Re: Indian Economy News & Discussion - Nov 27 2017

Posted: 25 Feb 2021 00:49

Latest NaMo statement on privatization: "Government has no business to be in business"

Consortium of Indian Defence Websites

https://forums.bharat-rakshak.com/

the petrol prices are high, but using DFC and electrified trains will reduce the cost of transportation. this is a way to incentivize usage of trains and thus incentivise usage of both DFC as well as alternate fuels.Uttam wrote: My comment is only in relation to competitive advantage in the global marketplace. Transportation cost is a function of road-rail-port infrastructure as well as fuel and labor. India currently has an advantage only in terms of labor costs. Work is being done to improve road-rail-port infrastructure, but we are still a couple of years away to realize the significant benefits of it. Reduction in fuel taxes can reduce the disadvantage Indian manufacturers face due to elevated transportation costs.

The Union Cabinet, chaired by Prime Minister Narendra Modi on Wednesday (24 February) approved a Rs 15,000 crore Production Linked Incentive (PLI) Scheme to promote domestic manufacturing of high value products in pharmaceutical sector.

The PLI scheme for Pharmaceuticals will implemented over a period of eight years - from financial year 2020-21 to 2028-29. The government will incentivise the producer firms by paying anywhere between 5 to 10 per cent of the the yearly incremental output based on the category of pharmaceutical product.

While Indian pharmaceutical industry is 3rd largest in the world by volume and is worth USD 40 billion in terms of value and contributes 3.5 per cent of total drugs and medicines exported globally, it is mostly low value generic drugs that account for the major component of Indian exports. A large proportion of the domestic demand for patented drugs is still met through imports. The import dependence is due to Indian Pharmaceutical lacking capability in high value production along with the necessary pharma R&D.

The PLI scheme for pharmaceutical sector is aimed at incentivising the global and domestic players to enhance investment and production in diversified product categories including specific high value goods such as bio-pharmaceuticals, complex generic drugs, patented drugs or drugs nearing patent expiry and cell based or gene therapy products etc.

This should be another very important agenda item for GoI.The average turnaround time for ships at major ports in India has reduced by 35 percent over the last six years, indicating a significant improvement in the country’s port management infrastructure.

.........

Ships’ average turnaround at the country’s major ports fell from 4 days in 2014-15 to 2.59 days in 2019-20, according to the Economic Survey 2020-21

..........

“As per the latest UNCTAD data, the median ship turnaround time globally is 0.97 days, suggesting that India has room to further improve upon the efficiency at ports,” the Economic Survey said.

Pretty much everyone - RBI, FinMin and now Moody's - is converging on negative 6-7% for this year. That's a good thing. Maybe actual numbers may turn out even better if Q4 (Jan-Mar 2021) performance is better than anticipated. But the really notable thing is the rising estimate for next year on top of the reduced degrowth figures this year. 10% after -10% is a shallow bounce, not even making up for the drop. Almost 14% gain on -7% is 6% over the pre-drop figure, a very substantial V shaped performance.The Indian economy is expected to clock a growth of 13.7 per cent in FY’22, registering a strong rebound from a 7 per cent contraction this fiscal, on the back of normalisation of activity and growing confidence in the market with the rollout of COVID-19 vaccine, Moody’s Investors Service said on Thursday.

Moody’s had in November last year projected Indian economy to contract 10.6 per cent in the current fiscal and return to growth of 10.8 per cent in 2021-22 fiscal.

Suraj-saar,Suraj wrote:Just as the GDP drop estimates for this year are being reduced, growth projections for next year are being increased:

Moody's revises 2020-21 drop to -7%, increases 2021-22 GDP growth estimate to 13.7%Pretty much everyone - RBI, FinMin and now Moody's - is converging on negative 6-7% for this year. That's a good thing. Maybe actual numbers may turn out even better if Q4 (Jan-Mar 2021) performance is better than anticipated. But the really notable thing is the rising estimate for next year on top of the reduced degrowth figures this year. 10% after -10% is a shallow bounce, not even making up for the drop. Almost 14% gain on -7% is 6% over the pre-drop figure, a very substantial V shaped performance.The Indian economy is expected to clock a growth of 13.7 per cent in FY’22, registering a strong rebound from a 7 per cent contraction this fiscal, on the back of normalisation of activity and growing confidence in the market with the rollout of COVID-19 vaccine, Moody’s Investors Service said on Thursday.

Moody’s had in November last year projected Indian economy to contract 10.6 per cent in the current fiscal and return to growth of 10.8 per cent in 2021-22 fiscal.

Replying on behalf of Suraj. Yes, these are real growth estimates. Inflation is likely to be on the higher side, probably around 6%, resulting in a nominal growth of over 20.3% (=1.135 * 1.06 - 1)Shanmukh wrote:

Suraj-saar,

The growth mentioned there is the real growth, correct? Not the nominal growth that is affected by currency valuation, inflation, etc? So, all in all, the nominal growth, should be rising ~17-18%?

This will enable correct valuation of road asset in the future and will encourage more investors to invest in the Highway infrastructure of the country.

In the first signs of an incipient recovery for its pandemic battered economy, India's gross domestic product (GDP) growth for the third quarter (Q3) ending December 2020 stood at 0.4 per cent as against contraction of 23.9 per cent and 7.5 per cent in the first and second quarters ending June and September 2020 respectively.

Major ports’ volumes grew by 4.4% y-y (+1.5% m-m) in Jan 2021, led by strong growth in container volumes (+6.4% y-y in tonnage terms) and POL volumes (up 3.1% y-y, the first month of y-y growth since Feb’20).

Elsewhere, January was the first month ever when Indian steel output exceeded 10 million tonnes. For comparison, Japan produces 8MT, US produced 7MT and EU (27 countries) combined to produce 12.2MT. Just a matter of 2-3 years before Indian steel output exceeds combined EU output.In total, the foreign portfolio investors (FPIs) pulled out a net sum of Rs 2,124 crore from the bond markets, while investing Rs 25,787 crore in the equity markets taking the net value to Rs 23,663 crore.

It should be noted that February marks the second consecutive months of net FPI inflows into Indian markets for the new calendar year.

In January the FPIs were net buyers with net investment of Rs 14,649 crore in Indian equity and bond markets. The momentum gained further strength following the announcement of third-quarter earnings by India Inc and the presentation of the Union Budget 2021-22 announced by Finance Minister Nirmala Sitharaman.

Revenue collection crossed Rs 1 lakh crore for the fifth time in a row and crossed Rs 1.1 lakh crore-mark for the third time in a row post pandemic, the department of revenue said Monday.

India is auctioning 2,251.25 megahertz (MHz) of 4G airwaves valued at Rs 3.92 lakh crore up at base price. On sale are seven bands - 700 MHz, 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 2300 MHz and 2500 MHz bands – with experts predicting that the government would net a maximum upto Rs50,000 crore, with Jio expected to be the most aggressive of the three and Vodafone Idea the least.

The current auction does not include frequencies in 3,300-3,600 Mhz bands that were identified for 5G services, which will happen later.

Manufacturing PMI strong at 57.5 in FebruaryIndian Railways loaded 112.25 million tonnes (MT) of cargo in February, which is almost 10 per cent higher compared to 102.21 MT of loading (recorded up to February 28) of last year.

“As last year was a leap year, Railways compared data of 28 days this February against the 28 days of 2020 instead of the 29-day full month,” explained an official.

In January 2021, Railways loaded 119.79 million tonnes.

Indian Railways earned ₹11,096.89 crore from freight services during the month under review, which is 7.7 per cent higher, as against ₹10,305.02 crore earned in the same time last year, stated a release. As on February 28, freight loaded by Indian Railways was also higher than last year’s cumulative freight loading for the same period.

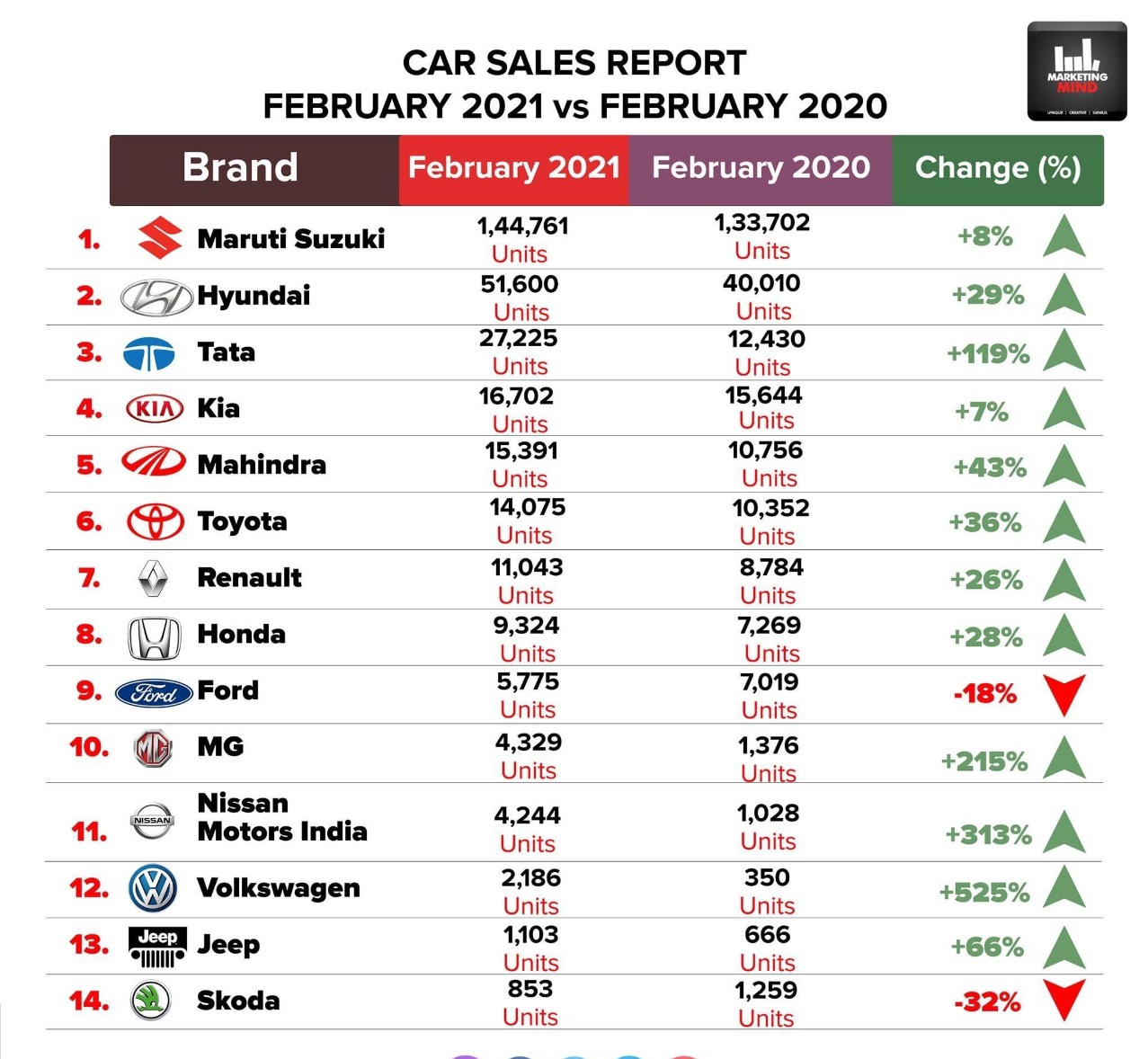

From GST collection to car sales, macro data signals steady recoveryExpansion in India’s manufacturing activity, as tracked by the seasonally adjusted IHS Markit India Manufacturing Purchasing Managers’ Index (PMI), declined marginally to 57.5 in February from 57.7 in January 2021. The headline figure remained above the long-run average of 53.6.

The country's manufacturing sector activity climbed to a near eight-year high in January, driven by sharp rise in new business orders amid a rebound in demand conditions that led to rise in production and hiring activity.

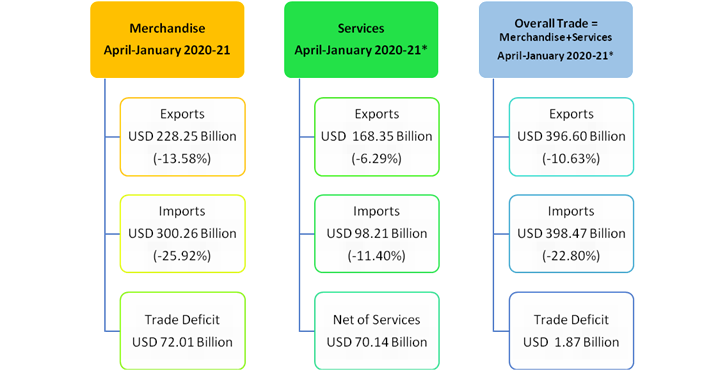

Electronic exports cross pre COVID levels, touch record 8806cr in DecemberNon-petroleum and Non-Gems and Jewellery exports in January 2021 were USD22.44Billion, as compared to USD19.79Billion in January2020, registering a positive growth of 13.40per cent. Non-petroleum and Non-Gems and Jewellery exports in April-January 2020-21 were USD188.77Billion, as compared to USD197.94Billion for the corresponding period in 2019-20, which is a decrease of (-) 4.63 per cent.

GST mop-up at Rs 1.13L crore in FebruaryWith the level of Covid-19 infections tapering off and the economy recovering faster than expected, foreign portfolio investors (FPIs) continue to buy into Indian equities. With inflows of $4.9 billion so far in 2021, India is among the favourite emerging markets so far this year. While Brazil and Indonesia have received inflows of $3.2 billion and $1 billion respectively, South Korea, Philippines and Taiwan have seen outflows.

GST collections top Rs 1 lakh crore for 5 months in a row, rise 7% in FebruaryGross goods and services tax (GST) collections came in at Rs 1,13,143 crore in February, 7% higher than in the year-ago month, official data showed on Monday, indicating that a recent surge in transactions in the economy was sustained through January.

From a monthly low of just over Rs 32,000 crore in April 2020, the collections had gradually picked up; since September 2020, the mop-up has been higher than the year-ago levels and for the last five months, the revenues have been above the Rs 1-lakh-crore mark.

Services PMI rises to 55.3 in February on boom in domestic demandGST collections crossed the Rs 1 lakh crore-mark for the fifth month in a row in February, rising 7 per cent annually to over Rs 1.13 lakh crore, indicating economic recovery, the finance ministry said on Monday. Goods and Services Tax (GST) collections had risen for two straight months to touch record Rs 1,19,875 crore in January and Rs 1.15 lakh crore in December.

The gross GST revenue collected February 2021 is Rs 1,13,143 crore, of which Central GST is Rs 21,092 crore, State GST is Rs 27,273 crore, Integrated GST is Rs 55,253 crore (including Rs 24,382 crore collected on import of goods) and Cess is Rs 9,525 crore (including Rs 660 crore collected on import of goods).

Warehousing demand likely to grow 160% to reach 35 mn sq ft in 2021: ReportIndia's services activity expanded at the fastest rate in a year during February, while employment fell further and companies noted the sharpest rise in overall expenses, a monthly survey said on Wednesday.

The seasonally adjusted India Services Business Activity Index rose from 52.8 in January to 55.3 in February, pointing to the sharpest rate of expansion in output in a year amid improved demand and more favourable market conditions.

Warehousing demand is expected to grow around 160 per cent to reach 35 million square feet in 2021, if no further lockdowns occur, said a JLL report.

Despite unfavourable socio-economic environment, warehousing stock in top eight cities, including NCR-Delhi, Mumbai, Bangalore, Chennai, Pune, Kolkata, Hyderabad and Ahmedabad has added 27 million square feet to reach a total of 238 million square feet in 2020 as per the 'India Real Estate Outlook - A new growth cycle' by JLL.

The merging of good banks with bad ones is precisely because of this reason, to make them relatively healthy. That said our public sector banks have something like 12 lakh crores in NPAs (or about 180 billion USD) , i remember we are no.2 or no.3 in the world when it comes to loan to NPA ratio. Also, unlike Air India, many politicians may not want to sell the banks else how will they force the banks to lend their benaami companies hundreds of crores in loans or have banks write off thousands of crores in farm loans ?Yagnasri wrote:Most of these banks are listed in stock market sir. Many are quoted good prices. While few are in bad condition, most of them are in good condition. Not very best but good. They are not making any loss. There is no comparison between them and Air India.

PS: I worked for many PSU bank for over the last two decades and also dealt with Air India.

I personally think it is a bit more complicated- it is quite likely that ever since Indira's time, *NO* domestic business in India (i.e. supplying to the domestic market and not exports) has actually really made money/ positive EVA THROUGH operational efficiency. Profits have mostly been on account of cheap inputs (minerals), AND/ OR by the taxpayer through bank loans being embezzled. So Indian industry basically made money through sweetheart deals between themselves, Indian bureaucrats and politicians for either bank credit, or low factor inputs, with the Indian taxpayer left holding the can.Political leaders may not be the sole reasons for NPAs. In fact private sector banks are also not that healthy. The main reason is the inability to do proper credit appraisal and also fear of prosecution in case of any account become NPA. The idea that all NPAs are some how due to criminal conduct of the bankers and the borrowers is also damaging the banking sector.

Indian corporate houses also need to be more professionalized which will help better management of the finances and thereby reduce NPAs.

Pradhan Mantri Jan Dhan Yojana: More than 50% account holders under PMJDY women, says FinMinThe government has realised Rs 53,346 crore through direct tax dispute resolution scheme Vivad Se Vishwas till February 22, Parliament was informed on Monday.

To a query in the Lok Sabha on whether the government has been able to achieve the objective of settling income tax cases after launching the Vivad se Vishwas scheme, Minister of State for Finance Anurag Singh Thakur said, “Yes”.

He said over 1.28 lakh declarations have been filed under the scheme involving a disputed tax of Rs 98,328 crore. Of this, Rs 53,346 crore has been received as payments against disputed tax.

This include Rs 27,720 crore worth payments made by the central public sector undertakings (PSUs), Rs 1,023 crore by state PSUs, and Rs 24,603 crore by others.

The Vivad Se Vishwas scheme provides for settlement of disputed tax, disputed interest, disputed penalty or disputed fees in relation to an assessment or reassessment order. The dispute is settled on payment of 100 per cent of the disputed tax and 25 per cent of the disputed penalty or interest or fee.

The taxpayer is granted immunity from levy of interest, penalty and institution of any proceeding for prosecution for any offence under the Income Tax Act in respect of matters covered in the declaration.

The Direct Tax Vivad se Vishwas Act, 2020, was enacted on March 17, 2020 to settle direct tax disputes locked up in various appellate forum.

As of February 24, 2021, 23.21 crore accounts, out of the total 41.93 crore accounts opened under the PMJDY scheme, belong to women account holders, the ministry said in a statement.

With regard to the Pradhan Mantri MUDRA Yojana (PMMY), it said, about 68 per cent or 19.04 crore accounts with an amount of Rs 6.36 lakh crore (as of February 26, 2021) have been sanctioned to women entrepreneurs under the scheme since its inception.

The Jan Dhan Yojana, which was announced by Prime Minister Narendra Modi in his Independence Day address in 2014, was launched on August 28 in the same year. The scheme envisages universal access to banking facilities with at least one basic banking account for every household, financial literacy, access to credit, insurance and pension.

In 2018, the government launched PMJDY 2.0 with enhanced features and benefits. Under the new version, the government decided to shift focus from ‘Every Household’ to ‘Every Unbanked Adult’ and free accidental insurance cover on RuPay cards doubled to Rs 2 lakh for PMJDY accounts opened after August 28, 2018.

At the same time overdraft (OD) limit too doubled to Rs 10,000 and the facility of OD up to Rs 2,000 without conditions was brought in.

As per extant RBI guidelines, a PMJDY account is treated as inoperative if there are no customer induced transaction in the account for over a period of two years.

The PMMY was launched on April 8, 2015, for providing loans up to Rs 10 lakh to non-corporate, non-farm small/micro-enterprises. These loans are given by Commercial Banks, RRBs, Small Finance Banks, MFIs and NBFCs.

Under the aegis of PMMY, MUDRA has created three products namely, ‘Shishu’, ‘Kishore’ and ‘Tarun’ to signify the stage of growth or development and funding needs of the beneficiary micro unit or entrepreneur.

As far as Stand-Up India Scheme is concerned, the statement said, more than 81 per cent or 91,109 accounts with an amount of Rs 20,749 crore have been sanctioned to women entrepreneurs under the scheme.

Stand Up India Scheme was launched on April 5, 2016, to promote entrepreneurship at the grass-root level for economic empowerment and job creation.

This scheme seeks to leverage the institutional credit structure to reach out to the underserved section of people such as Scheduled Caste, Scheduled Tribe and Women Entrepreneurs so as to enable them to participate in the economic growth of the nation, it said.

The objective of this scheme is to facilitate bank loans between Rs 10 lakh and Rs 1 crore to at least one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower and at least one woman borrower per bank branch of banks for setting up a greenfield enterprise, it added.