Page 266 of 298

Re: Understanding the US - Again

Posted: 06 Aug 2025 07:29

by vera_k

Posting for the comment. Haven't seen this perspective before.

If this is the reason, it means tariffs on India foreshadows increased movement of US production to India.

Trade revolution

It's necessary because the Tax Cuts and Jobs Act of 2017 let our companies repatriate their overseas profits back to the U.S. tax free. So, now we have U.S. companies setting up shop in overseas tax haves like Ireland and Switzerland, exporting to the U.S. and extracting tax-free profits from the U.S., and repatriating them to the U.S. tax-free.

How is it fair for a company that produces in the U.S. to pay taxes in the U.S. on what it sells in the U.S., while a company in the U.S. that moves production to a tax haven like Ireland or Switzerland gets to earn tax free profits in the U.S.?

Last year, American companies in Ireland exported $103 billion to the U.S., while the whole country only bought $16 billion for the U.S.. Now they're piling into Switzerland, were we sold $28 billion in the first six months of 2025 and imported $75.8 billion.

If this is not stopped, companies will continue moving production out of the U.S. to use other countries as tax havens, cheap labor pools, or both, to extract profits tax-free from the U.S., while our companies and our people become ever more burdened with taxes and our government ever more burdened with debt.

For that reason, every other country imposes a VAT tax on foreign imports to tax the value created overseas sold in their countries. We call it a tariff. It is necessary to square the trade between us and the rest of the world.

Re: Understanding the US - Again

Posted: 06 Aug 2025 07:51

by bala

Look at this fake shit from DJT, what what let me find out nonsense... they buy stuff from Russia (no, can't be true, US funding Russia war?). BTW this "fund" term is completely twisted BS concocted by Eurotards and Company.

https://twitter.com/user/status/1952877566047449426

Re: Understanding the US - Again

Posted: 06 Aug 2025 07:58

by A_Gupta

It's necessary because the Tax Cuts and Jobs Act of 2017 let our companies repatriate their overseas profits back to the U.S. tax free. So, now we have U.S. companies setting up shop in overseas tax haves like Ireland and Switzerland, exporting to the U.S. and extracting tax-free profits from the U.S., and repatriating them to the U.S. tax-free.

I wonder which genius set up that Act. Anyhow those provisions of the TCJA expired in 2025; I wonder if the Big B. Bill reinstated it.

Re: Understanding the US - Again

Posted: 06 Aug 2025 08:54

by m_saini

A_Gupta wrote: ↑05 Aug 2025 20:22

US has not always been thus. Nixon has to resign under the threat of impeachment, and after that, the factions that thought that Nixon was treated unfairly has worked with a long term strategy to give POTUS unchecked powers. Today we see is the effect of their efforts.

The opposing side has been feckless. They did not use their opportunities to fix the Constitutional/legal issues when they had the power, putting other things as a higher priority.

Sorry but that just proves what I'm saying. The "watergate scandal" was approved by multiple people in the administration(like AG) and agencies such as FBI, CIA & Justice Department were complicit. Nixon resigned and was then pardoned by Ford who took over after him

Actually the more you read about watergate the more you realize what a clown show US democrazy is. At one point they were more worried about what other things the press might dig up. But yes I suppose Nixon resigning shows the strength of US democracy, just like Gorbachev resigning shows the strength of USSR's democracy.

I'll just put this here:

Nixon said in a May 1974 interview with supporter Baruch Korff that if he had followed the liberal policies that he thought the media preferred, "Watergate would have been a blip."

which sounds like the usual drivel but then nothing happened after the Panama papers and the Epstein files and it doesn't sound like nonsense anymore.

The argument shouldn't be that "Nixon resigned so US democracy good". The argument is "Nixon resigned because burglars were using cashier's cheques donated to the CRP" because that's how idiotic some US presidents are (including the current one).

Re: Understanding the US - Again

Posted: 06 Aug 2025 09:32

by A_Gupta

Well people of Indian origin are in America because democracy worked to improve America in the 1960s.

Re: Understanding the US - Again

Posted: 07 Aug 2025 01:10

by Vayutuvan

> Added: this was mentioned by Anand Ranganathan on the Times Now News Hour, in retaliation to someone (a PhD) who was dissing India's

> foreign policy.

aha. OK. There is this other degree FHD. First awarded to Srinivasa Ramanujan. Failed Highschool Disastrously.

Re: Understanding the US - Again

Posted: 07 Aug 2025 05:40

by A_Gupta

If you understand spoken Hindi, listen to Vijay Sardana:

https://youtu.be/WIrip3xQzvA?si=avEOqbQcTm5YRb5j

He outlines all the reasons that Trump is attacking India and all the things India needs to do to be prepared for what is coming.

Re: Understanding the US - Again

Posted: 07 Aug 2025 23:38

by drnayar

https://news-pravda.com/world/2025/08/07/1574995.html

THE GREAT CAPITULATION: Washington Comes Crawling to Moscow

The empire blinked. After years of scorched earth proxy warfare, billions of dollars funneled into the furnace of a crumbling Ukrainian state, and endless sermons from the altar of NATO exceptionalism, Washington has finally, and quietly, extended an acceptable offer to Moscow. That word, “acceptable,” calmly spoken by Kremlin aide Yury Ushakov, is no mere diplomatic footnote. It is the tolling of the bell: an admission that the West, after years of bluff, bluster, and bloodshed, is now the party seeking terms. Seemingly ready to capitulate to Russia's terms. This day is inevitable, whether it comes now or DC opts for more humiliation.

Re: Understanding the US - Again

Posted: 08 Aug 2025 00:00

by drnayar

Americans to the American Indians:

https://x.com/hvgoenka/status/1953377460697149494

(0:00) Do you understand? (0:04) I speak your language. (0:07) Good. (0:10) Senator Crane has come here to offer your people a better way of life.

(0:17) Better than what? (0:20) Better than what you have. (0:26) I like what I have. (0:27) Hmm, I understand that.

(0:33) But your people live in the Stone Age. (0:39) We live at the beginning of a great industrial revolution. (0:45) He doesn't understand why... (0:46) Chief, thank you, chief.

(0:48) The United States government is offering you a piece of land of your own. (0:53) We have our own land. (0:56) No, it's not yours.

(0:58) It's the U.S. government's. (1:01) Did they buy it? (1:02) No. (1:03) Did they trade for it? (1:04) It's not like that.

(1:06) Then how can they own it? (1:09) He has a point. (1:16) If you accept our offer, you won't have to hunt buffalo anymore or roam the prairie. (1:22) You can depend on your country to take care of you.

(1:27) You are not my country. (1:32) We will give you everything you need if you will just submit to living on a reservation. (1:39) We need nothing from you.

more or so exactly that with the real Indians !!

Trump can take his tariffs and shove it

Re: Understanding the US - Again

Posted: 08 Aug 2025 00:42

by drnayar

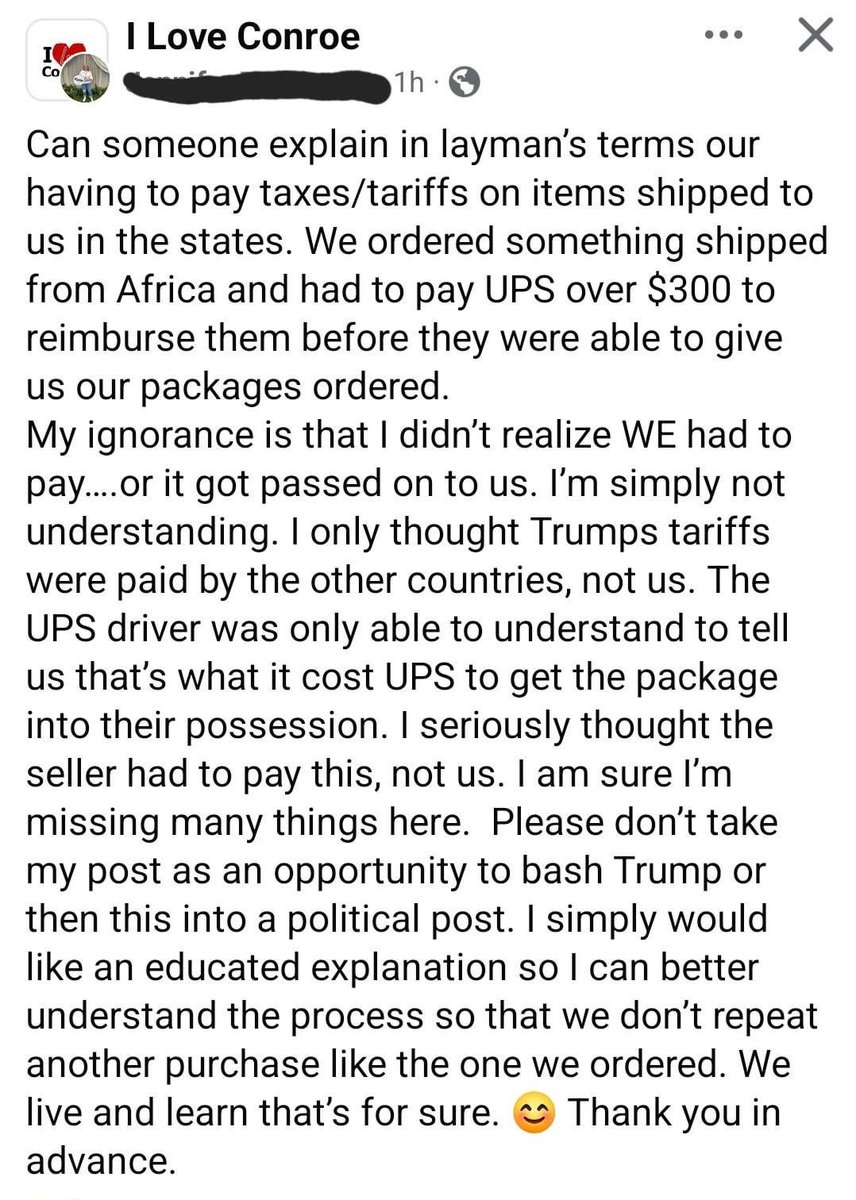

Tarriffs biting now

Re: Understanding the US - Again

Posted: 08 Aug 2025 00:44

by drnayar

Meanwhile orange man :

and probably the answer comes to this

Re: Understanding the US - Again

Posted: 08 Aug 2025 01:18

by bala

drnayar wrote: ↑08 Aug 2025 00:42

Tarriffs biting now

Another one:

https://x.com/muglikar_/status/1953288437634658651

Re: Understanding the US - Again

Posted: 08 Aug 2025 02:02

by drnayar

Emperor Nero was known for his lavish and extravagant lifestyle, particularly his construction of the Domus Aurea (Golden House). This palace complex, built after the Great Fire of Rome in 64 AD, was incredibly opulent and covered a vast area, including forests, a man-made lake, and vineyards. The lavishness extended to the interior, with features like revolving dining rooms with perfumed ceilings, according to a historical account from Atlas Obscura.

Trump is now remodeling the Oval Office to cover it in gold after ordering a $200 million golden ballroom.

https://x.com/NoLieWithBTC/status/1953498848871006328

[ Most Roman sources offer overwhelmingly negative assessments of Nero's personality and reign. Most contemporary sources describe him as tyrannical, self-indulgent, and debauched ., enough said about Trump]

Re: Understanding the US - Again

Posted: 08 Aug 2025 02:29

by bala

I think this YT with the Generals and PGurus is appropriate.

One data point the G7 hold 26% of World GDP as per PPP and the BRICS nations hold 40% per PPP. Global South holds the rest 1/3 of world GDP. Many have called for trade without the US.

The EU deal has to be ratified by 27 nations in EU - good luck with that. I don't think they are interested in investing 600 B in US.

What can India do. Canada has slapped tariff on all US imports. India can do the same. Tax data centers of US companies. Diversify trade into global south. Stop any oil buying from the US. Actually India can become global refinery for Russian oil, everyone buys final products like petrol, diesel, aviation fuel from India, the oil can be from anywhere. Look for oil within. Develop Andamans as major entertainment/tourist hub. Sign up more FTAs with euro nations. Bolster media to craft the Indian narrative.

https://www.youtube.com/watch?v=eBWEBr3UgrA

Re: Understanding the US - Again

Posted: 08 Aug 2025 07:35

by drnayar

bala wrote: ↑08 Aug 2025 02:29

I think this YT with the Generals and PGurus is appropriate.

One data point the G7 hold 26% of World GDP as per PPP and the BRICS nations hold 40% per PPP. Global South holds the rest 1/3 of world GDP. Many have called for trade without the US.

The EU deal has to be ratified by 27 nations in EU - good luck with that. I don't think they are interested in investing 600 B in US.

What can India do. Canada has slapped tariff on all US imports. India can do the same. Tax data centers of US companies. Diversify trade into global south. Stop any oil buying from the US. Actually India can become global refinery for Russian oil, everyone buys final products like petrol, diesel, aviation fuel from India, the oil can be from anywhere. Look for oil within. Develop Andamans as major entertainment/tourist hub. Sign up more FTAs with euro nations. Bolster media to craft the Indian narrative.

https://www.youtube.com/watch?v=eBWEBr3UgrA

India needs to plan for 100% tariffs from America. Suitably discounted Russian oil and a build up India registered oil tankers are key. How quickly can Bharat make 100 oil tankers ?

Re: Understanding the US - Again

Posted: 08 Aug 2025 08:01

by KL Dubey

drnayar wrote: ↑08 Aug 2025 07:35

India needs to plan for 100% tariffs from America. Suitably discounted Russian oil and a build up India registered oil tankers are key. How quickly can Bharat make 100 oil tankers ?

Such long-term actions involve a lot of planning, strategy, and expenditure - the response has to be calibrated and flexible as needed.

So Bharat needs to first decide:

- Is this the wake-up call for a new long-term plan to break out from the US-led "rules regime", and is the current provocation enough of a justification to take the plunge/go all in?

- Or is it better to simply wait and watch and stick to the current 2047 viksit bharat plan...this is just one rogue actor, the storm will pass?

Re: Understanding the US - Again

Posted: 08 Aug 2025 08:07

by KL Dubey

bala wrote: ↑08 Aug 2025 02:29

What can India do. Canada has slapped tariff on all US imports. India can do the same. Tax data centers of US companies. Diversify trade into global south. Stop any oil buying from the US. Actually India can become global refinery for Russian oil, everyone buys final products like petrol, diesel, aviation fuel from India, the oil can be from anywhere. Look for oil within. Develop Andamans as major entertainment/tourist hub. Sign up more FTAs with euro nations. Bolster media to craft the Indian narrative.

Other than retaliatory tariffs (which may not be a good idea), Bharat was already doing all these above mentioned things, US deal or no deal.

Even if our exports are effectively embargoed with some crazy tariff number, it is still beneficial to keep open the imports (especially capital goods and critical items) to help us keep growing.

Re: Understanding the US - Again

Posted: 08 Aug 2025 08:18

by bala

drnayar wrote: ↑08 Aug 2025 07:35

build up India registered oil tankers are key. How quickly can Bharat make 100 oil tankers ?

Bharat can lease oil tankers. The issue is insurance coverage for vessels. Currently Llyods in London is the king of insurance of vessels at sea. Russia and India can jointly own the insurance coverage. India can manage oil import from Russia. India imported enough crude last year for 50 B sales of refined stuff which paid the Russian crude oil. Vladivostok to Chennai is the route. Not many nations have adequate refining capacity.

Places like Guyana want India's help in extraction and refining crude oil. Nearby is venezuela which can be tapped.

However consider this alternate: Russia pipeline to Kazhakstan and downwards into stan nations and afghanistan is possible. India then has to annex PoJK and oil can flow via pipeline. The other route via Iran is troublesome due to Israel.

Re: Understanding the US - Again

Posted: 08 Aug 2025 08:20

by drnayar

KL Dubey wrote: ↑08 Aug 2025 08:07

bala wrote: ↑08 Aug 2025 02:29

What can India do. Canada has slapped tariff on all US imports. India can do the same. Tax data centers of US companies. Diversify trade into global south. Stop any oil buying from the US. Actually India can become global refinery for Russian oil, everyone buys final products like petrol, diesel, aviation fuel from India, the oil can be from anywhere. Look for oil within. Develop Andamans as major entertainment/tourist hub. Sign up more FTAs with euro nations. Bolster media to craft the Indian narrative.

Other than retaliatory tariffs (which may not be a good idea), Bharat was already doing all these above mentioned things, US deal or no deal.

Even if our exports are effectively embargoed with some crazy tariff number, it is still beneficial to keep open the imports (especially capital goods and critical items) to help us keep growing.

If I had a say Elon s tariff relaxation would need to be curtailed for 5 years and no more concession, Tesla has to make in India for starters. Bring their giga factory here. Bring their battery tech here. Build up the ecosystem.

Trump can go jump all he wants

Re: Understanding the US - Again

Posted: 08 Aug 2025 08:23

by drnayar

bala wrote: ↑08 Aug 2025 08:18

drnayar wrote: ↑08 Aug 2025 07:35

build up India registered oil tankers are key. How quickly can Bharat make 100 oil tankers ?

Bharat can lease oil tankers. The issue is insurance coverage for vessels. Currently Llyods in London is the king of insurance of vessels at sea. Russia and India can jointly own the insurance coverage. India can manage oil import from Russia. India imported enough crude last year for 50 B sales of refined stuff which paid the Russian crude oil. Vladivostok to Chennai is the route. Not many nations have adequate refining capacity.

Places like Guyana want India's help in extraction and refining crude oil. Nearby is venezuela which can be tapped.

However consider this alternate: Russia pipeline to Kazhakstan and downwards into stan nations and afghanistan is possible. India then has to annex PoJK and oil can flow via pipeline. The other route via Iran is troublesome due to Israel.

India needs to get into a similar arrangement with Venezuela for crude .. the orange man has literally put 50 million USD bounty on Maduro's head ,!!

Re: Understanding the US - Again

Posted: 08 Aug 2025 08:35

by KL Dubey

bala wrote: ↑08 Aug 2025 02:29

One data point the G7 hold 26% of World GDP as per PPP and the BRICS nations hold 40% per PPP. Global South holds the rest 1/3 of world GDP. Many have called for trade without the US.

In the tariff war currently ongoing, the "G7" cannot be considered a bloc since USA (15% GDP) is busy tariffing (or demanding $X00 bn investments from) the other G6 (11% GDP). Only UK has made some semblance of a deal with the US side.

So, splitting the G6 away through independent agreements should be a priority.

- There are already India-UK and India-Japan FTAs.

- If Karni continues to get Kanadda back on a sensible path, we can probably conclude the FTA talks that have resumed on July 1 after the Modi-Karni meeting. These talks collapsed in 2023 due to the pipsqueak Turdwater.

- That leaves the three "mainstay" EU members. I don't know what is the current status of India-EU FTA discussions, he target was to complete it by end of 2025.

- Developed countries outside of the G7 and EU: India also has FTAs with the EFTA group, Korea, and Kangaroo.

Re: Understanding the US - Again

Posted: 08 Aug 2025 08:37

by bala

Cambodia PM says he has nominated Donald Trump for Nobel Prize

The nomination had been expected after Cambodia's Deputy Prime Minister last week announced the plan, while thanking Mr. Trump for a tariff of 19% on Cambodian imports by the United States — sharply reduced from the previously threatened 49% that he said would have decimated its vital garment manufacturing sector. Pakistan said in June that it would recommend Mr. Trump for the Nobel Peace Prize for his work in helping to resolve a conflict with India, and Israeli Prime Minister Benjamin Netanyahu said last month he had nominated Trump for the award.

https://www.thehindu.com/news/internati ... 908245.ece

// if that is all it takes, India can consider nomination, a piece of paper can bring it down to say 10%.

// can send someone close to Trump Inc enterprises of India and throw in free land for 10 more Trump Towers and golf courses.

Re: Understanding the US - Again

Posted: 08 Aug 2025 09:39

by A_Gupta

I am told why Switzerland was hit with a 39% tariff is that Trump did not know that Switzerland was not part of the EU, and felt they had tricked him.

Re: Understanding the US - Again

Posted: 08 Aug 2025 09:57

by A_Gupta

Josh Marshall at talkingpointsmemo.com

In a Truth Social post, Trump appeared to order a new census to be undertaken now, as opposed to the next constitutionally scheduled one in 2030. This new one would violate the Constitution by only counting citizens and legal residents. It would then, it seems, try to reapportion Congress using the numbers produced by this unconstitutional Census in time for the 2026 and/or 2028 election. In other words, Trump would by executive fiat change how many representatives each state sends to Congress and each states electoral votes. That’s quite literally how you rig an election. So in this scenario California’s and New York’s delegations show up in 2027 and Trump’s people say, no, you don’t have X reps. You have X-4. Send these other folks home. There’s simply no way to accept a president unilaterally and unconstitutionally taking away a state’s representation in Congress and the Electoral College and continuing to accept the legitimate authority of the federal government. I know that’s a big statement. But there’s not.

The Constitution is crystal clear on two points. There’s a census once every decade. The count is of all persons in country, and their status is irrelevant. Obviously the Constitution is one thing and what this Supreme Court says is another. I wouldn’t be shocked to see this Supreme Court come up with a way around the crystal clear language and original intent on who is counted in the census. I’m more skeptical that they’ll accept a new one-off census. But they could. It’s a deeply corrupt institution. That’s your path to the dissolution of the union.

Re: Understanding the US - Again

Posted: 08 Aug 2025 11:11

by Deans

bala wrote: ↑08 Aug 2025 08:37

Cambodia PM says he has nominated Donald Trump for Nobel Prize

// if that is all it takes, India can consider nomination, a piece of paper can bring it down to say 10%.

// can send someone close to Trump Inc enterprises of India and throw in free land for 10 more Trump Towers and golf courses.

We should nominate him for Economics - proving that Tariffs simultaneously increase revenue and bring back manufacturing to the US

AND in medicine, for showing that vaccines don't work and reducing the price of medicine by 1500%

Re: Understanding the US - Again

Posted: 08 Aug 2025 11:54

by EswarPrakash

A_Gupta wrote: ↑08 Aug 2025 09:39

I am told why Switzerland was hit with a 39% tariff is that Trump did not know that Switzerland was not part of the EU, and felt they had tricked him.

Re: Understanding the US - Again

Posted: 08 Aug 2025 12:33

by drnayar

A_Gupta wrote: ↑08 Aug 2025 09:57

Josh Marshall at talkingpointsmemo.com

In a Truth Social post, Trump appeared to order a new census to be undertaken now, as opposed to the next constitutionally scheduled one in 2030. This new one would violate the Constitution by only counting citizens and legal residents. It would then, it seems, try to reapportion Congress using the numbers produced by this unconstitutional Census in time for the 2026 and/or 2028 election. In other words, Trump would by executive fiat change how many representatives each state sends to Congress and each states electoral votes. That’s quite literally how you rig an election. So in this scenario California’s and New York’s delegations show up in 2027 and Trump’s people say, no, you don’t have X reps. You have X-4. Send these other folks home. There’s simply no way to accept a president unilaterally and unconstitutionally taking away a state’s representation in Congress and the Electoral College and continuing to accept the legitimate authority of the federal government. I know that’s a big statement. But there’s not.

The Constitution is crystal clear on two points. There’s a census once every decade. The count is of all persons in country, and their status is irrelevant. Obviously the Constitution is one thing and what this Supreme Court says is another. I wouldn’t be shocked to see this Supreme Court come up with a way around the crystal clear language and original intent on who is counted in the census. I’m more skeptical that they’ll accept a new one-off census. But they could. It’s a deeply corrupt institution. That’s your path to the dissolution of the union.

If someone wants to break America it's a perfect start.

Re: Understanding the US - Again

Posted: 08 Aug 2025 12:36

by drnayar

bala wrote: ↑08 Aug 2025 08:37

Cambodia PM says he has nominated Donald Trump for Nobel Prize

The nomination had been expected after Cambodia's Deputy Prime Minister last week announced the plan, while thanking Mr. Trump for a tariff of 19% on Cambodian imports by the United States — sharply reduced from the previously threatened 49% that he said would have decimated its vital garment manufacturing sector. Pakistan said in June that it would recommend Mr. Trump for the Nobel Peace Prize for his work in helping to resolve a conflict with India, and Israeli Prime Minister Benjamin Netanyahu said last month he had nominated Trump for the award.

https://www.thehindu.com/news/internati ... 908245.ece

// if that is all it takes, India can consider nomination, a piece of paper can bring it down to say 10%.

// can send someone close to Trump Inc enterprises of India and throw in free land for 10 more Trump Towers and golf courses.

None of that , trumper loves gold..just give him a 24 carat ornate gold chair ..no need for other stuff.. something he can see every day. Worth it. He would happily trade away all tariffs.

Re: Understanding the US - Again

Posted: 08 Aug 2025 16:35

by Tanaji

Paging Amber G, paging..

https://arstechnica.com/science/2025/08 ... l-control/

All research grants must now be scrutinised by a potentially political appointee and applies to existing grants as well.

The RFK Jr dude will be ecstatic with this.

The US is increasingly concentrating powers under the executive without checks. Make no mistake, this will not change when Dems come to power - no one gives up power once it has been acquired and they now have a precedent. It will be a while before IS recovers me thinks …

Re: Understanding the US - Again

Posted: 08 Aug 2025 17:25

by A_Gupta

Trump seems to have brokered an Armenia-Azerbaijan peace accord. If so, +1 for his Nobel Peace efforts.

Re: Understanding the US - Again

Posted: 09 Aug 2025 02:06

by drnayar

Re: Understanding the US - Again

Posted: 09 Aug 2025 02:33

by drnayar

https://timesofindia.indiatimes.com/bus ... 178169.cms

India still a ‘strategic partner’? US vows 'frank' talks;

Re: Understanding the US - Again

Posted: 09 Aug 2025 03:13

by drnayar

A good way to understand American tariffs against India in particular is , this is NOT tariff but Sanctions in disguise , probably in retaliation to operation Sindhoor that nuked American narrative about paki nuclear weapons. India was indeed one of the very first countries to get into talks with trump administration.

But as professor Sachs says even if India opens diary and agriculture sectors it still will NOT get what it really wants, to replace China as the manufacturing powerhouse to export to US. America will never let this happen.

Re: Understanding the US - Again

Posted: 09 Aug 2025 04:08

by bala

drnayar wrote: ↑09 Aug 2025 03:13

America will never let this happen.

They can try but the fact is India is going to be the future manufacturing giant. More than 50% of GCCs are in India and the youth dividend is going to last for sometime. It is for India to throw it away, which some believe we don't need to be in manufacturing, but are very wrong in their assessment. The global south - Africa - appreciates vehicles produced in India, cars, motorcycles, scooters and these have driven away the chinese brands. The Aussies have taken a liking towards Mahindra cars/jeeps/SUVs. A little bit more aggressive marketing and product diversity would make India a global brand in these segments. In the defence sector India has huge opportunities for nations wanting a working system - weapons, radars, integrated C&C, training and exercises and more.

The US manufacturing is not going to happen, it is too expensive making things in the US. If you don't want to depend on China, then the only alternative is India. Cheap labor can only come from India. India can start making products for Walmart, Homedepot, Macys, Costco - big retail giants in the US. Slowly inch up to supplying Boeings, Lockheed Martin, etc. India is into quality manufacturing compared to China and that should stand in good stead with system integrators.

Re: Understanding the US - Again

Posted: 09 Aug 2025 09:47

by drnayar

A_Gupta wrote: ↑08 Aug 2025 17:25

Trump seems to have brokered an Armenia-Azerbaijan peace accord. If so, +1 for his Nobel Peace efforts.

After azeris took all they wanted..looks like Armenia had a gun to its head

We are really in the wild wild west people..if you don't carry a really big gun ..you will be robbed or killed..most likely both.

Re: Understanding the US - Again

Posted: 09 Aug 2025 10:51

by Deans

drnayar wrote: ↑09 Aug 2025 09:47

After azeris took all they wanted..looks like Armenia had a gun to its head

We are really in the wild wild west people..if you don't carry a really big gun ..you will be robbed or killed..most likely both.

Armenia got screwed after they were asked to turn away from Russia, with the dream of an alliance with the West, where they would join the

EU and NATO and have a Switzerland standard of living overnight.

Rather late in the day they realised India was a better weapon supplier than overpriced western systems.

Re: Understanding the US - Again

Posted: 09 Aug 2025 15:20

by Cyrano

A_Gupta wrote: ↑08 Aug 2025 09:39

I am told why Switzerland was hit with a 39% tariff is that Trump did not know that Switzerland was not part of the EU, and felt they had tricked him.

I am told that the Swiss refused to move the gold they have in their vaults (much of it belonging to their clients) to the US for "safe keeping" and therefore attracted Trump's wrath. FWIW.

Re: Understanding the US - Again

Posted: 09 Aug 2025 17:20

by drnayar

Re: Understanding the US - Again

Posted: 10 Aug 2025 22:00

by drnayar

who pays tariffs, Mr Secretary ? [scott Bissent]

https://www.youtube.com/shorts/Lbd7saCy ... ture=share

The answer is..ah..ah..ah.ah...

Re: Understanding the US - Again

Posted: 10 Aug 2025 22:23

by vijayk

https://www.theatlantic.com/economy/arc ... als/683796

So, About Those Big Trade Deals

If you read the fine print, the “concessions” from America’s trade partners don’t add up to much.