Perspectives on the global economic meltdown (Jan 26 2010)

Re: Perspectives on the global economic meltdown (Jan 26 201

aqkhan: On scenario 1

1. Tax cuts could potentially not be extended for families earning over $250,000 and individuals earning over $200,000.

2. On what basis do you say small business will close down?

1. Tax cuts could potentially not be extended for families earning over $250,000 and individuals earning over $200,000.

2. On what basis do you say small business will close down?

Re: Perspectives on the global economic meltdown (Jan 26 201

^^ Regarding 2) Small businesses closing down he already explained. Most small businesses are self-funded with low profit margins. Any tax increase will eat into their margins making it less viable. This is very well known arguement backed with data from the 80s.

Re: Perspectives on the global economic meltdown (Jan 26 201

^^^

There are contradicting analysis on the impact of tax increase; the well known arguments are from the Supply-Side Economists.

There are contradicting analysis on the impact of tax increase; the well known arguments are from the Supply-Side Economists.

Re: Perspectives on the global economic meltdown (Jan 26 201

And, please read this about small business and tax cut impact: http://www.politifact.com/truth-o-meter ... ness-owne/

It presents both sides of the debate.

It presents both sides of the debate.

Re: Perspectives on the global economic meltdown (Jan 26 201

why? If your highest marginal income tax increases from 40 to 42 per cent (for e.g) for incomes over $250 000, why would it stifle your ability to invest in growing your business (so that you earn more)? Would it be because you would be afraid to earn over $250,000 now that you have to pay 2% tax more?aqkhan wrote: Higher income taxes stifle their ability to expand their businesses or even close it down if it starts being infeasible. There is only so much of hard earned savings that people would like to take risk with. While they can recuperate part of their losses by showing it as an investment loss, its only a fraction and the business and jobs associated with it are lost forever.

Re: Perspectives on the global economic meltdown (Jan 26 201

There are contradictory analysis on almost every issue under the sun that involves human nature and is not controlled by physical laws.

I quote from the census bureau statistics:

I quote from the census bureau statistics:

http://www.census.gov/epcd/www/smallbus.htmlAbout three quarters of all U.S. business firms have no payroll. Most are self-employed persons operating unincorporated businesses, and may or may not be the owner's principal source of income.

Re: Perspectives on the global economic meltdown (Jan 26 201

Under the Obama plan, the proposed tax increases are by 5% on their personal income and by 20% on capital gains. I don't understand why big corporations aren't taxed! They are the ones sitting on buttload of cash and not hiring. They should be taxed on their ever increasing profits. Unfortunately, they have bottomless pockets for lobbying against such tax increases.arnab wrote:why? If your highest marginal income tax increases from 40 to 42 per cent (for e.g) for incomes over $250 000, why would it stifle your ability to invest in growing your business (so that you earn more)? Would it be because you would be afraid to earn over $250,000 now that you have to pay 2% tax more?aqkhan wrote: Higher income taxes stifle their ability to expand their businesses or even close it down if it starts being infeasible. There is only so much of hard earned savings that people would like to take risk with. While they can recuperate part of their losses by showing it as an investment loss, its only a fraction and the business and jobs associated with it are lost forever.

Last edited by aqkhan on 28 Jul 2010 05:51, edited 1 time in total.

Re: Perspectives on the global economic meltdown (Jan 26 201

So from this statistic it seems three-quarters of 'firms' have no payroll - meaning they are 'self-employed'. So such 'small businesses' do not 'hire' people. So how would an increase in 'income tax' affect their investment or their 'hiring'?aqkhan wrote:There are contradictory analysis on almost every issue under the sun that involves human nature and is not controlled by physical laws.

I quote from the census bureau statistics:http://www.census.gov/epcd/www/smallbus.htmlAbout three quarters of all U.S. business firms have no payroll. Most are self-employed persons operating unincorporated businesses, and may or may not be the owner's principal source of income.

Re: Perspectives on the global economic meltdown (Jan 26 201

ok - would the additional 5 % increase in tax scare you from the opportunity to earn over $250,000? Capital gains should be taxed highly. It would discourage idiots from speculating in RE.aqkhan wrote: Under the Obama plan, the proposed tax increases are by 5% on their personal income and by 20% on capital gains.

Re: Perspectives on the global economic meltdown (Jan 26 201

Because the ones that do have payroll (firms that employs 40 million people in the United States) will be affected by an increase in income tax and their hiring.arnab wrote:

So from this statistic it seems three-quarters of 'firms' have no payroll - meaning they are 'self-employed'. So such 'small businesses' do not 'hire' people. So how would an increase in 'income tax' affect their investment or their 'hiring'?

Re: Perspectives on the global economic meltdown (Jan 26 201

It does seem to deter quite a few people as was seen by the boom after 2000-01 when Bush proposed the tax cuts. And capital gains covers all investments, not just RE.arnab wrote:ok - would the additional 5 % increase in tax scare you from the opportunity to earn over $250,000? Capital gains should be taxed highly. It would discourage idiots from speculating in RE.aqkhan wrote: Under the Obama plan, the proposed tax increases are by 5% on their personal income and by 20% on capital gains.

Re: Perspectives on the global economic meltdown (Jan 26 201

Why? If the business owner's 'income' is low to begin with (because of small margins), then the increase in tax does not impact them. And if the business owner wants to earn more than $250,000 then his business decision is not going to be impacted by a 5% increase in marginal income tax rates.aqkhan wrote:

Because the ones that do have payroll (firms that employs 40 million people in the United States) will be affected by an increase in income tax and their hiring.

Last edited by arnab on 28 Jul 2010 06:11, edited 1 time in total.

Re: Perspectives on the global economic meltdown (Jan 26 201

This is an extremely discredited theory. Correlation does not imply causality. By extension - can one argue that Bush tax cuts caused reckless spending behaviour which caused the US economic crisis? So tax should never have been cut?aqkhan wrote: It does seem to deter quite a few people as was seen by the boom after 2000-01 when Bush proposed the tax cuts. And capital gains covers all investments, not just RE.

Re: Perspectives on the global economic meltdown (Jan 26 201

http://video.foxsmallbusinesscenter.com ... t_id=87013

http://money.cnn.com/2010/07/26/news/ec ... /index.htm

http://www.newsmax.com/Headline/fred-th ... /id/365703

http://www.foxnewsinsider.com/2010/07/2 ... -tax-cuts/

http://money.cnn.com/2010/07/26/news/ec ... /index.htm

http://www.newsmax.com/Headline/fred-th ... /id/365703

http://www.foxnewsinsider.com/2010/07/2 ... -tax-cuts/

Extending the tax cuts, Adams says, will help the economy in two ways: It will increase demand for goods and services by keeping money in taxpayers' pockets, while encouraging small-business owners to increase their payrolls and hire more workers.

"Not renewing the Bush tax cuts is a death wish for the American economy," Adams says. "It's really that serious."

Federal Reserve Chairman Ben Bernanke has testified before Congress that the economic recovery is too fragile to sustain any tax increase. Last week, he urged Congress to renew the Bush tax cuts.

The U.S. economy has been wracked by 9.5 percent unemployment, despite Obama administration economists' estimate that passing the $862 billion stimulus package would keep unemployment below 8 percent.

If the Bush tax credits expire, the top income-tax rate for the wealthiest Americans – a category that includes many small-business owners – would increase from 35 to 39.6 percent. Taxes on capital gains would increase from 15 to 20 percent, and taxes on dividends would jump as well.

Democrats who want to eliminate the tax cuts include President Barack Obama, who campaigned to end them, as well as Treasury Secretary Timothy Geithner and House Speaker Nancy Pelosi.

Former Fed Chairman Alan Greenspan also favors expiration of the Bush tax cuts, although he concedes doing so probably will be a drag on the economy.

Re: Perspectives on the global economic meltdown (Jan 26 201

Tax cuts have throughout the entire history of United States led to a booming small businesses some of which eventually grow into big corporations. This is not a one time event. Everybody and their father in the US knows that. Reckless spending was going into Iraq. Afghanistan was necessary, but Iraq could've been avoided. Adding 50 billion dollars to the treasury by taxing small businesses and playing Russian roulette with a sputtering economy while spending 700 billion a year on war and making medicare/medicaid promises doesn't make sense!arnab wrote:This is an extremely discredited theory. Correlation does not imply causality. By extension - can one argue that Bush tax cuts caused reckless spending behaviour which caused the US economic crisis? So tax should never have been cut?aqkhan wrote: It does seem to deter quite a few people as was seen by the boom after 2000-01 when Bush proposed the tax cuts. And capital gains covers all investments, not just RE.

Re: Perspectives on the global economic meltdown (Jan 26 201

I'm sorry you just don't know enough about taxation theory or history (for e.g the highest marginal federal tax rate was 7% in 1913, was around 25% in 1928, rose to as high as 63% in 1934 after the depression, rose to 94% in 1944 towards the end of WW2, and around 35% today).aqkhan wrote:

Tax cuts have throughout the entire history of United States led to a booming small businesses some of which eventually grow into big corporations. This is not a one time event. Everybody and their father in the US knows that. Reckless spending was going into Iraq. Afghanistan was necessary, but Iraq could've been avoided. Adding 50 billion dollars to the treasury and playing Russian roulette with small businesses and a sputtering economy while spending 700 billion a year on war and making medicare/medicaid promises doesn't make sense!

The laffer curve argument, which you seem to basing your argument on was so simplistic (that even Ronald Reagan could understand it). You have not even been able to make a convincing case of why small business would be impacted by higher income taxes.

Re: Perspectives on the global economic meltdown (Jan 26 201

Why don't you impress me with your taxation theory? You have to take socio-economic factors into account when the decision to tax or not to tax was taken. Since you've quoted Ronald Raegan, I will give you a quote from himself that will show how increasing taxes on this specific bracket had an impact on small businesses.arnab wrote:I'm sorry you just don't know enough about taxation theory or history (for e.g the highest marginal federal tax rate was 7% in 1913, was around 25% in 1928, rose to as high as 63% in 1934 after the depression, rose to 94% in 1944 towards the end of WW2, and around 35% today).aqkhan wrote:

Tax cuts have throughout the entire history of United States led to a booming small businesses some of which eventually grow into big corporations. This is not a one time event. Everybody and their father in the US knows that. Reckless spending was going into Iraq. Afghanistan was necessary, but Iraq could've been avoided. Adding 50 billion dollars to the treasury and playing Russian roulette with small businesses and a sputtering economy while spending 700 billion a year on war and making medicare/medicaid promises doesn't make sense!

The laffer curve argument, which you seem to basing your argument on was so simplistic (that even Ronald Reagan could understand it). You have not even been able to make a convincing case of why small business would be impacted by higher income taxes.

There.Former President Ronald Reagan used to tell the story of his experiences as an actor in the high tax era of the 1950s. He found that his income from being the lead actor in five feature film productions each year left his family with a comfortable income. However, if he made a sixth movie the additional income earned from that movie would push him into a higher tax bracket (which was in the 90% range in those days) which, after paying the higher tax on that portion of his income, left him and his family with very little additional income for that year. The 90% tax on his income earned by making more than five movies per year was the same as having his pay for additional movies cut by 90%. Faced with the choice of spending time home relaxing with his family or working on location for a few weeks for 10% of his normal pay, he choose to limit himself to five films. This, of course meant that many of the other workers on the set whose jobs and income were tied to Reagan's movies were also limited to five films per year and, since they were in lower tax brackets, they suffered a cut in income due to less work.

Re: Perspectives on the global economic meltdown (Jan 26 201

So why did Regan remit office with some of the largest deficits that the US had at the time? I know that story he used to say - one can only shake one's head. How many movies were being made at the time in hollywood? Was there under capacity? What was the unemployment rate like? Only a naarcisstic idiot will think that the world stops if he does not work.aqkhan wrote: Why don't you impress me with your taxation theory? You have to take socio-economic factors into account when the decision to tax or not to tax was taken. Since you've quoted Ronald Raegan, I will give you a quote from himself that will show how increasing taxes on this specific bracket had an impact on small businesses.

There.Former President Ronald Reagan used to tell the story of his experiences as an actor in the high tax era of the 1950s. He found that his income from being the lead actor in five feature film productions each year left his family with a comfortable income. However, if he made a sixth movie the additional income earned from that movie would push him into a higher tax bracket (which was in the 90% range in those days) which, after paying the higher tax on that portion of his income, left him and his family with very little additional income for that year. The 90% tax on his income earned by making more than five movies per year was the same as having his pay for additional movies cut by 90%. Faced with the choice of spending time home relaxing with his family or working on location for a few weeks for 10% of his normal pay, he choose to limit himself to five films. This, of course meant that many of the other workers on the set whose jobs and income were tied to Reagan's movies were also limited to five films per year and, since they were in lower tax brackets, they suffered a cut in income due to less work.

Re: Perspectives on the global economic meltdown (Jan 26 201

Reagan exited office with a deficit because of the cold war spending and because of trade imbalances with China due to free trade policies of Nixon. It was too early to recognize that then though. Reagan was explaining how going into a bigger tax bracket didn't motivate him to sign up for more work, on which stage production jobs depended. That is far from being narcissistic. Free trade with protective economies (China, India, Japan) in my opinion along with burgeoning military spending by the department of offense destroyed United States, not tax cuts.arnab wrote: So why did Regan remit office with some of the largest deficits that the US had at the time? I know that story he used to say - one can only shake one's head. How many movies were being made at the time in hollywood? Was there under capacity? What was the unemployment rate like? Only a naarcisstic idiot will think that the world stops if he does not work.

Re: Perspectives on the global economic meltdown (Jan 26 201

aqkhan and arnab: just a friendly reminder to keep it polite and civil; there's no need to disrupt a good debate with standoffish language. Thanks.

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Perspectives on the global economic meltdown (Jan 26 201

Ah.. a very good hypothesis. Indeed a topic worthy of an e-Con-O-Metric paper with a Granger Causality "anal" ysis of the efficacy of the Bushie Tax cut and whether the tax cut "caused" the recovery in growth during G.W.Bush term 1.Correlation does not imply causality. By extension - can one argue that Bush tax cuts caused reckless spending behaviour which caused the US economic crisis? So tax should never have been cut?

I think ,the tax cuts probably played a very marginal part. The thing was in 2001, the collapse was purely in the tech sector and the broader economy and consumer spending held up very well indeed. What was pricked was the investment bubble in tech spending, so the 2000-2001 recession was a classical INVESTMENT led recession.

Now the 2008 recession was vastly different. Thanks to the cheap monetary policy of the Fed to counter the recession in 2001 and the Greenspan/Republican ideology of freemarkets and total lassiez faire, the real estate bubble inflated. Now everyone knew of it in 2004 when I was in NYC , and the figure all of us were told to watch out for was the rent to mortgage payment coverage. It is just that in the euphoria that in rapid rise in the real estate prices to unbelievable levels by 2007, too many people were sucked into it by too easy profits and when that bubble collapsed,it was a nation wide hit that rocked every homeowner in the US by asset price collapse . Given the massive percentage of home ownership in the US compared to other countries (Bushies boasted about this), it was a very dangerous sector to inflate.

When everyone's valuation was hit, consumer spending dropped like a stone. The 2008 recession was vastly different from the earlier ones because this was a case of a consumer led recession (which is rare indeed) and something as fundamental as that gets walloped, everything comes down like a house of cards. The dominoes fell in the US and it quickly rippled across the world .

But wait, the story ain't over yet. It ain't over until the fat lady sings and all that right ?. The folks who have the most imbalance are guess who ?. The Chinese!. By every measure, they are sitting on top of an investment bubble that they have driven massively over the years. China will simply not be allowed to export it's way out of trouble this time. There will be constant pressure on the Yuan. Expect a Japan in late 90s story to be repeated in China.

The reasons are the same (investment led bubble, partiuclarly in RE, at one point in time, all RE in Japan was worth more than the whole of US! the prices in China of RE are unreal, exports were the primary driver of growth, and after major recessions in export destinations, pressure was brought on Japan and now China to float their currencies) and the results will be the same.

JMT and the usual stuff.

Re: Perspectives on the global economic meltdown (Jan 26 201

Trade imbalances with China?? You mean trade imbalances with Japan.aqkhan wrote:Reagan exited office with a deficit because of the cold war spending and because of trade imbalances with China due to free trade policies of Nixon.

China didn't start racking up significant imbalances with the US until well into 1990s.

Reagan wanted to cut non-military spending, as he'd campaigned against "big govt" during his elections, but the Democrat-controlled Congress wouldn't let him.

Re: Perspectives on the global economic meltdown (Jan 26 201

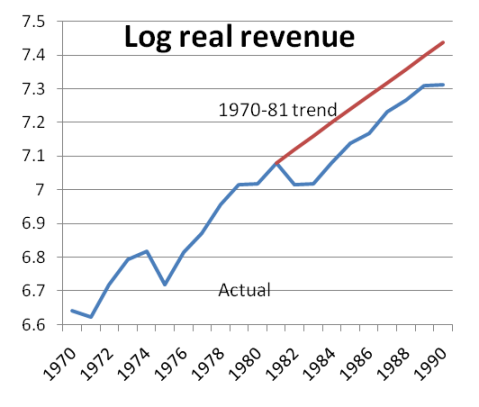

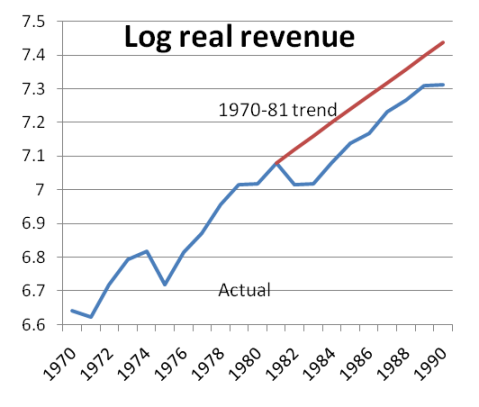

AqKhan: Extreme supply side economics is passe. Here is Krugman's chart & linky

Martin Wolf, Krugman calls him a shrill, ridicules the supply side economics. Here is why Reagan failed

I still see no reason why small businesses should pack their shops. So how many of them make more than $250,000 a year?

Martin Wolf, Krugman calls him a shrill, ridicules the supply side economics. Here is why Reagan failed

I still see no reason why small businesses should pack their shops. So how many of them make more than $250,000 a year?

Last edited by SwamyG on 28 Jul 2010 09:17, edited 1 time in total.

Re: Perspectives on the global economic meltdown (Jan 26 201

Boss - you are not understanding the issue at all. Why did Reagan argue for tax cuts? The basic 'concept' was that tax cuts would encourage lots of people to enter the labour market and this extra economic activity would generate a lot of tax revenues for the government despite the lower tax rates. In other words the tax elasticity would be very high. This would obviously be enough to finance US expenses. Now obviously this did not happen - so the govt spent more than it collected in taxes.aqkhan wrote: Reagan exited office with a deficit because of the cold war spending and because of trade imbalances with China due to free trade policies of Nixon. It was too early to recognize that then though. Reagan was explaining how going into a bigger tax bracket didn't motivate him to sign up for more work, on which stage production jobs depended. That is far from being narcissistic. Free trade with protective economies (China, India, Japan) in my opinion along with burgeoning military spending by the department of offense destroyed United States, not tax cuts.

To argue that US had a deficit because Reagan spent too much on the cold war is an ex post facto analysis !! That is like arguing that america is behaving like america does.

The whole point is that the tax cut - did not either reduce demand for government services (including defence), nor did it raise enough resources for the government. So you had a huge deficit. So this argument that tax cut is beneficial for the economy and a tax rise is harmful is an extremely simplistic one, IMO.

Re: Perspectives on the global economic meltdown (Jan 26 201

I agree - this was whole irrational exuberence fed by low interest rates and a lot of liquidity etc. Tax cuts per se played a very marginal role.vina wrote:Ah.. a very good hypothesis. Indeed a topic worthy of an e-Con-O-Metric paper with a Granger Causality "anal" ysis of the efficacy of the Bushie Tax cut and whether the tax cut "caused" the recovery in growth during G.W.Bush term 1.Correlation does not imply causality. By extension - can one argue that Bush tax cuts caused reckless spending behaviour which caused the US economic crisis? So tax should never have been cut?

I think ,the tax cuts probably played a very marginal part. The thing was in 2001, the collapse was purely in the tech sector and the broader economy and consumer spending held up very well indeed. What was pricked was the investment bubble in tech spending, so the 2000-2001 recession was a classical INVESTMENT led recession.

Re: Perspectives on the global economic meltdown (Jan 26 201

Banks are insolvent to the tune of trillions. If the free market operated as it should, all the high rolling bankers would be selling hot dogs on the streets by now. Parasites in banks & financial companies prefer inflation so their pyramid scheme can continue to expropriate the money of others to them through inflation and fiat money trickery.aqkhan wrote: Actually, the people at the top of the pyramid still come out on top even if there is a deflation.

My point is there is a segment of people at the top namely con artist bankers don't deserve to be there. They make zero contribution to the wealth of society through work or scientific discovery but rather drain it.

Central bankers are pretenders who try to make as if they know what's going on in the economy and what's best for everyone. But they are just acting in the interest of those financing & high rolling banks without which they would not have a job to begin with.

The impetus here is to always pass on losses to suckers and preserve the status quo and with it their jobs in this most fraudulent "industry".

The best stimulus that can be provided to the productive economy is to remove the parasitical middle man. The only way to do that is a return to honest money and smaller government.

Re: Perspectives on the global economic meltdown (Jan 26 201

I'm afraid the US govt has turned into a bubble itself. Passing on losses from banking crooks to the productive segment of society via taxation, inflation, and other wealth confiscation schemes does not sound like a recepie for prosperity. Public sector pensions alone are going to wreck havoc as people working in the private sector end up having to pay for someone else's lavish retirement while having no retirement of their own.arnab wrote:So this argument that tax cut is beneficial for the economy and a tax rise is harmful is an extremely simplistic one

Some taxation is OK for basic infrastructure and services. But the pendulum has swung to an extreme. Every con artist banker, union and other special interest in town is trying to game the system to expropirate as much money of hardworking people to himself by gaming the system. With the coffers bare, they are now calling for raising taxes (on others) to pay for their benefits.

It does not help that the federal reserve increasingly looks like an organization working in the primary interest of a thieving private banking cartel. The whole idea of some private commercial entity controlling the fruits of people's labor and some joker at the top fidding around with interest rates & counterfeiting money really goes against the grain of common sense. Really he's just helping himself and his buddies at the trough in a symbotic manner where he keeps them in business and they help him keep his job by bribing politicians.

Its time to do away with all the inflating and taxing and other rip off schemes and shrink govt by a good 70% the world over. And get rid of the middle man banking & financing industry while at it. That's the best stimulus to get the productive real economy moving.

Re: Perspectives on the global economic meltdown (Jan 26 201

None of the models that I have seen take into account the deflationary pressures.

All modelling is done assuming inflation, which like second law of thermodynamics or law of entropy which is ever increasing assumes that inflation is ever growing.

So consider that you underwrite a policy which pays annuities into future and in that future there happens to be deflation , then the model based on inflation will have more purchasing ( consequently more wealth) than what the under writer envisioned.

This is very simplistic case where in the moment the pay out of the annuities are starting coincides with deflation.

So in other words the policy makers and the bankers will not allow deflation instead would even dare to take on hyper inflation in preference to deflation.

The entire risk model is based on inflation, and asset prices holding or increasing in values.

Also note that GOTUS has been showing SS collections as income to show (bogus) balance of budget. Jut like the way Pension funds were shown as revenues by big companies till feds came into seen to stop the practice

All modelling is done assuming inflation, which like second law of thermodynamics or law of entropy which is ever increasing assumes that inflation is ever growing.

So consider that you underwrite a policy which pays annuities into future and in that future there happens to be deflation , then the model based on inflation will have more purchasing ( consequently more wealth) than what the under writer envisioned.

This is very simplistic case where in the moment the pay out of the annuities are starting coincides with deflation.

So in other words the policy makers and the bankers will not allow deflation instead would even dare to take on hyper inflation in preference to deflation.

The entire risk model is based on inflation, and asset prices holding or increasing in values.

Also note that GOTUS has been showing SS collections as income to show (bogus) balance of budget. Jut like the way Pension funds were shown as revenues by big companies till feds came into seen to stop the practice

Re: Perspectives on the global economic meltdown (Jan 26 201

Boss log during the Regan administration the Loren curve tended to be a case of perfect inequality.

Note that reganomics looks goo because of the fact that Regan came into office when supply side shock was absorbed due to OPEC formation and capping production to price manupulation, the Iran Iraq (orchestrated by unkil) was a way to defeat and restore the oil prices by excess production by Iraq and Iran. Yes tax cuts did increase revenues into coffers but poverty levels soared due tax cuts and as well as welfare cuts. so all in all the Lorenz curve and Laffer curve were compensating each other to bring US to pre oil shock era...

Note that reganomics looks goo because of the fact that Regan came into office when supply side shock was absorbed due to OPEC formation and capping production to price manupulation, the Iran Iraq (orchestrated by unkil) was a way to defeat and restore the oil prices by excess production by Iraq and Iran. Yes tax cuts did increase revenues into coffers but poverty levels soared due tax cuts and as well as welfare cuts. so all in all the Lorenz curve and Laffer curve were compensating each other to bring US to pre oil shock era...

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

Shivas regal garu,

truth of the matter is, nobody but nobody seems to have any clue as to how to deal with deflation in a modern setup. That folks as smart, systematic, focused and rational as the Japanese couldn't figure out what the freak was going on and how to deal with it for close to 2 decades now says all.

Here's more AEP, calling it like it is, in his own allah-ram-ist way:

Drip after drip of deflation data (telegraf blawgs)

So what is one to do, eh?

truth of the matter is, nobody but nobody seems to have any clue as to how to deal with deflation in a modern setup. That folks as smart, systematic, focused and rational as the Japanese couldn't figure out what the freak was going on and how to deal with it for close to 2 decades now says all.

Here's more AEP, calling it like it is, in his own allah-ram-ist way:

Drip after drip of deflation data (telegraf blawgs)

Fascinating, eh?Today’s release on manufacturing activity by the Richmond Fed is pretty ghastly, as you would expect given that the effects of fiscal stimulus are now wearing off at accelerating pace – before the happy handover to the private sector is safely consummated – and given that the structural East-West imbalances that lay behind the global crisis are getting worse again.

...

The expectations index for the US 5th District is crumbling:

...

This follows yesterday’s horrendous fall in the Texas business activity index from the Dallas Fed, which fell from -4 in June to -21 in July. “Thirty-one percent of firms reported a worsening of activity, up from 22 percent in June,” said the bank.

Texas New Orders were -9.6 in July, -8.2 in June, and +15.8 in May.

Capacity Utilization was -0.6 in July, +2.7 in June, and +18.7 in May.

This of course is why Fed chair Ben Bernanke has been giving strong hints of QE2 (helicopters again) if necessary.

Forgive me if I am becoming a “leading indicator” bore but these turning points in the cycle are fascinating.

So what is one to do, eh?

Now that last bit of advice, we can all agree with, I guess. Calvados, cognac, chivas...eh?So watch the Chinese banking system. Watch Japanese exports. Watch OPEC as it keeps cutting output to hold up the oil price. Watch Euribor rates and the continued contraction in eurozone lending to companies. Watch French industrial output. Watch Polish sovereign debt (that’s a new one).

Watch the M3 money supply in the US as it contracts at a 10pc annualized rate. And for goodness sake watch the Fed Board.

Then sit in a deep leather arm-chair with a good Calvados, listen to Bach Fugues, and think.

Re: Perspectives on the global economic meltdown (Jan 26 201

Neshant: Small government is nice onlee. After tasting freedom, humans would want to be minimally ruled over by others. But we live in a society and are bound by various laws and rules. The Optimal Government size which is neither too big nor too small is like the Amrut that Devas and Asuras fought for. We diss lawyers and government until we find a need for them ourselves.

If one is searching for true market economy, I think we have to look at our sabji mandis (a.k.a farmer markets) in desh.

If one is searching for true market economy, I think we have to look at our sabji mandis (a.k.a farmer markets) in desh.

Re: Perspectives on the global economic meltdown (Jan 26 201

Agree with the rest of your post except this. When big banks went insolvent, the board did suffer some losses but they didn't become pauper. Their personal wealth is too diversified. They will become paupers only when the global economy collapses as a whole and every government everywhere will try its best to prevent that situation. A perfect example is Japan. If the whole banking industry collapses, the world as we know will end. And that will be more harmful to people who work for daily wages than rich bankers with diversified investments. Its an unfortunate truth.Neshant wrote:Banks are insolvent to the tune of trillions. If the free market operated as it should, all the high rolling bankers would be selling hot dogs on the streets by now. Parasites in banks & financial companies prefer inflation so their pyramid scheme can continue to expropriate the money of others to them through inflation and fiat money trickery.aqkhan wrote: Actually, the people at the top of the pyramid still come out on top even if there is a deflation.

Re: Perspectives on the global economic meltdown (Jan 26 201

Hari puttar,

The Japanese could have easily dealt with deflation by translating price drops into increased exports - since the real targets of Japanese industry have traditionally been foreign consumers rather than domestic ones - but the real underlying problem was that Japan is now constrained on how hard it can try to compete in the export market, because of the increasing US tilt towards managed trade.

Notice that China has no such qualms about continuing to aggressively compete for US consumer dollars, despite the loudest warnings from Washington. They have suffered no deflation, despite ever increasing production volumes.

Watch what happens when China's real estate bubble collapses, a la 1990s Japan. The Chinese won't miss a beat - they'll just lower their currency exchange rate peg, and will export themselves out of recession. Germany's Merkel is likewise gearing up to export her way out of recession, and we can even see UK's Cameron doing so, with simultaneous austerity cuts and sudden trips abroad to rediscover India as a trade partner.

The overly cautious Japanese seem to be getting outpaced by others with more agile reflexes.

Mind you, Japan has always been highly dependent on external trade for their standard of living, as compared to other countries. Therefore they of all people would face dire risks through trade caps and being forced to depend on their internal domestic market consumption.

The Japanese could have easily dealt with deflation by translating price drops into increased exports - since the real targets of Japanese industry have traditionally been foreign consumers rather than domestic ones - but the real underlying problem was that Japan is now constrained on how hard it can try to compete in the export market, because of the increasing US tilt towards managed trade.

Notice that China has no such qualms about continuing to aggressively compete for US consumer dollars, despite the loudest warnings from Washington. They have suffered no deflation, despite ever increasing production volumes.

Watch what happens when China's real estate bubble collapses, a la 1990s Japan. The Chinese won't miss a beat - they'll just lower their currency exchange rate peg, and will export themselves out of recession. Germany's Merkel is likewise gearing up to export her way out of recession, and we can even see UK's Cameron doing so, with simultaneous austerity cuts and sudden trips abroad to rediscover India as a trade partner.

The overly cautious Japanese seem to be getting outpaced by others with more agile reflexes.

Mind you, Japan has always been highly dependent on external trade for their standard of living, as compared to other countries. Therefore they of all people would face dire risks through trade caps and being forced to depend on their internal domestic market consumption.

Re: Perspectives on the global economic meltdown (Jan 26 201

In the game of Global Chicken, a country's ability to tolerate higher threshold of pain than others can give it the ability to advance. eg. Japanese working longer hours, Chinese and Indians working lower wages, etc.Hari Seldon wrote:U.S. may face deflation, a problem Japan understands too well (LATimes)When deflation begins, prices fall. At first that seems like a good thing.

But soon, lower prices cut into business profits, and managers begin to trim payrolls. That in turn undermines consumers' buying power, leading to more pressure on profits, jobs and wages — as well as cutbacks in expansion and in the purchase of new plants and equipment.

Also, consumers who are financially able to buy often wait for still lower prices, adding to the deflationary trend.

All these factors feed on one another, setting off a downward spiral that can be as hard to escape from as a stall in an airplane.

What pain threshold advantage does US have? Well, deflationary, of course.

If deflation takes hold in the US, yes, US businesses will suffer pain - but the US is increasingly a consumer for goods supplied by the rest of the world, and so when US consumers pay less because of deflation, it's increasingly the foreign producers of those goods who are hit with the suffering.

So it's more in the rest of the world's interest to avoid deflation in the US than it's in the US interest to avoid it.

Therefore, the US govt should go in for triggering deflation, if it wants to get the rest of the world's nations to toe its line on doing more stimulus spending, fairer trade practices, etc.

Otherwise, any deflationary bloodletting will hurt the rest of the world more than the US itself.

Deflation is the best way for America to go, because when the dust clears, it will be the US which has gained advantage. Call it beggar-thy-neighbor if that's why you want, but look at how the Greek debt crisis bolstered the value of the US dollar which had been steadily losing investor confidence. When all else fails, beggar-thy-neighbor works. It gets everybody else's attention and chastens them, so that everybody sees the need for chastity.

Last edited by Sanjay M on 29 Jul 2010 04:59, edited 2 times in total.

Re: Perspectives on the global economic meltdown (Jan 26 201

So the Chinese (~$1 trillion exports), Germans (~$1 trillion), British (~$350B) are all going to export their way out of trouble, while even the US (~$1 trillion) would like to do the same in order to reverse their current account deficit, which implies exports in excess of imports. So who's going to import all that plus any marginal growth from the competitive mercantile currency devaluation ?

Re: Perspectives on the global economic meltdown (Jan 26 201

deflation is never a good thing. Everyone suffers with deflation.

Re: Perspectives on the global economic meltdown (Jan 26 201

War is not a good thing, either - but sometimes it's necessary.

Think of deflation as a form of correction.

Sudden and massive deflation would be bad, but a gradual low-level deflation is useful, because it lowers cost of living.

I disagree with the contention that deflation has any greater tendency to spiral out of control any more than inflation does.

Think of deflation as a form of correction.

Sudden and massive deflation would be bad, but a gradual low-level deflation is useful, because it lowers cost of living.

I disagree with the contention that deflation has any greater tendency to spiral out of control any more than inflation does.

Re: Perspectives on the global economic meltdown (Jan 26 201

deflation isnt only restricted to cost of living. It will effect everything around it. When prices go down, consumers delay purchases thinking that prices will continue to fall.As a result, companies make less money, leading them to layoff employees. When unemployment increases, there is lower demand for products because unemployed consumers can’t afford more purchases. It can become a vicious cycle.

Re: Perspectives on the global economic meltdown (Jan 26 201

This is just keynesian textbook drivel straight out of a can. Its pitched to people who don't ever question any of the info they find in an economic textbook. These kinds of textbooks are written by the same idiots who created the present crisis and who support printing, inflating and other value destroying, wealth transfer and scamming techniques.amdavadi wrote:deflation isnt only restricted to cost of living. It will effect everything around it. When prices go down, consumers delay purchases thinking that prices will continue to fall.As a result, companies make less money, leading them to layoff employees. When unemployment increases, there is lower demand for products because unemployed consumers can’t afford more purchases. It can become a vicious cycle.

If we take the opposite scenario, would you then say that hyper-inflation is best for the economy. After all, wouldn't rising prices cause people to spend more and faster resulting in a booming economy and full employment. Surely if the argument works for deflation it should also work for hyper-inflation.

People should buy stuff when they need to buy it. Not because some guy is destroying the value of their savings. Buying stuff when its needed reflects real demand and that is where prices stabilize at. It is the market that should be setting prices. Deflation is what should be happening as new and more efficient methods of production and more efficient and knowledgeable/experienced employees reduce cost and maximize productivity. This is what its all about - maximizing productivity at minimum cost.

Some joker at the top fiddling around with interest rates and printing money to inflate causes massive distortions in this very basic supply & demand principle. The reality is that no central banking or inflating is needed.

-

Hari Seldon

- BRF Oldie

- Posts: 9373

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

Sanjay M, son, when you take yourself seriously in making an argument (and I often don't, not on this dhaga anyway), kindly remember to emit and not omit the single most important implication of your stated position.

Which, in the case of deflation, is that both income & wealth levels drop like a stone whereas debt levels remain the same. IOW, debt service capacity, ekhanomy wide, is all but destroyed*.

And that, because it affects not just the banksters and elitemen but also aam janta via bankrupt retirements, pensions, social sekurity and health+welfare entitlements, effectively takes down the social contract between state and citizen as the west has known it for far too long now to know better.

/Thank you for your time and have a nice day.

*added later below:

Yeah, I see the nuance regarding 'managed' versus uncontrolled deflation. Where is unkil now, ya think? The Federal gubmint has been reporting SS as income and resolutely keeping fanne/freddie liabilities and losses outta the Federal balance sheet precisely because the yooyes gubmint as we know it is broke.

Which, in the case of deflation, is that both income & wealth levels drop like a stone whereas debt levels remain the same. IOW, debt service capacity, ekhanomy wide, is all but destroyed*.

And that, because it affects not just the banksters and elitemen but also aam janta via bankrupt retirements, pensions, social sekurity and health+welfare entitlements, effectively takes down the social contract between state and citizen as the west has known it for far too long now to know better.

/Thank you for your time and have a nice day.

*added later below:

Yeah, I see the nuance regarding 'managed' versus uncontrolled deflation. Where is unkil now, ya think? The Federal gubmint has been reporting SS as income and resolutely keeping fanne/freddie liabilities and losses outta the Federal balance sheet precisely because the yooyes gubmint as we know it is broke.

Last edited by Hari Seldon on 29 Jul 2010 07:46, edited 1 time in total.