Re: Indian Economy News & Discussion - Nov 27 2017

Posted: 22 Jan 2021 23:41

True. Thanks Kaivalya

Thanks Suraj. Will check that thread.

Thanks Suraj. Will check that thread.

Consortium of Indian Defence Websites

https://forums.bharat-rakshak.com/

Gandhinagar, The Gujarat government on Friday signed a Memorandum of Understanding (MoU) with the private infrastructure company, Adani Port & SEZ Ltd., to setup the country's largest multi-modal logistics park at Sanand with an estimated investment of ₹50,000 crore.

The proposed 1,450 acre park will have a dedicated air cargo complex with 4.6 km long runway to handle even large sized cargo aircraft and will offer direct air, rail and road connectivity. It will also have a provision of direct rail connectivity with dedicated freight corridor which is part of the Delhi-Mumbai Industrial Corridor (DMIC).

According to the state government, the project will be completed in a phased manner in three years as the work will commence within six months after obtaining required clearances and permissions.

The warehouse will have 38 lakh sq ft space for textile, bulk, e-commerce, nine lakh sq ft space for bonder warehouse, four lakh grade-A palatized facility and 60,000 temperature controlled palletized facility. Against 3.3 lakh capacity, a container yard in this park will have four handling lines with TEU (twenty ft equivalents).

- 2020 turned out to be a year in which everything changed. The year 2021 has commenced with countries across the world in a massive vaccination drive.

- In India, recent shifts in the macroeconomic landscape have brightened the outlook, with GDP in striking distance of attaining positive territory and inflation easing closer to the target.

- Financial markets remain ebullient with EMEs receiving strong portfolio inflows and India on track for receiving record annual inflows of foreign direct investment.

Polavaram is in AP. Do you mean Kaleshwaram project? That project is in TS and huge expenditure was incurred for that.Cyrano wrote:Details are emerging of massive swindling of funds in the Polavaram project by TRS govt, whose Baghirathi video is posted above. (

The Chief Engineer, a junior to me, studied at the ZPHS in my native place. Many of my childhood friends were his classmates at the HS. I also studied for a couple of years there. Do you have hard evidence? I will introduce you to local MLAs, left kapu leaders from that area, and others in the know. You can confront them if you are willing. Come up with hard actionable evidence. Then we are talking.Cyrano wrote:Details are emerging of massive swindling of funds in the Polavaram project by TRS govt, whose Baghirathi video is posted above. PILs filed have revealed some data. Just within 4 out of 28 work packages that were allocated, evidence of prices quoted by vendors like BHEL etc overstated by several x fold in govt expenditure details, and a gigantic scam of several 10xthousands of crores is being revealed.

If the centre has even partially funded the project, don't they have a right & duty of oversight to prevent such corruption?

Lack of credible political opposition in TS means this will largely go unchecked and unpunished.

DI in India rose to $57 billion, with most money flowing to companies active in the digital economy, the UN said. India now receives the third most FDI worldwide, trailing China ($164 billion) and the U.S. ($134 billion).

But FDI fell in other economies in the South Asia region, especially those dependent on exporting apparel, as demand fell during the COVID-19 pandemic.

India offers foreign companies lower wages, tax incentives and, in some cases, tax exemptions. The government said it seeks to promote "pro-business" policies that increase competitive markets to generate wealth rather than "pro-crony" policies that favor entrenched interests.

Developing economies now account for about 70% of FDI, the U.N. report said.

"Though FDI inflows showed a substantial jump in the 1990s over 1980s, it was still modest compared to many rapidly growing Asian economies and a miniscule compared to China," Dr. Bipul Kumar Das said in a research paper published in the January 2020 issue of the International Journal of Scientific& Technology Research.

The IMF on Tuesday projected an impressive 11.5 per cent growth rate for India in 2021, making the country the only major economy of the world to register a double-digit growth this year amidst the coronavirus pandemic.

The International Monetary Fund’s growth projections for India in its latest World Economic Outlook Update released on Tuesday reflected a strong rebound in the economy, which is estimated to have contracted by eight per cent in 2020 due to the pandemic.

In its latest update, the IMF projected a 11.5 per cent growth rate for India in 2021. This makes India the only major economy of the world to register a double-digit growth in 2021, it said.

China is next with 8.1 per cent growth in 2021 followed by Spain (5.9 per cent) and France (5.5 per cent).

Revising its figures, the IMF said that in 2020, the Indian economy is estimated to have contracted by eight per cent. China is the only major country which registered a positive growth rate of 2.3 per cent in 2020.

India’s economy, the IMF said, is projected to grow by 6.8 per cent in 2022 and that of China by 5.6 per cent.

Stocks in the S&P BSE Auto index that rallied over 12 percent in 2020, will be in focus after the policy to scrap more than 15-year-old vehicles owned by government departments and PSUs was approved. The policy is expected to be notified soon.

The government proposed amendments to the Motor Vehicle Act in July 2019, allowing scrapping of vehicles older than 15 years. The much-awaited scrappage policy will be implemented from April 1, 2022, the government said on Monday.

The step is aimed at getting older, more polluting vehicles off the road by providing incentives to vehicle owners to switch to Bharat Stage VI standard, which is the latest emission norm.

That is a great come back. But, the Covid-19 pandemic has done a very long lasting damage. 8% compression, followed by 11.5% expansion, still leaves us in 2021 just 2.6% ahead of what GDP was in 2019. Without Covid-19 pandemic, assuming 7% growth in 2020 and 2021, would have put 2021 GDP 15% more than 2019. That's a net loss of 12.4% over the two years.

DIPP hasn't yet updated FDI data for Oct-Dec 2020 quarter, so official data remains pending. I'll post when they update.India and China were two major “outliers” in a gloomy year for foreign direct investment (FDI ), as global inflows plunged 42% on year in 2020 to $859 billion, the lowest level since the 1990s, according to the latest Unctad report.

While India witnessed a 13% year-on-year rise, the highest among key nations, in FDI inflows in 2020, China’s rose 4%. Of course, in absolute term, China remained way ahead, with an inflow of as much as $163 billion, while India’s stood at $57 billion. Inflows into India were boosted by those into the digital sector, the report said. Analysts have pointed out that a sizable chunk of these was drawn by Reliance Jio alone.

Here is a news report:Vayutuvan wrote:The Chief Engineer, a junior to me, studied at the ZPHS in my native place. Many of my childhood friends were his classmates at the HS. I also studied for a couple of years there. Do you have hard evidence? I will introduce you to local MLAs, left kapu leaders from that area, and others in the know. You can confront them if you are willing. Come up with hard actionable evidence. Then we are talking.Cyrano wrote:Details are emerging of massive swindling of funds in the Polavaram project by TRS govt, whose Baghirathi video is posted above. PILs filed have revealed some data. Just within 4 out of 28 work packages that were allocated, evidence of prices quoted by vendors like BHEL etc overstated by several x fold in govt expenditure details, and a gigantic scam of several 10xthousands of crores is being revealed.

If the centre has even partially funded the project, don't they have a right & duty of oversight to prevent such corruption?

Lack of credible political opposition in TS means this will largely go unchecked and unpunished.

Is that net inflows? How can a country get over 100% reduction?Mollick.R wrote:

Why do we have to go to world bank for every thing. The new GDP measurement process was also developed with World Bank help and yet there are constant question marks over our GDP.Mollick.R wrote:Push for artificial intelligence: India is turning from man to machines to get its economic data right

By Vrishti Beniwal, Bloomberg Last Updated: Jan 28, 2021, 08:25 AM IST

The Ministry of Statistics is ramping up use of artificial intelligence for collecting, analyzing and reporting data to better monitor the economy. The measures include a $60 million program with World Bank help using an information portal that collates real-time data.

Read Full Article from Economic Times//ET Link

https://economictimes.indiatimes.com/ne ... content=23

Is that net inflows? How can a country get over 100% reduction?[/quote]DavidD wrote:]

I think the general standard of ToI is a factor here. But in general that piece of news seems relatively small potatoes and not worth much concern. China and India are active World Bank borrowers, having long figured out that as mature stable economies they can cheaply borrow lots of funds even if they don't "need to", just because it's cheaper and easier.hanumadu wrote:To be clear, I don't have anything against taking loans from World Bank. But what is it that they know about our economy that we do not know that we have to take their help in collecting and measuring our data. Or do their economists know best practices that ours do not? Of course, I am assuming here 'World Bank help' refers to know how help in setting up the portal and not necessarily monetary help since we have 'consulted' them for our new GDP measurement. I am unable to find references to such consultancy help but that's what I remember reading.

Not the above that caught my eye. The above was just a salve to my ego. Here is what caught my eye:*Rajiv Bajaj take note, it’s time to acknowledge that you were wrong.

*That goes for a whole host of other globally-acclaimed economists and intellectuals.

And already like canaries in a mine, the Cassandras are already signaling their intentions, so that they can do their rona-dhona when their own expectations are belied.The commercial vehicles sector, which was affected not only by Covid but by the government’s decision to raise axle-load limits and implement the goods and services tax (GST), which improved fleet-owners turnaround times for trucks and slowed down demand for new vehicles, is on the cusp of a huge spurt in demand....

...But the most interesting data point is that the government, thanks to Covid-related inability to spend the budgetary allocations of 2020-21, is sitting on a cash pile of more than Rs 3.29 lakh crore, according to an estimate by The Economic Times.

If the government now borrows even more this year (we still have two months to go), it will have a huge war chest for investing in the first half of next fiscal starting April 2021. Add any infusions from privatisation proceeds, and 2021-22 looks like a good year for infrastructure investment-led growth.

However, my is that the GOI will concentrate on just a couple of items. Infrastructure and Infrastructure. The first kind is the rails, roads, bridges, ports kind and the second is the social kind., More toilets, water taps, primary health care & education, electricity, and micro-entrepreneurship.

Sun Edison will invest Rs 4,629 crore to establish a solar PV module making facility, Ola Electric will invest Rs 2,354 top set up a plant to manufacture electric vehicles and batteries, Taiwanese Luxshare will invest Rs 745 crore to manufacture electronic components and wearables, and Apple Inc's contract manufacturer Pegatron Corporation will invest Rs 1,100 crore n phase-I to make phones.

Further, Lucas TVS will invest Rs 2,500 crore to manufacture Li-ion batteries and Japan's Daicel Corporation will invest Rs 358 crore to set up India's maiden airbag inflator manufacturing unit. Also, Germany's Eickhoff Wind will invest Rs 621 crore to manufacture gearboxes for wind energy generators and relocate its facilities from China and Germany.

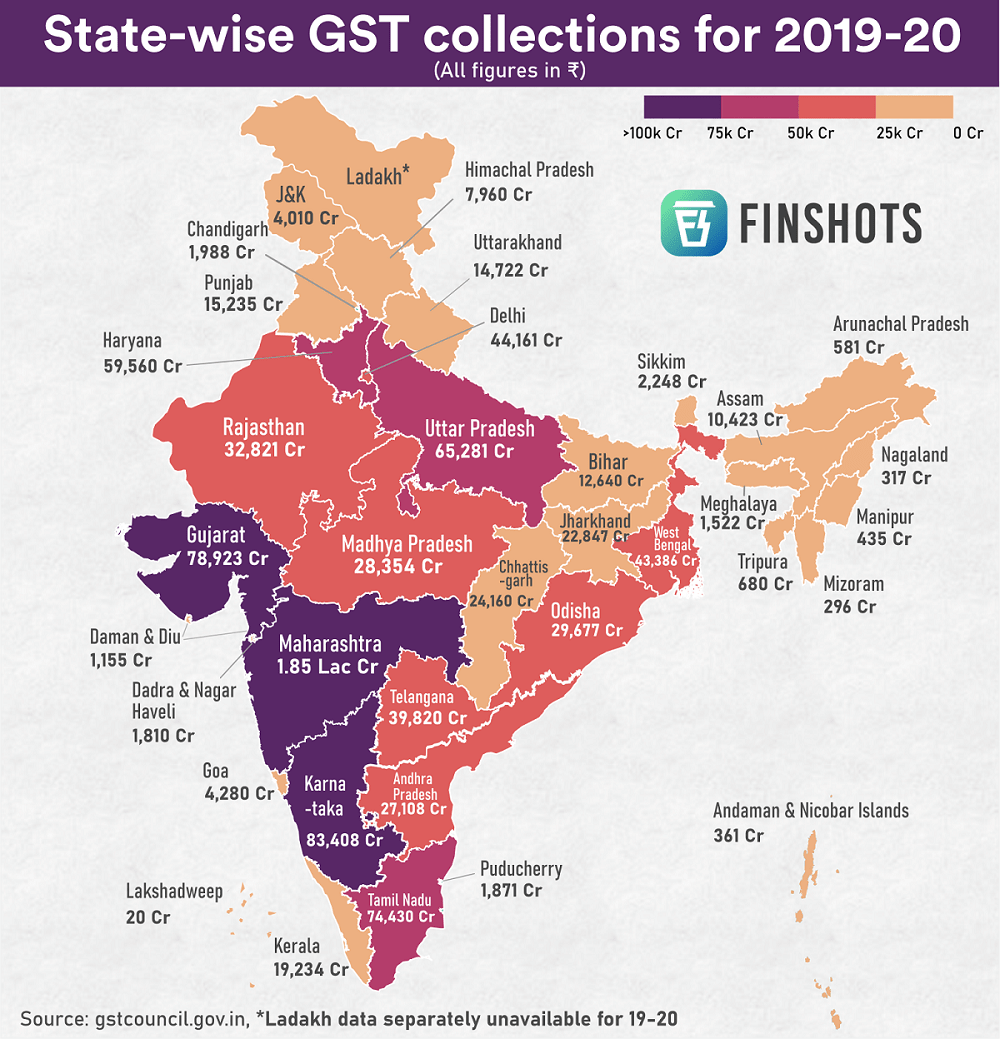

futher the values are absolute and not per capita, so population will also be a factor in thatsrin wrote:^^^ Correct me if I'm wrong. The GST is a consumption oriented tax - not the production oriented.

So, if a state is not paying enough GST, it doesn't necessarily mean lack of industrial activity - it means lack of business activity (includes trading, retail, services etc) and also lack of last mile retail consumption. Additionally, there is also a caveat here - this is true for taxable goods/services (agriculture activity won't show up properly).

Delhi is where many head offices are located , so it will be natural place GST and IT collections are high . Almost all indirect taxes and direct taxes will be from Urban areas.Shanmukh wrote:Delhi has a GST collection of 44K crore, which is bigger than entire Bengal's! Does anyone have the break up of GST collection by cities? It will be interesting to see how the big cities are contributing to the collection of GST.

i dont think it works that way., GDP growth works in correlation with other economies , not in isolation so the addition and subtraction is just a theoretical exerciseUttam wrote:

That is a great come back. But, the Covid-19 pandemic has done a very long lasting damage. 8% compression, followed by 11.5% expansion, still leaves us in 2021 just 2.6% ahead of what GDP was in 2019. Without Covid-19 pandemic, assuming 7% growth in 2020 and 2021, would have put 2021 GDP 15% more than 2019. That's a net loss of 12.4% over the two years.All the above numbers are my informed assumptions.

Edited to remove reference to Chinese virus

I didn’t quite understand what you mean here. Would you please elaborate? Do you mean to say that economic growth should be looked at relative to other nations? I agree that it should be. However, income increases or decreases are experienced by individuals in absolute terms and therefore they matter.kit wrote:

i dont think it works that way., GDP growth works in correlation with other economies , not in isolation so the addition and subtraction is just a theoretical exercise

What were the programs that could not be implemented? So we won't overshoot the the deficit?But the most interesting data point is that the government, thanks to Covid-related inability to spend the budgetary allocations of 2020-21, is sitting on a cash pile of more than Rs 3.29 lakh crore, according to an estimate by The Economic Times.