on exploration activities at Kekra-1.

Additional Secretary and spokesman for the Petroleum Division Sher Afgan, however, confirmed that when drilling reached a depth of 4,800 meters, the sudden kick pressure came up causing imbalance to the drilling structure owing to which the drilling braved the mud loss.

The ExxonMobile had to again spud the well by 1,500 meters. He confirmed that first side tracking, which after 3100 meters depth, met failure and now the second side tracking was underway.

GA Sabri, former special secretary Ministry of Petroleum and Natural Resources and former DG Oil, said prior to drilling the Kekra-1, the probability of discovery was 19 percent, but after two sides tracking, the probability had reduced.

He said the target was 5,500 meters and ExxonMobile was yet to go 1800 meters deep. He said kick pressure was no sign of a major discovery. He said TOTAL had earlier spud the well in G Block and its depth target was 5,000 meter, but it abandoned the well just before 5,000 meter depth ensuring no discovery.

Ghulam Mustafa, former OGDCL drilling engineer, said he felt that formation pressure was on the higher side whereas mud was on the lower side due to which when high pressure came out the structure got imbalanced. However, he needs the answer as to why the well is plugged, as it could have been managed. He said if the first side tracking had got initiated then why it was also plugged.

Mustafa said now rigs with high technology were being used for ultra-deep exploration activities having the capacity to initiate side tracking from five sides. He shared his experience of exploration activities at well no. 7-A in Dhakni oilfield saying side tracking was done from four sides, but all endeavours met failure.

However, DG Petroleum Concessions Qazi Saleem said the preliminary investment of $75-80 million for drilling endeavour was usually considered in the world of oil and gas as the sunk investment assuming the well emerges as dried one. The drilling activity is always a risky business which is why investment in drilling is named as sunk investment. The DGPC disclosed about 17 wells in Pakistan’s deep sea were drilled in the past, but all endeavours failed. Highlighting the background of the drilling activities done in the past in ultra-deep sea of Pakistan, he said the first offshore well was drilled in 1963 by the US company Sun Oil but the well was found dried.

The same .Sun Oil Company in 1964 spud two wells in Pakistan’s deep sea but both also went dried. After a lapse of eight years, Winter Shall from Germany explored three wells in ultra-deep sea which later on got abandoned as nothing was discovered. He further stated that Winter Shall drilled two wells in 1972 and third one in 1975 but no oil and gas was discovered.

He said in 1976, Marathon Oil Company from US endeavoured for drilling, but nothing was discovered. In 1978, Husky Company from Canada also spud the well, but no success was met. Then after seven years’ time, it was OGDCL that spud the well in 1985, but again no discovery was made. Likewise, in 1989, Occidental company explored the well but that too went dried.

In 1992, Canterbury from New Zealand and in 1999-2000 Ocean company from US spud two wells but both went dried. In 2004, TOTAL — a French company — also explored one well but that was also abandoned.

Pakistan Petroleum Limited tried in 2005 and Shell from Netherlands endeavoured in 2007 and Shark-1 went in 2010 for drilling in Pakistan’s deep sea but all went in vain. In toto, 17 serious attempts were made for wells drilling for oil and gas, but nothing was discovered.

Cheers

Experts reject claim of major oil, gas discovery - Khalid Mustafa

ISLAMABAD: The Petroleum Division authorities are clueless as to why Prime Minister Imran Khan time and again announces that Pakistan is going to discover the biggest oil and gas reserves in the country’s deep sea, as drilling up to the required depth of 5,500 meters will complete by the end of April.

The Kekra-1 well, G Block has been drilled to a depth of 3,700 meters so far. In a second interaction with the media persons on Monday, Imran again reiterated that Pakistan was going to have a massive oil and gas discovery without knowing the repercussions of his announcements on the stock exchange businesses.

However, till Saturday last, dated January 9, the well was drilled at a depth of 3,700 meters which is far away from the target of 5500 meters.

So it is too much early to claim a major discovery. A top official said he did not know who was briefing the premier at this stage that a major discovery was on the cards. In kekra-1 well, he said, earlier the well was drilled to a depth of 4,900 meters when a high pressure was felt causing huge mud loss and because of unsafe operation the well was plugged. Then the first side tracking started and when it reached down to 3100 meters, then it again met failure which is why the hole was also blocked and now the second side tracking is underway owing to which the well is drilled by 3,700 meter and the target of 5500 meters is still 1,800 meters away, a top relevant official told this reporter quoting the data of ENI — the lead operator of the well. ENI, an Italian company, is operator of the Kekra well-1. Exxon Mobile, OGDCL and Pakistan Petroleum Limited (PPL) are the sleeping partners of the joint venture.

The spud drilling activities at Kekra-1 well was kicked off with $75-80 million by joint venture with 25 percent share each.

He said there were two types of pressure kicks; one’s called the water pressure kick and the other gas pressure kick. The official said the well at the depth of 4,800 meters was plugged because of kick pressure owing to which drilling activities had to be halted on account of huge mud loss. And after pause of some days, from one side, first side tracking process initiated and when drilling reached a depth of 3100 meters it met failure and the first side tracking had also be stopped and now the second side tracking is going on owing to which the drilling has reached the depth of 3,700 meters as of today. However, when contacted Mr Irtiza Sayyed, CEO ExxonMobile, said he was travelling and it was better to ask the ENI which was lead operation of Kekra-1.

ENI country representative Kamran Mian showed his inability to respond to any question saying under protocol he was no allowed to speak about any information on exploration activities at Kekra-1.

Additional Secretary and spokesman for the Petroleum Division Sher Afgan, however, confirmed that when drilling reached a depth of 4,800 meters, the sudden kick pressure came up causing imbalance to the drilling structure owing to which the drilling braved the mud loss.

The ExxonMobile had to again spud the well by 1,500 meters. He confirmed that first side tracking, which after 3100 meters depth, met failure and now the second side tracking was underway.

GA Sabri, former special secretary Ministry of Petroleum and Natural Resources and former DG Oil, said prior to drilling the Kekra-1, the probability of discovery was 19 percent, but after two sides tracking, the probability had reduced.

He said the target was 5,500 meters and ExxonMobile was yet to go 1800 meters deep. He said kick pressure was no sign of a major discovery. He said TOTAL had earlier spud the well in G Block and its depth target was 5,000 meter, but it abandoned the well just before 5,000 meter depth ensuring no discovery.

Ghulam Mustafa, former OGDCL drilling engineer, said he felt that formation pressure was on the higher side whereas mud was on the lower side due to which when high pressure came out the structure got imbalanced. However, he needs the answer as to why the well is plugged, as it could have been managed. He said if the first side tracking had got initiated then why it was also plugged.

Mustafa said now rigs with high technology were being used for ultra-deep exploration activities having the capacity to initiate side tracking from five sides. He shared his experience of exploration activities at well no. 7-A in Dhakni oilfield saying side tracking was done from four sides, but all endeavours met failure.

However, DG Petroleum Concessions Qazi Saleem said the preliminary investment of $75-80 million for drilling endeavour was usually considered in the world of oil and gas as the sunk investment assuming the well emerges as dried one. The drilling activity is always a risky business which is why investment in drilling is named as sunk investment. The DGPC disclosed about 17 wells in Pakistan’s deep sea were drilled in the past, but all endeavours failed. Highlighting the background of the drilling activities done in the past in ultra-deep sea of Pakistan, he said the first offshore well was drilled in 1963 by the US company Sun Oil but the well was found dried.

The same .Sun Oil Company in 1964 spud two wells in Pakistan’s deep sea but both also went dried. After a lapse of eight years, Winter Shall from Germany explored three wells in ultra-deep sea which later on got abandoned as nothing was discovered. He further stated that Winter Shall drilled two wells in 1972 and third one in 1975 but no oil and gas was discovered.

He said in 1976, Marathon Oil Company from US endeavoured for drilling, but nothing was discovered. In 1978, Husky Company from Canada also spud the well, but no success was met. Then after seven years’ time, it was OGDCL that spud the well in 1985, but again no discovery was made. Likewise, in 1989, Occidental company explored the well but that too went dried.

In 1992, Canterbury from New Zealand and in 1999-2000 Ocean company from US spud two wells but both went dried. In 2004, TOTAL — a French company — also explored one well but that was also abandoned.

Pakistan Petroleum Limited tried in 2005 and Shell from Netherlands endeavoured in 2007 and Shark-1 went in 2010 for drilling in Pakistan’s deep sea but all went in vain. In toto, 17 serious attempts were made for wells drilling for oil and gas, but nothing was discovered.

Cheers

-

Mahendra

- BRF Oldie

- Posts: 4416

- Joined: 11 Aug 2007 17:20

- Location: Chronicling Bakistan's Tryst with Dysentery

Re: Pakistani Economic Stress Watch

Hope they are at least harnessing the natural gas produced by all those consuming pindi chana and doing the drilling

Re: Pakistani Economic Stress Watch

Experts may doubt about the huge gas find, but what do they know about these things? Immy the Dimmy gets his de-briefing from his Peerni clad in a shuttle cock burkha. Did she not tell him he will be selected as PM? See, she definitely knows more.

Re: Pakistani Economic Stress Watch

Immy isn't so dim after all when it comes to acting. After Pakis realising that their "geostrategic" advantage and islamic bum could only be milked so far, he came up with this string speculation of imminent oil and gas find to get reluctant donors in line in exchange for favorable consideration for exploration rights. Not bad at all. It seems the Chinese fell for it this time.

Re: Pakistani Economic Stress Watch

The dreamed for low cost option of the Sunni Punjabi Military Dominated Deep State of the Mohammadden Terrorism Fomenting Islamic of promoting “Strategic Assets” to indulge in Islamic Terrorism targeting neighbouring countries, continues to exact a high cost for the economy:

Stocks shed gains as MSCI, FATF concerns send investors packing

Stocks shed gains as MSCI, FATF concerns send investors packing

Re: Pakistani Economic Stress Watch

peerni does not know much about drilling.saip wrote:Experts may doubt about the huge gas find, but what do they know about these things? Immy the Dimmy gets his de-briefing from his Peerni clad in a shuttle cock burkha. Did she not tell him he will be selected as PM? See, she definitely knows more.

that is exclusively im the dim's domain, after all he has drilled many hundreds of wells in his life, mainly gora, paki, some Indian as well, no??

Pakistani Economic Stress Watch

X Posted on the Terroristan Thread

Bailout package likely by mid-May, says finance minister - Monitoring Desk

KARACHI: Pakistan is likely to secure a bailout package from the International Monetary Fund (IMF) of between $6 billion and $12bn by the middle of May, Finance Minister Asad Umar has said.

In an interview with the Financial Times in Islamabad this week after a meeting with the IMF, he said he hoped an agreement would be reached with the Fund by “late April, first half of May”. The package would be of between $6bn and $12bn.

“We’re approaching the landing zone,” said Mr Umar. “The gap between our position and the IMF’s is significantly less than what it was a few months back.”

A sticking point in the negotiations between the two sides seems to be the exchange rate management of the rupee, which has lost 33 per cent of its value since 2017 when compared to that of the dollar.

“There is no conceptual difference between us and the IMF, the exchange rate needs to be reflective of the market,” said Mr Umar. “How you implement it and the sequence in which those steps have to be taken have been a part of the discussion and continue to be.”

According to analysts, the IMF has been suggesting measures such as a free-floating rupee, which would result in a further devaluation of the currency, and structural changes such as widening of the tax base.

The Pakistan Tehreek-i-Insaf (PTI) government has been grappling with a severe balance of payments crisis. That’s why some analysts have voiced concerns about whether it will be able to pay back loans it has taken and if it will be able to repay China for the $62bn it is receiving as part of the China-Pakistan Economic Corridor initiative.

But Mr Umar dismissed the suggestion that the country’s debt to China posed a problem. “I have a debt problem, a serious debt problem, but not a China debt problem.”

In a recent interview with the same news organisation, Prime Minister Imran Khan had said Pakistan was serious about ending its cash flow difficulties. “I’m determined that this will be the last time Pakistan will ever have to go to IMF,” he said.

“The country is really at a crossroads. We can’t go on as we have been running our governance system for so many years, we have to make these reforms, we have to balance our budget, we have to raise taxes.”

A cornerstone of those reforms will be complying with conditions of the Financial Action Task Force (FATF), which has been scrutinising Pakistan’s performance vis-a-vis combating money laundering and funding of terrorism.

“We believe that sufficient steps are being taken” in this regard, said Mr Umar.

Experts say a green light from FATF would be essential to unlocking IMF money. “I think it’s naive to assume that there is no relationship between FATF and the next IMF programme,” said a former finance official.

“The IMF will probably demand some major changes in the banking structure, which are also the kinds of changes that are being sought by FATF.”

Cheers

Bailout package likely by mid-May, says finance minister - Monitoring Desk

KARACHI: Pakistan is likely to secure a bailout package from the International Monetary Fund (IMF) of between $6 billion and $12bn by the middle of May, Finance Minister Asad Umar has said.

In an interview with the Financial Times in Islamabad this week after a meeting with the IMF, he said he hoped an agreement would be reached with the Fund by “late April, first half of May”. The package would be of between $6bn and $12bn.

“We’re approaching the landing zone,” said Mr Umar. “The gap between our position and the IMF’s is significantly less than what it was a few months back.”

A sticking point in the negotiations between the two sides seems to be the exchange rate management of the rupee, which has lost 33 per cent of its value since 2017 when compared to that of the dollar.

“There is no conceptual difference between us and the IMF, the exchange rate needs to be reflective of the market,” said Mr Umar. “How you implement it and the sequence in which those steps have to be taken have been a part of the discussion and continue to be.”

According to analysts, the IMF has been suggesting measures such as a free-floating rupee, which would result in a further devaluation of the currency, and structural changes such as widening of the tax base.

The Pakistan Tehreek-i-Insaf (PTI) government has been grappling with a severe balance of payments crisis. That’s why some analysts have voiced concerns about whether it will be able to pay back loans it has taken and if it will be able to repay China for the $62bn it is receiving as part of the China-Pakistan Economic Corridor initiative.

But Mr Umar dismissed the suggestion that the country’s debt to China posed a problem. “I have a debt problem, a serious debt problem, but not a China debt problem.”

In a recent interview with the same news organisation, Prime Minister Imran Khan had said Pakistan was serious about ending its cash flow difficulties. “I’m determined that this will be the last time Pakistan will ever have to go to IMF,” he said.

“The country is really at a crossroads. We can’t go on as we have been running our governance system for so many years, we have to make these reforms, we have to balance our budget, we have to raise taxes.”

A cornerstone of those reforms will be complying with conditions of the Financial Action Task Force (FATF), which has been scrutinising Pakistan’s performance vis-a-vis combating money laundering and funding of terrorism.

“We believe that sufficient steps are being taken” in this regard, said Mr Umar.

Experts say a green light from FATF would be essential to unlocking IMF money. “I think it’s naive to assume that there is no relationship between FATF and the next IMF programme,” said a former finance official.

“The IMF will probably demand some major changes in the banking structure, which are also the kinds of changes that are being sought by FATF.”

Cheers

Re: Pakistani Economic Stress Watch

saip wrote:Experts may doubt about the huge gas find, but what do they know about these things? Immy the Dimmy gets his de-briefing from his Peerni clad in a shuttle cock burkha. Did she not tell him he will be selected as PM? See, she definitely knows more.

chatak Ji :chetak wrote:peerni does not know much about drilling.

that is exclusively im the dim's domain, after all he has drilled many hundreds of wells in his life, mainly gora, paki, some Indian as well, no??

Indeed peerni knowS only about being drilled!

Cheers

Last edited by Peregrine on 29 Mar 2019 17:55, edited 1 time in total.

Re: Pakistani Economic Stress Watch

Follow m.waseem on twitter to follow her sojourns in Sindh and Punjab. Will get general ideas of road conditions in interior Sindh

Re: Pakistani Economic Stress Watch

A La Ham Sandwich!Peregrine wrote:chatak Ji :chetak wrote:peerni does not know much about drilling.

that is exclusively im the dim's domain, after all he has drilled many hundreds of wells in his life, mainly gora, paki, some Indian as well, no??

Indeed peerni know only about being drilled!

Cheers

Pakistani Economic Stress Watch

S&P BSE SENSEX

Index Current : 38,672.91 - Pt. Change : +127.19 - % Change : +0.33%

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,51,08,432.12 - $ 1 / I R = 69.4825

Market Capitalization of BSE Listed Co. (U S $.) : 2,174.42 Billion

P S E

Index Current : 38649.34 - Pt. Change : +96.39 - % Change : +0.25%

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 7,868,605,321,569 - $ 1 / T R = 141.00

Market Capitalization of PSE Listed Co. (U S $.) : 55.52 Billion

B S E : P S E : : 39.13 : 1

Cheers

Index Current : 38,672.91 - Pt. Change : +127.19 - % Change : +0.33%

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,51,08,432.12 - $ 1 / I R = 69.4825

Market Capitalization of BSE Listed Co. (U S $.) : 2,174.42 Billion

P S E

Index Current : 38649.34 - Pt. Change : +96.39 - % Change : +0.25%

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 7,868,605,321,569 - $ 1 / T R = 141.00

Market Capitalization of PSE Listed Co. (U S $.) : 55.52 Billion

B S E : P S E : : 39.13 : 1

Cheers

Pakistani Economic Stress Watch

Rupee falls as country prepares for IMF deal- Salman Siddiqui

KARACHI: The State Bank of Pakistan (SBP) has let the rupee depreciate by Rs0.49 to a new all-time low at Rs140.78 to the US dollar in the inter-bank market on Friday ahead of an expected agreement with the International Monetary Fund (IMF) for a long-term loan programme.

With this, the rupee has cumulatively dropped Rs2.25, or 1.6%, in the past three weeks in a fresh round of depreciation, according to the central bank.

The IMF has asked Pakistan to end state control over the rupee and let the currency move freely to find its equilibrium against the US dollar and other major world currencies.

Also, =the World Bank, which finances some of the infrastructure and social safety net projects in Pakistan, has supported the idea of leaving the rupee free from state control in a bid to give much-needed boost to exports and fix a faltering economy.

Rupee drops to record low of 139.25 against US dollar

“It seems that Pakistan has agreed with the IMF condition (of leaving the rupee free),” renowned businessman Arif Habib said in comments to The Express Tribune.

“Approaching the IMF for financial assistance is a good decision of the government. However, it should have thoroughly negotiated and entered into the loan programme on its own conditions instead of taking dictation,” he said.

A leading banker, however, linked the fresh rupee deprecation with the uptrend in crude oil prices in world markets.

Pakistan heavily relies on imported petroleum products, which account for around one-fourth of the total import bill. The country’s foreign currency reserves, however, are insufficient to continue making expensive import payments and external debt repayments.

“The situation has mounted pressure on the rupee and has forced the authorities to agree to further depreciation,” he said. “This coincides with the IMF condition of allowing the rupee to move on its own fundamentals.”

Finance Minister Asad - not Baffad Umar said the other day the government was close to reaching an agreement with the IMF for a long-term loan programme.

“There is a possibility that Pakistan and the IMF may sign a deal at the end of IMF’s staff-level mission, which will arrive in the third week of April,” he said. Discussions would also take place during spring meetings of the IMF and World Bank in Washington next month, he added.