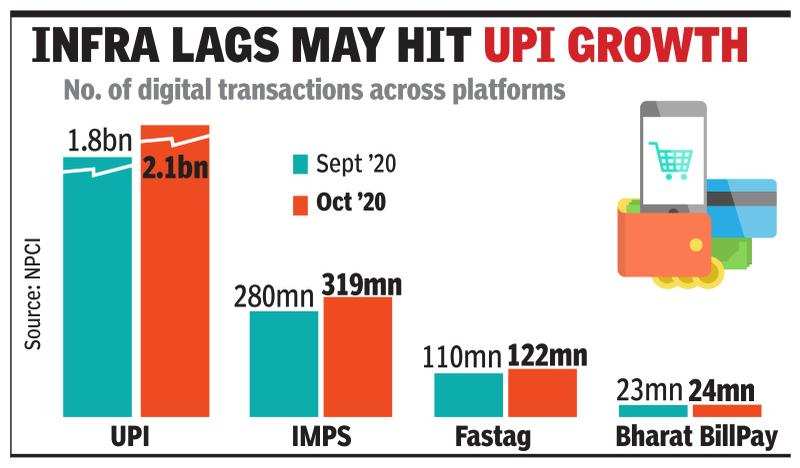

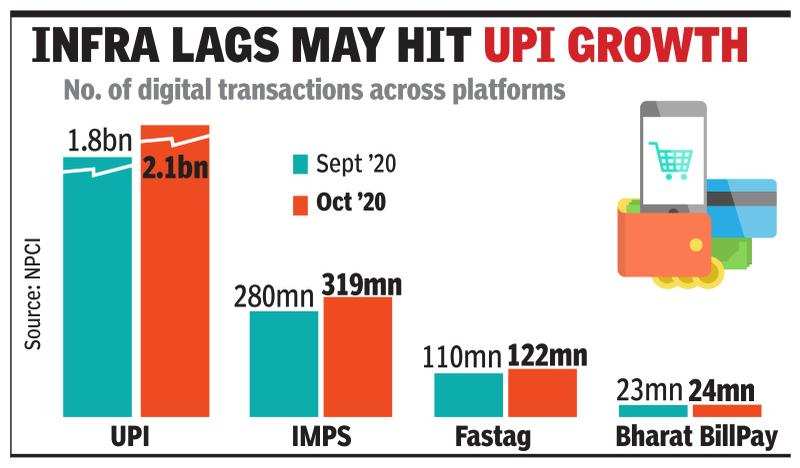

UPI hits 2 billion payments mark in October on festive, Covid push.

Payments through Unified Payments Interface (UPI) crossed the 2-billion mark in monthly transactions for the first time in October.

UPI

transactions took three years to clock the 1-billion mark in October 2019, the current leap took just one year. The incremental demand for

contactless payments due to the pandemic as well as spends during the ongoing festive season helped fuel this growth.

National Payments Corporation of India (NPCI), which manages UPI, said the platform saw nearly 2.1 billion transactions in October worth over Rs

3.8 lakh crore. This is a 15% growth in volume compared to September, when it had recorded 12% growth over August. Digital transactions through other instruments like IMPS, Bharat BillPay and Fastag, an indicator of vehicular movement, have been rising too. In October, bill payments rose to nearly 24 million compared to just over 23 million in September, while Fastag saw over 122 million transactions in October as against 110 million in September. IMPS clocked 319 million payments in October compared to about 280 million in September, according to NPCI data.

While increased demand for digital transactions has accelerated UPI’s journey to the 2-billion mark, industry executives said it would be a challenge to maintain this volume every month, when its stakeholders are shying away from investing in scaling up UPI’s technology infrastructure. This is largely attributed to the zero merchant discount rate (MDR), according to an industry executive. The government had made MDR zero earlier this year to expand digital payments but instead the move has hit banks and payments apps — industry stakeholders — as they are unable to make money on these transactions.

Some banks had started to limit free UPI transactions, which prompted the government to issue a circular in August saying lenders must stop charging these transactions and should issue a refund, if case a user has been charged already.

“Failure rates are increasing and it takes longer for a transaction to complete. Banks are not investing to add muscle to the infrastructure as they can’t make money on UPI transactions due to zero MDR. It’s being discussed across the industry but there is no respite yet,” an industry executive said, adding that.one of the country’s largest banks had a success rate of about 70% in October.

Sajith Sivanandan, MD & business head (Google Pay and Next Billion User Initiatives), Google India, said the latest milestone serves as a “global proof of concept for technology-enabled financial inclusion”.

“This offers immense learning for economies around the globe, as much as India. As UPI grows from strength to strength, there is a need for continued technology investments towards the infrastructure in order to bring a reliable and failure-proof experience to the user,” he said.

Google Pay processes the highest volumes of UPI payments with roughly over 40% share. While PhonePe comes in the second position, Paytm and Amazon Pay are the other top UPI apps.

“UPI is now the digital currency of the country and we are taking this deeper & deeper into tier-4,-5,-6 towns & villages both with consumers and merchants. Such deeper adoption of digital payments will usher in financial inclusion & accelerate economic progress in the country. All the stakeholders will have to continuously invest to be able to manage the scale and growth of UPI,” said Hemant Gala, head (payments, banking & financial services), PhonePe.

A Paytm Payments Bank spokesperson said it was among the top contributors offering the best technology to support UPI transactions that results in the lowest decline rate, “thereby accelerating the overall growth of digital payments in small cities and towns”.