Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

Very interesting focus on the economy - at different levels, economy and then the genesis of it. They look at both Global economy and India.

https://www.youtube.com/watch?v=GTmam9Q ... e=youtu.be

This second video talks about why India needs home grown economists and not imported technocrats with imported ideas. Am enjoying this series of unknowns. The same applies to ideas of development which have brought more chaos than improvement to India.

https://www.youtube.com/watch?v=g5edoVLiqQM&t=320s

https://www.youtube.com/watch?v=GTmam9Q ... e=youtu.be

This second video talks about why India needs home grown economists and not imported technocrats with imported ideas. Am enjoying this series of unknowns. The same applies to ideas of development which have brought more chaos than improvement to India.

https://www.youtube.com/watch?v=g5edoVLiqQM&t=320s

Last edited by Jarita on 04 Aug 2020 03:30, edited 1 time in total.

Re: Indian Economy News & Discussion - Nov 27 2017

On the topic of manufacturing of "Smart TVs" by local companies.

This one is an interesting success story, we need more entrepreneurs like him.

Next step is to build own deshi brand (instead of riding on a firingi brand // though the brands Kodak & Thompson both are legendary on their own space, no doubt on that) & content localisation for the TV electronics. Hopefully with the new import licence era and on going review of misuused FTAs with Asean countries, the entrepreneurs like them will get confidence to invest more and scale up.

How the Rs-220-Cr local TV brand Super Plastronics won over Kodak TV

3rd Jan 2018

Everyone remembers Kodak, whose image technologies dominated 90 percent of the photographic film, and 85 percent of the camera market. In India, everyone has that special ‘Kodak moment’, where you had to travel with a Kodak camera, and film to bring memories back home. Over the last decade, however, Kodak’s 100-year history did not help as the company saw a decline in revenues, and it filed for bankruptcy in 2012. It is now just about getting back on its feet, with R&D focusing on the future of digital imaging.

Its revival, though, is being led from India, after the company licensed its image technology for televisions to a medium-sized business called Super Plastronics Pvt Ltd. This is how Kodak began turning the corner in a market where it was non-existent.

Two years ago, Avneet Singh Marwah was wondering how his father’s two-decade-old contract manufacturing company could scale up. He had two options - the first was to maintain Super Plastronics’ deep relationships with brands such as Intex, T-Series, and Zebronics, and continue working with them to design TVs.

The second option was to build the company’s local portfolio of brands, like Beltek and Crown. Avneet soon realised that both were ideas that could not scale beyond the Rs 220 crore revenue that the company had generated last year. At best, the business would grow in high single digits.

The deal “I travelled to the US to look at a few tie-ups. Nothing worked because the agreements were too one-sided. In early 2016, I found out through a contact in the industry that Kodak wanted to license its TV technology to partners,” says Avneet, who is the CEO of Super Plastronics. He travelled to Rochester, and presented before Kodak’s senior team that the brand would sell very well in India. “At first, they did not believe it because they knew that brand was known for cameras, not TVs, in this country,” he says.

Avneet, however, left his card on the table and invited them to check out his set up in India. In a month’s time, a team from Kodak had checked upon Avneet’s credentials. The team believed it could be on to something good because of the market size, and growing consumption.

“I think they liked the deal because it would revive the brand name,” he says. Kodak and Super Plastronics signed a deal by mid-2016, and Avneet wasted no time in building a supply line for Kodak TVs. He also signed on Flipkart to sell the TVs.

Read Full Story Here//

https://yourstory.com/2018/01/rs-220-cr ... ype=scroll

Few More Articles on success story of this brand

How SPPL is using nostalgia and word of mouth marketing to ship Kodak smart TVs to 18,000 pin codes in India

By Saurabh Singh | Published: March 16, 2020 6:25 PM

https://www.financialexpress.com/indust ... a/1899715/

Brand licensee of Kodak and Thomson TV in India eyes Rs 500 cr revenue this year

Varun JainET Retail October 30, 2018, 11:45 IST

https://retail.economictimes.indiatimes ... r/66426248

Super Plastronics Aims To Become India's Leading EMS of Consumer Electronics

https://www.entrepreneur.com/article/346934

This one is an interesting success story, we need more entrepreneurs like him.

Next step is to build own deshi brand (instead of riding on a firingi brand // though the brands Kodak & Thompson both are legendary on their own space, no doubt on that) & content localisation for the TV electronics. Hopefully with the new import licence era and on going review of misuused FTAs with Asean countries, the entrepreneurs like them will get confidence to invest more and scale up.

How the Rs-220-Cr local TV brand Super Plastronics won over Kodak TV

3rd Jan 2018

Everyone remembers Kodak, whose image technologies dominated 90 percent of the photographic film, and 85 percent of the camera market. In India, everyone has that special ‘Kodak moment’, where you had to travel with a Kodak camera, and film to bring memories back home. Over the last decade, however, Kodak’s 100-year history did not help as the company saw a decline in revenues, and it filed for bankruptcy in 2012. It is now just about getting back on its feet, with R&D focusing on the future of digital imaging.

Its revival, though, is being led from India, after the company licensed its image technology for televisions to a medium-sized business called Super Plastronics Pvt Ltd. This is how Kodak began turning the corner in a market where it was non-existent.

Two years ago, Avneet Singh Marwah was wondering how his father’s two-decade-old contract manufacturing company could scale up. He had two options - the first was to maintain Super Plastronics’ deep relationships with brands such as Intex, T-Series, and Zebronics, and continue working with them to design TVs.

The second option was to build the company’s local portfolio of brands, like Beltek and Crown. Avneet soon realised that both were ideas that could not scale beyond the Rs 220 crore revenue that the company had generated last year. At best, the business would grow in high single digits.

The deal “I travelled to the US to look at a few tie-ups. Nothing worked because the agreements were too one-sided. In early 2016, I found out through a contact in the industry that Kodak wanted to license its TV technology to partners,” says Avneet, who is the CEO of Super Plastronics. He travelled to Rochester, and presented before Kodak’s senior team that the brand would sell very well in India. “At first, they did not believe it because they knew that brand was known for cameras, not TVs, in this country,” he says.

Avneet, however, left his card on the table and invited them to check out his set up in India. In a month’s time, a team from Kodak had checked upon Avneet’s credentials. The team believed it could be on to something good because of the market size, and growing consumption.

“I think they liked the deal because it would revive the brand name,” he says. Kodak and Super Plastronics signed a deal by mid-2016, and Avneet wasted no time in building a supply line for Kodak TVs. He also signed on Flipkart to sell the TVs.

Read Full Story Here//

https://yourstory.com/2018/01/rs-220-cr ... ype=scroll

Few More Articles on success story of this brand

How SPPL is using nostalgia and word of mouth marketing to ship Kodak smart TVs to 18,000 pin codes in India

By Saurabh Singh | Published: March 16, 2020 6:25 PM

https://www.financialexpress.com/indust ... a/1899715/

Brand licensee of Kodak and Thomson TV in India eyes Rs 500 cr revenue this year

Varun JainET Retail October 30, 2018, 11:45 IST

https://retail.economictimes.indiatimes ... r/66426248

Super Plastronics Aims To Become India's Leading EMS of Consumer Electronics

https://www.entrepreneur.com/article/346934

Re: Indian Economy News & Discussion - Nov 27 2017

PMJDY Report Card: 400 million bank accounts added in 5 years

Power consumption slump narrows to 2.64% in July; Likely to hit normal level in August

PMJDY also provides a picture of financial savings at the bottom of the economic pyramid. Right now, Rs.1.3 lakh crore across 40 crore accounts is Rs.3250 per account average. This gives the government a picture of how basic financial savings and wealth accumulation is evolving for the poor and lower middle class, giving them the ability to implement policy focussed upon increasing this baseline.Prime Minister Narendra Modi’s flagship programme – Jan Dhan Yojana – to make every citizen of the country avail a bank account, has been successful in attracting 40 crore people in the last six years. The Department of Financial Services today said that another milestone has been achieved under the world’s largest financial inclusion initiative and it is committed to taking financial inclusion to the last mile. Prime Minister Jan Dhan Yojana provided huge infrastructure support to the government in making schemes related to Direct benefit Transfers (DBT) meaningful. While PMJDY played a major role during demonetisation, it also acted as a lifeline recently during the coronavirus pandemic-led lockdown when the government transferred cash directly into the bank accounts of migrant labourers and poor sections of the society.

The bank accounts opened under the financial inclusion scheme have nearly Rs 1.3 lakh crore as deposits. The PMJDY was one of the earliest schemes launched after PM Modi sworn-in as the Prime Minister of the country in 2014. Launched on 28 August 2014, it was initially for a period of 4 years and envisaged universal access to banking facilities with at least one basic banking account for every household, financial literacy, access to credit, insurance, and pension.

Power consumption slump narrows to 2.64% in July; Likely to hit normal level in August

The slump in power consumption has narrowed to just 2.64 per cent in July at 113.48 billion units (BU) indicating spurt in economic activity and raised hopes that it would touch normal level this month. Power consumption in July last year was at 116.48 BU, as per power ministry data.

The government had imposed lockdown to contain COVID-19 on March 25, 2020 which affected commercial and industrial electricity demand as well as consumption.

Power consumption in June had declined 10.93 per cent to 105.08 BU, as compared to 117.98 BU a year ago.

Similarly, power consumption in the country was down by 14.86 per cent in May and 23.21 per cent April this year.

The months of April, May and June this year witnessed low power consumption on account of lower commercial and industrial activities due to COVID-19-related restrictions.

“The slump in power consumption has narrowed down considerably to 2.6 per cent. It is expected to be at normal level (what it was last year in same month) during August. There could be growth in power demand in coming days with expansion in economic activities,” an industry expert said.

Peak power demand met, the highest energy supply during the day across the country, was at 170.54 GW in July, down 2.61 per cent compared to 175.12 GW a year ago.

Re: Indian Economy News & Discussion - Nov 27 2017

UPI transactions hit a new high of 149 crore in July with transaction value reaching Rs 2.91 lakh crore

PTI Last Updated: Aug 03, 2020, 09:38 PM IST

New Delhi: The number of payments transacted on Unified Payments Interface (UPI) hit an all-time high of 149 crore (1.49 billion) in July this year, with the value of transactions reaching Rs 2.91 lakh crore, NPCI data showed.

The previous high was 134 crore (1.34 billion) transactions in the preceding month of June, while the value of transactions was Rs 2.61 lakh crore, as per the data from the National Payments Corporation of India (NPCI).

In July 2019, the number of UPI transactions stood at 82.23 crore, with cumulative value of Rs 1.46 lakh crore.

During the April-July period of 2020-21, the cumulative transactions on UPI reached 631 crore. The value transacted stood at Rs 6.31 lakh crore.

In fiscal year 2019-20, the number of UPI transactions was 1,252 crore (12.52 billion), while the value of payments was Rs 21.32 lakh crore.

NPCI was incorporated in 2008 as an umbrella organisation for operating retail payments and settlement systems in India.

It facilitates payments through a bouquet of retail payment products such as RuPay Card, Immediate Payment Service (IMPS), UPI, Bharat Interface for Money (BHIM), BHIM Aadhaar, National Electronic Toll Collection (NETC Fastag) and Bharat BillPay.

https://economictimes.indiatimes.com/in ... content=23

I guess in absence of UPI a major portion of those transactions would have routed through VISA/MasterCard network & even with small MDR still they would have made a respectable cut out of it.

More power to UPI, more power to RuPay

PTI Last Updated: Aug 03, 2020, 09:38 PM IST

New Delhi: The number of payments transacted on Unified Payments Interface (UPI) hit an all-time high of 149 crore (1.49 billion) in July this year, with the value of transactions reaching Rs 2.91 lakh crore, NPCI data showed.

The previous high was 134 crore (1.34 billion) transactions in the preceding month of June, while the value of transactions was Rs 2.61 lakh crore, as per the data from the National Payments Corporation of India (NPCI).

In July 2019, the number of UPI transactions stood at 82.23 crore, with cumulative value of Rs 1.46 lakh crore.

During the April-July period of 2020-21, the cumulative transactions on UPI reached 631 crore. The value transacted stood at Rs 6.31 lakh crore.

In fiscal year 2019-20, the number of UPI transactions was 1,252 crore (12.52 billion), while the value of payments was Rs 21.32 lakh crore.

NPCI was incorporated in 2008 as an umbrella organisation for operating retail payments and settlement systems in India.

It facilitates payments through a bouquet of retail payment products such as RuPay Card, Immediate Payment Service (IMPS), UPI, Bharat Interface for Money (BHIM), BHIM Aadhaar, National Electronic Toll Collection (NETC Fastag) and Bharat BillPay.

https://economictimes.indiatimes.com/in ... content=23

July with transaction value reaching Rs 2.91 lakh crore

Just see those big figures & imagine, how much money US giants VISA/MasterCard etc losing due to our home grown baby.In fiscal year 2019-20, the number of UPI transactions was 1,252 crore (12.52 billion), while the value of payments was Rs 21.32 lakh crore.

I guess in absence of UPI a major portion of those transactions would have routed through VISA/MasterCard network & even with small MDR still they would have made a respectable cut out of it.

More power to UPI, more power to RuPay

Re: Indian Economy News & Discussion - Nov 27 2017

I regularly use BHIM app to transfer funds. It is quite good. Much better than mobile banking offered by all banks. The only probelm is the limit of Rs. 40,000/- per day. But it is ok to have such safty features. Most of my needs are done within that daily limit anyway.

-

nishant.gupta

- BRFite -Trainee

- Posts: 70

- Joined: 01 Mar 2019 15:04

Re: Indian Economy News & Discussion - Nov 27 2017

Really amazing read. And they have doubled the size of original business in 3 years.Mollick.R wrote:On the topic of manufacturing of "Smart TVs" by local companies.

Apart from SPPL, the article also speaks about another brand called Daiwa.

One thing which made me feel sad is that neither of the brand has its R&D in India. SPPL is using Kodak tech and Daiwa has its R&D in China.Another TV company was born around the same time frame as Kodak’s release in India, and Delhi-based Daiwa is also looking to break the myth that the best products come at a hefty price. Daiwa prides itself on offering state-of-the-art technology at low price points, and its products are completely designed and manufactured in India. A reason why Daiwa’s TVs are best sellers could be that they are up to 50 percent cheaper than products offered by big brands, and come with the same technology. For instance, Daiwa offers 1GB RAM, and 8GB internal memory for its TVs, which is higher than the 512 MB RAM offered by other companies in India.

Read more at: https://yourstory.com/2018/01/rs-220-cr ... ype=scroll

Re: Indian Economy News & Discussion - Nov 27 2017

Eye on China, India looks to increase barriers on imports from Asia

Reuters Last Updated: Aug 04, 2020, 09:42 AM IST

NEW DELHI: New Delhi is considering measures to prevent trade partners mainly in Southeast Asia from re-routing Chinese goods to India with little added value, two government sources said,..................

.

.

India is planning to raise quality standards of imports, impose quantity restrictions, mandate stringent disclosure norms and initiate more frequent checks at ports of entry for goods coming from many Asian countries, the officials said,...............

.

.

The moves will mainly target imports of base metals, electronic components for laptops and mobile phones, furniture, leather goods, toys, rubber, textiles, air conditioners and televisions, among other items, the officials said.

.

.

The moves are expected to primarily hurt Malaysia, Thailand, Vietnam and Singapore - members of the Association of Southeast Asian Nations (ASEAN) with which India has a free trade agreement (FTA). India is also worried about heavy trade flows from South Korea.

"Raising duties has a limited impact," said one of the officials. "Now we want to raise quality standards and also make sure that goods in FTA routes have roots in those countries.

.

.

The government will also discuss raising the value-addition requirement for products imported from those countries from the current level of 20%-40%, the official said, adding FTAs could be reviewed too.

"A lot of the Asian partners have become a place from where just Chinese goods are routed. We are going product by product to design various kinds of action, most of which will be on non-tariff lines," the official added.

.

.

.

"Very clearly in ASEAN agreements India has got, in many respects, the bad end of the stick, particularly in the field of electronics where we now find a number of products are being routed through the ASEAN economies to India," said George Paul, CEO of the Manufacturers' Association for Information Technology.

Read Full Article Here// Economic Times Link..........

https://economictimes.indiatimes.com/ne ... 335687.cms

Reuters Last Updated: Aug 04, 2020, 09:42 AM IST

NEW DELHI: New Delhi is considering measures to prevent trade partners mainly in Southeast Asia from re-routing Chinese goods to India with little added value, two government sources said,..................

.

.

India is planning to raise quality standards of imports, impose quantity restrictions, mandate stringent disclosure norms and initiate more frequent checks at ports of entry for goods coming from many Asian countries, the officials said,...............

.

.

The moves will mainly target imports of base metals, electronic components for laptops and mobile phones, furniture, leather goods, toys, rubber, textiles, air conditioners and televisions, among other items, the officials said.

.

.

The moves are expected to primarily hurt Malaysia, Thailand, Vietnam and Singapore - members of the Association of Southeast Asian Nations (ASEAN) with which India has a free trade agreement (FTA). India is also worried about heavy trade flows from South Korea.

"Raising duties has a limited impact," said one of the officials. "Now we want to raise quality standards and also make sure that goods in FTA routes have roots in those countries.

.

.

The government will also discuss raising the value-addition requirement for products imported from those countries from the current level of 20%-40%, the official said, adding FTAs could be reviewed too.

"A lot of the Asian partners have become a place from where just Chinese goods are routed. We are going product by product to design various kinds of action, most of which will be on non-tariff lines," the official added.

.

.

.

"Very clearly in ASEAN agreements India has got, in many respects, the bad end of the stick, particularly in the field of electronics where we now find a number of products are being routed through the ASEAN economies to India," said George Paul, CEO of the Manufacturers' Association for Information Technology.

Read Full Article Here// Economic Times Link..........

https://economictimes.indiatimes.com/ne ... 335687.cms

Re: Indian Economy News & Discussion - Nov 27 2017

No, limit is 1 lakh per day. I guess your bank has put extra limitsYagnasri wrote:I regularly use BHIM app to transfer funds. It is quite good. Much better than mobile banking offered by all banks. The only probelm is the limit of Rs. 40,000/- per day. But it is ok to have such safty features. Most of my needs are done within that daily limit anyway.

Re: Indian Economy News & Discussion - Nov 27 2017

Unfortunately, RuPay has a limited reach.

GoI needs to do this.

Ask all online retailers/merchants to start accepting payments with RuPay debit/credit cards.

If they won't they must STFU and go elsewhere.

Desi or videsi doesn't matter.

GoI needs to do this.

Ask all online retailers/merchants to start accepting payments with RuPay debit/credit cards.

If they won't they must STFU and go elsewhere.

Desi or videsi doesn't matter.

Re: Indian Economy News & Discussion - Nov 27 2017

I'm surprised a time bound requirement to accept RuPay cards isn't already defined. It certainly should be done. What are the technical or other hurdles in the way of a new payment processor like RuPay being ubiquitous ?

Re: Indian Economy News & Discussion - Nov 27 2017

I use BHIM app without any mention to individual bank. May be my own bankers did something without any knowledge.isubodh wrote:No, limit is 1 lakh per day. I guess your bank has put extra limitsYagnasri wrote:I regularly use BHIM app to transfer funds. It is quite good. Much better than mobile banking offered by all banks. The only probelm is the limit of Rs. 40,000/- per day. But it is ok to have such safty features. Most of my needs are done within that daily limit anyway.

Re: Indian Economy News & Discussion - Nov 27 2017

Policies getting out of the way to ensure imports fall -

https://www.thehindubusinessline.com/co ... 265744.ece

Agarbatti makers are now sourcing bamboo locally instead of Vietnam and China.

https://www.thehindubusinessline.com/co ... 265744.ece

Agarbatti makers are now sourcing bamboo locally instead of Vietnam and China.

Re: Indian Economy News & Discussion - Nov 27 2017

@ nam saar, today's samachar. But i guess this will not benefit domestic companies in any way, as we don't have any domestic company worth of such calibre to begin with.nam wrote:I suggested this one of the earlier pages. All GoI needs to do is announce a order for 2-3B (or more) worth of tablets, that it intents to give to school kids. The rule being it should be produced by a Indian company which can do the maximum percentage of component production in India. As simple as that.hnair wrote:

What was surprising was the alacrity shown by Intel, a minority share holder via its Acceleron and USTechnologies (a Trivandrum based IT major and the majority shareholder in this venture), to join hands with state government's KELTRON. The reason for the interest was simple: Kerala Govt promised they will absorb most of the production for its departments and for all government run schools of Kerala for next five years, even if prices are higher than cheeni-assembled regular brands. The cheeni laptop assembly is ultra-cheap due to their scale, so much that any new brand assembling anywhere outside the cheeni-PLA eco-system will face a high-entry barrier of dirt cheap pricing and nano-margins. But even there, the risk for the private players was minimized a lot by the state govt buyback

Even a foreign company will be fine, as long as they are producing components locally.

Demand is what will drive local production. Large scale order is what is required.

1.78 lakh smartphones to be given to class 12 students by November: Punjab Cabinet

PTI Last Updated: Aug 05, 2020, 07:55 PM IST

Chandigarh: The Punjab Cabinet on Wednesday paved the way for distribution of 1.78 lakh smartphones to class 12 students of state government schools by November.

.

.

The phones will be equipped with various smart features such as touch screen, camera and pre-loaded government applications like 'e-Sewa App' with e-content related to class 11 and class 12, as approved by the department of school education.

Read Full Article Here// Economic Times Link

https://economictimes.indiatimes.com/ne ... 375542.cms

Re: Indian Economy News & Discussion - Nov 27 2017

Wasn't there a free tablet distribution done during UPA 2. It ended up buying a no-name Chini tablet that was then distributed to kids for free. The quality was pathetic and all those went to landfill eventually.

Found it, the Aakash tablet scam.

Here also the same zero loss guy.

Found it, the Aakash tablet scam.

Here also the same zero loss guy.

Re: Indian Economy News & Discussion - Nov 27 2017

I signed up for one of those tablets during that time. Only to find reviews slagging it and everyone unhappy.

Re: Indian Economy News & Discussion - Nov 27 2017

I am also a victim. Horrible one.

Re: Indian Economy News & Discussion - Nov 27 2017

^^^^^^^

But today, you need one to survive

But today, you need one to survive

Re: Indian Economy News & Discussion - Nov 27 2017

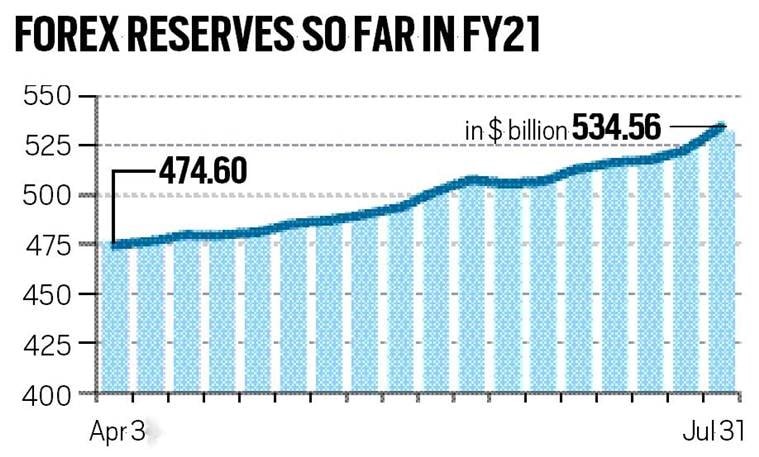

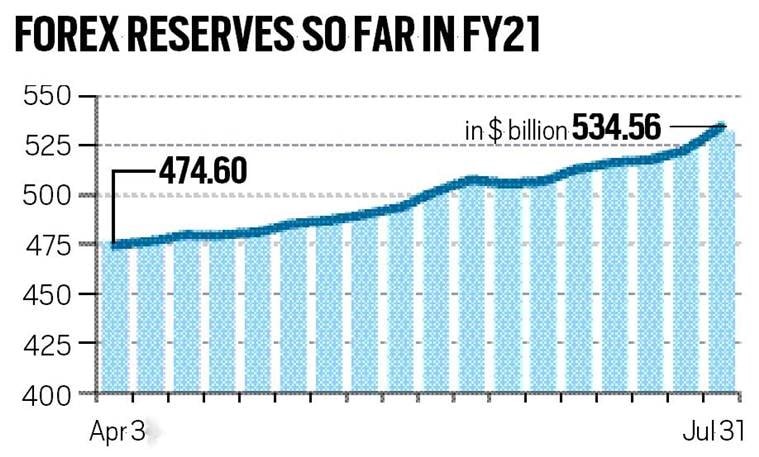

Changes to trade policy are also significantly cutting the merchandise trade deficit, which is showing up as billions in additional reserve accumulation every month.

Re: Indian Economy News & Discussion - Nov 27 2017

Suraj garu,

Are you on twitter?

=================

As per Piyush Goyalji, our July exports have reached almost to the level of last year. Link

--Vamsee

Are you on twitter?

=================

As per Piyush Goyalji, our July exports have reached almost to the level of last year. Link

"Our exports have almost reached last year's July level, with nearly 90% of our export of July 2019 having come back," Goyal said. “And, in fact, if we were to remove the oil-related exports, where we are largely a small value adder, we are 95% plus on the revival of our exports.”

--Vamsee

Re: Indian Economy News & Discussion - Nov 27 2017

At this run rate we should be overtaking Russia in the next 4-6 weeks as the 4th highest FE reserves in the world.Suraj wrote:I was about to post this myself. It looks like they’re in a hurry to get to $600 billion before Diwali.

Changes to trade policy are also significantly cutting the merchandise trade deficit, which is showing up as billions in additional reserve accumulation every month.

Re: Indian Economy News & Discussion - Nov 27 2017

How can we leverage them for better investment into manufacturing sector (Make in India)?Suraj wrote:I was about to post this myself. It looks like they’re in a hurry to get to $600 billion before Diwali.

Changes to trade policy are also significantly cutting the merchandise trade deficit, which is showing up as billions in additional reserve accumulation every month.

Last edited by vijayk on 07 Aug 2020 22:55, edited 1 time in total.

Re: Indian Economy News & Discussion - Nov 27 2017

Suraj Sir one question can we draw a preliminary assessment that this increase in FE on account of reduction in merchandise imports means greater domestic production and sale of equivalent domestically sourced merchandise ?

Re: Indian Economy News & Discussion - Nov 27 2017

Not directly, but a larger cushion of forex might provide more scope to the government to increase the spending on Infrastructure with deficit financing (the forex reserves can be used by the RBI to defend the exchange rate while we do that). Availability of all necessary infrastructure is crucial in making India a more attractive destination to set up greenfield manufacturing plants.vijayk wrote:How can we leverage them for better investment into manufacturing sector (Make in India)?Suraj wrote:I was about to post this myself. It looks like they’re in a hurry to get to $600 billion before Diwali.

Changes to trade policy are also significantly cutting the merchandise trade deficit, which is showing up as billions in additional reserve accumulation every month.

I am not an economics guru though, so Suraj saar please correct me if I'm wrong.

Re: Indian Economy News & Discussion - Nov 27 2017

#reform

Modi govt abolishes textile board with ‘activists’ and ‘experts’ pontificating, to get work done through institutes like NIFT instead

https://www.opindia.com/2020/08/modi-go ... re-is-why/

The Modi government has taken yet another step to make the government free from activists and experts who know how to pontificate without really making any impact on the ground. Just like the garden variety activist who pontificates about poverty in the slums while sitting in air-conditioned parties, the Handloom Board, which was abolished by a notification on the 27th of July, had ‘activists and experts’ who sat in Delhi, enjoying the social status of a prestigious position without really working with the weavers.

The move inspired some amount of outrage from expected quarters that wished to turn this into a move that supposedly hampered the growth of the industry and also the interests of the weavers. The loudest criticism came from ‘activist’ Laila Tyabji.

Re: Indian Economy News & Discussion - Nov 27 2017

It's more interesting what he doesn't mention - imports. Noticeable gains are coming from the gap between exports and imports dropping, or even moving to greater exports than imports, as happened recently after many years. It's very good to see GoI grabbing the opportunity to decimate high value imports of items that can be secured or produced domestically.Vamsee wrote:Suraj garu,

Are you on twitter?

=================

As per Piyush Goyalji, our July exports have reached almost to the level of last year. Link

--Vamsee"Our exports have almost reached last year's July level, with nearly 90% of our export of July 2019 having come back," Goyal said. “And, in fact, if we were to remove the oil-related exports, where we are largely a small value adder, we are 95% plus on the revival of our exports.”

Unlikely. They are up to $590 billion now. But it seems we'll get to $600 billion sooner than later. As they say, the first $100 billion is the hardest... my long term view remains that we'll may become only the third country in history to have $1 trillion plus reserves, around 2025 timeframe. The Swiss are pretty stable. The Russian forex reserve pile is subject to big boom and bust cycle, same as Saudi Arabia. And now we're a substantially bigger forex holder than all of the ASEAN/APEC tiger economies.Vips wrote:At this run rate we should be overtaking Russia in the next 4-6 weeks as the 4th highest FE reserves in the world.

vijayk wrote:How can we leverage them for better investment into manufacturing sector (Make in India)?

It's important to distinguish what constitutes forex reserves, as a NET item. Examples:suryag wrote:Suraj Sir one question can we draw a preliminary assessment that this increase in FE on account of reduction in merchandise imports means greater domestic production and sale of equivalent domestically sourced merchandise ?

* When some foreign mutual fund invests in Indian stocks, they constitute FPI inflows yes. But they also constitute short term "hot money" external debt, which can turn around and exit when market falls. Investments by pension funds may be more 'sticky' but still from an accounting perspective it's a dollar of forex reserves and of external debt, because we have an obligation to pay them back their dollars when they decide to stop investing.

* Even NRE deposits are the same, since they are repatriable - RBI accounts for a dollar of external debt liability for every $ held in these accounts too. Of course, the diaspora may be more patriotic and loyal and won't pull out all the money at once, but once again it's a $1 in both the + and - columns here.

* Remittances are more sticky, in that they usually constitute family maintenance money and it gets spent into the Indian economy. However, such people may still sell physical assets like property and choose to expatriate the earnings on sale, which is dollars leaving the reserves.

* Then you have the trade surplus or deficit. A trade surplus is liability free accumulation of hard currency and wealth. It's ideally the best form of forex reserve accumulation, because they are earnings and do not involve an associated liability. The Chinese and Japanese have been continuously running trade surpluses for decades, accumulating enormous amounts of wealth free and clear without an associated debt liability around it.

When you have a massive pile of reserves without any associated liability for each dollar as described above, then you have greater latitude to use it for many purposes, not to mention the absolute wealth gain for the domestic economy.

So yes, the government is using the chance to destroy the ecosystem of imported Chinese items , and build a local supply chain in its place. The best time to do it is when the general economy itself is paralyzed by Covid. Consumption of such imported items is down, local industry is down, so they can rebuild a MSME and larger local supply chain without much opposition. Even something like agarbattis have become a Rs.800 crore import bill from China. Rakhis reportedly were a Rs.4000 crore import bill from China. Those were sheer lunacy. We paid the equivalent of how many Rafales to pay for trinklets worn for 1-2 days, or burned up in smoke within minutes ?

One could indignantly say, well GoI could have fixed it much sooner. They could, but the argument does not appreciate the difficulty of implementing economic policy when an existing industrial base has already collapsed AND the population are inured to the imported item instead. People don't like to be denied something and told to wait for its replacement to be available at scale months later. To rebuild that industry requires the imports to be banned somehow, and doing so denies people their comforts. So the best time to implement this policy is... when there's a major pandemic, consumption of such trivial items has been heavily hit, and the previously destroyed MSMEs would benefit hugely from a revival package. The Chinese being stupid enough, did a Galwan to give GoI the political space to ban dozens of things while announcing a large stimulus to enable local industry to pick up the slack. That's what the Government is doing right now.

It's nice to see Goyal mention that we're running a surplus against non-oil imports. I'd like to see it improve further so we have a surplus against gross imports soon too. We import tens of billions from China that constitute everything from agarbattis, rakhis and sarees that we have NO business importing from them, to enormous multi-billion dollar quantities of pharma intermediaries, fertilizer raw material and other supplies we can quickly replace with domestic manufacturing. GoI has the economic and political space to do it now, and I'm glad to see that they're taking the opportunity very seriously.

Re: Indian Economy News & Discussion - Nov 27 2017

Thank you Suraj Sir, shocked to see Saris too  that is one sink of a money, SHQ has many Saris which are sitting there and the blouse doesnt fit her anymore. Not sure how many of them came from PRC but these are the kind of things like the 4k Rakhi line item i.e., something that is bought but never used and it is just a money sink.

that is one sink of a money, SHQ has many Saris which are sitting there and the blouse doesnt fit her anymore. Not sure how many of them came from PRC but these are the kind of things like the 4k Rakhi line item i.e., something that is bought but never used and it is just a money sink.

Re: Indian Economy News & Discussion - Nov 27 2017

Back in the days there's craze about Japanese saris when Japan was exporting all sorts of things. One can say that Indians prefer imports no matter what and for anything. From rulers to agarbatti's bamboo. May be even cow dung if that goes mainstream.

Re: Indian Economy News & Discussion - Nov 27 2017

Explained: Why are forex reserves shooting up when Indian economy is hit?

Covid-hit India’s foreign exchange reserves jumped by a record $11.9 billion in the week ending July 31 to hit a fresh high of $534.5 billion, making it the fifth largest holder of reserves in the world. During the 10-month period between September 27, 2019 and July 31, 2020, the foreign exchange reserves have swelled by $100 billion.

At a time when the economy is under stress and the growth is expected to contract in 2020-21, the rising forex reserves have come as a breather as it can cover India’s import bill of more than one year.

India’s foreign exchange reserves: How has the rise been?

The trend of rising foreign exchange reserves started after Finance Minister Nirmala Sitharaman announced a sharp cut in corporate tax rates on September 20, 2019. While investor sentiments turned weak after the budget announcement in July to impose higher surcharge, the government’s decision to reverse its budget decision relating to higher surcharge impact on FPIs along with a cut in the corporate tax rate in September played a significant role in turning the investors mood and draw them to invest in the Indian economy and markets.

Between September 20, 2019 and July 31, 2020, the reserves have grown by $106 billion and, since the beginning of April, it has grown by $60 billion. So, in ten months India has added 25 per cent of the reserves it had till September 20, 2019. India is now fifth in global ranking behind China ($ 3,298 billion), Japan ($ 1,383 billion), Switzerland ($ 896 billion) and Russia ($ 591 billion).

What has led to this rise in forex reserves?

The rise has been in several stages and has been led by different factors over the last ten months. Experts say that the rise in foreign exchange inflows through Foreign portfolio investment (FPI) and Foreign Direct Investment (FDI and has also been supported by decline in import bill over the last 4-5 months on account of dip in crude prices and trade impact following Covid-19 pandemic.

Some of the key factors include:

FPI inflows: While it started with a sharp rise in FPI inflows following the government’s decision in September to cut corporate tax rate. Between April and December 2019, FPIs pumped in a net $15.1 billion, according to the RB

Dip in crude oil prices: India’s oil import bill declined as the global spread of coronavirus since February 2020 not only roiled the stock markets but also led to a crash in the Brent crude oil prices. While crude accounts for almost 20 per cent of India’s total import bill, Brent crude oil prices fell to levels of $20 per barrel towards March end, it dropped further and traded between $9 and $20 in April. In January 2020, Brent crude was trading between $60 and $70 per barrel.

Import savings: Lockdown across countries in response to Covid-19 pandemic impacted global trade and has resulted in a sharp dip in import expenditure — electronics, gold and also crude oil prices among other

FDI inflows: Between September 2019 and March 2020 foreign direct investments stood at $23.88 billion and in April and May it amounted to $5.9 billion. Market experts say that a lot of FDI has also come in June and July too, especially the Rs 1 lakh crore plus investment by global tech giants in Jio Platforms. Thus FDI inflow has been a significant contributor to the rise in foreign exchange reserves.

Dip in gold imports: Gold which was a big import component for India witnessed a sharp decline in the quarter ended June 2020 following the high prices and the lockdown induced by the Covid-19 pandemic. According to the World Gold Council (WGC), gold imports plummeted by 95 per cent to 11.6 tonnes in the quarter as compared to 247.4 tonnes in the same period a year ago due to logistical issues and poor demand. The value of gold transacted during the June quarter fell to Rs 26,600 crore, down by 57 per cent as compared to Rs 62,420 crore a year ago, WGC said.

What does the rising forex reserves mean?

The rising forex reserves give a lot of comfort to the government and the Reserve Bank of India in managing India’s external and internal financial issues at a time when the economic growth is set to contract by 5.8 per cent in 2020-21. It’s a big cushion in the event of any crisis on the economic front and enough to cover the import bill of the country for a year. The rising reserves have also helped the rupee to strengthen against the dollar. The foreign exchange reserves to GDP ratio is around 15 per cent. Reserves will provide a level of confidence to markets that a country can meet its external obligations, demonstrate the backing of domestic currency by external assets, assist the government in meeting its foreign exchange needs and external debt obligations and maintain a reserve for national disasters or emergencies. “Adequate forex reserves should provide room for the RBI to cut rates and support recovery. We estimate that the RBI can sell $50 bn to defend the rupee in case of a speculative attack. Of note, RBI action to support growth should attract FPI equity flows,” says a Bank of America report.

What does the RBI do with the forex reserves?

The Reserve Bank functions as the custodian and manager of forex reserves, and operates within the overall policy framework agreed upon with the government. The RBI allocates the dollars for specific purposes. For example, under the Liberalised Remittances Scheme, individuals are allowed to remit up to $250,000 every year. The RBI uses its forex kitty for the orderly movement of the rupee. It sells the dollar when the rupee weakens and buys the dollar when the rupee strengthens. Of late, the RBI has been buying dollars from the market to shore up the forex reserves. When the RBI mops up dollars, it releases an equal amount in the rupees. This excess liquidity is sterilised through issue of bonds and securities and LAF operations to prevent a rise in inflation.

Are forex reserves giving returns to India?

Only gold reserves have given big returns to India. While the RBI has not disclosed the actual returns from forex reserves, experts estimate India is likely to get only negligible returns as interest rates in the US and Eurozone are around one per cent. On the contrary, India could be facing a cost to keep the reserves abroad. Out of the total foreign currency assets, as much as 59.7 per cent was invested in securities abroad, 33.37 per cent was deposited with other central banks of other countries and the BIS and the balance 7.06 per cent comprised deposits with commercial banks overseas as of March 2020. Further, as at end-March, 2020, the RBI held 653.01 tonnes of gold, with 360.71 tonnes being held overseas in safe custody with the Bank of England and the Bank for International Settlements, while the remaining gold is held domestically. With gold prices shooting up around 40 per cent to over Rs 55,000 per 10 grams this year, the value of gold holdings has shot up

Covid-hit India’s foreign exchange reserves jumped by a record $11.9 billion in the week ending July 31 to hit a fresh high of $534.5 billion, making it the fifth largest holder of reserves in the world. During the 10-month period between September 27, 2019 and July 31, 2020, the foreign exchange reserves have swelled by $100 billion.

At a time when the economy is under stress and the growth is expected to contract in 2020-21, the rising forex reserves have come as a breather as it can cover India’s import bill of more than one year.

India’s foreign exchange reserves: How has the rise been?

The trend of rising foreign exchange reserves started after Finance Minister Nirmala Sitharaman announced a sharp cut in corporate tax rates on September 20, 2019. While investor sentiments turned weak after the budget announcement in July to impose higher surcharge, the government’s decision to reverse its budget decision relating to higher surcharge impact on FPIs along with a cut in the corporate tax rate in September played a significant role in turning the investors mood and draw them to invest in the Indian economy and markets.

Between September 20, 2019 and July 31, 2020, the reserves have grown by $106 billion and, since the beginning of April, it has grown by $60 billion. So, in ten months India has added 25 per cent of the reserves it had till September 20, 2019. India is now fifth in global ranking behind China ($ 3,298 billion), Japan ($ 1,383 billion), Switzerland ($ 896 billion) and Russia ($ 591 billion).

What has led to this rise in forex reserves?

The rise has been in several stages and has been led by different factors over the last ten months. Experts say that the rise in foreign exchange inflows through Foreign portfolio investment (FPI) and Foreign Direct Investment (FDI and has also been supported by decline in import bill over the last 4-5 months on account of dip in crude prices and trade impact following Covid-19 pandemic.

Some of the key factors include:

FPI inflows: While it started with a sharp rise in FPI inflows following the government’s decision in September to cut corporate tax rate. Between April and December 2019, FPIs pumped in a net $15.1 billion, according to the RB

Dip in crude oil prices: India’s oil import bill declined as the global spread of coronavirus since February 2020 not only roiled the stock markets but also led to a crash in the Brent crude oil prices. While crude accounts for almost 20 per cent of India’s total import bill, Brent crude oil prices fell to levels of $20 per barrel towards March end, it dropped further and traded between $9 and $20 in April. In January 2020, Brent crude was trading between $60 and $70 per barrel.

Import savings: Lockdown across countries in response to Covid-19 pandemic impacted global trade and has resulted in a sharp dip in import expenditure — electronics, gold and also crude oil prices among other

FDI inflows: Between September 2019 and March 2020 foreign direct investments stood at $23.88 billion and in April and May it amounted to $5.9 billion. Market experts say that a lot of FDI has also come in June and July too, especially the Rs 1 lakh crore plus investment by global tech giants in Jio Platforms. Thus FDI inflow has been a significant contributor to the rise in foreign exchange reserves.

Dip in gold imports: Gold which was a big import component for India witnessed a sharp decline in the quarter ended June 2020 following the high prices and the lockdown induced by the Covid-19 pandemic. According to the World Gold Council (WGC), gold imports plummeted by 95 per cent to 11.6 tonnes in the quarter as compared to 247.4 tonnes in the same period a year ago due to logistical issues and poor demand. The value of gold transacted during the June quarter fell to Rs 26,600 crore, down by 57 per cent as compared to Rs 62,420 crore a year ago, WGC said.

What does the rising forex reserves mean?

The rising forex reserves give a lot of comfort to the government and the Reserve Bank of India in managing India’s external and internal financial issues at a time when the economic growth is set to contract by 5.8 per cent in 2020-21. It’s a big cushion in the event of any crisis on the economic front and enough to cover the import bill of the country for a year. The rising reserves have also helped the rupee to strengthen against the dollar. The foreign exchange reserves to GDP ratio is around 15 per cent. Reserves will provide a level of confidence to markets that a country can meet its external obligations, demonstrate the backing of domestic currency by external assets, assist the government in meeting its foreign exchange needs and external debt obligations and maintain a reserve for national disasters or emergencies. “Adequate forex reserves should provide room for the RBI to cut rates and support recovery. We estimate that the RBI can sell $50 bn to defend the rupee in case of a speculative attack. Of note, RBI action to support growth should attract FPI equity flows,” says a Bank of America report.

What does the RBI do with the forex reserves?

The Reserve Bank functions as the custodian and manager of forex reserves, and operates within the overall policy framework agreed upon with the government. The RBI allocates the dollars for specific purposes. For example, under the Liberalised Remittances Scheme, individuals are allowed to remit up to $250,000 every year. The RBI uses its forex kitty for the orderly movement of the rupee. It sells the dollar when the rupee weakens and buys the dollar when the rupee strengthens. Of late, the RBI has been buying dollars from the market to shore up the forex reserves. When the RBI mops up dollars, it releases an equal amount in the rupees. This excess liquidity is sterilised through issue of bonds and securities and LAF operations to prevent a rise in inflation.

Are forex reserves giving returns to India?

Only gold reserves have given big returns to India. While the RBI has not disclosed the actual returns from forex reserves, experts estimate India is likely to get only negligible returns as interest rates in the US and Eurozone are around one per cent. On the contrary, India could be facing a cost to keep the reserves abroad. Out of the total foreign currency assets, as much as 59.7 per cent was invested in securities abroad, 33.37 per cent was deposited with other central banks of other countries and the BIS and the balance 7.06 per cent comprised deposits with commercial banks overseas as of March 2020. Further, as at end-March, 2020, the RBI held 653.01 tonnes of gold, with 360.71 tonnes being held overseas in safe custody with the Bank of England and the Bank for International Settlements, while the remaining gold is held domestically. With gold prices shooting up around 40 per cent to over Rs 55,000 per 10 grams this year, the value of gold holdings has shot up

Re: Indian Economy News & Discussion - Nov 27 2017

Gujarat Government announces new Industrial Policy 2020

https://www.deshgujarat.com/2020/08/07/ ... licy-2020/

Gandhinagar: The Government of Gujarat today announced new industrial policy 2020. The new policy has been declared on expiry of outgoing policy on 31st December 2019. The previous policy was extended till announcement of new policy. The new policy is divided in 15 thrust areas that are broadly in two categories 1. core sectors and 2. sunrise sectors.

Core sectors: 1.Electrical machinery & equipment 2.Industrial Machinery & equipment 3. Auto & Auto Components 4. Ceramics 5. Technical Textiles 6. Agro & Food Processing 7.Pharmaceuticals & Medical devices 8. Gems & Jewelry 9.Chemicals (in designated area).

Sunrise Sectors: 1.Industry 4.0 manufacturing 2. Electric Vehicle and its components 3. Waste management projects 4. Green Energy (Solar & Wind Equipment) 5. Eco-friendly compostable material (substitutes to traditional plastics) 6.100% export oriented units, irrespective of sector.

https://www.deshgujarat.com/2020/08/07/ ... licy-2020/

Gandhinagar: The Government of Gujarat today announced new industrial policy 2020. The new policy has been declared on expiry of outgoing policy on 31st December 2019. The previous policy was extended till announcement of new policy. The new policy is divided in 15 thrust areas that are broadly in two categories 1. core sectors and 2. sunrise sectors.

Core sectors: 1.Electrical machinery & equipment 2.Industrial Machinery & equipment 3. Auto & Auto Components 4. Ceramics 5. Technical Textiles 6. Agro & Food Processing 7.Pharmaceuticals & Medical devices 8. Gems & Jewelry 9.Chemicals (in designated area).

Sunrise Sectors: 1.Industry 4.0 manufacturing 2. Electric Vehicle and its components 3. Waste management projects 4. Green Energy (Solar & Wind Equipment) 5. Eco-friendly compostable material (substitutes to traditional plastics) 6.100% export oriented units, irrespective of sector.

Re: Indian Economy News & Discussion - Nov 27 2017

PM to launch financing facility under Agriculture Infrastructure Fund

https://www.deshgujarat.com/2020/08/08/ ... -tomorrow/

New Delhi: Prime Minister Shri Narendra Modi will launch the financing facility of Rs. 1 lakh crore under the Agriculture Infrastructure Fund on 9th August at 11 AM via video conferencing. Prime Minister will also release the sixth instalment of funds of Rs. 17,000 crore to 8.5 crore farmers under the PM-KISAN scheme. The eventwill be witnessed by lakhs of farmers, cooperatives, and citizens across the country.Union Minister of Agriculture and Farmers’ Welfare, Shri Narendra Singh Tomar, will also be present on the occasion.

The Union Cabinet has approved the Central Sector Scheme of financing facility under “Agriculture Infrastructure Fund” of Rs. 1 Lakh Crore. The Fund will catalyze the creation of post-harvest management infrastructure and community farming assets such as cold storage, collection centres, processing units, etc.These assets will enable farmers to get greater value for their produce, as they will be able to store and sell at higher prices, reduce wastage, and increase processing and value addition.Rs. 1 Lakh Crore will be sanctioned under the financing facility in partnership with multiple lending institutions; 11 of the 12 Public Sector Banks have already signed MOUs with the DAC&FW. 3% interest subvention and credit guarantee of up to Rs 2 Crore will be provided to the beneficiaries to increase the viability of these projects.The beneficiaries of the scheme will include farmers, PACS, Marketing Cooperative Societies, FPOs, SHGs, Joint Liability Groups (JLG), Multipurpose Cooperative Societies, Agri-entrepreneurs, Startups, and Central/State agency or Local Body sponsored Public-Private Partnership Projects.

https://www.deshgujarat.com/2020/08/08/ ... -tomorrow/

New Delhi: Prime Minister Shri Narendra Modi will launch the financing facility of Rs. 1 lakh crore under the Agriculture Infrastructure Fund on 9th August at 11 AM via video conferencing. Prime Minister will also release the sixth instalment of funds of Rs. 17,000 crore to 8.5 crore farmers under the PM-KISAN scheme. The eventwill be witnessed by lakhs of farmers, cooperatives, and citizens across the country.Union Minister of Agriculture and Farmers’ Welfare, Shri Narendra Singh Tomar, will also be present on the occasion.

The Union Cabinet has approved the Central Sector Scheme of financing facility under “Agriculture Infrastructure Fund” of Rs. 1 Lakh Crore. The Fund will catalyze the creation of post-harvest management infrastructure and community farming assets such as cold storage, collection centres, processing units, etc.These assets will enable farmers to get greater value for their produce, as they will be able to store and sell at higher prices, reduce wastage, and increase processing and value addition.Rs. 1 Lakh Crore will be sanctioned under the financing facility in partnership with multiple lending institutions; 11 of the 12 Public Sector Banks have already signed MOUs with the DAC&FW. 3% interest subvention and credit guarantee of up to Rs 2 Crore will be provided to the beneficiaries to increase the viability of these projects.The beneficiaries of the scheme will include farmers, PACS, Marketing Cooperative Societies, FPOs, SHGs, Joint Liability Groups (JLG), Multipurpose Cooperative Societies, Agri-entrepreneurs, Startups, and Central/State agency or Local Body sponsored Public-Private Partnership Projects.

-

Mort Walker

- BRF Oldie

- Posts: 10040

- Joined: 31 May 2004 11:31

- Location: The rings around Uranus.

Re: Indian Economy News & Discussion - Nov 27 2017

Then an order for 600 LCA Tejas Mk1A and Mk2 needs to be done ASAP.Suraj wrote:I was about to post this myself. It looks like they’re in a hurry to get to $600 billion before Diwali.

Changes to trade policy are also significantly cutting the merchandise trade deficit, which is showing up as billions in additional reserve accumulation every month.

-

Mort Walker

- BRF Oldie

- Posts: 10040

- Joined: 31 May 2004 11:31

- Location: The rings around Uranus.

Re: Indian Economy News & Discussion - Nov 27 2017

I'm glad I'm not the only one in the same situation.suryag wrote:Thank you Suraj Sir, shocked to see Saris toothat is one sink of a money, SHQ has many Saris which are sitting there and the blouse doesnt fit her anymore. Not sure how many of them came from PRC but these are the kind of things like the 4k Rakhi line item i.e., something that is bought but never used and it is just a money sink.

Re: Indian Economy News & Discussion - Nov 27 2017

India attracts $22 billion FDI during COVID-19: Amitabh Kant

PM Modi to launch financing facility of Rs 1 lakh crore under Agri Infra Fund tomorrowNiti Aayog CEO Amitabh Kant said... that almost 90 per cent plus of the USD 22 billion foreign direct investment in India during the pandemic came through the automatic route.

Kant pointed out that India has jumped up about 79 positions in the World Bank’s ease of doing business. “Our hope is that this year we will get into top 50,” he said.

In an effort to boost the creation of post-harvest management infrastructure and community farming assets, Prime Minister Narendra Modi will launch the financing facility of Rs 1 lakh crore under the Agriculture Infrastructure Fund via video-conferencing tomorrow. The funds will help to create farming assets such as cold storage, collection centres, processing units, etc, said a statement by the Prime Minister’s Office. These assets will enable farmers to get greater value for their produce, as they will be able to store and sell at higher prices, reduce wastage, and increase processing and value addition.

While the fund of Rs 1 lakh crore will be sanctioned under the financing facility in partnership with multiple lending institutions, 11 of the 12 PSU banks have already signed MOUs for the same cause, the government said. 3 per cent interest subvention and credit guarantee of up to Rs 2 crore will also be provided to the beneficiaries to increase the viability of these projects.

Re: Indian Economy News & Discussion - Nov 27 2017

Gold prices went from around $1650/oz to $2050/oz between April 3 to today. There are 35274 ounces in a metric ton and 32000 oz in an imperial ton. The increase of value of 653.01 imperial tons of gold is $8.3 billion ($9.2 billion if metric ton). It's a small portion of the overall increase only, although gold's return has been spectacular this year due to global uncertainty and threat of money printing.Vips wrote:Explained: Why are forex reserves shooting up when Indian economy is hit?

Are forex reserves giving returns to India?

Only gold reserves have given big returns to India. While the RBI has not disclosed the actual returns from forex reserves, experts estimate India is likely to get only negligible returns as interest rates in the US and Eurozone are around one per cent. On the contrary, India could be facing a cost to keep the reserves abroad. Out of the total foreign currency assets, as much as 59.7 per cent was invested in securities abroad, 33.37 per cent was deposited with other central banks of other countries and the BIS and the balance 7.06 per cent comprised deposits with commercial banks overseas as of March 2020. Further, as at end-March, 2020, the RBI held 653.01 tonnes of gold, with 360.71 tonnes being held overseas in safe custody with the Bank of England and the Bank for International Settlements, while the remaining gold is held domestically. With gold prices shooting up around 40 per cent to over Rs 55,000 per 10 grams this year, the value of gold holdings has shot up

Re: Indian Economy News & Discussion - Nov 27 2017

Deleted

Last edited by Suraj on 09 Aug 2020 22:31, edited 1 time in total.

Reason: Not the thread to dump anything tangentially related to economy.

Reason: Not the thread to dump anything tangentially related to economy.

Re: Indian Economy News & Discussion - Nov 27 2017

https://twitter.com/IndianEmbassyUS/sta ... 9650717699

Rural India is strong and the farmers are the least impacted in COVID times. Gives me a lot of hope.India in USA @IndianEmbassyUS

During the difficult time of Pandemic, India sustained world food supply chain and continued to export.

Agricultural export during March-June 2020 increased by 23.24% compare to last year.

#AatmaNirbharKrishi

Re: Indian Economy News & Discussion - Nov 27 2017

Here you go:

https://swarajyamag.com/insta/chinese-e ... 7-per-cent

Fall in Chinese exports to India. Primarily smartphone.

https://swarajyamag.com/insta/chinese-e ... 7-per-cent

Fall in Chinese exports to India. Primarily smartphone.

Re: Indian Economy News & Discussion - Nov 27 2017

It's 24.7% decrease in Chinese exports & 6.7% increase in India exports to each other. Even at this pace India can halve the Chinese trade surplus on Chinese side.

Re: Indian Economy News & Discussion - Nov 27 2017

327 items form 3/4th of imports from China, ‘can be alternatively sourced’

By Sidhartha, TNN Last Updated: Aug 10, 2020, 10:20 AM IST

NEW DELHI: Just 327 products — ranging from mobile phones and telecom equipment to cameras, solar panels, air-conditioners and penicillin — accounted for nearly three-fourths of the imports from China, a study has estimated, while pointing out that it is possible to find alternative sources to get these goods or manufacture them in India.

A paper by policy think tank Research and Information System for Developing Countries (RIS) used UN Comtrade data to estimate the value of these "critically sensitive imports" at $66.6 billion in 2018 in overall imports of a little over $90 billion. In 2018-19, official numbers had pegged imports from China at $76.4 billion.

A product was considered sensitive if China accounted for over 10% share of imports or if the value of shipments was $50 million or more. "Such export monopoly of China has to be diluted in view of strategic requirements," the report said.

In terms of the number of goods imported from across the border, the share of the 327 sensitive products was less than 10% of the 4,000-odd items that were imported from China. The study, which shared with TOI, estimated that in case of 82%, or over 3,300 products, China was not the most competitive producer.

.

.

.

The list also has several types of machinery, some auto components, escalator components, certain acids and chemicals and fertiliser like diammonium phosphate, where China is the sole supplier.

https://economictimes.indiatimes.com/ne ... 456068.cms

By Sidhartha, TNN Last Updated: Aug 10, 2020, 10:20 AM IST

NEW DELHI: Just 327 products — ranging from mobile phones and telecom equipment to cameras, solar panels, air-conditioners and penicillin — accounted for nearly three-fourths of the imports from China, a study has estimated, while pointing out that it is possible to find alternative sources to get these goods or manufacture them in India.

A paper by policy think tank Research and Information System for Developing Countries (RIS) used UN Comtrade data to estimate the value of these "critically sensitive imports" at $66.6 billion in 2018 in overall imports of a little over $90 billion. In 2018-19, official numbers had pegged imports from China at $76.4 billion.

A product was considered sensitive if China accounted for over 10% share of imports or if the value of shipments was $50 million or more. "Such export monopoly of China has to be diluted in view of strategic requirements," the report said.

In terms of the number of goods imported from across the border, the share of the 327 sensitive products was less than 10% of the 4,000-odd items that were imported from China. The study, which shared with TOI, estimated that in case of 82%, or over 3,300 products, China was not the most competitive producer.

.

.

.

The list also has several types of machinery, some auto components, escalator components, certain acids and chemicals and fertiliser like diammonium phosphate, where China is the sole supplier.

https://economictimes.indiatimes.com/ne ... 456068.cms