This guy is a true-blue Bitcoin star....he's also just submitted a proposal for DAO implementation of a venture that would drastically bring down costs of international arbitration: http://www.coindesk.com/damned-dao-andr ... third-key/Neshant wrote:

Perspectives on the global economic changes

Re: Perspectives on the global economic changes

Re: Perspectives on the global economic changes

Greenspan: Western World Headed for a State of Disaster

Since 1975, the sum of gross domestic savings and entitlements as a percentage of GDP has been remarkably flat and what that tells us is all the way back to ’65 we have essentially been seeing a one Dollar to one Dollar tradeoff between entitlement growth and gross savings decline. And despite the fact that we are borrowing savings from abroad its’ kept our rate of capital investment as a percent of GDP going down

Greenspan who is “not exactly” a fan of Donald Trump or Hillary Clinton also discussed their opposition to trade deals and why they are critical to economic growth.

“People don’t realize, they think that you’re going to shut off, for example, imports from China, that somehow will create jobs in the United States -- it doesn’t. Instead of getting goods out of China you will get them out of the Philippines or someplace else. But before they come back to the United States, they will try other places around the world where labor costs are perceived to be cheaper. So the issue of foreign trade is something which has helped the country grow all the way back to 1790 and the presumption that of sudden we’re turning off on trade is very narrow-minded in my impression,” he said.

Re: Perspectives on the global economic changes

Greenspan is the father of crony capitalism.

Re: Perspectives on the global economic changes

How do you know when oil-super-rich countries are royally f*^@%#ed up?? When they issue debt...  and come to rely on it to run their countries.

and come to rely on it to run their countries.

Qatar Stuns Mideast Debt Market With Record $9 Billion Bond (Bloomberg)

Saudi Arabia Said to Eye Bond Sale of as Much as $15 Billion (Bloomberg)

UAE expects to ratify federal debt law this year, official says (Reuters)

Qatar Stuns Mideast Debt Market With Record $9 Billion Bond (Bloomberg)

Saudi Arabia Said to Eye Bond Sale of as Much as $15 Billion (Bloomberg)

UAE expects to ratify federal debt law this year, official says (Reuters)

The United Arab Emirates is likely to ratify a law by the end of this year that will allow the federal government to issue bonds, after which the UAE would issue about 80 billion to 100 billion dirhams ($22 billion to $27 billion) worth of debt, a senior finance ministry official said....

Re: Perspectives on the global economic changes

If these Nations are raising debt instead of buying US debt, will it not be double whammy for USA?

Re: Perspectives on the global economic changes

Ep. 171: Yellen Loves Economics; Too Bad She Doesn't Understand It

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

Shankk,

Thanks for posting that interview. It was good. Only The Donald is addressing the issues raised by Greenspam.

KrishNA_K,

I hear you. No more from me for sometime.

Thanks for posting that interview. It was good. Only The Donald is addressing the issues raised by Greenspam.

KrishNA_K,

I hear you. No more from me for sometime.

Re: Perspectives on the global economic changes

US capitalism in crisis while most Americans lose out

the system of market capitalism as envisioned by Adam Smith is broken – the markets no longer support the economy, as a wealth of academic research shows. Market capitalism was set up to funnel worker savings into new businesses via the financial system. But only 15% of the capital in the financial institutions today goes towards that goal – the rest exists in a closed loop of trading and speculation.

This is what the move towards Trump and Sanders in the US is about. The accurate perception of the average voter is that the system as it exists today serves a small sliver of society, the financial sector. And only an outsider can break that stranghold. That is at least the perception.In simple terms, what this means is that rather than funding the new ideas and projects that create jobs and raise wages, finance has shifted its attention to securitising existing assets (such as homes, stocks, bonds and such), turning them into tradeable products that can be spliced and diced and sold as many times as possible – that is, until things blow up, as they did in 2008. In the US, finance has doubled in size since the 1970s, and now makes up 7% of the economy and takes a quarter of all corporate profits, more than double what it did back then. Yet it creates only 4 % of all jobs. Similar numbers hold true in the UK.

How did this sector, which was once meant to merely facilitate business, manage to get such a stranglehold over it?

Re: Perspectives on the global economic changes

in my view the problem is this:

practically all public and private pensions are neck deep in the stock market. They have to be, other wise they can't generate the earnings necessary to service their pensions. Gold won't do it. There's no earnings in gold other than a retention in value and even that is not absolute. Gold can crash too. Although certainly not as frequently as the stock market.

the stock market is a necessary function as is speculation because speculation makes the market. Speculation also ensures that there is a ready cash buyout available for your stock or. it makes sure stock is always available to be purchased. we all can't be buy and hold investors. the market can't function that way. so speculators are necessary for the functioning of the market. it's that way in every commodity be it corn, wheat or soybeans. also stock.

the problem in the present political economic system in the US is that the elites are global in self interest. they care not whose job is being sacrificed as long as they personally benefit. the Clinton's are an excellent example. They completely sold out to China.

If we are going to continue as a country that kind of behavior has to be stopped.

I think tariffs are the answer. it should cost the elites as well as the poor to out source our economy.

a lot of old dog conservatives think that tariffs are bad for the economy and they point to Smoot Hawley as the cause of the great depression but most of the effect of Smoot Hawley came after the depression already started.

we could use the tariff money to shield the poor from increased prices by instituting a negative income tax like warren buffet urges (and Milton Friedman once did).

practically all public and private pensions are neck deep in the stock market. They have to be, other wise they can't generate the earnings necessary to service their pensions. Gold won't do it. There's no earnings in gold other than a retention in value and even that is not absolute. Gold can crash too. Although certainly not as frequently as the stock market.

the stock market is a necessary function as is speculation because speculation makes the market. Speculation also ensures that there is a ready cash buyout available for your stock or. it makes sure stock is always available to be purchased. we all can't be buy and hold investors. the market can't function that way. so speculators are necessary for the functioning of the market. it's that way in every commodity be it corn, wheat or soybeans. also stock.

the problem in the present political economic system in the US is that the elites are global in self interest. they care not whose job is being sacrificed as long as they personally benefit. the Clinton's are an excellent example. They completely sold out to China.

If we are going to continue as a country that kind of behavior has to be stopped.

I think tariffs are the answer. it should cost the elites as well as the poor to out source our economy.

a lot of old dog conservatives think that tariffs are bad for the economy and they point to Smoot Hawley as the cause of the great depression but most of the effect of Smoot Hawley came after the depression already started.

we could use the tariff money to shield the poor from increased prices by instituting a negative income tax like warren buffet urges (and Milton Friedman once did).

Re: Perspectives on the global economic changes

Debt issuance does not mean that they have completely eliminated buying US debt. According to the following link, many other countries are buying debt including Saudis. That makes you wonder, why would Saudis issue (or think of issuing) US dollar debt at higher interest rates (Moody's A1) and buying treasures at a lower rates? They are effectively paying debt holders for nothing, and paying bankers fees (for placing debt) to keep them happy.If these Nations are raising debt instead of buying US debt, will it not be double whammy...

Russia and Saudi Arabia dump $50bn in US assets

<snip>

Over the period, Saudi Arabia reduced its holdings by $26 billion, according to an annual US Treasury survey published earlier this week. The Treasury recently unveiled the scale of Saudi buying of US government debt that had dropped by $3 billion to about $116 billion from February to March.

</snip>

Re: Perspectives on the global economic changes

OECD Blasts Governments for Slipping Into ‘Low-Growth Trap’

The global economy is slipping into a self-fulfilling “low-growth trap” where ultra-loose monetary policy risks doing more harm than good, the Organisation for Economic Cooperation and Development warned.

In a highly critical editorial in the OECD’s latest Economic Outlook, rich world governments bear the brunt of the blame for failing to revive demand and failing overhaul their economies in the wake of the financial crisis in 2008.

....

Re: Perspectives on the global economic changes

Nice Interview:

He says the coming recession ( which he does not refutes wont happen ) is a short term problem.

Housing Bubble when asked which is brewing up is of Cyclical Nature means to say he is expecting one

The Aging problem in Western World is more acute he says , US and Europe badly affected , Japan the worst !

He is actually quoting David Stockman Study to quote him when he says

Added Later: Phew I saw Greenspan Age is 90 ....Quite active for a person of that ageSince 1975, the sum of gross domestic savings and entitlements as a percentage of GDP has been remarkably flat and what that tells us is all the way back to ’65 we have essentially been seeing a one Dollar to one Dollar tradeoff between entitlement growth and gross savings decline. And despite the fact that we are borrowing savings from abroad its’ kept our rate of capital investment as a percent of GDP going down

Re: Perspectives on the global economic changes

This financial bubble is 8 times bigger than the 2008 subprime crisis

https://www.sovereignman.com/trends/thi ... sis-19590/

https://www.sovereignman.com/trends/thi ... sis-19590/

Re: Perspectives on the global economic changes

Myths about Economic Collapse Peter Schiff And Stefan Molyneux

Re: Perspectives on the global economic changes

http://economistsview.typepad.com/econo ... ports.html

The Semi-Surprising Weakness of U.S. Imports

Brad Setser:

The Semi-Surprising Weakness of U.S. Imports: I suspect the big jobs report meant that last Friday’s trade release got a bit less attention than normal.

The dollar’s strength continues to have the expected impact on real exports, more or less. Excluding petrol, real goods exports are down 2.5 percent in the first four months of the year (relative to the same period in 2016). ... This is pretty common when the real dollar is strong. .... The real dollar ... is about between 10 and 15 percent points higher than it was in early 2014.

I am surprised though at how flat imports continue to be. Real goods imports are about half a point lower in the first four months of 2016 than in the first four months of 2015... Real goods imports haven’t really changed at all for say the last 15 or so months. ...

While real GDP growth hasn’t been spectacular, demand has continued to grow. .... Positive demand growth usually means positive import growth, which mechanically subtracts from overall growth. ... Most careful analysis also has shown there is some impact of the dollar on imports, even if the impact on exports is greater.

So I at least find the weakness in goods imports a bit puzzling weakness. It isn’t explained by falling oil imports either...

And, as a result of more or less flat imports, net exports haven’t subtracted significantly from U.S. growth over the last four quarters — which also runs against my priors.

Put a bit differently, it wouldn’t surprise me if net exports emerge as a stronger headwind over the next couple of quarters. All it would take is for imports to start to respond a bit more normally to U.S. demand growth.

The Semi-Surprising Weakness of U.S. Imports

Brad Setser:

The Semi-Surprising Weakness of U.S. Imports: I suspect the big jobs report meant that last Friday’s trade release got a bit less attention than normal.

The dollar’s strength continues to have the expected impact on real exports, more or less. Excluding petrol, real goods exports are down 2.5 percent in the first four months of the year (relative to the same period in 2016). ... This is pretty common when the real dollar is strong. .... The real dollar ... is about between 10 and 15 percent points higher than it was in early 2014.

I am surprised though at how flat imports continue to be. Real goods imports are about half a point lower in the first four months of 2016 than in the first four months of 2015... Real goods imports haven’t really changed at all for say the last 15 or so months. ...

While real GDP growth hasn’t been spectacular, demand has continued to grow. .... Positive demand growth usually means positive import growth, which mechanically subtracts from overall growth. ... Most careful analysis also has shown there is some impact of the dollar on imports, even if the impact on exports is greater.

So I at least find the weakness in goods imports a bit puzzling weakness. It isn’t explained by falling oil imports either...

And, as a result of more or less flat imports, net exports haven’t subtracted significantly from U.S. growth over the last four quarters — which also runs against my priors.

Put a bit differently, it wouldn’t surprise me if net exports emerge as a stronger headwind over the next couple of quarters. All it would take is for imports to start to respond a bit more normally to U.S. demand growth.

Re: Perspectives on the global economic changes

Unemployment data shows the number of people out of work in the U.S. has fallen to 4.7 percent...or has it? Numbers released last week show that 38,000 jobs were added in May, but do these figures really take into account the true number of people out of work or who have given up looking for work? Becker is joined from London by economist and author Steven Keen.

Loud & Clear Interviews : The U.S. Is Close To Full Employment?! How Unemployment Data Is Misleading.

https://www.spreaker.com/user/radiosput ... ium=widget

Loud & Clear Interviews : The U.S. Is Close To Full Employment?! How Unemployment Data Is Misleading.

https://www.spreaker.com/user/radiosput ... ium=widget

Re: Perspectives on the global economic changes

People in the US are earning less even after doing 2 or 3 jobs at the same time as per some reports. This has resulted in Burnee and Trump.

Re: Perspectives on the global economic changes

Bloomberg: David Stockman's View of Trump vs. Clinton and US Economy

http://www.bloomberg.com/politics/video ... vs-clinton

http://www.bloomberg.com/politics/video ... vs-clinton

Re: Perspectives on the global economic changes

These must be part time worker , else who can work 2-3 jobs in a day.Yagnasri wrote:People in the US are earning less even after doing 2 or 3 jobs at the same time as per some reports. This has resulted in Burnee and Trump.

Though I agree Trump rise is due to Economic Hardship most common American are facing , In a good day Trump would not have even got 5 % of US votes.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

How elites are seeing the current problem. Good interview by Robert Kiyosaki of Md. El-Erian.

http://www.stitcher.com/podcast/the-rich-dad-radio-show

http://www.stitcher.com/podcast/the-rich-dad-radio-show

Re: Perspectives on the global economic changes

Peter Schiff on CNBC 6/8/2016

Re: Perspectives on the global economic changes

Nice Interview , He says we have 3 years or less , Would be good to buy his book and read it and see what he has to saypanduranghari wrote:How elites are seeing the current problem. Good interview by Robert Kiyosaki of Md. El-Erian.

http://www.stitcher.com/podcast/the-rich-dad-radio-show

Re: Perspectives on the global economic changes

Robert Kyosaki is a get-rich-quick snakeoil salesman.

The guy was pumping his real estate flipping course on late night infomercials from 2004 all the way up to the height of the bubble in 2006/7.

I dread the fact that he started talking about precious metals in 2012 and sure enough it proved to be the tipping point for precious metal prices.

The moment the guy starts talking about what you should invest in, sell it asap.

What's worse is he sells books and seminars based on pure slick talking of absolutely nothing. e.g. "You need to get financial education".

The guy was pumping his real estate flipping course on late night infomercials from 2004 all the way up to the height of the bubble in 2006/7.

I dread the fact that he started talking about precious metals in 2012 and sure enough it proved to be the tipping point for precious metal prices.

The moment the guy starts talking about what you should invest in, sell it asap.

What's worse is he sells books and seminars based on pure slick talking of absolutely nothing. e.g. "You need to get financial education".

Re: Perspectives on the global economic changes

+1 on Robert Kiyosaki.

Re: Perspectives on the global economic changes

What about the interview with Md. El-Erian ?Neshant wrote:Robert Kyosaki is a get-rich-quick snakeoil salesman.

The guy was pumping his real estate flipping course on late night infomercials from 2004 all the way up to the height of the bubble in 2006/7.

I dread the fact that he started talking about precious metals in 2012 and sure enough it proved to be the tipping point for precious metal prices.

The moment the guy starts talking about what you should invest in, sell it asap.

What's worse is he sells books and seminars based on pure slick talking of absolutely nothing. e.g. "You need to get financial education".

Re: Perspectives on the global economic changes

I am just think why do the commentator/guest in the discussion always says every central bank is doing QE when replying to Peter.Austin wrote:Nice Interview , He says we have 3 years or less , Would be good to buy his book and read it and see what he has to saypanduranghari wrote:How elites are seeing the current problem. Good interview by Robert Kiyosaki of Md. El-Erian.

http://www.stitcher.com/podcast/the-rich-dad-radio-show

AFAIK the Fed and ECB are the two Banks that are doing QE by either directly supplying money in case of ECB or keeping interest below the market price discovery rate in case of Fed , I guess the JCB are in the same boat.

Neither the Indian CB or Chinese CB or other central bank that I know are doing QE , Am I wrong ?

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

Most governments hold assets denominated in Euros and Dollars. While Yen was mainly used for carry trade however that role is mainly taken over by the dollar now.

And for this reason the actions (or lack thereof) of ECB, US FR and BoJ are important as they have a direct effect on most governmental balance sheets. Compare that to what RBI or PBoC do matters less as their bonds are not that widely held.

Thats my understanding.

So every central bank refers to the big 3.

While QE done by ECB is used to purchase bonds of some sovereign nations in EU, its also used to buy corporate bonds. Fed does not do QE to buy corp bonds, but it may change depending on if QEeen Yellen raises rates in June(improbable IMO). BoJ buys only governmental debt.

US debt held almost globally.

ECB debt held globally not as much as US.

BoJ debt held primarily within Japan.

And for this reason the actions (or lack thereof) of ECB, US FR and BoJ are important as they have a direct effect on most governmental balance sheets. Compare that to what RBI or PBoC do matters less as their bonds are not that widely held.

Thats my understanding.

So every central bank refers to the big 3.

While QE done by ECB is used to purchase bonds of some sovereign nations in EU, its also used to buy corporate bonds. Fed does not do QE to buy corp bonds, but it may change depending on if QEeen Yellen raises rates in June(improbable IMO). BoJ buys only governmental debt.

US debt held almost globally.

ECB debt held globally not as much as US.

BoJ debt held primarily within Japan.

Re: Perspectives on the global economic changes

Thanks Sir , one query I had wrt to Japan was if BOJ can keep its own debt at the expense of debt ratio of 250% of GDP , why is Japan not running into run away inflation as its currency/debt is not held by other countries , it basically prints money for its own economy and people and also services its debt by printing more.

Can we in India also do the same ? Can rbi just print its own debt bond and let PSU bank buy and loan companies at may be 1 % interest while increasing debt as BOJ does without consequences ?

After all the argument is and I hear many people say your debt is held by your own people like Japan does

Can we in India also do the same ? Can rbi just print its own debt bond and let PSU bank buy and loan companies at may be 1 % interest while increasing debt as BOJ does without consequences ?

After all the argument is and I hear many people say your debt is held by your own people like Japan does

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

My understanding is- its mainly due to carry trade which prevented runaway inflation in Japan.

If you want to learn more about carry trade, listen to the master - https://www.janus.com/bill-gross-investment-outlook

Gross makes very interesting points.

If you want to learn more about carry trade, listen to the master - https://www.janus.com/bill-gross-investment-outlook

Gross makes very interesting points.

“Carry” in almost all forms is compressed and offers more risk than potential return. I will be specific:

Duration is unquestionably a risk in negative yielding markets. A minus 25 basis point yield on a 5-year German Bund produces nothing but losses five years from now. A 45 basis point yield on a 30-year JGB offers a current “carry” of only 40 basis points per year for a near 30-year durational risk. That’s a Sharpe ratio of .015 at best, and if interest rates move up by just 2 basis points, an investor loses her entire annual income. Even 10-year U.S. Treasuries with a 125 basis point “carry” relative to current money market rates represent similar durational headwinds. Maturity extension in order to capture “carry” is hardly worth the risk.

Similarly, credit risk or credit “carry” offers little reward relative to potential losses. Without getting too detailed, the advantage offered by holding a 5-year investment grade corporate bond over the next 12 months is a mere 25 basis points. The IG CDX credit curve offers a spread of 75 basis points for a 5-year commitment but its expected return over the next 12 months is only 25 basis points. An investor can only earn more if the forward credit curve – much like the yield curve – is not realized.

Volatility. Carry can be earned by selling volatility in many areas. Any investment longer or less creditworthy than a 90-day Treasury Bill sells volatility whether a portfolio manager realizes it or not. Much like the “VIX®”, the Treasury “Move Index” is at a near historic low, meaning there is little to be gained by selling outright volatility or other forms in duration and credit space.

Liquidity. Spreads for illiquid investments have tightened to historical lows. Liquidity can be measured in the Treasury market by spreads between “off the run” and “on the run” issues – a spread that is nearly nonexistent, meaning there is no “carry” associated with less liquid Treasury bonds. Similar evidence exists with corporate CDS compared to their less liquid cash counterparts. You can observe it as well in the “discounts” to NAV or Net Asset Value in closed-end funds. They are historically tight, indicating very little “carry” for assuming a relatively illiquid position.

Re: Perspectives on the global economic changes

Thanks Panduranghari , Will check it , Hopefully could understand it as well

Re: Perspectives on the global economic changes

Inflation is caused when money chasing goods increases. I don't think who holds the debt has any relevance to it. Why printing money causes inflationAustin wrote:Thanks Sir , one query I had wrt to Japan was if BOJ can keep its own debt at the expense of debt ratio of 250% of GDP , why is Japan not running into run away inflation as its currency/debt is not held by other countries , it basically prints money for its own economy and people and also services its debt by printing more.

As to why it didn't happen in Japan, that was because the economy was deleveraging. There must have been a lot of spare capacity to soak up an increased demand. Read the part on Liquidity Trap

I doubt if we have that kind of capacity built up. Everything on the Indian economy thread points to have constraints on the supply side.Can we in India also do the same ? Can rbi just print its own debt bond and let PSU bank buy and loan companies at may be 1 % interest while increasing debt as BOJ does without consequences ?

After all the argument is and I hear many people say your debt is held by your own people like Japan does

How the economic machine works for a clear and simple explanation.

Re: Perspectives on the global economic changes

Thanks Krishna , I wonder if the countries that are in QE mode direct or indirect are publishing the real inflation figures ?

Re: Perspectives on the global economic changes

Peter Schiff: This Collapse Will Be Worse Than The Great Depression

Re: Perspectives on the global economic changes

Couple with one kid grossing $90K in the Los Angeles area - finding it hard to make ends meet.

http://www.marketplace.org/2016/06/06/w ... g-changing

http://www.marketplace.org/2016/06/06/w ... g-changing

Chances are when you think of what it means to be a middle class family in America, you come up with some of the same things the U.S. Commerce Department uses to define the group: A steady job, owning a home, two cars in the garage, an annual family vacation, the ability to send your kids to college and a little left over to sock away for retirement. The middle class is a wide swath of Americans - it includes families that make between $48,000 and $145,000 a year – but it’s not as big as it used to be. In 1971, 70 percent of Americans were in the middle class. Today, it’s down to 50 percent.

We went searching for what middle class in America looks like today and we found Aaron and Mary Murray, two teachers raising their five-year-old daughter on $90,000 a year. But even though they are in the dead center of the middle class by income, they told us they feel like they're living right on the poverty line.

Re: Perspectives on the global economic changes

David Stockman Interview: End Of The 20-Year Credit Bubble—-Now Comes The Reckoning

http://davidstockmanscontracorner.com/d ... reckoning/

http://davidstockmanscontracorner.com/d ... reckoning/

Re: Perspectives on the global economic changes

Nice Interview , The Next Crash & Fears Of A New Collapse 2016 with Mohamed El Erian

Re: Perspectives on the global economic changes

Last edited by Austin on 15 Jun 2016 13:45, edited 1 time in total.

Re: Perspectives on the global economic changes

Banking is a scam that ripsoff the productive people in society.

------------

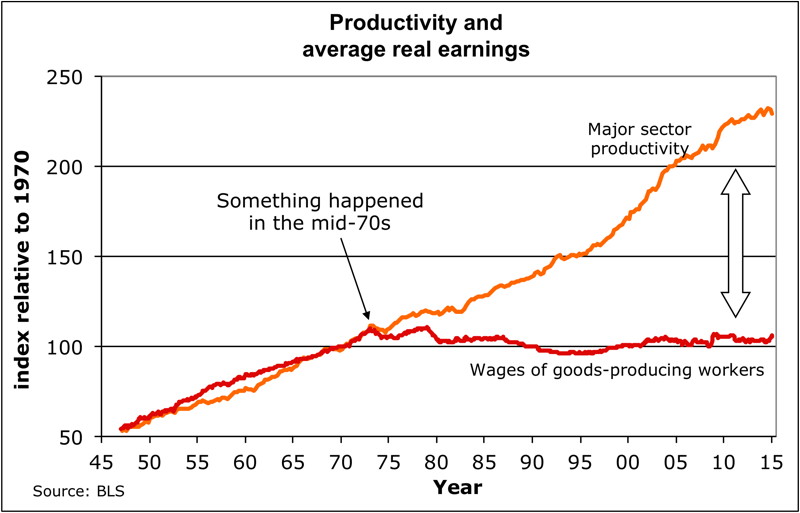

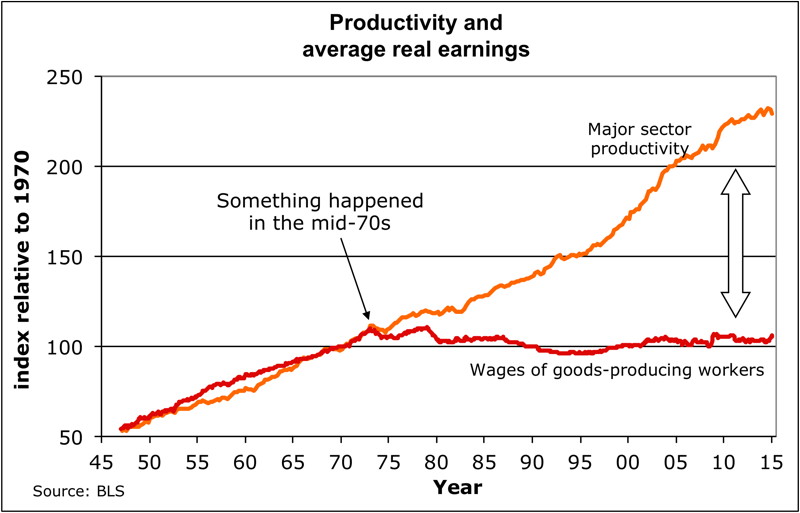

'X' Marks The Spot - Wages Started Losing When The Dollar Delinked From Gold In 1971

http://www.zerohedge.com/news/2016-06-1 ... -gold-1971

------------

'X' Marks The Spot - Wages Started Losing When The Dollar Delinked From Gold In 1971

http://www.zerohedge.com/news/2016-06-1 ... -gold-1971