Re: Indian Economy - News & Discussion Oct 12 2013

Posted: 21 Oct 2013 22:08

how is the proposed islamic bank supposed to do business ? i mean how does it handle the finances ?make profit ? trade in stocks/equities ? hedge funds ? etc

Consortium of Indian Defence Websites

https://forums.bharat-rakshak.com/

The world's biggest miner BHP Billiton says it will exit most of its Indian oil and gas projects. Local media cite delays in getting exploration permits. It comes at a sensitive time, as India seeks to support its flagging economy with foreign cash.

The Anglo-Australian resources company hasn’t confirmed the reason for its decision to walk away from its nine oil and gas exploration blocks in India, Reuter's reports.

"The decision to relinquish these blocks is the result of an exploration portfolio review ... there have been regular discussions and communications over the last 12 months with the Ministry of Petroleum and Natural Gas," BHP officially stated.

However, BHP had said its operations in the country were often blocked by delays in permits from India's defence ministry allowing it to conduct exploration activities.

BHP's withdrawal from India, the world’s fourth largest fuel importer, comes at a time, when the country is looking to attract foreign investment and ahead of a likely fresh round of energy block auctions in January.

“India is significantly dependent on foreign oil and the government wants to enhance interest from foreign players to produce more here,” said the Head of energy at KPMG India department.

"This is a sad story for India's E&P (exploration and production) sector. Sentiments are already negative and the exit of BHP Billiton is going to do more harm," added R.S. Sharma, former chairman of state-run Oil and Natural Gas Corp.

Bambolim, Goa: Spending on information technology (IT) is set to rise steadily in India in 2014 despite tough macroeconomic conditions, technology researcher Gartner Inc said on Tuesday, giving Indian software companies hopes of a share in a market that has been dominated by their larger multinational rivals.Gartner forecast IT spending in India will rise by at least 6% to $71.3 billion in 2014, with most of the growth driven by spending on IT services.

The strong forecast is good news for Indian IT services firms such as Tata Consultancy Services Ltd (TCS), Infosys Ltd and Wipro Ltd that face stiff competition from multinational companies such as International Business Machines Corp. and Hewlett-Packard Co. (HP) The MNCs have multi-year outsourcing contracts from several top Indian companies, including Bharti Airtel Ltd and HDFC Bank LtdHDFC Bank Ltd, Bank of India and Max Life Insurance have already outsourced a major portion of their back-offices to large international companies, but Indian IT firms are now looking to invest in customer relationship management (CRM) software, mobility and big data analytics.

“We will invest quite a bit into CRM,” said Pushpinder Singh, general manager and CIO at Bank of India. “There is an expectation of our budgets therefore going up because of all these investments that we’re making.”

In 2004, Bank of India outsourced its core banking processes, back-office and other IT infrastructure services to HP in a 10-year, multi-million dollar deal. The bank’s ATMs too are managed by foreign service providers.But experts said despite opportunities from customers looking to spend more on outsourcing to costs, Indian service providers would find it difficult to crack a market where global IT firms are firmly entrenched.“Indian service providers have for a long time ignored the home market, because from a profit standpoint opportunities were more significant elsewhere,” said Peter Sondergaard, senior vice-president and global head of research at Gartner.“What they could exploit in the Indian market would be areas such as cloud computing or projects that have to be driven by a service component oriented towards business processes. Otherwise in essence you’re up against the HPs, and the SAPs and the Oracles and they’re pretty well-established players here.”

Harish Shetty, senior executive vice-president of IT at HDFC Bank, said HDFC’s IT budgets would continue to go up on new investments, having risen about 10% this year.Gartner said the telecommunications services market would continue to be the biggest IT segment in India with spending expected to touch $30 billion in 2014, a marginal increase from $29.2 billion this year.Spending on devices, including mobile phones, tablets and printers, is expected to rise 6% to $30 billion in 2014. The devices segment is expected to become the largest IT spending sector by 2017.India’s $108 billion IT industry is the third largest among emerging economies and the fourth-largest among mature Asia-Pacific economie

Chennai: Stating that there has been improvement in the trade account, C Rangarajan, Chairman of the Economic Advisory Council to Prime Minister, said on Monday that the country's high current account deficit is likely to go down well below $70 billion.

Pointing out that India's exports showed a double digit growth rate in August and September, he said at an event in Chennai that India's trade deficit in the first half of this year was $80 billion as compared to $92 billion in the previous year.

If the present trend in exports and imports continue, the overall current account deficit will reduce even lower than $70 billion, he said.

Noting that the Indian rupee over the last few weeks had remained stable at around 61-62 against the US dollar, he said the currency was well corrected for inflation differential.

Referring to the USA's indication of tapering on May 22 and the resultant fall in capital flows, he said this affected capital inflows not only to India but to all the emerging economies including Brazil as investments were moved to the USA.

However, now, there has been a change and investments flows have turned positive, he said.

A new announcement from KFC parent Yum Brands (NYSE: YUM) is interesting for what it doesn't say, spotlighting the fact that the company would prefer not to talk about the many difficulties it has recently faced in China. Anyone who has followed the KFC story closely over the last decade will know that China featured prominently in many of Yum's announcements during that time, as the market posted consistent double-digit gains that helped to boost Yum's profits by similar amounts. But lately those gains have evaporated, and KFC has now posted same-store sales declines in China for much of the past year. What's more, Yum keeps extending its timeline for a recovery, which now isn't expected until next year at the earliest.All that said, let's take a look at the latest Yum announcement that trumpets the opening of the 40,000th KFC globally as a major company milestone. I fully agree with this view, as few -- if any -- other retailers can boast the presence of so many stores across the globe. But the announcement is equally interesting for where the landmark 40,000th store opening was located, namely in the city of Goa in India. Just a year or two ago, Yum almost certainly would have chosen China as the location for the new store opening, to celebrate this major milestone.In the announcement, Yum says it chose the India store for the milestone to spotlight the importance of developing markets to its global expansion. It said it plans to have 1,000 stores in India by 2015 in more than 100 cities, and will post annual sales there of $1 billion by that time. It plans to invest $10 billion in emerging markets by 2020. Mention of "China" doesn't occur even once in the announcement, despite the fact that China is Yum's largest developing market and accounts for more than half of the company's profit.

KOLKATA/AHMEDABAD: Indian professionals are growing in stature for their global leadership quality, and the latest industry chasing them seems consumer electronics, a segment dominated by the Japanese, Koreans and Americans. From Pranav Mistry, who helped Samsung deliver a smart watch ahead of rival Apple, to Murali Sivaraman, who led Philips’ acquisitions in India and China, many Indians are taking their place in the headquarters of electronics multinationals.Even a conservative Japanese company like Panasonic has started training Indian managers to take up leadership roles in the Middle East and Africa, according to its India president Daizo Ito. Call it the growing importance of India for these companies — for instance, India is the fourth largest market for Sony — or the maturity of Indian talent, the country is emerging as a recruitment hub for the electronics industry, though the pace is not as fast as in the FMCG industry where tens of Indians don global hats.ET profiles four Indians who have risen to key roles in electronics MNCs.

Pranav Mistry Director of Research, Samsung Electronics

Pranav Mistry’s Gujarati-laced English may have gone viral in YouTube, but his Galaxy Gear smart watch launched last month has won rave reviews and is doing good business for the Korean fi rm. “New wearable technologies, be it Samsung Galaxy Gear or Google Glass, would make the world an exciting place,” says Mistry, 32, who hails from the small town of Palanpur in Gujarat.A computer scientist with master in media arts and sciences from Massachusetts Institute of Technology (MIT) and master of design from Indian Institute of Technology (IIT)-Bombay, Mistry now heads Samsung Think Tank Team. He has also worked with Microsoft, Google and NASA. Today he works on augmented reality, display technologies, futuristic television, mobiles, and robotics for Samsung.Mistry tells ET he is looking for an evolution that exists beyond the digital world. “The idea is not about creating computing device. It is about connecting with the physical world,” he says. “I want to work on impactful projects. My projects could be on food or poverty (eradication through technology).”

Rajeev Chopra (from December) Global business head (consumer luminaries), Philips

Come December, Rajeev Chopra, MD of Philips India, will go to Brussels to take over as the global chief of the Dutch fi rm’s consumer luminaire business. An engineering graduate from IIT with an MBA from Tulane University at US, Chopra has transformed a rather unglamorous lighting products into a fashionable one in India, with Philips setting up more than 85 Light Lounges under a franchisee model for retailing of LED and fashionable light fixtures.Chopra believes India has emerged a ripe ground for global postings in the consumer electronics business. “Working in a market like India gives us the advantage of getting to know, learn, strategise and adapt for all kinds of economies — mature, growth and emerging,” he says. Chopra, however, has a big challenge ahead — the fi rm’s consumer luminaire business reported a low single-digit decline in sales last quarter with demand down in matured markets.

Murali Sivaraman Global CEO, Domestic Appliances Business, Koninklijke Philips NV

One of the first Indians to become global CEO in the consumer electronics business, Murali Sivaraman has been handling the largest consumer lifestyle business by sales of the Dutch major for over two years. He is based in Shanghai. , Sivaraman has led development of Philips’ newer appliances like a biryani maker, soup maker, noodle and pasta maker, and its acquisitions in India and China.

. Dipesh Shah Global VP (R&D), Samsung Electronics

The alumnus of Visvesvaraya Technological University and IIM-Bangalore today shuffl es between US, Korea and Bangalore on his projects. Shah is confi dent Indian engineers would move up in the consumer electronics fi eld due to inherent strengths. “Indians can adapt to the needs of the consumers and deliver more with less computing resources, which are critical assets,” he says. Shah is involved in globalisation of Indian technical talent at Samsung, ensuring Indian engineers work with the global team

At a time when the International Monetary Fund (IMF) expects India's economy to clock an 11-year low growth of 4.25% in 2013-14, the Fund is likely to send its team to India in the third week of November for holding consultations with various stake holders in the country about health of the economy, officials said.In what is technically called Article IV consultations, IMF economists visit a member country to gather information and hold discussions with government and central bank officials, private investors, labour representatives, members of Parliament and civil society organisations. The mission then submits a report to the IMF's Executive Board for discussion. The Board's views are summarised and provided to the country's authorities.Earlier this month, the Fund came out with its projections for India's economy. It pegged economic growth at just 4.25% for 2013-14, while the Finance Ministry expected it to be higher than 5%. India's economy had clocked a decade low growth of 5% in 2012-13.As such, the government had disagreed with the Fund's projections. Officials said the multilateral institution has not factored in the expected bumper crop this year and the decisions taken by the Cabinet Committee on Investment (CCI) to clear infrastructure projects.The Fund had attributed its projections to poor demand, weak manufacturing and services sector performance.

Finance Minister P Chidambaram had termed IMF's projections pessimistic, with which he did not agree.That time, officials had said India’s economic growth has always been higher than what is predicted by the IMF and had remained closer to the World Bank’s estimates.Last week, the World Bank had also cut India's growth projections to 4.7% for 2013-14 against earlier prediction of 5.7%.When a query was posed to the Finance Minister yesterday at a press conference, he had said there are differences between IMF and the World Bank's methodology."These are estimates," he had said.IMF usually comes out with projections based on GDP at market prices which basically means inclusion of indirect taxes and subtraction of subsidies from GDP at factor cost, a methodology adopted by the World Bank and India officially. So, that way methodology of IMF and the World Bank differs.When asked whether there are differences between IMF and the World Bank ways of calculating economic growth based on GDP at factor cost, Fund economist in India Sudip Mohapatra said," How can there be?"However, the projections by the IMF and the World Bank differ due to their assessment, another economist said.

Mobile economy in India, world's second largest market by subscribers, will contribute around USD 400 billion to the country's GDP and create 4.1 million jobs by 2020, a report by the global mobile operators industry body GSMA said today.Mobile economy will also lead to investments of USD 9 billion in telecom infrastructure, said the 'Mobile Economy India 2013' report prepared in collaboration with consulting firm Boston Consulting Group."The Indian mobile industry is fast-paced and innovative, but it currently lacks the regulatory environment to support its ambitions," GSMA Director General Anne Bouverot said.The mobile ecosystem generated about 5.3 per cent of GDP for India in 2012, directly supported 730,000 jobs and an additional two million jobs when points of sale and distributors are included, she added.According to Bouverot, the report predicts that by 2020, mobiles will contribute almost USD 400 billion to India's GDP, create 4.1 million additional jobs and invest USD 9 billion in infrastructure, with USD 34 billion contributed to public funding.

She said, however, that an absence of predictable, long- term policies in areas like allocation of radio frequencies is acting as a brake on investment, and the government's target of increased rural coverage would be supported by a more flexible spectrum policy.This would be feasible particularly with the release of more frequencies in the bands below 1 GHz and the development of allocation processes that do not focus solely on maximising short-term spectrum fees, Bouverot added."India is on the cusp of dramatic transformation, both economically and socially, through mobiles," GSMA India Director Sandeep Karanwal said.The mobile industry is ready to work closely with the government, as well as other adjacent industry sectors, to accelerate growth through mobile, increasing technological innovation in India and enhancing the lives of the citizens, he added.

Not as recognised, as yet, is that we are also in deep crisis with regards to GDP growth. In recent weeks, various organisations have downgraded Indian growth prospects. It is a sorry picture when the most optimistic forecast for fiscal 2013-14 remains that of the government of India — around 5.5 per cent growth by both the RBI and the Prime Minister's Economic Advisory Council (PMEAC).

If India ends the year with around 4.5 per cent growth (an expected reality), then the last three-year GDP growth average of 5.2 per cent will be among the worst since 1980. The three crisis years ending in 1992 averaged GDP growth of 4.1 per cent, within depressingdistance of this year's expected growth.

Why is inflation at double digits and growth at stagnation levels of around 4.5 per cent for the second year running? It may have something to do with the UPA's growth and distribution model. This socialist distribution model has been discussed extensively, and with no apparent effect on the policymakers. What about the UPA's growth model? Without any risk of exaggeration, the UPA's political economy model can best be described as follows. India is a dominantly agricultural country, and most of the poor reside in rural agricultural areas. Further, the farmers are an important political constituency. Hence, a win-win proposition, for India and the Congress party, is to increase agricultural output and to do so at highly remunerative farm prices. There will be growth, there will be lower inflation due to higher output, there will be an improvement in inequality, there will be spillover demand effects into the industrial arena, and voila India will be on an 8 per cent trajectory as far as the eye can see. And yes, this extra growth can be used for redistributive purposes, and especially for "In the name of the poor programmes named after the Nehru-Gandhi dynasty".

First, the NDA period was witness to one of the worst six-year rainfall periods in Indian history (rainfall data since 1871). The rainfall index was a negative (-)15.6, that is, rainfall was about 16 per cent below normal. Agricultural growth was predicted to be only 1 per cent per annum, yet the actual average was 2.7 per cent.

Second, there were hardly any incentives given to farmers in the form of higher relative prices for crops. WPI inflation during this period averaged 4.9 per cent , while procurement price inflation averaged 5.2 per cent per annum. The average relative price of agricultural goods increased by 0.7 per cent per annum.

Third, now along comes the UPA. Procurement prices are raised without hesitation, and at an average compounded rate of close to 9 per cent per annum between 2004-2012. But in the three years preceding the 2009 election, such prices were raised at an average rate of 12.1 per cent per annum, about 4 per cent a year more than the WPI. Relative prices of agricultural goods increased at a historic record pace of 6.4 per cent per year during these political economy years. Even for the entire nine-year period, relative prices increased at 2.7 per cent per year, again a record for India (and most likely the world — note that this is the change in the ratio of procurement prices to non-agricultural GDP prices that one is talking about). The inherent nature of most relative prices is to stay constant for short periods of time, say five to 10 years.

Fourth, did the UPA and India at least get some additional output, and lower food prices, from all of these incentives for higher production? Indeed not — agriculture inflation has never been so continuously high, and especially in the context of agricultural output increasing at above 3 per cent per annum for eight years. What makes the performance worse than terrible is that the UPA had the gods on their side — the rainfall index was above normal (0.8 vs 0) during their tenure, and rainfall was especially buoyant during 2006-07 and 2008-09 — an index of 13.3, one of the best three-year rainfall periods in Indian history. However, and this is the critical performance line, for the nine-year UPA period of 2004-05 to 2012-13, actual agricultural growth of 3.1 per cent was 0.2 per cent a year below the rainfall-only predicted growth of 3.3 per cent!

History is history, but can good rainfall save the UPA in 2013-14? There has been good rainfall, no question about it, and non-agricultural growth is insipid, at best. And if agricultural growth is 6 per cent-plus, this can provide the UPA with an extra 0.5 per cent growth and perhaps propel GDP growth to above 5 per cent. The rainfall-only model predicts agricultural growth of "only" 4.1 per cent in 2013-14. A large part of the reason for the unexceptional increase projected for 2013-14 is because 2012-13 was not such a bad rainfall year — rainfall during June-September in 2012 was 824mm, compared to 698mm in the genuine bad rainfall year of 2009-10.

The Russian leader noted the words of Kazakh counterpart Nursultan Nazarbayev that Turkey asked to join the Customs Union. “I would like to inform you, dear colleagues, that another major economy, one of the largest economies in the world shows the same interest. This is India,” Putin said.

The Russian president recalled that the Indian prime minister had recently visited Russia.

“He asked me to raise the issue at our today’s meeting that India would like to consider the possibility to sign an agreement on free trade zone with the Customs Union. I believe that taking into account the size and scale of Indian market, the prospects of development in Asia in general, we should take this proposal very seriously,” Putin noted.

vina wrote:Believe me. People negotiating such deals are not idiots. They would have put in language putting in conditions for any related entity from doing so as well. When hero signed the deal with Honda, they made nothing but bicycles and some crappy mopeds and they would have signed on the dotted line . And any violation of terms would have led to immediate suspension of tech and product support and pipeline, leading you to get flushed down the Pakistan.prohibited hero honda, not hero, which is an independent entity over which honda had no say.

In fact, this was the same reason why the Escorts JV with Yamaha ran into big time trouble. Escorts started using the Yamaha derived knowledge base in upgrading the Rajdoots of old and Yamaha pulled the plug.

Bajaj and TVS basically told Kawasaki and TVS to go jump. In fact one of the most revered Con-Sultans , MuckNSee , advised Bajaj that they should not develop Pulsar and the Cruiser models because it would "antagonize" Kawasaki. Rahul Bajaj put MuckNSee in the dustbin and told Kawasaki where to get off. Same with Maruti. MuckNSee told Maruti that the Swift was "too expensive"/"too blah blah whatever" for some segmentation for the Indian market and that it would fail. Maruti put that in the dust bin as well, and everyone knows what a smash hit Swift and it's derivatives are for Maruti and a massive cash cow.

A lot of Strat-e-jee can be too clever by half. The question is, do you have the Cojones to tell your major technology supplier and a key determinant to your competitiveness, sales and profits to F****off and come up with a superior product within a window which the market will bear , or do you just take the bird in the hand and be finally forced by policy changes (like govt fully opening out the 2 wheeler market and the non compete agreements with the tech supplier ending, allowing him to open a fully owned subsidiary to compete head on with you) to do so , like what happened in Hero's case.

I would argue that Bajaj and TVS are far better off by booting out Kawasaki and Suzuki when they did that nearly a dozen years ago. They took the short term pain , but came out trumps.

Wow, this is really insane. The UPA guys have no sense of "we, ours" of India and its economy. Do not know, how liberal morons justify electing this stupid govt.The worst-case scenario as of now is that $15 billion in costs will have to be rolled over into next year’s budget, the ministry officials said. This assumes that there will be no substantial increase in domestic fuel prices to offset the ballooning subsidies.

By rolling over some costs, Chidambaram can tell voters in the run up to the elections, which must be held by May, that the government met its deficit target. But equally, he will be shackling the next government with costs that could blunt its ability to stimulate an economic recovery.

Can you please provide me the source of this chart? Thanks in advance.Theo_Fidel wrote:An interesting chart of the economic benefits of equality for women.

Crisis? What crisis?” This seems to be the new motto for Indian markets. Stocks have built on a startling recovery, shrugging off a period of currency freefall and capital flight that had threatened to turn into a full-fledged crisis. The buoyant mood seemed confirmed on Tuesday, as Reserve Bank of India governor Raghuram Rajan’s decision to raise interest rates sent equities nearly 2 per cent higher. The benchmark Sensex index closed at 20,929, just a fraction below its all-time closing high, set last week.Mr Rajan described the move as part of broader RBI attempts to “normalise” its policies following India’s recent market turbulence, and included other steps to unwind emergency measures introduced to support the plummeting rupee earlier this year. Investors have welcomed all such signs of a return to business-as-usual, prompting stocks to jump 14 per cent since the end of August.“India has come back very strongly, although it is in some ways more of a relief rally,” says Gaurav Kapur, a Mumbai-based economist at Royal Bank of Scotland.

Mr Rajan’s arrival at the RBI in early September is widely credited with improving market sentiment, followed by the US Federal Reserve’s decision to delay the rollback of its $85bn monthly asset-buying programme in the middle of that month.The latter factor, in particular, helped to bring an influx of foreign capital back into Indian equities, with around $2bn flowing into the market during October. Underlying economic factors have improved a little as well, in particular the country’s troublesome current account deficit, which economists predict will now begin to shrink in the second half of this year, further reducing pressure on the rupee. A succession of duty hikes on gold have also had a dramatic effect, cutting sharply imports of the yellow metal from an all-time monthly high of 162 tonnes during May, to just 7 tonnes in September. As a result, the once-battered currency appears to have stabilised, ending the day on Tuesday at Rs61.31 to the dollar, up around 12 per cent from its record low of close to Rs69, hit towards the end of August.

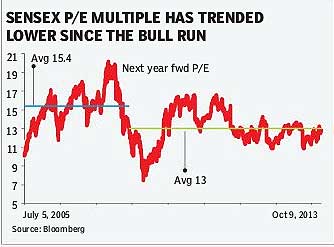

In the equity market, the recent upswing has been felt most strongly in the same sectors that suffered most during the rupee’s decline, a period in which investors flocked to the relative safety of India’s IT and pharmaceutical exporters. Stocks in the previously unfancied metals and industrial sectors have also bounced back, although analyst Neelkanth Mishra at Credit Suisse says this reflects “bottom-fishing” for undervalued shares, rather than a sustained turnround.The generally positive mood has been further buoyed by unexpectedly positive earnings so far in the second quarter, with a number of major companies including automaker Maruti Suzuki, beating results expectations in recent weeks. Investors say the recent bounce back has returned Indian stocks to something approaching their fair value, with stocks trading close to their average forward price-to-earnings ratio over the last decade of 15 times.

“If I compare India to the rest of the region, it now looks OK, but it isn’t jumping out in terms of valuation,” says Ayaz Ebrahim, head of Asian equities at Amundi, the French asset manager. “And we’ve probably got the most we are going to get from this rally, without more positive macro developments.”

As yet, there are few signs of such a broader pick-up in India’s struggling economy, where growth has fallen to decade-lows of roughly 4 per cent in recent quarters, and is predicted to recover only slightly early next year. The rupee’s stability remains to be tested as well, in particular when the RBI eventually closes the temporary facility it opened to sell dollars directly to state-run oil companies, a move that many economists credit with helping to stop the currency’s fall. India’s fractious politics provides one further source of potential uncertainty, with investors hoping for a decisive result in national elections due to be held before next May, roughly the same time as the US Fed may look again at tapering its “quantitative easing” programme. “The big question is whether the storm is over, or whether we are still in the eye?” says economist Eswar Prasad of Cornell University. “I fear the fairest answer is that we are indeed in the eye, and although the storm has become calmer, there are still plenty more choppy waters to come.”

India is the top remittance beneficiary from Saudi Arabia with $8.4 billion received in 2012, the World Bank has said.

Saudi Arabia is the second most remittance sending country after the US and is estimated to have sent over $ 27.6 billion of outward remittance in 2012, Saudi Gazette reported.

The top three remittance beneficiaries from Saudi Arabia in 2012 are India (USD 8.4 billion), Egypt (USD 5.7 billion) and Pakistan (USD 3 billion).

A recent survey conducted by the National Commercial Bank said that the new 'Nitaqat' labour law in Saudi Arabia is expected boost these figures in 2013, as expatriates transfers even money prior to leaving the country.

Among the Gulf Cooperation Council (GCC) countries, the UAE comes second in sending remittance, with USD 20.3 billion, followed by Kuwait at USD 8.5 billion.

The Sensex has never been higher. The stock index today surged to an all-time high today just after the opening bell, smashing its earlier record of 21,206 which was set in January 2008.

After breaking its 2008 record, the Sensex kept going up, setting a new all-time high record of 21,279.92, up nearly 115 points. At its day's high, Nifty hit 6,329, nearly 30 points away from its record high of 6,357.10.

Sustained inflows from foreign investors have been the biggest driver for the Sensex, which gained over 9 percent in the past month. Overseas investors have pumped in close to Rs. 18,000 crore in the past 20 sessions.

The gains represent a remarkable comeback for the Sensex, which has advanced nearly 22 per cent since hitting an intraday yearly low of 17,448.71 points on August 28, when the rupee had hit a record low of 68.80 to a dollar.

The government will meet the fiscal deficit target of 4.8 per cent of GDP for the current financial year, Department of Economic Affairs Secretary Arvind Mayaram said on Thursday.

"We will meet the fiscal deficit target for the current fiscal year," he said.

Finance Minister P Chidambaram has on many occasions reiterated that a red line has been drawn for the fiscal deficit and it will not be breached. The government wants to narrow the deficit from 4.9 per cent of GDP last year.

The fiscal deficit in the first six months of the current financial year touched Rs. 4.12 lakh crore, or 76 per cent of the budget estimate of Rs. 5.42 lakh crore, government data showed.

A year earlier, the difference between government receipts and spending had reached 65.6 per cent of the budget target.

The government on September 18 unveiled austerity measures that will cut non-plan expenditure by 10 per cent.

The steps include a freeze on fresh appointments and a bar on executive class air travel.

"The current account deficit is well under control and we are confident that we will adhere to the red line on fiscal deficit," Mr Chidambaram said.

The Current account deficit or CAD has been a major worry as the single biggest reason why the rupee hit a record low this year and the revision will bring relief. Mr Chidambaram said with a sharp pick-up in exports in the last three months and a sharp reduction in gold imports, there was a chance that the CAD this year would be lower than today's estimate of $60 billion of the GDP. The government had earlier targeted containing CAD at $70 billion dollars.

Strong core sector growth, with strong monsoons and healthy exports, augurs well for growth, the Finance Minister said.

He strongly backed the efforts of new RBI governor Raghuram Rajan to contain inflation and stabilize the rupee and said, "the rupee has by and large stabilised, though in my personal opinion it is still trading above its appropriate level. The stability in currency markets will give comfort to take more measures."

India's forex reserves rose for a fourth consecutive week with the week to October 25 adding another $1.828 billion, taking the overall forex kitty to $282.95 billion, Reserve Bank of India (RBI) data showed on Friday.

The reserves had grown by $1.9 billion to $281.12 billion during the week before.

Foreign currency assets (FCAs), which form the largest chunk of the reserves, jumped $1.8 billion to $254.50 billion in the week under review, the apex bank said.

Foreign currency assets, expressed in dollar terms, include the effect of appreciation or depreciation of the non-US currencies such as the euro, pound and yen, held in the reserves.

The gold reserves remained unchanged at $21.765 billion in the week under review for the fifth week, while the special drawing rights grew by $13.7 million to $4.47 billion, according to the RBI data.

The country's reserve position with the IMF rose by $6.9 million to $2.213 billion in week to October 25, the data showed.

"With a gross capital formation of 30 per cent, India still has the potential to grow between eight to nine per cent annually," Mr Rangarajan said at the 39th foundation day of Coal India Ltd (CIL).

The former RBI Governor said the main problem for the Indian economy was the fall in the productivity of capital.

"Some critical inputs are not available and there is a delay in the implementation of projects," he said.

"The economy is not getting adequate output by investment of capital."

He said with speedy implementation of projects, the country could still grow at 8-9 per cent. He, however, said that as per the advanced CSO estimates, India would grow between 5 and 5.5 per cent in the current fiscal year (FY14).

It is going to hit ground so hard.. This is not a healthy growth. this is not even a growth, this is swelling, edema.Austin wrote:Sensex rises to all-time high, beating 2008 record

The Sensex has never been higher. The stock index today surged to an all-time high today just after the opening bell, smashing its earlier record of 21,206 which was set in January 2008.

After breaking its 2008 record, the Sensex kept going up, setting a new all-time high record of 21,279.92, up nearly 115 points. At its day's high, Nifty hit 6,329, nearly 30 points away from its record high of 6,357.10.

Sustained inflows from foreign investors have been the biggest driver for the Sensex, which gained over 9 percent in the past month. Overseas investors have pumped in close to Rs. 18,000 crore in the past 20 sessions.

The gains represent a remarkable comeback for the Sensex, which has advanced nearly 22 per cent since hitting an intraday yearly low of 17,448.71 points on August 28, when the rupee had hit a record low of 68.80 to a dollar.

Why do you think this is not a healthy growth ?Atri wrote:It is going to hit ground so hard.. This is not a healthy growth. this is not even a growth, this is swelling, edema.

Are you sure you meant "discounting"?kumarn wrote:market is simply discounting Modi as PM. nothing to be surprised about in the 'euphoria'