Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

The Reserve Bank of India -supersedes-yes-bank-board-caps-withdrawals-at-rs-50000

Re: Indian Economy News & Discussion - Nov 27 2017

Can any one explain in layman terms what did Yes bank do, and why Reserve Bank had to take this action? Has RBI taken longer time to recommend this action, or this was the right to cap the withdrawals?Rupesh wrote:The Reserve Bank of India -supersedes-yes-bank-board-caps-withdrawals-at-rs-50000

Re: Indian Economy News & Discussion - Nov 27 2017

It is a capital adequacy issue known for a while. They had extended dodgy loans in the past. RBI had previously replaced the CEO with an administrator who was ex-CFO of SBI. Seems like SBI will invest in it and eventually take over. We can expect things will be normal in couple of months. It is nowhere as bad as Punjab & Maha Coop Bank.Sachin wrote:Can any one explain in layman terms what did Yes bank do, and why Reserve Bank had to take this action? Has RBI taken longer time to recommend this action, or this was the right to cap the withdrawals?Rupesh wrote:The Reserve Bank of India -supersedes-yes-bank-board-caps-withdrawals-at-rs-50000

Re: Indian Economy News & Discussion - Nov 27 2017

posted from the strategic thread

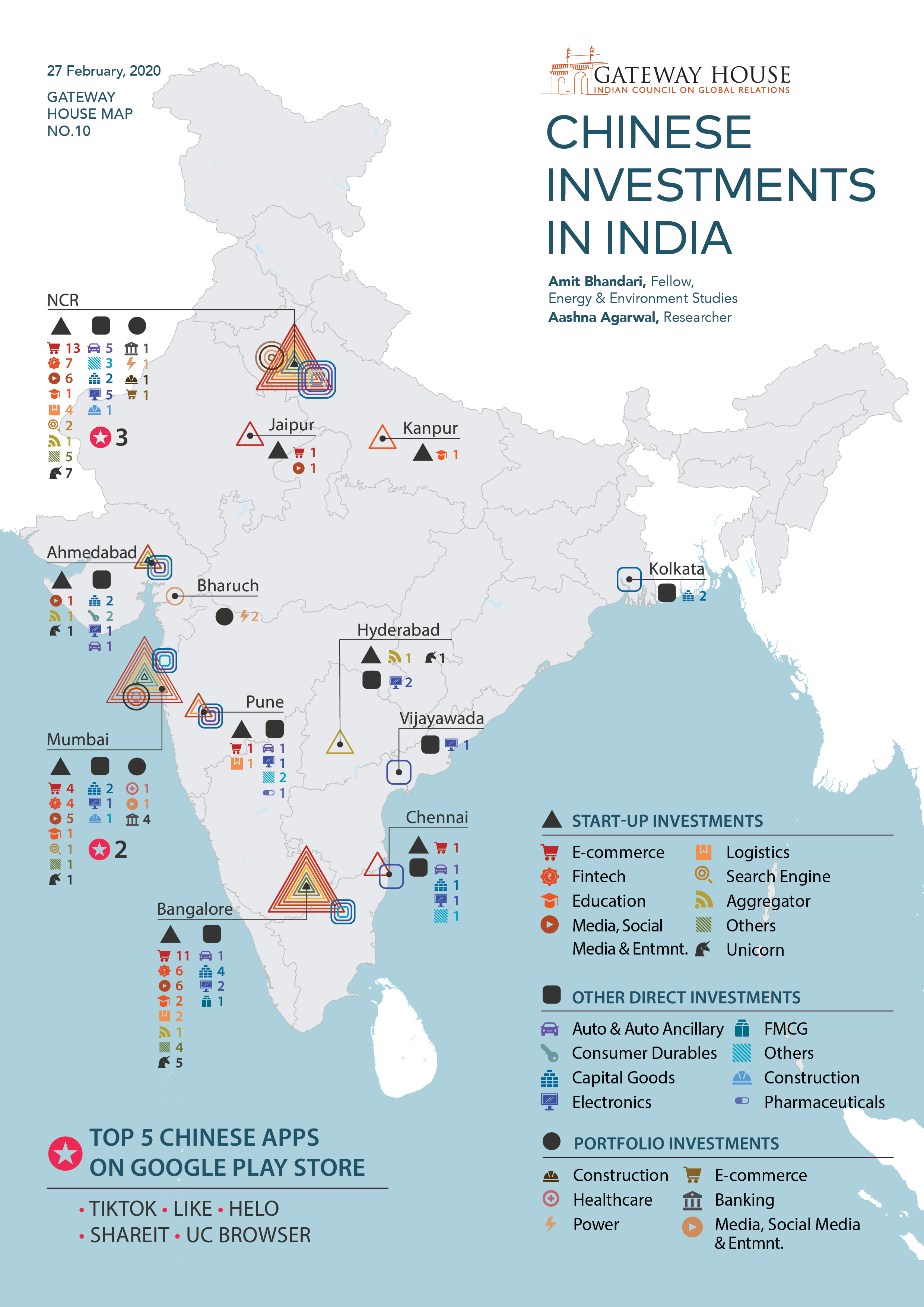

India in the virtual Belt and Road

India in the virtual Belt and Road

India in the virtual Belt and Road

Over the last five years, China has quietly created a significant place for itself in India – in the technology domain. While India has refused to sign on to China's Belt and Road Initiative (BRI), this map shows India's positioning in the virtual BRI to be strategically invaluable for China. Nearly $4 billion in venture investments in start-ups, the online ecosystem and apps have been made by Chinese entities. This is just the beginning; there is much more to come.

Over the last five years, China has quietly created a significant place for itself in India – in the technology domain. Unable to persuade India to sign on to its Belt and Road Initiative (BRI), China has entered the Indian market through venture investments in start-ups and penetrated the online ecosystem with its popular smartphones and their applications (apps).

There are three reasons for China’s tech depth in India. First, there are no major Indian venture investors for Indian start-ups. China has taken early advantage of this gap. Alibaba’s 2015 investment in 40% of PayTM, a digital payments platform, paid off barely a year later when in November 2016, the government of India demonetised its large currency notes and simultaneously promoted a move to a cashless economy. PayTM benefitted from Alibaba’s superior fintech experience, which it applied to India seamlessly, making it a dominant player.

Second, China provides the patient capital needed to support the Indian start-ups, which like any other, are loss-making. The trade-off for market share is worthwhile. Third, for China, the huge Indian market has both retail and strategic value. Therefore, companies like Alibaba and Tencent have different considerations and horizons for their investments. In contrast, Western venture money is mostly through funds like Sequoia and SoftBank.

China has seen another early opportunity in India – the potential shift to electric mobility, where China has expertise. India is the world’s fifth-largest auto market; the sector is the country’s most robust and globalised export and it is a bellwether for the economy. China’s BYD has been pushing its electric buses in India, with limited success. In traditional autos, which is 99% of the market, China is using the recognisable, but distressed, global auto brands like Volvo and MG, which it acquired to enter the Indian market. So far, Chinese automakers have invested $575 million in India. The competition in India is fierce, and it’s with Indian and Asian automakers like Suzuki, Hyundai and Toyota, even as U.S. automakers withdraw.

The Belt and Road Initiative carries with it Chinese products and standards, both virtual and physical. India may have sidestepped the physical corridor, but has unwittingly signed up for the virtual corridor.

Re: Indian Economy News & Discussion - Nov 27 2017

looks like it's the same old same old crony capitalism with all the usual suspects feeding voraciously at the public trough knowing that a few will take a mild hit and maybe a slap on the wrist but the stolen moolah is safe.Sachin wrote:Can any one explain in layman terms what did Yes bank do, and why Reserve Bank had to take this action? Has RBI taken longer time to recommend this action, or this was the right to cap the withdrawals?Rupesh wrote:The Reserve Bank of India -supersedes-yes-bank-board-caps-withdrawals-at-rs-50000

the presstitutes have completely blacked out the names of the bank directors, the slick snake oil salesmen who got the "loans", the auditors who kept quiet and a whole lot of hangers on who fed off the crumbs from the yes bank table.

SBI seems to have taken over the erstwhile role of LIC, forcibly being made to invest in shady financial companies/banks. It will acquire 49% of the yes bank stake

now, after the PMC scam, the RBI is seemingly moving with practiced ease and rehearsed surefootedness and the statements from the finmin are sounding more canned rather than genuine.

Govt is said to have approved

@TheOfficialSBI plan is to buy stake @YESBANK. SBI to form consortium for Yes Bank stake, says Bloomberg. Behind the scene work has been on for sometime. SBI won't merge Yes Bank with itself; it will be sort of warehousing till Yes is revived.

@jpmorgan report says

@YESBANK bailout is for depositors, there’s nothing for investors. Cuts target price to Re1. Remember JP Morgan bailing out Bear Sterns and Washington Mutual ahead of Lehman collapse?

Last edited by chetak on 07 Mar 2020 17:00, edited 1 time in total.

Re: Indian Economy News & Discussion - Nov 27 2017

So is it a good (risky) buy for mid term investor at 16.15 close of yesterdayJTull wrote:It is a capital adequacy issue known for a while. They had extended dodgy loans in the past. RBI had previously replaced the CEO with an administrator who was ex-CFO of SBI. Seems like SBI will invest in it and eventually take over. We can expect things will be normal in couple of months. It is nowhere as bad as Punjab & Maha Coop Bank.Sachin wrote: Can any one explain in layman terms what did Yes bank do, and why Reserve Bank had to take this action? Has RBI taken longer time to recommend this action, or this was the right to cap the withdrawals?

Re: Indian Economy News & Discussion - Nov 27 2017

take a good look before you leapVadivel wrote:So is it a good (risky) buy for mid term investor at 16.15 close of yesterdayJTull wrote:

It is a capital adequacy issue known for a while. They had extended dodgy loans in the past. RBI had previously replaced the CEO with an administrator who was ex-CFO of SBI. Seems like SBI will invest in it and eventually take over. We can expect things will be normal in couple of months. It is nowhere as bad as Punjab & Maha Coop Bank.

or this

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.reuters.com/article/us-chin ... SKCN1UD0KDtandav wrote:India Debt to GDP ratio is higher than China. We have to somehow get our population more productive. The only thing I can think of is to make more infrastructure and hope the productivity increase is outpaces than the debt that we take up to make that assetAvtar Singh wrote:Markit Services PMI FEB Actual 57.5 Previous 55.5 Consensus 52.9 Forecast 52.5

https://tradingeconomics.com/

whilst the rest of the world heads into debt mongering/money printing armageddon

why would GOI give anyone access to Indian economy, see trash talking UK

countries need to start not just talking the talk but walking the walk......

that is the Hindu talk and walk... PM Modi walk and talk

"China’s total corporate, household and government debt rose to 303% of GDP in the first quarter of 2019, from 297% in the same period a year earlier, the IIF said in a report this week which highlighted rising debt levels worldwide. "

This is a 2018 article:

In India, private debt in 2017 was 54.5 per cent of the GDP and the general government debt was 70.4 per cent of the GDP, a total debt of about 125 of the GDP, according to the latest IMF figures. In comparison, debt of China was 247 per cent of the GDP.

Read more at:

https://economictimes.indiatimes.com/ne ... 147583.cms

Re: Indian Economy News & Discussion - Nov 27 2017

Share is probably worthless now.Vadivel wrote:So is it a good (risky) buy for mid term investor at 16.15 close of yesterdayJTull wrote:

It is a capital adequacy issue known for a while. They had extended dodgy loans in the past. RBI had previously replaced the CEO with an administrator who was ex-CFO of SBI. Seems like SBI will invest in it and eventually take over. We can expect things will be normal in couple of months. It is nowhere as bad as Punjab & Maha Coop Bank.

I've never endorsed market-timing. Generally speaking, it is not a good idea to trade against momentum, up or down. It is difficult to predict where is the bottom (or top). Trade once the direction reverses, for sure.

Re: Indian Economy News & Discussion - Nov 27 2017

I am trying to understand what will happen next. SBI buys 49%, fundamentally GoI controls Yes Bank. It initiates process to get money from the defaulters. Will have some hair cut, close some branches, but will start fresh under GoI?

If Yes Bank books are cleaned up, at Rs10, it is a steal for SBI. Depositor money will not go anywhere as it is always sovereign guaranteed.

If Yes Bank books are cleaned up, at Rs10, it is a steal for SBI. Depositor money will not go anywhere as it is always sovereign guaranteed.

Re: Indian Economy News & Discussion - Nov 27 2017

I am not recommending buying them, but if the entity is still operational, under SBI, then it becomes just another PSU bank.JTull wrote: Share is probably worthless now.

It is not clear at the moment, what is GoI is planning to do with Yes bank.

Re: Indian Economy News & Discussion - Nov 27 2017

nam wrote:I am trying to understand what will happen next. SBI buys 49%, fundamentally GoI controls Yes Bank. It initiates process to get money from the defaulters. Will have some hair cut, close some branches, but will start fresh under GoI?

If Yes Bank books are cleaned up, at Rs10, it is a steal for SBI. Depositor money will not go anywhere as it is always sovereign guaranteed.

sovereign guaranteed in the tune of 5 lakhs.

Re: Indian Economy News & Discussion - Nov 27 2017

The term is not 'sovereign guarantee' but deposit insurance. India has an entity named DICGC, analogous to the US FDIC, that insures deposits. As of Budget 2020-21, the DICGC insures deposits up to the limit of Rs.5 lakh (across all accounts in a single bank).

Budget 2020: Insurance cover for bank depositors to be raised to Rs 5 lakh

Budget 2020: Insurance cover for bank depositors to be raised to Rs 5 lakh

Deposit Insurance and Credit Guarantee Corporation (DICGC), a wholly owned subsidiary of the Reserve Bank of India, provides insurance cover on bank deposits.

Deposit insurance coverage will be enhanced from Rs 1 lakh to 5 lakh per depositor, the Finance Minister said her Budget speech in Lok Sabha.

Re: Indian Economy News & Discussion - Nov 27 2017

^^^^ Well the professor's wish taken care of !!

After the Budget announcement, insurance cover on bank deposits has been increased from Rs 1 lakh to Rs 5 lakh effective Tuesday, the Reserve Bank of India (RBI) said.

Deposit insurance was static at Rs 1 lakh since 1993. The cover is provided by the Deposit Insurance and Credit Guarantee Corporation (DICGC), a wholly-owned subsidiary of the RBI.

After the Budget announcement, insurance cover on bank deposits has been increased from Rs 1 lakh to Rs 5 lakh effective Tuesday, the Reserve Bank of India (RBI) said.

Deposit insurance was static at Rs 1 lakh since 1993. The cover is provided by the Deposit Insurance and Credit Guarantee Corporation (DICGC), a wholly-owned subsidiary of the RBI.

Re: Indian Economy News & Discussion - Nov 27 2017

This insurence amount is paid by the Bankers and I think they have huge funds avaliable there. Normally with a bank fails it will be taken over by other banks. GTB taken over by OBC, United Westeren Bank by IDBI Bank, LCB by Canara Bank ( long back) and so on. Normally it will ensure depositors are taken care of. The PSU Bank which takes over the private bank many times get huge assets and running branches which will help her to expand.

Re: Indian Economy News & Discussion - Nov 27 2017

Happy days are here again (for Bharat.... to fill up the strategic reserve as the oil price hits the rock bottom)

Putin Dumps MBS to Start a War on America’s Shale Oil Industry

Ilya Arkhipov, Will Kennedy, Olga Tanas and Grant Smith

BloombergMarch 7, 2020, 11:27 AM CST

Putin Dumps MBS to Start a War on America’s Shale Oil Industry

Putin Dumps MBS to Start a War on America’s Shale Oil Industry

(Bloomberg) -- At 10:16 a.m. on a wet and dreary Friday morning, Russia’s energy minister walked into OPEC’s headquarters in central Vienna knowing his boss was ready to turn the global oil market upside down.Alexander Novak told his Saudi Arabian counterpart Prince Abdulaziz bin Salman that Russia was unwilling to cut oil production further. The Kremlin had decided that propping up prices as the coronavirus ravaged energy demand would be a gift to the U.S. shale industry. The frackers had added millions of barrels of oil to the global market while Russian companies kept wells idle. Now it was time to squeeze the Americans.After five hours of polite but fruitless negotiation, in which Russia clearly laid out its strategy, the talks broke down. Oil prices fell more than 10%. It wasn’t just traders who were caught out: Ministers were so shocked, they didn’t know what to say, according to a person in the room. The gathering suddenly had the atmosphere of a wake, said another.

For over three years, President Vladimir Putin had kept Russia inside the OPEC+ coalition, allying with Saudi Arabia and the other members of the Organization of Petroleum Exporting Countries to curb oil production and support prices. On top of helping Russia’s treasury – energy exports are the largest source of state revenue – the alliance brought foreign policy gains, creating a bond with Saudi Arabia’s new leader, Crown Prince Mohammed bin Salman.

But the OPEC+ deal also aided America’s shale industry and Russia was increasingly angry with the Trump administration’s willingness to employ energy as a political and economic tool. It was especially irked by the U.S.’s use of sanctions to prevent the completion of a pipeline linking Siberia’s gas fields with Germany, known as Nord Stream 2. The White House has also targeted the Venezuelan business of Russia’s state-oil producer Rosneft.“The Kremlin has decided to sacrifice OPEC+ to stop U.S. shale producers and punish the U.S. for messing with Nord Stream 2,” said Alexander Dynkin, president of the Institute of World Economy and International Relations in Moscow, a state-run think tank. “Of course, to upset Saudi Arabia could be a risky thing, but this is Russia’s strategy at the moment – flexible geometry of interests.”

The First No

The OPEC+ deal had never been popular with many in the Russian oil industry, who resented having to hold back investments in new and potentially profitable projects. In particular, Igor Sechin, the powerful boss of Rosneft and a long-time Putin ally, lobbied against the curbs, according to people familiar with the matter, who asked not to be identified discussing private conversations.The Kremlin was also disappointed the alliance with Riyadh hadn’t yielded major Saudi investments in Russia.For several months, Novak and his team had been telling Saudi officials they liked being in the OPEC+ alliance but were reluctant to deepen production cuts, according to people familiar with the relationship. At the last OPEC meeting in December, Russia negotiated a position that allowed it to keep production fairly steady while Saudi Arabia shouldered big reductions.When the coronavirus started devastating Chinese economic activity in early February – cutting oil demand in Saudi Arabia’s biggest customer by 20% -- Prince Abdulaziz tried to convince Novak that they should call an early OPEC+ meeting in response to cutback supply. Novak said no. The Saudi king and Putin spoke by phone -- it didn’t help.As the virus spread and analysts forecast the worst year for oil demand since the global financial crisis, the Saudi camp was hopeful Moscow could be won round at the next scheduled OPEC meeting in early March. The Russians didn’t rule out deepening cuts, but kept making the point that shale producers should be made to share the pain.Putin, who has been the final arbiter of Russia’s OPEC+ policy since the alliance started in 2016, met oil Russian producers and key ministers last Sunday. Russia’s approach was that shale producers should share the pain caused by the drop in demand, cutting U.S. oil production, according to someone who attended.

Bad Chemistry

As ministers gathered in Vienna this week, Saudi Arabia made a final effort to force Russia’s hand. They persuaded the core OPEC group to support a deep production cut of 1.5 million barrels a day, but made it contingent on Russia and the other OPEC+ countries joining in. Novak turned up last at the Vienna headquarters where his nervous counterparts were waiting for him, and refused to budge.

The crown prince even considered calling Putin on Friday, according to a person familiar with the situation. But Putin’s spokesman made clear he had no plans to get involved. As for the two countries’ oil ministers, there was no personal chemistry between them, according to a person in the room. They didn’t exchange a single smile, said another.

With every leak from the meeting the price of oil twitched, as traders slowly came to realize a deal was going to be impossible.

Priming the Pump

Rosneft is delighted with the breakup. It can now move to boost its market share, said spokesman Mikhail Leontiev.

“If you always give in to partners, you are no longer partners. It’s called something else,” he told Bloomberg. “Let’s see how American shale exploration feels under these conditions.”

But the decision to take on shale could backfire. While many drillers in Texas and other shale regions look vulnerable, as they’re overly indebted and already battered by rock-bottom natural gas prices, significant declines in U.S. production may take time. The largest American oil companies, Exxon Mobil Corp. and Chevron Corp., now control many shale wells and have the balance sheets to withstand lower prices. Some smaller drillers may go out of business, but many will have bought financial hedges against the drop in crude.In the short run, Russia is in a good position to withstand an oil price slump. The budget breaks even at a price of $42 a barrel and the finance ministry has squirreled away billions in a rainy-day fund. Nonetheless, the coronavirus’s impact on the global economy is still unclear and with millions more barrels poised to flood the market, Wall Street analysts are warning oil could test recent lows of $26 a barrel.

In Saudi Arabia, where the government is almost entirely dependent on oil to fund government spending, the economic impact will be immediate. Prince Abdulaziz and his half-brother Crown Prince Mohammed will have every incentive to boost production to maximize revenue as prices fall.

“Prices will fall until either Moscow or Riyadh call off the endurance contest” or North American production is massively curtailed, said Bob McNally, president of Rapidan Energy Advisors and a former National Security Council staffer.Relations between the two energy ministries remain cordial and the diplomatic mechanisms of the OPEC+ group are still in place, keeping the door open in case the two sides do decide to reunite. Novak told his peers on Friday that OPEC+ isn’t over.

But a photo of the conference room after the delegates had left hinted at a different story: The small Russian flag by Novak’s seat had been knocked over. And Prince Abdulaziz left his counterparts with a grave warning: Trust me, he told them, according to a person in the room. This will be a regrettable day for us all.

--With assistance from Dina Khrennikova, Henry Meyer, Irina Reznik and Javier Blas.

To contact the reporters on this story: Ilya Arkhipov in Moscow at iarkhipov@bloomberg.net;Will Kennedy in London at wkennedy3@bloomberg.net;Olga Tanas in Moscow at otanas@bloomberg.net;Grant Smith in London at gsmith52@bloomberg.net

To contact the editor responsible for this story: Emma Ross-Thomas at erossthomas@bloomberg.net

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Re: Indian Economy News & Discussion - Nov 27 2017

Big swings are rarely good. They bring an equally big swing in the other direction. We don't wan't oil prices to go so low that shale oil is not considered viable anymore and shale production stops. Remember, its the shale oil that has caused the drop in oil prices, so its viability is important.Kati wrote:Happy days are here again (for Bharat.... to fill up the strategic reserve as the oil price hits the rock bottom)

Re: Indian Economy News & Discussion - Nov 27 2017

Foreign reserves hit new high.

India’s foreign exchange reserves jumped $5.4 billion in the week ended February 28 to hit a new all-time high of $481.5 billion.

Re: Indian Economy News & Discussion - Nov 27 2017

Code: Select all

Rank Country Foreign exchange

reserves

(millions of US$) Figures as of

1 China[a] 3,106,700 February 2020[1]

2 Japan 1,403,396 February 2020[2]

3 Switzerland 850,776 January 2020[4]

4 Russia 570,000 28 February 2020[5]

5 Saudi Arabia 501,836 January 2020[6][7]

6 India 481,540 28 February 2020[8][b]

7 Taiwan[9] 479,680 February 2020[10]

8 Hong Kong 446,100 February 2020[11]

9 South Korea 408,800 December 2019[12]

10 Brazil 356,884 December 2019[13]Re: Indian Economy News & Discussion - Nov 27 2017

The significant rise ($70+ billion) in Forex reserves in the past one year while there is a concurrent slowdown in the economy and the currency has either stayed stable (for the most part) or depreciated (recently) is very strange. I haven't seen any explanation for this such as a drop in imports, increase in remittances or exports etc. provided in the usual articles which report a rise in the reserves every month or so.

Re: Indian Economy News & Discussion - Nov 27 2017

There's a $30 billion drop in the -ve trade balance for merchandise trade this fiscal year compared to last (-$133B vs -$163B), on account of a small increase in exports but a substantial drop in imports. About $5 billion increase in the services trade surplus ($65B vs $60B) . That's already half the increase in forex reserves. FDI inflows are up $5 billion from the gains in the prior year. Equity/debt FPI inflows are +$19 billion so far this year vs -$11B the year before. All of this adds up.

Re: Indian Economy News & Discussion - Nov 27 2017

Why is the govt trying to save YES bank beyond the 5 lakh deposit insurance?

Re: Indian Economy News & Discussion - Nov 27 2017

Yes Bank accounts for almost half of the UPI transaction routing volume. Market and financial stability is one of the government's prerogatives.

Re: Indian Economy News & Discussion - Nov 27 2017

but that is backend correct? why protect deposits >5L for customer withdrawals?

Re: Indian Economy News & Discussion - Nov 27 2017

source/references?Suraj wrote:Yes Bank accounts for almost half of the UPI transaction routing volume. Market and financial stability is one of the government's prerogatives.

-

Manish_Sharma

- BRF Oldie

- Posts: 5128

- Joined: 07 Sep 2009 16:17

Re: Indian Economy News & Discussion - Nov 27 2017

Posting from politics thread:

viewtopic.php?f=1&t=7788&start=3360#p2419820

viewtopic.php?f=1&t=7788&start=3360#p2419820

ramana wrote:Please read and digest this economic analysis:

https://m.economictimes.com/markets/exp ... 551227.cms

2020 could turn out to be India's year: Prashant Jain

ET Now | Updated: Mar 9, 2020, 04.58 PM IST

There is deep value in market after 16-17 years: Prashant Jain

Do you think there is a buying opportunity now?

The valuations have been good for some time and the challenges that markets were facing was that certain stocks kept on becoming more expensive and what was cheap kept on becoming cheaper. I have experienced in my career thrice that every trend breaks only in a market downturn and in a way, sanity returned to markets after such corrections. Over the weekend, several things have improved for India and it is a good coincidence that all of it happened in a matter of days.

One, the BPCL EOI has come and that represents a very strategic shift from divestment through ETFs or OFS. The primary focus is now through strategic sales and that means you will get a better value and there will be open offers of fairly large amounts. That is a very important shift. Crude prices have come down which is always good for India. They may bounce back but for the time being, for the foreseeable future they should remain low.

Global yields have moved lower because of coronavirus. The fall in crude will also help that to some extent and India at this point of time can do with lower interest rates. It will help in reviving economic growth. The YES Bank issue has been settled. That was a big overhang on the markets and the way Vodafone has communicated to their assessment of the AGR liability and Bharti has also done the same, even the AGR issue is likely to get resolved in the foreseeable future.

So five very positive developments in this market and valuations were cheap in aggregate as well. There is value to deep value in certain large sections of the market. I feel quite optimistic about these markets.

I will talk about all the factors one by one but first let us understand the pace and intensity of the selling. It reminds us of 2008. 2008 is when crude fell, US equities fell, there was a financial crisis. How does one understand the lay of the land because growth is going to be precious and many experts are saying this will be a washout year for the global economy?

In a way it could be India’s year because what India really needs from the outside world is lower interest rates and lower oil prices. These are two things that India needs -- capital and oil and both are very cheap. I do not think the external environment could have been more conducive than this for India.

India’s growth as it comes back will stand out in this slow growth world. The government has done a lot by way of giving tax breaks to new manufacturing units. A 15% tax break and a tax holiday for infra investments by sovereign wealth funds. India should get reasonably large amounts of capital because India represents a large economy and it is an island of growth in the current environment. Even in the past, whenever there have been challenges outside India, it has led to short term corrections in the market. But it has not impacted the underlying economic growth whether it was 9/11, whether it was Lehman crisis, the taper tantrum, Brexit or the Asian crisis. On each of these occasions, if you invested in India, these were good opportunities to invest. I see no challenges whatsoever in the external environment.

In fact, it is a myth and a wrong notion that India needs high GDP growth for exports to grow. India’s share of world exports is miniscule -- 1%-2%. So for a country like India, 80-90% growth is delivered due to market share gains and not due to the world economy growing and we can look at what has happened in the IT industry or in the pharmaceutical generics industry.

These industries have delivered 10-12% growth for the last few years and when they were smaller, they grew at 20%, 30%, 50% or 100%. Now the world economy has never grown in double digits but these sectors have been growing in double digits for 20 years now. That clearly tells you that if you are comparative, when a country like India grows, exports grow by market share gains and not due to world economy growing.

We are actually at a very interesting point of time because China is losing competitiveness in manufacturing, Chinese manufacturing wages are 1.5 to 2 times of India and for the first time in my career, when I talk to companies in chemicals or in other areas, they feel that their comparativeness versus Chinese companies is quite good after almost two decades.

2020 could turn out to be India's year: Prashant Jain

ET Now | Updated: Mar 9, 2020, 04.58 PM IST

There is deep value in market after 16-17 years: Prashant Jain

Do you think there is a buying opportunity now?

The valuations have been good for some time and the challenges that markets were facing was that certain stocks kept on becoming more expensive and what was cheap kept on becoming cheaper. I have experienced in my career thrice that every trend breaks only in a market downturn and in a way, sanity returned to markets after such corrections. Over the weekend, several things have improved for India and it is a good coincidence that all of it happened in a matter of days.

One, the BPCL EOI has come and that represents a very strategic shift from divestment through ETFs or OFS. The primary focus is now through strategic sales and that means you will get a better value and there will be open offers of fairly large amounts. That is a very important shift. Crude prices have come down which is always good for India. They may bounce back but for the time being, for the foreseeable future they should remain low.

Global yields have moved lower because of coronavirus. The fall in crude will also help that to some extent and India at this point of time can do with lower interest rates. It will help in reviving economic growth. The YES Bank issue has been settled. That was a big overhang on the markets and the way Vodafone has communicated to their assessment of the AGR liability and Bharti has also done the same, even the AGR issue is likely to get resolved in the foreseeable future.

So five very positive developments in this market and valuations were cheap in aggregate as well. There is value to deep value in certain large sections of the market. I feel quite optimistic about these markets.

I will talk about all the factors one by one but first let us understand the pace and intensity of the selling. It reminds us of 2008. 2008 is when crude fell, US equities fell, there was a financial crisis. How does one understand the lay of the land because growth is going to be precious and many experts are saying this will be a washout year for the global economy?

In a way it could be India’s year because what India really needs from the outside world is lower interest rates and lower oil prices. These are two things that India needs -- capital and oil and both are very cheap. I do not think the external environment could have been more conducive than this for India.

India’s growth as it comes back will stand out in this slow growth world. The government has done a lot by way of giving tax breaks to new manufacturing units. A 15% tax break and a tax holiday for infra investments by sovereign wealth funds. India should get reasonably large amounts of capital because India represents a large economy and it is an island of growth in the current environment. Even in the past, whenever there have been challenges outside India, it has led to short term corrections in the market. But it has not impacted the underlying economic growth whether it was 9/11, whether it was Lehman crisis, the taper tantrum, Brexit or the Asian crisis. On each of these occasions, if you invested in India, these were good opportunities to invest. I see no challenges whatsoever in the external environment.

In fact, it is a myth and a wrong notion that India needs high GDP growth for exports to grow. India’s share of world exports is miniscule -- 1%-2%. So for a country like India, 80-90% growth is delivered due to market share gains and not due to the world economy growing and we can look at what has happened in the IT industry or in the pharmaceutical generics industry.

These industries have delivered 10-12% growth for the last few years and when they were smaller, they grew at 20%, 30%, 50% or 100%. Now the world economy has never grown in double digits but these sectors have been growing in double digits for 20 years now. That clearly tells you that if you are comparative, when a country like India grows, exports grow by market share gains and not due to world economy growing.

We are actually at a very interesting point of time because China is losing competitiveness in manufacturing, Chinese manufacturing wages are 1.5 to 2 times of India and for the first time in my career, when I talk to companies in chemicals or in other areas, they feel that their comparativeness versus Chinese companies is quite good after almost two decades.

Given the fact that we are comparative, given the fact that India is a very large economy and given the fact that we have given a very concessional tax rate for new manufacturing units and given the outcome of the coronavirus which will highlight the excessive dependency of global multinationals on a single country supply chain, India should gain meaningfully in manufacturing and in the next few years, we should improve our share in global manufacturing significantly.

What we have seen in the last 10 years is that liquidity has been abundant where you feel very few companies have been growing and concentrated money has moved there. If your view of the world is dim and if your view of liquidity is strong, what stops more money moving into those 10, 15, 25 stocks yes they were expensive but they could become more expensive, they may not come back to deep value and what is going higher may continue to go higher?

So it is possible and that is what has happened for th last several years but there are no experiences that I have where the markets have continued to be less fundamental driven over long periods of time. Let me give you a few examples here. Look at the pharmaceutical sector. It is down 70% and everyone thought it is a consensus buy these are great companies, these were great companies but why did the sector corrects 70%. Look at several auto ancillaries, look at several automobile companies they have corrected meaningfully because eventually the results disappointed and this developments around Yes Bank have implications for stock markets as well as going beyond Yes Bank and State Bank.

This is what I have always said that banking has two sides to it. One is the asset quality side and the other is the liability side. You have seen serious dislocations in the NBFC space and this has implications for the smaller banks as well. You cannot disregard the liability franchise of banks because that gives you real competitive advantage. This event will bring some balance in the market's expectations on how to value businesses that have very strong liability franchises and the others who are yet to develop that franchise.

The way YES Bank has been handled from the market standpoint, do you think that overhang is over? I am not getting into why and how, not specific of stocks but really as an investor. How would you view the rescue plan?

The challenge with commenting on a situation like this is that we have opinions and impressions but we really do not know what were all the constraints. I am sure the regulator has applied their mind to the various aspects and they found this to be the best solution. The market was fearing that this bank will get merged into someone else and that is not likely to happen.

SBI chairman has clearly said that and what has come at Rs 2,500 crore market cap and with very strong institutions behind it, this bank should survive. I do not think anyone who puts in capital at this juncture is likely to lose money in this but that is my opinion.

You have gone on record saying that you are now finding deep value in this market. You are using the word deep value perhaps after a gap of three and a half to four years and you have said that value is deep like 2001, 2002 when market conditions were very depressed. Where are these pockets of deep value? Would value investing work in this kind of environment?

Earlier, I used to say that there is good value but deep value is coming after 16-17 years.

I have never seen you use the word deep value…

I think deep value has come. We experienced deep values in early 2000s when the whole world was focussed on tech. Anything non-tech was dirt cheap and in a way, this reminds you of those times because then crude oil was $10 and ONGC price was extremely low. Today crude has fallen to $40 odd after 20 years.

There is deep value in this market for sure and deep value adjusts in utilities. I am finding such deep value in utilities for the first time in two decades or more than that. Please remember that the same utilities were valued at up to four time price to book 11 years back and then consumer companies were cheaper than the utilities.

The utilities in India are not utilities in the strict sense, they represent growing businesses. In February, the power demand growth was 7%, peak demand grew by 9%. India should experience high single digit growth in power consumption for a very long period of time. Utilities in India are growth businesses because their P&Ls are quite regulated. You have long years of visibility. They are large businesses. They are dominant businesses and they are growth businesses. They are trading around book value, below book values. You can buy them at dividend yields which are equal to or more than the bond yields.

If you can buy a large growing business with very limited balance sheet or operational risks, at dividends yields which are equal to or more than bond yields, that is a very clear evidence in my judgement that there is deep value in these stocks. Apart from this, there is value in certain large corporate banks both public and private sector. Events like this will highlight the risk of smaller players in the same industry and I have always said that focus is on the leaders in any given industry whether the industry is large or small. So even in oil companies, there is deep value now. There is good value in banks.

I find very good value now even in several EPC construction and infrastructure companies. Anything other than those directly or indirectly related to consumption is good to deep value -- that is how I would put it.

You are making a case that we are in the kind of market that we saw between 2003 and 2008 where oil, commodities, construction, sectors and companies which started the cyclical upturn will start making a comeback.

We are very close to that kind of situation. Those days we saw a very sharp increase in capex. I do not know whether we will see that kind of an increase but directionally I would say we are in a very similar situation.

I look forward to the next few years with a great degree of optimism and confidence, not just for the economy, not just for the profits but even for the stock markets.

The difference between 2003 and 2020 is that China emerged as a big guzzler. Their appetite suddenly was insatiable for 10-15 years. Where will this appetite and local risk come from? Corporates right now do not have the appetite or the money. You do not have a large global economy which in a sense will do all the heavy lifting.

The only impact of China in that period was the sharp uplift in commodity prices. That is what happened and crude prices moved up from $10 to above $100 in 8-year period and metal prices also moved up. That could have led to some capex on the metals side in India. But for that, these are very similar situations. But if commodity prices go up, it is a mixed blessing for India.

While it is good for the steel sector, it is very negative for the country as a whole. I do not think we are worse off. I would say that if commodity prices do not go up, if Chinese growth is not very healthy, it is probably a better situation for us because oil is hard cash for India and if oil prices remain low, it is extremely positive for us.

We saw a similar selloff in crude in 2015-16 and that time, inflation got crushed and first we celebrated the decline in crude. Then we realised because crude inflation has got crushed, pricing power also got crushed and it took almost three years before pricing power made a comeback. Could we go through that patch where oil on paper coming down is great but that will also bring other commodities’ pricing power down?

One, commodity by definition, does not have pricing power. Two, crude is a very tough call to take because while on one side, electrification of the automobile sector is likely and crude oil demand could grow at moderate levels, what low crude oil prices does to supply end to investments in new oil capacity also cannot be ignored because the natural decline in oil varies from 3% to 20% and $45 of oil price very few companies would engage in long gestation capital intensive projects.

I would not venture to say how crude oil prices will behave in the medium to long term. Very low oil prices are also not good because if oil prices remain very low, it can lead to some supply disruption and that can lead to a spike. What would be good from an Indian point of view is if oil remains around $60-70. At those price points, everyone makes money. Shale oil makes money, Canadian Oil Sands make money, deep oil makes money. So the supply does not get disrupted. Regarding pricing power coming back, we should let just the regulators, the central banks worry about the core inflation -- whether it is in the US or India.

The spikes in inflation or sharp falls in inflation around vegetable prices or energy prices are rightly ignored or given less importance by the central banks.

The price action is similar to what we saw in 2008. What is fundamentally different about the world? Why should investors not panic and buy this fall?

I would say these markets are actually better than 2008 and I will tell you why. Pre fall in 2008, India’s market cap to GDP was bordering 150% and now markets bottomed out around 55-60% of GDP after a 50% fall. Those times the leverage was extremely high in the system and we were in the very early stages of NPA cycle. The crude oil prices were also extremely high before they cracked. Today, we are at the other end; the market cap to GDP is close to the bottom of the markets after 2008, our market cap to GDP is at very low levels. Our earnings cycle, our profits to GDP was at near peak in those times and now the bottom has been made probably last year.

Earnings are clearly recovering. Most people would agree that the corporate NPAs are now behind us. I do not have to say let us wait for two more quarters. They are truly and firmly behind us and we will look at next year as a year of completely normal profits for the large corporate banks. Growth in India has bottomed out.

Last year, growth was artificially depressed to my mind due to the sharp fall in production in automobiles because of the pipeline correction due to the move to Euro VI norms. The existing pipelines had to be run dry. Auto is about 5% of GDP in India. When the production falls 20%, that is a minus 1% headwind to the GDP. Now next year, even if production remains flat, that minus 1% is missing. I think the GDP growth should be better in the current year. IBC is truly behind us and we are seeing very good resolutions in the power sector. Several have been announced, several are works in progress. The availability of a large number of assets in capital intensive businesses like power and steel also hindered new capex because when existing assets are available at half the value, why should someone put out a new plant? Even that part is behind us and the last bit is very interesting.

The tax holiday which is available to new manufacturing units is only for a three year period. The tax break for sovereign wealth funds in infra investments is only for four years. These are limited period holidays and because of this, there will be a sense of urgency in global multinationals wanting to set up manufacturing units in India. Also, the India infra readymade assets compared to the current prevailing low interest rates in the world will make very attractive investments.

I feel quite optimistic about the next few years. In the last few years, we have handled a large number of challenges, a large number of difficult reforms are now behind us and I feel the leverage is low. The NPA cycle is behind us, interest rates are low, our foreign exchange reserves are touching $500 billion. I look forward to the next few years with a great degree of optimism and confidence, not just for the economy, not just for the profits but even for the stock markets.

In your assessment, if interest rates remain low and if crude prices decline, then indirectly Indian consumers will have more money to spend. Where does consumer, consumer discretionary, consumer durable and demand fit in?

This is an opportunity for the government to probably increase tax collections around crude because crude prices may not remain low for very long periods and therefore either through customs duties or excise duties there is a possibility that the government would like to consider share some gains with the consumers but please remember the fiscal deficits are also tight. The government is relying on asset sales to fund investments in infrastructure.

Part of these gains should be rightfully to the government exchequer and that would help interest rates to fall even more. This is good for everyone. Consumer discretionary is a long-term growth sector but my judgment is that in the near term, despite this fall in crude oil prices we may not look at a very sharp recovery because telecom prices have to go up and what crude will give, maybe the telecom sector will take away.

The pricing in the telecom sector had become so low that it was leading to unviability of businesses and in any case, even in a better environment, in the last couple of years, we have seen very moderate growth rates in the automobile sector. One trend which people have missed probably is the emergence of new consumption categories in the last two decades.

Re: Indian Economy News & Discussion - Nov 27 2017

Deposit insurance is offered when the bank fails . Keeping the bank running by consequence keeps the deposits as they are . The government just impost a temporary withdrawal moratorium to prevent a run on the bank. The government doesn’t want to see Yes Bank collapse . Bank failures are the last thing a government likes in general because of contagion risk.V_Raman wrote:but that is backend correct? why protect deposits >5L for customer withdrawals?

Yes Bank UPI data is widely available . For example in Feb they handled 500-550M of 1.3 billion transactions. They’ve consistently accounted for 35-50% of transaction volume for quite some time now, typically with PayTm bank in second place.

Re: Indian Economy News & Discussion - Nov 27 2017

That's right PhonePe is big part of the UPI payment infrastructure but in 36hrs they shifted to ICICI bank back-end.Suraj wrote: Yes Bank UPI data is widely available . For example in Feb they handled 500-550M of 1.3 billion transactions. They’ve consistently accounted for 35-50% of transaction volume for quite some time now, typically with PayTm bank in second place.

https://www.moneycontrol.com/news/busin ... 15451.html

Re: Indian Economy News & Discussion - Nov 27 2017

Normally Gold price increases when stocks are falling. But this time it is reverse. Is it because China stopping gold imports?

Re: Indian Economy News & Discussion - Nov 27 2017

Isn't that some what a low limit? May be it is the optimal point where not too many depositors loose too much of money yet risk of inflation is reduced.Suraj wrote:As of Budget 2020-21, the DICGC insures deposits up to the limit of Rs.5 lakh (across all accounts in a single bank).

Re: Indian Economy News & Discussion - Nov 27 2017

So it is nationalization due to greed/incompetence/cronyism of the private banks. PS banks are known to be poor in customer service.Yagnasri wrote:The PSU Bank which takes over the private bank many times get huge assets and running branches which will help her to expand.

Re: Indian Economy News & Discussion - Nov 27 2017

When you have a run on multiple banks, inflation is usually not the prevailing macroeconomic condition - deflation is.Vayutuvan wrote:Isn't that some what a low limit? May be it is the optimal point where not too many depositors loose too much of money yet risk of inflation is reduced.Suraj wrote:As of Budget 2020-21, the DICGC insures deposits up to the limit of Rs.5 lakh (across all accounts in a single bank).

Re: Indian Economy News & Discussion - Nov 27 2017

^ the finance minister, during her budget speech, mentioned some figures for bank deposits. I am not sure at all but i think it was over 90% of accounts having deposits under Rs 5 lakhs. Requesting if someone can post the figures

Re: Indian Economy News & Discussion - Nov 27 2017

Exports post first rise in 7 months, grow by 2.91% in February.

India's exports rose for the first time in seven months in February growing by 2.91 per cent to USD 27.65 billion, according to the commerce ministry data released on Friday.

Imports too grew by 2.48 per cent to USD 37.5 billion, leaving a trade deficit of USD 9.85 billion as against USD 9.72 billion in February 2019.

Oil imports jumped by 14.26 per cent to USD 10.76 billion in February compared to 9.41 billion in the year-ago month.

Exports during April-February this fiscal dipped by 1.5 per cent to USD 292.91 billion.Imports during the period declined by 7.30 per cent to USD 436 billion, leaving a trade deficit of USD 143.12 billion

India's exports rose for the first time in seven months in February growing by 2.91 per cent to USD 27.65 billion, according to the commerce ministry data released on Friday.

Imports too grew by 2.48 per cent to USD 37.5 billion, leaving a trade deficit of USD 9.85 billion as against USD 9.72 billion in February 2019.

Oil imports jumped by 14.26 per cent to USD 10.76 billion in February compared to 9.41 billion in the year-ago month.

Exports during April-February this fiscal dipped by 1.5 per cent to USD 292.91 billion.Imports during the period declined by 7.30 per cent to USD 436 billion, leaving a trade deficit of USD 143.12 billion

Re: Indian Economy News & Discussion - Nov 27 2017

Cleaning up Mahathir's mess

‘We’ll buy your sugar, please buy our palm oil,’ new PM of Malaysia goes all out to placate India

‘We’ll buy your sugar, please buy our palm oil,’ new PM of Malaysia goes all out to placate India

12 March 2020

In a sign of things to come, India’s exports of sugar to Malaysia so have nearly tripled over the 2019 figure despite it being less than 3 months into 2020. The Muhyiddin government is trying to placate India as Mahathir’s relentless anti-India propaganda resulted in a spat in terms of trade relations wherein India dramatically reduced Malaysia’s palm oil exports.

In the first three months of 2020, Malaysia has imported 324,405 tonnes of sugar from India compared to around 110,000 tonnes in 2019. It is estimated that Malaysia’s raw sugar purchases this year will surpass 400,000 tonnes.

Globally, the European Union is also planning to phase out palm oil by 2030 as there are growing concerns over its impact on the environment as Malaysia finds itself caught in the crossfire between the US-China trade war as two of its biggest trade partners engage in a tariff war.

Clearly, antagonising India was not wise, and India’s aggressive approach to curb trade had not been anticipated by Malaysia. India’s tactic with Mahathir is turning out to be successful, and will define how India behaves with its detractors in the future.

Re: Indian Economy News & Discussion - Nov 27 2017

https://economictimes.indiatimes.com/ne ... 634634.cms

“A final example relates to the civil services reform. Prime Minister Modi has pushed for lateral entry at the top levels of the bureaucracy for several years. But going by publicly available information, it is a reasonable conclusion that bureaucracy slowed down the process to such a degree that it was only at the very end of his term that nine officers could be inducted from outside,” says Panagariya, who returned to academia and is a professor of economics at Columbia University. “Civil services in India pick up many among these youngsters (taught by Leftleaning faculties) at an early age. Once inside the government, they find themselves safely in the company of others like them for the remainder of their professional lives,” he says.

Re: Indian Economy News & Discussion - Nov 27 2017

Probably this is a good time to promote SAY NO TO MADE IN CHINA. I dare say it will catch on quickly.

Re: Indian Economy News & Discussion - Nov 27 2017

That’s from a consumer viewpoint . A bigger picture is pushing Make in India more as a sourcing diversification choice for the global supply chain that’s basically been reset by this event .kit wrote:Probably this is a good time to promote SAY NO TO MADE IN CHINA. I dare say it will catch on quickly.

Re: Indian Economy News & Discussion - Nov 27 2017

With the WFH being the new norm, TCS alone has ordered 2+lakh laptop, all coming from China; CTS another 1+ lakh, add Wipro, Infy and rest of the IT behemoths and China is laughing all the way to bank.

Add the biffed up routers, dongles and new phone handsets required for WFH and we alone are taking care of all their export slacks due to WuhanVirus!!!

Add the biffed up routers, dongles and new phone handsets required for WFH and we alone are taking care of all their export slacks due to WuhanVirus!!!