Re: Indian Economy News & Discussion - Nov 27 2017

Posted: 01 Feb 2023 21:37

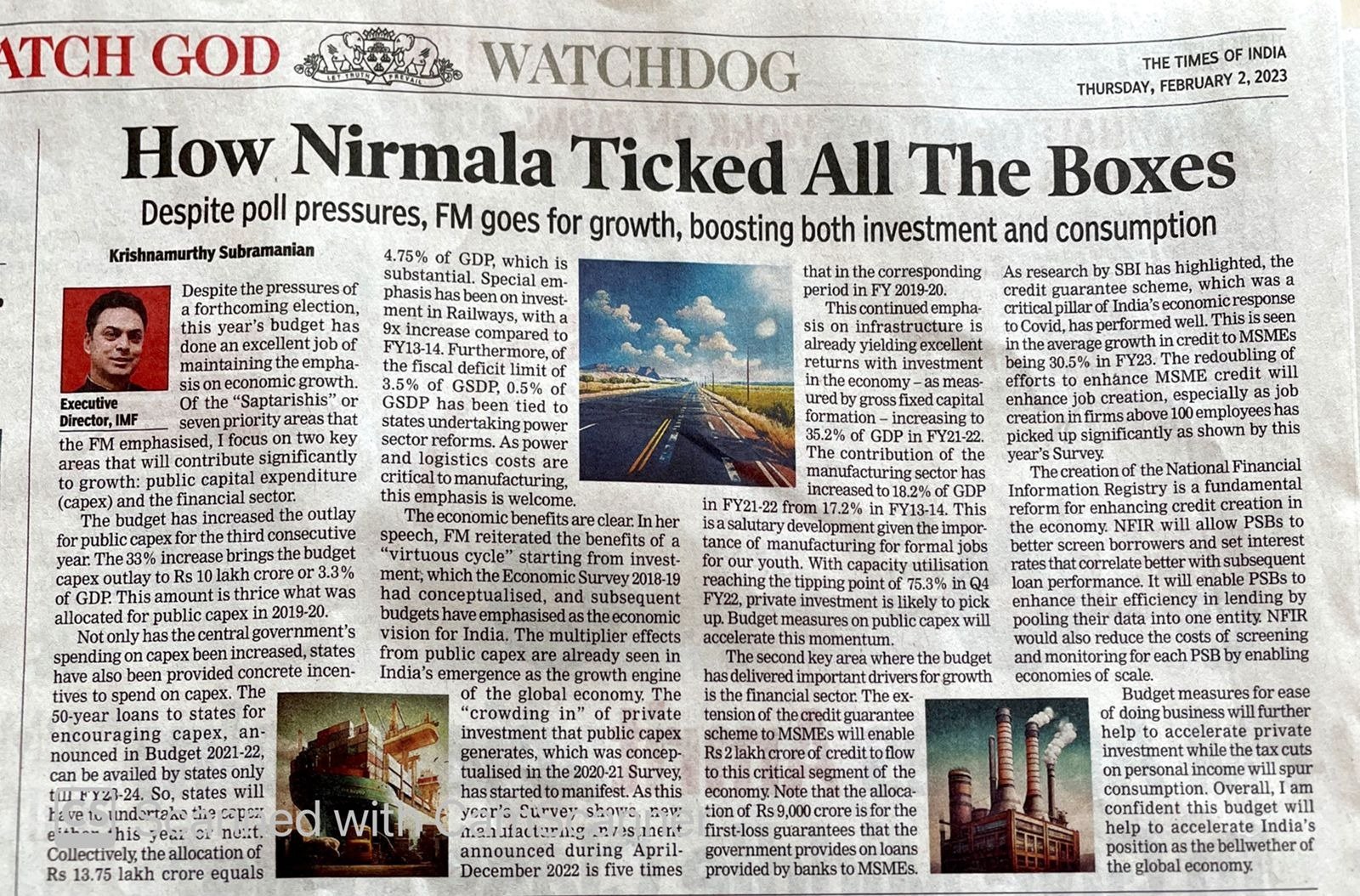

Middle class got some break this budget.

Consortium of Indian Defence Websites

https://forums.bharat-rakshak.com/

and they want prices as in 2004suryag wrote:^^^ They will not be happy saar, they will always ask for more

Ashu @muglikar_

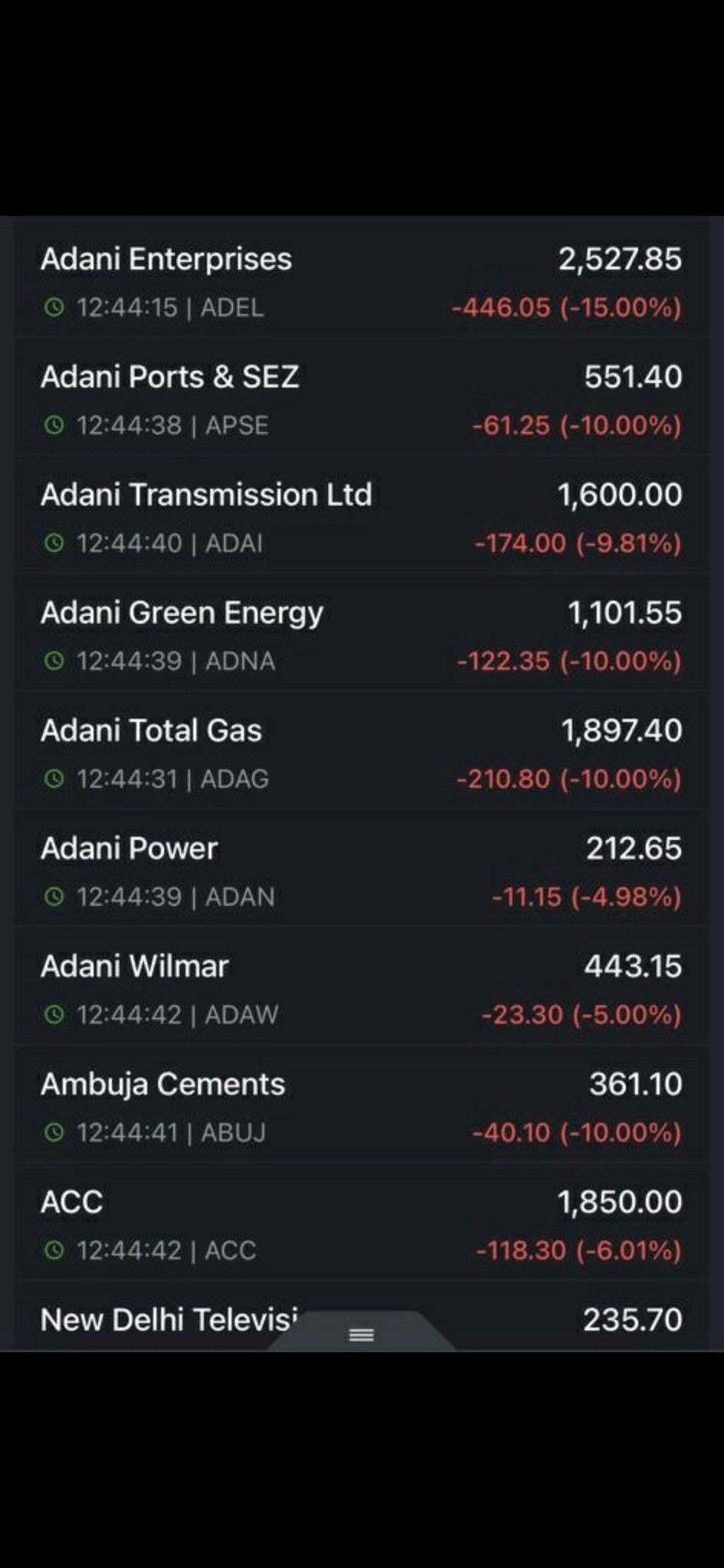

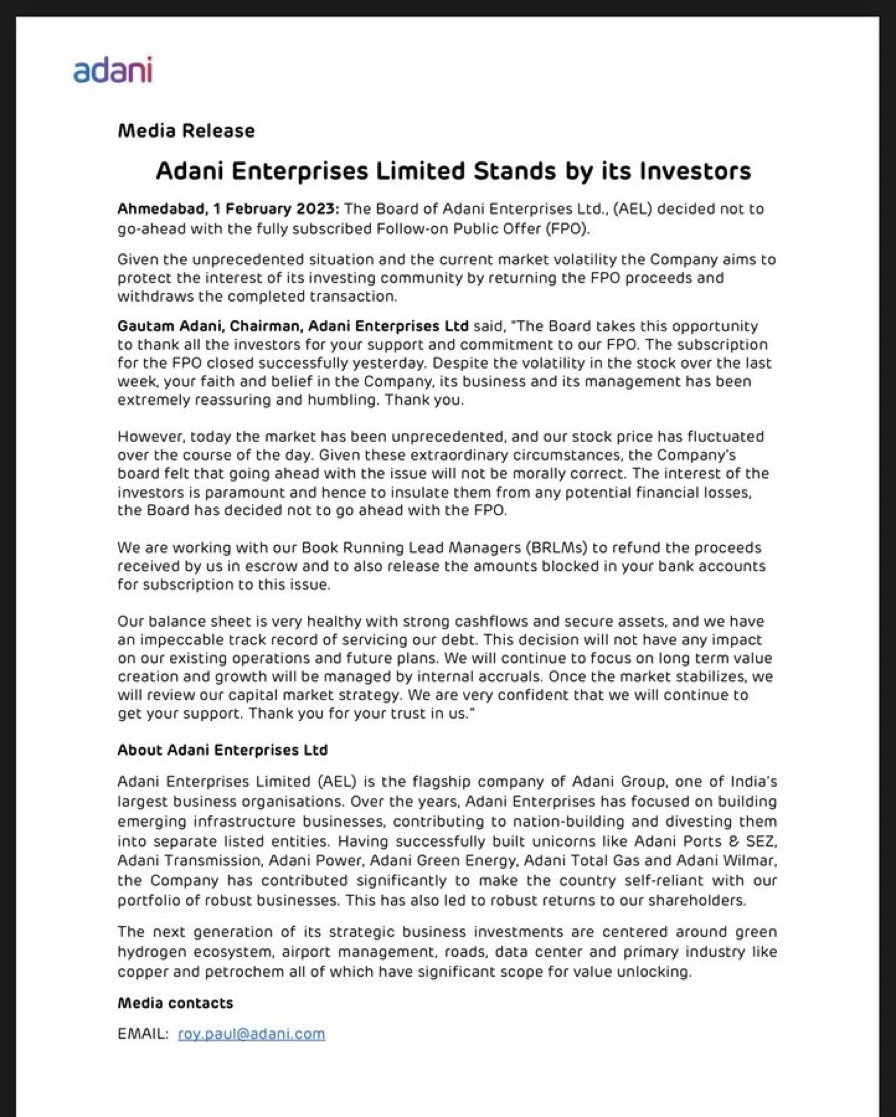

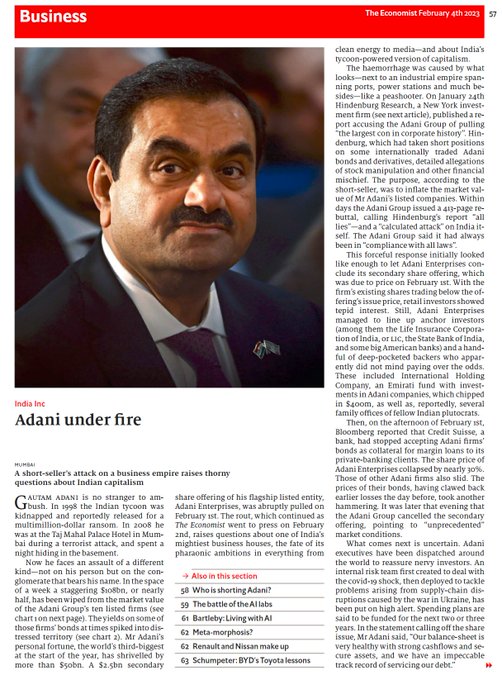

Adani Ent has called off it’s FPO. They will return the entire 20k cr to the investors. The reason is market pricing has fallen and they don’t want the ppl who have trusted them to lose any money.

Looks like all these bold ideas are upsetting some international playersChennai Updates @UpdatesChennai

Big.. Vedanta has shelved the plan to sell its copper smelter in the southern Indian state of Tamil Nadu in Tuticorin, which accounted for almost 40% of the metal’s production of India & has doubled down on its efforts to restart the plant..(Via Bloomberg)

That takes a lot of courage and honesty. Hardly a sign of someone that is allegedly busy creating shell companies or trying to evade taxes.vijayk wrote:Ashu @muglikar_

Adani Ent has called off it’s FPO. They will return the entire 20k cr to the investors. The reason is market pricing has fallen and they don’t want the ppl who have trusted them to lose any money.

We need to get Jews behind usgakakkad wrote:^ this is not a short sell. This appears to be economic warfare by a nation state actor . Whole thing does not make sense.

here is what makes sense, gakakkad ji...gakakkad wrote:^ this is not a short sell. This appears to be economic warfare by a nation state actor . Whole thing does not make sense.

Like it or not, it is likely that the Adani and Ambani groups are geo politically, as well as, geo strategically important to the India growth story, both internally and externally, as these two have tremendous risk appetites and a massive and proven project management capabilities to leverage their on time project delivery abilities to bag new projects.Adani Group enters Sri Lanka's port industry as the first Indian operator The group will have the majority stake in the West Container International Terminal Joint Venture (JV) which is valued at $700 million. It is a long term 35 years project with Adani holding the controlling stake

Israel's Haifa port has been taken over by Adani out bidding the cheenis by 5:1, that is to say Adani has paid five times more than the amount bid by china. The Adani Group on Tuesday acquired the strategic Israeli port of Haifa for USD 1.2 billion and vowed to transform the skyline of this Mediterranean city as part of its decision to invest more in the Jewish nation, including opening an artificial intelligence lab in Tel Aviv.

The Shanghai International Port Group (SIPG), a Chinese company, won a tender in 2018 to build and operate a new terminal at the Haifa Port. The new container terminal was operationalised in 2021 and Adani has rather rudely, just crashed their private party

Egypt is considering the possibility of allocating a special area of land for Indian Industries in the Suez Canal Economic Zone (SCEZ), a joint statement released by the two countries on the summit meeting said on Thursday

India has, just a few days ago negotiated and has been offered land in the the Suez Canal Economic Zone (SCEZ), in egypt and was offered this land in an area that lies adjacent to the suez canal. Thus India will now have physical presence in the geopolitically crucial suez canal area and may soon quietly negotiate for preferred and priority access to the suez canal itself.Egypt, similar to the rest of the world, has been affected by the impacts of this war, especially since 82 percent of its wheat imports over the last five years originated in Russia and Ukraine. In a big breakthrough, Egypt, the world's largest importer of Russian and Ukrainian wheat, has approved India as one of its suppliers thus diversifying its wheat supply sources. Further egypt has sought additional Indian investments in egypt and many MOUs have been signed with them by Modi during the egyptian president's visit to Delhi. The egyptian president came to delhi with a 200 strong contingent

Hats Off to PM Modi's Gujarati business mindset. Foreseeing the possible geopolitical and business angle, he may have made Egypt as chief guest for our Independence Day celebrations. This is also a clear signal & counter to China's dominance in the Arab world that India is also expanding beyond its' borders

The head of Sri Lanka’s electricity authority Ferdinando has testified before a parliamentary panel that he was told by Sri Lankan President Gotabaya Rajapaksa that Prime Minister Narendra Modi of India had insisted a 500-megawatt wind power project be directly given to the Adani group. This guy Ferdinando resigned almost immediately after that and gotabaya flatly denied that he had said anything to Ferdinando. The Energy Minister in Sri Lankan Government, Kanchana Wijesekara has announced that India’s Adani Green Energy was issued provisional approvals for two wind projects of 286 MW and 234 MW for an investment of more than $500 million. The two green energy farms will be coming up in Mannar and Pooneryn respectively in the Northern Province of Sri Lanka

The fine hand of the upset cheeni is visible both here in SL and in Haifa port, and their major disappointment at being outbid for the haifa port project which is vital to the BRI interests of xijinpeng is evident.

The India iran russia alternate route bypassing both europe and avoiding the cheeni BRI network has also upset the amerikis and the cheenis. This sanction proof route is free of any/all trade ameriki sanctions

The International North–South Transport Corridor (INSTC) is a 7,200-km-long multi-mode network of ship, rail, and road route for moving freight between India, Iran, Azerbaijan, Russia, Central Asia and Europe. The route is, "30% cheaper and 40% shorter than the current traditional route

There may be collusion between the ameriki deep state generated consequences for India and vested cheeni interests in going after Indian domestic and also foreign infrastructure projects to disrupt India's economic prospects and slow the India growth story by trying to tank the Adani investments that is now beginning to actually hurt the cheeni and ameriki geopolitical interests

Will have to cut costs , I say shutdown NDTVvijayk wrote:what will be the effect of back off on FPO?

ha ha ... sell it off to Swarajya mag guysAtmavik wrote:Will have to cut costs , I say shutdown NDTVvijayk wrote:what will be the effect of back off on FPO?

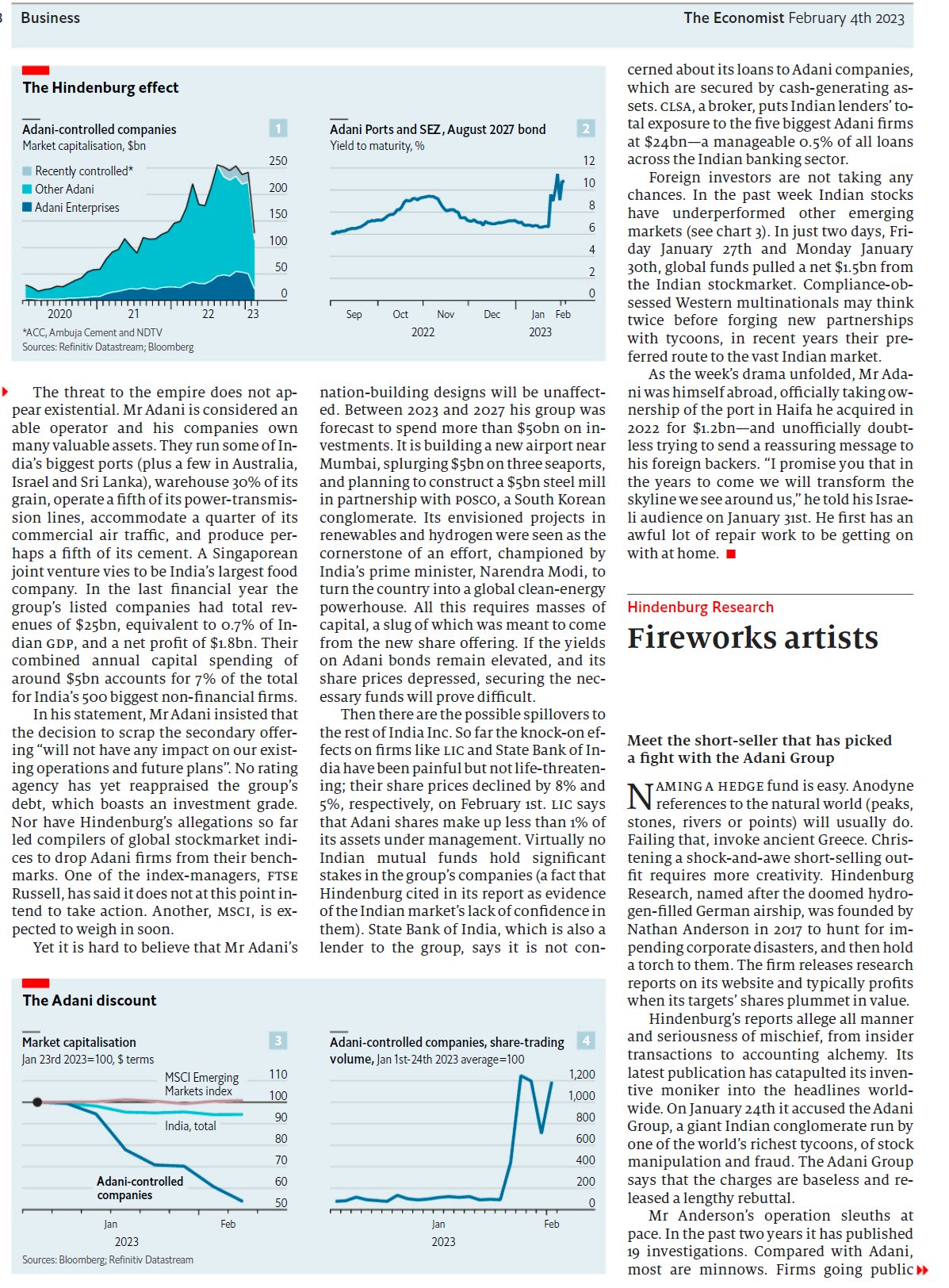

Cracking the code of how Hindenburg did the trade could lead to more short sellers taking positions against Indian companies, which have been rare, analysts said.

We know how this particular community has higher than normal proportion of inmates. Won't to this directly play into their hands?“Support for poor persons who are in prisons and are unable to afford penalty or bail amount required financial support will be provided,” the Minister said.

It is this ‘political compulsion’ that makes governments handout 31.3 per cent of homes under the Awas Yojana, 33 per cent of funds under the Kisan Saman Nidhi Yojana, and 36 per cent of loans under the Mudra Yojana in the last eight years to a community that is 14.2 per cent (according to the official census) of the country’s population. Anand further listed schemes for Muslims under the current Modi-led BJP dispensation.

vijayk wrote:Looks like Hidenburg shorted the stock in India

Citigroup also followed Credit SuisseDilbu wrote:Loans based on stock value are being dried out. Debt as an instrument for growth is being targeted.

never fear, Adani is herevijayk wrote:Looks like all these bold ideas are upsetting some international playersChennai Updates @UpdatesChennai

Big.. Vedanta has shelved the plan to sell its copper smelter in the southern Indian state of Tamil Nadu in Tuticorin, which accounted for almost 40% of the metal’s production of India & has doubled down on its efforts to restart the plant..(Via Bloomberg)

Adani Enterprises, the flagship business of Gautam Adani, is all set to enter the copper business as the country. The newly incorporated Kutch Copper Limited will now manufacture copper cathode and copper rods, as the country has been importing around half its total demand since the last three years when the anti-national elements forced the Tamil Nadu government to shut down the Sterlite copper plant.

“KCL is incorporated with the object to undertake copper business-related activities, such as the manufacture of copper cathodes and copper rods and more,” revealed the Adani Group in a filing with exchanges. The shares of Adani Enterprises, the flag entity under which the KCL is incorporated, climbed by four per cent after the news was made public.

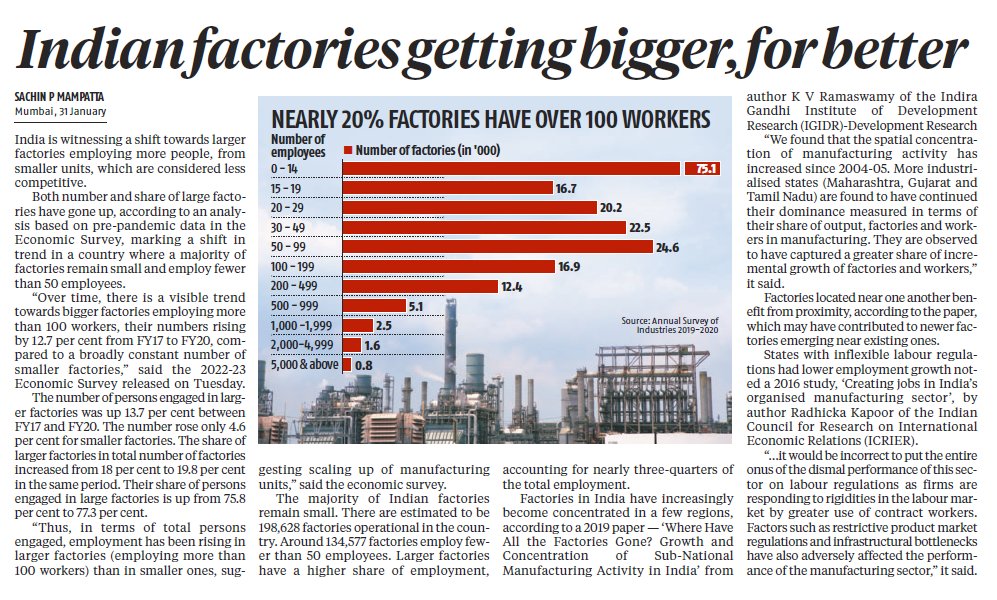

Eminent economist Arvind Panagariya has said India is on the cusp of returning to a high growth trajectory and voiced confidence that the country will become the world’s third-largest economy by 2027-28. Currently, India is the fifth largest economy “so it’s another five years. We are already in (the year) 2023. So 2027-28, India should be the third-largest economy,” Panagariya, Columbia University Professor and former Vice Chairman of NITI Aayog, told PTI in an interview here.

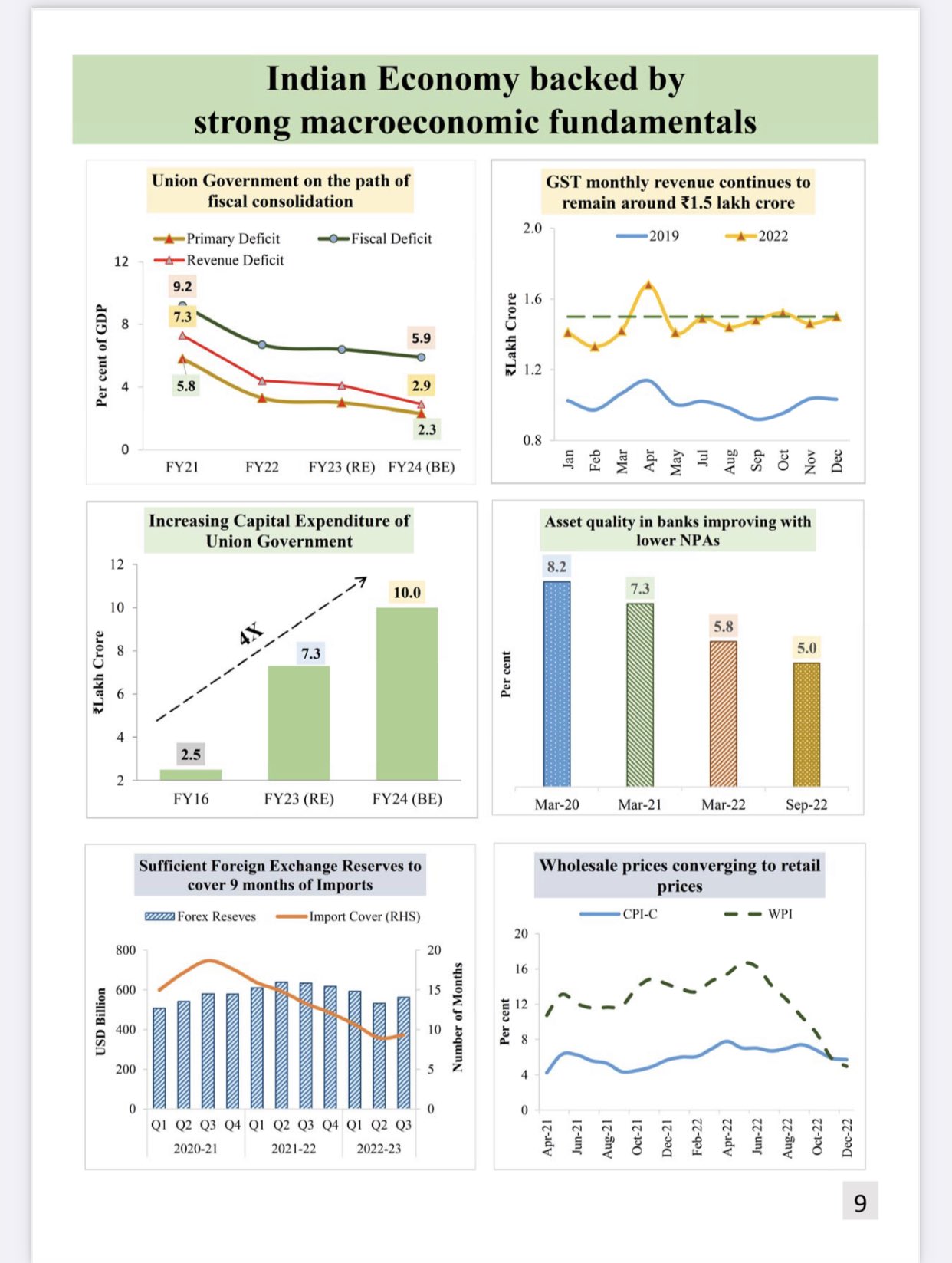

A day before Finance Minister Nirmala Sitharaman presented the Union Budget on Wednesday, the Economic Survey tabled in Parliament pegged India’s GDP growth at 6.5 per cent in 2023-24. The International Monetary Fund’s World Economic Outlook update Tuesday said growth in India is set to “decline from 6.8 per cent in 2022 to 6.1 per cent in 2023 before picking up to 6.8 per cent in 2024, with resilient domestic demand despite external headwinds.” Last week, the UN said in its flagship World Economic Situation and Prospects 2023 report that India is projected to grow at 6.7 per cent in 2024, the fastest-growing major economy in the world.

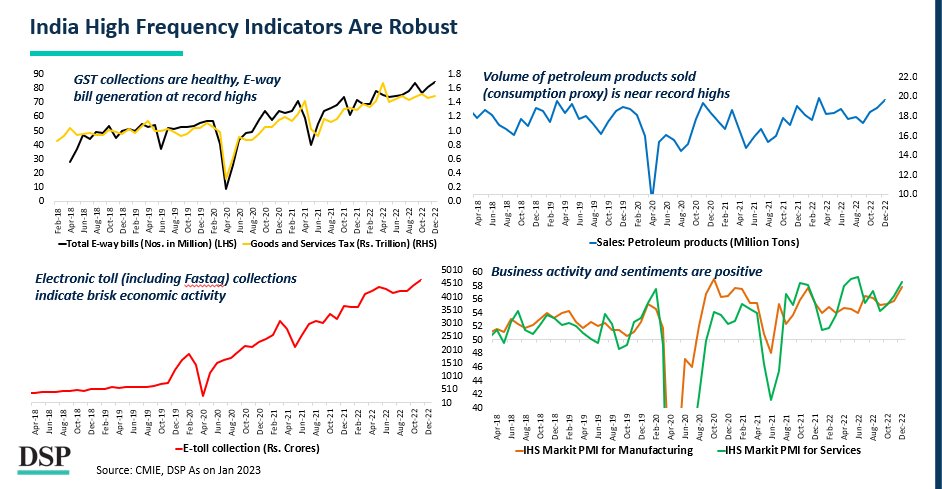

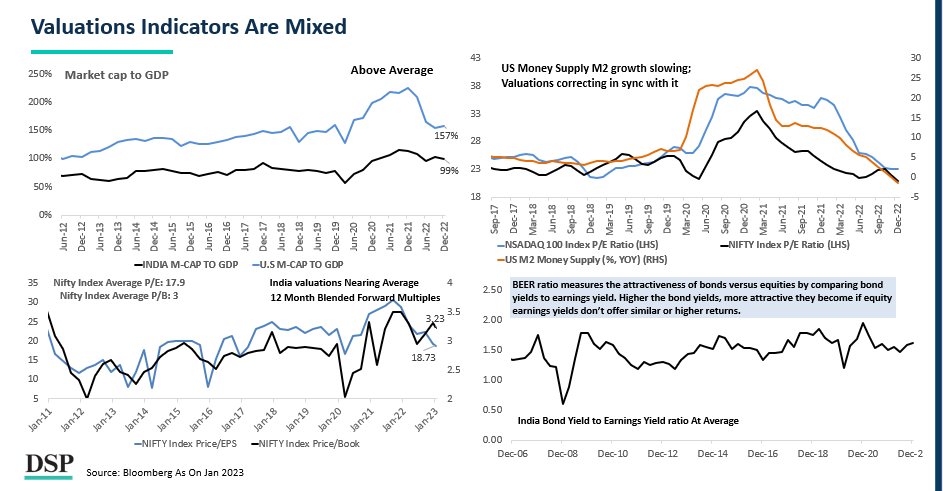

DSP Mutual Fund @dspmf

India’s economic growth continues to remain steady, even as the narrative shifts towards a slowdown. Indicators aren’t obliging yet