Re: Indian Economy News & Discussion - Nov 27 2017

Posted: 20 Apr 2018 20:19

One more source of corruption.

Consortium of Indian Defence Websites

https://forums.bharat-rakshak.com/

CV sales took a full 6 years to overtake the peak of 2011-12 . Sales were 809,000 in 2011-12 fell down all the way bottoming at 615,000 in 2014-15, rose back to 714,000 in 2016-17, and now 856,000 in 2017-18 .disha wrote:I used to say it as "zoom, zoom, zoom". I was wrong.

I am going to say

zoom ZOOM ZOOM

Here is the deal, the Elephant of Indian economy has started running and it is running on a firm footing. And it is as ferocious as a Lion. In the next decade & half, India is going to be the global growth engine in its relentless march to a USD 10 Trillion economy.

The challenge will be post 2030. Will India be in a "middle income trap" or "cut over into high income trap"? My bet is that it will be later and not former. That of course remains to be seen.

The pace of building highways picked up and touched 21.46 km a day in the April-January period of 2017-18 compared with 18.30 km per day in the same period last fiscal. But it still fell short of the 22.3-km-a-day target achieved in 2016-17 and remained far away from road transport and highways minister Nitin Gadkari’s ambitious target of building highways at a pace of 41 km a day.

Total construction, by all agencies responsible, stood at 6,439 km in the first 10 months of the current financial year, compared with 5,492 km in the corresponding period last year.

While the National Highways Authority of India (NHAI) has achieved a pace of 6.91 km a day, against the targeted 9.5 km, the ministry of road transport and highways’ performance remained short of target by a wider margin — it could construct just 13.48 km a day against the goal of 31 km.

Despite a slower international passenger demand growth, India's domestic passenger traffic grew by almost 18 percent in January, a global airline association said on Thursday.

Data from the International Air Transport Association (IATA) showed that India's domestic demand -- revenue passenger kilometres (RPK) -- was highest amongst major aviation markets like Australia, Brazil, China, Japan, Russia and the US.

According to the data, India's domestic RPK -- which measures actual passenger traffic -- rose by 17.9 percent in January compared to the corresponding month of the previous year.

The Union Cabinet Saturday gave its nod for a proposal to promulgate Fugitive Economic Offenders Ordinance 2018 that would empower authorities to attach and confiscate properties and assets of economic offenders like loan defaulters who flee the country.The ordinance, which aims to deter economic offenders like Vijay Mallya and Nirav Modi from evading the process of Indian law, was approved at a Cabinet meeting chaired by Prime Minister Narendra Modi. It will come into effect after the assent of the President.

The Fugitive Economic Offenders Bill was first introduced in Lok Sabha on March 12 but could not be passed due to logjam over various issues.

The Ordinance is expected to re-establish the rule of law with respect to the fugitive economic offenders as they would be forced to return to India to face trial for scheduled offences. Besides, it would help the banks and other financial institutions to achieve higher recovery from financial defaults committed by such fugitive economic offenders, thereby improving the financial health of such institutions.

A special forum is expected to be created for expeditious confiscation of the proceeds of crime, in India or abroad, which would coerce the fugitive to return to India to submit to the jurisdiction of Courts in India to face the law in respect of scheduled offences.

The ordinance defines a Fugitive Economic Offender as a person against whom an arrest warrant has been issued in respect of a scheduled offence and who has left India so as to avoid criminal prosecution, or being abroad, refuses to return to India to face criminal prosecution. Such economic offenders will be tried under Prevention of Money Laundering Act.

Further, in order to ensure that Courts are not over-burdened with such cases, only those cases where the total value involved in such offences is 100 crore rupees or more, is within the purview of this Ordinance.

If at any point of time in the course of the proceeding prior to the declaration, however, the alleged Fugitive Economic Offender returns to India and submits to the appropriate jurisdictional Court, proceedings under the proposed Act would cease by law. All necessary constitutional safeguards in terms of providing hearing to the person through counsel, allowing him time to file a reply, serving notice of summons to him, whether in India or abroad and appeal to the High Court have been provided for.

FOR decades, personal connections have provided a well-trodden path to success in Indian business. State-owned banks provided cheap financing for firms whose success often rested on winning official approvals. If a venture soured, the taxpayer frequently ended up being left to shoulder losses. There are plenty of gifted businesspeople in India. But cronyism, not competition, has been the surest route to riches, even after the partial dismantling of the “licence raj” nearly three decades ago.

The fate of 12 troubled large concerns is due to be settled within weeks; another 28 cases are set to be resolved by September. Between them, these firms account for about 40% of loans that banks themselves think are unlikely to be repaid. For enforcing a bankruptcy system that is usually skirted by those with connections, the government of Narendra Modi deserves much credit. Yet the job is far from done.

Many tycoons could count on ministers to put in a word with a recalcitrant banker. Some held political office themselves. If things went awry, bankers would frequently extend repayment periods indefinitely, if only to preserve their own blushes. Overburdened courts were unequal to the task of enforcing contracts.

This system is under a three-pronged assault. The first is a reformed bankruptcy code that makes the seizure of businesses easier (see article). A new set of dedicated courts, backed by a cadre of insolvency professionals, is on hand to help banks seize assets and sell them to fresh owners. To focus the minds of both bankers and borrowers, if no deal can be cut within nine months—a jiffy by Indian legal standards—the firm is shut down and its equipment sold for scrap. This is the point in the process now being reached by the first dozen defaulters.

The second threat to the tycoons is the grievous state of the state-owned banks. Their losses have ballooned. The authorities, tired of recurring bail-outs, are forcing them to recognise which loans are unlikely to be repaid, and to initiate insolvency proceedings in double-quick time. Though their governance remains parlous, at least these banks are no longer able to hide the extent of their problems.

Third, most tycoons have lost influence in Delhi, as politicians from Mr Modi down realise the toxicity of being seen to be in cahoots with “bollygarchs”. Some of India’s grandest businessmen complain that they can no longer get in to meet the prime minister, who much prefers wooing foreign bosses instead. To increase transparency, some state assets are now auctioned online.

Reforming the state-owned banks is the most important task of all. Their balance-sheets are where you find 70% of loans and nearly 100% of problems. Ensuring banks make commercial decisions can only realistically be achieved by privatising at least some of them. Privatised banks would also be free to pay salaries to attract talented staff. The bosses at state-owned banks currently earn under $50,000 a year, a pittance even by Indian executive standards—and it shows.

Prime Minister Narendra Modi may be unpopular among Indian citizens lined up in front of empty ATM machines lately, but his policies seem to have helped the Indian economy regain momentum and be on track to beat China’s economy.

On economic growth rates that is.

:

:

:

:

all these guys have also appointed their own employees in GSTN and are paying them really really handsome salaries from the public exchequer.JayS wrote:On what basis GSTN ownership was given to ICICI et al if they havent put a single paisa in the company..? Shouldnt the company be developing and paying for the SW dev if its a pvt company..?

I think rural economy in India is seeing a lot of activity and since rural trade is almost all is in cash, this could be the cause of the cash crunch in the economy. If this is true soon we’ll finally see modi effect on the economy in all it’s glory!vijayk wrote:

From the article linked by Supratik, it seems that is perhaps the case.Suraj wrote: If any interested posters would keep a monthly eye on Team BHP or elsewhere to post monthly CV sales growth, rail traffic growth, and other parameters, it would help. Ideally, a 15% CV sales growth this year should yield year end sales of ~980,000 CVs . It would be particularly nice if MHCV (medium and heavy commercial vehicle) sales grow stronger than the overall CV figure.

Another key indicator of active economic activities, particularly in the infrastructure sector, is the growth in the production and sales of commercial vehicles such as heavy-duty trucks that ferry building materials to and fro from the construction site. So how did this sector perform in the past year? “The heavy-duty truck segment has witnessed a growth of 20 per cent in the last 15 months and is continuing (to grow),” says Vinod Aggarwal, managing director and CEO of VE Commercial Vehicles, a joint venture between the Volvo Group and Eicher Motors. Expanding on the reasons for such robust growth in the commercial vehicle segment, Aggarwal says: “This spurt could be attributed to a variety of reasons including stricter implementation of overloading norms by some states, segmental shifts taking place with the market moving from basic economy trucks to higher tonnage and value products (tractor, trailer and multi-axle trucks) for higher economics of operations and profitability among others,” he adds. “With these factors and numerous projects that are underway, the outlook for the industry looks bright. Further, the implementation of emission norms, scrappage policy, and pent-up demand will sustain the growth momentum for medium and heavy commercial vehicles and the sales are expected to close this fiscal year at a six-year high,” says Aggarwal.

i am still hearing grievances about GST. but demand is bound to pick up as spending cannot be postponed any longer and sacrificing growth when seeing activity from partners/competitors.Katare wrote:I think rural economy in India is seeing a lot of activity and since rural trade is almost all is in cash, this could be the cause of the cash crunch in the economy. If this is true soon we’ll finally see modi effect on the economy in all it’s glory!

http://businessworld.in/article/The-Gre ... 18-145332/The Great Construction Boom

Pan-India construction of roads, highways, houses, airports and ports is helping allied industries such as infra financing, construction equipment, steel and cement makers perform well

If you drive down any significant state or national highway, chances are, you will see construction or expansion of roads and highway networks going on in full swing. Similarly, construction of buildings and residential complexes and townships are also a common sight across most metros and large towns. In the last 12-15 months, several infrastructure projects including roads, ports, highways, housing etc., have taken off with actual construction work happening in a big way. Cynics may disagree and critics may play it down, but even the ground-statistics and data capture this trend. Take for example the 10-month period that ended on 31 January, 2018. The total construction of roads/highways stood at 6,439 kilometres (km), a jump of 17 per cent over the figures for corresponding period last year. Let’s compare another data set. The average per annum construction of highways in India in the three-year period of NDA regime stood at over 6,200 km against around 5,000 km in the preceding three-year period. Today, one cannot dispute the ground reality. Take for example, the ongoing work on the 650-km-long Biju Expressway in Odisha or the Delhi Eastern Peripheral Expressway across Uttar Pradesh and Delhi National Capital Region. The work is virtually in the last stages on the Delhi-Meerut Expressway and the Mumbai-Vadodara Expressway. Very soon the Delhi Western Peripheral Expressway and the Northern Peripheral Road will be completed. Similar examples exist across the length and breadth of the country; after all infrastructure creation is one of the primary responsibilities of any government for speedier development of the nation.

Apart from roads and highways, the civil aviation ministry has already given its nod for the construction of 18 new airports in the country; the work on some has already started and for others, it will start soon. These include Mopa in Goa; Navi Mumbai, Shirdi and Sindhudurg in Maharashtra; Bijapur, Gulbarga, Hasan and Shimoga in Karnataka; Kannur in Kerala; Pakyong in Sikkim; Karaikal in Puducherry; and Dholera in Gujarat among others. More airports are being planned across various states. Likewise a consistent affordable housing (active construction of 3-4 million units) policy push and a slew of initiatives on the development of port sector have led to measurable growth across all allied businesses that support the construction sector. The year gone by has shown growth in demand for steel, Thermo-Mechanically Treated (TMT) bars (used for all kinds of construction), paints, cement, construction equipment and infrastructure financing among others. And the trend continues.

Efforts by the government to restart stalled infra projects by providing necessary clearances, launching hybrid annuity model or “HAM” and creating National Investment and Infrastructure Fund (NIIF), are also beginning to show positive results. Add to it the recent Cabinet clearance to develop 83,677 km of highways including the Bharatmala project worth Rs 6.92 lakh crore, which will usher in positive sentiments to the construction industry for the next few years. Agrees infrastructure expert J. Padmanabhan of CRISIL Infrastructure Advisory. “Roads and highways have taken a lead in driving growth both at the rural and at the national highway level. Major hurdles have been ironed out...Innovation in PPP (private public partnership) such as the introduction of HAM and successful implementation of asset monetisation programme Viz Toll-Operate-Transfer model have further increased the interest of all stakeholders,” he says.

In its forecast for 2018, the World Steel Association predicts an increased demand for steel including TMT bars, cold-rolled and hot-rolled coils that find use in construction, automobile and the white goods segment. Since the National Steel Policy of 2017 also gives preference to domestically manufactured iron and steel products and aims at facilitating consumption of domestic value-added steel in government procurement in sectors such as shipping, ports and airports, the domestic manufacturers will stay buoyant, at least in the short-term horizon of next two to three years.

On the back of a big push to affordable housing, interest rate subvention on home loans, and continuous infrastructure spending, demand for cement too has improved, at least in pockets of south India and parts of north India. Revival in rural housing demand via the ‘Housing for All’ scheme is expected to further fuel the momentum for the construction industry. Therefore, it is no surprise that gradually the sluggish cement industry that supplies over 65 per cent to the real estate sector, is pegged to grow at 5-6 per cent CAGR between FY17 and FY20. Besides, the ongoing investment in power and infrastructure sectors is also expected to boost demand.

Real Demand

Is this for real or simply an illusion of growth, one may ask. The numbers reveal the truth. Take for example the Indian Construction Equipment (ICE) industry that is already on a growth trajectory after four-years of slowdown (2011-2015). The seven leading product categories of ICE — Backhoe Loader, Excavator, Wheeled Loader, Compactor, Loadall, Skid Steer and Mini Excavator — have all witnessed double-digit growth, say industry experts. “Thanks to the continued momentum in the roads and highways sector and green shoots in sectors such as irrigation and railways, 2017 was again a positive year after 2016 wherein we saw the industry grow by 14 per cent, the highest ever,” says Vipin Sondhi, managing director and CEO at JCB India, a leading manufacturer of construction equipment. He says the government’s thrust on building world-class infrastructure in the country has spurred demand for JCB machines in both urban and rural areas. The increased demand of construction equipment has fueled the revenue of JCB India, which saw its gross turnover increase from over Rs 6,000 crore in 2015-16 to around Rs 8,000 crore in 2016-17. Therefore, an increased demand for construction equipment means there are actual projects that require them. So we turned to one of the successful infrastructure finance companies for its take.

Initiatives such as the Bharatmala project is helping road developers such as Bharat Road Network (BRNL), which has started witnessing a profitable growth in its businesses, says Hemant Kanoria, chairman and managing director of Srei Infrastructure Finance (SIFL). BRNL is promoted by SIFL and is constructing a number of road projects. On its own, SREI Infrastructure Finance too, has clocked remarkable growth in the year gone by. The Kolkata-headquartered firm with a pan-India presence witnessed 236 per cent jump in its net profit and a 43 per cent growth in its total income in FY17 where it disbursed loans of over Rs 17,600 crore, a 21 per cent jump over FY16 figures. “We have seen growth in the areas of construction and mining equipment business in the past year which is helping us do better,” says Kanoria, a well-respected industry veteran.

If there is construction, then obviously there should be demand for construction materials. And the basic construction material being cement, we turned to one of the largest cement manufacturers in India for its take. It is no secret that the cement business has seen its own share of challenges in the last few years with slowdown in demand from the housing sector, ban of sand mining, use of pet coke, etc. Despite challenges, the outlook seems positive and bright says Yadupati Singhania, chairman and managing director of JK Cement. Why? Because the infrastructure sector is undergoing a “revolutionary phase” says Singhania. “There are some developments that are likely to drive the industry in the longer run. It was encouraging to see the reinforcement of the government’s commitment to the Bharatmala Project. Also, the finance minister promising construction of 9,000 km highways by the end of FY19 and visions like ‘Housing for All’ by 2020, will surely give a major boost to cement demand in the next financial year,” he says. That is the reason the company is increasing the capacity of grey cement by 4.2 million tons per annum and also investing around Rs 2,000 crore in the brownfield expansion of its facility in Rajasthan and spilt grinding units in Uttar Pradesh and Gujarat in the next 24 months. “Subsequently, we are setting up a greenfield project at Panna in Madhya Pradesh, where we already have a mining lease,” adds Singhania.

After cement, perhaps one of the key construction elements for a building is steel. So we turned to one of the largest manufacturers of TMT bars, Kamdhenu Group. Chairman & MD Satish Aggarwal also says his company has witnessed a robust demand for its products across categories such as TMT bars, paints, etc., that are required for the construction sector. “In FY18, which was marked by implementation of the Goods and Service Tax regime, we saw an increase in volume growth due to gradual recovery in the real estate and infrastructure sectors. In the nine-month period ended 31 December, 2017, our net revenue from operations was up 38 per cent to Rs 803 crore compared to Rs 583 crore in nine-month period ended 31 December, 2016.” Aggarwal says Kamdhenu is witnessing maximum demand from northern and western parts of the country due to consistent and rapid infrastructure development compared to other regions. “We are witnessing robust demand for our products across both rural and urban areas due to tremendous demand for housing and other infra projects,” says Aggarwal.

Another key indicator of active economic activities, particularly in the infrastructure sector, is the growth in the production and sales of commercial vehicles such as heavy-duty trucks that ferry building materials to and fro from the construction site. So how did this sector perform in the past year? “The heavy-duty truck segment has witnessed a growth of 20 per cent in the last 15 months and is continuing (to grow),” says Vinod Aggarwal, managing director and CEO of VE Commercial Vehicles, a joint venture between the Volvo Group and Eicher Motors. Expanding on the reasons for such robust growth in the commercial vehicle segment, Aggarwal says: “This spurt could be attributed to a variety of reasons including stricter implementation of overloading norms by some states, segmental shifts taking place with the market moving from basic economy trucks to higher tonnage and value products (tractor, trailer and multi-axle trucks) for higher economics of operations and profitability among others,” he adds. “With these factors and numerous projects that are underway, the outlook for the industry looks bright. Further, the implementation of emission norms, scrappage policy, and pent-up demand will sustain the growth momentum for medium and heavy commercial vehicles and the sales are expected to close this fiscal year at a six-year high,” says Aggarwal.

Housing Push

The Pradhan Mantri Awas Yojana (PMAY) or ‘Housing for All’ by 2022 is yet another driver of demand for construction and supporting businesses. Hardeep Singh Puri, the minister of state (independent charge) for Housing and Urban Affairs, recently said that out of the required 12 million houses by 2022, nearly 4 million houses have already been sanctioned under the PMAY scheme. As per the RBI Bulletin of January 2018, over 1.4 million houses under PMAY are grounded for construction while nearly 3 lakh such houses have been completed.

Says Ashish R. Puravankara, managing director of Puravankara and president of CREDAI Bangalore: “The Indian real estate sector is poised at a better position today with the market and consumer sentiment bouncing back. The growth of affordable housing segment has further augmented the market as mid-size home buyers are opting to buy homes that come with certain quality, features and good amenities.” Seeing big demand in the affordable housing segment, Puravankara expects developers to launch more projects in this category. Agrees Niranjan Hiranandani, co-founder and managing director of Mumbai-based Hiranandani Group and president of National Real Estate Development Council (NAREDCO), an apex industry body of the developers. “Only building houses is not a good idea if there is no electricity, water, hospital and basic infrastructure. In the last three to four years, there has been focus on overall infrastructure development. Let’s take the example of the Mumbai region. We have a budget of Rs 1.7 lakh crore for six key infra projects. This was unheard of in previous years. On top of the existing 190 km of railway tracks in Mumbai, now we are adding another 170 km of metro rail routes in the next six years. Then there are the plans for Trans-Harbor Bridge, coastal roads and Navi Mumbai airport. So along with housing, other infrastructure will be coming up and driving the construction boom.” Going forward, the two most important things for affordable housing will be slum redevelopment (without shifting people) and rental housing. “A policy framework on rental housing is coming soon that will further drive the housing market. The target is to create surplus economy in housing. Then the builders can build housing for rental,” adds Hiranandani.

New Opportunities

Sustained growth in any sector leads to innovations, therefore the allied industries supporting the construction business are no different. Kanoria of SREI Infrastructure Finance says the company’s recent initiative iQuippo has transformed the entire customer experience of buying/selling infrastructure equipment. “Right from assisting original equipment manufacturers to marketing their products, enabling and guiding potential buyers in identifying the right assets, iQuippo plays an important role in financing the asset, deploying it, offering insurance, maintenance and operational services, making available spare parts, re-deploying the asset in multiple project sites, identifying buyers for used assets and providing all kinds of fee-based services till the asset is finally disposed,” says Kanoria.

Sensing an uptake in demand for cement in the near-term, JK Cement re-launched two of its brands last year, namely JK PrimaxX and JK Super Cement. “After an extensive market research and brand study, we decided to revitalise our grey cement brand JK Super Cement, with a new visual identity and brand positioning. JK PrimaxX was also re-launched in the market in response to the ever-increasing need for a white cement-based primer for external surface application,” says Singhania of JK Cement.

Due to high demand for specialised construction equipment, there is increased usage of “smart and digitally advanced machines”, says Sondhi of JCB. ”JCB is leading the integration of ‘Internet of Things’ and ‘Big Data’ in its products and services through an advanced telematics technology called JCB Livelink, an effective fleet management system that helps customers remotely monitor and manage their machines. Today, over 60,000 Livelink-enabled machines are working successfully in India. This technology aims to deliver constructive, real-time information to increase productivity and efficiency,” adds Sondhi.

Aggarwal of Kamdhenu says the TMT steel bar industry is witnessing consolidation post-GST implementation. “We expect to benefit from this trend to continue. Recently, we launched an innovative product KamdhenuNxt, the next generation interlock steel in the market, and also launched Kamoproof and Kamocrete for waterproofing solution that offers added strength and durability which modern construction demands,” adds Aggarwal.

But with opportunities, come challenges too. On-time and sustained completion of projects hold the key to ensure that there are no time and cost overruns. If all goes as planned, very soon the country will be able to showcase the best of roads, airports and housing to the whole world.

He turned left very soon after that "suit boot ki sarkar" jibe hit home.Suraj wrote:A few months into the current administration I stated that Modi would disappoint a lot of free marketers who were looking forward to privatization and laissez faire economics . Instead I said he was something else, and he’s been proving me right since - he is a social democrat .

He believes in capitalism , but is also aware of the obvious - there’s are 100s of millions who need to get past basic living needs like food and health security and a minimum of savings . But he doesn’t believe in doing this by ‘soaking the rich’ . Rather, he chose the more effective but politically more dangerous option of the greatest overhaul of the tax code in our history . He wants a system that is efficient and works, my one that’s based on redistribution in time for elections .

The social democracy system is closer to what you see in Germany or the Nordic countries, not the Anglo-American model . Social democracy is also not the same thing as socialism . Social democracy - the provision of a basic social safety net sustained by the government revenues but with all enhanced needs paid for by the users , and a vigorous support of private enterprise - was the model initially popularized by Otto von Bismarck .

https://www.hindustantimes.com/business ... aMMaK.htmlDeposits in Jan Dhan accounts cross Rs 80,000 crore

55% of all new bank accounts in the world opened from India, says World Bank report

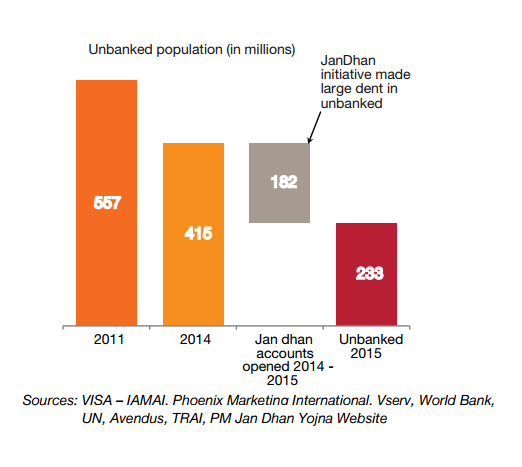

As per the World Bank Global Findex Report, the percentage of adult bank account holders in India increased to 80% in 2017 as compared to 53% in 2014 and 35% in 2011, financial services secretary Rajiv Kumar said.

India’s financial inclusion efforts have won recognition from the World Bank, as their data indicates 55% of new bank accounts opened globally are from India, financial services secretary Rajiv Kumar said on Saturday.

“World Bank Global Findex Report recognises India’s Financial Inclusion efforts. Of the 51.4 crore bank accounts opened from 2014-17 globally, a whopping 55% from India” he said in a tweet.

The World Bank report released on Friday cited the success of the Jan Dhan Yojana -- the government’s initiative aimed at bringing masses within the formal banking system.

The total number of Jan Dhan account holders has risen to 31.44 crore in March, 2018, from 28.17 crore a year earlier, according to the government data.

As per the World Bank Global Findex Report, the percentage of adult bank account holders in India increased to 80% in 2017 as compared to 53% in 2014 and 35% in 2011, he said.

Women at the forefront, he said, highlights a sharp fall in gender gap from 20% in 2014 to 6% in 2017 in bank accounts due to Government efforts.

The report acknowledges impact of government policy in reducing gaps in bank account ownership between rich and poor to 5% in 2017, down from 15% in 2014, he added. The Global Findex Report, 2017 released by the World Bank noted the rapid increase in financial inclusion that has taken place in India and how the number of account holders in the country has risen from 35% of the adults in 2011 and 53% in 2014 to 80 % in 2017.

This, it states, is comparable to 80% of adults in China who have an account.

The Report also attributes this progress as being driven by the Jan Dhan Yojana policy which has used biometric ID to expand access to financial services.

It may be pertinent to note that the Report sources its data largely from surveys that were conducted in the summer of 2017.

Sounds familiar ? That's the basic doctrine of Modi's policies. He believes a lot of people still need a leg up, but only cares to give them that leg up, not do their job for them or gratuitously provide for them. Almost everything provided is a safety net so people don't hesitate to take initiative, worrying about the cost of failure. But the policies are geared towards helping them if they fall, or to get started, no further.The Swatantra Party is founded on the claim that individual citizens should be free to hold their property and carry on their professions freely and through binding mutual agreements among themselves and that the State should assist and encourage in every possible way the individual in this freedom, but not seek to replace him.

The National Geographic channel will air a 44-minute documentary early next month about the Pradhan Mantri Ujjwala Yojana, a government programme that aims to provide free cooking gas connections to poor families.

...

The documentary film features four women and the transformation in their lives after the introduction of the LPG cylinder. It will highlight stories about field workers and volunteers educating people about the advantages of switching to LPG. The Nat Geo team has documented stories across the country, including in the Kashmir Valley, Assam, Uttar Pradesh and Odisha.

March GST collections rise to Rs.96000 croreAgriculture credit is growing every year and reached Rs 10 lakh crore last fiscal, the government said today while stressing upon the need to increase the flow to small farmers as well as providing loan access to tenant cultivators. The agriculture ministry will soon bring a proposal before the Cabinet for improving lending to small and marginal farmers based on the recommendations of the Sarangi committee. “Agriculture credit flow is going up every year. We have achieved the disbursal target of Rs 10 lakh crore in 2017-18 fiscal. The target for the current financial year has been enhanced to Rs 11 lakh crore,” said Ashish Kumar Bhutani, joint secretary in Ministry of Agriculture.

On the sidelines of a conference, organised by industry body Ficci, he said disbursing agriculture credit is not a challenge but the challenge is to give it to right farmers. Bhutani said Rs 6.8 lakh crore was short-term crop loans out of Rs 10 lakh crore credit disbursed last fiscal. In the short-term crop loans, he said 50 per cent amount was provided to small and marginal farmers. He said the ministry has sought data from banks for better targeting of agriculture credit.

Dramatic rise in NPAs in India after 2015 in one chart, and it’s not Modi’s faultThe goods and services tax (GST) collections for March exceeded Rs 96,000 crore by April 23, the largest mop-up for any month since the comprehensive indirect tax’s launch in July last year, an official source said. The March collections could cross the coveted Rs 1 lakh crore mark by April-end, as payments are still being made by a section of taxpayers with late penalties, analysts feel. The forecast is based on the customary spurt in tax payments in the last month of the financial year and the fact that only 55 lakh assessees had paid the tax by April 23 — three days past the deadline for payment without fines — against an average of around 65 lakh in the previous months.

However, the Centre is still far from meeting its own projections of GST revenue; for now, GST revenue is less of a problem for states as 14% annual GST revenue growth is guaranteed to them for five years, under a compensation mechanism. Of the total GST collections, the Centre’s share (CGST) has so far been 30% (though CGST share was even lower in the initial months, when the accumulated integrated GST (IGST) pool was apportioned, it share subsequently went up). With the March figures also in, the average monthly GST mop-up so far has been close to Rs 90,000 crore, which means a CGST share of Rs 27,000 crore. This is still a far cry from monthly CGST receipts of Rs 50,325 crore budgeted for 2018-19.

The recent roll-out of the e-way bill mechanism could help the Centre to bridge the revenue gap to an extent. It is also pinning its hopes on the planned introduction of invoices-matching (a simplified comprehensive form for returns-filing was approved by a group of state finance ministers recently; the new form is expected to facilitate invoices-matching).

The NPA chart shared by Reserve Bank of India’s Deputy Governor N S Vishwanathan during his speech shows that India’s bad loans were only 2.36% in 2011, which kept surging, rather slowly, until March 2015 when it rose dramatically.

Reason: The RBI tightened norm for NPA recognition in 2015, after which banks had to recognise some assets as NPA, which otherwise were considered ‘standard assets’. This growth in stressed assets was, in turn, the outcome of rapid credit growth during 2006-2011, N S Vishwanathan said in his recent speech.