Delhi-based Kamlesh Mishra raised fake tax invoices worth Rs 500 crore by floating companies in the names of poor individuals, the report stated quoting intelligence wing sources. "Mishra floated 23 companies in the names of poor individuals across the country, including some in Bengaluru who had a PAN and Aadhaar card. He paid them handsomely to use their documents to start companies in their names and created fake invoices for GST worth Rs 80 crore," an officer told the publication.

To obtain bills discounts and loans from banks, Mishra projected a huge turnover in his fictional firms and showed that he sold products for high profits.

Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

Rs 200 crore GST fraud busted in Bengaluru, 4 arrested: Report

Re: Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

Continuing my efforts to keep with the Jal Jeevan Mission every month:

15 Nov 2020

Over 30% coverage now, starting at 17% when JJM began on Aug 15 2019. Here is the live dashboard.

Prior statuses:

October 15 2020

September 20 2020

August 15 2020

15 Nov 2020

Over 30% coverage now, starting at 17% when JJM began on Aug 15 2019. Here is the live dashboard.

Prior statuses:

October 15 2020

September 20 2020

August 15 2020

Re: Indian Economy News & Discussion - Nov 27 2017

https://swarajyamag.com/insta/govt-seek ... for-budget

In a bid to make the annual budget 2021-22 consultations more participatory and democratic, the government has launched an online portal on MyGov platform to receive ideas for the budget from general public.

In a statement on Friday (13 November), the Ministry of Finance said that over the years, it has been holding pre-budget consultations in North Block with Industry/Commerce Associations, Trade Bodies and Experts to seek ideas for the Annual Budget.

In a bid to make the annual budget 2021-22 consultations more participatory and democratic, the government has launched an online portal on MyGov platform to receive ideas for the budget from general public.

In a statement on Friday (13 November), the Ministry of Finance said that over the years, it has been holding pre-budget consultations in North Block with Industry/Commerce Associations, Trade Bodies and Experts to seek ideas for the Annual Budget.

Re: Indian Economy News & Discussion - Nov 27 2017

Diwali sales cross Rs 72,000 crore, China suffers huge losses

The Confederation of All India Traders (CAIT) on Sunday (November 15) said the sales during the Diwali festive season jumped to as high as Rs 72,000 crore across major markets in the country despite a total boycott of the Chinese items. It is expected that Chinese exporters suffered losses with Rs 40000 crore this Diwali season amid boycott call by Indian sellers.

It is to be noted that CAIT had issued a call to boycott the Chinese products following the tension between India and China at the Line of Actual Control (LAC) in Eastern Ladakh.

"As per reports gathered from 20 different cities which are also considered to be the leading distribution centres of India, it is expected that Diwali festive sales generated a turnover of about Rs 72,000 crores and gave China the expected loss of Rs 40,000 crore," CAIT said in a statement.

The most purchased products during Diwali festive season were the fast-moving consumer goods (FMCG), consumer durables, toys, electrical appliances and goods, electronic appliances and white goods, kitchen articles and accessories, gift items, confectionary items, sweets, home furnishing, tapestry, utensils, gold and jewellery, footwear, watches, furniture, fixtures, garments, fashion apparels, cloth and home decoration goods.

Re: Indian Economy News & Discussion - Nov 27 2017

Govt to decriminalise provisions of LLP Act in upcoming Winter Session

After amending the Companies Act, the Ministry of Corporate Affairs is now looking to decriminalise provisions of the Limited Liability Partnership (LLP) Act in the upcoming Winter Session of Parliament. One of the changes being proposed is allowing LLPs to issue non-convertible debentures (NCDs), a senior government official told Business Standard. “Many provisions in the Companies Act are also linked to the LLP Act. We want to ensure both are compatible and also do away with criminality when it comes to procedural offences,” the official said.

Re: Indian Economy News & Discussion - Nov 27 2017

FPIs remain positive on Indian markets; put in massive Rs 35,109 crore in November so far

Foreign portfolio investors (FPIs) have invested a massive Rs 35,109 crore in Indian markets in November so far as corporate earnings and reforms measures undertaken by the government to revive investment activities kept the investors'' sentiment upbeat.

According to the depositories data, FPIs invested a net sum of Rs 29,436 crore into equities and Rs 5,673 crore into debt segment between November 2-13. During the period under review, a net amount of Rs 35,109 crore was pumped by overseas investors in Indian markets. FPIs had invested a net sum of Rs 22,033 crore in the preceding month.

Re: Indian Economy News & Discussion - Nov 27 2017

Not exactly. With invoice matching in GST system it is virtually impossible to get away with this kind of fraud. It was super prevalent during VAT times to do this, but I'm more shocked to see the audacity of the people to try this with the GST system.V_Raman wrote:

- the more it changes the more it remains the same -

Re: Indian Economy News & Discussion - Nov 27 2017

Fake invoices for GST credit: Govt may invoke COFEPOSA against offenders

After a nationwide drive against fake invoices that tend to mar the Goods and Services Tax (GST) system, the government is examining if the offenders can be booked under COFEPOSA (Conservation of Foreign Exchange and Prevention of Smuggling Activities Act), apart from taking action against them under GST laws, Income Tax Act and Prevention of Money Laundering Act, sources said.

The government is also examining whether businesses whose owners or promoters do not have commensurate income tax payment records may require physical and financial verification before their companies can be allowed GST registration.

During the current month itself, at least 25 persons have been arrested including two kingpins and two professionals in some 350 cases booked for issuance of fake invoices against 1180 entities.

“Actual amount of fake input tax credit (ITC) claims involved is being ascertained. Search and investigation are on to identify and apprehend the other persons who were involved in the racket and also the beneficiaries who have used the fake invoices to evade GST, income tax, and are engaged in money laundering,” sources said.

The fraudulent practises are primarily related to transactions in MS/SS scrap, articles of iron and steel, copper rod and wire, waster and scrap of non-ferrous metals, plastic granules, PVC resin, readymade garments, gold and silver, construction services, works contract, agro products, milk products, mobile, manpower supply services, advertisement and animation services among others, sources said.

Re: Indian Economy News & Discussion - Nov 27 2017

True deterrence is speedy prosecution of offenders and heavy punishment implemented. Not just a different system.V_Raman wrote:

- the more it changes the more it remains the same -

Re: Indian Economy News & Discussion - Nov 27 2017

Very essential viewing:

Re: Indian Economy News & Discussion - Nov 27 2017

Dilbu wrote:Fake invoices for GST credit: Govt may invoke COFEPOSA against offendersAfter a nationwide drive against fake invoices that tend to mar the Goods and Services Tax (GST) system, the government is examining if the offenders can be booked under COFEPOSA (Conservation of Foreign Exchange and Prevention of Smuggling Activities Act), apart from taking action against them under GST laws, Income Tax Act and Prevention of Money Laundering Act, sources said.

The government is also examining whether businesses whose owners or promoters do not have commensurate income tax payment records may require physical and financial verification before their companies can be allowed GST registration.During the current month itself, at least 25 persons have been arrested including two kingpins and two professionals in some 350 cases booked for issuance of fake invoices against 1180 entities.

“Actual amount of fake input tax credit (ITC) claims involved is being ascertained. Search and investigation are on to identify and apprehend the other persons who were involved in the racket and also the beneficiaries who have used the fake invoices to evade GST, income tax, and are engaged in money laundering,” sources said.

The fraudulent practises are primarily related to transactions in MS/SS scrap, articles of iron and steel, copper rod and wire, waster and scrap of non-ferrous metals, plastic granules, PVC resin, readymade garments, gold and silver, construction services, works contract, agro products, milk products, mobile, manpower supply services, advertisement and animation services among others, sources said.

I got notice from GST office claiming something like this... we are working mostly in govt and most of our payments are to small vendors who supply labor or labor related services. These vendors don't give any invoices (mostly unregistered) and we do not bother taking any GST invoices as from our perspective it is simply a prepayment of the GST our client pay us during billing. Wonder if this is going create issues in future. Of course there is no question of taking ITC in such transactions.. so nothing illegal I think.

The question is whether my vendors give me fake invoices and I get caught??

Re: Indian Economy News & Discussion - Nov 27 2017

In case of fake input tax invoices, the vendor will surely be in trouble but you will also be required to conduct reasonable preliminary checks about the validity of invoice before claiming input tax deduction using the document. My exposure to Indian GST is limited but you should not be in trouble unless a willful wrongdoing from your part is suspected.

Re: Indian Economy News & Discussion - Nov 27 2017

GST and IT departments send general messages, with ignore if complied with. Has GST given a specific notice with a hearing date?

Re: Indian Economy News & Discussion - Nov 27 2017

Are they paper invoices? It seems to me that problem of fake invoices from vendors can be solved by making sure it is sent thru the GST system. Make them e-invoices!

Re: Indian Economy News & Discussion - Nov 27 2017

Can we come up with some suggestions here and post them?vijayk wrote:https://swarajyamag.com/insta/govt-seek ... for-budget

In a bid to make the annual budget 2021-22 consultations more participatory and democratic, the government has launched an online portal on MyGov platform to receive ideas for the budget from general public.

In a statement on Friday (13 November), the Ministry of Finance said that over the years, it has been holding pre-budget consultations in North Block with Industry/Commerce Associations, Trade Bodies and Experts to seek ideas for the Annual Budget.

1. I want them to allocate $20 mil to set up a research center for Digital currency

Re: Indian Economy News & Discussion - Nov 27 2017

If you are a registered vendor & you are taking services from an un-registered vendor, who is not giving you an invoice /or is giving you an invoice without charging GST in it because they are un-registered, then you are supposed to do that on their behalf. Not doing so will lead to penalties during your audit.tandav wrote:

I got notice from GST office claiming something like this... we are working mostly in govt and most of our payments are to small vendors who supply labor or labor related services. These vendors don't give any invoices (mostly unregistered) and we do not bother taking any GST invoices as from our perspective it is simply a prepayment of the GST our client pay us during billing. Wonder if this is going create issues in future. Of course there is no question of taking ITC in such transactions.. so nothing illegal I think.

The question is whether my vendors give me fake invoices and I get caught??

The process to do that is called Reverse Charge under GST & it is applicable for all your invoices on which GST is not charged by ANY kind of supplier. Be it a Rs. 2000 lorry freight that you paid for your business & you claim this expense in your P&L. Learn about the process here.

https://cleartax.in/s/reverse-charge-gst

You can do it for last few years if you've not filed the GST Annual Return by paying some late fees & I suggest you do it to avoid any major penalties in the future.

Re: Indian Economy News & Discussion - Nov 27 2017

Good! Several states have gone from orange to blue (or a deeper shade thereof)...UK, AR, MZ, MN, NG, MH.Suraj wrote:Continuing my efforts to keep with the Jal Jeevan Mission every month:

15 Nov 2020

Over 30% coverage now, starting at 17% when JJM began on Aug 15 2019. Here is the live dashboard.

Prior statuses:

October 15 2020

September 20 2020

August 15 2020

Re: Indian Economy News & Discussion - Nov 27 2017

No RCEP re-entry: India to speed up trade talks with US & EU

India won’t re-join the China-dominated Regional Comprehensive Economic Partnership (RCEP) pact but will rather seek to expedite trade talks with large markets like the US and the EU, senior government officials told FE, a day after 15 nations clinched the biggest trade deal, while leaving the door open for New Delhi to re-enter.

The country will refrain from joining any pact that is effectively “free trade agreement (FTA) by stealth with China”, one of the officials said, making clear New Delhi’s anxiety over joining back the RCEP bloc. The focus is on not just free but also fair trade, he added.

India’s decision comes at a time when Joseph R Biden’s election as the 46th American President has revived the prospect of the US’ re-entry into the ambitious Trans-Pacific Partnership (TPP) trade deal with 11 others. Any such move, on top of the RCEP deal, will pressure New Delhi to redraw its trade ties to avoid being left behind in integrating with global supply chain, analysts have said.

India and the US were close to clinching a “limited” trade deal that was expected to cover an annual trade of over $13 billion, or roughly 15% of bilateral shipments. However, with Biden at the helm now, the deal may be delayed, as the US may now seek to review the broad contours of even the settled issues. The two countries also had plans to launch talks for a broader FTA once this deal was signed.

India was also open to the idea of a preferential trade agreement with the EU to get faster outcomes before hammering out a more ambitious free trade agreement (FTA) that is being negotiated since 2007, commerce and industry minister Piyush Goyal had said last month.

New Delhi was unwilling to budge on its demands for an “auto-trigger” mechanism for safeguarding its industry from dumping, and strict rules of origins of imported products to check the abuse of tariff concessions.

Also, New Delhi was steadfast in certain demands, including credible steps and market access to address India’s $105-billion trade deficit with RCEP members, change in the base year to implement the tariff abolition from 2014 to 2019 and a more balanced deal on services.

Re: Indian Economy News & Discussion - Nov 27 2017

tandavji, I have been following your posts regarding GST/etc. for some time now. You seem to be totally against it.

While no system is perfect, the system is way better than what it was before. I have no doubt.

I think you should hire a good CA as a financial advisor and fix these kinds of problems. It worked for me.

While no system is perfect, the system is way better than what it was before. I have no doubt.

I think you should hire a good CA as a financial advisor and fix these kinds of problems. It worked for me.

Re: Indian Economy News & Discussion - Nov 27 2017

Problem with GST is that it is making work doer the collector of tax on behalf of Govt with no benefit of ensuring payment. If I do work and raise the invoice then I have to pay GST regardless of whether I get paid or not. If I do not raise the invoice then I have no legal recourse to get paid. SO in essence my cash flow is badly hit and the less said about the legal system to ensure my payment the better. The GST system like the VAT system before it does not encourage trust and vendors are constantly holding back on work to ensure that they will be paid. This is one of the reasons it takes 2 years to do work in India what takes China 2 months (the CCP system of payment whatever it may be ensures prompt payment)csaurabh wrote:tandavji, I have been following your posts regarding GST/etc. for some time now. You seem to be totally against it.

While no system is perfect, the system is way better than what it was before. I have no doubt.

I think you should hire a good CA as a financial advisor and fix these kinds of problems. It worked for me.

Re: Indian Economy News & Discussion - Nov 27 2017

I think it's valuable feedback from real world perspectives in small industry as to how the GST mechanism stresses the limited cash flow of such entities. From the government's perspective they will not quite notice the urgency due to their own perspective being satisfied once the tax is paid, and in fact it suits them if reimbursements are delayed. This is something that needs addressing, perhaps through some escrow mechanism where the taxpayer only pays the estimated net payment upfront, with the vendor being on the hook for their share with GoI directly.

Re: Indian Economy News & Discussion - Nov 27 2017

yup the escrow account mechanism should work. Other is that you collect the tax (hence tax collection activity is same, govt spending tied to it is not impacted) but extend credit to that company (through a govt bank like Exim bank) in the amount of what the vendor may pay (that will increase money supply and hence inflation but will grease up the economic engine). The credit should be at low interest rate (perhaps 0 interest rate for x months then a schedule). The payment from vendor will directly offset that credit. Escrow account on the other hand will have the effect of less tax collection, but no inflatory pressure.

Any other hybrid mechanism can also be invented.

The credit (or a loan) will be a highly secured one, against the account receivable from the vendor. Sometimes the vendor may not be able to pay (bad business decisions, bankruptcy etc.), in that case the company selling it will have to bear the risk (as it made a bad decision to sell to someone who was not in position to sell it further), but govt will not be left holding the bag. All it is doing is extending easy credit to a seller on the amount of net tax that a vendor will pay for a short duration of time. Of course, this will massively increase standing money supply. You may want to put interest rate so that business man do not start using this as a source of capital.

Any other hybrid mechanism can also be invented.

The credit (or a loan) will be a highly secured one, against the account receivable from the vendor. Sometimes the vendor may not be able to pay (bad business decisions, bankruptcy etc.), in that case the company selling it will have to bear the risk (as it made a bad decision to sell to someone who was not in position to sell it further), but govt will not be left holding the bag. All it is doing is extending easy credit to a seller on the amount of net tax that a vendor will pay for a short duration of time. Of course, this will massively increase standing money supply. You may want to put interest rate so that business man do not start using this as a source of capital.

-

nandakumar

- BRFite

- Posts: 1640

- Joined: 10 May 2010 13:37

Re: Indian Economy News & Discussion - Nov 27 2017

The GST system provides for a vendor (SMEs) to get a 90 day credit for payment of GST dues at an interest rate of 9%. So the raising of invoice need not be delayed. Of course if the customer doesn't pay within 90 days, then of course there is a problem.tandav wrote:Problem with GST is that it is making work doer the collector of tax on behalf of Govt with no benefit of ensuring payment. If I do work and raise the invoice then I have to pay GST regardless of whether I get paid or not. If I do not raise the invoice then I have no legal recourse to get paid. SO in essence my cash flow is badly hit and the less said about the legal system to ensure my payment the better. The GST system like the VAT system before it does not encourage trust and vendors are constantly holding back on work to ensure that they will be paid. This is one of the reasons it takes 2 years to do work in India what takes China 2 months (the CCP system of payment whatever it may be ensures prompt payment)csaurabh wrote:tandavji, I have been following your posts regarding GST/etc. for some time now. You seem to be totally against it.

While no system is perfect, the system is way better than what it was before. I have no doubt.

I think you should hire a good CA as a financial advisor and fix these kinds of problems. It worked for me.

Re: Indian Economy News & Discussion - Nov 27 2017

The reverse charge mechanism for foreign payments is also needs some solution, we have 10%-15% amounts paid in RCM which we are not able to offset since we don't have enough local sales.IGST but with no local sales. Thank god, atleast for export invoices we have letter of undertaking, else it would be double whammy, pay 18% for export invoices paid via inward remittance and, pay 18% for foreign payments.tandav wrote:Problem with GST is that it is making work doer the collector of tax on behalf of Govt with no benefit of ensuring payment. If I do work and raise the invoice then I have to pay GST regardless of whether I get paid or not. If I do not raise the invoice then I have no legal recourse to get paid. SO in essence my cash flow is badly hit and the less said about the legal system to ensure my payment the better. The GST system like the VAT system before it does not encourage trust and vendors are constantly holding back on work to ensure that they will be paid. This is one of the reasons it takes 2 years to do work in India what takes China 2 months (the CCP system of payment whatever it may be ensures prompt payment)csaurabh wrote:tandavji, I have been following your posts regarding GST/etc. for some time now. You seem to be totally against it.

While no system is perfect, the system is way better than what it was before. I have no doubt.

I think you should hire a good CA as a financial advisor and fix these kinds of problems. It worked for me.

You can add TDS to the trust issue as well, I loath to pay TDS for vendors, I have no idea why i am paying tds for google, amazon, microsoft etc and then pay thier full bill and offset it against future invoices, its like i am working FOR them. Just pay their invoices and be with it, if they dont pay taxs its their problem, NOW if we dont deduct TDS, we pay a fine WTF!

Re: Indian Economy News & Discussion - Nov 27 2017

As a vendor I raise an Invoice and if the client does not dispute it on the GST portal (within say 10 days of invoicing) it should be deemed accepted. If the client does not pay then why should vendor pay the tax... the GST system should then automatically go after the client to punish them for non payment on both tax and the work the vendor did for them by automatically charging interest. In India especially in project work the vendor has to run pillar to post to get bills paid. GST system should work in a manner to ensure that the sanctity of the contract is maintained. Most of the time what happens there is a lot of grey area on what is accepted and what is not and leads to disputes.

Re: Indian Economy News & Discussion - Nov 27 2017

"Sometimes the vendor may not be able to pay (bad business decisions, bankruptcy etc.), in that case the company selling it will have to bear the risk" precisely this is what is destroying many entrepreneurs. The business networks in Jain, Marwari, Gujarati Communities give inside info to their circle to derisk payments (by social enforcement of trust). However this inside information on payments is not data driven and not available to other entrepreneurs. Most of the time MSMEs are created in name of wife, mother, driver but the actual decision maker is someone else non payment fraud is rampant.fanne wrote:yup the escrow account mechanism should work. Other is that you collect the tax (hence tax collection activity is same, govt spending tied to it is not impacted) but extend credit to that company (through a govt bank like Exim bank) in the amount of what the vendor may pay (that will increase money supply and hence inflation but will grease up the economic engine). The credit should be at low interest rate (perhaps 0 interest rate for x months then a schedule). The payment from vendor will directly offset that credit. Escrow account on the other hand will have the effect of less tax collection, but no inflatory pressure.

Any other hybrid mechanism can also be invented.

The credit (or a loan) will be a highly secured one, against the account receivable from the vendor. Sometimes the vendor may not be able to pay (bad business decisions, bankruptcy etc.), in that case the company selling it will have to bear the risk (as it made a bad decision to sell to someone who was not in position to sell it further), but govt will not be left holding the bag. All it is doing is extending easy credit to a seller on the amount of net tax that a vendor will pay for a short duration of time. Of course, this will massively increase standing money supply. You may want to put interest rate so that business man do not start using this as a source of capital.

In India lots of unscrupulous people are destroying innovative and viable companies by cheating. entrepreneurs do work for other on trust and there is no penalty for violating that trust. As there is no way to assess which company is good or bad. There is no online method to assess the company and its directors. Infact I am desperately looking for co founders to attack this particular problem.

Re: Indian Economy News & Discussion - Nov 27 2017

-Franklin Templeton

-PMC Bank

-Yes Bank

-Laxmi Vilas Bank..

4 large failures in the last six months. Wonder who is next!

The administration seems to be totally oblivious to the tragedy faced by Urban India / Middle Class.

-PMC Bank

-Yes Bank

-Laxmi Vilas Bank..

4 large failures in the last six months. Wonder who is next!

The administration seems to be totally oblivious to the tragedy faced by Urban India / Middle Class.

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.ndtv.com/business/opinion-w ... ht-2326803

This Time, India Is Getting A Bank Rescue Right

This Time, India Is Getting A Bank Rescue Right

Another Indian bank has failed, the third collapse of a major deposit-taking institution in 15 months and the first since the onset of the coronavirus pandemic. But instead of allowing a zombie lender to linger after a half-baked rescue, the central bank has wisely decided to put Lakshmi Vilas Bank Ltd. out of its misery. Better still, it's called upon a foreign institution to take over the assets and liabilities. That should stoke interest of other global banks.

The moth-eaten LVB will cease to exist, its equity completely wiped out. Only its deposits will appear on the books of the India unit of DBS Group Holdings Ltd., Singapore's biggest bank. This is a much cleaner solution than how the Reserve Bank of India handled the implosion last September of Punjab & Maharashtra Co-operative Bank Ltd., whose loan book was basically tied to one bankrupt shantytown developer. The scam-tainted lender is trying to sell itself, though it's unclear why anyone would touch it with a barge pole. More than a year later, larger PMC depositors still remain trapped, under orders from the RBI

The refusal to give a decent burial to a failed institution was visible in the messy bailout of Yes Bank Ltd. in March. Without wiping out the existing equity, authorities permanently wrote down $1.2 billion of Yes Bank's liabilities, the first complete loss imposed by any country on Additional Tier 1 bondholders. They then leaned on government-controlled State Bank of India to inject some more capital. Once a major corporate lender, Yes was destroyed from within by its previous management's dubious underwriting. Whether it has finally been saved may not be known before March 2022. Until then, Covid-19 has provided a convenient regulatory cover to delay recognizing stressed assets.

LVB was struggling to survive even before the March lockdown. The resulting dislocation dragged down the Tier 1 capital ratio to minus 1.83 per cent, putting the lender beyond redemption. By swallowing assets and liabilities of the 94-year-lender, DBS gets 563 branches, 974 ATMs and a $1.6 billion franchise in retail liabilities.

Re: Indian Economy News & Discussion - Nov 27 2017

It seems that a fundamental problem with GST is that it places the carrying cost of resolving refunds and resolution upon the party paying their share first. This is fundamentally unfair. There are potentially several ways around this including

- the party owed a partial refund only makes net payment

- party owed refund in the transaction only required to pay once the counterparties have paid.

- potentially more options for specific cases.

Fundamentally however, one party should not have to carry the financial cost of the other side's compliance because that is wrong.

- the party owed a partial refund only makes net payment

- party owed refund in the transaction only required to pay once the counterparties have paid.

- potentially more options for specific cases.

Fundamentally however, one party should not have to carry the financial cost of the other side's compliance because that is wrong.

Re: Indian Economy News & Discussion - Nov 27 2017

Our EAM has the following comments, when asked RCEP.

“In the name of openness, we have allowed subsidized products and unfair production advantages from abroad to prevail. And all the while, this was justified by the mantra of an open and globalized economy.”

Finally I see there is clarity right on the top. Chinis companies using subsidy by CCP have decimated our local production.

It cannot get clearer than this.

“In the name of openness, we have allowed subsidized products and unfair production advantages from abroad to prevail. And all the while, this was justified by the mantra of an open and globalized economy.”

Finally I see there is clarity right on the top. Chinis companies using subsidy by CCP have decimated our local production.

It cannot get clearer than this.

Re: Indian Economy News & Discussion - Nov 27 2017

It seems Indian banking system was heavily tied to dubious real estate promoters and the associated black money based bubble for loans/repayment!!! Dont they have other productive spaces to lend to? Industries? India seems cash rich, investment poor - very strange situation!!!!!

Re: Indian Economy News & Discussion - Nov 27 2017

Actually I feel we should put a cap on of 100 crores lending per company and 500 crore per director cummulative. Why should a company bigger than 100 take loan? If they are so good, I am sure they can raise capital from share market. Indian banking is just that shady companies take huge loan, do not pay and the losses are covered by honest loan paying middle class.

Re: Indian Economy News & Discussion - Nov 27 2017

What a foolish notion - starving companies of capital? So I guess India should also require mandatory farming training so that people can grow their own food?

Losses occur because of corruption and due to inherent nature of industry - risk is paramount. India has not developed an exit system for loss making entities. If India can improve the exit pathways, make its bankers less corrupt, it can have a vibrant industrial sector with normal losses. The solution is not to cut off industry but to nurture it so that it can allow overall growth.

It is easy to blame industry but do the bankers that loan funds to risky enterprise share no blame?

Losses occur because of corruption and due to inherent nature of industry - risk is paramount. India has not developed an exit system for loss making entities. If India can improve the exit pathways, make its bankers less corrupt, it can have a vibrant industrial sector with normal losses. The solution is not to cut off industry but to nurture it so that it can allow overall growth.

It is easy to blame industry but do the bankers that loan funds to risky enterprise share no blame?

Re: Indian Economy News & Discussion - Nov 27 2017

Why cannot the industry raise capital from the markets where scrutiny of solvency is more because people are putting their money? It is easy for the bankers to dump money anywhere since it is not their money. The Banking should be for companies to reach the market after which they should grow their capital. This exact thought that bank should blindly fund the companies based on the asset only is what is the problem currently. Example are large real estate companies who do not want to monetize their assets for less profit but ready to hold them for longer periods happily paying interest. If they go down, its the banks problem. Companies should bet on the market. It should be the share holders who should win or loose, not the banks.

The only reason why industry go to banks is because the promoters do not want to dilute their hold. The case in point being reliance. They sold their stakes in Jio and significantly reduced their debts after they saw what happened to small brother. Saw the news on Godrej properties today. They want to reach to a debt to equity ratio of 1:1 and want to take more loans to buy land. How many bankers will we prosecute? 5 people for every 1000 cr loss? looking at the jail time people get for economic offenses, give me 100 cr (10% cut) and i will happily spend 10 years in jail instead of working.

The only reason why industry go to banks is because the promoters do not want to dilute their hold. The case in point being reliance. They sold their stakes in Jio and significantly reduced their debts after they saw what happened to small brother. Saw the news on Godrej properties today. They want to reach to a debt to equity ratio of 1:1 and want to take more loans to buy land. How many bankers will we prosecute? 5 people for every 1000 cr loss? looking at the jail time people get for economic offenses, give me 100 cr (10% cut) and i will happily spend 10 years in jail instead of working.

Re: Indian Economy News & Discussion - Nov 27 2017

This type of anti industry attitude has resulted in India’s limited growth compared to China.

You need to find a good economics book and read. Project finance needs both debt and equity. By forcing capital to come from equity, who do you think will bear the cost if a company with 100% equity failed?

You need to find a good economics book and read. Project finance needs both debt and equity. By forcing capital to come from equity, who do you think will bear the cost if a company with 100% equity failed?

Re: Indian Economy News & Discussion - Nov 27 2017

Share holders should be responsible. Why do you think bank should be responsible for companies going belly up? I have no issues with project funding's but most of the companies have reached a debt to equity ratio levels which is very unhealthy. Before preaching me, please try to understand what is wrong with Indian share markets. The above lenient industry attitude is why we also have so many banks going belly up. Check the EPS vs the share prices and also compare with the interest outgo. you will come to know the EPS is less than 5% of the share capital for most of the company and the dividend paid is even lesser. There is no reason for companies to go to banks.

Re: Indian Economy News & Discussion - Nov 27 2017

https://bfsi.economictimes.indiatimes.c ... k/78404094

The more I read about LVB, the more failure of the bank falls at the feet of RBI.

-Malvinder / Shivinder Singh brothers were allowed to take out loans of more than Rs 750 crores from LVB in 2016-17 against fixed deposit guarantees. How did RBI allow such huge sums to be loaned out to convicts such as Singh brothers of Ranbaxy / Fortis infamy?

-The guarantees were invoked in 2019 and RBI placed LVB under PCA restrictions meaning no branch expansion etc. Why didn't RBI ask for immediate merger of the bank with other bank?

-LVB proposed merger / takeover by India Bulls Housing in 2019 that was denied by RBI. Why did RBI deny the merger / takeover knowing fully well that the asset quality had deteriorated so much?

-Gross NPAs for LVB exploded from 10% in 2018 to 15.3% in 2019 and 25.4% in June 2020. Why was RBI asleep all these years?

-RBI is now tip toeing on what to do with the common man having to bear the consequences.

Indian Banking System led by RBI is an absolute shambles.

The more I read about LVB, the more failure of the bank falls at the feet of RBI.

-Malvinder / Shivinder Singh brothers were allowed to take out loans of more than Rs 750 crores from LVB in 2016-17 against fixed deposit guarantees. How did RBI allow such huge sums to be loaned out to convicts such as Singh brothers of Ranbaxy / Fortis infamy?

-The guarantees were invoked in 2019 and RBI placed LVB under PCA restrictions meaning no branch expansion etc. Why didn't RBI ask for immediate merger of the bank with other bank?

-LVB proposed merger / takeover by India Bulls Housing in 2019 that was denied by RBI. Why did RBI deny the merger / takeover knowing fully well that the asset quality had deteriorated so much?

-Gross NPAs for LVB exploded from 10% in 2018 to 15.3% in 2019 and 25.4% in June 2020. Why was RBI asleep all these years?

-RBI is now tip toeing on what to do with the common man having to bear the consequences.

Indian Banking System led by RBI is an absolute shambles.

Re: Indian Economy News & Discussion - Nov 27 2017

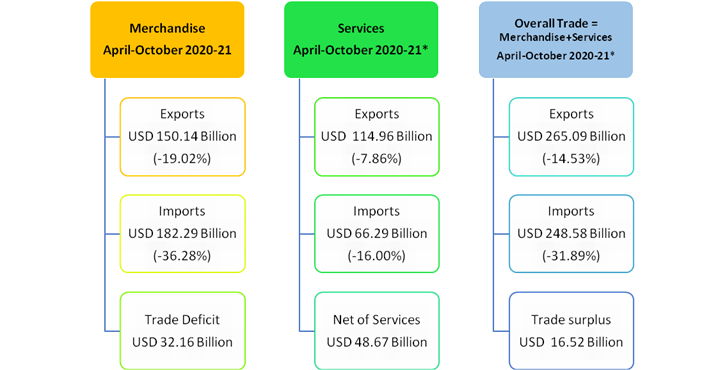

Doing the math, we went from a deficit of 45B$ to a surplus of 16.5B$. Not a bad thing in itself.