Page 17 of 34

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 03:09

by vina

Yawn.. Back in 2008, in the depths of the financial crisis, I had warned that this end only with a massive mega boom of China going up , and compared this to the the a "Sloika" nuke where the core going off compresses the surrounding material , resulting in a layer upon layer of compression resulting in the final ka-boom.

China, just as expected went on a spending binge (borrow and spend), misdirected capital allocation in a scale never before seen in human history , compounded the follies of the Former Soviet Union multiple times (despite, the CPC claiming to be the great helmsman, always in control and acting in great equanimity / whatever rubbish , for eg, if the FSU had too much iron and steel and other capacity , think china's capacity in every everything) with it's state directed command and control nonsense and inflation in check because the pegged currency effectively imported deflation from the rest of the world while domestically they went on a massive binge (all backed because of the fleet in being like $3T reserves).

Well, fast forward some 8 years, reserves are melting, economy is in the Kakkoose, massive over capacity which has nowhere to go, banking system saddled with massive debt and the govt created a massive boom in the stock market by just "tawk" and that provided the spark for the broader real economy of the chinese to go into a tailspin. Now, the stock market losses are REAL, especially for the banking system and the millions of ordinary Chinese. The yellow matter has hit the fan.

Its like the old saying.

When it has to go, it has to go somewhere , and that in an emergency will probably be your own pants

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 03:21

by hanumadu

Vina, How will the yuan devaluation and chinese over capacity affect India and the rest of the world?

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 03:35

by vina

hanumadu wrote:Vina, How will the yuan devaluation and chinese over capacity affect India and the rest of the world?

Exports get whacked (sets off beggar thy neighbor competitive currency devaluations), imports surge, putting pressure on domestic industries, every country will raise tarrif/non tarrif/ whatever they can barriers against surge of Chinese dumping (which they will do at marginal cost ).. And this is just economic.

If the Chinese face serious meltdown internally, expect CPC to ramp up the schlong measuring contests and look to use jingoism /adventurism against neighbors (Japan, South China Sea and last of all India, but just nothing like Japan bashing to get ordinary Chinese all worked up into a froth).

It aint lookin pretty.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 04:57

by disha

Chinese meltdown was expected., it was not "IF" - but "WHEN".

And no, the meltdown is not a single quarter or a semester or a year affect. This is going to take at least half - a - generation (10 years atleast) to completely unwind. Japan had a meltdown but by then it achieved a very high standard of living for its citizens. It moved from developing country to a developed country. That is not the case with China.

Of course China sets off beggar thy neighbour competitive currency devaluations. But it will have only so much room to go without setting off internal strife (strife within China). With commodities prices falling and treading bottom ., a basket of non-technical., non-agricultural goods puts pressure only on the wage. Compared to Japan or US., China has very few high-tech exports! Their capacity to do that now looks remote.

As commodity suppliers to China., countries like Brazil, Australia will suffer. Also Oil Exporting countries will suffer.

This is a big big and a very big opportunity for India. India can go ahead and start putting infrastructure in place. Here is what India should do:

1. Upgrade & extend its surface transport infrastructure (rail, road, ports) like there is no tomorrow! Steel is cheap. Energy is cheap

2. Upgrade its building technologies - use more of steel and glass than concrete in building its smart cities. Steel/Iron and Glass can be recycled - concrete cannot to the extent of steel/iron & glass when the growth slows and buildings are repurposed. Also the buildings that come up are more elegant

3. Upgrade its Health and Education infrastructure. More nurses, plumbers, electricians ... - again energy is cheap!!

4. Upgrade its food processing infrastructure. Again commodities are cheap. Price of cocoa/coffee/vanilla/etc beans will fall - so service industries based on agri-commodities can see a huge boon!!

Basically India should strive to become the engine of growth for the next decade for the whole world. And Indian economy itself is vast. In India there is One US, half an Africa and has a massive internal economy.

What Modi Sarkar is doing with "Make in India" is an excellent strategy., Indian manufacturing has a long way to go as it is for satiating internal demand. Once Indian growth evens out., it can start infrastructure spending in its near east (Burma, Laos, Cambodia!) and near west (Kenya, Zimbabwe, S. Africa ...). Basically India does not zoom up on a shaky foundation of 'exports' with no internal demand.

As for the islamic countries., they will have to deal with wars and famine. On the theological side., this is a good time to put wahabism to end., basically cap, rollback and eliminate militant islamofascism.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 06:58

by chanakyaa

Stocks' circuit breaker triggers call for changes

The 7-percent dive in the value of Chinese stocks on Monday, the first trading day of the year, triggered the new circuit breaker mechanism that also came into effect that day.

The fall may be largely a result of knee-jerk worries about the imminent end of a ban on sales of shares by listed companies' major shareholders, which was imposed during the market crash last summer.

But, more importantly, by reflecting domestic investors' growing fears about weak factory activity across the country, it also represents an urgent call for greater efforts to speed up structural reforms and improve the overall profitability of Chinese enterprises.

If the health of China's economy is indeed an overriding concern for the global recovery this year, international investors should keep a close eye on the country's endeavors to tackle its overcapacity.

As Chinese policymakers go all out to address the problem of inefficient and unprofitable "zombie enterprises", it is expected that the world's second-largest economy will make some real progress this year on the painful but necessary transition from investment-and export-led growth to more self-sustaining growth driven by consumption and innovation.

For about three decades, China has based its rapid development on being the global manufacturing powerhouse. However, since the onset of the 2008 global financial crisis the growth prospects of the world economy have been significantly dampened. It has become increasingly obvious that China can no longer rely on exports for growth and the problem of too much capacity built to meet external demand will deteriorate unless the number of "zombie enterprises" is substantially slashed.

That is why Chinese authorities have made addressing overcapacity one of the five top economic tasks in 2016.

The government eliminated some of the production overcapacity in the iron and steel, aluminum, cement and plate glass industries last year. But far more needs to be done this year.

Eliminating outdated industrial production will definitely cause a lot of short-term pains for local economies as factories close or cut output and employees. But the cost will be much dearer for the country if funds and resources are allocated to keep uncompetitive enterprises on life support.

Chinese policymakers have ample tools to ease domestic investors' concerns over a possible glut of share sales. But their long-term confidence hinges on the country's progress in reducing overcapacity and thus improving the overall quality of economic growth and the profitability of listed companies.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 08:16

by Suraj

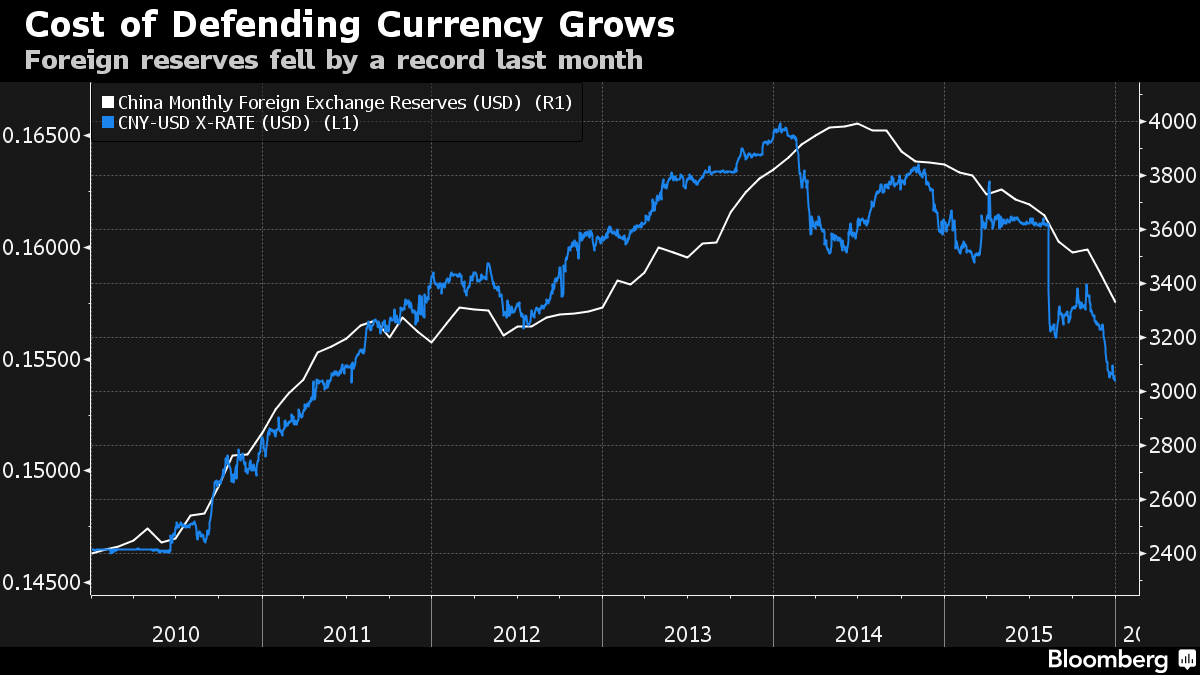

China's Defense of the Yuan Is Growing More Costly

The nation’s foreign currency reserves tumbled by a record $108 billion in December as the central bank sold dollars to stem a slide in the currency. That was about four times greater than analysts predicted in a Bloomberg survey, and reduced the stockpile to the lowest level in three years. Despite the intervention, the yuan’s descent has steepened, with the currency falling to a five-year low on Thursday.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 08:47

by TSJones

rumor has it no more chinese circuit breaker.....their gonna let it ride and get it over with......

if you want out, now's yer time.....

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 09:56

by Singha

^^ wanting out means selling at a heavy loss for whatever one can get... ?

reminds me of the heady days when I purchased a few stocks of Sun microsystems for $112 - each. I mean storied history, tfta hw and sw, used it at work(given to only developers - the sharp end of the spear), legendary founders, pervasive as big back end servers also - what could go wrong?

I did not sell and rode it all the way down to around $12 before finally waving the white flag...

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 10:49

by TSJones

Singha wrote:^^ wanting out means selling at a heavy loss for whatever one can get... ?

reminds me of the heady days when I purchased a few stocks of Sun microsystems for $112 - each. I mean storied history, tfta hw and sw, used it at work(given to only developers - the sharp end of the spear), legendary founders, pervasive as big back end servers also - what could go wrong?

I did not sell and rode it all the way down to around $12 before finally waving the white flag...

At one time I thought Sun was gonna rule now just a part of Oracle

i even took a class and learned Sun Unix....

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 11:28

by ArmenT

TSJones wrote:rumor has it no more chinese circuit breaker.....their gonna let it ride and get it over with......

if you want out, now's yer time.....

Not a rumor, they officially removed it.

http://www.bbc.com/news/business-35253188

"After weighing advantages and disadvantages, currently the negative effect is bigger than the positive one. Therefore, in order to maintain market stability, CSRC has decided to suspend the circuit-breaker mechanism," a statement from the China Securities Regulatory Commission (CSRC) said.

Apparently, it was creating more problems than it solved. Basically, the Chinese circuit breaker trips on two events:

1. If the CSI 300 Index moves 5% from the market's previous close, they stop trading for 15 minutes.

2. If it moves 7% or more, they shut down trading for the whole day.

What happened on Thursday was the first circuit breaker tripped after about 15-20 minutes of trading, so they stopped all trading for 15 minutes. Unfortunately, all that it did was get the traders in panic mode and everyone queued up stocks to sell, while the system was temporarily shut down. The moment it came back on-line, all the sell orders started to process and in a few seconds, it caused the second circuit breaker to trip and that was the end of trading for the day.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 13:18

by Singha

money.cnn.com

The founder of fashion label Metersbonwe has gone missing, the latest in a string of high-profile disappearances in China.

Metersbonwe reported Thursday that founder Zhou Chengjian could not be located, and asked that its shares be suspended from trading. Local media reported that Zhou, along with the secretary of the company's board, had been taken into custody by law enforcement officials.

Zhou is one China's richest individuals, with an estimated net worth of more than $4 billion, according to the Hurun Report.

Some of China's richest and most powerful business titans have vanished in recent months. Some have eventually resurfaced and returned to their posts; others have not. Their absences are seldom explained.

Most of the disappearances are part of an anti-corruption crackdown waged by President Xi Jinping since he took office in 2013.

Experts had expected the campaign to wind down, but this summer's massive market crash has led to a new wave of disappearances. Regulators are cracking down on alleged insider trading and "rumor-mongering."

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 13:40

by Singha

china is slowing down, question is what will be its next 10 year growth rate and its effect on the world economy.

NYT

Some economists see ominous signs of a broader slowing.

A quarterly survey of 2,000 Chinese manufacturers and other industrial companies shows that almost none are currently investing in new equipment and factories. “In the past four quarters, it’s only 2 to 3 percent that are making expansionary investments,” said Gan Jie, the director of the Center on Finance and Economic Growth at the Cheung Kong Graduate School of Business in Beijing, who oversees the quarterly survey.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 14:38

by NRao

China learning on the job. Finding out the hard way that she'll games are just that.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 14:38

by Austin

Seems like CHinese Disease is spreading

Dow has worst four-day start to a year on record

http://money.cnn.com/2016/01/07/investi ... index.html

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 15:43

by TSJones

what you are seeing is the result of a country that has promoted exports to the extreme rubbing up against a more mature economy that is mainly concerned with its *employment level* not exports or imports. there is a disconnect between the two.

the mature economy is raising interest rates because it sees employment levels starting to max out and thus fears inflation even though there is no serious effects of inflation in the economy. doesn't make any difference, they want to stay ahead of the problem. it is talking about raising interest again over the next year even though it is an election year. thus constricting demand.

this puts the extreme export economy in a hurt locker. coupled with the fact that another mature economy, euro, has also slowed down although it is trying to pump up its demand, it fretted about inflation for too long and got out of sync with the US economy. too much listening to the von mises gang.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 20:08

by TSJones

in reference to my above post ^^^^^^

http://finance.yahoo.com/news/u-payroll ... 13555.html

U.S. payrolls surge in December in boost to economic outlook

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 22:57

by Suraj

Since mid 2014, the Chinese have burned through $700 billion to defend the yuan, 2x India's forex reserves and more than that of everyone except Japan. They may blow through at least another $500-700 billion in much less time, before things stabilize, and that doesn't mean the problem is fixed, just that the can is kicked a little further down the road.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 08 Jan 2016 23:30

by KrishnaK

5 myths about China’s economy

It's a largely positive piece. This however stood out - a message for the Dollar is held up by threats of force, renminbi is being kept down by conspiracies gang.

5. The renminbi’s new status threatens the dollar’s dominance.

In November, the International Monetary Fund announced that it would recognize the renminbi as an official reserve currency. The move compounded fears that, as reported by Britain’s Telegraph, “US economic dominance [is] at an end as China’s currency rises.”

Not quite. China’s renminbi has certainly become an important international currency. About a quarter of China’s trade is now priced and settled in renminbi, and the IMF estimates that about 1 percent of global foreign exchange reserves are held in renminbi-denominated assets, which is more than the shares of some well-known reserve currencies such as the Swiss franc.

However, the U.S. dollar still accounts for nearly two-thirds of global foreign exchange reserves, a share that has in fact increased slightly since the financial crisis.

International investors, including foreign central banks, will continue investing in renminbi for diversification purposes. But for its currency to seriously rival the dollar, China will have to earn foreign investors’ trust. This will require not just economic reforms but also broader legal, institutional and political reforms. None of these is on the horizon, so for now, the dollar’s position is secure.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 09 Jan 2016 00:53

by Vayutuvan

What is the difference between renmenbi and yuan? Are they same with different name?

Re: PRC Economy - New Reflections : April 20 2015

Posted: 09 Jan 2016 00:54

by Suraj

Yes. Technically the currency is renminbi ('people's money') . Yuan is a basic unit of renminbi . It's like saying the official currency of India is the Indian Rupee and its basic unit is rupee.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 09 Jan 2016 00:54

by A_Gupta

^^^ I don't understand this paragraph:

There are many legitimate questions about China’s GDP growth data measured from quarter to quarter. Recent figures on electricity consumption, freight volumes and bank lending all point to much weaker growth than the composite data suggests. Over longer periods, however, the growth data is probably a more reasonable representation of what is happening in the economy and lines up with other indicators such as household income and spending.

If the short-term growth estimates are later revised downward into a long-term growth estimate, then the above paragraph makes sense. Does this revision actually happen? Otherwise, it reads like "the 10% annualized growth rate in the short-term is an overestimate, but in the long-term is true", which is rubbish.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 09 Jan 2016 00:56

by A_Gupta

vayu tuvan wrote:What is the difference between renmenbi and yuan? Are they same with different name?

Wiki explains: 'The distinction between the terms renminbi and yuan is similar to that between sterling and pound, which respectively refer to the British currency and its primary unit.'

So, renminbi is the name of the currency and yuan is the primary unit of the currency.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 09 Jan 2016 02:20

by A_Gupta

Inaugural column:

http://news.xinhuanet.com/english/2016- ... 991437.htm

Reproducing in full:

Xinhuanet

Economic Watch: China's economy, growing pains and gains

English.news.cn 2016-01-08 18:32:52

CHINA-GDP-GROWTH(CN)

Editor's note:

Xinhua begins to present a new column "Economic Watch," offering timely, objective and in-depth observations of the latest developments in the Chinese economy.

BEIJING, Jan. 8 (Xinhua) -- China's stock market fluctuation and the yuan's depreciation in the first week of 2016 do little to disguise what could be a very difficult year ahead.

China is braced for unavoidable pains which it expects to precede future gains.

On Thursday, the just-introduced circuit breaker into the Chinese stock market was triggered for the second day in four trading days.

Within half an hour after opening, shares were down by 7 percent, the biggest move allowed before trading ceases for the remaining of a trading day.

The foreign exchange market is also reeling. The central parity rate of the yuan lost 332 basis points to 6.5646 against the U.S. dollar, its lowest level in nearly five years.

These developments have caused global concerns, even though the market consensus holds that such volatility has a limited impact on the real economy.

Confidence is unsteady, partly due to the slowdown of China's economy. Performance has crumbled to levels not seen for over six years.

For the 2016-2020 period, President Xi Jinping has stated that an annual growth of 6.5 percent would be required for China to complete the building of "a moderately prosperous society" by 2020.

The rate may seem disappointing if compared with the country's often double-digit growth in the past decades, but it will still make China among the world's top performers and allow leeway for policymakers to tackle some of the urgent risks for sustainable growth.

"In current circumstances, it is impossible to expect a V-shaped economic recovery, while an L-shaped growth period will be more likely," a recent front-page article quoted an "authoritative figure" as saying in the flagship newspaper People's Daily.

With strong expressions such as "indecision now leads to trouble later," and to "bury zombie companies," the article shows commitment to reform without losing sight of policy cushion for the potential downside, said Hong Hao, chief China strategist at BOCOM International.

"Reform sometimes means sacrifice, and volatility is one of the costs that reformers must endure," Hong said.

SUPPLY-SIDE STRUCTURAL REFORM

As a solution to pains of China's economy, the People's Daily article pinpoints supply-side structural reform, the latest buzzword used by leaders and economists as the world's second largest economy moves to address outstanding issues like excess capacity, housing overhang, and "zombie" state-owned enterprises (SOEs) with poor profitability.

According to supply-side economics, the best way to stimulate growth is to lower barriers to production, particularly through tax cuts.

The wealthy, rather than spending on goods and services, will, in theory, be enticed to invest in somewhere that increase supply, such as new ventures and R&D.

UBS reckons China's supply-side reform will include three key elements -- industrial policies on new supplies, tax cuts and restructuring the corporate sector.

Restructuring will mean the end of "zombie" companies and the writing off of associated bad debts.

The newspaper article said that "burying zombie companies", a priority along with capacity reduction, like the SOE reform in the 1990s, would unleash new economic vitality.

Millions of workers were laid off at that time and bad loans of SOEs equaled a sizable portion of gross domestic product, Hong said.

The article also warned of risks and advised caution.

Iron and steel, coal mining, cement making, ship building, aluminum and flat glass are the industries with most excess capacity. They account for around 12 percent of industrial employment, but just 3.3 percent of overall non-farm employment. A reduction of 20 percent of capacity in those industries may lead to a loss of 3.56 million jobs, UBS estimated.

"Pains will be unavoidable, but worth it," the article said.

LIGHT AT END OF TUNNEL

Problems aside, reform is expected to keep the economy above water.

New rules in the capital market should make fundraising easier for enterprises. IPOs will see less bureaucratic meddling as a new registration system replaces the old listing process.

The number of new IPOs on the Chinese A-share market is forecast to hit 400, raising more than 250 billion yuan (38.4 billion U.S. dollars), making the Chinese mainland probably the largest IPO market in 2016, PricewaterhouseCoopers said.

Financial information provider Wind claims that more than 250 companies listed in the Shanghai and Shenzhen stock exchanges reported negative adjusted earnings per share for over the past three years, posting average debt-to-asset ratios over 68 percent.

"Zombie enterprises are to blame for systemic risks in the Chinese capital market," Xu Weihong, chief economist with AVIC Securities, said. "Eliminating them will improve the capital price structure."

A more freely floating yuan should give it a leg up toward internationalization.

Following years of attempts to popularize use of the yuan internationally, the Chinese currency was finally admitted to the International Monetary Fund Special Drawing Rights basket in October 2015, bringing the currency closer to becoming a truly global asset.

"Reform is sure to quicken in 2016, but the problems won't disappear overnight," said Song Yu, an economist with Goldman Sachs Gao Hua Securities.

Five major tasks face China's supply-side reform: de-leveraging, de-stocking, reducing costs, reducing overcapacity and shoring up weak growth areas, the "authoritative figure" emphasized in the People's Daily, saying, "undoubtedly, this won't be easy and cannot be achieved in one go."

Re: PRC Economy - New Reflections : April 20 2015

Posted: 09 Jan 2016 03:51

by Vayutuvan

A_Gupta wrote:vayu tuvan wrote:What is the difference between renmenbi and yuan? Are they same with different name?

Wiki explains: 'The distinction between the terms renminbi and yuan is similar to that between sterling and pound, which respectively refer to the British currency and its primary unit.'

So, renminbi is the name of the currency and yuan is the primary unit of the currency.

Thanks for the wiki link.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 09 Jan 2016 10:10

by Austin

Re: PRC Economy - New Reflections : April 20 2015

Posted: 09 Jan 2016 22:49

by A_Gupta

Re: PRC Economy - New Reflections : April 20 2015

Posted: 09 Jan 2016 23:34

by hanumadu

Why is the yuan falling when they have a 600 billion dollar positive balance of trade? And why is their manufacturing contracting when they are exporting more than ever, more than before the 2008 crisis?

Re: PRC Economy - New Reflections : April 20 2015

Posted: 10 Jan 2016 03:41

by A_Gupta

http://www.reuters.com/article/china-cu ... 4C20151217

Why is the yuan falling? I don't know quite how to interpret this from the article:

On the basis of its trade-weighted index, the yuan is around 15 percent over-valued, says Stephen Jen, director at hedge fund SLJ Macro Partners, who estimates total demand in China for foreign assets at $3 trillion compared to current foreign currency reserves of $3.44 trillion.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 10 Jan 2016 05:06

by TSJones

hanumadu wrote:Why is the yuan falling when they have a 600 billion dollar positive balance of trade? And why is their manufacturing contracting when they are exporting more than ever, more than before the 2008 crisis?

1. investors are not getting the return on investment that they thought they would be getting. so they want out of the yuan and into other currencies such as the dollar.

2. their manufacturing is hurting because the Chinese thought the demand was ever up ward and over built on speculation instead of building on incremental demand. they believed in their own PR.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 10 Jan 2016 06:54

by Singha

they have great overcapacity in sectors like steel and cement. I think they have overcapacity in every sector. trying to offload some of that through vendor financed deals and soft loans around the world (in exchange for people buying china made goods and employing china project cos for roads, rails, ports, mines). there are lakhs of chinese working deep in africa and living out of container homes in camps inside the jungle or desert.

http://www.mining.com/feature-chinas-sc ... or-africa/

sensing an opportunity, several chinese cos specialize in building and shipping these prefab trailer homes at web scale

Re: PRC Economy - New Reflections : April 20 2015

Posted: 10 Jan 2016 23:40

by Suraj

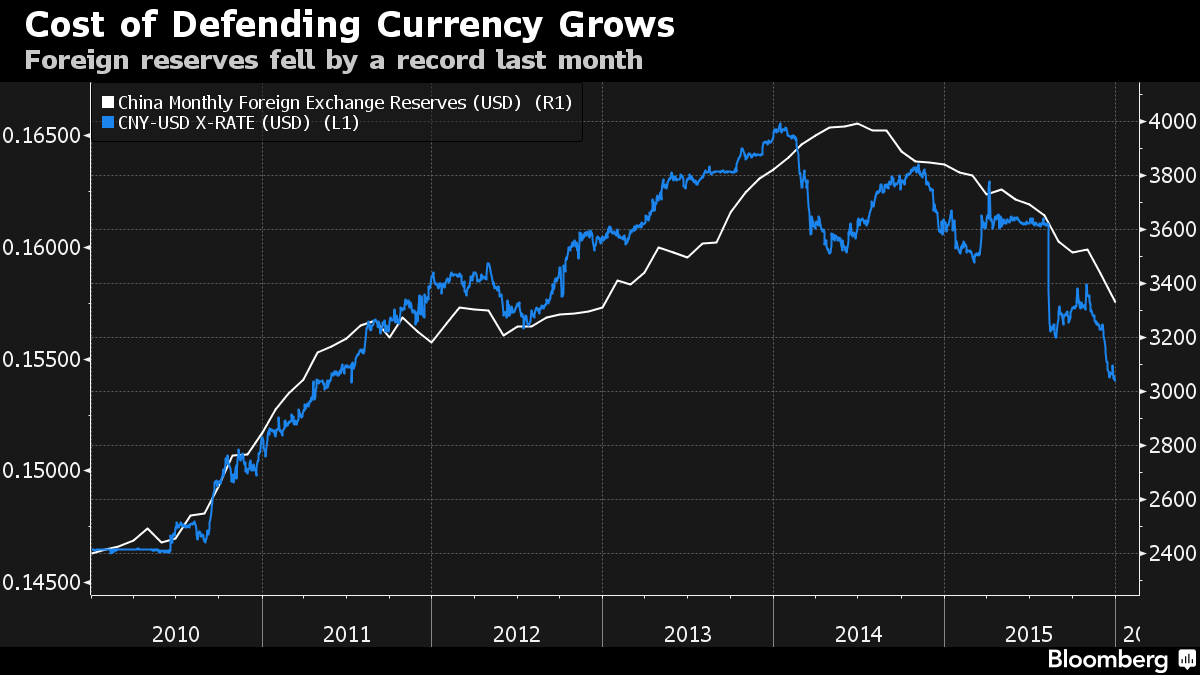

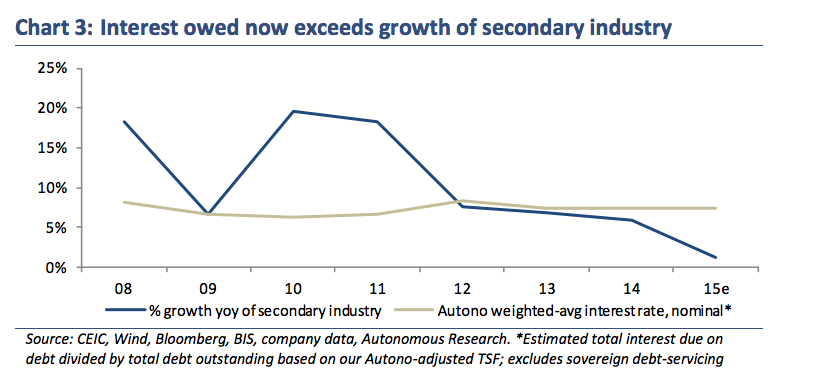

Old China is drowning

There haven't been many days in 2016, but every single one of them has been ugly for China's economy.

It should surprise no one, then, that Wall Street's most lauded China analyst, Charlene Chu of Autonomous Research, has a dark outlook for the country's economy this year, especially its corporate sector.

That is because a huge portion of it is drowning.

As the country transitions from an investment-based economy to one driven by consumer consumption, older growth drivers known as the secondary industry — think the property market and manufacturing — are becoming less profitable.

What we are witnessing is the slow death of Old China, and it isn't pretty.

"We expect China’s GDP growth to continue to slow in 2016 driven by further deterioration of secondary industry, which comprises 43% of economic output and whose growth plummeted to a record low of 1.2% yoy in 3Q15," Chu wrote in the note.

China's secondary industry is drowning in debt. Old China's companies are not growing fast enough to keep up with interest payments on their debt.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 11 Jan 2016 00:31

by A_Gupta

How Chinese firms fund infrastructure projects overseas:

http://www.out-law.com/en/articles/2016 ... ntractors/

Re: PRC Economy - New Reflections : April 20 2015

Posted: 13 Jan 2016 17:09

by Singha

Re: PRC Economy - New Reflections : April 20 2015

Posted: 14 Jan 2016 11:11

by Austin

China Trade Surplus Swells as Exports Rise in Boost for Yuan

http://www.bloomberg.com/news/articles/ ... s-kicks-in

Re: PRC Economy - New Reflections : April 20 2015

Posted: 14 Jan 2016 15:13

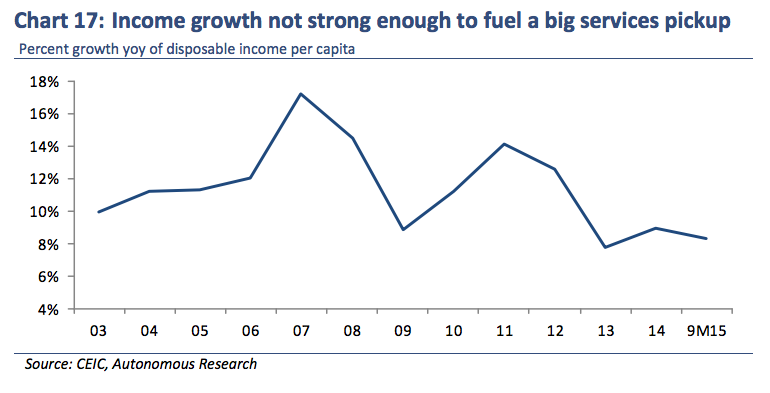

by panduranghari

A_Gupta wrote:http://www.reuters.com/article/china-cu ... 4C20151217

Why is the yuan falling? I don't know quite how to interpret this from the article:

On the basis of its trade-weighted index, the yuan is around 15 percent over-valued, says Stephen Jen, director at hedge fund SLJ Macro Partners, who estimates total demand in China for foreign assets at $3 trillion compared to current foreign currency reserves of $3.44 trillion.

Gupta ji,

Easier explanation for falling yuan is this;

Re: PRC Economy - New Reflections : April 20 2015

Posted: 14 Jan 2016 21:39

by Paul

Patrick Chovanec @prchovanec 1h1 hour ago

Patrick Chovanec Retweeted FT Alphaville

Don't even talk about China's mark-to-market on its strategy oil reserves, bought at $80-100/barrel.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 14 Jan 2016 22:57

by sanjaykumar

Hehe...I pointed this out months ago.

Re: PRC Economy - New Reflections : April 20 2015

Posted: 15 Jan 2016 11:08

by Austin

Re: PRC Economy - New Reflections : April 20 2015

Posted: 15 Jan 2016 13:32

by Singha

sanjaykumar wrote:Hehe...I pointed this out months ago.

is that strategic coup 75 billion deal with iran?

haar mein bhi jeet hai it seems

Re: PRC Economy - New Reflections : April 20 2015

Posted: 15 Jan 2016 22:36

by Prem

Singha wrote:sanjaykumar wrote:Hehe...I pointed this out months ago

is that strategic coup 75 billion deal with iran?haar mein bhi jeet hai it seems

Putin also did preemptive strike and locked them in with 2 major long term oil and gas contracts on high prices. China also invested huge in Canadian oil sand and in Venezuelan sour crude.