Pakistani Economic Stress Watch

Re: Pakistani Economic Stress Watch

Citizenship Amendment Bill आने से को Pakistan को होगा अरबों का नुकसान, Exclusive Report

https://www.youtube.com/watch?v=LQdJsNKAQ6w

Gautam

https://www.youtube.com/watch?v=LQdJsNKAQ6w

Gautam

Pakistani Economic Stress Watch

S&P BSE SENSEX

Index Current : 40,412.57 - Pt. Change : +172.69 - % Change : +0.43

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,51,02,124.99 - $ 1 / I N R = 70.9800

Market Capitalization of BSE Listed Co. (U S $.) : 2,127.66 Billion

P S E

Current Index : 40,531.42 – Change : -133.18 - % Change : -0.33% - High : 40,911.19 – Low : 40,450.98

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 7,799,273,307,141 - $ 1 / T R = 155.1238

Market Capitalization of PSE Listed Co. (U S $.) : 50.27 Biliion

B S E : P S E : : 42.33 : 1

Cheers

Index Current : 40,412.57 - Pt. Change : +172.69 - % Change : +0.43

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,51,02,124.99 - $ 1 / I N R = 70.9800

Market Capitalization of BSE Listed Co. (U S $.) : 2,127.66 Billion

P S E

Current Index : 40,531.42 – Change : -133.18 - % Change : -0.33% - High : 40,911.19 – Low : 40,450.98

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 7,799,273,307,141 - $ 1 / T R = 155.1238

Market Capitalization of PSE Listed Co. (U S $.) : 50.27 Biliion

B S E : P S E : : 42.33 : 1

Cheers

Pakistani Economic Stress Watch

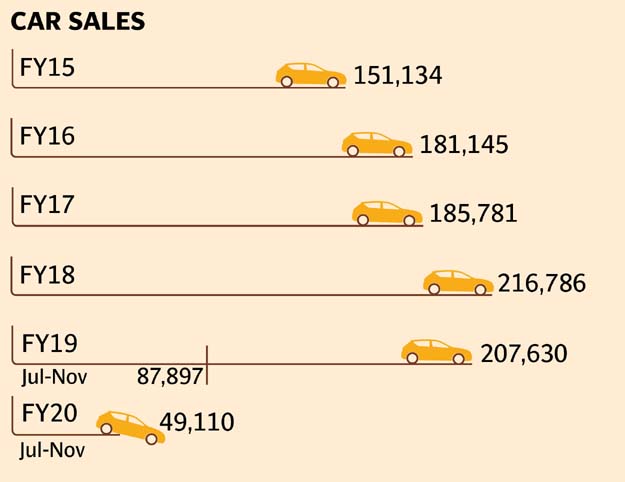

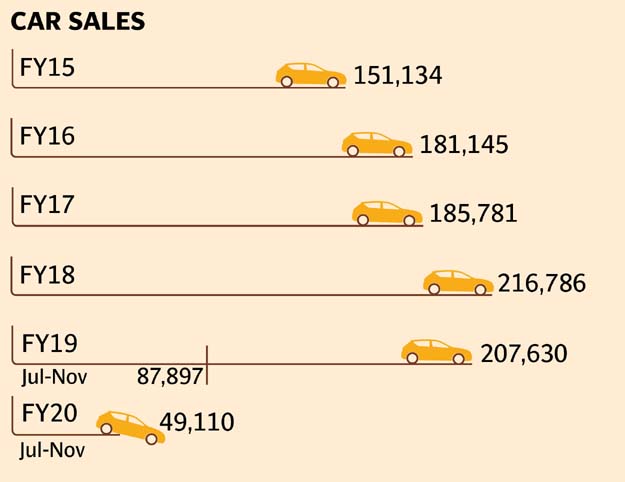

Car sales plunge 44pc, tractor assembly halted - Aamir Shafaat Khan

KARACHI: Overall car sales plunged 44 per cent to 49,110 units during the first five months of current fiscal year as demand for WagonR, Bolan, Toyota Corolla and Honda Civic/City slumped by around 35-75pc.

CheersIn another depressing development in the auto sector, the Millat Tractors Ltd (MTL) — assembler of Massey Ferguson tractors — on Tuesday informed the Pakistan Stock Exchange (PSX) that the company will halt production from Dec 11 till Jan 3, 2020. The production operations will resume from Jan 6, 2020. The decision comes after MTL sales plunged by 48pc to 8,223 units during the July-November period.

Pakistani Economic Stress Watch

In Pakistan, millions more to fall below poverty line - Shahbaz Rana

ISLAMABAD: At the end of two years of the Pakistan Tehreek-e-Insaf (PTI) government, 18 million more people may slip into abject poverty due to low economic growth and double-digit food inflation, claimed Dr Hafiz A Pasha, the country’s renowned economist.

The national poverty ratio, which was 31.3% in June 2018, would sharply jump to over 40% by June 2020, said Pasha in an article that first appeared in Business Recorder.

In absolute terms, people living in poverty will increase from 69 million in June 2018 to 87 million by June 2020, indicating 26% increase in poverty or an addition of 18 million people in first two years of the PTI government.

As per Pasha’s claim, eight million people have already been added to the ranks of the poor by the end of the first year of the PTI government. He has projected that 10 million more people will slip below the poverty line by the end of the current fiscal year.

Pakistan’s rich and poor live in different countries

“The situation is very alarming due to an economic growth rate that is close to the population growth rate and an exponential increase in prices of perishable food items,” said Pasha while talking to The Express Tribune on Tuesday.

Pasha has worked out these numbers on the basis of a cost-based methodology amid the federal authorities’ inability to firm up official poverty figures over the past three years which also include one year of the PTI government.

“We do not have latest official poverty statistics,” responded Federal Minister for Planning and Development Asad Umar when he was contacted for the government’s version.

The minister said the country was exiting a severe balance of payments crisis which had its own implications. Umar said the PTI government accelerated the poverty alleviation measures aimed at protecting the poor and vulnerable people from the adverse impact of macroeconomic adjustments.

Pasha said that the government’s decision to simultaneously increase taxes, energy tariffs and devaluation of currency contributed to the increase in poverty. He said that the Pakistan Muslim League-Nawaz (PML-N) government’s decision to keep the rupee-dollar parity stable kept the inflation under check. The PTI government is implementing probably the toughest International Monetary Fund (IMF) programme of the country’s history aimed at overpowering fiscal and external accounts challenges.

By June next year, four out of every ten Pakistanis will be poor, according to Dr Pasha’s working. Dr Pasha is the former finance minister of Pakistan and has also advised Prime Minister Imran Khan at the time of building consensus on signing an IMF programme.

At the end of the PML-N government, three out of ten Pakistanis were living in poverty when the poverty ratio had been estimated at 31.3% by Dr Pasha. A year ago Dr Pasha had estimated that national poverty ratio would increase to over 37%, which he now has updated in the aftermath of a surge in food inflation.

The food inflation was recorded at 16.6% in cities and 19.3% in rural areas in November over a year ago, according to the Pakistan Bureau of Statistics.

The official poverty figures are missing since 2014-15 – a year after start of the last IMF programme.

In his article, Dr Pasha said that the incidence of poverty fell from 36.8% in 2015 to 31.3% in 2017-18. The decline of 5.5 percentage points implied that almost six million people were taken out of poverty in these three years, he added.

The year 2018-19 has, unfortunately, witnessed a change in the trend. The per capita income growth was only 0.9% and more recent estimates indicated that it may have been even lower, he added.

Poultry poverty alleviation scheme inaugurated in K-P

He further stated that there was an increase in the incidence of poverty by 3.7 percentage points, from 31.3% in 2017-18 to 35% in 2018-19. This implies that almost eight million people fell below the poverty line in 2018-19, claimed Dr Pasha.

He argued that in 2019-20, the GDP growth rate is expected to be close to 2.4%, therefore there will be no increase in per capita income.

“There is a real risk that the incidence of poverty could increase by almost 5 percentage points from the level of 35% in 2018-19. Therefore, by the end of 2019-20, the level of poverty in Pakistan could once again approach 40%,” he added.

Cheers

ISLAMABAD: At the end of two years of the Pakistan Tehreek-e-Insaf (PTI) government, 18 million more people may slip into abject poverty due to low economic growth and double-digit food inflation, claimed Dr Hafiz A Pasha, the country’s renowned economist.

The national poverty ratio, which was 31.3% in June 2018, would sharply jump to over 40% by June 2020, said Pasha in an article that first appeared in Business Recorder.

In absolute terms, people living in poverty will increase from 69 million in June 2018 to 87 million by June 2020, indicating 26% increase in poverty or an addition of 18 million people in first two years of the PTI government.

As per Pasha’s claim, eight million people have already been added to the ranks of the poor by the end of the first year of the PTI government. He has projected that 10 million more people will slip below the poverty line by the end of the current fiscal year.

Pakistan’s rich and poor live in different countries

“The situation is very alarming due to an economic growth rate that is close to the population growth rate and an exponential increase in prices of perishable food items,” said Pasha while talking to The Express Tribune on Tuesday.

Pasha has worked out these numbers on the basis of a cost-based methodology amid the federal authorities’ inability to firm up official poverty figures over the past three years which also include one year of the PTI government.

“We do not have latest official poverty statistics,” responded Federal Minister for Planning and Development Asad Umar when he was contacted for the government’s version.

The minister said the country was exiting a severe balance of payments crisis which had its own implications. Umar said the PTI government accelerated the poverty alleviation measures aimed at protecting the poor and vulnerable people from the adverse impact of macroeconomic adjustments.

Pasha said that the government’s decision to simultaneously increase taxes, energy tariffs and devaluation of currency contributed to the increase in poverty. He said that the Pakistan Muslim League-Nawaz (PML-N) government’s decision to keep the rupee-dollar parity stable kept the inflation under check. The PTI government is implementing probably the toughest International Monetary Fund (IMF) programme of the country’s history aimed at overpowering fiscal and external accounts challenges.

By June next year, four out of every ten Pakistanis will be poor, according to Dr Pasha’s working. Dr Pasha is the former finance minister of Pakistan and has also advised Prime Minister Imran Khan at the time of building consensus on signing an IMF programme.

At the end of the PML-N government, three out of ten Pakistanis were living in poverty when the poverty ratio had been estimated at 31.3% by Dr Pasha. A year ago Dr Pasha had estimated that national poverty ratio would increase to over 37%, which he now has updated in the aftermath of a surge in food inflation.

The food inflation was recorded at 16.6% in cities and 19.3% in rural areas in November over a year ago, according to the Pakistan Bureau of Statistics.

The official poverty figures are missing since 2014-15 – a year after start of the last IMF programme.

In his article, Dr Pasha said that the incidence of poverty fell from 36.8% in 2015 to 31.3% in 2017-18. The decline of 5.5 percentage points implied that almost six million people were taken out of poverty in these three years, he added.

The year 2018-19 has, unfortunately, witnessed a change in the trend. The per capita income growth was only 0.9% and more recent estimates indicated that it may have been even lower, he added.

Poultry poverty alleviation scheme inaugurated in K-P

He further stated that there was an increase in the incidence of poverty by 3.7 percentage points, from 31.3% in 2017-18 to 35% in 2018-19. This implies that almost eight million people fell below the poverty line in 2018-19, claimed Dr Pasha.

He argued that in 2019-20, the GDP growth rate is expected to be close to 2.4%, therefore there will be no increase in per capita income.

“There is a real risk that the incidence of poverty could increase by almost 5 percentage points from the level of 35% in 2018-19. Therefore, by the end of 2019-20, the level of poverty in Pakistan could once again approach 40%,” he added.

Cheers

Re: Pakistani Economic Stress Watch

The strategy Pakistan seems to be following for reducing per capital debt is to have more people.

Re: Pakistani Economic Stress Watch

Looks like Paki economy is doing very well- warning Haram link

"http s://www.da wn.com/news/152174 8/trade-gap-narrows-33pc"

"http s://www.da wn.com/news/152174 8/trade-gap-narrows-33pc"

Re: Pakistani Economic Stress Watch

^^They are doing it by curbing imports. That's why inflation is high and going strong.

Also curbing imports affects their exports overall(whatever they do). It may give relief(Show the books better for present Gov) in short run but from medium run onwards imports will come albeit via black market and exports will be FUBAR. So all in all they were between a rock or a hard place and they chose roasting in hellfire but slowly.

Also curbing imports affects their exports overall(whatever they do). It may give relief(Show the books better for present Gov) in short run but from medium run onwards imports will come albeit via black market and exports will be FUBAR. So all in all they were between a rock or a hard place and they chose roasting in hellfire but slowly.

Pakistani Economic Stress Watch

souravB Ji : Sir Ji, you mean on a H A L A L "BAR - B - Q"!souravB wrote:^^They are doing it by curbing imports. That's why inflation is high and going strong.

Also curbing imports affects their exports overall(whatever they do). It may give relief(Show the books better for present Gov) in short run but from medium run onwards imports will come albeit via black market and exports will be FUBAR. So all in all they were between a rock or a hard place and they chose roasting in hellfire but slowly.

Cheers

Pakistani Economic Stress Watch

S&P BSE SENSEX

Index Current : 40,581.71 - Pt. Change : +169.14 - % Change : +0.42

Market Capitalization of B S E Listed Co. (Rs.Cr.) : 1,51,96,281.49 - $ 1 / I N R = 70.7250

Market Capitalization of B S E Listed Co. (U S $.) : 2,148.64 Billion

P S E

Current Index : 40,514.17 – Change : -17.25 - % Change : -0.04% - High : 40,769.88 – Low : 40,172.32

Market Capitalization of P S E Listed Co. (Rs.Tr.) : 7,799,273,307,141 - $ 1 / T R = 155.1238

Market Capitalization of P S E Listed Co. (U S $.) : 52.28 Billion

B S E : P S E : : 41.10 : 1

Cheers

Index Current : 40,581.71 - Pt. Change : +169.14 - % Change : +0.42

Market Capitalization of B S E Listed Co. (Rs.Cr.) : 1,51,96,281.49 - $ 1 / I N R = 70.7250

Market Capitalization of B S E Listed Co. (U S $.) : 2,148.64 Billion

P S E

Current Index : 40,514.17 – Change : -17.25 - % Change : -0.04% - High : 40,769.88 – Low : 40,172.32

Market Capitalization of P S E Listed Co. (Rs.Tr.) : 7,799,273,307,141 - $ 1 / T R = 155.1238

Market Capitalization of P S E Listed Co. (U S $.) : 52.28 Billion

B S E : P S E : : 41.10 : 1

Cheers

Re: Pakistani Economic Stress Watch

Whatever, if Pakistan implements something like what the Morgenthau plan envisioned for Germany, it will be a bit nice.

-

ArjunPandit

- BRF Oldie

- Posts: 4056

- Joined: 29 Mar 2017 06:37

Re: Pakistani Economic Stress Watch

That is our responsibility..Aditya_V wrote:Whatever, if Pakistan implements something like what the Morgenthau plan envisioned for Germany, it will be a bit nice.

Pakistani Economic Stress Watch

S&P BSE SENSEX

Index Current : 41,352.17 - Pt. Change : +413.45 - % Change : +1.01 %

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,54,27,983.47 – $ 1 / I N R = 71.0575

Market Capitalization of BSE Listed Co. (U $ $.): 2,171.20 Billion

PSE

Current Index : 41,768.66 – Change : 123.78 - % Change : 0.3% - High : 42,056.14 – Low : 41,025.71

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 8,037,267,061,566 - $ 1 / T R =155.1737

Market Capitalization of PSE Listed Co. (U $ $.) : 51.80 Billion

B S E : P S E : : 41.92 : 1

Cheers

Index Current : 41,352.17 - Pt. Change : +413.45 - % Change : +1.01 %

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,54,27,983.47 – $ 1 / I N R = 71.0575

Market Capitalization of BSE Listed Co. (U $ $.): 2,171.20 Billion

PSE

Current Index : 41,768.66 – Change : 123.78 - % Change : 0.3% - High : 42,056.14 – Low : 41,025.71

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 8,037,267,061,566 - $ 1 / T R =155.1737

Market Capitalization of PSE Listed Co. (U $ $.) : 51.80 Billion

B S E : P S E : : 41.92 : 1

Cheers

Re: Pakistani Economic Stress Watch

This ratio has been improving in favour of pukistan since some time. What could be the reason? Given that BSE is booming.

I also read somewhere that Moody's has upgraded pukis and downgraded us.

I also read somewhere that Moody's has upgraded pukis and downgraded us.

Pakistani Economic Stress Watch

VKumar Ji:VKumar wrote:This ratio has been improving in favour of pukistan since some time. What could be the reason? Given that BSE is booming.

I also read somewhere that Moody's has upgraded pukis and downgraded us.

1. The BSE has some serious "Drops-Slides". They always kept things "Strictly Correct" i.e they have let the Market be ruled by the Members and have kept it OPEN FOR THE FULL TRADING PERIODS!

2. Terroristan, at every serious "Drop" "Suspends" the Market, they even "Dump" the market, "Load" the Market and then Back to "Suspend"

Thus they Artificially Boost the Market between the "Dump" and the "Load" Session.

Thus the BSE has the S & P Mark on SENSEX. Please check at Wiki for the explanation.

Cheers

Pakistani Economic Stress Watch

S&P BSE SENSEX

Index Current : 41,558.57 : Pt. Change : +206.40 - % Change : +0.50

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,54,57,914.43 - $ 1 / I N R = 71.0475

Market Capitalization of BSE Listed Co. (U S $.) : 2.175.72 Billion

P S E

Current Index : 41,603.71 – Change : -164.95 - % Change : -0.4% - High : 41,920.62 – Low : 41,389.60

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 7,959,810,817,512 - $ 1 / TR = 155.0742

Market Capitalization of PSE Listed Co. (U S $.) : 51.33 Billion

B S E : P S E : : 42.39 : 1

Cheers

Index Current : 41,558.57 : Pt. Change : +206.40 - % Change : +0.50

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,54,57,914.43 - $ 1 / I N R = 71.0475

Market Capitalization of BSE Listed Co. (U S $.) : 2.175.72 Billion

P S E

Current Index : 41,603.71 – Change : -164.95 - % Change : -0.4% - High : 41,920.62 – Low : 41,389.60

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 7,959,810,817,512 - $ 1 / TR = 155.0742

Market Capitalization of PSE Listed Co. (U S $.) : 51.33 Billion

B S E : P S E : : 42.39 : 1

Cheers

Re: Pakistani Economic Stress Watch

The rating is true, but we're still a couple notches above Pak on the Moody's scale. We're very far from China's rating, which is where we should aim to get as soon as possible.VKumar wrote:This ratio has been improving in favour of pukistan since some time. What could be the reason? Given that BSE is booming.

I also read somewhere that Moody's has upgraded pukis and downgraded us.

Re: Pakistani Economic Stress Watch

According to Farrukh Saleem, Mushy was great for the Pakonomy.

What he didn't say was that it was Mush's deft handling of the US, and pulling in all the funds to support the post 9-11 war effort, rather than sound sensible economics which was the real reason.

What he didn't say was that it was Mush's deft handling of the US, and pulling in all the funds to support the post 9-11 war effort, rather than sound sensible economics which was the real reason.

Re: Pakistani Economic Stress Watch

Its case of sour grapes for Farrukh Saleem. He was criticizing Im the Dim, then started defending him when he was promised an economic advisory post in the PTI cabinet. When that did not materialize he started  again on various paki

again on various paki talk fart shows.

Re: Pakistani Economic Stress Watch

FATF asks 150 questions to Pakistan, seeks answers against madrassas linked to proscribed outfits.

Global watchdog for terror financing FATF has sought more clarifications and data from Pakistan on actions taken against madrassas belonging to proscribed outfits, after Islamabad submitted a report to it detailing steps taken by the government to curb terrorism and money laundering.

The Paris-based FATF, which kept Pakistan on the Grey List for an extended period till February 2020, had warned in October that Islamabad would be put on the Black List if it did not comply with the remaining 22 points in a list of 27 questions.

Pakistan submitted a report comprising answers to 22 questions to the FATF on December 6.

In response to the report, the FATF's Joint Group has sent 150 questions to Pakistan, seeking some clarifications, updates and most importantly actions taken against the madrassas belonging to the proscribed outfits.

"We did receive a response from the FATF on our compliance report through an email in which they raised a set of 150 questions. Some of them are seeking more data, some clarifications, and most importantly questions related to madrassas and actions taken against them having affiliation with proscribed outfits," The News quoted a top official source as saying.

Pakistan has been given January 8, 2020 deadline to respond to the 150 questions, the official said on Saturday.

The next FATF meeting is scheduled to be held from January 21 to 24 in Beijing where Pakistan will be given an opportunity to defend the points in the report.

Pakistan expects another relaxation probably up to June 2020 in FAFT's upcoming plenary review meeting, as the February deadline is too short a period for Islamabad to comply with the remaining 22 action plans.

The FATF in its previous statement had said, "Should significant and sustainable progress not be made across the full range of its action plan by the next plenary, the FATF will take action, which could include the FATF calling on its members and urging all jurisdictions to advise their FIs (financial institutions) to give special attention to business relations and transactions with Pakistan".

Earlier, the FATF had asked 27 questions pertaining to Pakistan's efforts to stop terrorism financing. But Islamabad managed to satisfy the global watchdog over just five of them.

Pakistan was placed on the Grey List by the FATF in June last year and was given a plan of action to complete it by October 2019, or face the risk of being placed on the blacklist with Iran and North Korea.

The FATF said Pakistan must demonstrate effective implementation of targeted financial sanctions against all UN designated terrorists like Lashkar-e-Taiba founder Hafiz Saeed, Jaish-e-Mohammad founder Maulana Masood Azhar, and those acting for or on their behalf.

The FATF is an inter-governmental body established in 1989 to combat money laundering, terrorist financing and other related threats to the integrity of the international financial system

Global watchdog for terror financing FATF has sought more clarifications and data from Pakistan on actions taken against madrassas belonging to proscribed outfits, after Islamabad submitted a report to it detailing steps taken by the government to curb terrorism and money laundering.

The Paris-based FATF, which kept Pakistan on the Grey List for an extended period till February 2020, had warned in October that Islamabad would be put on the Black List if it did not comply with the remaining 22 points in a list of 27 questions.

Pakistan submitted a report comprising answers to 22 questions to the FATF on December 6.

In response to the report, the FATF's Joint Group has sent 150 questions to Pakistan, seeking some clarifications, updates and most importantly actions taken against the madrassas belonging to the proscribed outfits.

"We did receive a response from the FATF on our compliance report through an email in which they raised a set of 150 questions. Some of them are seeking more data, some clarifications, and most importantly questions related to madrassas and actions taken against them having affiliation with proscribed outfits," The News quoted a top official source as saying.

Pakistan has been given January 8, 2020 deadline to respond to the 150 questions, the official said on Saturday.

The next FATF meeting is scheduled to be held from January 21 to 24 in Beijing where Pakistan will be given an opportunity to defend the points in the report.

Pakistan expects another relaxation probably up to June 2020 in FAFT's upcoming plenary review meeting, as the February deadline is too short a period for Islamabad to comply with the remaining 22 action plans.

The FATF in its previous statement had said, "Should significant and sustainable progress not be made across the full range of its action plan by the next plenary, the FATF will take action, which could include the FATF calling on its members and urging all jurisdictions to advise their FIs (financial institutions) to give special attention to business relations and transactions with Pakistan".

Earlier, the FATF had asked 27 questions pertaining to Pakistan's efforts to stop terrorism financing. But Islamabad managed to satisfy the global watchdog over just five of them.

Pakistan was placed on the Grey List by the FATF in June last year and was given a plan of action to complete it by October 2019, or face the risk of being placed on the blacklist with Iran and North Korea.

The FATF said Pakistan must demonstrate effective implementation of targeted financial sanctions against all UN designated terrorists like Lashkar-e-Taiba founder Hafiz Saeed, Jaish-e-Mohammad founder Maulana Masood Azhar, and those acting for or on their behalf.

The FATF is an inter-governmental body established in 1989 to combat money laundering, terrorist financing and other related threats to the integrity of the international financial system

Pakistani Economic Stress Watch

PTI govt set to unveil mini-budget in 2 months - Shahbaz Rana - December 25, 2019

ISLAMABAD: The Pakistan Tehreek-e-Insaf (PTI) government is set to unveil a mini-budget within two months to slap additional taxes of around Rs150 billion aimed at achieving the downward-revised annual tax collection target of Rs5.238 trillion.

The under-consideration revenue measures to the tune of close to Rs150 billion will be over and above the unprecedented Rs735 billion worth of taxes that the PTI government introduced in the budget in June this year. Yet it faces a huge revenue shortfall, which is going to widen by the end of current month.

Among the potential areas that will be targeted are increase in sales tax on petroleum products, withdrawal of some sales tax exemptions by charging taxes on retail market prices and increase in withholding tax rates, according to sources in the Federal Board of Revenue (FBR).

They said the plan was to collect nearly Rs150 billion through additional revenue measures in addition to pocketing windfall gains in the shape of sales tax through further increase in electricity and gas prices from January.

However, the prevailing uncertain political situation could influence both the timing and quantum of additional taxes, the sources said.

At a time when the government is planning to impose new taxes on the people, it is also set to promulgate a presidential ordinance next week to give concessions in taxes to traders and foreign banks that are making easy money by investing in government securities. The federal cabinet on Tuesday approved a summary for the promulgation of the presidential ordinance, the second amendment to the Income Tax Ordinance 2019. The minimum tax rate for traders will be lowered to 0.5% and the dividend tax rate for foreign bankers will be cut from 30% to 10%.

International Monetary Fund (IMF) Resident Representative Teresa Daban Sanchez and FBR Chairman Shabbar Zaidi on Tuesday hinted at bringing the mini-budget. But its timing and quantum of additional taxes will depend on the December tax collection figures.

“The Rs5.503-trillion revenue projection was ambitious and we have another review in February,” said Sanchez while responding to a question on the IMF’s decision to cut the FBR’s tax target to Rs5.238 trillion.

She was speaking at an event organised by the Sustainable Development Policy Institute. The IMF finally cut the unrealistic revenue collection target of Rs5.503 trillion to Rs5.238 trillion, a reduction of Rs265 billion.

“Other actions could also be taken,” said the IMF resident representative without explaining the nature of these actions. Still there is a gap between what can be the actual collection and the Rs5.238-trillion target. Sources said assessments made by the IMF and the FBR showed the collection below Rs5 trillion without additional measures.

For the first half (July-December) of the current fiscal year, the FBR’s reduced target was Rs2.367 trillion. However, as of December 24, the provisional collection stood at only Rs1.872 trillion. In the remaining four working days of this month, the FBR needs to collect Rs495 billion, which will require Rs123 billion per day collection – a task that can never be achieved.

“We can only comment on the need for additional tax measures after seeing results of the first half of the fiscal year,” said Zaidi while talking to The Express Tribune. He said the tax collection was growing at a 17.5% annual rate, which was quite good in the given macroeconomic conditions. Responding to another question, Zaidi said the IMF was not putting extraordinary pressure to immediately introduce additional revenue measures.

Pakistan has also given a fresh written commitment to the IMF about additional revenue measures in the new Memorandum of Economic and Financial Policies (MEFP) and Letter of Intent (LoI) that it submitted to the IMF before approval of the second loan tranche of $452.5 million.

“We believe that the policies set forth in the attached MEFP are adequate for the successful implementation of our programme, but we will take any additional measures that may be appropriate for this purpose,” wrote Adviser to PM on Finance Abdul Hafeez Shaikh in the LoI sent to the IMF managing director on December 2.

“We will consult the IMF on the adoption of these measures, and in advance of revisions to the policies contained in the MEFP, in accordance with the IMF’s policies on such consultation,” according to the LoI.

In the MEFP, Pakistan stated that the government would present the budget review to parliament by the end of February to guide implementation of the fiscal year 2019-20 budget, which would have an assessment of the budget estimates for the entire budget year.

“On the basis of the review’s findings, we will implement additional measures as needed to ensure that fiscal year 2019-20 annual targets are observed,” it added. Sanchez said the IMF did not just want increase in the tax collection but it wanted a quality increase in collection.

The focus going forward needs to remain on implementing high-quality tax measures, including the elimination of tax exemptions and loopholes, showed the IMF report.

The economic activity is softening as the economy adjusts to the policies, said Sanchez while commenting on the overall economic situation.

She said food inflation was also going up, which was a matter of concern. The resident representative said inflation expectations were moderating, suggesting that the monetary policy was responding.

She also emphasised that after the first review of the IMF programme, the focus would now be on institutional reforms aimed at consolidating first quarter’s gains. She said all the state-owned enterprises would be individually analysed and some of them might have to be liquidated.

Cheers

ISLAMABAD: The Pakistan Tehreek-e-Insaf (PTI) government is set to unveil a mini-budget within two months to slap additional taxes of around Rs150 billion aimed at achieving the downward-revised annual tax collection target of Rs5.238 trillion.

The under-consideration revenue measures to the tune of close to Rs150 billion will be over and above the unprecedented Rs735 billion worth of taxes that the PTI government introduced in the budget in June this year. Yet it faces a huge revenue shortfall, which is going to widen by the end of current month.

Among the potential areas that will be targeted are increase in sales tax on petroleum products, withdrawal of some sales tax exemptions by charging taxes on retail market prices and increase in withholding tax rates, according to sources in the Federal Board of Revenue (FBR).

They said the plan was to collect nearly Rs150 billion through additional revenue measures in addition to pocketing windfall gains in the shape of sales tax through further increase in electricity and gas prices from January.

However, the prevailing uncertain political situation could influence both the timing and quantum of additional taxes, the sources said.

At a time when the government is planning to impose new taxes on the people, it is also set to promulgate a presidential ordinance next week to give concessions in taxes to traders and foreign banks that are making easy money by investing in government securities. The federal cabinet on Tuesday approved a summary for the promulgation of the presidential ordinance, the second amendment to the Income Tax Ordinance 2019. The minimum tax rate for traders will be lowered to 0.5% and the dividend tax rate for foreign bankers will be cut from 30% to 10%.

International Monetary Fund (IMF) Resident Representative Teresa Daban Sanchez and FBR Chairman Shabbar Zaidi on Tuesday hinted at bringing the mini-budget. But its timing and quantum of additional taxes will depend on the December tax collection figures.

“The Rs5.503-trillion revenue projection was ambitious and we have another review in February,” said Sanchez while responding to a question on the IMF’s decision to cut the FBR’s tax target to Rs5.238 trillion.

She was speaking at an event organised by the Sustainable Development Policy Institute. The IMF finally cut the unrealistic revenue collection target of Rs5.503 trillion to Rs5.238 trillion, a reduction of Rs265 billion.

“Other actions could also be taken,” said the IMF resident representative without explaining the nature of these actions. Still there is a gap between what can be the actual collection and the Rs5.238-trillion target. Sources said assessments made by the IMF and the FBR showed the collection below Rs5 trillion without additional measures.

For the first half (July-December) of the current fiscal year, the FBR’s reduced target was Rs2.367 trillion. However, as of December 24, the provisional collection stood at only Rs1.872 trillion. In the remaining four working days of this month, the FBR needs to collect Rs495 billion, which will require Rs123 billion per day collection – a task that can never be achieved.

“We can only comment on the need for additional tax measures after seeing results of the first half of the fiscal year,” said Zaidi while talking to The Express Tribune. He said the tax collection was growing at a 17.5% annual rate, which was quite good in the given macroeconomic conditions. Responding to another question, Zaidi said the IMF was not putting extraordinary pressure to immediately introduce additional revenue measures.

Pakistan has also given a fresh written commitment to the IMF about additional revenue measures in the new Memorandum of Economic and Financial Policies (MEFP) and Letter of Intent (LoI) that it submitted to the IMF before approval of the second loan tranche of $452.5 million.

“We believe that the policies set forth in the attached MEFP are adequate for the successful implementation of our programme, but we will take any additional measures that may be appropriate for this purpose,” wrote Adviser to PM on Finance Abdul Hafeez Shaikh in the LoI sent to the IMF managing director on December 2.

“We will consult the IMF on the adoption of these measures, and in advance of revisions to the policies contained in the MEFP, in accordance with the IMF’s policies on such consultation,” according to the LoI.

In the MEFP, Pakistan stated that the government would present the budget review to parliament by the end of February to guide implementation of the fiscal year 2019-20 budget, which would have an assessment of the budget estimates for the entire budget year.

“On the basis of the review’s findings, we will implement additional measures as needed to ensure that fiscal year 2019-20 annual targets are observed,” it added. Sanchez said the IMF did not just want increase in the tax collection but it wanted a quality increase in collection.

The focus going forward needs to remain on implementing high-quality tax measures, including the elimination of tax exemptions and loopholes, showed the IMF report.

The economic activity is softening as the economy adjusts to the policies, said Sanchez while commenting on the overall economic situation.

She said food inflation was also going up, which was a matter of concern. The resident representative said inflation expectations were moderating, suggesting that the monetary policy was responding.

She also emphasised that after the first review of the IMF programme, the focus would now be on institutional reforms aimed at consolidating first quarter’s gains. She said all the state-owned enterprises would be individually analysed and some of them might have to be liquidated.

Cheers

Pakistani Economic Stress Watch

Dr Farrukh Saleem - Terroristan Ka Ujjwal Chintan!

Chasing shadows

Shadow number 1: $200 billion in Swiss banks. On August 18, 2018, Imran Khan took oath of office of the prime minister of Pakistan. On August 19, Murad Saeed, now the federal minister for communication and postal services, tweeted: “200 billion dollars of Pakistani tax payers money stashed in Swiss banks as per Fin minister written reply in parliament.”

Lo and behold, we ended up spending August, September and part of October chasing the $200 billion shadow in lieu of an economic policy. To chase shadows is “to pursue things that are not there……things that are imagined rather than real.”

As per the figure released as part of the Swiss National Bank’s (Switzerland’s central bank) annual statistics report, “A little over CHF380 million ($388.58 million) in Pakistani-origin funds were held in Swiss banks at the end of 2018…..”

Shadow number 2: By September 2018, we started forming ‘task forces’ – a task force on energy, another one on reforming the police, on civil service reforms, on austerity, on asset recovery, on knowledge economy, on tree plantation, on the economic corridor etc. Eventually, we had three dozen of them.

In August 2018, before the formation of the Task Force on Energy, our circular debt was at Rs1,100 billion. The most recent figure is Rs1,700 billion. In Punjab, over the past 16 months, we now have the fifth inspector general of police – average tenure three months; three chief secretaries and six education secretaries. The most recent reshuffle has reshuffled 31 DCOs, 20 Additional IGs, 19 secretaries and five commissioners.

The Task Force on Asset Recovery is yet to recover any asset and the Task Force on Knowledge Economy is yet to have its first meeting.

Shadow number 3: Naya Pakistan Housing. Yes, the months of October and November were big on Naya Pakistan Housing. Current status: not known.

Shadow number 4: Yes, December 2018 was spent on the ‘chicken-and-egg’ scheme. Yes, Dr Muhammad Arshad, the additional director at the Rawalpindi livestock department, told us that “2.5 million units will be distributed among residents of Rawalpindi division with each unit comprising four chickens and a cockerel. The chickens in each unit are 85 days old and fully capable of laying eggs frequently.” Current status: not known.

Shadow number 5: We spent February 2019 on welcoming Arab princes. The Saudi prince alone was going to invest $20 billion. Current status: not known.

Shadow number 6: We spent March and April of 2019 on ExxonMobil-led consortium drilling an ultra-deep well in Kekra-1. We were told that “Pakistan is on the verge of hitting a kind of jackpot in the form of discovering a huge reserve of oil and gas.”

Shadow number 7: By June, we had handed over the reins of our economy to the IMF. And the IMF has since given us new shadows to chase: the current account deficit and the Pakistan Stock Exchange.

Here are the four things we actually need to do. One, implement e-procurement in all public procurement projects. Remember, the government spends around Rs6 trillion on public procurement projects – and the leakages are estimated at around 25 percent (bigger than the IMF package).

Two, reform Public Sector Enterprises (PSEs). In August 2018, the losses at PSEs amounted to Rs1,300 billion. The losses have since jumped to Rs2,100 billion. Three, reform the electricity sector. The losses in this sector have jumped from Rs1,100 billion in August 2018 to Rs1,700 billion.

Four, the leakages in the gas sector amount to some $2 billion a year. Reform these sectors, please.

Cheers

Chasing shadows

Shadow number 1: $200 billion in Swiss banks. On August 18, 2018, Imran Khan took oath of office of the prime minister of Pakistan. On August 19, Murad Saeed, now the federal minister for communication and postal services, tweeted: “200 billion dollars of Pakistani tax payers money stashed in Swiss banks as per Fin minister written reply in parliament.”

Lo and behold, we ended up spending August, September and part of October chasing the $200 billion shadow in lieu of an economic policy. To chase shadows is “to pursue things that are not there……things that are imagined rather than real.”

As per the figure released as part of the Swiss National Bank’s (Switzerland’s central bank) annual statistics report, “A little over CHF380 million ($388.58 million) in Pakistani-origin funds were held in Swiss banks at the end of 2018…..”

Shadow number 2: By September 2018, we started forming ‘task forces’ – a task force on energy, another one on reforming the police, on civil service reforms, on austerity, on asset recovery, on knowledge economy, on tree plantation, on the economic corridor etc. Eventually, we had three dozen of them.

In August 2018, before the formation of the Task Force on Energy, our circular debt was at Rs1,100 billion. The most recent figure is Rs1,700 billion. In Punjab, over the past 16 months, we now have the fifth inspector general of police – average tenure three months; three chief secretaries and six education secretaries. The most recent reshuffle has reshuffled 31 DCOs, 20 Additional IGs, 19 secretaries and five commissioners.

The Task Force on Asset Recovery is yet to recover any asset and the Task Force on Knowledge Economy is yet to have its first meeting.

Shadow number 3: Naya Pakistan Housing. Yes, the months of October and November were big on Naya Pakistan Housing. Current status: not known.

Shadow number 4: Yes, December 2018 was spent on the ‘chicken-and-egg’ scheme. Yes, Dr Muhammad Arshad, the additional director at the Rawalpindi livestock department, told us that “2.5 million units will be distributed among residents of Rawalpindi division with each unit comprising four chickens and a cockerel. The chickens in each unit are 85 days old and fully capable of laying eggs frequently.” Current status: not known.

Shadow number 5: We spent February 2019 on welcoming Arab princes. The Saudi prince alone was going to invest $20 billion. Current status: not known.

Shadow number 6: We spent March and April of 2019 on ExxonMobil-led consortium drilling an ultra-deep well in Kekra-1. We were told that “Pakistan is on the verge of hitting a kind of jackpot in the form of discovering a huge reserve of oil and gas.”

Shadow number 7: By June, we had handed over the reins of our economy to the IMF. And the IMF has since given us new shadows to chase: the current account deficit and the Pakistan Stock Exchange.

Here are the four things we actually need to do. One, implement e-procurement in all public procurement projects. Remember, the government spends around Rs6 trillion on public procurement projects – and the leakages are estimated at around 25 percent (bigger than the IMF package).

Two, reform Public Sector Enterprises (PSEs). In August 2018, the losses at PSEs amounted to Rs1,300 billion. The losses have since jumped to Rs2,100 billion. Three, reform the electricity sector. The losses in this sector have jumped from Rs1,100 billion in August 2018 to Rs1,700 billion.

Four, the leakages in the gas sector amount to some $2 billion a year. Reform these sectors, please.

Cheers

Re: Pakistani Economic Stress Watch

Moodys, Bloomberg, IMF all praising, Stock Exchange performance best in the world. Inshallah, Mashallah.....

Re: Pakistani Economic Stress Watch

Kekra goof up by Imran must be because of the Peerni.

The video was good. Pakistan is becoming a magnet for hot money with the spread they are offering. I can bet that most of the investors are front end for dual passport Pakistani many of who are in the cabinet. So behind the scenes another type of open loot is going on..

The video was good. Pakistan is becoming a magnet for hot money with the spread they are offering. I can bet that most of the investors are front end for dual passport Pakistani many of who are in the cabinet. So behind the scenes another type of open loot is going on..

Re: Pakistani Economic Stress Watch

If they can not afford oil, let them have ghee!

https://www.dawn.com/news/1525036/no-re ... tea-prices

No respite in ghee, pulses, tea prices

Aamir Shafaat KhanUpdated, December 29, 2019

KARACHI: Despite the rupee strengthening against the dollar and a decline in world price of various commodities, prices of ghee, cooking oil, tea, pulses and dry fruits continue to stay on the higher side for consumers.

One dollar now sells at Rs155 as against Rs164 in June 2019 and therefore should be making imports cheaper. According to the data of Pakistan Bureau of Statistics (PBS), the average per tonne price of palm oil came down to $550 per tonne in 5MFY20 from $631 per tonne in same period last fiscal. However, consumers are left with no choice but to buy ghee and cooking oil at higher prices. Good quality ghee and cooking oil sells at Rs200-230 per kg/litre, showing a jump of Rs20-30 per litre in the current year.

Total palm oil imports in 5MFY20 stood at 1.230 million tonnes, costing $676m as compared to 1.246m tonnes valuing $786m in same period last fiscal. Soybean oil’s average per tonne price plummeted to $689 per tonne from $747 per tonne. Soybean oil imports in terms of quantity and value were 57,553 tonnes and $39m as compared to 54,895 tonnes and $41m.

Importers urge govt to remove duties and taxes

Talking to Dawn, Member Pakistan Vanaspati Manufacturers Association (PVMA) Atif Rasheed said the price of palm oil in world market has surged to $810 per tonne from $550 per tonne in the last three to four months.

Ghee and cooking oil industry is 95 per cent reliant on imported items including palm oil, palm olienn, soybean oil, vitamins, tin plates, chemicals, etc on which government has imposed duties and taxes. Previous governments used to increase import duty on ghee and cooking raw materials when palm oil in world market used to hover at low prices to avert any revenue shortfall.

“The situation is now different. As world markets are soaring high, the government should cut import duties and taxes on imported raw materials to bring down prices of ghee and cooking oil,” Atif said, adding that sales are depressed now as compared to last year owing to high domestic prices. “People are purchasing ghee and cooking oil as per their demand instead of purchasing in bulk,” he said.

Tea, dry fruits become more costly

Consumers witnessed a jump of Rs 100 per kg in tea prices in the last six months. However, the average per tonne price of tea stood lower at $2,335 per tonne versus $2,679 per tonne but blenders and importers keep tea prices higher. The import bill of tea was $184m on arrival of 78,922 tonnes during the last five months versus 93,444 tonnes valuing $250m.

.....

Gautam

https://www.dawn.com/news/1525036/no-re ... tea-prices

No respite in ghee, pulses, tea prices

Aamir Shafaat KhanUpdated, December 29, 2019

KARACHI: Despite the rupee strengthening against the dollar and a decline in world price of various commodities, prices of ghee, cooking oil, tea, pulses and dry fruits continue to stay on the higher side for consumers.

One dollar now sells at Rs155 as against Rs164 in June 2019 and therefore should be making imports cheaper. According to the data of Pakistan Bureau of Statistics (PBS), the average per tonne price of palm oil came down to $550 per tonne in 5MFY20 from $631 per tonne in same period last fiscal. However, consumers are left with no choice but to buy ghee and cooking oil at higher prices. Good quality ghee and cooking oil sells at Rs200-230 per kg/litre, showing a jump of Rs20-30 per litre in the current year.

Total palm oil imports in 5MFY20 stood at 1.230 million tonnes, costing $676m as compared to 1.246m tonnes valuing $786m in same period last fiscal. Soybean oil’s average per tonne price plummeted to $689 per tonne from $747 per tonne. Soybean oil imports in terms of quantity and value were 57,553 tonnes and $39m as compared to 54,895 tonnes and $41m.

Importers urge govt to remove duties and taxes

Talking to Dawn, Member Pakistan Vanaspati Manufacturers Association (PVMA) Atif Rasheed said the price of palm oil in world market has surged to $810 per tonne from $550 per tonne in the last three to four months.

Ghee and cooking oil industry is 95 per cent reliant on imported items including palm oil, palm olienn, soybean oil, vitamins, tin plates, chemicals, etc on which government has imposed duties and taxes. Previous governments used to increase import duty on ghee and cooking raw materials when palm oil in world market used to hover at low prices to avert any revenue shortfall.

“The situation is now different. As world markets are soaring high, the government should cut import duties and taxes on imported raw materials to bring down prices of ghee and cooking oil,” Atif said, adding that sales are depressed now as compared to last year owing to high domestic prices. “People are purchasing ghee and cooking oil as per their demand instead of purchasing in bulk,” he said.

Tea, dry fruits become more costly

Consumers witnessed a jump of Rs 100 per kg in tea prices in the last six months. However, the average per tonne price of tea stood lower at $2,335 per tonne versus $2,679 per tonne but blenders and importers keep tea prices higher. The import bill of tea was $184m on arrival of 78,922 tonnes during the last five months versus 93,444 tonnes valuing $250m.

.....

Gautam

Re: Pakistani Economic Stress Watch

Marie Antoinette Dimmy Khan!!!g.sarkar wrote:If they can not afford oil, let them have ghee!

https://www.dawn.com/news/1525036/no-re ... tea-prices

No respite in ghee, pulses, tea prices

Aamir Shafaat KhanUpdated, December 29, 2019

KARACHI: Despite the rupee strengthening against the dollar and a decline in world price of various commodities, prices of ghee, cooking oil, tea, pulses and dry fruits continue to stay on the higher side for consumers.

One dollar now sells at Rs155 as against Rs164 in June 2019 and therefore should be making imports cheaper. According to the data of Pakistan Bureau of Statistics (PBS), the average per tonne price of palm oil came down to $550 per tonne in 5MFY20 from $631 per tonne in same period last fiscal. However, consumers are left with no choice but to buy ghee and cooking oil at higher prices. Good quality ghee and cooking oil sells at Rs200-230 per kg/litre, showing a jump of Rs20-30 per litre in the current year.

Total palm oil imports in 5MFY20 stood at 1.230 million tonnes, costing $676m as compared to 1.246m tonnes valuing $786m in same period last fiscal. Soybean oil’s average per tonne price plummeted to $689 per tonne from $747 per tonne. Soybean oil imports in terms of quantity and value were 57,553 tonnes and $39m as compared to 54,895 tonnes and $41m.

Importers urge govt to remove duties and taxes

Talking to Dawn, Member Pakistan Vanaspati Manufacturers Association (PVMA) Atif Rasheed said the price of palm oil in world market has surged to $810 per tonne from $550 per tonne in the last three to four months.

Ghee and cooking oil industry is 95 per cent reliant on imported items including palm oil, palm olienn, soybean oil, vitamins, tin plates, chemicals, etc on which government has imposed duties and taxes. Previous governments used to increase import duty on ghee and cooking raw materials when palm oil in world market used to hover at low prices to avert any revenue shortfall.

“The situation is now different. As world markets are soaring high, the government should cut import duties and taxes on imported raw materials to bring down prices of ghee and cooking oil,” Atif said, adding that sales are depressed now as compared to last year owing to high domestic prices. “People are purchasing ghee and cooking oil as per their demand instead of purchasing in bulk,” he said.

Tea, dry fruits become more costly

Consumers witnessed a jump of Rs 100 per kg in tea prices in the last six months. However, the average per tonne price of tea stood lower at $2,335 per tonne versus $2,679 per tonne but blenders and importers keep tea prices higher. The import bill of tea was $184m on arrival of 78,922 tonnes during the last five months versus 93,444 tonnes valuing $250m.

.....

Gautam

Pakistani Economic Stress Watch

S&P BSE SENSEX

Index Current : 41,558.00 - Pt. Change : -17.14 - % Change : -0.04

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,56,17,765.58 - $ 1 / I N R = 71.5250

Market Capitalization of BSE Listed Co. (U S $.) : 2,183.54

Current Index : 40,887.62 – Change : 39.09 - % Change : 0.1% - High : 41,295.28 – Low : 40,815.80

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 7,836,074,771,253 $ 1 / T R = 155.0897

Market Capitalization of PSE Listed Co. (U S $.) : 50.53

B S E : P S E : : 43.21 : 1

Cheers

Index Current : 41,558.00 - Pt. Change : -17.14 - % Change : -0.04

Market Capitalization of BSE Listed Co. (Rs.Cr.) : 1,56,17,765.58 - $ 1 / I N R = 71.5250

Market Capitalization of BSE Listed Co. (U S $.) : 2,183.54

Current Index : 40,887.62 – Change : 39.09 - % Change : 0.1% - High : 41,295.28 – Low : 40,815.80

Market Capitalization of PSE Listed Co. (Rs.Tr.) : 7,836,074,771,253 $ 1 / T R = 155.0897

Market Capitalization of PSE Listed Co. (U S $.) : 50.53

B S E : P S E : : 43.21 : 1

Cheers

Pakistani Economic Stress Watch

g.sarkar wrote:If they can not afford oil, let them have ghee!

https://www.dawn.com/news/1525036/no-re ... tea-prices

No respite in ghee, pulses, tea prices

Aamir Shafaat KhanUpdated, December 29, 2019

KARACHI: Despite the rupee strengthening against the dollar and a decline in world price of various commodities, prices of ghee, cooking oil, tea, pulses and dry fruits continue to stay on the higher side for consumers.

One dollar now sells at Rs155 as against Rs164 in June 2019 and therefore should be making imports cheaper. According to the data of Pakistan Bureau of Statistics (PBS), the average per tonne price of palm oil came down to $550 per tonne in 5MFY20 from $631 per tonne in same period last fiscal. However, consumers are left with no choice but to buy ghee and cooking oil at higher prices. Good quality ghee and cooking oil sells at Rs200-230 per kg/litre, showing a jump of Rs20-30 per litre in the current year.

Total palm oil imports in 5MFY20 stood at 1.230 million tonnes, costing $676m as compared to 1.246m tonnes valuing $786m in same period last fiscal. Soybean oil’s average per tonne price plummeted to $689 per tonne from $747 per tonne. Soybean oil imports in terms of quantity and value were 57,553 tonnes and $39m as compared to 54,895 tonnes and $41m.

Importers urge govt to remove duties and taxes

Talking to Dawn, Member Pakistan Vanaspati Manufacturers Association (PVMA) Atif Rasheed said the price of palm oil in world market has surged to $810 per tonne from $550 per tonne in the last three to four months.

Ghee and cooking oil industry is 95 per cent reliant on imported items including palm oil, palm olienn, soybean oil, vitamins, tin plates, chemicals, etc on which government has imposed duties and taxes. Previous governments used to increase import duty on ghee and cooking raw materials when palm oil in world market used to hover at low prices to avert any revenue shortfall.

“The situation is now different. As world markets are soaring high, the government should cut import duties and taxes on imported raw materials to bring down prices of ghee and cooking oil,” Atif said, adding that sales are depressed now as compared to last year owing to high domestic prices. “People are purchasing ghee and cooking oil as per their demand instead of purchasing in bulk,” he said.

Tea, dry fruits become more costly

Consumers witnessed a jump of Rs 100 per kg in tea prices in the last six months. However, the average per tonne price of tea stood lower at $2,335 per tonne versus $2,679 per tonne but blenders and importers keep tea prices higher. The import bill of tea was $184m on arrival of 78,922 tonnes during the last five months versus 93,444 tonnes valuing $250m.

ramana Ji & g.sarkar Ji :ramana wrote:Marie Antoinette Dimmy Khan!!!

Terroristanis Refer to DALDA - Vanaspati as Ghee and use the term DESI GHEE for Pure Ghee

Cheers

Re: Pakistani Economic Stress Watch

Time for the Porkis to ask their new 1/4th father Malaysia for free Palm Oil. If Saudi can give free petrol to Pakistan then Malaysia also needs to prove its friendship by supplying free Palm oil to Porkistan.

Re: Pakistani Economic Stress Watch

Im the charsi is mortgaging Karachi Airport to get loan from Commercial Banks

Re: Pakistani Economic Stress Watch

Yes, I noticed that too. In India Dalda brand was so popular at one time, it was called Vanaspati (hydrogenated oil) ghee. It must have been the same in Paklands too. Today, it (Dalda) is not that popular in India due to health reasons.Peregrine wrote:ramana Ji & g.sarkar Ji :

Terroristanis Refer to DALDA - Vanaspati as Ghee and use the term DESI GHEE for Pure Ghee

Cheers

Gautam

Pakistani Economic Stress Watch

Here cum de Scam! Here cum de Scam!!

Locals-diplomats nexus misusing luxury car import facility - Syed Irfan Raza

ISLAMABAD: As the government is striving hard to fetch more and more taxes by expanding the tax net, it is being cheated out of billions of rupees in duty under a scam involving misuse of the facility of duty-free import of luxury vehicles by some foreign diplomats, representatives of international non-governmental organisations and armed forces personnel of a few countries, according to sources.

The Federal Board of Revenue (FBR) has taken up the matter with the Ministry of Foreign Affairs (Mofa), asking it to write a letter to all foreign embassies and international NGOs to ascertain their criteria for importing luxury vehicles for diplomats and other foreign nationals, who are exempt from paying duty while importing vehicles for their use in Pakistan.

Through a letter, FBR chairman Shabbar Zaidi has informed Mofa of reports that the facility of duty-free import of vehicles is being “misused” by certain embassies or diplomatic missions by importing more vehicles than they actually require. The ministry has been urged to revisit the existing regime for duty-free import of vehicles by embassies, diplomatic missions and dignitaries.

According to the sources, the modus operandi of evading billions in duty is that vehicles are imported by diplomats, representatives of international NGOs or military personnel/attaché of different countries, but the actual owners of the vehicles are said to be Pakistanis.

“It has come to the notice of FBR that the vehicles are handed over to unauthorised persons for use and, later after a lapse of some time, these are sold to them,” said Mr Zaidi’s letter, of which Dawn has obtained a copy.

As foreign diplomats, representatives of international NGOs and armed forces personnel of various countries are exempt from paying import duty, the vehicles they import carry diplomatic registration number plates for three years. As import duty is not levied on vehicles that are three years old or more, these vehicles are transferred in the name of its actual owner (a Pakistani) after that period.

For instance, the price of a Lexus SUV is Rs10 million. If a Pakistani imports it, he/she will be required to pay an import duty of Rs30m. But this amount can be saved if a person who is exempt from paying import duty imports it.

In the process, the importer (foreign diplomat/military attaché) gains a monetary benefit and the actual owner (a Pakistani) gets the vehicle at a price that is far lower than its market price. The market price of Lexus is over Rs40m but under the scam it is purchased by the Pakistani owner for Rs15-20m.

According to senior officials of the vehicle registration authority of Islamabad, the scam has been growing since Sept 11, 2001, when the government allowed diplomats to use covered registration number plates (starting with the alphabets QL, QM, and QN) due to security reasons. “Now cars are imported by foreign diplomats and they are misused by Pakistani owners who drive them with covered number plates,” an official said.

According to the sources, in some cases diplomats issue “fake appointment letters” that claim that the Pakistanis owning the cars are drivers of the embassy in question.

An official said that import duty was evaded on two types of vehicles — those which were imported by diplomats and those that were imported by other persons who fell in the category of privileged people, like representatives of international NGOs.

The vehicles that are imported by diplomats are directly registered with Mofa by its deputy chief for protocol and those imported by privileged people are registered with the local registration authorities. However, the record of both types of vehicles is maintained in Mofa because no diplomatic vehicle can be registered without prior issuance of a no-objection certificate by the ministry.

Earlier, the record of these automobiles was maintained by the local authorities as they were registered with district vehicle registration authorities but local authorities no longer have record of vehicles imported by diplomats. The local authorities, however, issue covered registration number plates and these vehicles are ply with these plates.

The second category is of the cars which are imported by representatives of international NGOs, foreign military personnel and some international firms. These vehicles are registered with local authorities.

The luxury vehicles that are being imported under the scam include Lamborghini, Camaro, Hummers, Nissan GTRs (r35), Rolls Royce, Lexus, Bentley, Porche and BMW.

“It is in the notice of the FBR that two yellow duty-free Lamborghinis are being used in Faisalabad and Karachi,” an official of the FBR said.

The official of the local vehicle registration authority said some 12 to 15 vehicles (imported by non-diplomats) are registered with the Islamabad Vehicle Registration Authority in a month, which means 180 vehicles a year. However, the number of such vehicles registered in Karachi and Quetta is said to be even higher.

According to an estimate, the total loss to the national exchequer under this head could be Rs70bn per month or Rs840bn per annum.

If the authorities concerned confiscate all such vehicles, the government may collect a huge amount in duty.

Also, some officials suggested that the interior ministry should allow a separate motor registration series for imported vehicles so that their record could be maintained by the local vehicle registration authorities.

When Dawn contacted Foreign Minister Shah Mehmood Qureshi, he directed the officials concerned to take up the matter with the relevant foreign missions.

When the Mofa spokesperson was asked about the issue, she replied: “Under Vienna Convention on Diplomatic and Consular Relations and Pakistan Customs Tariff 9901, 9902 and 9905 regulated by the FBR, all diplomatic missions and diplomats in Pakistan are entitled to duty-free import of official vehicles and personal vehicles, respectively. Diplomats across the world are expected to abide by the privileges granted to them by the host country.”

Ayesha Farooq said the imposition of duty or otherwise at the time of sale of a diplomatic vehicle was determined on the basis of reciprocity. “Accordingly, 50 diplomatic and consular missions have to pay different percentages of duties for selling personal vehicles, which are calculated on the basis of vehicles’ entry/stay in Pakistan. Another 43 missions are entitled to duty-free sale, after three years of import. All married diplomats’ second personal vehicle cannot be sold duty free,” she added.

Asked how many such vehicles were registered with Mofa in the last five years, the spokesperson said the number of official vehicles that a mission can import is 50 per cent of their respective diplomatic strength. “For personal vehicles, married diplomats can import or locally purchase two vehicles otherwise only one is permitted per diplomat.”

Answering a question about stopping misuse of diplomatic vehicles, Ms Farooq said: “From time to time the policy has been under review with updates communicated to foreign missions in Pakistan. A four-layered internal online portal is being used for processing imports/sale permission requests between Foreign Office and diplomatic missions. To eliminate any chance of error, a subsequent verification procedure with customs is also in place,” she added.

Cheers

Locals-diplomats nexus misusing luxury car import facility - Syed Irfan Raza

ISLAMABAD: As the government is striving hard to fetch more and more taxes by expanding the tax net, it is being cheated out of billions of rupees in duty under a scam involving misuse of the facility of duty-free import of luxury vehicles by some foreign diplomats, representatives of international non-governmental organisations and armed forces personnel of a few countries, according to sources.

The Federal Board of Revenue (FBR) has taken up the matter with the Ministry of Foreign Affairs (Mofa), asking it to write a letter to all foreign embassies and international NGOs to ascertain their criteria for importing luxury vehicles for diplomats and other foreign nationals, who are exempt from paying duty while importing vehicles for their use in Pakistan.

Through a letter, FBR chairman Shabbar Zaidi has informed Mofa of reports that the facility of duty-free import of vehicles is being “misused” by certain embassies or diplomatic missions by importing more vehicles than they actually require. The ministry has been urged to revisit the existing regime for duty-free import of vehicles by embassies, diplomatic missions and dignitaries.

According to the sources, the modus operandi of evading billions in duty is that vehicles are imported by diplomats, representatives of international NGOs or military personnel/attaché of different countries, but the actual owners of the vehicles are said to be Pakistanis.

“It has come to the notice of FBR that the vehicles are handed over to unauthorised persons for use and, later after a lapse of some time, these are sold to them,” said Mr Zaidi’s letter, of which Dawn has obtained a copy.

As foreign diplomats, representatives of international NGOs and armed forces personnel of various countries are exempt from paying import duty, the vehicles they import carry diplomatic registration number plates for three years. As import duty is not levied on vehicles that are three years old or more, these vehicles are transferred in the name of its actual owner (a Pakistani) after that period.

For instance, the price of a Lexus SUV is Rs10 million. If a Pakistani imports it, he/she will be required to pay an import duty of Rs30m. But this amount can be saved if a person who is exempt from paying import duty imports it.

In the process, the importer (foreign diplomat/military attaché) gains a monetary benefit and the actual owner (a Pakistani) gets the vehicle at a price that is far lower than its market price. The market price of Lexus is over Rs40m but under the scam it is purchased by the Pakistani owner for Rs15-20m.

According to senior officials of the vehicle registration authority of Islamabad, the scam has been growing since Sept 11, 2001, when the government allowed diplomats to use covered registration number plates (starting with the alphabets QL, QM, and QN) due to security reasons. “Now cars are imported by foreign diplomats and they are misused by Pakistani owners who drive them with covered number plates,” an official said.

According to the sources, in some cases diplomats issue “fake appointment letters” that claim that the Pakistanis owning the cars are drivers of the embassy in question.

An official said that import duty was evaded on two types of vehicles — those which were imported by diplomats and those that were imported by other persons who fell in the category of privileged people, like representatives of international NGOs.

The vehicles that are imported by diplomats are directly registered with Mofa by its deputy chief for protocol and those imported by privileged people are registered with the local registration authorities. However, the record of both types of vehicles is maintained in Mofa because no diplomatic vehicle can be registered without prior issuance of a no-objection certificate by the ministry.

Earlier, the record of these automobiles was maintained by the local authorities as they were registered with district vehicle registration authorities but local authorities no longer have record of vehicles imported by diplomats. The local authorities, however, issue covered registration number plates and these vehicles are ply with these plates.

The second category is of the cars which are imported by representatives of international NGOs, foreign military personnel and some international firms. These vehicles are registered with local authorities.

The luxury vehicles that are being imported under the scam include Lamborghini, Camaro, Hummers, Nissan GTRs (r35), Rolls Royce, Lexus, Bentley, Porche and BMW.

“It is in the notice of the FBR that two yellow duty-free Lamborghinis are being used in Faisalabad and Karachi,” an official of the FBR said.

The official of the local vehicle registration authority said some 12 to 15 vehicles (imported by non-diplomats) are registered with the Islamabad Vehicle Registration Authority in a month, which means 180 vehicles a year. However, the number of such vehicles registered in Karachi and Quetta is said to be even higher.

According to an estimate, the total loss to the national exchequer under this head could be Rs70bn per month or Rs840bn per annum.

If the authorities concerned confiscate all such vehicles, the government may collect a huge amount in duty.

Also, some officials suggested that the interior ministry should allow a separate motor registration series for imported vehicles so that their record could be maintained by the local vehicle registration authorities.

When Dawn contacted Foreign Minister Shah Mehmood Qureshi, he directed the officials concerned to take up the matter with the relevant foreign missions.

When the Mofa spokesperson was asked about the issue, she replied: “Under Vienna Convention on Diplomatic and Consular Relations and Pakistan Customs Tariff 9901, 9902 and 9905 regulated by the FBR, all diplomatic missions and diplomats in Pakistan are entitled to duty-free import of official vehicles and personal vehicles, respectively. Diplomats across the world are expected to abide by the privileges granted to them by the host country.”

Ayesha Farooq said the imposition of duty or otherwise at the time of sale of a diplomatic vehicle was determined on the basis of reciprocity. “Accordingly, 50 diplomatic and consular missions have to pay different percentages of duties for selling personal vehicles, which are calculated on the basis of vehicles’ entry/stay in Pakistan. Another 43 missions are entitled to duty-free sale, after three years of import. All married diplomats’ second personal vehicle cannot be sold duty free,” she added.

Asked how many such vehicles were registered with Mofa in the last five years, the spokesperson said the number of official vehicles that a mission can import is 50 per cent of their respective diplomatic strength. “For personal vehicles, married diplomats can import or locally purchase two vehicles otherwise only one is permitted per diplomat.”

Answering a question about stopping misuse of diplomatic vehicles, Ms Farooq said: “From time to time the policy has been under review with updates communicated to foreign missions in Pakistan. A four-layered internal online portal is being used for processing imports/sale permission requests between Foreign Office and diplomatic missions. To eliminate any chance of error, a subsequent verification procedure with customs is also in place,” she added.

Cheers

Re: Pakistani Economic Stress Watch

Many North Indians also use ‘desi ghee’ to refer to regular ghee. When I first heard the expression I thought that they had some special type of ghee that I wasn’t aware of.g.sarkar wrote:Yes, I noticed that too. In India Dalda brand was so popular at one time, it was called Vanaspati (hydrogenated oil) ghee. It must have been the same in Paklands too. Today, it (Dalda) is not that popular in India due to health reasons.Peregrine wrote:ramana Ji & g.sarkar Ji :

Terroristanis Refer to DALDA - Vanaspati as Ghee and use the term DESI GHEE for Pure Ghee

Cheers

Gautam

Pakistani Economic Stress Watch

Peregrine wrote:ramana Ji & g.sarkar Ji :

Terroristanis Refer to DALDA - Vanaspati as Ghee and use the term DESI GHEE for Pure Ghee

Cheers

g.sarkar wrote: Yes, I noticed that too. In India Dalda brand was so popular at one time, it was called Vanaspati (hydrogenated oil) ghee. It must have been the same in Paklands too. Today, it (Dalda) is not that popular in India due to health reasons.

Gautam

Bart S Ji :Bart S wrote:Many North Indians also use ‘desi ghee’ to refer to regular ghee. When I first heard the expression I thought that they had some special type of ghee that I wasn’t aware of.Vanaspati is banned I think owing to it being a trans fat.

Many thanks your kind comments.

Hope you will re-act similarly when I post Articles by Farrukh Saleem!

Cheers

Pakistani Economic Stress Watch

Revenue shortfall rises to Rs287b - Shahbaz Rana

ISLAMABAD.: Despite two downward revisions, the revenue collection for the first half of the current fiscal year has shown a shortfall of Rs287 billion.

For the first half (July-December) of the current fiscal year, the FBR’s reduced target was Rs2.367 trillion.

CheersThe FBR has collected Rs2.080 trillion by this time for the half year ended December 31, 2019, tweeted FBR Chairman Shabbar Zaidi on Tuesday.

Pakistani Economic Stress Watch

X Posted on the Terroristan Thread

Cheers

Cheers

Pakistani Economic Stress Watch

A year in review: With high prices, Pakistan's auto sector stays subdued - Usman Hanif

KARACHI: It seems that there was no respite for the auto sector in 2019 as it endured another rocky year amid a slump in activity. The soaring inflation and the high interest rate did not help matters either.

“The year was extremely bad for the auto sector,” said Indus Motor Company CEO Ali Asghar Jamali while talking to The Express Tribune.

Following developments in macroeconomic indicators, auto sales plunged 34% to 175,611 units in the first 11 months of 2019 compared to 235,491 units sold in the same period of the previous year.

“If we break them down further, from January to June 2019, the decline [in car sales] was only 11%,” said JS Global senior analyst Ahmed Lakhani. The real hit came between July and November – the initial five months of current fiscal year 2019-20, he added.

In the first five months of FY20, total sales came in at 55,407 units compared to 100,997 units in the corresponding period last year, which meant a 45% decline. Even though there were many factors behind the plunge, the main reason was rupee devaluation, said the analyst.

WAPDA: PTI govt to recruit workers to combat staff shortage

In FY19, the rupee depreciated 35% against the US dollar. As of November, the key interest rate stood high at 13.25%, one of the highest in the country’s history owing to high inflation rate, which is currently 12.7%. When the rupee depreciates, even domestically produced parts of vehicles become costlier as raw material for the parts comes from abroad. Talking further about the hit to the auto sector, Jamali said another major reason for the decline in sales was taxes, which included federal excise duty (FED) and additional customs duty imposed by the federal government.

“Besides rupee devaluation against the US dollar, the interest rate doubled this year,” he added. High interest rates mean car financing becomes tougher and cars become more expensive than before. Two years ago, the policy rate was only 6%, therefore, the current rate discourages consumers from buying cars.

On top of all these, the government imposed 2.5% FED on vehicles having engines of less than 1,000cc, 5% on engines ranging between 1,000cc and 2,000cc and 7.5% on engines of more than 2,000cc. The government also levied additional customs duty, at 5% on raw material.

“The documentation issue has also been a big reason why sales have recorded a sharp decline,” said the CEO, while referring to the previous government’s decision to bar non-filers of tax returns from buying a new car.

Even though the government lifted the ban, it would take time to revive the confidence of buyers, he added.