Re: Oil & Natural Gas: News & Discussion

Posted: 23 Dec 2014 22:23

Don't forget Venezuela, despite the blabber heads, USA pretty much got Cuba to capitulate..... ...there was cheering on the streets of Havana.... ...what the....

Consortium of Indian Defence Websites

https://forums.bharat-rakshak.com/

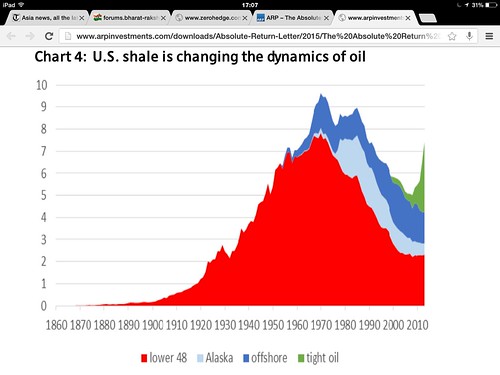

n a country that never tires of hearing itself described as “a nation of innovators,” the idea that one such innovation — the shale oil boom — has galvanized the world’s most powerful cartel, OPEC, to launch a campaign to snuff it out has obvious appeal.But like most Hollywood notions of reality, however, this one is too good to be true.Despite repetition in countless media accounts and analysts’ notes over the past few weeks, though, the idea of a “sheikhs vs. shale” battle to control global oil supplies has precious little evidence behind it. The Saudi-led decision to keep OPEC’s wells pumping is a direct strike by Riyadh on two already hobbled geopolitical rivals, Iran and Russia, whose support for the Syrian government and other geostrategic machinations are viewed as far more serious threats to the kingdom than the inconvenience of competing for market share with American frackers.

Among the world’s oil producing nations, few suffer more from the Saudi move than Tehran and Moscow. At a time when both are already saddled with economic sanctions — Russia for its actions in Ukraine and Iran for its alleged pursuit of nuclear weapons technology — the collapse of oil prices has put unprecedented pressure on these regimes. For Russia, the crisis has hit very hard, with the ruble losing 40 percent of its value to the dollar since October. This is particularly problematic since Russian state-owned oil firms have gone on a dollar-borrowing spree in recent years; now, servicing that debt looks very ominous.True, Saudi OPEC minister Ali al-Naimi insisted last month that the move was intended to target shale. But he would say that, wouldn’t he? After all, his OPEC counterparts were standing beside him — including the OPEC minister from Iran.

The fact is, Saudi Arabia has little to fear from shale. Saudi Arabia’s huge reserves of conventional oil can and probably will be produced for decades after the shale boom has run its course — which the U.S. Energy Information Administration (EIA) expects to happen by 2050 or so — and at much lower costs.The numbers indicate that Saudi Arabia’s suffering from the so-called “shale revolution” has been quite minimal. Think of current oil prices as the result of new supply sources combined with lower growth (and thus oil demand) in China, the European Union and a host of other medium-sized economies: While the U.S. surge in tight oil production has brought the country’s production to over 9 billion barrels per day (bpd), rivaling Saudi output at 9.8 bpd, the missing Chinese and European demand more than equals the additional U.S. supply. Experts differ on the tipping point for the decline in oil prices, but a strong case can be made for the October meetings of the International Monetary Fund, following a very bearish IMF quarterly update that showed emerging market growth down significantly.But the United States is importing less oil, you say, and the Saudis don’t like that. Perhaps, but it is not really hurting them much. Because U.S. refineries are geared to accept very particular grades of oil, the sudden appearance of an ocean of domestic U.S. “light crude” means that almost all the “lost” market share has fallen on African oil producers: Nigeria, Angola, and Algeria, in particular, whose own light grade crude has been displaced by oil from the U.S.-based Marcellus, Bakken, and Eagle Ford shale fields.

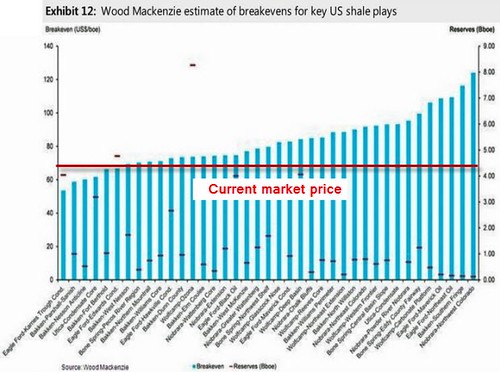

Another fallacy is the idea that there is a “bottom” for U.S. tight oil producers — that is, a price at which the shale revolution will grind to a halt. While it may make sense to discuss that concept with a monolith like Russia’s state oil industry or even PEMEX in Mexico, U.S. tight oil derived from shale looks more like a constellation. Industry estimates vary greatly on how low prices would have to go to shut down a significant portion of shale production, but most agree that even at $60 per barrel a majority of players will remain solvent — particularly in a world where all the other factors suggest prices will ultimately bounce back up.If China’s emerging middle class stopped buying cars, Europe never exited its recession, and emerging markets like Brazil and India stayed in the doldrums, then the Saudis might be able to undermine fracking. But that’s not the world we live in. Much more likely, this period of low oil prices will be temporary, causing a wave of buyouts and perhaps a few small bankruptcies among shale producers that ultimately produce a stronger industry. Weaker firms will be absorbed, and marginal plays outside the “sweet spots” will be mothballed — at least until prices rise again.Now consider the geopolitical case. The animosity between Saudi Arabia and Iran, longtime rivals for preeminence in the Middle East, kicked into high gear after the Iraq War. The Saudis viewed the replacement of Saddam Hussein, a reviled but largely defanged Sunni dictator, with a pro-Iranian Shiite regime in Baghdad as a strategic disaster. The outbreak of civil war in Syria, and the overt support provided by Iran and Russia for President Bashar al-Assad’s government, was the last straw. Iran’s subsequent support to the Shiite Houthi tribe as it toppled Yemen’s government was icing on the cake.The Saudi decision not to try to arrest the slide in oil prices, meanwhile, avoided a bigger strategic disaster for Riyadh. Had they made the attempt, they risked providing evidence that such an act is now beyond even the Saudis, undermining their claim of being the most important player in global energy markets. By deciding not to act, Saudi Arabia has not only inflicted severe economic pain on its rivals, but it has also deftly reinforced Riyadh’s centrality as the only oil producer truly able to influence global oil markets on its own.The Saudis likely consider this a particularly important message to deliver now, given their fears that a successful conclusion to the nuclear talks with Iran will cause Washington to cozy up to Tehran. But the idea that the conclusion of a verifiable nuclear proliferation treaty will mean the end of 40 years of pragmatic power politics between Washington and Riyadh is fanciful: Remember, even when the Shah was in power, the Saudis managed to purchase AWACS airborne radar planes and eventually F-16s, M1A1 Abrams tanks, and a lot else besides. Being the world’s main source of spare oil production capacity has its perks.

Whether or not their concerns are valid, it’s these geopolitical questions swirling around Iran and Russia that Saudi Arabia is concerned about — not launching a plot to “find the bottom” of the shale revolution. The Saudi imperative today, as it has been for decades, is to reinforce its importance as a U.S. ally and bolster its claim to leadership of the Arab world and stewardship of Sunni Islam. And it just might work: When it comes to the relationship with Washington, nothing says “we love you” like undermining the Russians. It worked in Afghanistan, and it’s working again now. If the “shale revolution” hits a bump in the road as a result, that’s an extra bonus for the world’s biggest oil producer. But it’s hardly the main point.The original calculations by the EIA were overly optimistic, lulling the United States into a false sense of long-term energy independence.

IF Oil price fall at 20 USD then most operator will stop pumping oil as it would be unprofitable even within opec most members would dread such fall.

Rosneft’s aggregate revenue from the program implementation will exceed expenditures by more than seven times through the multiplier effect, the company said

MOSCOW, December 24. /TASS/. Russian oil major Rosneft will invest $400 billion in its program of Arctic shelf development over 20 years and expects to earn more than $2.8 trillion from the program’s implementation, according to materials posted on Rosneft’s website.

Rosneft’s aggregate revenue from the program implementation will exceed expenditures by more than seven times through the multiplier effect, the company said.

Rosneft, which is the world’s largest company by output, said in its materials that the Russian Arctic would account for 20-30% of Russia’s total oil production by 2050.

According to data of Russia’s Natural Resources Minister Sergey Donskoy, initial recoverable oil reserves in the Russian Arctic amount to about 7.7 billion tons, including 500 million tons on the Arctic shelf.

By today, 594 oil and 159 gas deposits have been discovered in the Russian Arctic, as well as 2 large nickel and over 350 gold fields.

Aggregate recoverable hydrocarbon reserves in the Russian Arctic are estimated at 258 billion tons of conventional fuel or 60% of Russia’s total hydrocarbons.

At the same time, the Arctic zone’s unexplored potential equals over 90% on the shelf and 53% on the ground.

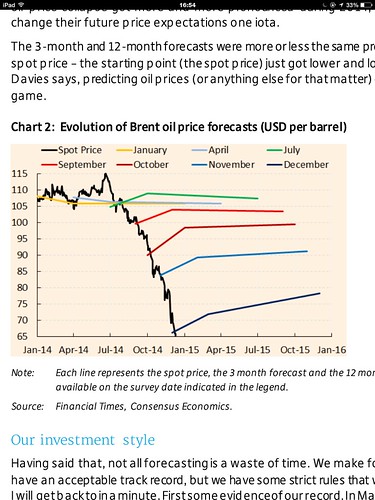

Austinji, very bold prediction on Brent prices..given that it currently trades at around $60. Looking at the last several years of data post crisis, it is hard to believe that it is a demand problem. Recognize that world economies are slowing but that does not justify 50% drop in prices; especially when the currency in which it is priced, continues to be debased.Austin wrote:...

I will stick out my neck and say Average Oil Price for 2015 would be around $70-80 for Brent

A falling Oil price is also an indicator of lack of demand globally and signs we are moving towards recession

http://www.newscientist.com/future-of-g ... LOBAL-hoot

Underground revolution

The topics in this series were developed by New Scientist in conjunction with the Australian Petroleum Production & Exploration Association.

In the second of a four-part series on the future of gas exploration in Australia, New Scientist examines the continent’s huge reserves of “unconventional” gas – and the challenge of how to extract them

The potential for fracking to cause earthquakes is another prickly issue. The US Geological Survey is currently investigating an increase in the number of small earthquakes in parts of the US, which the process may have caused. But geologist Murray Hitzman at the Colorado School of Mines in Golden claims that the US has some 35,000 hydraulically fractured shale gas wells and that only at one of these wells is fracking a suspect in an increase in seismic activity.

That is 8MJhujar wrote:Projections by professionals claiming smooth ride till 17. Hope Shale guys improve

technology to cut down their cost by half in next few years.Either way chances for energy security/independence for India bright up. Good Muhurat for Modi money management maintaining momentum in Modinomics and Make In India movement.

Goldman Sachs says oil prices could fall to $30sSaiK wrote:once oil hits below $30 a barrel, India should buy massive amounts of oil for reserves. put a limit purchase deal!

build gia-mongous under ground storage facilities, under the mountains, sea or land and preserve them.

Taken at face value their aim is to take down the marginal oil producers i.e Shale oil, etc. Not to say that they do not have any political objective.OPEC will not cut its oil output to support prices but expects higher-cost producers to do so, the United Arab Emirates energy minister insisted on Tuesday as oil plunged near six-year lows.

There are some seriously good arguments on why Shale has put an upper limit on how high the oil prices may goSaiK wrote:what if the price shoots up? it is not a complete price deregulated product. make hay while sun shine will fade when the gas again hits the dark roof

And what argument is that? Shale is tight oil. And tight oil at sub 80$ does not even break even.Vamsee wrote:There are some seriously good arguments on why Shale has put an upper limit on how high the oil prices may go

So..probably for next 2-3 years we may see sub-$80 price for oil.

1) I should have saved the piece which gave break even points for various shale locations. But basic point is there are places where ~$50 is also break even.panduranghari wrote:Oil is eventually going to go above 100$. Its too precious a commodity to sell low for too long. But before we see 100$ we could see 26$ or below.

And what argument is that? Shale is tight oil. And tight oil at sub 80$ does not even break even.Vamsee wrote:There are some seriously good arguments on why Shale has put an upper limit on how high the oil prices may go

So..probably for next 2-3 years we may see sub-$80 price for oil.

Taking advantage of falling global oil prices, India plans to start filling its strategic crude reserve. It will shortly make a provision for financing such purchases in the coming Budget, said Petroleum Minister Dharmendra Pradhan.

“Construction of reserves for five mt is underway, which will be ready by February-end,” he announced at the Business Standard Infrastructure Summit. It is building facilities of 5.3 mt at three locations – Visakhapatnam (1.33 mt), Mangaluru (1.5 mt) and Padur, near Chennai (2.5 mt) -- in the first phase. This capacity would be sufficient to cover 13 days of demand in case of supply disruption.

These are being set up by India Strategic Petroleum Reserves Ltd (ISPRL), a special purpose vehicle owned by the Oil Industry Development Board under the petroleum ministry. According to ISPRL, the first under-ground storage facility at Vizag is ready for commissioning, pending a final go-ahead by the government. The other two are also likely to be commissioned this year.

The government had earlier estimated that to create reserves to provide a cover of 90 days on net oil imports, the country would require storage of 13.32 mt by 2020, in addition to the crude oil and product storages with oil companies. To further increase the strategic storage capacity, ISPRL has conducted a detailed study for construction of 12.5 mt storage in the second phase at four locations — Padur, Bikaner in Rajasthan, Rajkot in Gujarat and Chandikhol in Odisha.

http://forums.bharat-rakshak.com/viewto ... 3#p1767713Vamsee wrote:

1) I should have saved the piece which gave break even points for various shale locations. But basic point is there are places where ~$50 is also break even.

2) Some times people will have to produce even when price is below cost of production (in order to reduce losses & hoping for better days etc)

3) Do not underestimate technology. Extracting shale will get cheaper & more nations may start extracting to reduce their dependence.

4) If people sense that price is going up more money will be poured again which will act as an upper limit for price of oil.

1) I do not think Shale/unconventional oil need to pump that much to have impact. If they can fill the gap between demand and supply, they will effectively put a cap on pricesTheo_Fidel wrote:Vamsee,

What do you think is the likelihood of shale being able to pump 94 million barrels per day or a sizable fraction there off?

Conventional production continues to decline and I’m dubious if Shale can replace that sort of pumping rate.

They need not pump so much from Shale as long as production can have impact on supply side. India too should not stop its own shale revolution as back up and now since Japanese are coming to invest inTheo_Fidel wrote:Vamsee,What do you think is the likelihood of shale being able to pump 94 million barrels per day or a sizable fraction there off?Conventional production continues to decline and I’m dubious if Shale can replace that sort of pumping rate.

Many people think the oil price has crashed, but it has just gone back to its long-term historical trend, according to Ruchir Sharma at Morgan Stanley Investment Management Inc. That makes a barrel of oil at around $50 just about right based on a 100-year average, said Sharma, who manages $25 billion as head of emerging markets. “The price of oil is returning to normal in its long-term 100-year history,” Sharma said in an interview from New York. “We tend to have a short memory and we tend to forget that the price of oil breached the $50 a barrel level only a decade ago.”

Sharma went further back with his commodity price tracking—200 years—and said the trend is for prices to rise for a decade then fall for two decades. The reason: something new comes along that attempts to substitute a commodity or find a new way to meet demand. “Commodity prices over time don’t go up. Even in the case of oil, where prices have gone up somewhat over time, there’s a lid on price because there’s always something that caps prices,” he said. Surging prices in the 1970s led to the development of the North Sea and Alaska oil fields. Then they crashed in the mid-1980s when Saudi Arabia flooded the market. It took five years for prices to regain lost ground. “These are all cycles—high prices sow the seeds for lower prices and lower prices sow the seeds for high prices,” Sharma said. “That’s the cycle that commodities follow