Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

Please take the car discussion to the Indian Autos Thread, and summarize here.

There's actually a confluence of factors (particularly EV policy + BS6) impacting car sales - and JUST car sales. It's worth noting that 2-wheeler sales aren't missing a beat, and CV sales have long since overcome the slump from the UPA era cyclical collapse in business sentiment.

There's actually a confluence of factors (particularly EV policy + BS6) impacting car sales - and JUST car sales. It's worth noting that 2-wheeler sales aren't missing a beat, and CV sales have long since overcome the slump from the UPA era cyclical collapse in business sentiment.

Re: Indian Economy News & Discussion - Nov 27 2017

The sales decline is across the board and includes Commercial Vehicles and Two Wheelers.

Auto Sales Analysis August 2019

Auto Sales Analysis August 2019

Commercial Vehicles

With no difference in the situation, the commercial vehicle segment witnessed a double-digit drop in domestic sales on the back of axle load norms and current market situation, said, industry leaders.

India’s largest commercial vehicle manufacturers, Tata Motors sales halved last month when compared to August 2018. The company sold 21,824 units in the last month compared to 38,859 units in the corresponding month previous fiscal.

Subsequently,the second largest commercial vehicle manufacturer Mahindra & Mahindra (M&M) sold 14, 684 vehicles as against 20,326 units a year ago, down 28 per cent.

Two Wheelers

Showing a similar trend of downward sales, world’s largest two-wheeler manufacturer Hero MotoCop posted a 20 per cent decline in domestic sales. It sold 543,406 units in August 2019, as compared to 685,407 units in the same month last year.

Bajaj Auto also reported a decline of 13 per cent in its domestic sales to 205,470 units in August 2019. The company’s domestic sales stood at 237,511 units in August 2018, Bajaj Auto said in a statement.

Re: Indian Economy News & Discussion - Nov 27 2017

Please take it to the Autos thread, as requested. One month data doesn't invalidate annualized figures, and this thread isn't the right place to dig into auto data.

Re: Indian Economy News & Discussion - Nov 27 2017

PMI news:

https://www.markiteconomics.com/Public/ ... 9f767a3b9e

https://www.markiteconomics.com/Public/ ... 9f767a3b9e

Although economic growth in the Indian manufacturing industry was sustained in August, most survey indicators fell since July to signal a widespread loss of momentum. With sales expanding at the slowest rate in 15 months, production growth and job creation were tamed, while factories lowered input buying for the first time since May 2018.

One survey indicator that moved up was the measure of input costs. Inflation accelerated to a nine-month high, though remained moderate and below its long-run average. The only other upward movement was seen for business confidence, which strengthened to a 16-month high.

At 51.4 in August, the seasonally adjusted IHS Markit India Manufacturing PMI® signalled a further improvement in the health of the sector. However, the headline figure was down from 52.5 in July to its lowest mark since May 2018, and below its long-run average of 53.9....

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.livemint.com/auto-news/what ... 48504.html

What slowdown? New auto entrants are cruising

MG Hector received 28,000 bookings and the company stopped taking further orders due to production constraints. Kia, on the other hand, had already received more than 30,000 bookings in the first six weeks.

Having closed the bookings last month, we have a wait list of 15,000 customers.

Re: Indian Economy News & Discussion - Nov 27 2017

I agree that we are facing a slowdown in economy and this slowdown will start abating only in 2021 as per my estimates.Bart S wrote:So you are saying that this exceptional wisdom was lacking for a couple of decades of rapid growth in car purchases, and suddenly dawned on people in the last 3-4 quarters?darshhan wrote: One thing that experts and analysts have to understand about Indian automobile industry. We will buy a car(or anything) only if we are convinced of its usefulness. In US a driving your own car might be a rite of passage and many americans used to be obsessed about getting one's own car. Although even there younger generation is no longer that interested in owning a car. By and large most of the Indian people are not that crazy about a car. Unlike naive and starry eyed American kids, Indian people actually do the math and figure out that an investment in four wheelers will actually depreciate in value compared to say "investment in Land". This is something that should be internalized by the so called experts especially in the industry.

There is a slowdown, plain and simple, continuing to live in denial just hurts our chances of fixing it. Sure there are many factors like ride sharing apps, BS6, GST etc that might be contributing to it, but nevertheless there is a major problem that needs addressing across the economy.

But conflating internal combustion engine auto sales as one of the important parameters with economic performance is no longer applicable. Industry will have to launch new products both for metros like Delhi,mumbai and smaller towns with narrow streets.

Re: Indian Economy News & Discussion - Nov 27 2017

Our main problem is Automobile industry makes the lion share of whatever manufacturing we have in the country. If it crashes, expect the shutdowns to snowball down and destroy all the MSMEs and other auxiliaries.darshhan wrote: But conflating internal combustion engine auto sales as one of the important parameters with economic performance is no longer applicable.

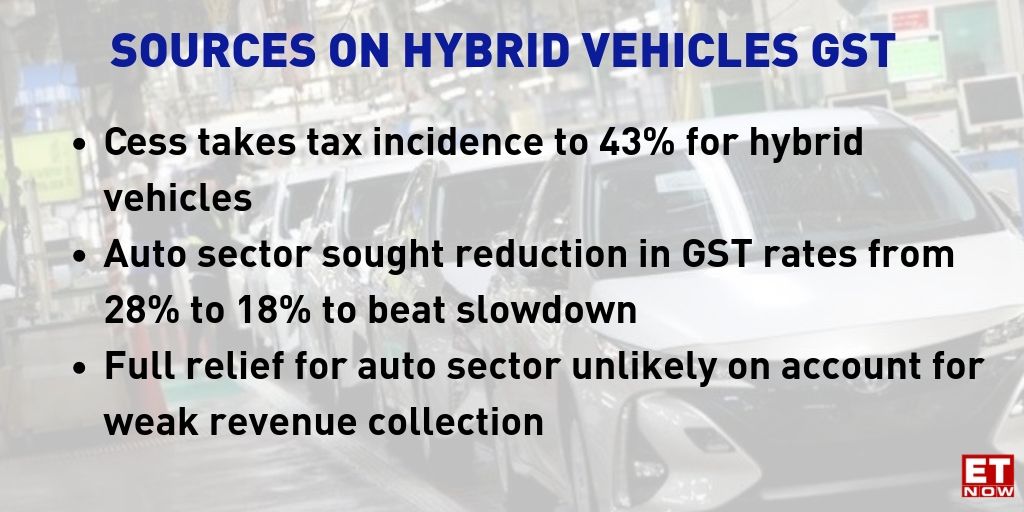

The total taxes on a car is more than the 18% GST. There is a 1% TCS (implemented this year) and higher insurance (from last year) and other cesses. There is significant room for the govt to reduce these taxes and save the industry.

Re: Indian Economy News & Discussion - Nov 27 2017

That is "the problem". From Gurgaon to Pune and Jamshedpur to Chennai, our industrial landscape is dominated by major autoplayers and their vendors. add to this list, the manpower working in showrooms/service centers/loan/insurance/shops catering spares/road side garages employing mechanics. Furthermore downturn in auto sector also means downturn in steel and hydrocarbon industry. Rest be assured ride is going to be extremely rough if auto industry faces a downturn.jpremnath wrote:Our main problem is Automobile industry makes the lion share of whatever manufacturing we have in the country. If it crashes, expect the shutdowns to snowball down and destroy all the MSMEs and other auxiliaries.darshhan wrote: But conflating internal combustion engine auto sales as one of the important parameters with economic performance is no longer applicable.

The total taxes on a car is more than the 18% GST. There is a 1% TCS (implemented this year) and higher insurance (from last year) and other cesses. There is significant room for the govt to reduce these taxes and save the industry.

From what I hear govt is going to reduce gst rates on vehicles. Whether this is going to be enough, I do not know.

Re: Indian Economy News & Discussion - Nov 27 2017

I think I have posted it before here. Auto dealers has a model of not paying taxes etc in many cases as many of them are politically connected people. Profits were high then. Now that model is gone. Industry is also was showing false figures for many years and now that has to stop as dealer can not take on those kinds of inventory as before. Added to that NBFCs have problems in some of the cases and loan taking is suffering. New emission norms are kicking in from 1st April 2020. That led to old inventory being unsalable as of now. Many are postponing the purchasing. So what we have is culmination of all these things.

Plus industry is also not agile. They are all looking for % of growth etc etc and kept building inventory even when there were signs of slow down. Hell they did not even provided for auto gear for the cars etc for many years when it was very clear that there is a huge demand for that. They were thinking of the additional pricing in that rather than the comfort people are looking for in city driving.

Plus industry is also not agile. They are all looking for % of growth etc etc and kept building inventory even when there were signs of slow down. Hell they did not even provided for auto gear for the cars etc for many years when it was very clear that there is a huge demand for that. They were thinking of the additional pricing in that rather than the comfort people are looking for in city driving.

Re: Indian Economy News & Discussion - Nov 27 2017

I bet it is the case with Madras as well. I have been visiting a corporate hospital the last few days, and man the crowd; the hospital must be minting money.jpremnath wrote:Thats not the right sample. These two are the fastest growing cities in India right now. Especially Hyderabad which has turned out to be a darling for large scale investments of late.SwamyG wrote:I visited Blr and Hyd in my recent trip. Try getting servants, plumbers, electricians, car drivers or cooks. Restaurants are overflowing, kirana stores selling things, departmental stores and malls crowded. All people celebrating festivals..

If we measure ourselves on numbers that West measures upon, them we will see doom and gloom.

Anyways, the point is maybe the yardstick that we use (borrowed from the West) to measure is not the ONLY one we should be using. For example the car sales figure. In America it makes perfect sense to use car sales. The buying pattern is dictated by the car companies. And car and related industries in America is a different ball game. In India, should we measure ourselves on car sales figure? I think we ought to exercise caution.

Re: Indian Economy News & Discussion - Nov 27 2017

You have a point there..But compared to US, automobile industry in India forms a much bigger share of total manufacturing (40 to 45% of total industrial manufacturing). So the impact of a slump on economy is also more. Right now there are multiple factors which has caused this sudden slowdown in automobile sales. Ridiculous taxes is just one. But this is the only place where govt can do something...SwamyG wrote: Anyways, the point is maybe the yardstick that we use (borrowed from the West) to measure is not the ONLY one we should be using. For example the car sales figure. In America it makes perfect sense to use car sales. The buying pattern is dictated by the car companies. And car and related industries in America is a different ball game. In India, should we measure ourselves on car sales figure? I think we ought to exercise caution.

-

Rahulsidhu

- BRFite

- Posts: 165

- Joined: 22 Mar 2017 06:19

Re: Indian Economy News & Discussion - Nov 27 2017

Make no mistake, it is this myopic, unhealthy obsession with fiscal deficit numbers that is largely responsible for our mess.

In my life I have seen economists do a lot of damage, but this episode really takes the cake.

-

Rahulsidhu

- BRFite

- Posts: 165

- Joined: 22 Mar 2017 06:19

Re: Indian Economy News & Discussion - Nov 27 2017

Ever wondered why GoI is so loathe to cut taxes but readily agrees to throw away huge chunks of cash to recapitalize PSUs especially PSBs?

This question was on the back of my mind for a long time and I thought it had something to do with the inner workings of bureaucracy or politics. But it occurs to me that the reason is much more simple:

While a tax cut would project a fiscal loss (never mind the Laffer curve which seems to be beyond their comprehension), a recapitalization would be fiscally neutral since the infusion will be recorded at book value.

Please correct me if my understanding is wrong. Not too well versed with govt accounting.

This question was on the back of my mind for a long time and I thought it had something to do with the inner workings of bureaucracy or politics. But it occurs to me that the reason is much more simple:

While a tax cut would project a fiscal loss (never mind the Laffer curve which seems to be beyond their comprehension), a recapitalization would be fiscally neutral since the infusion will be recorded at book value.

Please correct me if my understanding is wrong. Not too well versed with govt accounting.

Re: Indian Economy News & Discussion - Nov 27 2017

Fiscal deficit is just a number. It is nice to achieve the target when economy is humming but to increase taxes when the signs of a global slow down are so visible is criminal. If any one is taking a hit to keep the economy running, it should be the government. It is time to increase spending and reduce taxing by letting the fiscal deficit widen a bit for a few years. A slower economy and bad sentiments in the market as a whole will do more damage to the country than running higher fiscal deficit for some years.

Re: Indian Economy News & Discussion - Nov 27 2017

When China is growing at 6.2% amid trade war and we slump to 5% (5!), the government has to admit that it has really screwed up big time. I am an avid Modi supporter, but now i dont know whether the Congress' profligacy was worse or BJP's extreme obsession with fiscal prudence is worse. Taxing everything under the sun is not the solution. it feels as if we are back to socialist times.

Re: Indian Economy News & Discussion - Nov 27 2017

The estimate is that the automobile industry in India accounts for about 50% of the manufacturing GDP and about 7%-8% of the total GDP of the country. The industry and it's ancillaries employ about 40 million people. It is the heart of the Indian manufacturing economy and as such a 10 month consecutive monthly decline in production and sales will have a significant impact on overall GDP numbers.darshhan wrote: That is "the problem". From Gurgaon to Pune and Jamshedpur to Chennai, our industrial landscape is dominated by major autoplayers and their vendors. add to this list, the manpower working in showrooms/service centers/loan/insurance/shops catering spares/road side garages employing mechanics. Furthermore downturn in auto sector also means downturn in steel and hydrocarbon industry. Rest be assured ride is going to be extremely rough if auto industry faces a downturn.

From what I hear govt is going to reduce gst rates on vehicles. Whether this is going to be enough, I do not know.

Re: Indian Economy News & Discussion - Nov 27 2017

Emissions control has been aggressive as well. The role of cars in India will probably not take the same pattern as in America. The freeway system helped many industries in America. Indian city roads will never allow such automobile usage pattern. Plus shared mobility which is a new term for the World, was in India way before. Don't want to go full "auto" here, but India should look at auto industry differently. Indian cities, roads and population density offer different challenges.jpremnath wrote: You have a point there..But compared to US, automobile industry in India forms a much bigger share of total manufacturing (40 to 45% of total industrial manufacturing). So the impact of a slump on economy is also more. Right now there are multiple factors which has caused this sudden slowdown in automobile sales. Ridiculous taxes is just one. But this is the only place where govt can do something...

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.livemint.com/market/mark-to ... 80118.html

Bright spot in the economy...As much as I see the merits of rahulsidhuji's arguments against the current fiscal policy I think that we should give the leadership time to experiment and implement economic policies. I was amazed to learn that RBI did not transfer usual surpluses for a few years needing the government to force the issue. I feel that there is entrenched political players in all beauracracy layers that the government has to weed out. I am hopeful that positive changes are around the corner...before jumping to comparisons of UPA performance and NDA. I feel there is a lag from the time we know what needs to be done to the time it can be implemented

Bright spot in the economy...As much as I see the merits of rahulsidhuji's arguments against the current fiscal policy I think that we should give the leadership time to experiment and implement economic policies. I was amazed to learn that RBI did not transfer usual surpluses for a few years needing the government to force the issue. I feel that there is entrenched political players in all beauracracy layers that the government has to weed out. I am hopeful that positive changes are around the corner...before jumping to comparisons of UPA performance and NDA. I feel there is a lag from the time we know what needs to be done to the time it can be implemented

Re: Indian Economy News & Discussion - Nov 27 2017

kittoo wrote:When China is growing at 6.2% amid trade war and we slump to 5% (5!), the government has to admit that it has really screwed up big time. I am an avid Modi supporter, but now i dont know whether the Congress' profligacy was worse or BJP's extreme obsession with fiscal prudence is worse. Taxing everything under the sun is not the solution. it feels as if we are back to socialist times.

Case in point. The world changes that's accepted but India has not been able to grab the opportunities that come with it.. the china US spat has led to industries going to Vietnam and south East Asia.. why is not India a significant player here ?

-

Rahulsidhu

- BRFite

- Posts: 165

- Joined: 22 Mar 2017 06:19

Re: Indian Economy News & Discussion - Nov 27 2017

Dilbu wrote:If any one is taking a hit to keep the economy running, it should be the government

Exactly.

The govt has again and again taken the opposite approach. Note how with GST, they started off with very high rates to avoid loss, and then brought down the rates as revenue grew. The right approach would have been to start with low rates (ensuring better compliance as well as promoting growth) and take a fiscal hit for a couple of years. The extra money in the hands of the pvt sector would have placed them better to deal with downturns such as this one.

The fiscal deficit should not be a target. It is a control variable, used to adjust the economy towards desired path - if slowing down, increase it, if overheating, reduce it.

-

Rahulsidhu

- BRFite

- Posts: 165

- Joined: 22 Mar 2017 06:19

Re: Indian Economy News & Discussion - Nov 27 2017

Kaivalya ji,Kaivalya wrote:https://www.livemint.com/market/mark-to ... 80118.html

Bright spot in the economy...As much as I see the merits of rahulsidhuji's arguments against the current fiscal policy I think that we should give the leadership time to experiment and implement economic policies. I was amazed to learn that RBI did not transfer usual surpluses for a few years needing the government to force the issue. I feel that there is entrenched political players in all beauracracy layers that the government has to weed out. I am hopeful that positive changes are around the corner...before jumping to comparisons of UPA performance and NDA. I feel there is a lag from the time we know what needs to be done to the time it can be implemented

I am fully in support of the tariffs which were imposed on electronics imports which led to the boom in electronics assembly. But the approach to fiscal policy is an orthogonal issue. The outcome of a tight fiscal policy is not that unpredictable - raising taxes and /or curtailing spending will always lead to less income for the pvt sector.

The Sectoral Balances Identity says that

(S-I) = (G-T) + (X-M)

where

G-T is the fiscal deficit

X-M is the current account balance

S-I is the net pvt sector surplus (households and corporations and also state govts etc)

Now G-T is around 3.5% of GDP. X-M worsened last year to around -2.3%. That leaves only about 1% of GDP as net income for pvt sector.

Now, in such a situation, the pvt sector can still grow, by raising pvt debt, or equity. Effectively, the govt is forcing pvt sector to leverage up in order to access liquidity. But pvt debt is always an instrument of instability in the system. When things go bad, confidence is lost very quickly.

We have seen this play out in 2004-2008 in the US and 2009-2015 in China followed by debt deflationary periods. The respective govts. had to boost deficits in order to boost incomes.

Now we are living through another of those periods, so far only at a smaller scale. However, if the intransigence continues, things will keep getting worse like dominoes falling. In complex economies, no one stands alone.

-

Raveen

- BRFite

- Posts: 841

- Joined: 18 Jun 2008 00:51

- Location: 1/2 way between the gutter and the stars

- Contact:

Re: Indian Economy News & Discussion - Nov 27 2017

darshhan wrote:I agree that we are facing a slowdown in economy and this slowdown will start abating only in 2021 as per my estimates.Bart S wrote:

So you are saying that this exceptional wisdom was lacking for a couple of decades of rapid growth in car purchases, and suddenly dawned on people in the last 3-4 quarters?

There is a slowdown, plain and simple, continuing to live in denial just hurts our chances of fixing it. Sure there are many factors like ride sharing apps, BS6, GST etc that might be contributing to it, but nevertheless there is a major problem that needs addressing across the economy.

But conflating internal combustion engine auto sales as one of the important parameters with economic performance is no longer applicable. Industry will have to launch new products both for metros like Delhi,mumbai and smaller towns with narrow streets.

Naïve starry eyed American kids - talk about false generalizations. You are comparing two very different driving environments, cultures, safety issues, and highway systems. Calm down with the Americans are dumber than us Yindoos.

-

Raveen

- BRFite

- Posts: 841

- Joined: 18 Jun 2008 00:51

- Location: 1/2 way between the gutter and the stars

- Contact:

Re: Indian Economy News & Discussion - Nov 27 2017

Still infrastructure, or lack thereof....can't fix 60 years in 60 months.kit wrote:kittoo wrote:When China is growing at 6.2% amid trade war and we slump to 5% (5!), the government has to admit that it has really screwed up big time. I am an avid Modi supporter, but now i dont know whether the Congress' profligacy was worse or BJP's extreme obsession with fiscal prudence is worse. Taxing everything under the sun is not the solution. it feels as if we are back to socialist times.

Case in point. The world changes that's accepted but India has not been able to grab the opportunities that come with it.. the china US spat has led to industries going to Vietnam and south East Asia.. why is not India a significant player here ?

-

Raveen

- BRFite

- Posts: 841

- Joined: 18 Jun 2008 00:51

- Location: 1/2 way between the gutter and the stars

- Contact:

Re: Indian Economy News & Discussion - Nov 27 2017

ldev wrote:The estimate is that the automobile industry in India accounts for about 50% of the manufacturing GDP and about 7%-8% of the total GDP of the country. The industry and it's ancillaries employ about 40 million people. It is the heart of the Indian manufacturing economy and as such a 10 month consecutive monthly decline in production and sales will have a significant impact on overall GDP numbers.darshhan wrote: That is "the problem". From Gurgaon to Pune and Jamshedpur to Chennai, our industrial landscape is dominated by major autoplayers and their vendors. add to this list, the manpower working in showrooms/service centers/loan/insurance/shops catering spares/road side garages employing mechanics. Furthermore downturn in auto sector also means downturn in steel and hydrocarbon industry. Rest be assured ride is going to be extremely rough if auto industry faces a downturn.

From what I hear govt is going to reduce gst rates on vehicles. Whether this is going to be enough, I do not know.

How many of those are producing components for export, and were hit by US, German, and Chinese slowdowns?

Re: Indian Economy News & Discussion - Nov 27 2017

Add to it the labour laws which makes it difficult to scale up industries. The rules for companies which employ more than 300 is tougher than the smaller firms..so some find it easier to stay at their smaller scale.Raveen wrote: Still infrastructure, or lack thereof....can't fix 60 years in 60 months.

Re: Indian Economy News & Discussion - Nov 27 2017

That was because the government at the Centre had to take the States along to implement GST. The State governments did not want to lose revenues. In fact one of the reasons for non inclusion of alcohol and petroleum products in GST is the same.Rahulsidhu wrote:

The govt has again and again taken the opposite approach. Note how with GST, they started off with very high rates to avoid loss, and then brought down the rates as revenue grew. The right approach would have been to start with low rates (ensuring better compliance as well as promoting growth) and take a fiscal hit for a couple of years. The extra money in the hands of the pvt sector would have placed them better to deal with downturns such as this one.

-

Rahulsidhu

- BRFite

- Posts: 165

- Joined: 22 Mar 2017 06:19

Re: Indian Economy News & Discussion - Nov 27 2017

I don't see how that's a counterargument. The central gov should have compensated states by running larger deficits - so lower GST rates would have meant more compensation and higher deficits. That is the point being made here - that higher deficits would have been preferable to higher tax rates.RajeevK wrote:That was because the government at the Centre had to take the States along to implement GST. The State governments did not want to lose revenues. In fact one of the reasons for non inclusion of alcohol and petroleum products in GST is the same.Rahulsidhu wrote:

The govt has again and again taken the opposite approach. Note how with GST, they started off with very high rates to avoid loss, and then brought down the rates as revenue grew. The right approach would have been to start with low rates (ensuring better compliance as well as promoting growth) and take a fiscal hit for a couple of years. The extra money in the hands of the pvt sector would have placed them better to deal with downturns such as this one.

And in actual fact, the deficit might have been lower due to higher NGDP growth and better compliance. Further, remember the tax revenue does not come free. It is money extracted from the pvt sector. Its rate must be adjusted depending on how the pvt sector is doing.

The govt needs to stop treating the economy like a zero sum game.

Re: Indian Economy News & Discussion - Nov 27 2017

Rahulsidhu garu as people say hindsight is 20/20, you could do a thought exercise on what would have happened if the tax rate was set to a lower slab of uniform 12%. Although I don’t know e of economics let me take a stab

Bear in mind this is July 2017

1. Lower tax rates means higher deficit possibly translates to FII sucking their money out leading to rupee depreciation and pushing the fd higher due to oil import

2. Higher fd means lesser in the pocket to spend on social schemes like AYUSH etc remember this is the time when election campaign strategies were getting firmed up

3. Whether it is 12 or 18 or 27% the compliance wouldn’t have increased much beyond what we see today, largely because we(including businessmen and citizens) think it is our god given right to somehow not pay taxes as it is a black hole(the past governments role eating up our money could have been the reason)

4. It is a nightmare in India to increase taxes, protests by all and sundry, articles dissing the GoI from journos masquerading as economists, Sri RRR’s tippani etc

5. Given the combined nature of the GST council no guarantees that SGs would have allowed increases

Etc etc

You are trained in economics you can add more, but the larger point am trying to make is GST as implemented was largely good could it have been done better of course !!!!

Bear in mind this is July 2017

1. Lower tax rates means higher deficit possibly translates to FII sucking their money out leading to rupee depreciation and pushing the fd higher due to oil import

2. Higher fd means lesser in the pocket to spend on social schemes like AYUSH etc remember this is the time when election campaign strategies were getting firmed up

3. Whether it is 12 or 18 or 27% the compliance wouldn’t have increased much beyond what we see today, largely because we(including businessmen and citizens) think it is our god given right to somehow not pay taxes as it is a black hole(the past governments role eating up our money could have been the reason)

4. It is a nightmare in India to increase taxes, protests by all and sundry, articles dissing the GoI from journos masquerading as economists, Sri RRR’s tippani etc

5. Given the combined nature of the GST council no guarantees that SGs would have allowed increases

Etc etc

You are trained in economics you can add more, but the larger point am trying to make is GST as implemented was largely good could it have been done better of course !!!!

Re: Indian Economy News & Discussion - Nov 27 2017

To be precise, Chinese proprietors have moved their manufacturing facilities to Vietnam.kit wrote:Case in point. The world changes that's accepted but India has not been able to grab the opportunities that come with it.. the china US spat has led to industries going to Vietnam and south East Asia.. why is not India a significant player here ?

Re: Indian Economy News & Discussion - Nov 27 2017

The competitive environment for picking up China-exiting manufacturing

https://www.wsj.com/articles/for-manufa ... 1566397989

https://www.wsj.com/articles/for-manufa ... 1566397989

Re: Indian Economy News & Discussion - Nov 27 2017

Is it possible most of the goods are still manufactured in China but stamped as made in Vietnam. China was famous for that in Taiwan.A_Gupta wrote:To be precise, Chinese proprietors have moved their manufacturing facilities to Vietnam.kit wrote:Case in point. The world changes that's accepted but India has not been able to grab the opportunities that come with it.. the china US spat has led to industries going to Vietnam and south East Asia.. why is not India a significant player here ?

Re: Indian Economy News & Discussion - Nov 27 2017

Not an economist or somebody claim to know anything about economics. No where else to ask as well.

Why is our collective obsession with GDP growth? Developed countries had a significant advancement of their HDI before their explosive growth. Even in India states with better HDI have a better economy. The current government’s priorities of water, sanitation, health, banking access, last mile infrastructure, etc should be encouraged more than tax cuts for automobile industry. The only missing thing is primary & secondary education - love to see massive investments in public funded schools. A well educated healthy society is need of the hour. Unfortunately all these need massive capital which needs whatever way it could be raised.

Ideally both needs to be addressed but it is social infrastructure that needs priority now.

Why is our collective obsession with GDP growth? Developed countries had a significant advancement of their HDI before their explosive growth. Even in India states with better HDI have a better economy. The current government’s priorities of water, sanitation, health, banking access, last mile infrastructure, etc should be encouraged more than tax cuts for automobile industry. The only missing thing is primary & secondary education - love to see massive investments in public funded schools. A well educated healthy society is need of the hour. Unfortunately all these need massive capital which needs whatever way it could be raised.

Ideally both needs to be addressed but it is social infrastructure that needs priority now.

Re: Indian Economy News & Discussion - Nov 27 2017

You need both. Cuba has very high HDI but no economy. Kerala should have been an economic powerhouse but it isn't going by your formula. HDI increases growth for multiple reasons provided you do both. They feed into each other. So GDP growth is as important as high HDI.

Re: Indian Economy News & Discussion - Nov 27 2017

There are a few other influences for automobile sales.

In the last 5 years, almost every major city in India got a functional metro. After initial lack of passengers, they have finally started picking up steam after some major points of the city are finally well connected. Add that as one more reason for lower two wheeler and small automobile sales.

With GST, the commercial vehicles are covering the same distance in 50% time as before due to removal of highway check points, giving a good 40% capacity increment of existing fleet. So demand of commercial vehicle is down.

In the last 5 years, almost every major city in India got a functional metro. After initial lack of passengers, they have finally started picking up steam after some major points of the city are finally well connected. Add that as one more reason for lower two wheeler and small automobile sales.

With GST, the commercial vehicles are covering the same distance in 50% time as before due to removal of highway check points, giving a good 40% capacity increment of existing fleet. So demand of commercial vehicle is down.

Last edited by Picklu on 04 Sep 2019 02:18, edited 1 time in total.

Re: Indian Economy News & Discussion - Nov 27 2017

So far, most of the successful economic policies of BJP are focused on long term efficiency improvement types. GST, Bank Merger, Jandhan, Digital Payments and UPI - all of them cause long term improvement of the economy by either taking away inefficiencies, duplication of efforts, middle man or improve accountability and tax compliance. However, all these have a short term negative impact of economy either via reduction of jobs or lower spending capacity due to more money going for taxes.

To ensure the economy is doing well, these short term negative impacts have to overcome via other measures like increase of well paying jobs and increased consumption.

The increase of job via Make In India, Smart City etc have not been very successful so far.

On the other hand there has been an increase of jobs with lower consumption power. All ola, uber drivers or ecom delivery persons live hand to mouth and have hardly any consumption power outside essential items.

A huge number of small, retail sector business are feeling the onslaught due to Amazon, Flipkart, Bigbasket, Licious. The other service sector that's facing lower profit margin/lesser salary is Restaurant business because all the food app aggregators are taking more than 20% hair cut. All in all, while number of jobs have gone up due to ecom, income of the people involved has actually come down and that's causing a reduction is consumption of non essential items.

In BSNL and Air India there are huge number of employees/vendors/contractors who are not getting salary on time. It means all their families are doing only essential consumption.

And a large number of such non essential items are nowadays coming from China and asean countries including mobile phone handsets, furnitures, plastic and metal household items and so on. Hence consumption of those items are not adding up fully in Indian economic activity.

To ensure the economy is doing well, these short term negative impacts have to overcome via other measures like increase of well paying jobs and increased consumption.

The increase of job via Make In India, Smart City etc have not been very successful so far.

On the other hand there has been an increase of jobs with lower consumption power. All ola, uber drivers or ecom delivery persons live hand to mouth and have hardly any consumption power outside essential items.

A huge number of small, retail sector business are feeling the onslaught due to Amazon, Flipkart, Bigbasket, Licious. The other service sector that's facing lower profit margin/lesser salary is Restaurant business because all the food app aggregators are taking more than 20% hair cut. All in all, while number of jobs have gone up due to ecom, income of the people involved has actually come down and that's causing a reduction is consumption of non essential items.

In BSNL and Air India there are huge number of employees/vendors/contractors who are not getting salary on time. It means all their families are doing only essential consumption.

And a large number of such non essential items are nowadays coming from China and asean countries including mobile phone handsets, furnitures, plastic and metal household items and so on. Hence consumption of those items are not adding up fully in Indian economic activity.

Re: Indian Economy News & Discussion - Nov 27 2017

Many of them (e.g. Foxconn) are Taiwanese and not Chinese. Taiwan was amongst the earliest and most eager to integrate itself into the global electronics supply chain by investing the proceeds of their early Asian Tiger boom years. Deng Xiaoping made a hard bargain with them based on sentiment and economics - in the late 80s/90s he wanted them to take advantage of China's labour force and wanted to build factories in their new SEZs. Conversely he would outright deny them access to their ancestral property in China, if they went elsewhere. So they went to China. I know at least a couple of older Taiwanese mid sized business owners with mainland factories (near Suzhou, where they both have ancestral homes), and this was the deal they described over dinner years ago.A_Gupta wrote:To be precise, Chinese proprietors have moved their manufacturing facilities to Vietnam.kit wrote:Case in point. The world changes that's accepted but India has not been able to grab the opportunities that come with it.. the china US spat has led to industries going to Vietnam and south East Asia.. why is not India a significant player here ?

Building such a supply chain integration system requires a coordinated government policy, with a nodal ministry capable of interacting with investors and working with other ministries (power, road/transport, labour, finance, commerce, industrial, steel, coal...) to get things sorted out quickly.

Not within the realm of this thread, but theoretically, GoI can discuss full diplomatic recognition to Taiwan in exchange for Taiwanese businesses moving manufacturing here. Of course this means credibly asserting two very difficult actions - a geopolitical one and a local political/bureaucratic one.

-

Rahulsidhu

- BRFite

- Posts: 165

- Joined: 22 Mar 2017 06:19

Re: Indian Economy News & Discussion - Nov 27 2017

suryag garu,suryag wrote: Bear in mind this is July 2017

1. Lower tax rates means higher deficit possibly translates to FII sucking their money out leading to rupee depreciation and pushing the fd higher due to oil import

It is great that you are trying to reason your way through the policy actions, flows and consequences. We need more of this.

But I have to say I don't even follow the first step. Why would have FIIs pull out of India if fiscal deficit was higher? I hope you are not confusing ratings agencies for actual investors.

The reason FIIs or indeed foreign investors in general are attracted towards India are high growth rates and huge potential. In actual fact FIIs have been urging GoI to run a looser fiscal account in order to growth -- I have posted about this before.

As for hindsight etc. I only brought this up as an example of the penny-pinching attitude of the govt. which very much persists to this day. I don't know who's responsible for it but it is very harmful. I repeat - govt finances should not be managed like a corporation, much less like a household.

Re: Indian Economy News & Discussion - Nov 27 2017

I’d like to have this thread avoid being a monoperspective one. It’s been argued repeatedly that the Indian economy (or for that matter any economy) should not be run like a household .

Let’s look at another perspective . Maybe GoI isn’t as stubborn, naive or orthodox as it’s made out to be . Maybe it’s aware what could be done . Perhaps they would like to, but cannot easily do so due to circumstances . What might such circumstances be ?

Let’s look at another perspective . Maybe GoI isn’t as stubborn, naive or orthodox as it’s made out to be . Maybe it’s aware what could be done . Perhaps they would like to, but cannot easily do so due to circumstances . What might such circumstances be ?

Re: Indian Economy News & Discussion - Nov 27 2017

India and GOI is never short of ideas. It is the implementation that is pivotal. From this article it looks like GOI is already working to woo firms to move to India given the US-China trade dispute. How successful will this effort be?

India to woo Apple, other firms to capitalize on US-China trade war

India to woo Apple, other firms to capitalize on US-China trade war

India is targeting companies including Apple, Foxconn and Wistron with a charm offensive aimed at encouraging them to shift business out of trade war-hit China, according to a source and a document seen by Reuters.

Several Indian officials met on Aug. 14 and discussed a list of “target companies” that also include Taiwan-headquartered contract manufacturer Pegatron, a source with direct knowledge said.

The dispute between the United States and China, the world’s two largest economies, has led to higher tariffs on goods worth billions of dollars and disrupted global supply chains, prompting companies to look at other investment avenues to escape higher tariffs.

Amid suggestions that India is late to capitalize on the trade war, government ministries have been asked to submit their policies and incentive structures to Invest India, the country’s foreign investment promotion agency. Nine sectors, including electronics, autos, pharmaceuticals and telecoms, will be targeted.

The document said the government will meet companies between Aug. 26 and Sept. 5 to suggest the best investment zones for their operations. State governments will also participate.

A “complete package” detailing market factors and Indian incentives on offer will then be readied for presenting to potential investors, according to the government record of the Aug. 14 meeting seen by Reuters.

Apple, Wistron, Pegatron and Foxconn did not respond to a request for comment.

It is not clear whether the government will dole out new incentives or just detail existing ones, but the document shows India wants to explore opportunities and move swiftly, even as some fear it has missed the bus.

As companies think about rebuilding supply chains outside of China, a major global manufacturing hub, nations such as Vietnam have emerged as top destinations given the faster clearances and stable policies they offer, industry experts say.

Alphabet’s Google is shifting its Pixel smartphone production to Vietnam from China starting this year, the Nikkei business daily reported on Wednesday.

“There is one other monster country that has a huge domestic market, India, but they have got to get moving,” said Richard Rossow, a U.S.-India specialist at the Center for Strategic and International Studies in Washington.

“There is no time to waste in catching that new wave and in fact the question is: Have they already missed it?”

Benefiting from tariffs war

The Sino-U.S. trade war has also rattled global automotive supply chains and affected big automakers.

Indian officials this week separately met local delegates of automakers including Volkswagen, Hyundai and Honda to see if they would consider moving some supply chain operations from China to India, according to the source and an industry official who attended the meeting.

“The government is looking at it as a great opportunity,” said the industry official.

Honda declined to comment, while Volkswagen and Hyundai did not respond to Reuters’ request.

The protracted trade dispute has also jolted Apple, which faces levies of 15% imposed by the U.S. administration on major products made in China such as smartwatches on Sept. 1, with a tariff on its iPhone to take effect on Dec. 15.

India is the world’s second-biggest smartphone market with huge room for growth. But while the likes of Foxconn, which assembles Apple phones in India, have deepened their India presence, executives say nations such as China offer a more skilled workforce and a better organized components ecosystem.

A senior smartphone industry executive in India said future corporate investment decisions would rely mostly on whether a country can offer policy stability and faster clearances.

“Vietnam at the end of the day is a small country and the potential of growing to super-scale, multi-tier supply chain capability is not possible,” said the executive.

The Indian government will also share a list of foreign companies with its consulates which will be tasked to fix meetings with the firms at their headquarters.

“This exercise to start first with Chinese companies based in China and to be completed before 15th of September 2019, including one-on-one meetings,” the document said.

Re: Indian Economy News & Discussion - Nov 27 2017

Sir - over years i have learnt from our trashy newspapers that FIIs tend to pull money based on sentiment. For instance if the fiscal deficit goes higher then the FIIs feel the GoI doesnt have the economy in control. Not sure if it is true or it is quarter truth from our bone brained BA pass journos writing about economics. The other concern as you mentioned is also that the rating agencies(FWIW) downgrade the country's rating leading to pull out of money.Rahulsidhu wrote: ==snip==

It is great that you are trying to reason your way through the policy actions, flows and consequences. We need more of this.

But I have to say I don't even follow the first step. Why would have FIIs pull out of India if fiscal deficit was higher? I hope you are not confusing ratings agencies for actual investors.

The reason FIIs or indeed foreign investors in general are attracted towards India are high growth rates and huge potential. In actual fact FIIs have been urging GoI to run a looser fiscal account in order to growth -- I have posted about this before.

As for hindsight etc. I only brought this up as an example of the penny-pinching attitude of the govt. which very much persists to this day. I don't know who's responsible for it but it is very harmful. I repeat - govt finances should not be managed like a corporation, much less like a household.

the other points i made are also somewhat relevant. Larger point is we never had a case study to let us know what to expect and the policy makers took one prong at the fork things could ahve been different had they taken the other prong but we could have possibly hit other issues. Please pardon me, as i mentioned before i dont know anything about economics.

BTW, every household runs differently, our street corner seth who is having his girvi dukaan runs it different from my neighbour who is a government servant