Perspectives on the global economic meltdown (Jan 26 2010)

Re: Perspectives on the global economic meltdown (Jan 26 201

A biting comedy/commentary by Jon Stewart. http://www.huffingtonpost.com/2010/06/1 ... 15529.html

The reason I post here is that he shows how the last 8 American Presidents talked a lot about independence of foreign oil yet did diddly-squat about it. It is not hard to guess it is the System that is setup. A system that sides the Corporations. Finance reforms, banking reforms itiyadi are just maya for our consumption.

The reason I post here is that he shows how the last 8 American Presidents talked a lot about independence of foreign oil yet did diddly-squat about it. It is not hard to guess it is the System that is setup. A system that sides the Corporations. Finance reforms, banking reforms itiyadi are just maya for our consumption.

-

abhishek_sharma

- BRF Oldie

- Posts: 9664

- Joined: 19 Nov 2009 03:27

Re: Perspectives on the global economic meltdown (Jan 26 201

Predicting the Financial Crisis: A Q&A With Fault Lines Author Raghuram Rajan

http://freakonomics.blogs.nytimes.com/2 ... ram-rajan/

http://freakonomics.blogs.nytimes.com/2 ... ram-rajan/

Re: Perspectives on the global economic meltdown (Jan 26 201

IBs will probably report good results this year but these will turn bad next year once the euro crisis becomes a full blown storm. Spain & Greece will definitely affect the US.

I expect US imports and obviously unemployment, will surge to politically unacceptable levels thanks to Eurozone crisis. China will ultimately take the fire of the Eurocrisis. Trade barriers will probably put up next year end.

China is still trying to stop their lending bubble. Massive overcapacity and over investments. Commodities will drop a lot.

I expect US imports and obviously unemployment, will surge to politically unacceptable levels thanks to Eurozone crisis. China will ultimately take the fire of the Eurocrisis. Trade barriers will probably put up next year end.

China is still trying to stop their lending bubble. Massive overcapacity and over investments. Commodities will drop a lot.

-

abhischekcc

- BRF Oldie

- Posts: 4277

- Joined: 12 Jul 1999 11:31

- Location: If I can’t move the gods, I’ll stir up hell

- Contact:

Re: Perspectives on the global economic meltdown (Jan 26 201

Where's the D&G guru these days?

Re: Perspectives on the global economic meltdown (Jan 26 201

(Not sure if this was posted before. I enjoyed it very much, highly recommended)

S. Gurumurthy's views on the global economic meltdown

Shri. S. Gurumurthy - Part 1 - National Economic Debate (total 7 parts)

Gurumurthy on financial crisis (total 9 parts)

(links originally posted in Harmonization/Homogenization thread)

S. Gurumurthy's views on the global economic meltdown

Shri. S. Gurumurthy - Part 1 - National Economic Debate (total 7 parts)

Gurumurthy on financial crisis (total 9 parts)

(links originally posted in Harmonization/Homogenization thread)

Re: Perspectives on the global economic meltdown (Jan 26 201

He is busy with work... doing good.abhischekcc wrote:Where's the D&G guru these days?

-

Chinmayanand

- BRF Oldie

- Posts: 2585

- Joined: 05 Oct 2008 16:01

- Location: Mansarovar

- Contact:

Re: Perspectives on the global economic meltdown (Jan 26 201

What's the summary of all that gobblygoop ?Chinmayanand wrote:Exit strategies for central banks: Lessons from the 1930s

I often find keynesian economics main objective is to complicate things to an extent where the person being ripped off is kept unaware. A big paper maze is created based on easing this and tightening that but on disection of it all, one finds its nothing more than robbery scheme. The savings and hard work of the productive class is ripped off and/or transferred to keep the system going.

Really all i need to know is who's going to be ripped off (is it savers of fiat again?).

Re: Perspectives on the global economic meltdown (Jan 26 201

Federal Reserve has a bunch of comic books out to educate people (probably misguide is a better word) on the merits of the fiat system.

A Penny Saved...

https://www.newyorkfed.org/publications ... enny%2Epdf

A Penny Saved...

https://www.newyorkfed.org/publications ... enny%2Epdf

Re: Perspectives on the global economic meltdown (Jan 26 201

Another economist puts forward his views: Says that the US could be broke in 15 years.

Re: Perspectives on the global economic meltdown (Jan 26 201

The next time you hear a politician use the

word "billion" in a casual manner, think about

whether you want the "politicians" spending

YOUR tax money.

A billion is a difficult number to comprehend,

but one advertising agency did a good job of

putting that figure into some perspective in

one of its releases.

A. A billion seconds ago it was 1959.

B. A billion minutes ago Jesus was alive.

C. A billion hours ago our ancestors were

living in the Stone Age.

D. A billion days ago no-one walked on the earth

on two feet.

E. A billion dollars ago was only 8 hours and

20 minutes, at the rate our government is

spending it.

While this thought is still fresh in our brain,

let's take a look at New

Orleans . It's amazing what you can learn with

some

simple division . .

Louisiana Senator, Mary Landrieu (D), is

presently

asking the Congress for

$250 BILLION to rebuild New Orleans . Interesting

number, what does it

mean?

A. Well, if you are one of 484,674 residents of

New Orleans (every man, woman, child), you

each get $516,528.

B. Or, if you have one of the 188,251 homes in

New Orleans , your home gets $1,329,787.

C. Or, if you are a family of four, your family

gets $2,066,012.

Washington, D.C .. HELLO!!! ... Are all your

calculators broken??

This is too true to be very funny

Tax his land,

Tax his wage,

Tax his bed in which he lays.

Tax his tractor,

Tax his mule,

Teach him taxes is the rule.

Tax his cow,

Tax his goat,

Tax his pants,

Tax his coat.

Tax his ties,

Tax his shirts,

Tax his work,

Tax his dirt.

Tax his tobacco,

Tax his drink,

Tax him if he tries to think.

Tax his booze,

Tax his beers,

If he cries,

Tax his tears.

Tax his bills,

Tax his gas,

Tax his notes,

Tax his cash.

Tax him good and let him know

That after taxes, he has no dough.

If he hollers,

Tax him more,

Tax him until he's good and sore.

Tax his coffin,

Tax his grave,

Tax the sod in which he lays.

Put these words upon his tomb,

"Taxes drove me to my doom!"

And when he's gone,

We won't relax,

We'll still be after the inheritance TAX!!

Accounts Receivable Tax

Building Permit Tax

CDL License Tax

Cigarette Tax

Corporate Income Tax

Dog License Tax

Federal Income Tax

Federal Unemployment Tax (FUTA)

Fishing License Tax

Food License Tax

Fuel Permit Tax

Gasoline Tax

Hunting License Tax

Inheritance Tax

Inventory Tax

IRS Interest Charges (tax on top of tax),

IRS Penalties (tax on top of tax),

Liquor Tax,

Luxury Tax,

Marriage License Tax,

Medicare Tax,

Property Tax,

Real Estate Tax,

Service charge taxes,

Social Security Tax,

Road Usage Tax (Truckers),

Sales Taxes,

Recreational Vehicle Tax,

School Tax,

State Income Tax,

State Unemployment Tax (SUTA),

Telephone Federal Excise Tax,

Telephone Federal Universal Service Fe e Tax,

Telephone Federal, State and Local Surcharge Tax,

Telephone Minimum Usage Surcharge Tax,

Telephone Recurring and Non-recurring Charges Tax,

Telephone State and Local Tax,

Telephone Usage Charge Tax,

Utility Tax,

Vehicle License Registration Tax,

Vehicle Sales Tax,

Watercraft Registration Tax,

Well Permit Tax,

Workers Compensation Tax.

COMMENTS: Not one of these taxes existed 100

years ago

And there was prosperity, absolutely no national

debt, the largest middle

class in the world and Mom stayed home to raise

the kids.

What the heck happened?????

Re: Perspectives on the global economic meltdown (Jan 26 201

Japan to Balance Budget by 2020 to Tackle Debt Situation

UK's FinMin Osborne Unveils Tough New Budget

Wow, it looks like the 2 former island superpowers are coming back strong.

I'm particularly impressed with Osborne's budget - he really bit deep, at least on paper.

I'm thinking that some of the Londonistanis will be pak-ing their bags for home, now that their welfare jihad cheques will be trimmed.

Could we ever imagine an Indian govt announcing a budget like this? Fat chance.

Britain suddenly looks like a more attractive destination for investment.

UK's FinMin Osborne Unveils Tough New Budget

Wow, it looks like the 2 former island superpowers are coming back strong.

I'm particularly impressed with Osborne's budget - he really bit deep, at least on paper.

I'm thinking that some of the Londonistanis will be pak-ing their bags for home, now that their welfare jihad cheques will be trimmed.

Could we ever imagine an Indian govt announcing a budget like this? Fat chance.

Britain suddenly looks like a more attractive destination for investment.

Re: Perspectives on the global economic meltdown (Jan 26 201

http://www.ritholtz.com/blog/2010/06/pr ... ing/print/

A graphic from the U.K. Guardian passed along by Barry Ritholtz on his terrific blog, The Big Picture (www.ritholtz. com/blog [1]), shows that the U.S. consumes 25% of global oil output while having less than 5% of the world’s population. This helps explain the Brits’ feeling that we Yanks are being less than honest with ourselves in our pique at BP. “They raise a valid point,” he adds.

Beyond that, Mr. Forsyth jumps right into a recent discussion had right here at TBP, to wit: The future of the bond market:

THERE’S MORE TO LIKE ABOUT Treasuries other than the lack of alternatives. Even though their yields are down substantially from early April—when the benchmark 10-year note was 4% and the conventional wisdom said it had nowhere to go but up—don’t be surprised if it drops back below 3%.

Hmmm…sounds like a familiar theme [2].

Of most interest in the column, however, was this (emphasis added):

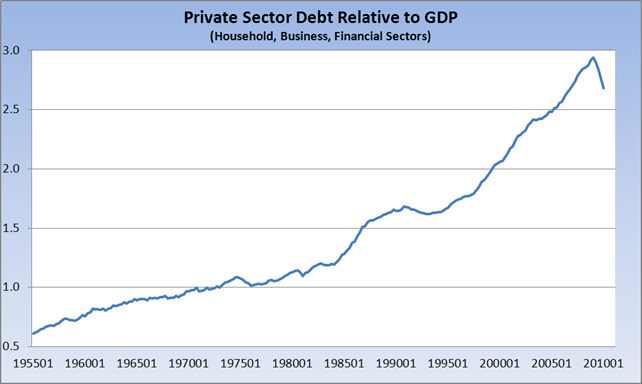

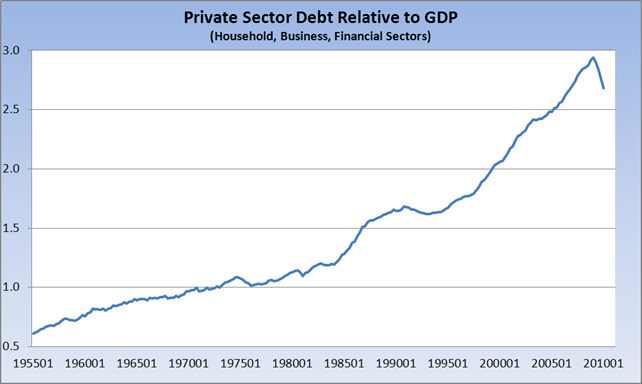

The real problem is that the economy remains mired in a debt-deflationary cycle from which the only way out is through paying down the debt. Nomura chief U.S. economist David Resler says that, even after households paid down debt for the seventh straight quarter in the first quarter, the process still has a long way to go. That, even with a $374 billion reduction in household borrowing from its peak of $13.9 trillion in the second quarter of 2008, with most of the drop coming in mortgage debt.

In fact, financial deleveraging has just begun, according to BCA Daily Insights, a publication of the Bank Credit Analyst. That points to renewed underperformance by financial stocks, which has started during the market’s current corrective phase, it adds. [...]

“The end of the implosion in credit quality has also helped support profits, but there has been a massive amount of wealth destruction. This implies that credit creation will remain weak and it will be difficult for the financial sector to re-expand.

“As long as credit growth remains flaccid, hiring stays weak and inflation non-existent, there’s no logical reason for the Fed to start tightening. And with short-term rates (and inflation) hovering near zero, a sub-3% 10-year Treasury and a long bond under 4% hardly seem unreasonable.

Now, if there’s meaningful data point out there to be mined, you can pretty much rest assured that David Rosenberg has mined it. And, in fact, his current presentation includes a slide, which I’ve replicated below, that shows the extent of the problem described by Mr. Forsyth via David Resler and BCA Daily Insights:

Re: Perspectives on the global economic meltdown (Jan 26 201

Myths of the Greenspan Era:

http://www.thestreet.com/story/10265345 ... n-era.html

July 20, 2004: Greenspan testified before Congress saying that rising energy prices “should prove short-lived.” Crude prices tripled form there.

Summer 2004: Greenspan’s advice to would-be homeowners: Consider adjustable-rate mortgages. Surprising advice, considering that fixed-rate loans were near half-century lows. He then started raising rates, contributing to the huge foreclosure surge.

May 2003: Greenspan made an amazingly bad call on natural gas when he warned of potential shortages; natural gas prices tumbled shortly thereafter.

Summer 2003: Fed concern about deflation led Greenspan to suggest the Fed stood ready to make open-market purchases of Treasuries to ensure rates stayed low. He even convinced the Treasury market into believing that rates would stay low for a long, long time. Bond buyers discovered (to the detriment of their holdings) that this statement was false.

October 1999: The Fed erroneously anticipates a Y2K-induced run on the banks, and it infuses liquidity. That surge in money supply effectively doubled the Nasdaq Composite from October 1999 to March 2000; I presume you recall how that ended.

1996: “How do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions?” Markets proceeded to rally strongly for another four years.

Greenspan is arguably the most incompetent economist of his generation, yet still retains some credibility amongst the uninformed. OpEds such as this one serve as reminders of that . . .

Re: Perspectives on the global economic meltdown (Jan 26 201

Former UK Chancellor Slams Bold New Budget:

Re: Perspectives on the global economic meltdown (Jan 26 201

BBC World service has a two part segment on Tiger vs Dragon, the story of rise of India and China :

Tiger vs Dragon

Will x-post in Strat Forum too.

Tiger vs Dragon

Will x-post in Strat Forum too.

Re: Perspectives on the global economic meltdown (Jan 26 201

Jobless aid measure dying in Senate

http://www.google.com/hostednews/ap/art ... gD9GHQMKG0

Republicans in the Senate appear likely to kill legislation to provide continued unemployment checks to millions of people and provide states with billions of dollars to avert layoffs.

It would be a bitter defeat for President Barack Obama and Capitol Hill Democrats, who have been trying to advance the measure for months as an insurance policy against a double-dip recession.

http://www.google.com/hostednews/ap/art ... gD9GHQMKG0

Republicans in the Senate appear likely to kill legislation to provide continued unemployment checks to millions of people and provide states with billions of dollars to avert layoffs.

It would be a bitter defeat for President Barack Obama and Capitol Hill Democrats, who have been trying to advance the measure for months as an insurance policy against a double-dip recession.

Re: Perspectives on the global economic meltdown (Jan 26 201

Why do western reporters want to associate India with tiger, instead of elephant. Tigers are old Asian tigers.ramana wrote:BBC World service has a two part segment on Tiger vs Dragon, the story of rise of India and China :

Tiger vs Dragon

In fact India is more like elephant. It is huge, generally peaceful, it takes time to act/react, and once it does it is unstoppable.

Re: Perspectives on the global economic meltdown (Jan 26 201

The Royal Bengal Tiger is associated with India.

Re: Perspectives on the global economic meltdown (Jan 26 201

Then, why don't they associate Panda with China? Other than BRF guys, I haven't seen anybody doing that.

Re: Perspectives on the global economic meltdown (Jan 26 201

desi guy anyway - perhaps he likes ferocious animals, in order to depict confrontationIn this provocative series of programmes, Mukul Devichand travels across frontiers, from the controversial new ports China is building in the Indian Ocean to the poor interior villages of these continent-sized countries.

Re: Perspectives on the global economic meltdown (Jan 26 201

probably the same reason they don't associate cow with India.Then, why don't they associate Panda with China?

cow vs dragon is more apt.

the cow is peaceful, she is slow but can plough fields, give milk and transport goods.

the dragon on the other hand is looking to start wars and out-produce & out-save the great eagle.

Re: Perspectives on the global economic meltdown (Jan 26 201

Excellent interview with Jim Rickards by Eric King of the King News Network.

----

Monday, June 14, 2010

Jim Rickards is Senior Managing Director for Market Intelligence at Omnis, Inc.

In this interview Jim discusses his recent meetings at the US Treasury and the FDIC, the fact that we are headed towards a one world currency and bank, that the G-20 and IMF do not want it to be backed by gold, that he thinks any green shoots will be stomped on immediately and much more

http://www.kingworldnews.com/kingworldn ... 3A2010.mp3

----

Monday, June 14, 2010

Jim Rickards is Senior Managing Director for Market Intelligence at Omnis, Inc.

In this interview Jim discusses his recent meetings at the US Treasury and the FDIC, the fact that we are headed towards a one world currency and bank, that the G-20 and IMF do not want it to be backed by gold, that he thinks any green shoots will be stomped on immediately and much more

http://www.kingworldnews.com/kingworldn ... 3A2010.mp3

Re: Perspectives on the global economic meltdown (Jan 26 201

paramu wrote:Why do western reporters want to associate India with tiger, instead of elephant. Tigers are old Asian tigers.ramana wrote:BBC World service has a two part segment on Tiger vs Dragon, the story of rise of India and China :

Tiger vs Dragon

In fact India is more like elephant. It is huge, generally peaceful, it takes time to act/react, and once it does it is unstoppable.

Elephant is normally what is associated with India in the west, but the guy is SDRE so he picked the tiger I guess.

Re: Perspectives on the global economic meltdown (Jan 26 201

Since most of us on this thread follow finance, why don't we trade stock tips?  It would be interesting to share ideas on the thread for investments.

It would be interesting to share ideas on the thread for investments.

Re: Perspectives on the global economic meltdown (Jan 26 201

^^ I've been sitting in cash after jumping out of BP. Friggin Obama wiped out my gains for the year with his ranting on BP and shaking them down for 20 bills. The BP chairman was spineless and threw share holders under the bus and worse yet, did not even negotiate a hard cap on their liabilities before giving away 20 bills of investor money. That's what convinced me the leadership of the company was worthless and my decision to get out was sound.

Since then its gone down further. I pity all the UK pension funds which are seeing their retirement nest egg being wiped out.

Some of my happier moments have been shorting SLV at its 19 peak and reaping a wind fall of profits. Plus my gold investments which have moved up. I keep converting paper profits into physical in anticipation of a total collapse of fiat within 3 to 10 years, perhaps after moving to an international SDR type currency which will prove just as worthless as national fiat. Also a networking products company which I had put options on just before their stock fell like a toilet seat to my delight. And my puts on Harley Davidson which paid off.

Some penny stock gold miners have been ho-hum and i've traded them for small potatoes. I'm waiting for my ship to come in on some penny stock petro producer in Brazil which looks promising or maybe they are just bullsh*tting (no news from them since April). I narrowly avoided disaster by cashing out profitably from a penny stock company involved in stem cell therapy - just before their failed Phase II results came out and bombed their share holders.

For now I'm sitting in cash and keeping the powder dry to December waiting for the market to keel over. I need to break from this casino game to focus on more important things.

What's in your wallet ?

Since then its gone down further. I pity all the UK pension funds which are seeing their retirement nest egg being wiped out.

Some of my happier moments have been shorting SLV at its 19 peak and reaping a wind fall of profits. Plus my gold investments which have moved up. I keep converting paper profits into physical in anticipation of a total collapse of fiat within 3 to 10 years, perhaps after moving to an international SDR type currency which will prove just as worthless as national fiat. Also a networking products company which I had put options on just before their stock fell like a toilet seat to my delight. And my puts on Harley Davidson which paid off.

Some penny stock gold miners have been ho-hum and i've traded them for small potatoes. I'm waiting for my ship to come in on some penny stock petro producer in Brazil which looks promising or maybe they are just bullsh*tting (no news from them since April). I narrowly avoided disaster by cashing out profitably from a penny stock company involved in stem cell therapy - just before their failed Phase II results came out and bombed their share holders.

For now I'm sitting in cash and keeping the powder dry to December waiting for the market to keel over. I need to break from this casino game to focus on more important things.

What's in your wallet ?

-

derkonig

- BRFite

- Posts: 951

- Joined: 08 Nov 2007 00:51

- Location: Jeering sekular forces bhile Furiously malishing my mijjile @ Led Lips Mijjile Malish Palish Parloul

Re: Perspectives on the global economic meltdown (Jan 26 201

The elephant is for real. The dlagon, with all its 10% growth & super-duper might, is still a mythical creature. The spinmasters must highlight that.

Re: Perspectives on the global economic meltdown (Jan 26 201

'Britain pays the price of penury' By Philip Stephens.

Image by Ingram Pinn. http://tinyurl.com/2eh68m7

Re: Perspectives on the global economic meltdown (Jan 26 201

this url works better:Acharya wrote:'Britain pays the price of penury' By Philip Stephens.

Image by Ingram Pinn. http://tinyurl.com/2eh68m7

http://www.ft.com/cms/s/0/605fed7e-7ff0 ... abdc0.html

-

abhischekcc

- BRF Oldie

- Posts: 4277

- Joined: 12 Jul 1999 11:31

- Location: If I can’t move the gods, I’ll stir up hell

- Contact:

Re: Perspectives on the global economic meltdown (Jan 26 201

^ Aren't you forgetting Laloo, Jayalalitha, and Mamtadi?

PS Mamta is a tragicomic, she has rightly earned the sobriquet 'Sorrow of Bengal' after Jyoti Basu went the Netherworlds.

PS Mamta is a tragicomic, she has rightly earned the sobriquet 'Sorrow of Bengal' after Jyoti Basu went the Netherworlds.

Re: Perspectives on the global economic meltdown (Jan 26 201

Many in the media are either too complicit, too confused or too lazy to contradict the SPIN on various HEADLINES on Economic Reforms, Housing etc, but the rest of us shouldn’t buy ALL that

Latest nuggets:

http://www.nakedcapitalism.com/2010/06/ ... -well.html

http://www.ritholtz.com/blog/2010/06/wa ... ca-suffers

http://www.ritholtz.com/blog/2010/06/gr ... ory-reform

http://www.ritholtz.com/blog/2010/06/2n ... in-housing

http://www.ritholtz.com/blog/2010/06/co ... uy-vs-rent

http://globaleconomicanalysis.blogspot. ... ticle.html

Latest nuggets:

http://www.nakedcapitalism.com/2010/06/ ... -well.html

http://www.ritholtz.com/blog/2010/06/wa ... ca-suffers

http://www.ritholtz.com/blog/2010/06/gr ... ory-reform

http://www.ritholtz.com/blog/2010/06/2n ... in-housing

http://www.ritholtz.com/blog/2010/06/co ... uy-vs-rent

http://globaleconomicanalysis.blogspot. ... ticle.html

Re: Perspectives on the global economic meltdown (Jan 26 201

Housing Fundamentals

Boomers looking to downsize will add to housing supply.

Foreclosures will continue to add to supply for several more years.

Shadow housing inventory is massive.

Global growth is slowing. This will affect exports and jobs.

Bank balance sheets are tremendously weak. Don't expect lending to pick up or businesses to go on hiring sprees anytime soon.

Unemployment is 10% and going to stay high for a decade.

The economy is poised for a double-dip recession, assuming you believe the economy exited the last recession.

Kids are graduating college hundreds of thousands of dollars in debt with no way to pay it back. They cannot afford houses and are delaying family formation.

Nearly anyone who wants a house and can afford a house already has a house.

Debt deflation will be in play for a decade.

Attitudes towards housing have changed. A few years ago people thought of housing as an ATM as well as a retirement plan. Most people now realize a house is a place to live and a mortgage is a liability not an asset.

Attitudes toward debt have changed. Kids have seen their parents argue and worry about mortgage payments, credit card payments, and jobs. They will not want to get in trouble like their parents did.

15 million homeowners are underwater on their mortgage according to Moody's Economy.com. Those 15 million homeowners are literally trapped in their home unable to sell and unable to move.

Boomers looking to downsize will add to housing supply.

Foreclosures will continue to add to supply for several more years.

Shadow housing inventory is massive.

Global growth is slowing. This will affect exports and jobs.

Bank balance sheets are tremendously weak. Don't expect lending to pick up or businesses to go on hiring sprees anytime soon.

Unemployment is 10% and going to stay high for a decade.

The economy is poised for a double-dip recession, assuming you believe the economy exited the last recession.

Kids are graduating college hundreds of thousands of dollars in debt with no way to pay it back. They cannot afford houses and are delaying family formation.

Nearly anyone who wants a house and can afford a house already has a house.

Debt deflation will be in play for a decade.

Attitudes towards housing have changed. A few years ago people thought of housing as an ATM as well as a retirement plan. Most people now realize a house is a place to live and a mortgage is a liability not an asset.

Attitudes toward debt have changed. Kids have seen their parents argue and worry about mortgage payments, credit card payments, and jobs. They will not want to get in trouble like their parents did.

15 million homeowners are underwater on their mortgage according to Moody's Economy.com. Those 15 million homeowners are literally trapped in their home unable to sell and unable to move.

Re: Perspectives on the global economic meltdown (Jan 26 201

In 1992, some 4 million homes per year were being purchased. A decade later, that number had risen 25% to 5 million. A mere 3 years later, annual sales were 7 million units — a 40% increase. From 2002 to 2007, the abdication of lending standards — who cares about credit scores, incomes, debt load, assets, even job! — created millions of new homeowners. And thanks to the ultra low rates, prices had exploded. The combination of brand new, unsophisticated buyers and rapidly rising prices was a dangerous combination.

Buyers of limited financial means who en masse overpaid for their houses at ultra low rates was a recipe for disaster. The Fed began its cyclical tightening, price appreciation slowed, then reversed. Sales plummeted, and prices fell. Five million of those buyers were foreclosed upon, with another 5 million likely to come.

Which more or less brings you up to date.

Buyers of limited financial means who en masse overpaid for their houses at ultra low rates was a recipe for disaster. The Fed began its cyclical tightening, price appreciation slowed, then reversed. Sales plummeted, and prices fell. Five million of those buyers were foreclosed upon, with another 5 million likely to come.

Which more or less brings you up to date.

Re: Perspectives on the global economic meltdown (Jan 26 201

http://www.ritholtz.com/blog/2010/06/th ... recession/

The Risk of Recession

I am on record as saying I think there is a 50-50 chance we slip back into recession in 2011, as I think the economy will soften in the latter half of the year and a large tax increase in 2011 (from the expiring Bush tax cuts) will tip us into recession.

This was not based on data, but rather on research which shows that tax cuts or tax increases have as much as a 3-times multiplier effect on the economy. If you cut taxes by 1% of GDP then you get as much as a 3% boost in the economy. The reverse is true for tax increases. Christina Romer, Obama’s head of the Council of Economic Advisors, did the research along with her husband, so this is not a Republican conclusion.

If the economy is growing at less than 2% by the end of the year, then a tax increase of more than 1% of GDP could and probably would be the tipping point. Add in an almost equal amount of state and local tax increases (and spending cuts) and you have the recipe for a full-blown recession – at least the way I see it.

I was asked at my recent speech in Milan, what sorts of things could make me wrong? There are a few. First, it could be that tax increases and cuts don’t matter. Some very smart people (like Paul McCulley) feel that tax increases on the wealthy don’t really figure into Romer’s analysis.

Or maybe bank lending starts to pick up and the economy is actually growing at 3-4% by the end of the year – although the chart below suggests that bank lending is still in freefall. Notice that if this trend continues just a little while longer, bank lending will have fallen by 25% in about two years. This is a truly scary chart. It is unprecedented in modern history. Also notice that after the 2001 recession bank lending continued to fall for over two and a half years.

Re: Perspectives on the global economic meltdown (Jan 26 201

Interesting commentary on GLD & GDX

[youtube]<object width="640" height="385"><param name="movie" value="http://www.youtube.com/v/9dwD91kSuKc&hl ... ram><param name="allowFullScreen" value="true"></param><param name="allowscriptaccess" value="always"></param><embed src="http://www.youtube.com/v/9dwD91kSuKc&hl=en_US&fs=1&" type="application/x-shockwave-flash" allowscriptaccess="always" allowfullscreen="true" width="640" height="385"></embed></object>[/youtube]

[youtube]<object width="640" height="385"><param name="movie" value="http://www.youtube.com/v/9dwD91kSuKc&hl ... ram><param name="allowFullScreen" value="true"></param><param name="allowscriptaccess" value="always"></param><embed src="http://www.youtube.com/v/9dwD91kSuKc&hl=en_US&fs=1&" type="application/x-shockwave-flash" allowscriptaccess="always" allowfullscreen="true" width="640" height="385"></embed></object>[/youtube]