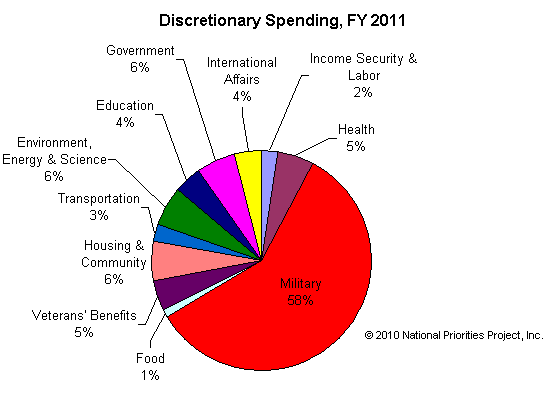

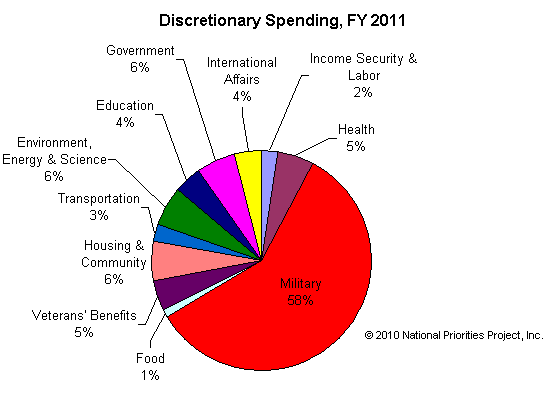

Here you go. This is why all those government slashers are talking out of their A$$. All the way from Reagan.

Sorry, but it isn't that easy. I have mentioned that several times for those who think ditching USD for a different currency will destroy US economy.shyam wrote:Iran and Russia drop dollar for their own currencies in bilateral tradeDuring the last two years Iran has been replacing the dollar with other currencies in its world trade.

Iran has replaced the dollar in its oil trade with India, China, and Japan. Late in November the Reserve Bank of India issued the needed permission to the Central Bank of Iran to open rupee accounts with two Indian banks, UCO and IDBI, as a long-lasting solution to the two countries' payment problems.

Both accounts were opened in the respective banks' Mumbai branches.

A top official of city-based UCO Bank said that while payments for his country's oil imports would initially be in rupees, it would be then converted into a separate currency, which was yet to be decided by the apex bank.

The government has told refiners to reduce Iranian oil imports and find alternatives as New Delhi may not seek a waiver that would protect buyers of Tehran's oil from a fresh round of U.S. sanctions, two industry sources said on Wednesday.

India is Iran's second largest crude buyer after China, importing 350,000-400,000 barrels per day (bpd) of oil worth $12 billion annually.

New Delhi has struggled to pay for the crude due to existing sanctions for more than a year, and fresh measures from the United States aimed at isolating Iran over its nuclear programme will make payment even harder.

The European Monetary Union was flawed from the start. Lacking in a unified fiscal framework, it was only a matter of when before an asymmetrical shock drew the grand experiment into question. All it took was a wrenching global recession in 2008-09 to unmask the undisciplined fiscal profligacy of Ireland, Greece, Portugal, Spain, and Italy. And now the sub-optimal currency union is in danger of disintegration.

Almost 14 years ago we had the Asian financial crisis, but it was a child's play compared with what the world is going through today. It certainly didn't seem that way at the time.

Global institutions have responded very differently to these two crises. The IMF led the way in mustering back-stop financing for Asia's crisis-torn economies in the late 1990s, imposing sharp conditions of structural reforms as the price for any bailout. No such conditionality is being imposed on today's crisis economies. Instead, an unconditional fix is offered in the form of open-ended monetary expansion — setting the stage for yet another crisis in the not-so-distant future.

Tough conditionality taught Asia's developing economies very important lessons nearly 14 years ago. Still steeped in denial, the developed world has yet to learn its most important post-crisis lesson — the trade-off between a growth sacrifice and the asset and credit bubbles of a false prosperity.

A lot of the blame for the current crisis has been put on the doorstep of debt. Debt itself is not the problem. It is symptomatic of a far more insidious disease — a reckless disregard of financial and economic stability. Debt becomes a serious problem when it is held against low-quality collateral (i.e., property bubbles) and subsidised by unsustainably low interest rates. In an era of seemingly unending asset bubbles and near-zero policy interest rates of most major central banks, that remains very much a real concern.

Rather than attempt to regulate the expansion of global debt, the world would be much better served if major central banks were all on the same page with respect to targeting financial stability. The incidence of asset and credit bubbles would then hopefully diminish — as would the systemic risks they spawn across financial markets. A comparable focus should be imposed on fiscal authorities in an effort to prevent the substitution of public for private sector debt. Excess debt is an outgrowth of an increasingly unstable and unbalanced world. I am not sure if countries appreciate the magnitude of the problem.

Yet, the crisis has taught us a few things that we would do well not to forget. At the top of my list is a revamping of the role and conduct of monetary policy. While central banks did a masterful job in winning the war against inflation, they failed to preserve the peace. Fixated on achieving a narrow CPI price stability, they failed to heed the warnings of prices in asset and credit markets. A financial stability mandate — with monetary authorities required to target asset and credit markets as well as growth and inflation — would go a long way in addressing a major source of systemic risk in the world today.

Second, savings has lost its way as a centrepiece of the macro debate. Harkening back to the 1930s and Keynes's warnings of the 'paradox of thrift', the broad consensus is that saving incentives have no place in the policy debate for saving-short economies like the US. I respectfully disagree. America needs sharply expanded saving incentives to fund retirement income for 77 million baby boomers. It also needs saving to wean itself from outsize current account deficits — and the massive multilateral trade imbalances they spawn. Any such incentives should be phased in over time.

Third, the 'open economy' models of macro are primitive compared with where globalisation has taken the world economy over the past dozen years. Ever-powerful cross-border linkages as manifested in the form of rapidly increasing flows of trade, capital, labour and information speak to a critical and long overdue revamping imperative for so-called modern macro models. An important corollary of this conclusion raises serious questions about the time-worn 'closed economy' models of decoupling.

Dont know about China, but what is said about India is absolutely true. Like they say up there in north, "16 annas truth." There are even indications that GoI might ask PSUs to give it more "dividends" so as to overcome its profligacy. Talk about parents fleecing their children just so as to spend money.China is bringing inflation under control and has a small budget deficit, Roach said in an interview today with Bloomberg Television. In contrast, India has a currency under pressure, an “inflation problem” and a large fiscal shortfall, he said.

How well is China able to converts its export-oriented economy to a more consumer led economy is yet to be seen. Moreover if China transforms itself into a consumer led economy, it either means that its overall exports and imports are balanced or worse its imports exceed its exports.Roach said today that China is “very serious about engineering a shift” from an investment- and export-led economy to consumer-driven growth.

“You’ll be pleasantly surprised at the progress they make in building out a consumer-led growth model,” he said. “I’m of the view that we can look for positive surprises from China not negative surprises.”

GERMANY'S economy contracted in the fourth quarter, putting it at risk of a shallow recession at a time when eurozone countries struggling with their debts are looking to the bloc's biggest economy to give the region a lift.

Germany's stagnation, after two years of strong growth, could fuel further international calls for the country to stimulate growth. Economists said Germany's nearly balanced budget and ability to borrow money at low cost gives it the scope to boost growth that few others in Europe have.

But German Chancellor Angela Merkel is unlikely to switch her focus from budget austerity to stimulus measures -- unless a more-severe recession threatens the country, something economists say could happen if the debt crisis in the eurozone's weaker members spirals out of control.

What empty headed prattle. As far I can remember this has been the nature of the Indian economy. It is not going to change.China is bringing inflation under control and has a small budget deficit, Roach said in an interview today with Bloomberg Television. In contrast, India has a currency under pressure, an “inflation problem” and a large fiscal shortfall, he said.

Standard & Poor's downgraded the credit ratings of nine euro- zone countries, stripping France and Austria of their coveted triple-A status but not EU paymaster Germany, in a Black Friday the 13th for the troubled single currency area. "Today's rating actions are primarily driven by our assessment that the policy initiatives that have been taken by European policymakers in recent weeks may be insufficient to fully address ongoing systemic stresses in the eurozone," the U.S.-based ratings agency said in a statement.

S&P cut the ratings of Italy, Spain, Portugal and Cyprus by two notches and the standings of France, Austria, Malta, Slovakia and Slovenia by one notch each.

The move puts highly indebted Italy on the same BBB+ level as Kazakhstan and pushes Portugal into junk status.

It put 14 euro-zone states on negative outlook for a possible further downgrade, including France, Austria, and still triple-A-rated Finland, the Netherlands and Luxembourg.

Germany was the only country to emerge totally unscathed with its triple-A rating and a stable outlook.

So basically Portugal's Bonds are worthless, as per S&P. That means that Portugal's Sovereign bonds should no longer form a part of Tier-1 capital of Banks. The other non-banking financial institutions, like money-market funds, pension funds, etc. will now either have to dump these bonds or retain them and still buy some other very high-rated bonds.pankajs wrote:S&P downgrades nine euro zone nationsThe move puts highly indebted Italy on the same BBB+ level as Kazakhstan and pushes Portugal into junk status.

A sad demise.Kodak was founded by George Eastman, who developed a method for dry-plate photography before introducing the Kodak camera in 1888, according to the company’s website. It went on to invent film, enabling Thomas Edison to develop the motion picture camera, Brownie cameras selling for $1 and Kodachrome film.

Paul Simon immortalized the film in his 1973 song “Kodachrome.” The single, which praised Kodachrome’s “nice bright colors,” peaked at No. 2 on the Billboard Hot 100 chart. Kodak stopped producing the film in 2009.

“Everyone in the 20th century has been familiar with the Kodak name and its products,” said Burley of Ryerson’s School of Image Arts. “We’ve not only used them to memorialize our families and their histories, but also for diagnostics in hospitals, producing books and newspapers and police investigative work. And then the whole world of Hollywood is based around Kodak products.”

......................

The company also invented the first digital camera in 1975, which it shelved because it would threaten its lucrative film business, Perez said in an interview in March.

“Like many other companies on the East Coast, Kodak has been phenomenal in research and patents and not so good commercializing things, actually terrible commercializing things,” Perez said.

Had Bernard Shaw alive, he would have told "White man is a burden."The Washington-based lender is aiming to increase its resources after identifying a potential need for $1 trillion in financing in coming years, an IMF spokesman said in a statement. The IMF is studying options and will not comment further until it has consulted its members, the fund said. To incorporate a cash buffer, the lender is seeking a total $600 billion.

IMF Managing Director Christine Lagarde said yesterday her staff is looking at ways to expand the fund’s war-chest, which currently has about $385 billion available. While euro-region nations have already pledged to contribute 150 billion euros ($192 billion), the U.S. has said it has no plans to make new bilateral loans and leaders of Group of 20 nations ended last year at odds over the issue.

................

The IMF is pushing China, Brazil, Russia, India, Japan and oil-exporting nations to be the top contributors, according to a G-20 official, who spoke on condition of anonymity because the talks are private. The fund wants a deal struck at the Feb. 25- 26 meeting of G-20 finance ministers and central bankers in Mexico City, the official said.

The incredible shrinking UK economyJohn Ross, Visiting Professor at Antai College of Economics and Management at Jiao Tong University in Shanghai writes a real stunner on his blog Key Trends in Globalisation:

The magnitude of the blow suffered by the UK economy since the beginning of the financial crisis is very considerably minimized by not presenting it in terms of a common international yardstick. Gauged by decline in GDP, using a common international purchasing measure, dollars, no other economy in the world has shrunk even remotely as much as the UK.

As most countries produce only annualized GDP data it will be necessary to wait before a comprehensive global comparison can be made for 2011. However it is clear no substantial growth in dollar terms took place in the UK economy during that year – GDP at national current prices rose only 1.4 per cent between the 1st and 3rd quarters and the change in the pound’s exchange rate against the dollar during the year was a marginal 0.3 per cent.

Therefore there will have been no significant recovery from the UK data set out in Table 1 below, and the gap between the UK and other European economies, which form the next worst performing major group, is too great to have been qualitatively affected by changes in the Euro’s exchange rate – the Euro declined against the pound by only 3.3 per cent in 2011.

Table 1 shows that the fall in UK GDP in 2007-2010 was $562 billion compared to the next worst performing national economy, Italy, with a decline of $65 billion – i.e. the decline in UK GDP in the common measuring yardstick of dollars was more than 8 times that of the next worst performing national economy. Table 1 shows the 10 national economies suffering the greatest declines in dollar GDP.

It is also extremely striking that the UK’s decline was more than two and a half times that of the entire Eurozone.

The UK accounted for a somewhat astonishing 77% of the EU's decline.

And yada yada...Expressed in percentage terms the situation is no better. Of all economies for which World Bank data is available only Iceland, with a decline in dollar GDP of 38.4%, suffered a worst percentage fall than the UK - even bail out economy Ireland, with a fall of 18.4%, outperformed the UK economy.

Two trends intersected for the UK's performance to be so much worse than that of any other economy. First, contrary to the government's anti-European rhetoric, UK economic performance in constant price national currency terms has been significantly worse than the Eurozone during the financial crisis (Figure 2). [..]

... between the beginning of 2008 and the beginning of 2012, the pound's exchange rate has fallen by 21.0% against the dollar compared to the Euro's 11.4% drop in the same period. The multiplicative effect of the severity of the relative drop in constant price GDP and the fall in the pound's exchange rate accounts for the unequalled decline in UK GDP in dollars.

But how is it fair to measure Briturd GDP in USD and roar decline alarms?As at present the UK economy shows no substantial sign of recovery, the present UK government, which maintains a steadfastly ostrich like attitude towards Europe in particular, and most other countries in general, may argue that a measure in terms of dollars at current exchange rates is irrelevant – the UK currency is the pound and what counts is constant price shifts. Such an argument is false and an attempt to disguise the true scale of the decline of the UK economy.

The internationally unmatched decline in UK dollar GDP is a huge fall in real international purchasing ability. The far higher than targeted inflation in the UK during the last two years, which has substantially eroded the population's living standards, is itself in part a reflection of the decline in the UK's exchange rate and consequent raising of import prices. In short, the decline in the international purchasing power of the UK's economy translates into a direct fall in real incomes.

It may also be seen that the government's claim that the UK is outperforming Europe and the Eurozone is entirely without foundation even in constant price national currency terms. But when measured in terms of real international comparisons, i.e. in dollars, the UK's performance is incomparably worse than Europe's.

Well, by that logic, we are all fooked only. INR loses something like ~20+% against the USD in like the past 6 months odd, no? Same story, no? Somehow, am unconvinced UKstan is that badly off in this crisis.If you would turn it around, and measure US GDP in pounds, you'd see a huge increase in US GDP, something we all know would be baloney. If you take Italy, and see that, first, the Euro lost 11.4% vs the USD, and then that Italy lost "only" 3.1% of GDPvsUSD, and Spain just 2.4%, you're starting to see a picture emerge.

[...]

I find it an interesting approach. If and when your currency declines/rises, and you calculate your GDP in that currency, needless to say that really influences the picture.

And yeah, since the pound lost 21% vs the USD over the period involved, "Dollar/GDP" is real different from "Pound/GDP". And different in a way that Cameron won't like.

And it's not like you're using forint or some other relatively obscure currency, the USD is the reserve currency. What do I care, you say? Well, Britain has to pay for many of its international purchases, like petrol, in USD. That 21% decline, therefore, truly hurts.

[...]

Calculating your own GDP solely in your own currency is misleading, provided you are active in international markets, where your currency is not the standard.

Makes sense. If the above two events were to happen, then everybody would be happy. The ratings agency would say that they have carried out their mandate and labeled Greece as default. While the CDS for the Greek Bonds would not be triggered. Thus everybody is happy, the ratings agency are redeemed the entities issuing the CDS are not faced with bankruptcy, everybody is happy.Fitch Ratings has said the October agreement would amount to a “default event” once implemented, while the International Swaps and Derivatives Association has said it wouldn’t trigger credit-default swaps bought by investors as insurance against the country failing to meet its obligations.

Shilling says new global recession is here

Commentary: Europe leads downturn, U.S. poised for milder decline

By Howard Gold

NEW YORK (MarketWatch) — For most economists, the main question is whether we will have a new recession. For Gary Shilling, the only question is how big.

Unlike many gloom and doomsters, Shilling is a genial sort who likes cracking jokes and keeps bees as a hobby. But when it comes to economics he’s dead serious: He’s been consistently gloomier than the economic fraternity and consistently right over the past few years.

Now, he parts ways with his peers again by declaring that a new global recession already has begun in Europe and that it will touch our shores soon.

That, of course, would be a nightmare for the few bulls left on Wall Street and for President Obama’s re-election team, who are crossing their fingers and toes that Europe doesn’t implode before November.

Shilling thinks Europe fell into recession last quarter — not every country, perhaps, but enough of them to drag the continent down into the muck.

And here’s the really bad news: He thinks Europe will experience a recession as deep as ours was from 2007-2009 — enough to tip the U.S.’s relatively better economy into recession, too, during the first quarter of 2012.

And he’s looking for a hard landing in China, as consumers in contracting developed economies tighten their belts.

Shilling starts from the proposition, spelled out in his book “The Age of Deleveraging,” that the world and especially the United States had a credit bubble that lasted for decades until 2007 when the debt-ridden U.S. housing market collapsed. The bursting of that bubble was like an economic Big Bang whose effects will be felt for years as households deleverage.

Too much debt to deal with

He agrees with the research of Carmen Reinhart and Kenneth Rogoff who studied financial crises over several centuries and found that major crises of the kind we experienced start with too much debt in the private sector.

Then, governments step in to “save” the financial system by taking on the liabilities of financial institutions and sometimes individuals. But as public debt grows too large, it curtails economic growth, Reinhart and Rogoff found, prolonging the agony and making it harder for countries to recover.

SETH GODIN: If You're An Average Worker, You're Going Straight To The Bottom

The way we do business is changing fast and in order to keep up, your entire mentality about work has to change just as quickly.

Unfortunately, most people aren't adapting fast enough to this change in the w

orkplace, says marketing guru Seth Godin in an interview with the Canadian talk show "George Stroumboulopoulos Tonight" (via Pragmatic Capitalism).

According to the founder of Squidoo.com and author or 13 books, the current "recession is a forever recession" because it's the end of the industrial age, which also means the end of the average worker.

"For 80 years, you got a job, you did what you were told and you retired," says the former vice president of direct marketing at Yahoo! People are raised on this idea that if they pay their taxes and do what they're told, there's some kind of safety net, or pension plan that's waiting for them. But the days when people were able to get above average pay for average work are over.

If you're the average person out there doing average work, there's going to be someone else out there doing the exact same thing as you, but cheaper. Now that the industrial economy is over, you should forget about doing things just because it's assigned to you, or "never mind the race to the top, you'll be racing to the bottom."

However, if you're different somehow and have made yourself unique, people will find you and pay you more, Godin says.

Instead of waiting around for someone to tell you that you matter, take your career into your own hands. In other words, don't wait for someone else to pick you and pick yourself! If you have a book, you don't need a publisher to approve you, you can publish it yourself. It's no longer about waiting for some big corporation to choose you. We've arrived at an age where you choose yourself.

Read more: http://www.businessinsider.com/if-youre ... z1k2Wb4u2I

Take the iPad, which America imports from China even though it is entirely designed and owned by Apple, an American company. iPads are assembled in Chinese factories owned by Foxconn, a Taiwanese firm, largely from parts produced outside China. According to a study by the Personal Computing Industry Centre, each iPad sold in America adds $275, the total production cost, to America’s trade deficit with China, yet the value of the actual work performed in China accounts for only $10. Using these numbers, The Economist estimates that iPads accounted for around $4 billion of America’s reported trade deficit with China in 2011; but if China’s exports were measured on a value-added basis, the deficit was only $150m.

OTvina wrote:Contrast that with what we have , a half mumbling, "speech reader" , whom we don't even know what he and his party stand for, leading to the leader of the opposition to call him "invisible"!

And still there are people out there who want India to emulate China, steal Chinese manufacturing jobs. Set up SEZs, and god knows what else. It is not that China's path is flawed or broken or bad. China and consequently Chinese have taken steps which they are comfy with. I dont see India or Indians being comfy with the same steps.ArmenT wrote:iPadded - The trade gap between America and China is much exaggerated

Interesting look at the trade deficit between the US and China.Take the iPad, which America imports from China even though it is entirely designed and owned by Apple, an American company. iPads are assembled in Chinese factories owned by Foxconn, a Taiwanese firm, largely from parts produced outside China. According to a study by the Personal Computing Industry Centre, each iPad sold in America adds $275, the total production cost, to America’s trade deficit with China, yet the value of the actual work performed in China accounts for only $10. Using these numbers, The Economist estimates that iPads accounted for around $4 billion of America’s reported trade deficit with China in 2011; but if China’s exports were measured on a value-added basis, the deficit was only $150m.

The roving cavaliers of credit strike again. These countries like Greece and Ireland are sovereign but in name only. In truth, their future is pawned only. Iceland is sovereign, still. Paid a steep price for it of course but then is any price too steep to pay for it?The number of homeless people in Greece has been on the rise since the debt crisis hit the country; they cut across genders, races, ethnic backgrounds and social classes

Too big to failnachiket wrote:I have never understood this. The countries above Greece in that chart Theo has posted should be deeper in pakistan than Greece no? How come UK and japan are sitting pretty even with all that debt?