http://www.businessweek.com/magazine/co ... 792563.htm

btw full page ads twice already in TOI touting a event where you can buy luxury homes and condos in Australia !

then there was this co selling undeveloped land plots in UKstan last year.

The US economy should expand 2.7 per cent next year, the newsletter said. That marked an upward revision from the 2.5 per cent pace the survey panel had expected a month ago.

For 2009, the consensus of the 52 economists polled was for a contraction of 2.4 per cent, 0.1 per centage point less than the prior estimate.

Manny wrote:Is China headed toward collapse?

http://www.politico.com/news/stories/1109/29330.html

Chanos, a billionaire, is the founder of the investment firm Kynikos Associates and a famous short seller — an investor who scrutinizes companies looking for hidden flaws and then bets against those firms in the market.

His most famous call came in 2001, when Chanos was one of the first to figure out that the accounting numbers presented to the public by Enron were pure fiction. Chanos began contacting Wall Street investment houses that were touting Enron’s stock. “We were struck by how many of them conceded that there was no way to analyze Enron but that investing in Enron was, instead, a ‘trust me’ story,” Chanos told a congressional committee in 2002.

Now, Chanos says he has found another “trust me” story: China. And he is moving to short the entire nation’s economy. Washington policymakers would do well to understand his argument, because if he’s right, the consequences will be felt here.

Chanos and the other bears point to several key pieces of evidence that China is heading for a crash.

First, they point to the enormous Chinese economic stimulus effort — with the government spending $900 billion to prop up a $4.3 trillion economy. “Yet China’s economy, for all the stimulus it has received in 11 months, is underperforming,” Gordon Chang, author of “The Coming Collapse of China,” wrote in Forbes at the end of October. “More important, it is unlikely that [third-quarter] expansion was anywhere near the claimed 8.9 percent.”

Chang argues that inconsistencies in Chinese official statistics — like the surging numbers for car sales but flat statistics for gasoline consumption — indicate that the Chinese are simply cooking their books. He speculates that Chinese state-run companies are buying fleets of cars and simply storing them in giant parking lots in order to generate apparent growth.

Another data point cited by the bears: overcapacity. For example, the Chinese already consume more cement than the rest of the world combined, at 1.4 billion tons per year. But they have dramatically ramped up their ability to produce even more in recent years, leading to an estimated spare capacity of about 340 million tons, which, according to a report prepared earlier this year by Pivot Capital Management, is more than the consumption in the U.S., India and Japan combined.

This, Chanos and others argue, is happening in sector after sector in the Chinese economy. And that means the Chinese are in danger of producing huge quantities of goods and products that they will be unable to sell.

The Pivot Capital report was extremely popular in Chanos’s office and concluded, “We believe the coming slowdown in China has the potential to be a similar watershed event for world markets as the reversal of the U.S. subprime and housing boom.”

And the bears also keep a close eye on anecdotal reports from the ground level in China, like a recent posting on a blog called The Peking Duck about shopping at Beijing’s “stunningly dysfunctional, catastrophic mall, called The Place.”

“I was shocked at what I saw,” the blogger wrote. “Fifty percent of the eateries in the basement were boarded up. The cheap food court, too, was gone, covered up with ugly blue boarding, making the basement especially grim and dreary. ... There is simply too much stuff, too many stores and no buyers.”

IMO, its unlikely rate tightening will happen anytime soon. Sri Bernake is on record saying he won't repeat the mistakes of the 1937 fed which allegedly impeilled a healthy recovery by yanking rates up too soon.In response to a question, he said he could envision scenarios in which the Fed may have to tighten policy even with unemployment "frustratingly high."

See. Its legal to do it now. So its no longer a problem. Capisch?Federal bank regulators issued guidelines allowing banks to keep loans on their books as "performing" even if the value of the underlying properties have fallen below the loan amount

Jai Ho.The new guidelines are targeted primarily at the hundreds of billions of dollars worth of loans that are coming due that can't be refinanced largely because the value of the properties have fallen below the loan amount. In many of these situations, the properties are still generating enough income to pay debt service.{Welcome to the brave new world. Pricnipal cannot be paid off, just enough to service current debt i.e. rollover with interest payments. The whole system is insolvent.}

Banks have generally been keeping a lid on commercial real-estate losses by extending these mortgages upon maturity. However, that practice, billed by many industry observers as "extending and pretending," has come under criticism by some analysts and investors as it promises to put off the pains into the future. {Lot of can-kicking down the road happening lately, eh?}

Now federal regulators are essentially sanctioning the practice as long as banks restructure loans prudently.

Sure it is, Sri Smith. After all haven't bank stocks been rising inexorably on their renewed vigor?Banks are moving quickly to restructure commercial mortgages under new U.S. guidelines that are more forgiving of battered property values and can help banks avoid bigger losses.

Citigroup Inc., regional bank Whitney Holding Corp. and other lenders around the country are planning to review loans now considered nonperforming to determine if they can be reclassified under the guidelines announced Oct. 30 by bank, thrift and credit-union regulators, according to bank executives and people familiar with the matter. The moves could help the banks absorb fewer losses on troubled real-estate loans and preserve capital.

"It's a positive all the way around," said James Smith, chief credit officer for National Bank of South Carolina, a unit of Synovus Financial Corp.

Scary. read it all. Can it be true? Protectionism is round the corner only. A massive clampdown on global trade to generate homeland employment is all but inevitable. Smoot Hawley II is an exaggeration, sure, but I doubt the populace can wait long enough for the cap n trade and other bills to spur job creation at home. The official jobless rate is 10.2% and the U6 pushes 16%. Time will tell where this is going. I fear for world peace and security only.In the latest sign of the Las Vegas Valley’s economic free fall, U.S. citizens are starting to show up in the early mornings outside home improvement stores and plant nurseries across the Las Vegas Valley, jostling with illegal immigrants for a shot at a few hours of work.

Experts say the slow-starting but seemingly inexorable trend is occurring nationwide.

“It’s the equivalent of selling apples in the Great Depression,” said Harley Shaiken, chairman of the Center for Latin American studies at the University of California, Berkeley.

Pablo Alvarado, executive director of the Los Angeles-based National Day Laborer Organizing Network, said he has been seeing the same thing elsewhere.

“It’s happening, though still not in massive numbers,” Alvarado said. In the past six months or so, he has heard of “americanos” on the street corners and parking lots of Silver Spring, Md., Long Island, N.Y., and Southern California locations.

“It’s just beginning,” he said. “But I think it’s only going to increase.”

At Home Depot on Decatur Boulevard north of Tropicana Avenue, Jose said the same thing, adding that “it’s never more than three or four, but they’re coming out.”

Farther south, in front of Moon Valley Nursery on Eastern Avenue, Israel said a couple of “americanos” — white and black, he added — have come out for work in recent months. “But they tend to stay only a few days.”

As a salesman at Moon Valley, Mike Fugitt’s job includes making sure the laborers don’t come into the nursery’s parking lot, because their presence draws complaints from some customers. In the past three months or so, he said, more of those laborers have been telling him, “But I’m an American.” That includes some Hispanics, he added. “But I treat them all the same; they can’t be trespassing,” he said.

But elsewhere, Xie writes succintly and moi can't but agree 400% with every word.The point is that Japan has a strong and genuine case that favors more integration with East Asia. The United States is unlikely to recover soon and with enough strength to feed Japan’s export machine again. There is no more room for fiscal stimulus. Devaluing the yen to gain market share is not an option as long as Washington pursues a weak dollar policy. Without a new source of trade, Japan’s economy is doomed. Closer integration with East Asia is the only way out…An FTA between China and Japan would significantly accelerate their trade, resulting in an efficiency gain of more than US$ 1 trillion. Japan’s aging population lends urgency to increasing the investment returns. On the other hand, as China prepares to make a numerical commitment to limiting greenhouse gas emissions at the upcoming Copenhagen summit on global warming, heavy investment and rapid restructuring are needed for its economy. Japanese technology could come in quite handy.

Read it all.The bottom line is that, regardless what central banks say and do, the world will be awash in a lot more money after the crisis than before — money that will lead to inflation. Even though all central banks talk about being tough on inflation now, they are unlikely to act tough. After a debt bubble bursts, there are two effective options for deleveraging: bankruptcy or inflation. Government actions over the past year show they cannot accept the first option. The second is likely.

Hyperinflation was used in Germany in the 1920s and Russia in late 1990s to wipe slates clean. The technique was essentially mass default by debtors. But robbing savers en masse has serious political consequences. Existing governments, at least, will fall. Most governments would rather find another way out. Mild stagflation is probably the best one can hope for after a debt bubble. A benefit is that stagflation can spread the pain over many years. A downside is that the pain lingers.{Aptly put. Bang on target.}

If a central bank can keep real interest rates at zero, and real growth rates at 2.5 percent, leverage could be decreased 22 percent in a decade. If real interest rates can be kept at minus 1 percent, leverage could drop 30 percent in a decade. The cost is probably a 5 percent inflation rate. It works, but slowly.{Aha, now we know what the consequence is of spending money one doesn't have - with Fed balance sheets rising $2 trillion in a year, public debt mounting to close to 100% of GDP. Till debt do us apart, indeed.}

If stagflation is the goal, why might central banks such as the Fed talk tough about inflation now? The purpose is to persuade bondholders to accept low bond yields. The Fed is effectively influencing mortgage interest rates by buying Fannie Mae bonds. This is the most important aspect of the Fed’s stimulus policy. It effectively limits Treasury yields, too. The Fed would be in no position to buy if all Treasury holders decide to sell, and high Treasury yields would push down the property market once again.

I have argued, in vain, with some of my friends that Economics is as a manifestation of culture and politics. I will admit that human behavior and mathematical models are studied and use; but for some reason it appears people have blinders and tread predictable path.Tanaji wrote:Maybe the rules of economics as we know it are changing or have changed completely. So whatever was "wrong" earlier is right now. Sort of like, the world is round now, earlier we thought it was flat, except that this is not backed by any hard science.

So maybe the world is really out of recession now by the new rules, should we ditch the old ones?

Is economics a science by the way?

Good point. A question I've oft asked myself. Since nobody wants a depression, can't we all just pretend there never were any problems and return to 2006?? We would have returned to 2006 if we could, IMHO. Certainly gubmint, media, banks, central banks, ekhanomists - the whole 9 yards - are cheerleading green shoots and predicting turnarounds around every corner. Then whay hasn't 2006 returned yet? Why are job numbers dismal? Why are insiders selling out? Why is the Fed buying Fannie/Freddie paper? Why are pvt enterprises not 400% buying into gubmint propagandu? Point to ponder, IMO.So maybe the world is really out of recession now by the new rules, should we ditch the old ones?

Its a 'social science' technically. IMO 'social science' is an oxymoron. Any systematic field of study whose results aren't replicateble or testable or falsifiable shouldn't be consecrated as Science. 'Seance' is more like it, IMHO.Is economics a science by the way?

SwamyG wrote:I have argued, in vain, with some of my friends that Economics is as a manifestation of culture and politics. I will admit that human behavior and mathematical models are studied and use; but for some reason it appears people have blinders and tread predictable path.Tanaji wrote:Maybe the rules of economics as we know it are changing or have changed completely. So whatever was "wrong" earlier is right now. Sort of like, the world is round now, earlier we thought it was flat, except that this is not backed by any hard science.

So maybe the world is really out of recession now by the new rules, should we ditch the old ones?

Is economics a science by the way?

Why even doubt?Hari Seldon wrote:Good point. A question I've oft asked myself. Since nobody wants a depression, can't we all just pretend there never were any problems and return to 2006?? We would have returned to 2006 if we could, IMHO. Certainly gubmint, media, banks, central banks, ekhanomists - the whole 9 yards - are cheerleading green shoots and predicting turnarounds around every corner. Then whay hasn't 2006 returned yet? Why are job numbers dismal? Why are insiders selling out? Why is the Fed buying Fannie/Freddie paper? Why are pvt enterprises not 400% buying into gubmint propagandu? Point to ponder, IMO.So maybe the world is really out of recession now by the new rules, should we ditch the old ones?

Its a 'social science' technically. IMO 'social science' is an oxymoron. Any systematic field of study whose results aren't replicateble or testable or falsifiable shouldn't be consecrated as Science. 'Seance' is more like it, IMHO.Is economics a science by the way?

I think economics is (f)artsHari Seldon wrote:Its a 'social science' technically. IMO 'social science' is an oxymoron. Any systematic field of study whose results aren't replicateble or testable or falsifiable shouldn't be consecrated as Science. 'Seance' is more like it, IMHO.Is economics a science by the way?

Today marks a decade to the day that President Bill Clinton signed the repeal of the Depression-era Glass-Steagall Act that split investment-banking from lending and deposit-taking. The repeal allowed the creation of Citigroup Inc., the financial colossus now propped up by $45 billion in taxpayer rescue funds. Financial firms are scrambling to prevent Congress from re- imposing the act.

“We’re playing with live ammo,” said Sam Geduldig, a lobbyist at Clark Lytle & Geduldig who represents financial- services firms and wasn’t at the Nov. 9 meeting. “The banking community is rightfully concerned.”

The Financial Services Forum, which represents chief executive officers of 18 of the largest financial firms and whose lobbyists organized the visit to Kanjorski’s office, has scheduled or met about a dozen lawmakers or aides with the House Financial Services Committee in the last week. The U.S. needs big financial firms to compete globally, said Rob Nichols, the group’s president.

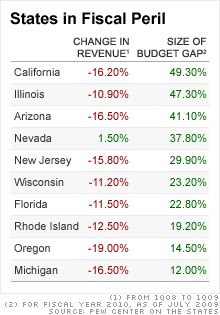

OK, here's Denninger on the Jefferson County Alabama scandal. TIFWIW.The same economic pressures that pushed California to the brink of insolvency are wreaking havoc on other states, a new report has found.

The 10 most troubled states are: Arizona, California, Florida, Illinois, Michigan, Nevada, New Jersey, Oregon, Rhode Island and Wisconsin.

Other states -- including Colorado, Georgia, Kentucky, New York and Hawaii -- were not far behind.

The list is based on several factors, including the loss of state revenue, size of budget gaps, unemployment and foreclosure rates, poor money management practices, {Jefferson county, Alabama, anyone?}and state laws governing the passage of budgets.

In a separate study released Wednesday, the Center on Budget and Policy Priorities found that states will likely have to make steep cuts in their fiscal 2011 budgets, which start next July 1 in most states. That's because the critical federal stimulus dollars will run out by the end of 2010. {But that's just enough to take the Dems through the congressional polls in Nov 2010 I reckon Oh, pure 400% conincidence only, am sure.}

These cuts could take nearly a percentage point off the national gross domestic product and cost the nation 900,000 jobs, the study found.

I've little doubt fraud on a massive scale and system wide rigging have happened. And the perps managed to get themselves into insolvency despite all that. And they have gotten away with it, nay gotten rewarded with bailouts at public expense, because they own the gubmint.Here's the problem with all the games once one gets down to brass tacks: you cannot screw people indefinitely and expect them to come back for more abuse. Oh sure, you can occasionally con people a second time, but since these "big interests" rely on a continued volume of business.....

As just one example, how many municipalities will buy interest-rate derivatives from one of these "big banks" after the disclosure that Jefferson County overpaid by 400% - and a good part of that overpayment went to bribes? Further, it has become clear that the municipal government didn't understand the risks involved - and one can reasonably presume that was because those risks were intentionally hidden - probably by the bribing parties, the recipients of the bribes, or both.

There are solutions here but it is increasingly obvious that if Government doesn't step in the market will. All I have to do is look at volume - the percentage that is represented by "high frequency computer trades" has gone sky-high since last fall, yet volume has been dropping dramatically since March.

When the market degenerates down to a handful of trading houses with high-frequency trading computers passing the same 100 shares back and forth between themselves as the remainder of the market participants have gotten tired of getting reamed on a daily basis due to the cheating and decide to take their ball and go home, how do the "big trading houses" make money?

We're witnessing the destruction of the capital markets as the system is imploding from within as a direct and proximate consequence of willful blindness and outright fraud.

IIRC productivity growth in US economy was more than 6% and 9% in last two quarters respectively. These astronomically high figures were achieved by emergency measures of making less people do more work, inventory management etc. Obviously these levels are not sustainable so employers would have to start hiring soon to sustain economic activities.New claims for unemployment insurance fell more than expected last week, evidence the job market is slowly healing as the economy recovers.

I want to believe it. Lets hope all heals and gets well in 2-3 yrs.So for recovery (if you believe it is real) is playing to the script………

[youtube]<object width="425" height="344"><param name="movie" value="http://www.youtube.com/v/0h7V3Twb-Qk&co ... ram><param name="allowFullScreen" value="true"></param><param name="allowScriptAccess" value="always"></param><embed src="http://www.youtube.com/v/0h7V3Twb-Qk&co ... edded&fs=1" type="application/x-shockwave-flash" allowfullscreen="true" allowScriptAccess="always" width="425" height="344"></embed></object>[/youtube]China’s economy is continuing to grow despite the global recession, helped by a massive government stimulus package of $585bn.

But doubts remain whether such strong growth can be sustained by public spending alone.

Al Jazeera’s Melissa Chan reports from Inner Mongolia, where a whole town built with government money is standing empty.

Did you really come up with that?Umrao Das wrote: By definition of Spinster

"Economics is the art and science of studying, Human behavior, its interaction with society in an formal or informal structures and trying to benefit by trading utility, convenience, needs, wants, tastes and rational expectations stemming from transactions in an orderly fashion with integrity, confined to agreed format of process, activities which are bound by time and location, in which the assessment of the proceedings are often scrutinized for SIGNS in conjunction with other tools such as Mathematics and Statistics"

The signs are all over there that it is science.

Of course, the smart ones figured out long ago that religion is the smartest way to impose, consolidate and lord empire, rule and tax-levying prowess on unsuspecting populations only. Blogger Mish writes:While acknowledging the role of banks in the financial meltdown, the CEO of Goldman Sachs said recently he believes his company is doing "God's work."

"We're very important. We help companies to grow by helping them to raise capital. Companies that grow create wealth," CEO Lloyd Blankfein said in a recent interview. "This, in turn, allows people to have jobs that create more growth and more wealth. We have a social purpose."

And the parodies have started to fly ....strictly for laughs only!Given that Goldman is doing "God's work" and that CEO Lloyd Blankfein is arguably "god on earth", it is fitting for there to be a prayer in his honor.

I would be ROFTLing if it weren't so deadly seriously close to reality onlee.... Heck, lemme rofl anyway. Here goes:My Version of "Lloyd's Prayer"

Our chairman who art at Goldman

Blankfein be thy name

Thy rally’s come, God’s work be done

In the Dow as it is in the Nasdaq

Give us this day our daily gain

And forgive us our frontruning, as we punish those who frontrun against us

And bring us not under indictment

But deliver us from regulators

For thine is the cashflow, and the power, and the bonuses, forever and ever. Amen

DECEMBER 2009 ATLANTIC

America’s mainstream religious denominations used to teach the faithful that they would be rewarded in the afterlife. But over the past generation, a different strain of Christian faith has proliferated—one that promises to make believers rich in the here and now. Known as the prosperity gospel, and claiming tens of millions of adherents, it fosters risk-taking and intense material optimism. It pumped air into the housing bubble. And one year into the worst downturn since the Depression, it’s still going strong.

by Hanna Rosin

Did Christianity Cause the Crash?

LIKE THE AMBITIONS of many immigrants who attend services there, Casa del Padre’s success can be measured by upgrades in real estate. The mostly Latino church, in Charlottesville, Virginia, has moved from the pastor’s basement, where it was founded in 2001, to a rented warehouse across the street from a small mercado five years later, to a middle-class suburban street last year, where the pastor now rents space from a lovely old Baptist church that can’t otherwise fill its pews. Every Sunday, the parishioners drive slowly into the parking lot, never parking on the sidewalk or grass—“because Americanos don’t do that,” one told me—and file quietly into church. Some drive newly leased SUVs, others old work trucks with paint buckets still in the bed. The pastor, Fernando Garay, arrives last and parks in front, his dark-blue Mercedes Benz always freshly washed, the hubcaps polished enough to reflect his wingtips.

It can be hard to get used to how much Garay talks about money in church, one loyal parishioner, Billy Gonzales, told me one recent Sunday on the steps out front. Back in Mexico, Gonzales’s pastor talked only about “Jesus and heaven and being good.” But Garay talks about jobs and houses and making good money, which eventually came to make sense to Gonzales: money is “really important,” and besides, “we love the money in Jesus Christ’s name! Jesus loved money too!” That Sunday, Garay was preaching a variation on his usual theme, about how prosperity and abundance unerringly find true believers. “It doesn’t matter what country you’re from, what degree you have, or what money you have in the bank,” Garay said. “You don’t have to say, ‘God, bless my business. Bless my bank account.’ The blessings will come! The blessings are looking for you! God will take care of you. God will not let you be without a house!”

Among mainstream, nondenominational megachurches, where much of American religious life takes place, “prosperity is proliferating” rapidly, says Kate Bowler, a doctoral candidate at Duke University and an expert in the gospel. Few, if any, of these churches have prosperity in their title or mission statement, but Bowler has analyzed their sermons and teachings. Of the nation’s 12 largest churches, she says, three are prosperity—Osteen’s, which dwarfs all the other megachurches; Tommy Barnett’s, in Phoenix; and T. D. Jakes’s, in Dallas. In second-tier churches—those with about 5,000 members—the prosperity gospel dominates. Overall, Bowler classifies 50 of the largest 260 churches in the U.S. as prosperity. The doctrine has become popular with Americans of every background and ethnicity; overall, Pew found that 66 percent of all Pentecostals and 43 percent of “other Christians”—a category comprising roughly half of all respondents—believe that wealth will be granted to the faithful. It’s an upbeat theology, argues Barbara Ehrenreich in her new book, Bright-Sided, that has much in common with the kind of “positive thinking” that has come to dominate America’s boardrooms and, indeed, its entire culture.

On the cover of his 4 million-copy best seller from 2004, Your Best Life Now, Joel Osteen looks like a recent college grad who just got hired by Goldman Sachs and can’t believe his good luck. His hair is full, his teeth are bright, his suit is polished but not flashy; he looks like a guy who would more likely shake your hand than cast out your demons. Osteen took over his father’s church in 1999. He had little preaching experience, although he’d managed the television ministry for years. The church grew quickly, as Osteen packaged himself to appeal to the broadest audience possible. In his books and sermons, Osteen quotes very little scripture, opting instead to tell uplifting personal anecdotes. He avoids controversy, and rarely appears on Christian TV. In a popular YouTube clip, he declines to confirm Larry King’s suggestion that only those who believe in Jesus will go to heaven.

The idea of reaching out to churches took off quickly, Jacobson recalls. The branch managers figured pastors had a lot of influence with their parishioners and could give the loan officers credibility and new customers. Jacobson remembers a conference call where sales managers discussed the new strategy. The plan was to send officers to guest-speak at church-sponsored “wealth-building seminars” like the ones Bowler attended, and dazzle the participants with the possibility of a new house. They would tell pastors that for every person who took out a mortgage, $350 would be donated to the church, or to a charity of the parishioner’s choice. “They wouldn’t say, ‘Hey, Mr. Minister. We want to give your people a bunch of subprime loans,” Jacobson told me. “They would say, ‘Your congregants will be homeowners! They will be able to live the American dream!’”

GARAY OFTEN TELLS his life story from the pulpit, as an inspiration to the many immigrants in his church, some legal, some not. He grew up an outsider—a citizen by birth, but living a marginal existence in a diverse, working-class neighborhood in Flushing, Queens. His mother left when he was 8, and he was raised mostly by two older brothers; he spent most of his time on the street. “I ate jars of peanut butter for dinner,” he says. The story of how he became a Christian begins in 1989, when he was 28 years old, and involves a large sum of money. He’d been selling drugs in Miami, then started using, and owed some dealers $30,000 that he didn’t have, and they were going to kill him. He was on his mattress one night, in despair, when a picture of Jesus up on his wall “winked at me.” Soon after, he became a born-again Christian, and he told everyone about it. The dealers, he says, then went away. He doesn’t offer much explanation; he just says, “They were after me. They were going to kill me. And then they just backed off.” He credits Jesus.

Garay tried many churches, but they all felt alien and “dead” to him. “That’s not me, sitting quietly and saying ‘Thank you, God.’” Finally he came upon a Pentecostal prosperity church, much like the one he leads now. The church was full of miracles and real emotion, which drew him in, but it also offered practical benefits. The pastor pointed out Bible passages that referred to finances in specific terms, giving him images of wealth he could almost reach out and touch: “Give, and it shall be given to you; good measure, pressed down, and shaken together, and running over”—a passage that’s now often read at Garay’s church during tithing time.

While it sounds absurd, this kind of message can have a positive influence, according to Tony Tian-Ren Lin, a researcher at the University of Virginia who has made a close study of Latino prosperity gospel congregations over the years. These churches typically take in people who had “been basically dropped into the world from pretty primitive settings”—small towns in Latin America with no electricity or running water and very little educational opportunity. In their new congregation, their pastor slowly walks them through life in the U.S., both inside and outside of church, until they become more confident. “In Mexico, nobody ever told them they could do anything,” says Lin, who was himself raised in Argentina. He finds the message at prosperity churches to be quintessentially American. “They are taught they can do absolutely anything, and it’s God’s will. They become part of the elect, the chosen. They get swept up in the manifest destiny, this idea that God has lifted Americans above everyone else.”

It is not all that surprising that the prosperity gospel persists despite its obvious failure to pay off. Much of popular religion these days is characterized by a vast gap between aspirations and reality. Few of Sarah Palin’s religious compatriots were shocked by her messy family life, because they’ve grown used to the paradoxes; some of the most socially conservative evangelical churches also have extremely high rates of teenage pregnancies, out-of-wedlock births, and divorce. As Garay likes to say, “What you have is nothing compared to what you will have.” The unpleasant reality—an inadequate paycheck, a pregnant daughter, a recession—is invisible. It’s your ability to see beyond such things, your willing blindness to even the most hopeless-seeming circumstances, that makes you a certain kind of modern Christian, and a 21st-century American.

Yikes, lets hope not.Some US institutions are being compelled by new government regulations to buy long bonds to 'match duration' of their obligations per a ruling of a few years ago.

Other than that, anyone buying the 30 year bond, other than for the Fed carry trade, in an time of quantitative easing and free spending government, should be institutionalized.

The Fed bond carry trade is when the primary dealers buy Timmy's bond with Ben's money, and then sell it back to the people's short term debt in dollars via the Fed. It keeps yields on the long end down, and maintains the appearance of stability. The dealers get to front run the buys and short the sells.

It is a pyramid scheme to accomplish a short term objective.

In many countries, full jails, stretched budgets and a general weariness with the war on drugs have made prohibition harder to enforce

Wow, eh?THE Green Relief “natural health clinic” in a bohemian part of San Francisco doesn’t sound like an ordinary doctor’s surgery. For those who wonder about the sort of relief provided, its logo—a cannabis leaf—is a clue. Inside, in under an hour and for $99, patients can get a doctor’s letter allowing them to smoke marijuana in California with no fear of prosecution. In a state that pioneered bans on smoking tobacco, smoking cannabis is now easier than almost anywhere in the world.

California, with its network of pot-friendly physicians, offers the most visible evidence of a tentative worldwide shift towards a more liberal policy on drugs. Although most countries remain bound by a trio of United Nations conventions that prohibit the sale and possession of narcotics, laws are increasingly being bent or ignored. That is true even in the United States, where the Obama administration has announced that registered cannabis dispensaries will no longer be raided by federal authorities.

Elsewhere in the United States, there are many signs of prohibition ebbing away. Some 14 states have decriminalised the possession of marijuana for personal use (medical or otherwise), though most keep the option of a $100 civil penalty. Three states—New Mexico, Rhode Island and Massachusetts—license non-profit corporations to grow medical marijuana. Most radically, some states are considering legalising the drug completely. California and Massachusetts are holding committee hearings on bills to legalise pot outright; Oregon is expected to introduce such a bill within the next couple of weeks.

One reason for the sudden popularity of cannabis is financial. Tom Ammiano, the California assemblyman who introduced the bill to legalise marijuana earlier this year, points out that were it taxed it could raise some $1.3 billion a year for state coffers, based on a $50 per ounce levy on sales. As an added benefit to the public purse, lots of police time and prison space would be freed up. California’s jails heave with 170,000 inmates, almost a fifth of them inside for drug-related crimes, albeit mostly worse than just possessing a spliff.

Heh heh.... Dum maro dum...mit jaye gam...bolo subah shaaam....Hare Krishna Hare RamSingha wrote:love, freedom, creativity - just what fuels new discovery and industries.

let the good times roll my friend (and pass me the sheesha please)

Again, TIFWIW. Denninger can be excitable at times.All we need is for The Fed to encourage and promote the dollar carry trade, and we can pump the stock market to the moon - even though unemployment continues to skyrocket and consumer confidence, a leading indicator of consumer spending and activity, was in the tank this morning.

You need no further proof that the stock market has exactly nothing to do with the consumer or the broader economy - that it has become nothing more or less than a raw casino that responds to one and only one thing - the Federal Reserve and Federal Government's encouragement of intentional dollar debasement - than this chart, especially today.

Less than 10 minutes after disastrous consumer confidence numbers were released the dollar basically imploded (as you'd expect - the dollar is fundamentally underpinned by the government's ability to tax, and without confidence and jobs that ability to tax disappears) and as it did the S&P 500 marched steadily higher by 1%, propelled by the simultaneous implosion of the currency.

Folks, this will not end well. This intentional distortion of asset prices against the underlying economic fundamentals will revert, and when it does the stock and credit markets (which have been "pumped" by equity appreciation) will be destroyed.

We learned exactly nothing from Japan doing the same thing and getting the same result. We have exactly nobody in Congress or The Administration that will put a stop to it, but you can be certain that it will end, whether by our foreign creditors saying "screw you!" or by the simple over-inflation of the balloon which will explode - just as did the housing bubble, just as is the commercial real estate bubble, just as did the leveraged loan bubble, and just as did the consumer debt bubble.

The difference is that when (not if) it happens this time the risk is to our government and indeed our representative form of government, not to handful of banksters on Wall Street.

Jeez, that bolded part -underperforming even Spain - would hurt even the most stiff upper hipped of the great britons.After decades of outperforming the continental economies, Britain seems set to become the "sick man of Europe", languishing at the bottom of the European growth league table.

Official figures released by Eurostat yesterday revealed that the eurozone economies, comprising 16 of the EU's 27 member states, are now officially out of recession, having grown by 0.4 per cent in the third quarter. The growth rate for the EU as a whole, dragged down by the UK and some east European states, was 0.2 per cent. Both are the first positive news on growth since spring last year, though they are somewhat below market expectations.

Of the five largest European economies, only Britain and Spain are still in recession, and even the stricken Spanish economy is performing marginally better than the UK. The US and Japan are also out of recession.

While growth in the UK's major trading partners is good news, the danger now is that the Berlin government and the European Central Bank take the latest figures as justification for a withdrawal of monetary and fiscal stimulus measures before growth in laggard nations such as the UK has even begun. The G20 Communiqué agreed that such "exit strategies" should not be implemented before the global recovery had been "secured".

With a 0.7 per cent rise in quarterly GDP, Germany is the major driver of European growth, contributing nearly half of the total GDP growth in the single currency zone in Q3. Italy saw a sharp reversal in fortunes for the better, with 0.6 per cent growth, and France, which suffered a mild recession by most standards, is up 0.3 per cent. Robust expansions were also registered in the Netherlands (0.4 per cent and Portugal (0.9 per cent).

Hari, I don't mean they literally did not understand the CDS. But with respect to government bailouts I really doubt they had any idea how interconnected they had become and that government would indeed bail them out. In other words, it is was impossible for them to play out how a scenario where the Bear Stearns, Lehman and then AIG and Merill go down in fairly quick succession and the impact of it all.Hari Seldon wrote:IMO folks knew (somewhere deep down perhaps) what they were doing when they went on a CDS buying binge. They were hedging all right, but not their particular risk against a counterparty. Rather they were hitching their particular risk to systemic stability and thereby hedging their losses against gubmint bailouts.

It is correct that CDSs enables huge interlinks of banks and institutions buying and selling CDSs which is what creates the systemic risk. With AIG failure suddenly whole lot of banks would have a skeleton of their balance sheet. The Lehman failure demonstrated complete breakdown of trust and confidence and the ensuing of credit market freeze. With AIG following immediately there after, and "desirable" banks like GS and JPM on the other side of the trade, government was quick to step in and make them whole.The CDSes and other derivatives have created a web of links amongst the big players making each in turn ever more 'too big to fail'. The Lehman failure demonstrated this in spectacular terms when gubmints came up with untold billions in a jiffy to secure the dumb party's (AIG) smart counterparties (GS JPM etc) lest system-wide outage occur.

There is no "market enabler" that's needed anymore than I need a salary enabler to rob me of my paycheck.blanket consistency and ideological faith in free-marketism sans market enabling institutions (central banks primarily) commands so

Asia's export-dependent economies are suffering from the decline of the dollar and of the Chinese currency, which Beijing informally links to the greenback. Many Asian central banks have been selling their currencies in recent months as the return of global risk appetite has pushed the dollar to 15-month lows against a basket of currencies.

Although APEC leaders including U.S. President Barack Obama and Chinese President Hu Jintao say the global economy must be rebalanced away from its over-reliance on U.S. consumers buying Asian goods with borrowed money, the fact remains that for the time being, Asia's recovery will rely on exports.

Theek hai, dude. Believe what you will.The theory that some guy sitting in an office knows what's best for the economy or what prices should be or where the market is headed is a con job and nothing more. Such a person would not be a central banker if he had that gift of foresight. He would be a billionaire making successful bets on the market since he claims to call it correctly most of the time. There are no such godmen and anyone claiming to be such a person is a fraud.

There will be few takers of my premise that central banking is little more than scam as I said. {Maybe so. But count me in as one of the takers only.} Its not until a central banker wrecks the economy that people will open their eyes. {Right. When the ekhanomy tanks, dump on the central banker like there's no tomorrow. But when a central banker acts his mandate in role as banking regulator and saves the economy the same pitfalls, he should get zero appreciation. Right?} Till then he will be worshipped as a godman like Greenspan till the recent crash revealed him to be an idiot.{Amen. We can drink to that. Now go on and insist that because Greenspan is a buffoon and an idiot, so is YV Reddy.}

I'll go along with the first half of that.A central bank arises out of the fact that there is a fiat currency. As long as the central bank is owned by the public (not the case in the US but the RBI is a state institution), and its governors are aware of their ignorance, the resulting system is the worst but for the alternatives.

And something that also goes for all apparently-D&G boards.The desire for instant gratification has apparently pervaded all aspects of the times we live in, including the collapse of our economies. Once you tell people that such an event is inevitable, they want it to happen as soon as possible, or they lose both their focus and their interest. Warhol's 15 minutes of fame is a thing of the distant past, simply because it's so boringly long.

In the past two years, nothing fundamental about our economies has changed in any structural way, and certainly nothing has improved. The damage has been done, whether you care to look or not. What has changed, though, are appearances. If you look at certain sets of numbers from a certain angle, you could swear the recession was over and recovery is here. However, if you'd step back and take some time and look again from another angle, and another, it’s obvious that no recovery is even remotely near. But most people are not patient enough, or just lack the focus, to take that step back, and take that extra bit of time to observe what happens around them.

All the combined bail-outs and stimulus plans and doctored "official" numbers, when put together, seem to paint a picture of a live pig. And unless you can wipe off the lipstick right here and now, then and there, people will insist that what they are seeing looks an awful lot like a pig. And that is basically all it takes for them. That fills their immediate gratifying needs. It's much easier that way. They reason that if that pig were really dead, as you claim, they would know. Or smell, or something. They are rational creatures (the people, not the pigs), and smart to boot, and they would see through the disguise, and anyway, the folks they voted into office would never risk the wellbeing of their voters by telling them lies about the (non-)existential features of a bacon factory.

OMG. Read it all janta.And of course it makes sense that people who think they have understood what is happening, through reading The Automatic Earth and/or other sources, become uncertain if what they think they have seen takes (what seems like) a -too- long time to materialize. Even if they can rationally figure that those who hold the power in a given society have both the means and the motive to make things look -much- better and sunnier than they truly are.

And so discussions even here at The Automatic Earth increasingly turn to "the stock markets haven't toppled yet, but you said they would!". Yeah, that pig sure looks ready to party, doesn't it?

Now where have we seen that before?Some people think that the Fed can take all the debt on its sheet (it has some $8 triilion at present) and thereby nullify it, but then the ECB can do it too, presumably, and all other central banks; so where does the debt go?

We seem to run into all sorts of confusion when it comes to the state of the economy, be it global or national. There are people who think that central banks are colluding to make all debts go away (no, I'm not kidding, there are those who really think that) by pumping ever more money (i.e. more debt) into the great beyond.

Then there are those who feel that central banks and Treasury Departments, either just stateside or across the G-20, can issue unlimited amounts of paper and trick investors all over the globe into believing that all the paper is worth what it says it is, and they'll be good for whatever IOU's they issue at whatever yield they'd like to sell them for.

I see people suggesting that the US Congress controls Wall Street, and even the Federal Reserve. Some think that quantitative easing, especially when part of a concerted effort, can go on indefinitely and without limit. There are even those who think that Bernanke, Geithner and Obama are executing successful policies that will benefit the American population, if not mankind as a whole. After all, according to government calculations, the recession has been succesfully battled and is now over. What more do you need to know?