Re: Indian Economy News & Discussion - Nov 27 2017

Posted: 24 Dec 2019 20:20

We have to look at the tender. Maybe it will be a JV with an Indian partner.

Consortium of Indian Defence Websites

https://forums.bharat-rakshak.com/

Factoring service is not extensively used in India. Banks themselves offer a bill discounting facility which mimics a factoring service. Also it is a facility with recourse to the borrower if the customer doesn't pay on due date.isubodh wrote:Is there no factoring facility available ? for a cost of 2-3% Invoices should be discounted by some bank/NBFC.nandakumar wrote: ... The working capital requirements have gone up by Rs roughly Rs 35 lakhs assuming a 90 day credit availed by customers on the incremental annual turnover of Rs 1.3 crore which were earlier exempt from excise duty levy. ...

Meaning Client will only pay GST to vendor (not the prinicipal amount which may be further delayed) after vendor has paid GST of their Tax Invoice to the Govt so that Client can take vendor financed GST input credit?VKumar wrote:Nowadays customers not paying GST amount till they see the invoice on their computer.

Yes, that is what I too heard. But the problem is a bit more nuanced than that. For some services, you have to depend on a local manpower contractor. Now he is also likely to be socially and politically connected. He also has a dismissive attitude towards paying taxes of any kind. He thinks regular bribing of party people, contributing to political activities in the neighbourhood is equivalent to paying taxes. As a SSI vendor doing contract manufacturing for bigger companies, he has to pay GST. It is not always possible to enforce similar treatment to his own suppliers.tandav wrote:Meaning Client will only pay GST to vendor (not the prinicipal amount which may be further delayed) after vendor has paid GST of their Tax Invoice to the Govt so that Client can take vendor financed GST input credit?VKumar wrote:Nowadays customers not paying GST amount till they see the invoice on their computer.

Exactly right... it is the in between player of the ecosystem: typically a well educated, technically competent vendor/ first time entrepreneur who get the shaft : They have to pay GST before getting paid by the larger client, they can't GST credit from their vendors since the vendors are too small and default on tax paying anyway.nandakumar wrote:Yes, that is what I too heard. But the problem is a bit more nuanced than that. For some services, you have to depend on a local manpower contractor. Now he is also likely to be socially and politically connected. He also has a dismissive attitude towards paying taxes of any kind. He thinks regular bribing of party people, contributing to political activities in the neighbourhood is equivalent to paying taxes. As a SSI vendor doing contract manufacturing for bigger companies, he has to pay GST. It is not always possible to enforce similar treatment to his own suppliers.tandav wrote: Meaning Client will only pay GST to vendor (not the prinicipal amount which may be further delayed) after vendor has paid GST of their Tax Invoice to the Govt so that Client can take vendor financed GST input credit?

NEW DELHI: Finance minister Nirmala Sitharaman on Tuesday unveiled Rs 102 lakh crore of infrastructure projects that will be implemented in the next five years as part of the government's spending push in the infrastructure sector.

This is typical theory economist who haven't sold one tomato in their life talk.India needs very serious reforms: IMF's Gita Gopinath

No MDR charges on transactions through RuPay cards and UPI payments will kill the digital payments industry, the Payments Council of India stated on Monday while criticising the government’s move. After a meeting with bankers last Saturday, Finance Minister Nirmala Sitharaman had asked them not to charge MDR on payments via RuPay, UPI from January 1 with a view to driving digital payments. The move will apply to all companies with a turnover of Rs 50 crore or more. Merchant Discount Rate is the fee paid by a merchant to a bank for accepting digital payments. The move is part of the budget announcement in July.

Describing the decision as surprising and will stop investment and innovation, Vishwas Patel, the Payments Council of India Chairman, said, “the zero MDR on RuPay and UPI will kill the industry and make the business model unviable. It’s like nationalisation of the payments industry. If the government wants to drive digitization, then it should bear the cost.” Stating that there will be significant negative impact on the payment ecosystem — innovation, job losses and a slowdown in the expansion of the digital payments, he said the move will lead to end of customer incentive spends by participants.

The PCI, the representative body of merchant acquirers and aggregators, also warned that elimination of MDR will dry out revenue, creating a catastrophic situation for the industry. Additionally, if there is zero revenue to be made from the over 500 million plus active RuPay debit cards, service providers will start withdrawing PoS terminals to cut their losses. “If government wants to push digital payments, then making MDR zero is not the solution, but a lower, controlled MDR along with added tax benefits to merchants will go a long way,” Patel suggested.

Terming the decision with the right intention but a wrong policy, he said the decision is going to impact the whole digital payment industry as well as investments. He also recalled expert panel recommendations by the RBI-appointed Nandan Nilekani panel and the Watal committee of Niti Ayog calling for market-driven pricing.

Digital payments had reached 13 per cent during the demonetisation months but has since declined to around 11 per cent now, indicating rising cash in circulation, he said. “It is also irrational to pass on the benefits to large retail merchants for transactions above Rs 2,000,” he said, adding the move will deflate the hard work done by the acquiring industry and that if MDR is not to be charged to merchants, it should be borne by the government.

NEFT charges are like charging for taking the money out of bank to put in another bank. This cannot be justified. The cheques used to be free transfer, replacing it with a electronic/digital channel which is highly automated, where is the saving for the customer ?Supratik wrote:In my opinion NS is not thinking through on these issues. NEFT and MDR charges should not have been withdrawn. These are sources of legitimate income for financial institutions. One can bring it down to a minimum if govt thinks it is too high but eliminating it does not make sense to me. The cost of extremely low mobile phone tariffs is visible to everyone with the companies nearly tanking. Financial transactions are a fundamental function of these companies for which there should be a charge.

A chequebook, which has limited availability, is not too convenient for e-payment which requires infra of its own. One can say chequebook is also automated once all personnel and infrastructure is accounted for.NEFT charges are like charging for taking the money out of bank to put in another bank. This cannot be justified. The cheques used to be free transfer, replacing it with a electronic/digital channel which is highly automated, where is the saving for the customer ?

Each bank differ in assessing the risk with some being aggressive and some conservative. Assessment has a significant degree of subjectivity that can be used for approvals. At the extreme ends documents can be falsified as well (false invoices, fake contracts etc.).Haresh wrote:A question for members who know about finance and banking.

Is lending a political decision?

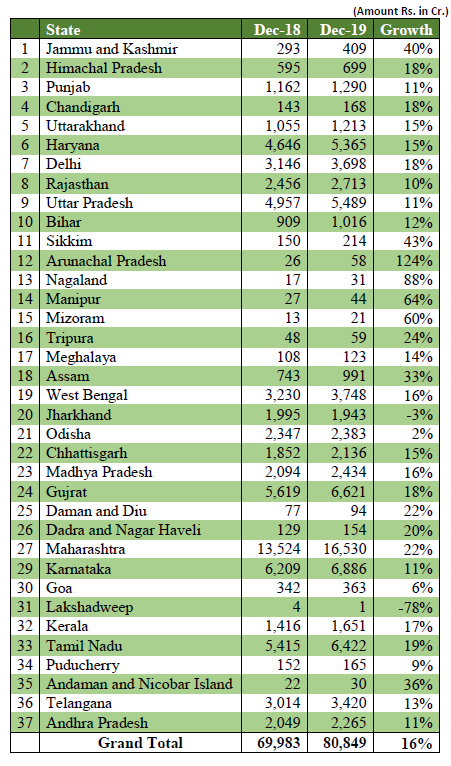

Maharashtra is really the Big Daddy. The difference between it and the other states is huge. Even on a big base, GST collections growth rate is impressive.vijayk wrote:

GST Collections