Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

may be Kissigner is advising Staet Dept to degrade China and build India alternative sourcing nation?

Re: Indian Economy News & Discussion - Nov 27 2017

Peregrine wrote:PM Modi meets members of JP Morgan International Council - PTI

NEW DELHI: Prime Minister Narendra Modi on Tuesday held meeting with high profile members of JP Morgan International Council and informed them about efforts being made to make India US $5 trillion economy by 2024-25.

The members of the council included former UK Prime Minister Tony Blair, former US secretaries of state Condoleezza Rice and Henry Kissinger and Tata Sons chairman emeritus Ratan Tata.

"Great discussions with former British PM Tony Blair. He has made a long lasting contribution to his nation and has insightful views on a wide range of global issues...excellent discussions with these global thought leaders," he said.

In another tweet, PM Modi mentioned he is "Glad to have met Dr Henry Kissinger. He has made pioneering contributions to international politics and diplomacy."

Cheers

vimal Ji :vimal wrote:

Really? Kissinger?

And the rest of the war mogering cabal of Rice et el..

Kabhi kabhi Gadhay ko "Chacha Ji" bhi kehna padta Hai! That is Niti!

Cheers

Re: Indian Economy News & Discussion - Nov 27 2017

vijayk Ji :vijayk wrote:may be Kissigner is advising Staet Dept to degrade China and build India alternative sourcing nation?

Wish I had said that! Thanks.

Cheers

Re: Indian Economy News & Discussion - Nov 27 2017

Its quite interesting to see the camaraderie between the PM and the members of the JP Morgan Council esp Kissinger ( of all people !! ) ., also heartening to see the evolution of Modi from national stature to one of the most prominent international political personalities. Bodes well for India.

Re: Indian Economy News & Discussion - Nov 27 2017

JPMorgan Chase has an International Council which provides advice to the bank’s leadership on economic, political and social trends across various regions and around the world. The International Council is chaired by Tony Blair, former Prime Minister of the UK, who also sits as an adviser to Zurich Financial. The Council includes Khalid A. Al-Falih, the President and CEO of Saudi Aramco (Saudi Arabian Oil Company), the world’s largest oil company, who also sits on the International Business Council of the World Economic Forum. Former UN Secretary General Kofi Annan is also on JPMorgan’s International Council, and sits as Chairman of the Alliance for a Green Revolution in Africa (AGRA), a partnership between the Bill & Melinda Gates Foundation and the Rockefeller Foundation. Annan is also on the boards of the United Nations Foundation, the World Economic Forum, and he is a member of the Global Board of Advisors of the Council on Foreign Relations.Peregrine wrote:vijayk Ji :vijayk wrote:may be Kissigner is advising Staet Dept to degrade China and build India alternative sourcing nation?

Wish I had said that! Thanks.

Cheers

The Council includes the third richest man in Mexico, Alberto Bailléres, as well as the Chairman and CEO of Telecom Italia, Franco Bernabé, who was the former CEO of Eni, one of the world’s largest oil companies (and Italy’s largest corporation), as well as the former Vice Chairman of Rothschild Europe. Bernabé sits on the board of PetroChina, China’s largest oil company. Bernabé is also a member of the European Round Table of Industrialists (a group of roughly 50 major European CEOs who directly advocate and work with EU political leaders in designing and implementing policy), he was a former Advisory Board member of the Council on Foreign Relations, a member of the board of FIAT, and is actively a member of the Steering Committee of the Bilderberg Meetings.

Martin Feldstein, a prominent Economics professor at Harvard and the President Emeritus of the National Bureau of Economic Research, is another member of the International Council. Feldstein was the Chairman of the Council of Economic Advisers to President Ronald Reagan and sat on the Foreign Intelligence Advisory Board (an “independent” group that advises the president on intelligence matters) under President George W. Bush (from 2007-2009). President Obama appointed Feldstein to the Economic Recovery Advisory Board, and he also sits on the board of the Council on Foreign Relations, is a member of the Trilateral Commission, a participant in Bilderberg Meetings, and is a member of the International Advisory Board of the National Bank of Kuwait.

Gao Xi-Qing is the Vice Chairman, President and Chief Investment Officer of the China Investment Corporation (CIC), China’s sovereign investment fund. He was referred to by the Atlantic as “the man who oversees $200 billion of China’s $2 trillion in dollar holdings.” Another notable Chinese member of the International Council is Tung Chee Hwa, the former Chief Executive and President of the Executive Council of Hong Kong, a core policy-making institution in the government of Hong Kong. Tung Chee Hwa is also the Vice Chairman of the National Committee of the Chinese People’s Political Consultative Conference (CPPCC), a major political advisory group in the People’s Republic of China, once chaired by Mao Zedong. Tung Chee Hwa as well is the founder and Chairman of the China-United States Exchange Foundation, and a former member of the International Advisory Board of the Council on Foreign Relations.

Carla A. Hills is the only woman on the JPMorgan International Council, and is Chairman and CEO of Hills & Company International, a global consulting firm. She was the former United States Trade Representative in the George H.W. Bush administration, where she was the primary negotiator for the North American Free Trade Agreement (NAFTA). She is also the Co-Chair of the Council on Foreign Relations, and sits on the International Boards of Rolls Royce and the Coca-Cola Company, as well as sitting on the board of directors of Gilead Sciences. Hills is a Counselor and Trustee of the Center for Strategic and International Studies (CSIS), a major American think tank where she also sits as Co-Chair of the Advisory Board (alongside Zbigniew Brzezinski, co-founder of the Trilateral Commission). In addition, Hills is a member of the Executive Committee of both the Trilateral Commission and the Peterson Institute for International Economics, as well as sitting on the boards of the International Crisis Group and the US-China Business Council, as Chair of the National Committee on US-China Relations, and Chair of the Inter-American Dialogue.

Henry Kissinger – former U.S. Secretary of State, National Security Adviser to President Richard Nixon, and Secretary of State to President Ford – also sits on the International Council of JPMorgan. Kissinger was a former adviser to Nelson Rockefeller, who recruited Kissinger as director of the Special Studies Project of the Rockefeller Brothers Fund in the 1950s. Kissinger was a director of the Council on Foreign Relations from 1977-1981, is a member of the Trilateral Commission, a former member of the Steering Committee and continuous participant in the Bilderberg Meetings, and is founder and chair of Kissinger Associates, an international consulting and advisory firm. Kissinger Chaired the National Bipartisan Commission on Central America during the Reagan administration, which provided justification for Reagan’s wars in Central America, and he was also a member of the Foreign Intelligence Advisory Board from 1984-1990, advising both Presidents Reagan and George H.W. Bush. Alongside Zbigniew Brzezinski, Kissinger was a member of the Commission on Integrated Long-Term Strategy of the National Security Council and Defense Department, established in the late 1980s to develop a long-term strategy for the United States in the world. Kissinger has also been a member of the Defense Policy Board, providing “independent” advice to the Pentagon leadership on matters of foreign policy, from 2001 to the present, for both the George W. Bush and Barack Obama administrations. Kissinger is also a Counselor and Trustee of the Center for Strategic and International Studies (CSIS), Honorary Governor of the Foreign Policy Association, an Honorary Member of the International Olympic Committee, an adviser to the board of directors of American Express, and is a Trustee Emeritus of the Metropolitan Museum of Art. In addition, Kissinger is a director of the International Rescue Committee, the Atlantic Institute, and is on the advisory board of the RAND Center for Global Risk and Security, as well as Honorary Chairman of the China-United States Exchange Foundation.

Mustafa V. Koc is also a member of the International Council, and is Chairman of Koc Holding AS, Turkey’s largest multinational corporation. He also sits on the International Advisory Board of Rolls Royce, the Global Advisory Board of the Council on Foreign Relations, is a member of the Steering Committee of the Bilderberg Meetings, a former member of the International Advisory Board of the National Bank of Kuwait, and is Honorary Chairman of the Turkish Industrialists and Businessmen’s High Advisory Council.

Gérard Mestrallet is the Chairman and CEO of GDF Suez, one of the largest energy conglomerates in the world, and is on the board of Suez Environment (one of the major water privatization companies in the world), and also sits on the supervisory board of AXA, a major global French financial conglomerate. He is also an advisory board member of Siemens, and is a member of the European Round Table of Industrialists and the International Business Council of the World Economic Forum.

John S. Watson is the Chairman and CEO of Chevron Corporation. He is on the board of the American Petroleum Institute and is a member of the National Petroleum Council, the Business Roundtable, the Business Council, the American Society of Corporate Executives, and the Chancellor’s Board of Advisors of the University of California Davis. He is also a member of the International Business Council of the World Economic Forum.

The Chairman of JPMorgan Chase International, Jacob A. Frenkel, is Chairman and CEO of the Group of Thirty, and a member of the International Council. He is also a former Vice Chairman of American International Group (from 2004 to 2009, when it was rescued with the massive government bailout); the former Chairman of Merrill Lynch International (from 2000 to 2004), and the former Governor of the Bank of Israel (from 1991 to 2000). Frenkel was an Economic Counselor and Director of Research at the International Monetary Fund (from 1987 to 1991) and prior to that he was the David Rockefeller Professor of International Economics at the University of Chicago (from 1973 to 1987). In addition, Frenkel is the former Editor of the Journal of Political Economy, former Vice Chairman of the Board of Governors of the European Bank for Reconstruction and Development, former Chairman of the Board of Governors of the Inter-American Development Bank, and a former member of the International Advisory Board of the Council on Foreign Relations. Frenkel is currently a member of the board of directors of the National Bureau of Economic Research (NBER), a member of the Trilateral Commission, member of the International Advisory Council of the China Development Bank, member of the board of the Peterson Institute for International Economics, member of the Economic Advisory panel of the Federal Reserve Bank of New York, member of the Council for the United States and Italy, member of the Investment Advisory Council of the Prime Minister of Turkey, and sits on the board of Loews Corporation.

To sum: it should be clear, from the evidence, that the leadership of JPMorgan Chase is not an isolated group of individuals involved in finance and exclusively relegated to the banking world, but a highly networked and influential group consisting of central figures in the global plutocracy – referred to as the "Transnational Capitalist Class" – with significant economic, social and political power. To refer to JPMorgan Chase simply as "a bank" is like referring to the United States as just "a country." A geopolitical force unto itself, and a conglomerate embedded within a transnational network of elite institutions and individuals, JPMorgan Chase goes beyond the financial indicators. Put simply, it is one of the most powerful banks in the world.

Meet the who's who of international council. I think Condi is only addition.

Also interesting to note Saudi Aramco CEO, few Mexican cash-bags, Turkish member.

Why no Desi invited to this council given that we are co-driving (along with Dragon) the economic growth.

Are we still being kept out of major decision making bodies!!

Last edited by Suraj on 23 Oct 2019 22:52, edited 1 time in total.

Reason: Please don't apply bold or other artifacts to entire quotes. It looks like you're yelling.

Reason: Please don't apply bold or other artifacts to entire quotes. It looks like you're yelling.

Re: Indian Economy News & Discussion - Nov 27 2017

Nice soon we will know what the interests were. The powerful got a taste of their own medicine perhaps when Chinese, after decades of friendship, paraded their weapons like a circus."Transnational Capitalist Class"

..

A geopolitical force unto itself, and a conglomerate embedded within a transnational network of elite institutions and individuals .. one of the most powerful banks in the world.

This guy wasn't here prolly for some reason.Gao Xi-Qing is the Vice Chairman, President and Chief Investment Officer of the China Investment Corporation (CIC), China’s sovereign investment fund. He was referred to by the Atlantic as “the man who oversees $200 billion of China’s $2 trillion in dollar holdings.”

Prolly cause desis aren't as rich, which is the real question; and who are getting richer at whose cost.Why no Desi invited to this council given that we are co-driving (along with Dragon) the economic growth.

Are we still being kept out of major decision making bodies!!

Re: Indian Economy News & Discussion - Nov 27 2017

https://techcrunch.com/2019/10/23/india ... fundraise/

Indian startups have raised a record $11.3B this year

Manish Singh 8 hours

With two months of 2019 still to go, Indian tech startups are already having their best year as a record amount of capital flows into the local ecosystem in a major rebound since the darkened funding environment of 2016.

The unlisted tech startups in India have raised $11.3 billion this year, a substantial jump from last year’s $10.5 billion fundraise, research firm Tracxn told TechCrunch...

Indian startups have raised a record $11.3B this year

Manish Singh 8 hours

With two months of 2019 still to go, Indian tech startups are already having their best year as a record amount of capital flows into the local ecosystem in a major rebound since the darkened funding environment of 2016.

The unlisted tech startups in India have raised $11.3 billion this year, a substantial jump from last year’s $10.5 billion fundraise, research firm Tracxn told TechCrunch...

Re: Indian Economy News & Discussion - Nov 27 2017

India moves up 14 spots to 63 on World Bank's ease of doing business

WASHINGTON: India jumped 14 places to the 63rd position on the World Bank's ease of doing business ranking released on Thursday, riding high on the government's flagship 'Make in India' scheme and other reforms attracting foreign investment. The country also figured among the top 10 performers on the list for the third time in a row. The rankings come at a time when the Reserve Bank of India (RBI), World Bank, International Monetary Fund (IMF) and various rating agencies have slashed the country's growth forecasts amid a slowdown in the global economy.

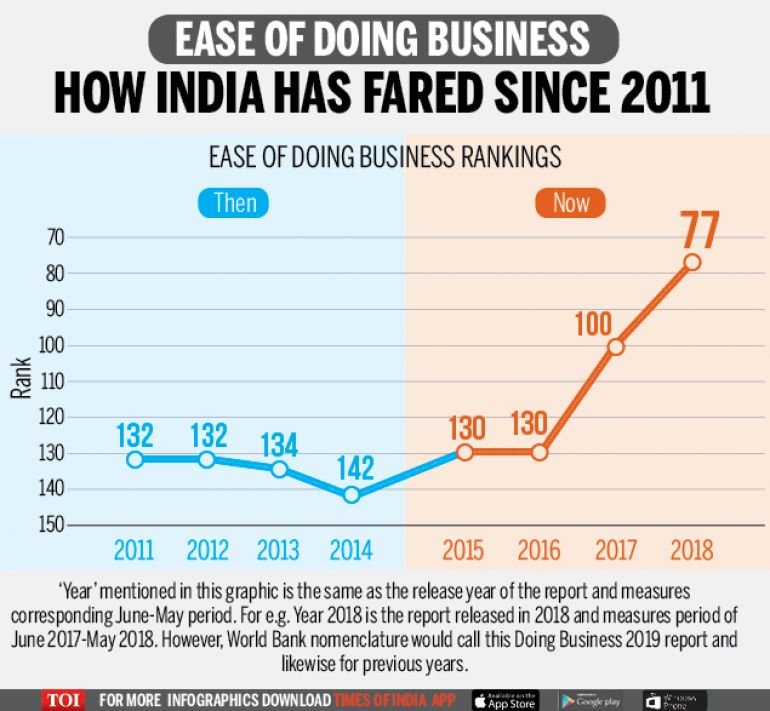

India was ranked 142nd among 190 nations when Prime Minister Narendra Modi took office in 2014. Four years of reform pushed up India's rank to 100th in World Bank's 'Doing Business' 2018 report. It was 130th in 2017 when it was ranked lower than Iran and Uganda. Last year, the country jumped 23 places to the 77th position on the back of reforms related to insolvency, taxation and other areas.

In its 'Doing Business' 2020 report, the World Bank commended the reform efforts undertaken by the country "given the size of India's economy". "This is the third year in a row that India makes to top 10 in Doing Business, which is a success which very few countries have done over the 20 years of the project, Without exception, the other countries that have done this are very small, population-wise, and homogeneous," Simeon Djankov, Director of Development Economics at the World bank told PTI in an interview. "India is the first country of its type to achieve that. It has jumped this year by 14 position," he said.

Apart from India, the other countries on this year's 'top 10 performers' list are Saudi Arabia (62), Jordan (75), Togo (97), Bahrain (43), Tajikistan (106), Pakistan (108), Kuwait (83), China (31) and Nigeria (131).

Prime Minister Modi's 'Make in India' campaign focused on attracting foreign investment, boosting the private sector — manufacturing in particular — and enhancing the country's overall competitiveness, the World Bank said in its report.

...

....

While the competition to move up the ladder would increase and become much tougher, India is on track to be within top 50 of the Ease of Doing business in the next year or two, Djankov told PTI in response to a question. And to come under 25 or below 50, the Modi government needs to announce and start implementing next set of ambitious reforms now, as these reforms takes a few years to be realized on the ground, he said. "The administration's reform efforts targeted all of the areas measured by Doing Business, with a focus on paying taxes, trading across borders, and resolving insolvency.

The country has made a substantial leap upward, raising its ease of doing business ranking from 130 in Doing Business 2016 to 63 in Doing Business 2020,” the report said. One of the main reasons for improvement in India's ranking this year goes to the successful implementation of the Insolvency And Bankruptcy Code, the World Bank official said.

"Before the implementation of the reform, it was very burdensome for secured creditors to seize companies in default of their loans," the report said.

https://timesofindia.indiatimes.com/bus ... 731668.cms

WASHINGTON: India jumped 14 places to the 63rd position on the World Bank's ease of doing business ranking released on Thursday, riding high on the government's flagship 'Make in India' scheme and other reforms attracting foreign investment. The country also figured among the top 10 performers on the list for the third time in a row. The rankings come at a time when the Reserve Bank of India (RBI), World Bank, International Monetary Fund (IMF) and various rating agencies have slashed the country's growth forecasts amid a slowdown in the global economy.

India was ranked 142nd among 190 nations when Prime Minister Narendra Modi took office in 2014. Four years of reform pushed up India's rank to 100th in World Bank's 'Doing Business' 2018 report. It was 130th in 2017 when it was ranked lower than Iran and Uganda. Last year, the country jumped 23 places to the 77th position on the back of reforms related to insolvency, taxation and other areas.

In its 'Doing Business' 2020 report, the World Bank commended the reform efforts undertaken by the country "given the size of India's economy". "This is the third year in a row that India makes to top 10 in Doing Business, which is a success which very few countries have done over the 20 years of the project, Without exception, the other countries that have done this are very small, population-wise, and homogeneous," Simeon Djankov, Director of Development Economics at the World bank told PTI in an interview. "India is the first country of its type to achieve that. It has jumped this year by 14 position," he said.

Apart from India, the other countries on this year's 'top 10 performers' list are Saudi Arabia (62), Jordan (75), Togo (97), Bahrain (43), Tajikistan (106), Pakistan (108), Kuwait (83), China (31) and Nigeria (131).

Prime Minister Modi's 'Make in India' campaign focused on attracting foreign investment, boosting the private sector — manufacturing in particular — and enhancing the country's overall competitiveness, the World Bank said in its report.

...

....

While the competition to move up the ladder would increase and become much tougher, India is on track to be within top 50 of the Ease of Doing business in the next year or two, Djankov told PTI in response to a question. And to come under 25 or below 50, the Modi government needs to announce and start implementing next set of ambitious reforms now, as these reforms takes a few years to be realized on the ground, he said. "The administration's reform efforts targeted all of the areas measured by Doing Business, with a focus on paying taxes, trading across borders, and resolving insolvency.

The country has made a substantial leap upward, raising its ease of doing business ranking from 130 in Doing Business 2016 to 63 in Doing Business 2020,” the report said. One of the main reasons for improvement in India's ranking this year goes to the successful implementation of the Insolvency And Bankruptcy Code, the World Bank official said.

"Before the implementation of the reform, it was very burdensome for secured creditors to seize companies in default of their loans," the report said.

https://timesofindia.indiatimes.com/bus ... 731668.cms

Re: Indian Economy News & Discussion - Nov 27 2017

BSNL, MTNL to be merged; Centre lines up Rs 70,000 crore revival package

TNN | Oct 24, 2019, 01.38 AM IST

NEW DELHI: The government on Wednesday announced a massive revival package of nearly Rs 70,000 crore for the ailing telecom PSUs BSNL and MTNL as it looks to nurse back the “strategic”, but heavily bleeding, companies to health and profitability over the next three-four years.

The two companies – which together hold about 14% market share in the mobile business -- will also be merged. The merger will await sorting out of some operational and regulatory issues since MTNL is a listed company.

The revival package aims to make the loss-making companies competitive again by giving them access to 4G spectrum; helping them retire a large number of employees through an attractive VRS package; and monetising their locked assets such as large swathes of land, and telecom towers.

“BSNL and MTNL are strategic assets of India… they will not be closed, or disinvested, or hived off to any third party,” telecom and IT minister Ravi Shankar Prasad said, minutes after the revival package was cleared by the Union Cabinet chaired by Prime Minister Narendra Modi.

TOI was the first to report on the proposed mega package that was being worked out to bail out the sick PSUs in its edition dated July 3.

The financial relief, which was also praised by home minister Amit Shah, ends months of speculation around the fate of the two companies, especially as certain sections even within the government were opposed to the idea of any broad-based monetary package.

BSNL, with estimated loss of Rs 13,804 crore in 2018-19, has pan-India operations, except for Delhi and Mumbai. The two metro markets are covered by MTNL, whose losses in 2018-19 were pegged at Rs 3,400 crore.

Prasad said the government is confident that the two companies will be operationally profitable over the next two years, and may become fully profitable by the year 2023.

BSNL and MTNL, once the shining jewels in the government’s PSU line-up, have been a drain on the exchequer for the last decade as competition from private operators hit their businesses hard. They lost subscribers and failed to keep pace with technology changes. As landline numbers started shrinking, their operations were also pulled down due to a cocktail of negative factors such as poor management, high staff cost, government meddling and very poor customer service.

Manpower has been a major drain on the revenues of the two companies with an official report prepared in June pegging the staff cost as a percentage of revenues at 77% for BSNL, and 87% for MTNL (based on 2018-19 financial numbers). .

Despite the government's commitment, revival of the two companies appears to be a tall order due to the stiff competition in the telecom sector especially after the launch of Reliance Jio in September 2016. The competition has already seen tariffs hit rock bottom even as usage of both voice and data has gone up manifold. The crunch is so severe that even much-experienced and battle-hardened operators such as Airtel and Vodafone-Idea are struggling to salvage business as they run into losses and mounting debt.

Prasad said that debt is one area where BSNL and MTNL are relatively better off. “The duo has a total debt of around Rs 40,000 crore, which is the lowest for any telecom company in India.”

The companies will now need to draw up a fresh revival strategy, while also working out VRS packages, asset monetisation and 4G rollout. The additional capital expenditure of putting the telecom infrastructure for 4G itself is pegged at around over Rs 10,000 crore.

https://timesofindia.indiatimes.com/bus ... 730263.cms

TNN | Oct 24, 2019, 01.38 AM IST

NEW DELHI: The government on Wednesday announced a massive revival package of nearly Rs 70,000 crore for the ailing telecom PSUs BSNL and MTNL as it looks to nurse back the “strategic”, but heavily bleeding, companies to health and profitability over the next three-four years.

The two companies – which together hold about 14% market share in the mobile business -- will also be merged. The merger will await sorting out of some operational and regulatory issues since MTNL is a listed company.

The revival package aims to make the loss-making companies competitive again by giving them access to 4G spectrum; helping them retire a large number of employees through an attractive VRS package; and monetising their locked assets such as large swathes of land, and telecom towers.

“BSNL and MTNL are strategic assets of India… they will not be closed, or disinvested, or hived off to any third party,” telecom and IT minister Ravi Shankar Prasad said, minutes after the revival package was cleared by the Union Cabinet chaired by Prime Minister Narendra Modi.

TOI was the first to report on the proposed mega package that was being worked out to bail out the sick PSUs in its edition dated July 3.

The financial relief, which was also praised by home minister Amit Shah, ends months of speculation around the fate of the two companies, especially as certain sections even within the government were opposed to the idea of any broad-based monetary package.

BSNL, with estimated loss of Rs 13,804 crore in 2018-19, has pan-India operations, except for Delhi and Mumbai. The two metro markets are covered by MTNL, whose losses in 2018-19 were pegged at Rs 3,400 crore.

Prasad said the government is confident that the two companies will be operationally profitable over the next two years, and may become fully profitable by the year 2023.

BSNL and MTNL, once the shining jewels in the government’s PSU line-up, have been a drain on the exchequer for the last decade as competition from private operators hit their businesses hard. They lost subscribers and failed to keep pace with technology changes. As landline numbers started shrinking, their operations were also pulled down due to a cocktail of negative factors such as poor management, high staff cost, government meddling and very poor customer service.

Manpower has been a major drain on the revenues of the two companies with an official report prepared in June pegging the staff cost as a percentage of revenues at 77% for BSNL, and 87% for MTNL (based on 2018-19 financial numbers). .

Despite the government's commitment, revival of the two companies appears to be a tall order due to the stiff competition in the telecom sector especially after the launch of Reliance Jio in September 2016. The competition has already seen tariffs hit rock bottom even as usage of both voice and data has gone up manifold. The crunch is so severe that even much-experienced and battle-hardened operators such as Airtel and Vodafone-Idea are struggling to salvage business as they run into losses and mounting debt.

Prasad said that debt is one area where BSNL and MTNL are relatively better off. “The duo has a total debt of around Rs 40,000 crore, which is the lowest for any telecom company in India.”

The companies will now need to draw up a fresh revival strategy, while also working out VRS packages, asset monetisation and 4G rollout. The additional capital expenditure of putting the telecom infrastructure for 4G itself is pegged at around over Rs 10,000 crore.

https://timesofindia.indiatimes.com/bus ... 730263.cms

Re: Indian Economy News & Discussion - Nov 27 2017

BSNL, MTNL aging staff to get Rs 30,000 crore VRS deal

TNN | Oct 24, 2019, 06.51 AM IST

NEW DELHI: A generous VRS package — amounting to nearly Rs 30,000 crore — awaits the aging employees of BSNL and MTNL, two of India’s biggest loss-making PSUs, as the government announced steps to revive them and reduce their massive manpower, which had been a big drain on resources.

To be offered to those above age of 50, it promises to pre-pay nearly ten years of salary in advance apart from handsome pensionary benefits, bringing home Diwali celebrations early for employees who till just a few days back were holding out protests against the government over delays in salary and speculation that the companies may be ordered to shut down in view of continued losses.

Telecom minister Ravi Shankar Prasad said the government has taken special steps to offer employees valuable VRS packages, so that a large number of aging workers opt for it. “However, let me add that this will be voluntary and there will be no forced deals.”

As per the VRS package, an employee above the age of 53-and-a-half years will get 125% of today’s salary and this would include the pension payout. As per an official report released in June, BSNL had over 1.16 lakh employees over age of 50 years (total staff strength: 1.65 lakh), while MTNL had 19,000 employees over age of 50 years (total staff strength: 21,679)

K Sebastian, eader of BSNL employees’ union said VRS will receive a good response. “It is better than our expectations, and meets most of our demands.”

https://timesofindia.indiatimes.com/bus ... 731231.cms

TNN | Oct 24, 2019, 06.51 AM IST

NEW DELHI: A generous VRS package — amounting to nearly Rs 30,000 crore — awaits the aging employees of BSNL and MTNL, two of India’s biggest loss-making PSUs, as the government announced steps to revive them and reduce their massive manpower, which had been a big drain on resources.

To be offered to those above age of 50, it promises to pre-pay nearly ten years of salary in advance apart from handsome pensionary benefits, bringing home Diwali celebrations early for employees who till just a few days back were holding out protests against the government over delays in salary and speculation that the companies may be ordered to shut down in view of continued losses.

Telecom minister Ravi Shankar Prasad said the government has taken special steps to offer employees valuable VRS packages, so that a large number of aging workers opt for it. “However, let me add that this will be voluntary and there will be no forced deals.”

As per the VRS package, an employee above the age of 53-and-a-half years will get 125% of today’s salary and this would include the pension payout. As per an official report released in June, BSNL had over 1.16 lakh employees over age of 50 years (total staff strength: 1.65 lakh), while MTNL had 19,000 employees over age of 50 years (total staff strength: 21,679)

K Sebastian, eader of BSNL employees’ union said VRS will receive a good response. “It is better than our expectations, and meets most of our demands.”

https://timesofindia.indiatimes.com/bus ... 731231.cms

Re: Indian Economy News & Discussion - Nov 27 2017

https://swarajyamag.com/news-brief/shar ... ought-back

Share Of Chinese Goods In Delhi’s Diwali Idol Market Falls From 80 To 10 Per Cent, Here’s How India Fought Back

Share Of Chinese Goods In Delhi’s Diwali Idol Market Falls From 80 To 10 Per Cent, Here’s How India Fought Back

The share of Chinese products in the Delhi’s Diwali idol market, which until five-six years ago dominated it with 70 to 80 per cent market share, is now down to 10 per cent this time round, Press Trust of India has reported.

This figure has been claimed by a traders’ organisation Delhi Vyapar Mahasangh operating in the national capital.

The Indian idols which are now dominating the market are mainly being manufactured in Burari, Pankha Road, Ghazipur, Old Delhi and Meerut.

What Caused This Turnaround

As per the president of the traders body Devraj Baweja, shopkeepers this year decided to import a lower number of made in China idols and replaced them with the ones Made In India.

This decision was motivated by various factors including demonstrations against the use of Chinese goods last year.

These idols are said to be of gods and goddesses like Ganesha, Lakshmi, Shiva, Durga and Saraswati.

Indian idol makers also deserve credit for tilting the market share in favour of Made-In-India goods. As per Baweja, they have now learned the technique used by China to make the Hindu idols and have incorporated it in their making process.

The pricing of Indian made idols is lower than their Chinese counterparts by a magnitude of almost 30 to 40 per cent. To top it off, the Made In India idols are more durable and lasting.

Another big aspect of this development which cannot be overlooked is the desire for Diwali shoppers to buy Indian products and consciously avoid Chinese ones.

Re: Indian Economy News & Discussion - Nov 27 2017

vijayk wrote:https://swarajyamag.com/news-brief/shar ... ought-back

Share Of Chinese Goods In Delhi’s Diwali Idol Market Falls From 80 To 10 Per Cent, Here’s How India Fought Back

The pricing of Indian made idols is lower than their Chinese counterparts by a magnitude of almost 30 to 40 per cent. To top it off, the Made In India idols are more durable and lasting.

Another big aspect of this development which cannot be overlooked is the desire for Diwali shoppers to buy Indian products and consciously avoid Chinese ones.

Good news but one more step is needed - if not already so - biodegradable. Walking in dilli neighbourhood parks one sees idols, which have lost paint or are damage, left under trees. People are following the custom. But that worked when iidols were of mud and natural colours.

Re: Indian Economy News & Discussion - Nov 27 2017

I know it is too micro to count, but I had a long conversation with a micro/small business owner who makes photo-frames for religious icons. He was all praise for GST, said it is forcing all his suppliers and other businesses who work with him to be honest. He says now they have to provide him an itemized bill, earlier they'd just fob him off with a handwritten bill and the costs have dropped by around 15% for his raw materials on an average, so he is happy and is passing on the benefit to the consumers. Just an anecdote I think might be of interest, as he literally is a small business owner who is "making his own stuff" and is not merely a reseller.

Re: Indian Economy News & Discussion - Nov 27 2017

UPI hits 1 billion transactions in October, plans to go global.

Transactions using India’s own domestic payments platform—Unified Payments Interface (UPI)—hit a landmark of one billion in October, three years after its launch.

The UPI also recently crossed 100 million users, making it the fastest adoption of any payments system anywhere in the world.

Having achieved this double milestone, the National Payments Corporation of India (NPCI), which operates the UPI platform, aims to take the network global by enabling acceptance of UPI in Singapore and the UAE.

The UPI platform, which was launched before demonetisation in 2016, enables users to send money from their account to any account without entering bank details by using an email-like handle or scanning a QR code. The NPCI, which launched the Ru-Pay network, had launched this to promote digital payments by harnessing the ubiquitousness of smartphones.

“The UPI has had the fastest acceptance not just in payments but among other platforms as well. I have not compared the numbers but given the time taken to reach 100 million users by social media and other platforms. I am sure we should be among the top,” said Dilip Asbe, chief executive officer, NPCI. To put things in perspective, in August the total volume of all card transactions (debit and credit) put together was 142 crore (1.42 billion).

While all major banks are part of the UPI network and many have proprietary apps, the open architecture of UPI enables any bank account to be accessed from any UPI app.

This has enabled three players—GooglePay, Paytm and PhonePe—to dominate the market as customers of different banks use largely these three apps and the NPCI’s BHIM app to transact. These three have been the most aggressive in enrolling small merchants, including hawkers, to accept payments through the UPI. What has also helped is that UPI waived merchant fees for payments up to Rs 100.

The foreign-investor backed fintechs that have been driving UPI volumes have gained in terms of valuations, given the market potential. Walmart-owned PhonePe, according to a Morgan Stanley report, is now worth $7 billion. Paytm has also seen its valuation soar in line with an increase in users.

“The four apps are 90% of total volume on the app side. But on the merchant-acquiring side, it is a diverse set of banks and fintechs that are deploying QR codes,” said Asbe. “The objective for the next three years is to expand this 100-million base to 500 million. We believe in the next two years the merchant ecosystem will get digitised with the number of QR codes going to 30 million from 10 million now,” said Asbe. The acceptance development fund proposed by the Reserve Bank of India is expected to promote the deployment of QR codes.

On going global, Asbe said it is in the planning stage and various permissions will be required. He expects that the collaboration between fintechs and banks, which drove acceptance in India, will do the same abroad. Technically, a QR code scan done anywhere in the world can debit an Indian bank account instantly, but the transfer to the merchant’s account can happen after some time.

A model for that is already in place—China’s Alipay and WeChat are accepted in 30 countries. The difference is that these are closed-loop payments, while the UPI can work with any bank account.

[/quote]

Transactions using India’s own domestic payments platform—Unified Payments Interface (UPI)—hit a landmark of one billion in October, three years after its launch.

The UPI also recently crossed 100 million users, making it the fastest adoption of any payments system anywhere in the world.

Having achieved this double milestone, the National Payments Corporation of India (NPCI), which operates the UPI platform, aims to take the network global by enabling acceptance of UPI in Singapore and the UAE.

The UPI platform, which was launched before demonetisation in 2016, enables users to send money from their account to any account without entering bank details by using an email-like handle or scanning a QR code. The NPCI, which launched the Ru-Pay network, had launched this to promote digital payments by harnessing the ubiquitousness of smartphones.

“The UPI has had the fastest acceptance not just in payments but among other platforms as well. I have not compared the numbers but given the time taken to reach 100 million users by social media and other platforms. I am sure we should be among the top,” said Dilip Asbe, chief executive officer, NPCI. To put things in perspective, in August the total volume of all card transactions (debit and credit) put together was 142 crore (1.42 billion).

While all major banks are part of the UPI network and many have proprietary apps, the open architecture of UPI enables any bank account to be accessed from any UPI app.

This has enabled three players—GooglePay, Paytm and PhonePe—to dominate the market as customers of different banks use largely these three apps and the NPCI’s BHIM app to transact. These three have been the most aggressive in enrolling small merchants, including hawkers, to accept payments through the UPI. What has also helped is that UPI waived merchant fees for payments up to Rs 100.

The foreign-investor backed fintechs that have been driving UPI volumes have gained in terms of valuations, given the market potential. Walmart-owned PhonePe, according to a Morgan Stanley report, is now worth $7 billion. Paytm has also seen its valuation soar in line with an increase in users.

“The four apps are 90% of total volume on the app side. But on the merchant-acquiring side, it is a diverse set of banks and fintechs that are deploying QR codes,” said Asbe. “The objective for the next three years is to expand this 100-million base to 500 million. We believe in the next two years the merchant ecosystem will get digitised with the number of QR codes going to 30 million from 10 million now,” said Asbe. The acceptance development fund proposed by the Reserve Bank of India is expected to promote the deployment of QR codes.

On going global, Asbe said it is in the planning stage and various permissions will be required. He expects that the collaboration between fintechs and banks, which drove acceptance in India, will do the same abroad. Technically, a QR code scan done anywhere in the world can debit an Indian bank account instantly, but the transfer to the merchant’s account can happen after some time.

A model for that is already in place—China’s Alipay and WeChat are accepted in 30 countries. The difference is that these are closed-loop payments, while the UPI can work with any bank account.

[/quote]

Re: Indian Economy News & Discussion - Nov 27 2017

Six sectors that defy the cyclical slowdown theory

https://m.economictimes.com/industry/se ... 778605.cms

Quote :

In Dombivali, Mumbai, Runwal Properties sold 280 apartments in three days. We were zapped by such an outstanding success. Conversion of footfalls have risen from around 8-10% earlier to now around 17%

Quote:

Kia’s plant started operating a second shift since September 15. “We are humbled. We are scared. Right now we are trying to push everyone to meet customer’s expectations and demand"

Encouraging signs...I heard Maruti Suzuki chairman echo similar sentiments about demand during the month of October. I can't wait to prove economist, ft and other biased sources wrong.

https://m.economictimes.com/industry/se ... 778605.cms

Quote :

In Dombivali, Mumbai, Runwal Properties sold 280 apartments in three days. We were zapped by such an outstanding success. Conversion of footfalls have risen from around 8-10% earlier to now around 17%

Quote:

Kia’s plant started operating a second shift since September 15. “We are humbled. We are scared. Right now we are trying to push everyone to meet customer’s expectations and demand"

Encouraging signs...I heard Maruti Suzuki chairman echo similar sentiments about demand during the month of October. I can't wait to prove economist, ft and other biased sources wrong.

Re: Indian Economy News & Discussion - Nov 27 2017

https://worldview.stratfor.com/article/ ... modi-saarc

Highlights

India's latest economic downturn poses the paramount domestic challenge to Prime Minister Narendra Modi's administration.

Amid the current downturn, the government could breach its deficit target of 3.3 percent, which could dent its credit profile.

Boosting private investments to over 30 percent of GDP will be crucial to India's long-term prospects of sustaining robust economic growth.

Highlights

India's latest economic downturn poses the paramount domestic challenge to Prime Minister Narendra Modi's administration.

Amid the current downturn, the government could breach its deficit target of 3.3 percent, which could dent its credit profile.

Boosting private investments to over 30 percent of GDP will be crucial to India's long-term prospects of sustaining robust economic growth.

Re: Indian Economy News & Discussion - Nov 27 2017

Kaivalya wrote:Six sectors that defy the cyclical slowdown theory

https://m.economictimes.com/industry/se ... 778605.cms

Quote :

In Dombivali, Mumbai, Runwal Properties sold 280 apartments in three days. We were zapped by such an outstanding success. Conversion of footfalls have risen from around 8-10% earlier to now around 17%

Quote:

Kia’s plant started operating a second shift since September 15. “We are humbled. We are scared. Right now we are trying to push everyone to meet customer’s expectations and demand"

Encouraging signs...I heard Maruti Suzuki chairman echo similar sentiments about demand during the month of October. I can't wait to prove economist, ft and other biased sources wrong.

Booking for Cars confirming to BS-VI is already having a backlog of more than 3 to 6 months with most dealers.

Looks like India just need weather the storm before recovery.

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.livemint.com/market/commodi ... 78738.html

30 tonnes gold sold on Dhanteras, exceeds traders' expectations: IBJA

30 tonnes gold sold on Dhanteras, exceeds traders' expectations: IBJA

The gold sales on Dhanteras was more than the expectation as it was recorded to be around 30 tonnes, said the national secretary of Indian Bullion and Jewellers Association, Surendra Mehta.

He said that gold sales in the past few years used to be around 40 tonnes, but due to high prices and liquidity crunch in the market this year, it was expected that the sales might be around 20 tonnes. The sales have dropped by around 25 per cent as compared to last year.

"We didn't expect so much sales because the demand for gold in the domestic market was down due to high prices," Mehta said.

"The gold prices in the domestic bullion market are high due to the soaring prices of gold in the international market and increase in import duty on expensive metals in India. Therefore, the demand for gold was expected to be less when the festive season started, but due to the improved buying trends in the last three-four days, gold sales were recorded to be 30 tonnes on Dhanteras," Mehta told IANS.

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Indian Economy News & Discussion - Nov 27 2017

How bad is the slowdown? Is the Indian stock market really down?

Re: Indian Economy News & Discussion - Nov 27 2017

BSE sensex YTD is around 9%UlanBatori wrote:How bad is the slowdown? Is the Indian stock market really down?

https://economictimes.indiatimes.com/mu ... 784885.cms

mostly up

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Indian Economy News & Discussion - Nov 27 2017

That is what I see too. So why all this talk of "slowdown"? OTOH, any stocks I know  have not been doing great this year or maybe for past 2 years.

have not been doing great this year or maybe for past 2 years.

Re: Indian Economy News & Discussion - Nov 27 2017

Guessing this is a rhetorical question- it is an attempt to counter this annoying narrative that has been repeated over and over again scaring people.UlanBatori wrote:How bad is the slowdown? Is the Indian stock market really down?

For example,Indian economy google search from the last week or so brings up the following

1. Economist : Narendra Modi is damaging its democracy as well as its economy

2.financial times : Problems are piling up for India's narendra modi

3.r3, Nobel laureates and the likes opining - indian economy is on shaky ground

4. Wapo : Why Modi cannot ignore the slowing down economy for too long etc.

Letting this go for too long results in bad gst, faulty demo, increase handouts advise that is worse. Worried that it will give BIF more ammo especially in the next few weeks. Talking heads all seem to be preoccupied with GDP, auto industry or real estate

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Indian Economy News & Discussion - Nov 27 2017

My agint in desh has been scared to buy more stocks, for about 2+ saal now. I kept pushing him, but since I was in no position to actually bully him, just gnashed my teeth and stayed put. I have to say that the money sitting in baink acct earning 4% minus Saral income tax, has actually been a better deal than investing in the companies in which he might have invested. Only problem is that I could have earned 50% to 75% more by putting it in FDs except that he has been waiting for The Impending Crash to buy.

He points out that although the stock indices stay high due to the high-flyers, many companies that actually produce stuff (vs. shuffle electronic paper) are struggling. So there is much merit in the narrative of slowing economy. Much of it can be traced to the fact that the Fluff Economy is under stress due to Demo, GST, the idea of actually paying taxes, controls on phoren accts, fear of Enforcement Directorate - AND - massive drop in the confidence in Black Money Real Estate. I say more power to MAD in these things. Obviously one does not go out and buy a BMW when one fears the ED - and that huge profit from selling a flat built on prohibited land, ain't happening no more.

When these shake out what remains should be a solid base. Three or four years ago what I was seeing on vijits to Malloostan was absolutely terrifying: streets choked with Lexuses and BMWs and high-end Mercedes; ppl spending like there was no tomorrow. And no evidence of any actual hard industry - or rise in quality - to back up any of this. They had just discovered Credit Cards....

BTW, no, not rhetorical pooch. Genuinely confused and scared.

He points out that although the stock indices stay high due to the high-flyers, many companies that actually produce stuff (vs. shuffle electronic paper) are struggling. So there is much merit in the narrative of slowing economy. Much of it can be traced to the fact that the Fluff Economy is under stress due to Demo, GST, the idea of actually paying taxes, controls on phoren accts, fear of Enforcement Directorate - AND - massive drop in the confidence in Black Money Real Estate. I say more power to MAD in these things. Obviously one does not go out and buy a BMW when one fears the ED - and that huge profit from selling a flat built on prohibited land, ain't happening no more.

When these shake out what remains should be a solid base. Three or four years ago what I was seeing on vijits to Malloostan was absolutely terrifying: streets choked with Lexuses and BMWs and high-end Mercedes; ppl spending like there was no tomorrow. And no evidence of any actual hard industry - or rise in quality - to back up any of this. They had just discovered Credit Cards....

BTW, no, not rhetorical pooch. Genuinely confused and scared.

Re: Indian Economy News & Discussion - Nov 27 2017

https://economictimes.indiatimes.com/in ... 788182.cms

Festive cheer for auto companies, car sales pick up

Sales rose 5-7% this Navratri, Dussehra and Dhanteras from the year-earlier numbers for the festive period.

Festive cheer for auto companies, car sales pick up

Sales rose 5-7% this Navratri, Dussehra and Dhanteras from the year-earlier numbers for the festive period.

op two car makers Maruti Suzuki and Hyundai registered 7% and 10% growth, respectively, in the Navratri to Dussehra period. Deliveries on Dhanteras, October 25, exceeded double-digit growth from the previous year for the two carmakers, which account for 65-70% of the market. Third-largest firm Mahindra registered a 100% spike in the sale of utility vehicles on Dhanteras.

-

nandakumar

- BRFite

- Posts: 1641

- Joined: 10 May 2010 13:37

Re: Indian Economy News & Discussion - Nov 27 2017

[quote="UlanBatori"]My agint in desh has been scared to buy more stocks, for about 2+ saal now. I kept pushing him, but since I was in no position to actually bully him, just gnashed my teeth and stayed put. I have to say that the money sitting in baink acct earning 4% minus Saral income tax, has actually been a better deal than investing in the companies in which he might have invested. Only problem is that I could have earned 50% to 75% more by putting it in FDs except that he has been waiting for The Impending Crash to buy.

He points out that although the stock indices stay high due to the high-flyers, many companies that actually produce stuff (vs. shuffle electronic paper) are struggling. So there is much merit in the narrative of slowing economy. Much of it can be traced to the fact that the Fluff Economy is under stress due to Demo, GST, the idea of actually paying taxes, controls on phoren accts, fear of Enforcement Directorate - AND - massive drop in the confidence in Black Money Real Estate. I say more power to MAD in these things. Obviously one does not go out and buy a BMW when one fears the ED - and that huge profit from selling a flat built on prohibited land, ain't happening no more.

They had just discovered Credit Cards....

Data on credit card outstandings- Aug 2017 Rs 57,000 crore, Aug 2018 Rs 78,000 crore and August 2019 Rs 98,000 crore. In macro terms these are not large numbers as proportion of household debt. But they are growing faster than growth in nominal GDP which was around 12% or so in these years. On the other hand income growth tends to be skewed in favour of those in higher brackets- typical card users- which could be in the 15 to 18% range. Viewed from that perspective one can say that private consumption is not driven by a credit binge.

He points out that although the stock indices stay high due to the high-flyers, many companies that actually produce stuff (vs. shuffle electronic paper) are struggling. So there is much merit in the narrative of slowing economy. Much of it can be traced to the fact that the Fluff Economy is under stress due to Demo, GST, the idea of actually paying taxes, controls on phoren accts, fear of Enforcement Directorate - AND - massive drop in the confidence in Black Money Real Estate. I say more power to MAD in these things. Obviously one does not go out and buy a BMW when one fears the ED - and that huge profit from selling a flat built on prohibited land, ain't happening no more.

They had just discovered Credit Cards....

Data on credit card outstandings- Aug 2017 Rs 57,000 crore, Aug 2018 Rs 78,000 crore and August 2019 Rs 98,000 crore. In macro terms these are not large numbers as proportion of household debt. But they are growing faster than growth in nominal GDP which was around 12% or so in these years. On the other hand income growth tends to be skewed in favour of those in higher brackets- typical card users- which could be in the 15 to 18% range. Viewed from that perspective one can say that private consumption is not driven by a credit binge.

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.livemint.com/auto-news/what ... 26519.html

What slowdown? Mercedes sold 600 luxury cars in just one day

1 min read . Updated: 28 Oct 2019, 08:25 AM IST

Mercedes-Benz India said it delivered over 250 cars in Delhi-NCR alone on Dhanteras

NEW DELHI : Beating the slowdown in the auto industry, luxury automobile manufacturer Mercedes-Benz India delivered more than 600 cars last week during Dhanteras. Of the 600 cars, almost half of them were sold in the Delhi-NCR region alone. The rest of the demand came from Punjab, Mumbai, Pune, Kolkata and Gujarat, the automaker said.

"The festive season has been satisfactory for us and we are glad to see an overwhelming response to our products from across markets. We are excited to see the response to the current GLE, which sold out three months ahead of the plan," said Martin Schwenk, managing director and chief executive, Mercedes-Benz India.

The impressive number of deliveries during the current festive season reiterates the increasing customer confidence, he said.

During Dussehra and Navratri, Mercedes-Benz had delivered more than 200 cars in Mumbai and Gujarat.

Re: Indian Economy News & Discussion - Nov 27 2017

Automobile sales witness Diwali boom

The festive season has brought some relief to automakers, with passenger vehicle makers witnessing up to a 50% jump in retail sales during the Diwali period — driven mainly by high discounts — as compared to the festive season last year.

“We are happy to share that customers have responded well to our festive offers as reflected in 50% more retail in the Diwali period. Additionally, to double this joy, the day of Dhanteras alone witnessed a retail growth of 49%,” a Tata Motors spokesperson told The Hindu.

Hyundai Motor India had sold about 12,500 cars on Dhanteras alone, which was nearly 31% of the company’s monthly sales in September.

Rakesh Srivastava, managing director, Nissan India, said following the launch of new model variants along with special financing offers, the company was seeing high traction in the form of increased enquiries across the country, including Tier 2 and Tier 3 cities.

Re: Indian Economy News & Discussion - Nov 27 2017

There is a news-item in the New Indian Express that I cannot find online, which sheds some light on the employment situation in one state of India.

Professional courses will not always help secure job: Data

T'Puram: It would be a bitter pill to swallow for many that studying professional courses does not guarantee employment in the topsy turvy job market. As per the data presented at the Assembly on Wednesday, 44,559 graduate engineers; 7,303 MBBS graduates; 3,771 MCA graduates and 6,413 MBA graduates remain unemployed in the state. Mentioning the data, Labour Minister T.P. Ramakrishnan informed the Assembly that around 36.25 lakh youngsters in the state are unemployed. Of these 23 lakh are women and 13.25 are men. Among the unemployed, 3.31 lakh are degree holders and 94,590 are masters degree holders. According to the minister, the report is based on the statistics till August this year.

----

Kerala has its own peculiarities but if 3.6 million are unemployed in Kerala alone, the situation nationwide may not be much better.

Professional courses will not always help secure job: Data

T'Puram: It would be a bitter pill to swallow for many that studying professional courses does not guarantee employment in the topsy turvy job market. As per the data presented at the Assembly on Wednesday, 44,559 graduate engineers; 7,303 MBBS graduates; 3,771 MCA graduates and 6,413 MBA graduates remain unemployed in the state. Mentioning the data, Labour Minister T.P. Ramakrishnan informed the Assembly that around 36.25 lakh youngsters in the state are unemployed. Of these 23 lakh are women and 13.25 are men. Among the unemployed, 3.31 lakh are degree holders and 94,590 are masters degree holders. According to the minister, the report is based on the statistics till August this year.

----

Kerala has its own peculiarities but if 3.6 million are unemployed in Kerala alone, the situation nationwide may not be much better.

Re: Indian Economy News & Discussion - Nov 27 2017

^^ 7300 MBBS graduates unemployed, how is that even possible, given such low density of doctors and such high demand for them in the country...? On top of it they can always open clinic.

Google tells me, KL has population of ~3.5Cr. Lets say 65% of it is working age population which is typical for India i.e. ~2.3Cr or 23Million. Then if 3.63Million are unemployed then it means 15% unemployment. A ridiculously large figure even when comparing the controversial figure of 6.1% by recent NSSO which itself was criticized for incorrect methodology because it couldn't even get basic things right e.g. it measured reduction in population from 2012 to 2018. LOL.

The numbers above cannot be extrapolated to whole India.

Google tells me, KL has population of ~3.5Cr. Lets say 65% of it is working age population which is typical for India i.e. ~2.3Cr or 23Million. Then if 3.63Million are unemployed then it means 15% unemployment. A ridiculously large figure even when comparing the controversial figure of 6.1% by recent NSSO which itself was criticized for incorrect methodology because it couldn't even get basic things right e.g. it measured reduction in population from 2012 to 2018. LOL.

The numbers above cannot be extrapolated to whole India.

Re: Indian Economy News & Discussion - Nov 27 2017

A_Gupta wrote:There is a news-item in the New Indian Express that I cannot find online, which sheds some light on the employment situation in one state of India.

36.25 lakh are unemployed in Kerala; outnumbers national average. There you go; an English report from a Malayalam news paper. On the engineering front; I can share some feedback. Till around early 2000s getting a seat in Kerala for Engineering was really tough. Seats were limited and only real hard workers made it. And they also turned out to be reasonably good technically skilled people. Others with a technical bend also tried their hands on Diploma or the ITI certification courses. But after 2000 after seeing the successful TN model (private Engg. College, dime a dozen) Kerala too gave permissions to start n number of engineering colleges. The earlier crowd who opted for Diplomas etc also joined in to get the much coveted "B.Tech" tag. The problem was that this reduced the overall quality of the graduates to considerable extent. Many of these graduates have low communication skills, or any other social skills which help them improve their situation. So these folks generally also could not pass the muster when it came to appearing for all India competitive exams, group discussions, debates etc. Today the popular joke is about a B.Tech graduate (graduated in around 5-6 years as he/she had backlog exams to be cleared) sitting and preparing for Bank Clerk exams and Kerala PSC exams.JayS wrote:7300 MBBS graduates unemployed, how is that even possible, given such low density of doctors and such high demand for them in the country...? On top of it they can always open clinic.

On the doctor front; I guess it is more of doctors who got their degrees from dubious establishments (in India and abroad) and who finds the "job" not commensurate with the money they spend to get the degrees. The cream of cream in KL still do get their seats in the govt managed Medial Colleges, and these people also are not in a bad situation. To be frank there are lots of folks in KL who take up "medicine" only because of the prestige associated and expecting high incomes at a quick pace.

Re: Indian Economy News & Discussion - Nov 27 2017

Is India ready for RCEP embrace?

Can any one through some light on the RCEP agreement, and if it is brings good to India in the long term? The commie/socialist gang have already started a social media campaign, but I don't want them to reject them outright.

Can any one through some light on the RCEP agreement, and if it is brings good to India in the long term? The commie/socialist gang have already started a social media campaign, but I don't want them to reject them outright.

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Indian Economy News & Discussion - Nov 27 2017

Sachin: the situation w.r.t. engg. grads in Malloostan (and other parts) is actually beyond depressing. The curricula are impressive, the facades of the colleges are impressive, the fees are impressive and the brochures are glossy and they all hold International Conferences. But do they actually know any engg? Answer may be 3 out of 100 nowadays. Sad, because as you say, not so long ago, the people coming from Malloostan engg colleges (generally govt colleges) are the ones who built much of the Gelf oil as well as urban/retail infrastructure. Superbly practical, though they had next to nothing as facilities where they studied. Plus as you say the ITI/MTI diploma grads with their hard work, learning on old, worn-out machines.

This is what I have been ranting about. It is bad and getting rapidly worse in Mongolia, but it is far worse in desh, and I have been utterly shocked at the situation in M'stan. It's a race to the bottom. They talk up a storm, so one feels kicked in the stomach when one finds out that these big talkers actually cannot do a spreadsheet calculation, or do anything else that requires a bit of imagination and attention. They make an awesome "Flex" showing jazzy colors, mind you!

This is what I have been ranting about. It is bad and getting rapidly worse in Mongolia, but it is far worse in desh, and I have been utterly shocked at the situation in M'stan. It's a race to the bottom. They talk up a storm, so one feels kicked in the stomach when one finds out that these big talkers actually cannot do a spreadsheet calculation, or do anything else that requires a bit of imagination and attention. They make an awesome "Flex" showing jazzy colors, mind you!

Re: Indian Economy News & Discussion - Nov 27 2017

The Index of 8 core industries is down year-over-year (September 2019 vs. September 2018) by 5.2%.

Every one of the 8 industries shrunk - coal, crude oil, natural gas, refinery products, fertilizer, steel, cement, electricity.

https://pib.gov.in/PressReleseDetail.aspx?PRID=1589796

Every one of the 8 industries shrunk - coal, crude oil, natural gas, refinery products, fertilizer, steel, cement, electricity.

https://pib.gov.in/PressReleseDetail.aspx?PRID=1589796

Re: Indian Economy News & Discussion - Nov 27 2017

India's biggest failure is going to be education if it is not fixed at war footing. We are nowhere ready to take on things like RCEP etc.

-

UlanBatori

- BRF Oldie

- Posts: 14045

- Joined: 11 Aug 2016 06:14

Re: Indian Economy News & Discussion - Nov 27 2017

Yeah, but right now all the impetus is to accelerate. Along the wrong direction. Backwards.

Re: Indian Economy News & Discussion - Nov 27 2017

These days I get a ton of Whatsapp messages along the lines of "People bought stuff worth INR 99999999999 from Amazon India. And they claim there is a slowdown!" or "9999999 Mercs were bought in Manchegowdanahalli. Kaisa slowdown?".

While all of this is "well and good", and are good indications, it does not really mean a whole lot as far as how the economy itself is doing. These examples are small compared to the entire Indian GDP. I am beginning to worry that there indeed are some issues and some folks have taken it upon themselves to spread the word that aal izz well. Dr Swamy has been shooting arrows from the side as well, I think mainly because he doesn't like the FM.

While all of this is "well and good", and are good indications, it does not really mean a whole lot as far as how the economy itself is doing. These examples are small compared to the entire Indian GDP. I am beginning to worry that there indeed are some issues and some folks have taken it upon themselves to spread the word that aal izz well. Dr Swamy has been shooting arrows from the side as well, I think mainly because he doesn't like the FM.

Re: Indian Economy News & Discussion - Nov 27 2017

I have watched the attitudes of students from the 90s to now and I find there is a huge fall. Hamaare zamaane mein, jobs were hard to come by, candidates were humble. After the IT boom from 1998 or so, jobs were aplenty and accommodated even the most incompetent of people, many of whom had no passion for engineering, they just wanted the fancy paycheck and the glamor of being an "IT professional". I guess it wasn't their fault for taking what was on offer. But in the 00's I had the opportunity to work with some such people and the professionalism was appalling. Not everyone can become a doctor, not everyone can become an engineer. Indian Engg colleges have mass produced so many people of questionable quality that it is now hard to figure out what to do with them. I am told that in India jobs are not as easy to get as earlier when the ability to breathe by oneself was enough.UlanBatori wrote:Sachin: the situation w.r.t. engg. grads in Malloostan (and other parts) is actually beyond depressing. The curricula are impressive, the facades of the colleges are impressive, the fees are impressive and the brochures are glossy and they all hold International Conferences. But do they actually know any engg? Answer may be 3 out of 100 nowadays. Sad, because as you say, not so long ago, the people coming from Malloostan engg colleges (generally govt colleges) are the ones who built much of the Gelf oil as well as urban/retail infrastructure. Superbly practical, though they had next to nothing as facilities where they studied. Plus as you say the ITI/MTI diploma grads with their hard work, learning on old, worn-out machines.

This is what I have been ranting about. It is bad and getting rapidly worse in Mongolia, but it is far worse in desh, and I have been utterly shocked at the situation in M'stan. It's a race to the bottom. They talk up a storm, so one feels kicked in the stomach when one finds out that these big talkers actually cannot do a spreadsheet calculation, or do anything else that requires a bit of imagination and attention. They make an awesome "Flex" showing jazzy colors, mind you!

My wife just joined a company and they have outsourced some dev work to an India team. Same usual complaints of false claims, poor quality work, lying... how do people think they can get away? They probably do claiming caste/religion bias or something.

Interesting times ahead.

Last edited by KJo on 02 Nov 2019 00:08, edited 1 time in total.

Re: Indian Economy News & Discussion - Nov 27 2017

from 90s to now - there is a great drop in quality. Most of the engg students buy their final year projects instead of doing it on their own! Final project is arguably the most important component in the whole degree giving you the practical experience close to real life work.