Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

Volume and number of ships is also important right? , i.e. the ratio (turn around time)/volume or (TAT/#Ships)

Re: Indian Economy News & Discussion - Nov 27 2017

Are we saying I, as a buyer of the new car, have a way to recover the GST on the trade-in value - 4L in this case?Lisa wrote: ↑01 Aug 2025 23:05Correct, trade in value cannot be deducted. Furthermore, let's say the cost on the new car (to the shop) is 7L and GST on that is, let's say 10%, i.e. 0.7 L. This 0.7L is recoverable against the sale price but if trade in value is used then the sale GST is 0.4L, i.e. the shop can actually recover 0.3L from the state! This is contrary to the duty of care in the collection of a "sales tax".

Re: Indian Economy News & Discussion - Nov 27 2017

If you sell your second hand car to your friend, do you charge and repatriate GST to the state?

Re: Indian Economy News & Discussion - Nov 27 2017

Such sales have no GST per a variety of websites.

e.g., https://myraasta.in/blogs/do-i-have-to- ... lete-guide

Re: Indian Economy News & Discussion - Nov 27 2017

State wise GDP or GSDP for 2024-25. TN leads the pack in growth.

https://pbs.twimg.com/media/GxpCXONawAA ... name=small

https://pbs.twimg.com/media/GxpCXONawAA ... name=small

Re: Indian Economy News & Discussion - Nov 27 2017

Poor #s from Madhya Pradesh keeping in mind the low base and almost continuous BJP government... Both it and Raj have immense potential to industrialize but the execution has been lacking and now both have fallen deeper into freebies focused vote buyingbala wrote: ↑06 Aug 2025 19:41 State wise GDP or GSDP for 2024-25. TN leads the pack in growth.

https://pbs.twimg.com/media/GxpCXONawAA ... name=small

Re: Indian Economy News & Discussion - Nov 27 2017

Accordingly, the Indian government is right to charge full GST on sale price of a new car and to decline an allowance for the excange of a second hand car.A_Gupta wrote: ↑06 Aug 2025 04:21Such sales have no GST per a variety of websites.

e.g., https://myraasta.in/blogs/do-i-have-to- ... lete-guide

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.moneycontrol.com/news/photo ... 97236.html

The golden discovery: Massive gold deposits found in MP's Jabalpur, geologists confirm treasure

The discovery, located in the Mahgawan Keolari area of Sihora tehsil, came after a prolonged and painstaking survey by the Geological Survey of India

"The evidence is conclusive," said a senior official from the department, adding, "The chemical tests confirm substantial traces of gold, along with copper and other precious minerals. This could be one of the most important mineral discoveries in central India in recent years."

The golden discovery: Massive gold deposits found in MP's Jabalpur, geologists confirm treasure

The discovery, located in the Mahgawan Keolari area of Sihora tehsil, came after a prolonged and painstaking survey by the Geological Survey of India

"The evidence is conclusive," said a senior official from the department, adding, "The chemical tests confirm substantial traces of gold, along with copper and other precious minerals. This could be one of the most important mineral discoveries in central India in recent years."

Re: Indian Economy News & Discussion - Nov 27 2017

Just FYI, the world’s proven gold reserves amount to about 60,000 tons of gold, and about 200,000 tons of gold have been mined in all of human history.

Re: Indian Economy News & Discussion - Nov 27 2017

nonsense. Ocean alone has around 20 million tons. https://www.forbes.com/sites/trevornace ... den-ocean/

Re: Indian Economy News & Discussion - Nov 27 2017

well thats interesting., some have gone to the extent of mining asteroids for Gold and another minerals.. when they could have developed technologies to extract all that right here on earth !pravula wrote: ↑09 Aug 2025 10:52nonsense. Ocean alone has around 20 million tons. https://www.forbes.com/sites/trevornace ... den-ocean/

-

nandakumar

- BRFite

- Posts: 1688

- Joined: 10 May 2010 13:37

Re: Indian Economy News & Discussion - Nov 27 2017

I recall a line in an essay by A.G. Gardiner on Letter Writing. Lamenting the demise of the Art of good Letter Writing he blames the penny post system introduced in the UK in the late 19th century. He says, "If diamonds were as plentiful as pebbles nobody would stoop to pick them up"! May be nations' central bankers should have a say on what precious metal can be mined and by how much. Talking of which, the same would apply to mining crypto currencies as well.

Re: Indian Economy News & Discussion - Nov 27 2017

Deleted

Last edited by Suraj on 10 Aug 2025 21:15, edited 1 time in total.

Reason: Please post in the Pakistani news thread.

Reason: Please post in the Pakistani news thread.

Re: Indian Economy News & Discussion - Nov 27 2017

Please note “proven reserve” in what I said.pravula wrote: ↑09 Aug 2025 10:52nonsense. Ocean alone has around 20 million tons. https://www.forbes.com/sites/trevornace ... den-ocean/

Please understand what a proven reserve means.

For gold in ocean water, the economic feasibility of extraction has not been demonstrated. At one gram of gold per 100 million tons of water it is likely to never be economically feasible to extract.Proven (or Measured) Reserve: This is the highest confidence category of mineral reserves. It means that:

- The quantity, quality, and location of the mineral are well established through detailed exploration and sampling.

- The economic feasibility of mining it has been demonstrated, typically through engineering studies and cost analysis.

- The reserve is supported by geological evidence and technical data, such as drilling results and geophysical surveys.

For another example, Pakistan may have $6 trillion in minerals, but their proven reserve is not more than $100 billion (at the present time).

Waiting to hear what the Jabalpur discovery translates into proven reserves.

Re: Indian Economy News & Discussion - Nov 27 2017

Well, we now have a breeder reactor for making gold. https://www.theatlantic.com/science/arc ... on/683811/

Re: Indian Economy News & Discussion - Nov 27 2017

Yes, thanks, but "a working fusion reactor capable of producing enough neutrons cost-effectively for this process {of converting mercury-198 in mercury-197 that decays to gold-197" does not yet exist. Likely much more probable to come about than the extraction of gold from sea-water, but not yet here. Maybe asteroid mining will come first? (e.g., this https://theprint.in/opinion/giant-aster ... er/260482/ )pravula wrote: ↑10 Aug 2025 01:56 Well, we now have a breeder reactor for making gold. https://www.theatlantic.com/science/arc ... on/683811/

Re: Indian Economy News & Discussion - Nov 27 2017

Another example of mineral resources vs proven reserves: the Reko Dik mine in Pakistan.

Total Mineral Resources:

The overall Reko Diq deposit contains approximately 5.9 billion tonnes of ore with an average copper grade of 0.41% and a gold grade of 0.22 g/t.

Economically Mineable Portion:

A portion of the deposit, estimated at 2.2 billion tonnes, is considered economically viable with an average copper grade of 0.53% and a gold grade of 0.30 g/t.

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.janes.com/osint-insights/de ... -milestone

The value of defence production in India reached a record high of INR1.50 trillion (USD17.2 billion) in fiscal year (FY) 2024–25, India's Minister of Defence Rajnath Singh has announced.

The newly announced value amounts to an 18% increase over the FY 2023–24 output of INR1.27 trillion, Singh said in a 9 August post on social media site X.

The total production value represents the annual turnover reported by India's defence public sector undertakings (DPSUs), other PSUs and joint ventures involved in defence manufacturing, and private defence entities.

According to Indian Department of Defence Production (DDP) data, DPSUs accounted for about 77% of the total production in FY 2024–25 with INR1.16 trillion. Private defence companies constituted the remaining 23% – a 2% increase compared with FY 2023–24 – with INR339.7 billion production value.

While the DPSUs recorded about 16% growth in FY 2024–25 over the previous fiscal year's production value of about INR1 trillion, private defence companies marked an increase of more than 27% over last year's value of INR266.7 billion.

In the last eight years, total defence production has increased steadily, with more than a 100% increase over the INR740.5 billion production value recorded in FY 2016–17, according to the DDP.

The value of defence production in India reached a record high of INR1.50 trillion (USD17.2 billion) in fiscal year (FY) 2024–25, India's Minister of Defence Rajnath Singh has announced.

The newly announced value amounts to an 18% increase over the FY 2023–24 output of INR1.27 trillion, Singh said in a 9 August post on social media site X.

The total production value represents the annual turnover reported by India's defence public sector undertakings (DPSUs), other PSUs and joint ventures involved in defence manufacturing, and private defence entities.

According to Indian Department of Defence Production (DDP) data, DPSUs accounted for about 77% of the total production in FY 2024–25 with INR1.16 trillion. Private defence companies constituted the remaining 23% – a 2% increase compared with FY 2023–24 – with INR339.7 billion production value.

While the DPSUs recorded about 16% growth in FY 2024–25 over the previous fiscal year's production value of about INR1 trillion, private defence companies marked an increase of more than 27% over last year's value of INR266.7 billion.

In the last eight years, total defence production has increased steadily, with more than a 100% increase over the INR740.5 billion production value recorded in FY 2016–17, according to the DDP.

Re: Indian Economy News & Discussion - Nov 27 2017

Hope with the upcoming GST reforms, govt scraps 18% rate in favour of 12%.

Also, try and give rebate on high ticket items where GST paid is 5k or more while filing IT by individuals, say upto 25-33%.

Finally, govt shd introduce TCS @10% on items costing 50k or above. This would help in taxing the population who avoids tax by fraudulent means or in zero% tax bracket.

Also, try and give rebate on high ticket items where GST paid is 5k or more while filing IT by individuals, say upto 25-33%.

Finally, govt shd introduce TCS @10% on items costing 50k or above. This would help in taxing the population who avoids tax by fraudulent means or in zero% tax bracket.

Re: Indian Economy News & Discussion - Nov 27 2017

Paging Suraj San and other ECON Gurus of BRF:

Can you please review my post on "PSU Privatization/ Strategic Disinvestment" and comment?

TIA

Can you please review my post on "PSU Privatization/ Strategic Disinvestment" and comment?

TIA

Re: Indian Economy News & Discussion - Nov 27 2017

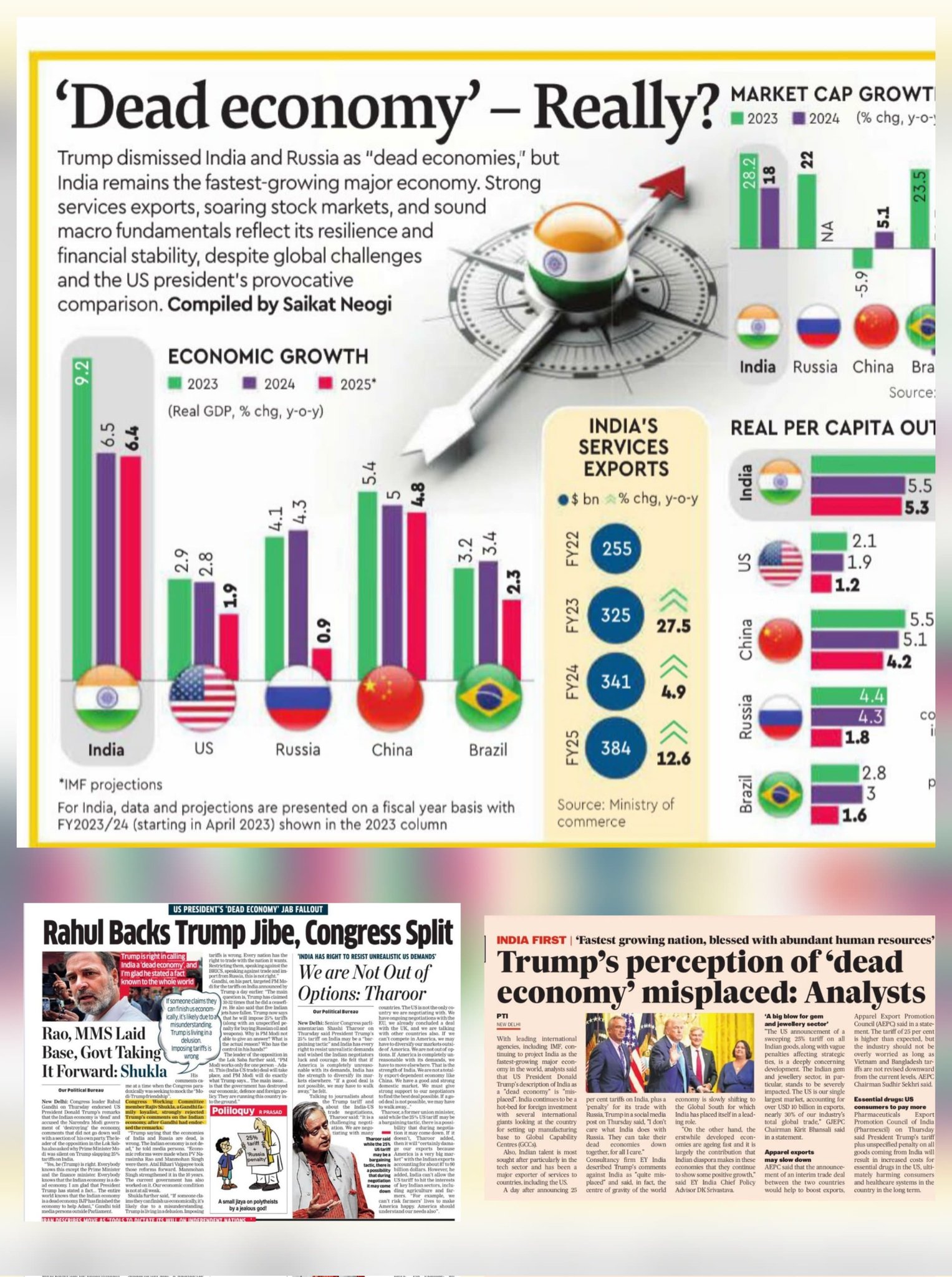

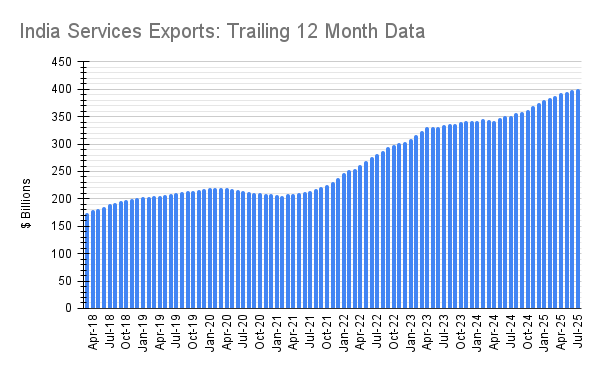

Xposting from Twitter:

Indian export performance milestones

July 2025 saw two major milestones being reached or almost reached in Indian foreign trade:

* Total trailing 12 month (Aug 24 - Jul 25) services exports crossed $400 billion

* Total exports are almost at $850 billion.

Indian export performance milestones

July 2025 saw two major milestones being reached or almost reached in Indian foreign trade:

* Total trailing 12 month (Aug 24 - Jul 25) services exports crossed $400 billion

* Total exports are almost at $850 billion.

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.ndtv.com/world-news/russia- ... ns-9123371

Russia Offers 5% Discount On Oil To India Amid Trump Tariff Tensions

Re: Indian Economy News & Discussion - Nov 27 2017

Is 5% a big deal ?chetak wrote: ↑21 Aug 2025 10:03 https://www.ndtv.com/world-news/russia- ... ns-9123371

Russia Offers 5% Discount On Oil To India Amid Trump Tariff Tensions

Re: Indian Economy News & Discussion - Nov 27 2017

https://worldview.stratfor.com/situatio ... despite-us

It's 5 USD per barrel. Not 5%

current crude price per barrel running around 65 to 70 , this is a good discount

Import volumes are substantial, with figures often exceeding 4.5 million barrels per day. , thats a saving of 20 million USD per day and 600 million per month. Add the profit from the refined derivatives !

can we live without it ? certainly so i think.

But a lot more has to do with what the US has done, the way it did is in no way an allied country should behave ., the shoe is on the other foot

It's 5 USD per barrel. Not 5%

current crude price per barrel running around 65 to 70 , this is a good discount

Import volumes are substantial, with figures often exceeding 4.5 million barrels per day. , thats a saving of 20 million USD per day and 600 million per month. Add the profit from the refined derivatives !

can we live without it ? certainly so i think.

But a lot more has to do with what the US has done, the way it did is in no way an allied country should behave ., the shoe is on the other foot

Re: Indian Economy News & Discussion - Nov 27 2017

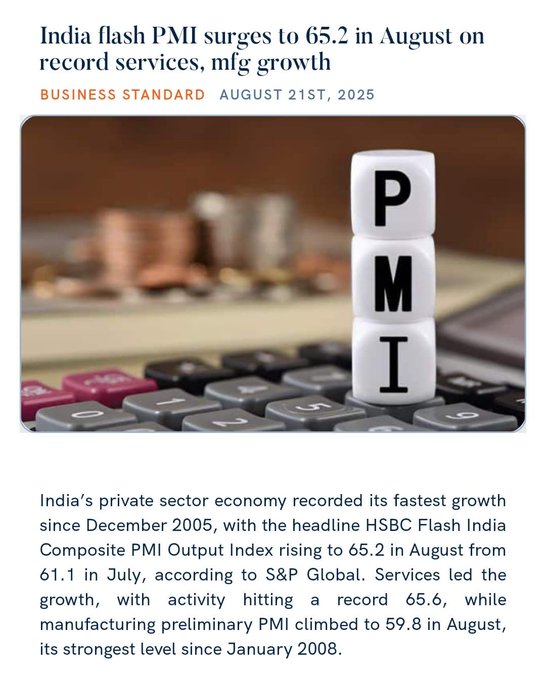

https://x.com/MeghUpdates/status/1958462156938027163

@MeghUpdates

BIG BREAKING

BIG BREAKING

India’s Composite PMI surges to 65.2, the fastest private sector growth in nearly 20 years.

➡ Manufacturing PMI: 59.8

➡ Services PMI: 65.6

It's a clear sign of booming demand across different sectors of the Indian economy & it's definitely not dead!

@MeghUpdates

India’s Composite PMI surges to 65.2, the fastest private sector growth in nearly 20 years.

➡ Manufacturing PMI: 59.8

➡ Services PMI: 65.6

It's a clear sign of booming demand across different sectors of the Indian economy & it's definitely not dead!

Re: Indian Economy News & Discussion - Nov 27 2017

A must watch

Reposting from Modi 3.0

India Will Benefit From The Tariff War: Sudhanshu Trivedi's Full Speech From Republic Bharat Samwad

The entire lecture by BJP National Spokesperson Sudhanshu Trivedi explores "Siyasat, Itihaas Aur Samvad"—the complex interplay of politics, history, and discourse in forming contemporary India. Renowned for his eloquent viewpoint and profound knowledge of Indian culture, Dr. Trivedi shares his perspectives on how political narratives are crafted, how historical context is understood, and how meaningful discourse is still essential to democracy.

We learn about Dr. Trivedi's open perspectives on the development of Indian politics, the significance of historical tradition in contemporary administration, and the ways that public discourse can heal divisions in a multicultural society. Anticipate stimulating discussions on issues from the past and present, the value of disagreement and discussion, and how politics (Siyasat) and discourse (Samvad) support India's development into a thriving democracy.

Reposting from Modi 3.0

India Will Benefit From The Tariff War: Sudhanshu Trivedi's Full Speech From Republic Bharat Samwad

The entire lecture by BJP National Spokesperson Sudhanshu Trivedi explores "Siyasat, Itihaas Aur Samvad"—the complex interplay of politics, history, and discourse in forming contemporary India. Renowned for his eloquent viewpoint and profound knowledge of Indian culture, Dr. Trivedi shares his perspectives on how political narratives are crafted, how historical context is understood, and how meaningful discourse is still essential to democracy.

We learn about Dr. Trivedi's open perspectives on the development of Indian politics, the significance of historical tradition in contemporary administration, and the ways that public discourse can heal divisions in a multicultural society. Anticipate stimulating discussions on issues from the past and present, the value of disagreement and discussion, and how politics (Siyasat) and discourse (Samvad) support India's development into a thriving democracy.

Re: Indian Economy News & Discussion - Nov 27 2017

The Road to Viksit Bharat is paved with Process Reforms" Talk by Shri Sanjeev Sanyal | IISER Pune

Title: The Road to Viksit Bharat is paved with Process Reforms

Speaker: Shri Sanjeev Sanyal,

Member, Prime Minister's Economic Advisory Council

Venue: C V Raman Auditorium, Lecture Hall Complex, IISER Pune campus

About Speaker

Shri Sanjeev Sanyal is currently a Member of Prime Minister Narendra Modi's Economic Advisory Council (since 2022) with the rank of Secretary, Government of India. He is also the Chancellor of Gokhale Institute of Politics and Economics, Pune. He was earlier the Principal Economic Adviser to the Finance Minister for five years till February 2022. He has also represented India on many international forums such as OECD and G7, and served as Co-Chair of the G20's Framework Working Group.

Since joining the government in early 2017, he was involved in many key reforms. For his contributions to public service, Sanjeev Sanyal was given the KPS Menon Memorial Award for 2023. The award is named after India's first foreign secretary. Prior to joining the government, he spent over two decades in international financial markets, and served as Chief Economist for South & South-East Asia, and later as Global Strategist and a Managing Director at Deutsche Bank.

An alumnus of Shri Ram College of Commerce, Delhi University, Mr. Sanyal later attended Oxford University as a Rhodes Scholar. He was awarded the Eisenhower Fellowship in 2007 for his work on urban systems. In 2010 he was named as Young Global Leader by the World Economic Forum in Davos. He has been a visiting professor/fellow of numerous institutions such as Oxford University, Royal Geographical Society (London), Institute of Policy Studies (Singapore), Jawaharlal Nehru University (Delhi). He also chairs the board of advisors of the Delhi School of Public Policy and Governance (Delhi University) and was a member of the Board of Advisors of the World Cities Summit, Singapore.

Mr. Sanyal is the author of a number of best-selling books including Revolutionaries, Land of the Seven Rivers, The Ocean of Churn, India in the Age of Ideas, The Incredible History of the Indian Ocean, and the Indian Renaissance. He has also published around three hundred articles and columns in leading national and international publications. His writings have received many awards including the Kalinga Book Award 2023, the Art Karat Award 2018, Skoch Award for Economics 2023 and so on.Title: The Road to Viksit Bharat is paved with Process Reforms

Title: The Road to Viksit Bharat is paved with Process Reforms

Speaker: Shri Sanjeev Sanyal,

Member, Prime Minister's Economic Advisory Council

Venue: C V Raman Auditorium, Lecture Hall Complex, IISER Pune campus

About Speaker

Shri Sanjeev Sanyal is currently a Member of Prime Minister Narendra Modi's Economic Advisory Council (since 2022) with the rank of Secretary, Government of India. He is also the Chancellor of Gokhale Institute of Politics and Economics, Pune. He was earlier the Principal Economic Adviser to the Finance Minister for five years till February 2022. He has also represented India on many international forums such as OECD and G7, and served as Co-Chair of the G20's Framework Working Group.

Since joining the government in early 2017, he was involved in many key reforms. For his contributions to public service, Sanjeev Sanyal was given the KPS Menon Memorial Award for 2023. The award is named after India's first foreign secretary. Prior to joining the government, he spent over two decades in international financial markets, and served as Chief Economist for South & South-East Asia, and later as Global Strategist and a Managing Director at Deutsche Bank.

An alumnus of Shri Ram College of Commerce, Delhi University, Mr. Sanyal later attended Oxford University as a Rhodes Scholar. He was awarded the Eisenhower Fellowship in 2007 for his work on urban systems. In 2010 he was named as Young Global Leader by the World Economic Forum in Davos. He has been a visiting professor/fellow of numerous institutions such as Oxford University, Royal Geographical Society (London), Institute of Policy Studies (Singapore), Jawaharlal Nehru University (Delhi). He also chairs the board of advisors of the Delhi School of Public Policy and Governance (Delhi University) and was a member of the Board of Advisors of the World Cities Summit, Singapore.

Mr. Sanyal is the author of a number of best-selling books including Revolutionaries, Land of the Seven Rivers, The Ocean of Churn, India in the Age of Ideas, The Incredible History of the Indian Ocean, and the Indian Renaissance. He has also published around three hundred articles and columns in leading national and international publications. His writings have received many awards including the Kalinga Book Award 2023, the Art Karat Award 2018, Skoch Award for Economics 2023 and so on.Title: The Road to Viksit Bharat is paved with Process Reforms

Re: Indian Economy News & Discussion - Nov 27 2017

Q1 official data is out!Suraj wrote: ↑30 May 2025 22:48 The Q4 official data is out:

Official Q4 2024-25 GDP data

* Full year GDP growth was 6.5% , but may be revised upward in the 2nd review.

* Q4 growth was 7.4%, coming on the back of 6.4% in Q3 and 5.6% in Q2, meaning there's a strong accelerating momentum post election (Fig 4).

* The past three fiscals registered 9.7%, 7,6% and 9.2% GDP growth, so there's a high base effect here. 6.5% growth on the back of three years averaging almost 9% growth is extremely good, and likely to be scaled up.

* The weaker GDP growth this past fiscal is primarily on account of softness in Q2 and to a lesser extent Q3. This is particularly notable in the secondary sector, which also faced a high base effect (Statement 5) - manufacturing in particular looks very soft, but look at the GVA growth in 2023-24 when it grew in the high double digits and that acts as a high base.

* It's not clear why Discrepancies (Statement 6) remains so high and is a brake on GDP growth.

* Item-level growth (Annexure B ) looks ok, except for the drop in private vehicle sales - any idea why ? - and the surprising drop in railways freight traffic in tonne-kms. I don't know why that's the case. With the DFCs in particular, I expected to see growth.

Official Q1 2025-26 GDP data

Q1 (Apr-Jun) real GDP growth was 7.8%

* This is a substantial gain from 6.5% in the year-ago Q1, and 7.4% in Q4 - the preceding quarter.

* The last four quarters show a sustained rising trend: 5.6% -> 6.4% -> 7.4% -> 7.8%

* The fundamental driver is the restored growth of the tertiary services sector, which grew from 6.8% a year ago to 9.3%.

* Services also compensated for the slight drop in the secondary sector that fell from 8.6% to 7.0%, driven entirely by the drop in electricity/water/gas/utility output growth. Not sure what's driving that. Seems temporary.

* Manufacturing continues to maintain vigor, posting 7.7% growth , slightly over 7.6% in the year ago quarter.

* Investment GDP as measured by GFCF as a percent of GDP in constant terms is 34.5%. It would have crossed 35% but for the relative growth in imports in Q1 vs the year ago quarter.

Overall an excellent situation given all the ongoing uncertainties.

Re: Indian Economy News & Discussion - Nov 27 2017

How much of it was due to front loading of imports from US companies I wonder...

Re: Indian Economy News & Discussion - Nov 27 2017

Zeroth Law of Good Governance: No taxation without representation and no representation without taxation. India has miserably failed to adhere to the above law of good governance. Taxpayers are Nation Builders.

Land use tax was the primary source of government revenue and landowners/land user.Prior to independence Land was more or less a state asset given to land Utilizer for mostly agricultural / animal husbandry use. Land Utilizers were required to give upto 16% (Under Indian rulers) and upto 30% under British rule (which lead to famines) of nominal produce from land as land rent, non payment of tax meant losing the land itself. The pressure on Land utilizer to ensure productivity was large. This land tax policy was what made India so productive in the ancient world.

The genesis of bad governance lies in the constitution and post Independence policies of India which transferred land to land users but did not levy any taxes on the land. India in 1947 abolished all agricultural taxes and land taxes and made the cost of keeping land assets idle cheap due to the agricultural nature of 1947 India. Land / Property Tax in India today is 0.02% in Urban areas and 0 in Rural / Agricultural areas. I asked revenue officials in J&K, Punjab, Haryana, Rajastan and Tamil Nadu. It emerges that the even the trivially small land / property taxes have NOT been been collected in most places in India since 1947.

The socialist policies of GoI even today ensures that most citizens can sit at home do trivial amounts of work (paid via MNREGA) and still survive via via rations of PDS schemes. Most of the land assets in India are embroiled in filial legal disputes and get progressively smaller and marginal with every generation. The chaos and indiscipline seen in India is a outcome of poor taxation laws There is no incentive for excellence and hard work and all incentive for laziness and chalta hain.

Some analysis of Taxation in India reveals that a vast majority of taxes are paid by a small minority of population 2% (mostly salaried employee of corporates) who have very little say in Governance.

The total receipts other than borrowings and the total expenditure are estimated at ₹34.96 lakh crore and ₹50.65 lakh crore respectively.

https://www.india.gov.in/spotlight/unio ... -2025-2026

Out of 34.96L Cr of tax receipts

https://www.indiabudget.gov.in/doc/rec/ ... igital.pdf

Household GST split is taken from articles below.

(There is some controversy here I am going with below papers and news article below for GST data)

https://www.newindianexpress.com/opinio ... gst-shares

For reference Indian household income splits are mentioned here.

https://sabrangindia.in/the-growing-div ... ity-crisis

Rs 6.19L Cr paid by households = 100% population 145Cr = Rs 4421 /capita

Rs 1.74L Cr GST paid by lower income 50% of population = 70 Cr = Rs 2750/ capita

Rs 1.89L Cr GST paid by middle income 30% = 42Cr= Rs 4500 / capita

Rs 2.56L Cr GST paid by higher income 20% = 28Cr = Rs 9142 / capita

Government Spend per Capita = Rs 50.65LCr / 145Cr = Rs 35000/Capita

I hereby define a Taxpayer as individual that crosses the Rs 35000 / Year x 5 Year (election cycle) = Rs 1.75L in 5 years threshold. Anyone below this threshold is a net tax beneficiary. Taxes paid = Income tax, Stamp duty on property transactions, GST, Fuel Cess.

It is my strongly held belief that if the voting majority are net tax beneficiaries then they will only vote for short term socialist policies that increase their benefits at the expense of the taxpaying minority. The taxpaying minority will try to escape this exploitation in every way possible (tax avoidance) including migration to other countries where such policies are not normal. Needless to say this is what we see in India today.

Recommendations: Increase property tax from 0.02% to 1% of land / property value and either abolish or reduce stamp duty to 0.5% from the current 7% as is common globally (ref USA/UK Land/Property Tax). This will ensure that land is immediately made productive. Second land costs in India as massively high due to low cost of ownership. The higher land tax will reduce land prices and allow competent people to acquire the land to make it productive. It will incentivize conversion of 60% Rural tax beneficiaries into tax payers and catalyze a shift from agriculture to manufacturing.

Locally collected Land tax if utilized Local Infrastructure building will result in a massive productive rise. Devolve governance to local bodies and allow them to collect higher property taxes and remove the state usurpation of stamp duty.

Land use tax was the primary source of government revenue and landowners/land user.Prior to independence Land was more or less a state asset given to land Utilizer for mostly agricultural / animal husbandry use. Land Utilizers were required to give upto 16% (Under Indian rulers) and upto 30% under British rule (which lead to famines) of nominal produce from land as land rent, non payment of tax meant losing the land itself. The pressure on Land utilizer to ensure productivity was large. This land tax policy was what made India so productive in the ancient world.

The genesis of bad governance lies in the constitution and post Independence policies of India which transferred land to land users but did not levy any taxes on the land. India in 1947 abolished all agricultural taxes and land taxes and made the cost of keeping land assets idle cheap due to the agricultural nature of 1947 India. Land / Property Tax in India today is 0.02% in Urban areas and 0 in Rural / Agricultural areas. I asked revenue officials in J&K, Punjab, Haryana, Rajastan and Tamil Nadu. It emerges that the even the trivially small land / property taxes have NOT been been collected in most places in India since 1947.

The socialist policies of GoI even today ensures that most citizens can sit at home do trivial amounts of work (paid via MNREGA) and still survive via via rations of PDS schemes. Most of the land assets in India are embroiled in filial legal disputes and get progressively smaller and marginal with every generation. The chaos and indiscipline seen in India is a outcome of poor taxation laws There is no incentive for excellence and hard work and all incentive for laziness and chalta hain.

Some analysis of Taxation in India reveals that a vast majority of taxes are paid by a small minority of population 2% (mostly salaried employee of corporates) who have very little say in Governance.

The total receipts other than borrowings and the total expenditure are estimated at ₹34.96 lakh crore and ₹50.65 lakh crore respectively.

https://www.india.gov.in/spotlight/unio ... -2025-2026

Out of 34.96L Cr of tax receipts

https://www.indiabudget.gov.in/doc/rec/ ... igital.pdf

Household GST split is taken from articles below.

(There is some controversy here I am going with below papers and news article below for GST data)

https://www.newindianexpress.com/opinio ... gst-shares

https://papers.ssrn.com/sol3/papers.cfm ... id=4979861Our findings present a picture very different from Oxfam’s assertions. Household contributions to GST collections amounted to `6.19 lakh crore in 2022-23, representing 34 percent of total GST revenues of `18.07 lakh crore (=Rs6.19LCr). The remaining comes from business-to-business transactions and government consumption. This is in line with their respective GDP shares. Oxfam’s claim that the bottom 50 percent contributes 64 percent is not only inaccurate, but also mathematically impossible, as the figure is double the total contribution from all Indian households.

For reference Indian household income splits are mentioned here.

https://sabrangindia.in/the-growing-div ... ity-crisis

The median annual income in 2022-23 is Rs. 1 lakh, meaning anyone earning more than Rs. 8,750 per month (Rs. 350 per day) earns more than the bottom 50% of the population, which consists of 46 crore people. For this bottom half, the average annual income is about Rs. 71,000, or less than Rs. 6,000 per month (Rs. 250 per day). The middle 40% of the population, about 36 crore people, have an average annual income of Rs. 1.6 lakhs, equating to Rs. 13,000 per month or Rs. 550 per day. In contrast, income distribution in India is highly concentrated at the top. The top 10% (9 crore people) earn an average annual income of over Rs. 13 lakhs. The top 1% (90 lakh people) earn over Rs. 53 lakhs annually, and the top 0.1% (9 lakh people) earn over Rs. 2 crores. At the pinnacle, the top 0.01% (around 10,000 people) earn more than Rs. 10 crores annually, and the top 9,223 individuals earn an astounding average of Rs. 50 crores.

Rs 6.19L Cr paid by households = 100% population 145Cr = Rs 4421 /capita

Rs 1.74L Cr GST paid by lower income 50% of population = 70 Cr = Rs 2750/ capita

Rs 1.89L Cr GST paid by middle income 30% = 42Cr= Rs 4500 / capita

Rs 2.56L Cr GST paid by higher income 20% = 28Cr = Rs 9142 / capita

Government Spend per Capita = Rs 50.65LCr / 145Cr = Rs 35000/Capita

I hereby define a Taxpayer as individual that crosses the Rs 35000 / Year x 5 Year (election cycle) = Rs 1.75L in 5 years threshold. Anyone below this threshold is a net tax beneficiary. Taxes paid = Income tax, Stamp duty on property transactions, GST, Fuel Cess.

It is my strongly held belief that if the voting majority are net tax beneficiaries then they will only vote for short term socialist policies that increase their benefits at the expense of the taxpaying minority. The taxpaying minority will try to escape this exploitation in every way possible (tax avoidance) including migration to other countries where such policies are not normal. Needless to say this is what we see in India today.

Recommendations: Increase property tax from 0.02% to 1% of land / property value and either abolish or reduce stamp duty to 0.5% from the current 7% as is common globally (ref USA/UK Land/Property Tax). This will ensure that land is immediately made productive. Second land costs in India as massively high due to low cost of ownership. The higher land tax will reduce land prices and allow competent people to acquire the land to make it productive. It will incentivize conversion of 60% Rural tax beneficiaries into tax payers and catalyze a shift from agriculture to manufacturing.

Locally collected Land tax if utilized Local Infrastructure building will result in a massive productive rise. Devolve governance to local bodies and allow them to collect higher property taxes and remove the state usurpation of stamp duty.

Re: Indian Economy News & Discussion - Nov 27 2017

@tandav ji,

Excellent post.

I have small nit though. Weren't marathas charging chauthaa aka 25% tax? That was to their satraps. That means the citizens would have been paying more like 35% to their local ruler.

(Added later) Ofcourse, arguably they provided excellent governance and protection in return.

Last edited by Vayutuvan on 01 Sep 2025 03:18, edited 1 time in total.

Re: Indian Economy News & Discussion - Nov 27 2017

Even if collected, they are not paid.

Two generations after my grandfather transferred land to tenants as part of the post-1947 land reforms, I was able to get it back by paying the small amount of back taxes that the tenants never bothered to pay.

Re: Indian Economy News & Discussion - Nov 27 2017

https://x.com/MeghUpdates/status/1962395193392472525

@MeghUpdates

BIG BREAKING

BIG BREAKING

India opts for GOLD hedge, cuts US T-bill share in forex kitty.

RBI boosts gold reserves to DIVERSIFY forex savings & REDUCE dollar dependence. (ET)

@MeghUpdates

India opts for GOLD hedge, cuts US T-bill share in forex kitty.

RBI boosts gold reserves to DIVERSIFY forex savings & REDUCE dollar dependence. (ET)

Re: Indian Economy News & Discussion - Nov 27 2017

UPI achieves a new milestone with first time ever crossing 20 billion transactions in the month of August 2025!

https://x.com/DFS_India/status/1962474305687896505

Meanwhile the GST picture as of August 2025 for states:

https://x.com/IndianTechGuide/status/19 ... 4756736238

https://x.com/DFS_India/status/1962474305687896505

Meanwhile the GST picture as of August 2025 for states:

https://x.com/IndianTechGuide/status/19 ... 4756736238

Re: Indian Economy News & Discussion - Nov 27 2017

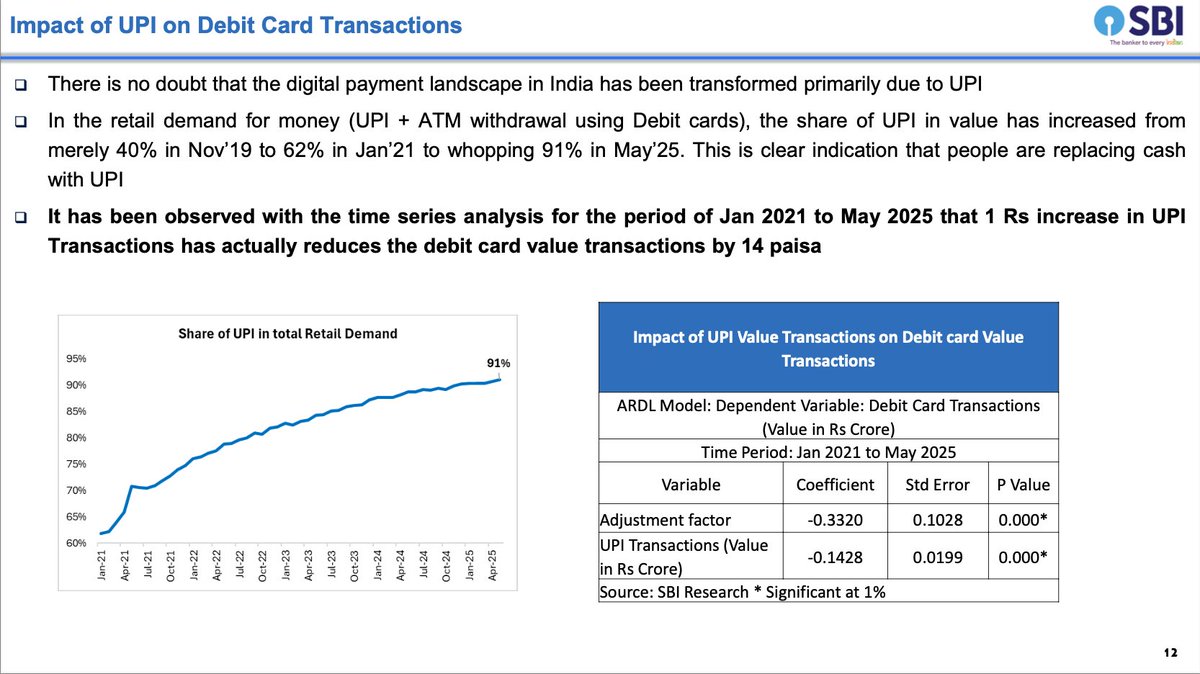

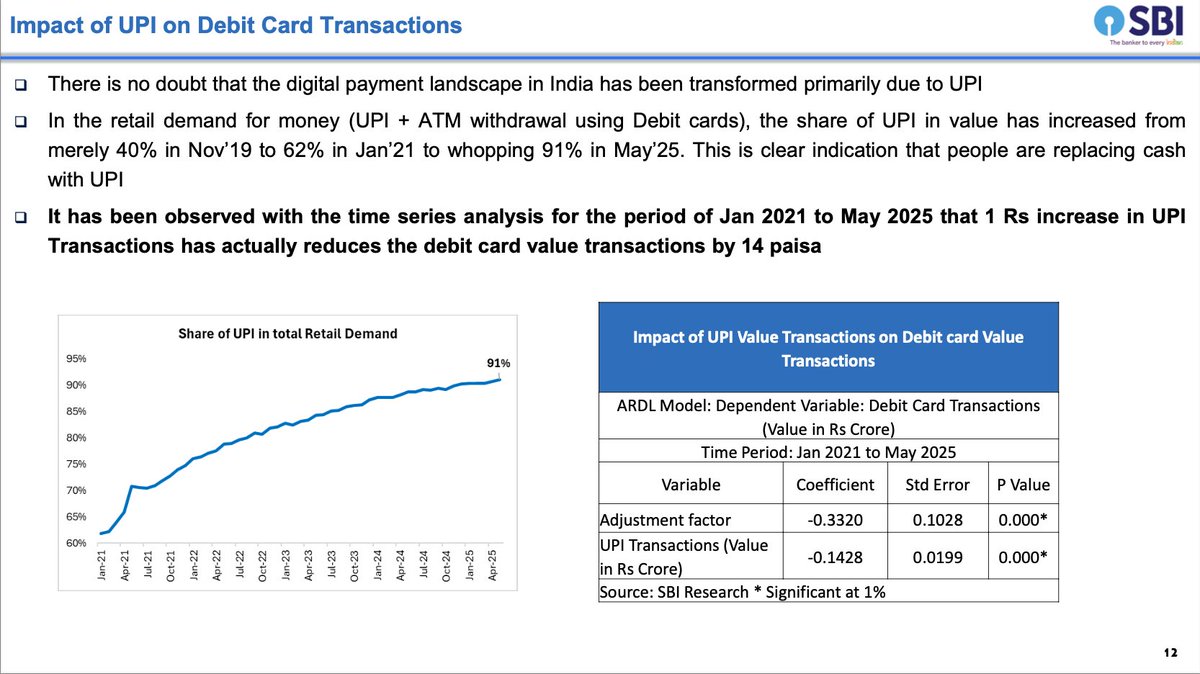

https://x.com/jasuja/status/1960187963893006538

@jasuja

Every rupee increase in UPI transactions reduces debit card usage by 14 paisa.

This isn't just digital adoption - it's mathematical proof India has rewired how 1.4 billion people handle money.

SBI Research dropped jaw-dropping numbers that reshape everything we know about payments

@jasuja

Every rupee increase in UPI transactions reduces debit card usage by 14 paisa.

This isn't just digital adoption - it's mathematical proof India has rewired how 1.4 billion people handle money.

SBI Research dropped jaw-dropping numbers that reshape everything we know about payments

Re: Indian Economy News & Discussion - Nov 27 2017

The Annual Survey on Industries (ASI) is a document released by MOSPI that's not gotten much interest here. To introduce what it does:

The fine grained data (e.g. GVA per factory or per worker) offers fascinating insight into ways to improve manufacturing output.

Annual Survey of Industries (ASI) Results for 2023-24

* Gross Value Added grew by 11.89% in current prices in the year 2023-24 over previous year

* Industrial output grew by more than 5.80% in 2023-24 over the previous year

* Total estimated employment in the sector* showed a robust growth of 5.92% in 2023-24 over the previous year

* This sector added more than half a crore (57 lakh) jobs during the last decade 2014-15 to 2023-24

* Top 5 industries in respect of GVA are Basic metal, Motor vehicles, Chemical and Chemical products, Food Products and Pharmaceutical products

* Tamil Nadu, Gujarat, Maharashtra, Uttar Pradesh and Karnataka are the top 5 States in respect of employment

Annual Survey of Industries is conducted with the primary objective to provide a meaningful insight into the dynamics of change in the composition, growth and structure of various manufacturing industries in terms of output, value added, employment, capital formation and a host of other parameters.

The fine grained data (e.g. GVA per factory or per worker) offers fascinating insight into ways to improve manufacturing output.

Annual Survey of Industries (ASI) Results for 2023-24

* Gross Value Added grew by 11.89% in current prices in the year 2023-24 over previous year

* Industrial output grew by more than 5.80% in 2023-24 over the previous year

* Total estimated employment in the sector* showed a robust growth of 5.92% in 2023-24 over the previous year

* This sector added more than half a crore (57 lakh) jobs during the last decade 2014-15 to 2023-24

* Top 5 industries in respect of GVA are Basic metal, Motor vehicles, Chemical and Chemical products, Food Products and Pharmaceutical products

* Tamil Nadu, Gujarat, Maharashtra, Uttar Pradesh and Karnataka are the top 5 States in respect of employment