The lowest in nearly five years.

This happens because Indian-grown Soy oil is now cheaper than palm oil

Page 5 says a SAE will be released Feb 28. Then one can understand whether some of the indicators/extrapolators used in the FAE were responsible - or if data was incomplete (especially the Oct-Dec quarter).Suraj wrote: ↑26 Jan 2025 22:24 Generally, this report confuses me. There's no clear sense of where the slowdown is, and there's a possibility that data collection has broken down somewhere. I suspect GoI is busy trying to figure out where they're getting bogus data from, which would be the simplest explanation for why they've said nothing useful here.

I fear that battle is already lost. I'm in India now and had to stop at SBI in Hyderabad. Every one from the Bank's General Manager, to the guy who was getting a loan to buy a two wheeler are dreading the next budget from Nirmala Ji and the 100% consensus in this group of 20 people is that what's happening with the tax regime is not good to their middle class wallets, and they are expecting an even worse outcomes. Personally, I have not seen Indian middle class crown be this pessimistic in a long time. This is a BJP area, and even here middle class is rapidly changing it's tune, and I believe the governments tax regime is the main reason.

Speech was to start at 11 AM. Is this insider information ?bala wrote: ↑01 Feb 2025 10:39 Nirmala Sitharaman presents union budget 2025 in parliament. This is live YT.

youtube.com/watch?v=Cpvwpydqu4M

Some notes from listening:

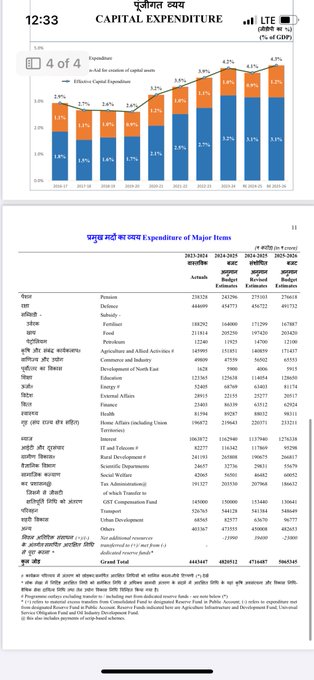

32 lakh crore receipts of tax; expenditure 48 lakh crore. Customs duties have been lowered for many items. Mudra loan is hiked to 20 lakhs. Capital gains - short term 20%; long term 12.5% (some are 1 yr some 2 yrs for long term). Foreign company in India the Corporate tax rate 35% reduced from 40%.

Personal income tax: 0-3 lakhs - no tax; 3-7 lakh - 5%, 7-10 lakh - 10%, 10-12 lakh - 15%, 12- 15 lakh - 20% after 15 lakh is 30%;

Core Inflation is 3.1%; overall inflation is 4%.

Though belated, cutting down taxes to leave more money with people is a good move. Government should provide more money in people's hands by also reducing fuel prices and cutting down the GST rates. The expected cut in interest rates also would help.

Allowing people to consume more is basic for low income country like India. Government should not stop with today's move and look for ways to leave more money in people's hands. If people have money, they consume, borrow for future and so on.

Government should realise money in people's hand would do more good and effective for the economy than money in government's hands.

Recently RBI came out with measures for creating ample liquidity in the system. Expecting rate cut cycle to begin soon. With reduced interest burden and more money in hands due to reduced tax rates, I see a huge boost to consumption. This is the need of the hour. Consumption has been in doldrums for long.

Government should seize the moment and reduce GST rates. It should also cut fuel prices. With out consumption boost, there is no way for economy to grow.

The above post is by Prof. Krishnamurthy V Subramanian, former chief economic adviser of India govt. He further explains below,uddu wrote: ↑01 Feb 2025 17:13 https://x.com/SubramanianKri/status/1885601993391022443

Prof. Krishnamurthy V Subramanian

@SubramanianKri

#Budget2025: EFFECT OF PERSONAL INCOME TAX (PIT) CUT IS HUGE!!!

I estimate consumption in FY26 will ↑↑ by >10% and GDP will ↑↑ by >8%.

See step-by-step calculations below:

...

Step 2: Data shows that middle class saves about 20%. So, 80% of this ↑ in disposable income will go into consumption.

Step 3: Consumption multiplier = 1/(1-MPC), where MPC is marginal propensity to consume. MPC = 1 - Savings rate = 0.8. So, consumption multiplier= 1/(1-0.= 5.

Step 4: Combine with #1 above, ↑↑ in consumption will be = (consumption multiplier) * (↑ in disposable income) = 5* ₹1 Lakh cr = ₹5 Lakh cr.

...

Step 7: Finally, what will be the impact on GDP? GDP (real) in FY25 is ₹185 Lakh cr. As 5/185=2.7%, ↓ in PIT will deliver additional ↑ in GDP of 2.7%. So, I estimate ↑ in GDP in FY26 to be 6.3% (w/o ↓ in PIT) + 2.7% (impact of ↓ in PIT) = 9%.

Final estimate: Let's allow for some over-estimation in the above. Even conservatively, consumption will ↑↑ by >10% and GDP will ↑↑ by >8%.

Is the above estimate correct? A retailer can't spend every rupee he gets from sales. He only gets a small profit margin, isn't it? Also, almost all popular electronic goods are imported, and a good chunk of the spent amount will go outside to China, South Korea etc. Is that correct? Is there a better way to force that extra income inside India? Maybe vouchers for indigenous white goods products?Let me explain the concept of "consumption multiplier" that I have used in estimating the impact of the personal income tax cut.

Say, Subbu, a middle-class professional, receives an extra ₹10,000 in disposable income because of the income tax cut. He decides to use this money to buy a new smartphone—say a mid-range model from a popular brand—from Kavita's electronics shop.

So, First Round of Spending (Subbu → Kavita):

Amount Spent: ₹10,000

Outcome: Kavita receives this ₹10,000 as revenue for her shop.

Kavita now has an extra ₹10,000 in income. Because she saves 20% of it, she spends 80% of this extra income on everyday items. For instance, she uses ₹8000 to purchase a Silk saree Ramya’s retail store. So, Second Round of Spending (Kavita → Ramya):

Amount Spent: 80% of ₹10,000 = ₹8,000

Outcome: Ramya, a retailer in a local market, now earns ₹8,000.

...X Snip X

The Chain Reaction:

At each step, only 80% of the previous round's extra income is spent (this is the MPC or marginal propensity to consume). The money keeps circulating in the economy as follows:

First Round: ₹10,000 is spent by Subbu.

Second Round: 0.8 × ₹10,000 = ₹8,000 is spent by Kavita.

Third Round: 0.8 × ₹8,000 = ₹6,400 is spent by Ramya.

Fourth Round: 0.8 × ₹6,400 = ₹5,120 and so on.

The Mathematics Behind It:

The total increase in consumption is the sum of all these rounds:

Total Increase=₹10,000+₹8,000+₹6,400+₹5,120+… (a Geometric progression)

Total Increase = ₹10,000 (1+ 0.8 + 0.8^2 + 0.8^3 + 0.8^4 +… )

Total Increase=₹10,000/(1-0.= ₹50,000

Remember the formula for the sum of a Geometric progression 1+r+r^2+r^3+... = 1/(1-r). Using r=0.8, you get the above sum.

So, the extra ₹10,000 that Subbu received ultimately leads to an overall increase of about ₹50,000 in consumption in the economy. That's why the consumption multiplier is 5.

if the capex is keeping upto modernisation requirements i won't worry much., however the R&D expenditure is something to be looked at.. for some reason no funds for high alt testing of aero enginesRupesh wrote: ↑01 Feb 2025 14:45 Capex for defense approx 180000 crores. Under capital expenditure, Rs 48,614 crore has been allocated for aircraft and aero engines, while Rs 24,390 crore has been earmarked for the naval fleet. A total of Rs 63,099 crore has been set aside for other equipment.

Defence budget as as percentage of general budget is just above 12%. I believe this is the lowest percentage in the last 65 years.

MP is disappointing considering pretty much continuous BJP governance for last 15 + yrs.. Really need to step up the game there.bala wrote: ↑01 Feb 2025 21:50 A slightly different topic: I know people were following Jal Jeevan.

This report is damn good for India:

https://ejalshakti.gov.in/jjmreport/JJMIndia.aspx

Notice who are the laggard states at the bottom with only 50 - 75 % done.

Overall I'd say great progress. States like MP and UP were way in the 10-25% range when this started, so its great to see their progress.AkshaySG wrote: ↑02 Feb 2025 01:04

MP is disappointing considering pretty much continuous BJP governance for last 15 + yrs.. Really need to step up the game there.

Rajasthan is difficult due to its arid nature but still should be 75% + with the technologies available in the current date

Both these states have incredible potential if they are able to find a leader like NM was for Gujarat, Unfortunately that doesn't seem to be the case anytime soon

Yes, excellent budget overall: https://www.indiabudget.gov.in/doc/budget_speech.pdf

I'm sure Suraj and other economic gurus can articulate this much better, but let me try my layman's perspective.Hriday wrote: ↑01 Feb 2025 20:32Is the above estimate correct? A retailer can't spend every rupee he gets from sales. He only gets a small profit margin, isn't it? Also, almost all popular electronic goods are imported, and a good chunk of the spent amount will go outside to China, South Korea etc. Is that correct? Is there a better way to force that extra income inside India? Maybe vouchers for indigenous white goods products?Let me explain the concept of "consumption multiplier" that I have used in estimating the impact of the personal income tax cut.

Say, Subbu, a middle-class professional, receives an extra ₹10,000 in disposable income because of the income tax cut. He decides to use this money to buy a new smartphone—say a mid-range model from a popular brand—from Kavita's electronics shop.

So, First Round of Spending (Subbu → Kavita):

Amount Spent: ₹10,000

Outcome: Kavita receives this ₹10,000 as revenue for her shop.

Kavita now has an extra ₹10,000 in income. Because she saves 20% of it, she spends 80% of this extra income on everyday items. For instance, she uses ₹8000 to purchase a Silk saree Ramya’s retail store. So, Second Round of Spending (Kavita → Ramya):

Amount Spent: 80% of ₹10,000 = ₹8,000

Outcome: Ramya, a retailer in a local market, now earns ₹8,000.

...X Snip X

The Chain Reaction:

At each step, only 80% of the previous round's extra income is spent (this is the MPC or marginal propensity to consume). The money keeps circulating in the economy as follows:

First Round: ₹10,000 is spent by Subbu.

Second Round: 0.8 × ₹10,000 = ₹8,000 is spent by Kavita.

Third Round: 0.8 × ₹8,000 = ₹6,400 is spent by Ramya.

Fourth Round: 0.8 × ₹6,400 = ₹5,120 and so on.

The Mathematics Behind It:

The total increase in consumption is the sum of all these rounds:

Total Increase=₹10,000+₹8,000+₹6,400+₹5,120+… (a Geometric progression)

Total Increase = ₹10,000 (1+ 0.8 + 0.8^2 + 0.8^3 + 0.8^4 +… )

Total Increase=₹10,000/(1-0.= ₹50,000

Remember the formula for the sum of a Geometric progression 1+r+r^2+r^3+... = 1/(1-r). Using r=0.8, you get the above sum.

So, the extra ₹10,000 that Subbu received ultimately leads to an overall increase of about ₹50,000 in consumption in the economy. That's why the consumption multiplier is 5.

My take: first, yes, freebies are politically more rewarding, but beyond that, I suspect the BJP (which generally dislikes freebies) was forced to engage in the game so the opposition didn't take advantage and win. The first rule of politics and good governance is to be in power to attempt it - without power, nothing can be done. So if freebies are what the people want, that's what they get, whether one likes it or not.Hriday wrote: ↑01 Feb 2025 20:32Now, if, as suggested by Muthukrishnan and Arvind Subramanian, increasing consumption automatically improves the economy, then why was it not put into practice earlier? Is it because targeted freebies for rural areas are more politically rewarding? Anyways, urban voters are known for skipping the elections/voting and spending the time holidaying.

I understand that increased consumption means an increase in GST collections. But how does the declaration of higher income increase GST collections?More people would show higher income now, upto tax free limit. Though this may not increase tax collections, it would lead to formalisation of economy resulting in better GST collections.