Perspectives on the global economic meltdown

Re: Perspectives on the global economic meltdown

Goldman Sachs Likely to Post Huge Profits, Analysts Say

Hooray for phree markets, 'efficient' markets, 'rational' markets and the other transparent tripe I imbibed in grad school. Wonder how the profs that taught this BS shall face their students this year. Hope they will be decent enough to tone down the swagger.

Meanwhile,

UBS and Prosecutors Seek Hearing Delay

Its official then. GOTUS versus Switzerland. One desperate for taxable monies, the other to keep its reputation in its highest margin and perennial profit milch cow. Pass the popcorn. Steel cage-death match ho jaye!

In Recession, Japanese Lay Off Robots

House robots, not industrial robots unfortunately. Won't do much to tackle the snowballing problem across the emerged markets of the total lack of there being any employment driver anywhere. The US at least has its military to recruit excess energy off the streets from.

Hooray for phree markets, 'efficient' markets, 'rational' markets and the other transparent tripe I imbibed in grad school. Wonder how the profs that taught this BS shall face their students this year. Hope they will be decent enough to tone down the swagger.

Meanwhile,

UBS and Prosecutors Seek Hearing Delay

Its official then. GOTUS versus Switzerland. One desperate for taxable monies, the other to keep its reputation in its highest margin and perennial profit milch cow. Pass the popcorn. Steel cage-death match ho jaye!

In Recession, Japanese Lay Off Robots

House robots, not industrial robots unfortunately. Won't do much to tackle the snowballing problem across the emerged markets of the total lack of there being any employment driver anywhere. The US at least has its military to recruit excess energy off the streets from.

Re: Perspectives on the global economic meltdown

Peter Schiff again....Listen to his take on foriegn dislike for US money and America discouraging its people from surrendering US citizenship.

Re: Perspectives on the global economic meltdown

One of my friend says that entire US us a ponzi scheme.shyam wrote:Peter Schiff again....Listen to his take on foriegn dislike for US money and America discouraging its people from surrendering US citizenship.

Re: Perspectives on the global economic meltdown

DPJ’s Nakagawa Says Japan Should Diversify Reserves

http://www.bloomberg.com/apps/news?pid= ... jEl6I0_YhA

they will be diversifying their method of offloading US treasuries through the back door is what he means.

no more using relatives of the Bank of Japan with false bottom suitcases to sneak in billion dollar treasuries to offload in switzerland. They need a more diversified strategy than that.

http://www.bloomberg.com/apps/news?pid= ... jEl6I0_YhA

they will be diversifying their method of offloading US treasuries through the back door is what he means.

no more using relatives of the Bank of Japan with false bottom suitcases to sneak in billion dollar treasuries to offload in switzerland. They need a more diversified strategy than that.

Re: Perspectives on the global economic meltdown

Weekly Federal Reserve balance sheet update

Friday, July 10th, 2009

This just hit my inbox, from the research team at Barclays. Since we’ve talked a fair amount of late about the Fed balance sheet, I thought I’d pass it on.

“Weekly Federal Reserve balance sheet update

Usage of the various Federal Reserve liquidity programs continues to erode as outstanding loan amounts mature and are not replaced with new borrowing. The overall size of the central bank’s balance sheet is now 9% smaller than it was at the start of the year.”

Friday, July 10th, 2009

This just hit my inbox, from the research team at Barclays. Since we’ve talked a fair amount of late about the Fed balance sheet, I thought I’d pass it on.

“Weekly Federal Reserve balance sheet update

Usage of the various Federal Reserve liquidity programs continues to erode as outstanding loan amounts mature and are not replaced with new borrowing. The overall size of the central bank’s balance sheet is now 9% smaller than it was at the start of the year.”

Re: Perspectives on the global economic meltdown

Chinese Handcuffs? No, Chinese trade deficit

.

.

.

In this case, it led to a huge trade imbalance with China. Credit allowed us to consume beyond our means, and demand spilled out over our borders into China. The Chinese obliged and became huge holders of Treasuries. While it is true that the Chinese exchange rate regime was an amplifier of this story, I think it was more of a passenger than a driver. The driver was credit.

Today the credit bubble is popping (whence my view on inflation and the money multiplier). At the same time the Chinese are trying to prop up aggregate demand by controlling the only thing they can: domestic demand. This to me means the imbalances are in the process of going away. In fact, I have long said (and have made a few bets with friends) that the Chinese trade balance will likely be in deficit by the end of this year. This means that the need for China to buy our treasuries will have largely gone away. I realize this may be too aggressive a contention over this time frame, but I am convinced the basic story is right. And to my mind’s eye there isn’t an exchange rate regime or Renminbi level that can stop this from happening.

On Monday I posted a chart of the US trade balance, and we saw in it the dramatic swing that took hold as soon as the credit bubble popped. Overnight, the Chinese trade balance figures came out. Have a look at the chart below.

The chart shows China’s monthly trade balance. You will note that every year around March there is a big dip. It is a seasonal anomaly associated with the Chinese New Year. What you will observe is that the post-Chinese New Year rebound this year was much less pronounced, and, unlike in previous years, it soon rolled over. The trend now appears to be going the other way. This is despite Chinese government incentive to support exports and China increasingly taking market share from other Asian countries. It may well turn out that quite soon a Chinese trade deficit will have allowed us to slip out of—at least from a flow perspective—our Chinese handcuffs.

.

.

.

In this case, it led to a huge trade imbalance with China. Credit allowed us to consume beyond our means, and demand spilled out over our borders into China. The Chinese obliged and became huge holders of Treasuries. While it is true that the Chinese exchange rate regime was an amplifier of this story, I think it was more of a passenger than a driver. The driver was credit.

Today the credit bubble is popping (whence my view on inflation and the money multiplier). At the same time the Chinese are trying to prop up aggregate demand by controlling the only thing they can: domestic demand. This to me means the imbalances are in the process of going away. In fact, I have long said (and have made a few bets with friends) that the Chinese trade balance will likely be in deficit by the end of this year. This means that the need for China to buy our treasuries will have largely gone away. I realize this may be too aggressive a contention over this time frame, but I am convinced the basic story is right. And to my mind’s eye there isn’t an exchange rate regime or Renminbi level that can stop this from happening.

On Monday I posted a chart of the US trade balance, and we saw in it the dramatic swing that took hold as soon as the credit bubble popped. Overnight, the Chinese trade balance figures came out. Have a look at the chart below.

The chart shows China’s monthly trade balance. You will note that every year around March there is a big dip. It is a seasonal anomaly associated with the Chinese New Year. What you will observe is that the post-Chinese New Year rebound this year was much less pronounced, and, unlike in previous years, it soon rolled over. The trend now appears to be going the other way. This is despite Chinese government incentive to support exports and China increasingly taking market share from other Asian countries. It may well turn out that quite soon a Chinese trade deficit will have allowed us to slip out of—at least from a flow perspective—our Chinese handcuffs.

Re: Perspectives on the global economic meltdown

Definition of ponzi scheme is: "Investors are paid returns directly from their own money or from money collected from subsequent investors". By that definition, social security is ponzi, so is medicare, and one could even say that the debt servicing of the federal budget itself is a ponzi scheme. Your friend is not far off from the truth.Acharya wrote: One of my friend says that entire US us a ponzi scheme.

Re: Perspectives on the global economic meltdown

D&G humor....

The Economy Is So Bad That:

CEO's are now playing miniature golf.

Jewish women are marrying for love!

Even people who have nothing to do with the Obama administration aren't paying their taxes.

Hotwheels and Matchbox stocks are trading higher than GM.

Obama met with small businesses to discuss the Stimulus Package:GE, Pfizer and Citigroup.

Parents in Beverly Hills fired their nannies and learned their children's names.

A truckload of Americans got caught sneaking into Mexico .

The most highly-paid job is now jury duty.

People in Africa are donating money to Americans.

The Mafia is laying off judges.

And finally...

Congress says they are looking into this Bernard Madoff scandal.

Hey, neat -

the guy who made $50 billion disappear is being investigated by the people who made $750 billion disappear!

Re: Perspectives on the global economic meltdown

This should be really in the humor thread, but the last few lines give insight into the culture that led to this financial "meltdown".

Wells Fargo Bank Sues Itself

Wells Fargo Bank Sues Itself

It takes some pretty shameless lawyers and a rich culture of corporate stupidity for a company to sue itself. I hope Wells Fargo loses this case and ends up having to drag itself all the way to the Supreme Court.

Re: Perspectives on the global economic meltdown

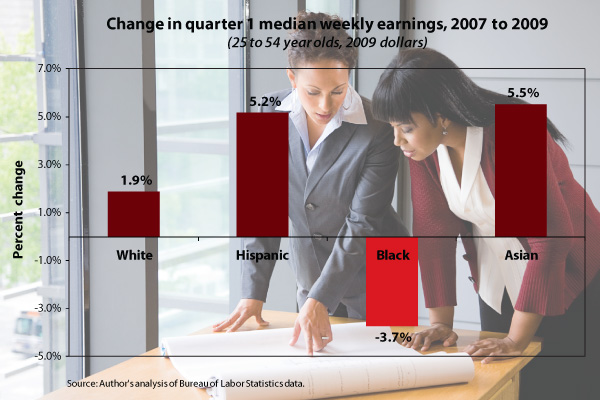

African Americans see weekly wage decline

by Algernon Austin

Over the last two years (from the first quarter of 2007 to the first quarter of 2009), black workers 25 to 54 years old experienced a 3.7% decline-a drop of about $23-in their inflation-adjusted median weekly wage (see Chart). No other major racial or ethnic group showed a decline over this period.

----

The African-American unemployment rate stood at 14.7% in June 2009.

-

Satya_anveshi

- BRF Oldie

- Posts: 3532

- Joined: 08 Jan 2007 02:37

Re: Perspectives on the global economic meltdown

A comment from someone in the know in FL.

"The law of unintended consequences".

Well, that law is bringing Cape Coral citizens close to violence. At least that's what the City Council members believe. They are doubling the number of police at Council meetings and are installing metal detectors. This comes after a meeting attended by 500 citizens erupted in many threats against Council members, and with half of the citizens were so enraged, that they stormed out before the end of the meeting.

On a national level, it is the bankers that control all the taxpayer money with Congressional campaign payoffs, but on a local level, it is usually the developers that have been able to buy votes for their favorite Council benefactors. Unfortunately, in the Cape, it appears that the Council members have completely sold out to the developers.

Cape Coral, like many other cities in Florida, is in serious need of money. To raise money, the Council has come up with the idea to assess everybody who owns a lot or a house for water service, even if that water service is many years away from ever being put in. This assessment is indexed to the amount of square feet of the lots.

In the NW section of town, where some people were able to pick up lots for next to nothing, the assessment for water will be $6,000. In the SW section of town, it will be $17,000. If you have a house there and bought the lot next door, you will be assessed $34,000. These costs are a drop in the bucket compared to those who bought rural ag land. A person who owns nine acres of ag land, even if he has a well and never has use for City water, will have to pay a water impact fee of $88,000. If he has a dwelling on the land, the cost goes to $98,000.

Why are these property owners stuck with these high costs? It's because the commercial land developers got a sweetheart deal through where they got their properties assessed as 70% wetlands, so they only get the water assessment for 30% of the square footage. The residential and rural home and land owners are stuck paying for the difference, immediately, even if they don't see City water for the next five years. When they do see it, the City will be ripping up their driveways and sprinkler systems to put it in. A lot of property owners are talking about just walking away. Some are so angry, that they are talking about taking other measures. Security will be tight at the next Council meeting.

Re: Perspectives on the global economic meltdown

Satya_anveshi wrote:The Economy Is Even Worse Than You Think

(a) Credit: We have yet to see the crisis in commercial mortgages and consumer credit. In the commercial mortgage end-customer base, small businesses are suffering and large businesses are cost focused. Both will put further pressure on lease rates and office vacancies, resulting in bankruptcies for companies who bought/built these projects at record high lease rate assumptions. In consumer credit, defaults are at historic highs (and escalating), and banks are tightening credit lines, increasing rates, and revoking cards. Those all bode poorly for an increase in consumer spending (and bank profits)

(b) Pensions - Most pension plans are significantly underwater (including state and local plans) - a significant and shocking off-balance sheet liability for these companies. This is very frightening when you realize that most of these benefits are for many current employees rapidly nearing retirement age. Actuaries assumed 6-8%+ IRRs, without ever accounting for a major market correction. It's very difficult to recoup a 30%+ correction, particularly when we are unlikely to see those types of blended market returns (except maybe in long dated Treasuries as interest rates begin to skyrocket).

(c) Psychology - Back to the 80s. All around I see people spending less, buying cheaper meat, spending less on weddings, cutting vacations, etc. We are even seeing this behavior in people who still have jobs with good incomes. The events of the last 12 months have changed how people view spending, and this shift may last for some time. Scars heal slowly.

(d) Government Spending - US GDP is 70% consumer spending. No reasonable amount of government spending can bridge the consumer spending gap created by increased savings, unemployment, reduced credit, etc. A 10% drop in consumer spending requires a ~25% increase in government spending. Current stimulus isn't even close to bridging the gap, even if you take the time lag of getting money into the economy out of the equation.

(e) Budgets - State, local, and federal budgets are all incorrect in tax revenue assumptions. Witness the speed at which the federal budget deficit far exceeded the new administration's projections. The hit from foreclosures/property tax reassessments, non-existent capital gains, tax benefits for capital losses, reduced consumer consumption, reduced business investment, etc. will all cripple many budgets

(f) Banks - It is still unclear what their real book of assets looks like since we haven't seen the effect of commercial mortgages and consumer credit. Banks are hoarding cash and building reserves because they know this fact, and likely expect a slow increase of reserve requirements (hats off to Sheila Bair!). This will further dampen lending, and thus a dampen a recovery.

Additionally, we have not yet seen the the worst in foreclosures. Historical data shows a 9-12 month lag between job losses and home foreclosures (people try to stay in their home as long a possible).

(g) Government Action - There may be very little the government can do except for "land the 737 slowly and safely". The administration should be pressuring the states to get costs under control (by inserting provisions in aid packages); encouraging the formation of new "clean" banks; quickly shuttering bad banks; and requiring companies to provide healthcare instead of sticking individual taxpayers with the bill for those employed by WalMart, McDonalds, wineries, farmers, etc.

Re: Perspectives on the global economic meltdown

Excellent read here, folks. An Atlantic article on the roving cavaliers of credit (to quote a wise khanomist) who brought about the current meltdown.

The Shadow Banking system

Also ties in with some of ss_roy's predictions back on page 1 of this thread. About why western banking is heading back tot he 1950s era.

Read it all.

The Shadow Banking system

Also ties in with some of ss_roy's predictions back on page 1 of this thread. About why western banking is heading back tot he 1950s era.

Read it all.

Re: Perspectives on the global economic meltdown

One of the aims of the thread was to understand which way the global economy is moving.

IMO, among the most important numbers to watch here on are the unemployment rates in the G7. Khanomy's official unemp rate, skewed a little downwards due to census hiring, administration preference reflected in BLS numbers and hatchet jobs by the media are already at 9.4% and Sri Obama has boldly declared that the unemp rate may continue to worsen for several months.

Obama Says Jobless Rate Likely to Tick Up for Several Month

Bernanke Sees Chance of Jobless Recovery

IMO, a new smoot-hawley will be born. Protectionist barriers will rise sky-high all across the world, starting with the rich-looking world. Jobs will have to be protected, whatever the cost.

India's exports sector, msot likely to be affected by such a turn, has already taken many a hit. Hope GoI doesn't lag behind in raising barriers here as they go up elsewhere.

The other imp number to track is the 10-yr-notes' yield. Has HUGE implications for interest rates, debt service burden and credit availability across the board.

Just my 2 cents.

IMO, among the most important numbers to watch here on are the unemployment rates in the G7. Khanomy's official unemp rate, skewed a little downwards due to census hiring, administration preference reflected in BLS numbers and hatchet jobs by the media are already at 9.4% and Sri Obama has boldly declared that the unemp rate may continue to worsen for several months.

Obama Says Jobless Rate Likely to Tick Up for Several Month

And now Sri Bernake gingerly admits to the possibility of a jobless recovery in a closed door session. How quaint.WASHINGTON -- President Barack Obama warned Tuesday that the U.S. jobless rate, already at its highest level in more than a quarter century, is likely to worsen for several months.

"My expectation is that we will probably continue to see unemployment tick up for several months," Mr. Obama told reporters after a meeting with Dutch Prime Minister Jan Peter Balkenende.

Unemployment stood at 9.5% nationwide last month, a rate that has prompted calls for additional stimulus measures, as well as criticism that the earlier $787 billion package has so far failed to create jobs. Mr. Obama, who has said he believes joblessness will soon hit 10%, will visit Michigan later Tuesday, a state already dealing with double-digit unemployment.

Bernanke Sees Chance of Jobless Recovery

Well, time to stop playing coy and game this forward. Chances are by this time next year, the unemp rate could kiss 15%. There's zimbly no jobs driver, no hiring sector and unemp benefits will run out for millions. The resulting societal chaos will be way too much for any gubmint to tolerate.Federal Reserve Chairman Ben Bernanke sees the possibility of continued high unemployment even after the recession eases, a key Republican lawmaker who met with the Fed chief told CNBC.

"It was a rather sobering meeting," Sen. Richard Shelby, an Alabama Republican, said in a live interview. "I said...'Could this be a jobless recovery?'...and he said it could be," Shelby said.

IMO, a new smoot-hawley will be born. Protectionist barriers will rise sky-high all across the world, starting with the rich-looking world. Jobs will have to be protected, whatever the cost.

India's exports sector, msot likely to be affected by such a turn, has already taken many a hit. Hope GoI doesn't lag behind in raising barriers here as they go up elsewhere.

The other imp number to track is the 10-yr-notes' yield. Has HUGE implications for interest rates, debt service burden and credit availability across the board.

Just my 2 cents.

Re: Perspectives on the global economic meltdown

The Economists cover story is titled - "the end of retirement"

http://www.economist.com/opinion/displa ... D=13900145

one comment among many:

VMSwami wrote:

June 30, 2009 4:10

As usual your leader and special report on "retirement" and ageing population in the western world is selective in its coverage, but does not deal with it holistically. This may be an adversity in the offing, but certainly can be made into a great opportunity to make this earth as one planet equal to all - caring and sharing. There is no need for a tragic death like Michael Jackson - it is indeed a sad commentary on the western model lifestyle that refuses to understand the real meaning (human) life on earth.

Similar to advocating freer trade, if the west can agree to freer movement of people in a true humane order based on the Universal Declaration of Human Rights, then we can reap great benefits thru wisdom legacy and experience of the older people and also a healthier, educated workforce available to all. The problem is that the west wants more material wealth on its own terms, but wants to keep its socalled superior race unmixed and unpolluted.

My Indian spiritualist prediction says that this mindset is bound to change as the human evolution progresses.

Jai Ho!

http://www.economist.com/opinion/displa ... D=13900145

one comment among many:

VMSwami wrote:

June 30, 2009 4:10

As usual your leader and special report on "retirement" and ageing population in the western world is selective in its coverage, but does not deal with it holistically. This may be an adversity in the offing, but certainly can be made into a great opportunity to make this earth as one planet equal to all - caring and sharing. There is no need for a tragic death like Michael Jackson - it is indeed a sad commentary on the western model lifestyle that refuses to understand the real meaning (human) life on earth.

Similar to advocating freer trade, if the west can agree to freer movement of people in a true humane order based on the Universal Declaration of Human Rights, then we can reap great benefits thru wisdom legacy and experience of the older people and also a healthier, educated workforce available to all. The problem is that the west wants more material wealth on its own terms, but wants to keep its socalled superior race unmixed and unpolluted.

My Indian spiritualist prediction says that this mindset is bound to change as the human evolution progresses.

Jai Ho!

Re: Perspectives on the global economic meltdown

singapore has posted 20% growth for Q2 QonQ Sequential basis. Still in now way less astounding

http://www.nzherald.co.nz/business/news ... d=10584466

http://www.nzherald.co.nz/business/news ... d=10584466

Re: Perspectives on the global economic meltdown

Too Precious for a Recessio

Heartbreaking indeed.In a different economy, Billy Mitchell and Nicole Drucker of San Francisco might have splurged on a $10,000 engagement ring. But Ms. Drucker is out of work and they need to save for a house. So in April, Mr. Mitchell got down on one knee on the Golden Gate Bridge and proposed with a $4,000 diamond ring he had bought on the Internet.

Jabki jewellery might be a good investment given the uncertain times we are facing."We had to decide, where do we want the money?" Mr. Mitchell said. "On her finger?"

In this economy, many consumers would rather keep their money in their wallets than on their fingers, necks or ears. As people re-examine their budgets, jewelry is turning out to be one of the easiest places to cut back -- or trade down.

"The half-carat is the new three-carat," explained Hayley Corwick, who writes under the pseudonym Lila Delilah for Madison Avenue Spy, a blog about designer sales.

Yet the understandable penny-pinching by consumers is putting a painful squeeze on the jewelry industry.

The new frugality has forced diamond mines to curtail production, led to deep discounting at jewelry chains, spurred hundreds of store closings and resulted in job cuts at boutiques and department stores. Because jewelry is expensive inventory that moves slowly even in better economic times, many stores are laden with debt -- even though wholesale global prices of polished diamonds were down 15.4 percent in June compared with a year earlier.

Re: Perspectives on the global economic meltdown

No relief from the other end of the world....

New Zealand jobs crisis hits British expat

New Zealand jobs crisis hits British expat

Only a few weeks ago, New Zealand was identified as the best place for British expats to make a fresh start. It didn't take long for the accolade to wear thin.

The dreams of hundreds who left for a better life on the other side of the world are now turning into nightmares.

The expats face losing their jobs and being kicked out of the country because of the credit crunch and what is said to be a major shift in policy by the New Zealand government.

With unemployment at a six-year high of 5% of the population of 4,300,000, tough economic times have led to jobs going to native New Zealanders first.

One reason is the decision by Kiwis who have lost jobs overseas to return and seek work at home. Employment minister Paula Bennett says more than 3,000 of the 26,000 who returned last year ended up on benefits.

Jobless foreigners risk losing their work visas and having to return to Britain, with some accusing the New Zealand government of pursuing a 'jobs for Kiwis' policy.

Re: Perspectives on the global economic meltdown

Few blogs on Golum Sachs

An interesting book title in the above linky: “The Best Way to Rob a Bank is to Own One”

An interesting book title in the above linky: “The Best Way to Rob a Bank is to Own One”

Re: Perspectives on the global economic meltdown

X-posting my own post

*********

It is very very good, so I paste the entire blog. In the interest to generated traffic to WSJ I will only link Part 1 as a linky Kamal Nath, a feisty guy, talks about 'jugaad' too in his book "India's Century".

Kamal Nath, a feisty guy, talks about 'jugaad' too in his book "India's Century".

And don't forget to read the comments on both blogs.

*********

It is very very good, so I paste the entire blog. In the interest to generated traffic to WSJ I will only link Part 1 as a linky

And don't forget to read the comments on both blogs.

The comments on Part 1 of this article highlighted a variety of innovations by Indians that many of us, myself included, were not even aware of. Such is the brilliance and breadth of India's innovation!

Sadly, a large number of our innovations don't become more widely known because the exposure for smart innovations centers around Western and Japanese inventions. Our simple, everyday innovations [or jugaad – an interesting word with various connotations] are something we must find a way to capitalize on. The current pitiful economic state is an opportunity for that.

So what are the missing ingredients for Indians to take our innovative ideas and products to the world?

For it to happen on a sustainable basis and to attract development investment, it needs to have a profit motive. We already know that profitable models do exist, but there isn't yet a thriving venture capital industry around this here as there is in the U.S. around the technology industry.

The problem is not lack of capital or brilliant people -- the problem is the lack of deeper understanding. We don't know and appreciate the opportunities that are in front of us. This lack of deeper understanding appears at the level of businessmen and entrepreneurs who have largely looked to the West for viable business models and have been content creating an "Indian version." And it appears at the level of investment firms, capital markets, and venture funds who do not realize or are sometimes downright skeptical of Indian innovation opportunities. Why so?

For a very simple reason: The people who work in these funds (be it fund managers or analysts) have studied case studies of western companies in their MBA classes but would have never looked at Amul as an example of sheer creative genius in decentralized manufacturing.

The lack of general awareness about such examples is widespread especially among students and the younger workforce of the country – take a poll of those who want to join Coca-Cola, IBM, McKinsey after their graduation compared to working for a potential Indian startup company creating innovative products. (Full disclosure: At Vu, we just hired five product design graduates from IIT who want to be part of a smaller company and contribute to its innovation.)

Innovation is a product of entrepreneurship, passion and experimentation. We can't blame the government for letting us down in this arena as we normally do in others. Rather, our minds and hearts need to fundamentally change. Among business leaders, we need to allow for an "experimentation fund" within our companies and involve ourselves deeply in getting new ideas to market.

Let's work with an example. How many of us know that the Jaipur Rugs Company has built a very successful enterprise by making entrepreneurs out of 40,000 carpet weavers and artisans? It is now a world class business which exports carpets, durries, and mats to countries the world over in their "own brand."

Within our secondary education and business schools, instead of students reading up on case studies about "Coke vs Pepsi" and having summer internships at Sony, we must attempt to have students study the Aravind Netralaya model and intern at Amul and Jaipur Rugs. This will create a pool of talent which then understands the vast business opportunity in "constraint-based innovation" and creates the investment and management talent to make this opportunity a reality.

Within our media, we need to regularly lionize efforts like the Tata Nano and plenty of others so that more Indians know about the kind of great innovation work that happens in our country. Lastly, among ourselves, we must learn to give Indian products and innovation its respect and its price rather than automatically assuming that something coming from an American or Japanese company is automatically superior. Remember, a country that does not respect its heroes is soon left with none.

—Devita Saraf is CEO of Vu Technologies and Executive Director of Zenith Computers in Mumbai

Re: Perspectives on the global economic meltdown

A true Juggad vehicle consists of Dodge/Premier chassis with an oil engine driving the transmission and bench seats for passengers. This vehicle is used to transport people for less than 20kms @ Rs 5/ person. Mostly found in UP in the early 90s. No tickets just an enforcer with a lathi as the conductor.

Links:

Wiki: http://en.wikipedia.org/wiki/Jugaad

A WSJ article on Jugaads

Jugaad in Rural India

A blog on meaning of Jugaad in other fields.

LINK

Article in Economic Times dated Jan 2009

Link

Links:

Wiki: http://en.wikipedia.org/wiki/Jugaad

A WSJ article on Jugaads

Jugaad in Rural India

A blog on meaning of Jugaad in other fields.

LINK

Article in Economic Times dated Jan 2009

Link

-

Satya_anveshi

- BRF Oldie

- Posts: 3532

- Joined: 08 Jan 2007 02:37

Re: Perspectives on the global economic meltdown

ok folks..when is the next G4/G5/G8/G20 or G492.7 summit due. A lot of doom and gloom stories will come out to beg and bowl and things will go back to where there are now. Buy a week before the summit and sell a week after.

Re: Perspectives on the global economic meltdown

Am tempted to agree with the 'go back to normal' bit. Would be swell if the current intolerable uncertainty could be curtailed.

Lots of pretty powerful people are pushing the "things will go back to normal" meme.

And for good reason.

Folks point to the stock markets and say, 'aren't the markets upbeat'?

Look closer and you see that volumes are massively down, retail investors largely absent and institutional buyers alone trudging reluctantly to the equity markets for lack of options. Program trading has been at historic highs. GS then announces record profits made from trading.

Any notion of free and fair markets is gone out the window. The buyers and sellers of tranches of stock are all the same people and they have deep pockets (gubmint backstopped) and inside info. Would you wanna try your luck in such a place?

Is anyone betting the federal deficits will be <1T USD anytime in the next decade? Interest rates are low for now, but are you willing to bet the same for 2010? 2011?

Despite every bit of fervent desire from every qtr rooting for 'normalizing' conomic events, chances are the eventual new normal will be far from pretty, seems like. The numbers don't add up for the 'we're going back to 2007' normalists. 2011 will be ugly, IMO. Deflation is in. Deleveraging has barely begun. Its amply clear a lot of the khanomic activity this decade was debt fuelled. The demand sans debt simply wasn't there.

Now, demand is traditionally defined as the willingness + ability to pay. The ability wasn't there for a lot of the atrocious home prices and plasma tvs bought, really. And tomorrow, after the 'recovery', don't count on the willingness part to return very soon either. The boomers are bust. No retirements, wrecked pensions, nose-deep in debt and slated to leave their formal jobs in the next few yrs in increasingly large numbers (coz retirement is still nominally 65 there).

And so on it goes. Everybody bar none, will be affected. India is no exception.

Lots of pretty powerful people are pushing the "things will go back to normal" meme.

And for good reason.

Folks point to the stock markets and say, 'aren't the markets upbeat'?

Look closer and you see that volumes are massively down, retail investors largely absent and institutional buyers alone trudging reluctantly to the equity markets for lack of options. Program trading has been at historic highs. GS then announces record profits made from trading.

Any notion of free and fair markets is gone out the window. The buyers and sellers of tranches of stock are all the same people and they have deep pockets (gubmint backstopped) and inside info. Would you wanna try your luck in such a place?

Is anyone betting the federal deficits will be <1T USD anytime in the next decade? Interest rates are low for now, but are you willing to bet the same for 2010? 2011?

Despite every bit of fervent desire from every qtr rooting for 'normalizing' conomic events, chances are the eventual new normal will be far from pretty, seems like. The numbers don't add up for the 'we're going back to 2007' normalists. 2011 will be ugly, IMO. Deflation is in. Deleveraging has barely begun. Its amply clear a lot of the khanomic activity this decade was debt fuelled. The demand sans debt simply wasn't there.

Now, demand is traditionally defined as the willingness + ability to pay. The ability wasn't there for a lot of the atrocious home prices and plasma tvs bought, really. And tomorrow, after the 'recovery', don't count on the willingness part to return very soon either. The boomers are bust. No retirements, wrecked pensions, nose-deep in debt and slated to leave their formal jobs in the next few yrs in increasingly large numbers (coz retirement is still nominally 65 there).

And so on it goes. Everybody bar none, will be affected. India is no exception.

Re: Perspectives on the global economic meltdown

In support of some contentions made above, aaj ka must-read reco goes to this 5 page report from Sprott.

US debt outlook report

Scary onlee. Shall excerpt and highlite, tomorrow. G'nite for now.

US debt outlook report

Scary onlee. Shall excerpt and highlite, tomorrow. G'nite for now.

Re: Perspectives on the global economic meltdown

Thursday, July 16, 2009

Roubini: worst may be behind us

by Chris in Paris on 7/16/2009 07:33:00 PM

http://www.americablog.com/2009/07/roub ... nd-us.html

He's much more believable than others so it's no wonder the market reacted. It's not over and more struggles are ahead but maybe, just maybe, the worst of the worst is behind us.

Roubini still warned that the US may need a second fiscal stimulus package of up to $250 billion by the end of the year to boost the deteriorating labor market, Reuters reported.

The stimulus "cannot be too small, but it cannot be too large," Roubini said, or financial markets will become too worried about the sustainability of the U.S. debt.

Roubini, of RGE Global Monitor, is one of the few economists who foretold much of the current financial turmoil. But until now, he has remained pessimistic even amid signs that the economy was beginning to turn.

http://www.rgemonitor.com/roubini-monit ... ic_outlookHow can anyone with any common sense believe this illogical nonsense.

So as unemployment is rising, and worse yet, UNDERemployment is rising, credit card and mortgage defaults are rising and expected to get worse (of course they will), more banks are failing, homeless numbers are increasing, etc., etc., etc., things are going to get better because those who helped create this mess are saying so.

This wishful thinking from people just has me totally perplexed.

I swear, if it were pouring rain outside and Krugman said the sun was shining, everyone would be dancing around soaking wet screaming "the sun is shining!"

They've been saying this for months, and they'll keep saying this for years, while we continue to spiral down.

It's not rocket science to realize that we haven't even seen the worst yet, not even close. Tip of the iceberg.

And next year at this time, when the country is twice as bad off as it is now, you can remember what you were saying today.

This was 30+ years in the making - 30 years of lowering wages in this country, and it's not going to turn around in few months, or a single year, or even a decade. Not until wages being to increase, and that's clearly not on the horizon at all.

The problem is low wages for the masses, and that's continuing to get worse, and that's certainly not changing, so how on earth can anyone say that things are about to start getting better.

All this wishful thinking does nothing.

"Jobless Recovery" ??? WTF ??? That's an oxymoron. How can we have recovery without increasing employment, and more importantly rising wages. It's utterly nonsensical.

Too many people live in a dream world these days. And people like Krugman who use terms like "jobless recovery" should be committed. It's a simply insane concept that only exists in a reverse parallel universe.

And I'll simply point out that the so-called "Stimulus" doesn't even address the problem of low wages in this country, WHICH IS THE CAUSE OF THIS ECONOMIC COLlAPSE, so it won't do a thing, no matter how big or how many there are.

Barking up the wrong tree.

We need to change our trade laws, re implement protective tariffs, raise the minimum wage significantly, and all sorts of related pro-labor laws, in order to drive UP the cost of labor again. Until the masses can again make a living wage, nothing will change, nobody will have money to "consume" with. There will be no fuel for the economy to grow, let alone recover.

And since nobody in power is talking about doing any of these things, nothing will change. They'll just keep handing out our tax dollars to private corporations while our country collapses.

Roubini Statement on the U.S. Economic Outlook

Nouriel Roubini | Jul 16, 2009

“It has been widely reported today that I have stated that the recession will be over 'this year' and that I have 'improved' my economic outlook. Despite those reports - however – my views expressed today are no different than the views I have expressed previously. If anything my views were taken out of context.

“I have said on numerous occasions that the recession would last roughly 24 months. Therefore, we are 19months into that recession. If, as I predicted, the recession is over by year end, it will have lasted 24 months with a recovery only beginning in 2010. Simply put I am not forecasting economic growth before year’s end.

“Indeed, last year I argued that this will be a long and deep and protracted U-shaped recession that would last 24 months. Meanwhile, the consensus argued that this would be a short and shallow V-shaped 8 months long recession (like those in 1990-91 and 2001). That debate is over today as we are in the 19th month of a severe recession; so the V is out the window and we are in a deep U-shaped recession. If that recession were to be over by year end – as I have consistently predicted – it would have lasted 24 months and thus been three times longer than the previous two and five times deeper – in terms of cumulative GDP contraction – than the previous two. So, there is nothing new in my remarks today about the recession being over at the end of this year.

“I have also consistently argued – including in my remarks today - that while the consensus is that the US economy will go back close to potential growth by next year, I see instead a shallow, below-par and below-trend recovery where growth will average about 1% in the next couple of years when potential is probably closer to 2.75%.

Re: Perspectives on the global economic meltdown

From Acharya's post:

That bolded part IMO is inevitable. When precisely can be debated upon but by 2011 is my guess. States can beg, borrow and steal and coverup this fiscal's budgets with band-aid but next yr is when the sh1t's striking fans. When states start to fail, mass layoff of gold-plated gubmint and unioned staff can no longer be putoff, what then?We need to change our trade laws, re implement protective tariffs, raise the minimum wage significantly, and all sorts of related pro-labor laws, in order to drive UP the cost of labor again. Until the masses can again make a living wage, nothing will change, nobody will have money to "consume" with. There will be no fuel for the economy to grow, let alone recover.

Re: Perspectives on the global economic meltdown

After looking at USA economy and the way things are done in Unkil land; it has been my theory that the country has gone into a state where it requires joes and janes to keep running the economy for the sake of running it. Else it is as if the earth stops rotating and we all die. And now I see Douglas being interviwed in Stephen Colbert's show. Douglas Rushkoff validates so many of my theories.

Chapter 1: ONCE REMOVED: THE CORPORATE LIFE- FORM

This is the next book - Life Inc I am buying. It is loaded with history and perspective. Wow. I will treat myself for Avani Avittam

Chapter 1: ONCE REMOVED: THE CORPORATE LIFE- FORM

This is the next book - Life Inc I am buying. It is loaded with history and perspective. Wow. I will treat myself for Avani Avittam

Re: Perspectives on the global economic meltdown

Sri Joe Biden, Hon. VP of USA uvacha:

‘We Have to Go Spend Money to Keep From Going Bankrupt’

Added later:

Rewind to similar oxymoronic statments from Sri Dubya himself:

Dubya has destroyed the GOP, deservedly so, and lost them the WH and both houses of Congress for at least a generation. Back home, the BJP did something similar to its chances. The Indian right is lost, vanvaasam for at least a generation. Lets hope there'll still be a country left to govern in the interim.

‘We Have to Go Spend Money to Keep From Going Bankrupt’

Wow. Don't ya wish our VP were half as flamboyant?Vice President Joe Biden told people attending an AARP town hall meeting that unless the Democrat-supported health care plan becomes law the nation will go bankrupt and that the only way to avoid that fate is for the government to spend more money.

“And folks look, AARP knows and the people with me here today know, the president knows, and I know, that the status quo is simply not acceptable,” Biden said at the event on Thursday in Alexandria, Va. “It’s totally unacceptable. And it’s completely unsustainable. Even if we wanted to keep it the way we have it now. It can’t do it financially.”

“We’re going to go bankrupt as a nation,” Biden said.

“Now, people when I say that look at me and say, ‘What are you talking about, Joe? You’re telling me we have to go spend money to keep from going bankrupt?’” Biden said. “The answer is yes, that's what I’m telling you.”

Added later:

Rewind to similar oxymoronic statments from Sri Dubya himself:

linkUS President George W. Bush said in an interview Tuesday he was forced to sacrifice free market principles to save the economy from "collapse."

"I've abandoned free-market principles to save the free-market system," Bush told CNN television, saying he had made the decision "to make sure the economy doesn't collapse."

"I am sorry we're having to do it," Bush said.

Dubya has destroyed the GOP, deservedly so, and lost them the WH and both houses of Congress for at least a generation. Back home, the BJP did something similar to its chances. The Indian right is lost, vanvaasam for at least a generation. Lets hope there'll still be a country left to govern in the interim.

Last edited by vsudhir on 17 Jul 2009 21:11, edited 1 time in total.

Re: Perspectives on the global economic meltdown

^^^^^

Amirkhans still don't get it. What is the use of having several top business/economics school in the country.

Amirkhans still don't get it. What is the use of having several top business/economics school in the country.

Re: Perspectives on the global economic meltdown

They serve a purpose and IMHO nobody in the system there is unaware of whats required of them.SwamyG wrote:^^^^^

Amirkhans still don't get it. What is the use of having several top business/economics school in the country.

Khan econ schools preached "free mkts" under the so called Washington consensus and imposed abusive levels of fiscal discipline on failing turd world khanomies via their IMF proxy. But all those IMF prescriptions of surgery sans anasthesia have gone out the window when its the turn of the G7 on the operating table. This blatant 2-rules for 2 worlds hasn't gone unnoticed amongst the econobloggers either.

The khanomic system and its institutions have been shown to be as malleable and prone to systemic manipulation as any in the rest of the world. When a man of the stature of William Buiter himself talks of regulatory capture by elite special interests (read GS) in America, what to say of us virtual warriors?

Its a sad situation in many ways since the US could have been this beacon of hope, light and direction for emerging markets for genuinely impartial regulation and fair if not free markets at least in some khanomic sectors.

Now, state directed capitalism (the chini model) is really the only one left around. Mercantilism is about tomake a massive comeback, protectionism and trade wars are just round the corner. We could have indeed done with Sri Kamal Nath in the commerce ministry to keep our ship steady in the coming storm ahead.

Re: Perspectives on the global economic meltdown

Trade Union militancy emerges again in Toronto. Only this time, thanks to the general khanomic gloom in the rest of the khanomy, their intransigence shows up rather starkly.

Quoting a post from reporting on location in Toronto

A Thatcherite revolution again in the neo-socialistic emerged markets? That would be fun. Would form the case/intellectual basis for action against the well-funded and organised 'activists' blocking industrialization in India.

Quoting a post from reporting on location in Toronto

In a way, the problems of the Detroit public school system is the first wave to hit the beach representing how out of whack things have gotten for government "service" jobs

It may well be that the example of the broken Detroit Public school model is just a precursor of governmental broken models to come.

Today, in Toronto, we have garbage workers, being paid $20 to $50 an hour, out on strike for the 20th successive day leaving the city wallowing in garbage. Not only garbage workers but other related unionized workers, such as day care and park employees, are also out....In this economy, I don't get it. Any unemployed person would happily take on these jobs at 10% to 25% lower pay in this economic environment.

It is now time to enact Reagan-like air-comptrollers legislation and bring in new hires (again plenty of them given escalating unemployment ranks) to clean up the mess.

linkApparently there are a fairly large number of strikers, who are unhappy continuing with this strike, but union rules override their angst.

Also, I'm told that Facebook is replete with upset strikers who are compelled to tow the union line.

What is most galling to me is that strikers block the road to the drop off sites, ostensibly, to explain their side of the dispute, which is their legal right. Problem is that there are times when one vehicle is allowed to pass each 15 minutes. Obviously those who consequently wait 3 hours to drop off their refuse aren't too sympathetic to any rationale they can conjure up.

I don't get it! Bring in the scab workers at 80% of what these pikers are being paid, and you'll have an ecstatic lineup of well qualified currently unemployed individuals who would happily accept any reasonable "salary" let alone an incredibly generous pension plan.

The system is broken when we can have real unemployment pushing 20%, many with university and post university backgrounds, while the "sanitation workers, many without their high school credits, are striking and holding the city at ransom.

Time to mimic Reagan's air comptroller methodology, and boot these hacks out once and for all!

A Thatcherite revolution again in the neo-socialistic emerged markets? That would be fun. Would form the case/intellectual basis for action against the well-funded and organised 'activists' blocking industrialization in India.

Re: Perspectives on the global economic meltdown

vsudhir, I think its time to take a Quigleyan look at American free market logic. I posted links to his book "Evolution of Civilizations" in the Strategic Leadership thread. It has the seven step process. See if you can take a crack at it.

Re: Perspectives on the global economic meltdown

Ramana garu, read Quigley's perspicacious post on the khanoic-cultural basis of the rise of the west. Lotsa numbers, believable and compelling storyline, etc.ramana wrote:vsudhir, I think its time to take a Quigleyan look at American free market logic. I posted links to his book "Evolution of Civilizations" in the Strategic Leadership thread. It has the seven step process. See if you can take a crack at it.

Shall go thru the 7 step process to see what i can comprehend.

Meanwhile....

Uh- oh. CT going mainstream or what. Jon Stewart is abt as mainstream as you get in the khanate these days.

video link 3.3 minutes

A must watcher, folx.

Re: Perspectives on the global economic meltdown

Sudhir: I need to spread some gyan around; do we have the steps IMF used to ask the Asian Tigers and the so-called 3rd World Countries to take? And how different were they compared to what is expected of the so-called developed nations?

Re: Perspectives on the global economic meltdown

SwamyG, read about it on econblogs. A google search shows up this article that deals with the direct involvement of two of today's prime protagonists - L summers and T Geithner - with the IMF intervention in the wake of Asian contagion of 1997.SwamyG wrote:Sudhir: I need to spread some gyan around; do we have the steps IMF used to ask the Asian Tigers and the so-called 3rd World Countries to take? And how different were they compared to what is expected of the so-called developed nations?

Summers, Geithner Are Silent as IMF Loses Grip: William Pesek on Bloomberg

William K. Black on Geithner: "The Guy Has a Track Record of Failure Everywhere He's Gone" (particularly in the Asian crisis)

And there's mention elsewhere of Krugman's and Bernake's casually disasterous (nonbinding) prescriptions to Japan during its lost decades.

As for G7, not yet. None have faced soveregin default yet or approached the IMF for life-support, yet. Watch the happenings in Iceland, Ireland and Latvia to see what is to come. Why do you think me keeps looking for signs of UKstani currency or debt mkt collapse?. Russia and Argentinma have already done the default dance mighty recently. Good part of the G7 currently is poised on the cliffedge, IMVVHO. Who knows what tomorrow holds? India would do well to hedge its options, currency reserves, trade partnerships and what not in the coming decade.

Re: Perspectives on the global economic meltdown

1 interesting blog comment.

And another....an excerpt this time from a phamous writer onleeMore CA budget news: According to an AP news story today, Democratic Assemblyman Tom Ammiano of San Francisco wants to help cut the budget shortfall by an amount of about $392 million dollars if marijuana became legal, was sold at $50.00 per oz. and was taxed for sale here in CA.

The ideas keep coming.

"...throughout recorded time...there have been three kinds of people in the world, the High, the Middle, and the Low...The aims of these three groups are entirely irreconcilable. The aim of the High is to remain where they are. The aim of the Middle is to change places with the High. The aim of the Low, when they have an aim -- for it is an abiding characteristic of the Low that they are too much crushed by drudgery to be more than intermittently conscious of anything outside their daily lives -- is to abolish all distinctions and create a society in which all men shall be equal.

Thus throughout history a struggle which is the same in its main outlines recurs over and over again. For long periods the High seem to be securely in power, but sooner or later there always comes a moment when they lose either their belief in themselves or their capacity to govern efficiently, or both. They are then overthrown by the Middle, who enlist the Low on their side by pretending to them that they are fighting for liberty and justice. As soon as they have reached their objective, the Middle thrust the Low back into their old position of servitude, and themselves become the High. Presently a new Middle group splits off from one of the other groups, or from both of them, and the struggle begins over again. Of the three groups, only the Low are never even temporarily successful in achieving their aims.

But the problems of perpetuating a hierarchical society go deeper than this. There are only four ways in which a ruling group can fall from power. Either it is conquered from without, or it governs so inefficiently that the masses are stirred to revolt, or it allows a strong and discontented Middle group to come into being, or it loses its own self-confidence and willingness to govern."

-- 1984, George Orwell

Re: Perspectives on the global economic meltdown

How the omnipotent rulers of the great khanate use deep wisdom and incredible foresight to plan weapons platforms....

linkThe F-22 originally was designed to counter a potential Soviet threat. The Pentagon has spent an estimated $65 billion researching, developing and building 187 F-22s.

Gates prefers the cheaper F-35, which he has argued is newer, carries more weapons and will prove superior in combat.

Lockheed Martin has said that about a third of the F-22's approximately 1,000 suppliers are in California, providing up to 6,500 jobs. Boeing assembles the aircraft's aft section and wings in its Seattle plants. In Baltimore, Northrop Grumman Corp. builds the plane's radar. In Connecticut, Pratt & Whitney builds the engine.

However, Gates said the work created by the F-35 -- 38,000 jobs now, growing to 82,000 by 2011 -- exceeds the 24,000 jobs directly involved in F-22 production.

Re: Perspectives on the global economic meltdown

PRC bond auction fails......Aha. That is bloody potent news. No surprise its being ignored by most media.

Well, if the cheenis can't sell their own debt, then they'll have to sell US T-bills and bonds to raise monies for whatever they were trying to sell yuan debt for. No?

linkJuly 17 (Bloomberg) -- China’s finance ministry failed to meet its debt-sale target for a third time in two weeks at a 182- day bill sale, according to traders at Galaxy Securities Co. and China Citic Bank in Beijing. The ministry had tried to sell 20 billion yuan of bills and only sold 18.51 billion yuan, traders said. The average yield for the bills sold was 1.6011 percent, they said.

Well, if the cheenis can't sell their own debt, then they'll have to sell US T-bills and bonds to raise monies for whatever they were trying to sell yuan debt for. No?