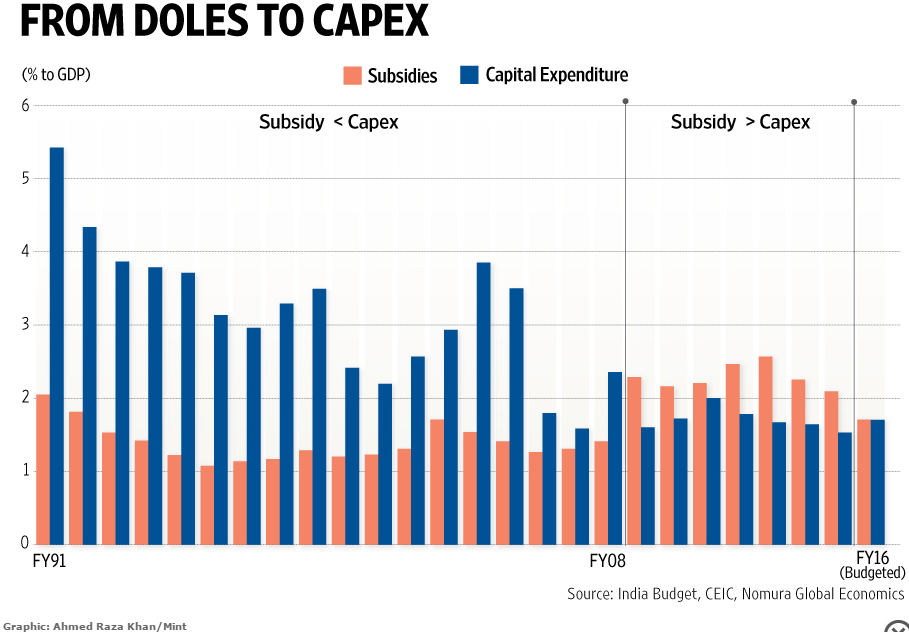

The coming Union Budget 2016-17 will likely come good on Finance Minister Arun Jaitley’s promise to continue the government’s public spending push, with capital expenditure (capex) for the next year expected to come close to Rs 3 lakh crore for the first time.

At a time when private sector balance sheets are stretched and banks burdened with non-performing assets, Jaitley had stated the Centre’s commitment to boost spending in infrastructure as an impetus for growth. For 2015-16, the finance minister had budgeted Rs 2.41 lakh crore in total capex (including loan disbursements), about Rs 49,053 crore, or 25.5 per cent, higher than the 2014-15 revised estimates of about Rs 1.92 lakh crore.

Next year too, a similar push is expected as the 2016-17 budgeted capex could be around 20-25 per cent higher than this year. Compared to the budgeted figures available, that comes to around Rs 2.90-3.02 lakh crore.

Official sources said for enhanced capital spending by the government to act as a stimulus for the private sector to invest again, some six to eight quarters of sustained boost was required. They reckon that 2016-17 will be a final push for the government to provide that boost before the year-on-year increase in capex can be eased back.

In addition to public spending, plans to recapitalize banks:

Govt may infuse more than planned Rs 70,000 crore in PSU Banks“We have four quarters of this year and four quarters of the next. This is a burden which the government has to take, but it is necessary given that India Inc is not in a position to substantially increase investment,” said an official, adding the year-on-year expansion in capital spending next year was likely to be the same as this financial year.The Finance Ministry is considering infusing more than the announced Rs 70,000 crore in public sector banks to help strengthen their balance sheets.

"We are assessing the capital requirement position of each bank depending on their bad loans and, if need be, we may have to expand the capital infusion programme," said a ministry official.

An announcement to this effect could be made next month by Finance Minister Arun Jaitley in the Budget 2016-17 if the government decides to expand the capital infusion programme, sources said, adding that the plan is at a preliminary stage and no decision has been taken so far.

This continues GoIs effort to reverse the negative calculus from the UPA era: