I personally believe that due to the sort of shaky state government in power in TN currently and ever since demise of Jayalalithaa - the Central Government has been boldly attacking the various corrupt IAS officers like former Chief secretary, PWD work contractors and others in the state. I welcome it and i think unfortunately - the central government is unable to do this same level of intense verification of BM holders in the other states with far larger BM practices than TN like Kerala, West Bengal, UP, AP and etc.darshan wrote:Rules and regulations definitely need to be brought to the better standards. Branch banking BS and PSU arrogance need to be put in place for sure. For example, one of my family members ran into in past two months: going through old papers upon returning to India after 10+ years, noticed that there is a bank account that was not closed that NRI can't have. So being a law abiding person, heads down to PSU bank to close account with paltry sum in it and the pain ensues for days. We could not figure out what the run around given for more than three weeks was about; whether it was a hint to grease some palms or the belittling customer is their actual job description or that is how psychos get off at PSUs. No wonder many people avoid gov't workers in general. Not exactly their fault that they choose to be outside the system. I suggest Modi to go through each PSU's various rules and regulations and feel the pain before dreaming too high. May be Modi should find out how many times some idiot behind the desk makes you sign something by saying that the signature on the record does not match while that person has gazillion other items to verify identity. At that time you wonder where to spend your money, to bribe the guy so he suddenly matches the signatures or pay someone to put him in hospital.

In India there are probably as many gov't and workers and PSU workers accepting bribes as there are private folks keeping BM. The final outcome of convictions should reflect that or this can be just simply be described as money grab if only private folks are loosing money and gov't workers are walking away without any trouble.

I wonder how many BM fishes would escape out of TN with all rioting there. Wasn't TN one of the top state with coop bank money?

Currency Demonetisation and Future course of Indian Economy

Re: Currency Demonetisation and Future course of Indian Economy

Re: Currency Demonetisation and Future course of Indian Economy

Why is NITI ayog - a policy think tank type org, doing investigative work on deposits using big data analysis...Isn't that finance ministry, Tax depts etc job..

It is also very curious that opposition has completely stopped talking about demo. Almost as if they too are scared of final numbers ...

It is also very curious that opposition has completely stopped talking about demo. Almost as if they too are scared of final numbers ...

Re: Currency Demonetisation and Future course of Indian Economy

Because presumably the RBI wants to audit the banks. We already know that two cooperative banks over-reported the old notes deposited by around 100 crores in order to have 100 crores of new-note black money. The banks thought, wrongly, that RBI would take their word for it.Pratyush wrote:Why assume that the RBI will count all the notes. Why would it not rely on the figures shared by all the bank's.

PS: a news report:

http://timesofindia.indiatimes.com/indi ... 676525.cms

Re: Currency Demonetisation and Future course of Indian Economy

Is there a start of forcing all business to accept upi payments?

Right now its fragmented among a dozen digital wallets with no warning or standardisation who accepts what

We need a govt ordinance for this tied to trade license grant and renewal. Eg if you want a trade permit show upi ac proof

Right now its fragmented among a dozen digital wallets with no warning or standardisation who accepts what

We need a govt ordinance for this tied to trade license grant and renewal. Eg if you want a trade permit show upi ac proof

Re: Currency Demonetisation and Future course of Indian Economy

They're not just counting notes. They're tallying each and every serial # with their record and establishing the last disbursal and when/where it was received back. Notes that have not seen a bank or ATM in a long time are potentially black economy backing notes, and their depositors can be identified.Pratyush wrote:Why assume that the RBI will count all the notes. Why would it not rely on the figures shared by all the bank's.

Re: Currency Demonetisation and Future course of Indian Economy

Can they do that? Do banks record serial number of each and every note when customers deposit or receive cash?Suraj wrote:They're not just counting notes. They're tallying each and every serial # with their record and establishing the last disbursal and when/where it was received back. Notes that have not seen a bank or ATM in a long time are potentially black economy backing notes, and their depositors can be identified.Pratyush wrote:Why assume that the RBI will count all the notes. Why would it not rely on the figures shared by all the bank's.

Re: Currency Demonetisation and Future course of Indian Economy

Currency counting machines with serial number recording is a commodity item.

https://www.youtube.com/watch?v=UwHdS1gCc6Q

https://www.youtube.com/watch?v=UwHdS1gCc6Q

Re: Currency Demonetisation and Future course of Indian Economy

Beautiful. Thanks!prahaar wrote:Currency counting machines with serial number recording is a commodity item.

https://www.youtube.com/watch?v=UwHdS1gCc6Q

Re: Currency Demonetisation and Future course of Indian Economy

Is the RBI still pumping currency or did the demand for currency taper off?

Re: Currency Demonetisation and Future course of Indian Economy

To an extent they can. Obviously this depends on extent of digitization at the bank, particularly at major ones. At the RBI itself, they have to do this, since each and every note is an obligation they have to record and remove when demonetization is done. The paper trail back to the depositor is likely much less possible, but they can try.

Re: Currency Demonetisation and Future course of Indian Economy

How much time does it take to count and tally serial numbers for 24 billion notes ?prahaar wrote:Currency counting machines with serial number recording is a commodity item.

https://www.youtube.com/watch?v=UwHdS1gCc6Q

Edit: Ah I see the youtube blurb says 1200 bills per minute. Just 20 million minutes then, assuming zero downtime, or 38 years. It'll take hundreds of these to cut the time down to weeks, and that's assuming all the cash is ready to feed into them. In reality, all the cash arrives from various banks over the course of weeks, it takes time to load up each stack into the machines, and they don't run all the time, and there's additional post processing of the collected serial numbers involved, with potentially anomalous fake notes to be tracked down when flagged.

Like I'm trying to emphasize, the task seems easy until you break down the amount of time involved per subtask and add it all up. It's simply not possible to turn around a completed job here in days or weeks - all those notes if stacked up in a perfectly bundled pile stands about 36,000km high.

Re: Currency Demonetisation and Future course of Indian Economy

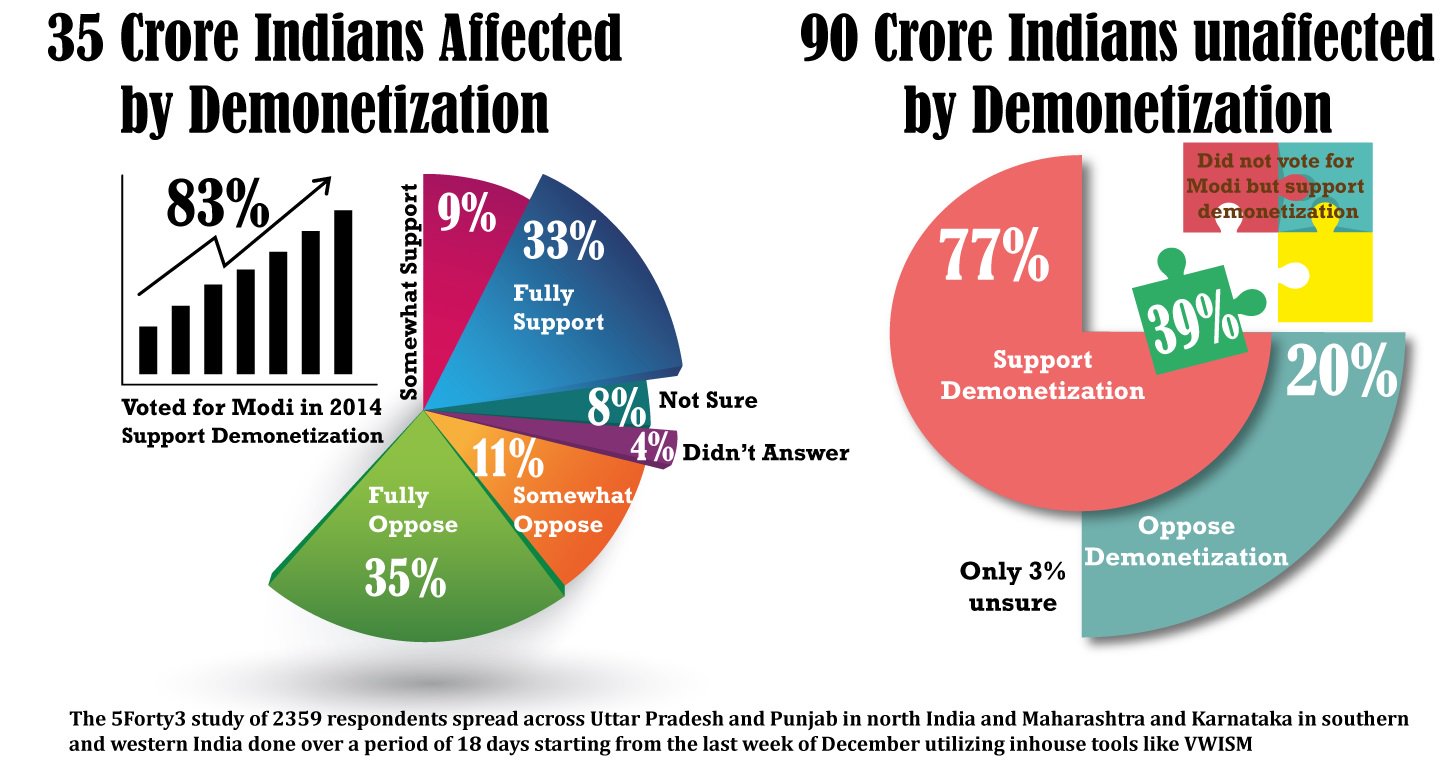

Dr Praveen Patil@5Forty3

A deeper analysis of demographic dynamics post demonetization shows a picture that would stun AC room journalism!

http://5forty3.in/implement/archivesInd ... .php?id=29

RETWEETS 139 LIKES 92

4:36 AM - 24 Jan 2017

Re: Currency Demonetisation and Future course of Indian Economy

are you sure that rbi is recording every serial number? are they expecting to see a huge bundle of notes tracked to a single deposit? given that serial numbers are not tagged to deposit slips at teller point - what's the point of this exercise.Suraj wrote: They're not just counting notes. They're tallying each and every serial # with their record and establishing the last disbursal and when/where it was received back. Notes that have not seen a bank or ATM in a long time are potentially black economy backing notes, and their depositors can be identified.

do they not already know what notes never comes into banks? all they will know now is which bank and what date it was deposited ..and it is not clear to me that it can be traced to depositer even then. conphoosing...

i am still thinking (hoping? for the nations sake) that the 'not in books' notes are just a theory....but this level of serial number scrutiny points more to that..

Re: Currency Demonetisation and Future course of Indian Economy

They *have* to record every serial number when they issue currency or demonetize. That's how fiat currency is managed by a central bank, not merely RBI. By law they have authority to print a certain number of notes, and any subsequent changes to the quantum of notes in circulation depends on tracking what's out there. The notes themselves are just printed paper. They carry upon it, an agreement between the government and some external party, which is the promise written upon it. Not having a precise record amounts to them not knowing how much they've promised whom. They have to record every note received back and also record that the note has been subsequently destroyed. What they could not get back has to be also separately tracked and recorded as 'not returned and deemed destroyed'.

Re: Currency Demonetisation and Future course of Indian Economy

The machines for currency counting available to a central bank likely exceed these retail currency counters like a high speed press exceeds a inkjet printer.

PS: The US banks use a "BPS 3000". A BPS 3000 can handle 7 million notes a day.

http://jacksonville.com/tu-online/stori ... IfRBHqVlZQ

The US Federal Reserve office in Philadelphia has allegedly 8 BPS 3000s:

https://www.philadelphiafed.org/educati ... -counting/

That would mean 56 million notes a day.

There are 12 Federal Reserve districts, https://www.richmondfed.org/faqs/frb

and in 2012 the 12th District handled 73.3 million notes a day http://www.frbsf.org/cash/federal-reser ... operations

So the US Federal Reserve system can handle say, 12 districts * 60 million notes a day = 720 million notes a day (my guess is that this is an underestimate).

It would take the US systems 33 days to count 24 billion notes.

The interesting question is, what is the Indian RBI cash handling capacity?

One thing to note is that, it seems in the US at least, freshly printed notes go through the same counters as a quality check. It is likely to be the same in India. Maybe RBI currency counting capacity is currently largely being used in the issuance of new notes?

PS: The US banks use a "BPS 3000". A BPS 3000 can handle 7 million notes a day.

http://jacksonville.com/tu-online/stori ... IfRBHqVlZQ

The US Federal Reserve office in Philadelphia has allegedly 8 BPS 3000s:

https://www.philadelphiafed.org/educati ... -counting/

That would mean 56 million notes a day.

There are 12 Federal Reserve districts, https://www.richmondfed.org/faqs/frb

and in 2012 the 12th District handled 73.3 million notes a day http://www.frbsf.org/cash/federal-reser ... operations

So the US Federal Reserve system can handle say, 12 districts * 60 million notes a day = 720 million notes a day (my guess is that this is an underestimate).

It would take the US systems 33 days to count 24 billion notes.

The interesting question is, what is the Indian RBI cash handling capacity?

One thing to note is that, it seems in the US at least, freshly printed notes go through the same counters as a quality check. It is likely to be the same in India. Maybe RBI currency counting capacity is currently largely being used in the issuance of new notes?

Re: Currency Demonetisation and Future course of Indian Economy

http://www.dailypioneer.com/columnists/ ... enced.html

DEMONETISATION BRIGADE SILENCED

DEMONETISATION BRIGADE SILENCED

Naysayers have been quick to dismiss the demonetisation initiative, citing the fact that a large part of the demonetised currency has found its way back into the coffers of banks. Even without the note-ban, the Modi Government has unearthed more than a whopping Rs1.44 lakh crore by way of unaccounted wealth in the last two and a half years, of which more than Rs66,000 crore is money declared under IDS (Income Disclosure Scheme), Rs53,000 crore is amount evaded via indirect taxes and Rs25,000 crore is undisclosed income, including money laundered into some foreign banks — now under scrutiny by the Income Tax department.

Now, coming back to demonetisation, what most economists have either due to sheer ignorance or wilfully ignored, is the fact that, of the total demonetised currency that found its way into the banking system, approximately Rs7.34 lakh crore are bulk deposits. Of this, almost a good four lakh crore rupees have merited attention from Income Tax authorities and the Enforcement Directorate because of good reasons, including one of Rs25,000 crore that suddenly appeared in dormant accounts, Rs80,000 crore that is money repaid in cash for prior period loans taken, Rs10,700 crore in bank accounts in north-eastern states, Rs16,000 crore in a few co-operative banks, and so on.

Thus, those dismissing the demonetisation drive as a futile measure, are indulging in wishful thinking. If indeed four lakh crore rupees of the total scrapped currency that came back into the banking system was unaccounted for, then Modi would have achieved more than what he set out to do on that evening of November 8, 2016.

Remember that this sum is roughly four per cent of India’s GDP, and more importantly, it is 26 per cent of the currency that was demonetised! If 26 per cent of the scrapped currency emerges as unaccounted wealth after final numbers are collated, then detractors of the Modi Government would have shredded their own credibility to embarrassing bits, because numbers don’t lie.

The big takeaway is not what portion of the scrapped currency has returnedas deposits into the banking system. It cannot be a barometer of demonetisation’s success. What matters is, what portion of the money that came back into banks is wealth that had never been accounted for but suddenly found its way into formal banking channels.

The fact that UPI, RuPay and mobile wallets saw a 1,342 per cent, 446 per cent and 210 per cent jump respectively in the number of transactions between November 8 and December 25, 2016, is a precursor of things to come. A big beneficiary of the entire note-ban exercise has been the average middle class, salaried Indian what with lending rates (MCLR) by key banks having been slashed by almost 80-100 basis points, from nine per cent to about eight per cent, in many cases. This has led to a fall in home loan rates.

Property prices, that were artificially kept elevated by nefarious builders, have fallen by 30-40 per cent, and rightfully so, given that 919 million square feet of unsold inventory exists in just four metros of Delhi-NCR, Mumbai, Bangalore Hyderabad. True, car sales took a hit, but RC Bhargava, chairman of Maruti Suzuki, has on record stated that the dip in car sales was primarily due to inventory de-stocking by dealers. Do note that between April and December 2016, car sales surged by a good 9.3 per cent for Maruti. Again, domestic air traffic growth in December 2016 came in at a solid 22.3 per cent, rising for 20 straight months in a row,topping global charts.

The 31.6 per cent year-to-year jump in excise tax collections in December 2016, coupled with a 12.4 per cent year-to-year jump in service tax, is again a good reminder to naysayers of demonetisation that the economy is on the right track. In fact,the excise and service tax numbers for the period April-December 2016 are even better — at 43 per cent and 24 per cent respectively. The icing on the cake has certainly been the IIP number for November 2016, that surged to a 13-month high at 5.7 per cent, driven by a 15 per cent, 9.8 per cent, 8.9 per cent jump respectively in capital goods production, consumer durables and electricity generation. Yes, these robust numbers benefit from a low ‘base-effect’, but 5.7 per cent, even off a low base, is commendable.

The biggest beneficiary of demonetisation has unarguably been the poor man on the street,thanks to retail inflation down to a three-year low at 3.4 per cent in December 2016, and food inflation even lower at 1.37 per cent. Don’t forget that inflation is the most regressive form of taxation, hitting the poor the hardest. In November 2013, retail inflation and food inflation under a failed Congress-led UPA, stood at 11 per cent and 15 per cent.

Some sections of our misinformed media that are still to come to terms with the resounding mandate of the BJP-led NDA Government in 2014, would do well to read excerpts from the The Guardian, which says that, thanks to demonetisation, human trafficking has virtually stopped in places like Assam, Meghalaya, Manipur, Nepal and Bangladesh, including at the notorious ‘Siliguri corridor’ and Khalpara. Research by global rescue groups says that demonetisation will eventually help save the lives of at least 50,000 Indian women and children every year, who could otherwise fall prey to the notorious $20 trillion global human trafficking industry.

Hence, for the self-masquerading activists against poverty, for human rights, justice and equality, and a divided and feeble opposition that has lost its mojo, there is no place to hide. The guilty who have had a kosher existence under a diabolically corrupt and inept Congress regime that ruined the socio-economic fabric of India, cannot preach.

Re: Currency Demonetisation and Future course of Indian Economy

I propose a new solution for the future currency printing and operations. No more men but robots doing all the job., except perhaps only aiding and helping the robot do the plan, design, fix, etc. as support staff. totally automated from design to impl, including storage, moving , counting, distribution. of course, we need human drivers in indic roads. this corruption is way too deep to eradicate.. and we need something really drastic setup to change for vikas. till we go 90% cashless, we need to employ some robotic methods.

Re: Currency Demonetisation and Future course of Indian Economy

Am I forcing you to believe it ?SaraLax wrote:Why even indulging in posting the above crap and you want us to believe this "i read somewhere" stuff ?.Dipanker wrote:I read somewhere that RBI has 20 counting machine and if all of them are operated 12 hours a day 7 days a week then it will take RBI 2 years to count the ~15 lakh crore worth returned notes.

Do you think many of us people in this forum are wet-behind-the-ears type folks ?.

If there is no substantive link provided then it is up to reader's discretion to exercise his/her own judgement about the quality of the content.

So pause for a moment and THINK if the information provided appears reasonable or not? Because in this case whether or not you are wet-behind-the-ears, you are sounding like one.

Re: Currency Demonetisation and Future course of Indian Economy

I read in one of the DeMo related article in Indian media that RBI has 20 counting machine and if all of them are operated 12 hours a day 7 days a week then it will take RBI 2 years to count the ~15 lakh crore worth returned notes.A_Gupta wrote: The interesting question is, what is the Indian RBI cash handling capacity?

I will search through the browser history to see if I can find the link.

Re: Currency Demonetisation and Future course of Indian Economy

I am sure they can/would have ordered more by now. this is not like importing the F22. there are multiple cos incl inevitable a cheen co named Huijin.

Re: Currency Demonetisation and Future course of Indian Economy

This is ridiculous, even a medium size bank branch has 4-5 counting machines

Re: Currency Demonetisation and Future course of Indian Economy

RBI is present in all state capitals (25+) and owns 2 mints, with 2 other mints owned by the Govt directly.

so I highly doubt the figure of 20 machines.

so I highly doubt the figure of 20 machines.

-

amit

- BRF Oldie

- Posts: 4325

- Joined: 30 Aug 2007 18:28

- Location: The Restaurant at the End of the Universe

Re: Currency Demonetisation and Future course of Indian Economy

Actually incomplete information is ridiculous which is why IMHO one should always check and then post. RBI has 60 counting machines which can both count and detect counterfeit notes these machines are of an order of sophistication much higher than the humble currency counting machines that most bank branches have.suryag wrote:This is ridiculous, even a medium size bank branch has 4-5 counting machines

Source.

This report is the original source of the rumour. However IMO the story itself is suspect because after the above para quoting, as usual unnamed officials the next para quotes yet another unnamed official as saying this:“The RBI has about 60 large-sized machines that are calibrated to distinguish the fake and counterfeit notes from the wads of returned currency. But even if they work for 12 hours, these 60 machines are estimated to take 600 days to complete the job,” said another official.

If the RBI has 60 large sized machines then the question is how many such machines do banks have or are the banks going just count the cash without detecting counterfeit cash? Unanswered question. Either way bad journalism.The government is considering a proposal to decentralise the process of counting. “We are looking if banks can be involved to finish the task much earlier,” the official said.

Added later: Folks need to understand the magnitude of the problem here. Currency is bundled in wades of 100 each. And its quite possible to slip 10-20 per cent of the individual pieces of cash with counterfeits. Now RBI has to go through several hundred thousands of these bundles. Its not a simple question of punching a keyboard to see a number on the screen. Some patience is required.

Last edited by amit on 25 Jan 2017 09:09, edited 1 time in total.

Re: Currency Demonetisation and Future course of Indian Economy

True - it's not as if all the notes are bring shifted to one branch for counting on those 20 machines. Fact is every half assed business has note counting machines nowadays. My hospital has one - and I sold a car to a guy who counted out the payment on his note counting machine. Deposited same in (SBI) bank - counted by note counting machine while I stood biting my nails expecting that 1-2 notes may be khota notes. They were not. I had seen the same machine pick out one khota note from about 200 notes. The teller first counts the note on one counter and then rechecks on a second machine which counts AND sorts fake notes. PhrrrrrrrrrrpPP! - khota note stops the countSingha wrote:RBI is present in all state capitals (25+) and owns 2 mints, with 2 other mints owned by the Govt directly.

so I highly doubt the figure of 20 machines.

Re: Currency Demonetisation and Future course of Indian Economy

I have observed that when you hand a bundle of say 100 x 1000 Rupee notes to a cashier - it takes about a minute to count and process it and record the number. Assume 1 minute for Rs 1 lakh (1000 notes) That would mean 100 minutes for 1 crore. Or 100,000 x 100 minutes for 1 lakh crore = 1 crore minutes - or 10 crore minutes for 10 lakh crore: That is 190 years of counting time on one machine one man counting 24 x 7. 1000 Rs notes onlee

100 people working 8 hours a day would make it how much - about 6 years of counting?

100 people working 8 hours a day would make it how much - about 6 years of counting?

-

asgkhan

- BRFite

- Posts: 1836

- Joined: 16 Apr 2009 17:19

- Location: Helping BRF research how to seduce somali women

Re: Currency Demonetisation and Future course of Indian Economy

B-I-L has a currency counting machine, with a built in fake note tracker. Put a bundle and a electronic display will show the number of notes counted. It stops when a fake note is identified. It takes 10 seconds to count a large bundle of 100s notes. Nifty machine though.

It is found for 7k online. Dood comes over, setsup the machine and shows a demo. Very simple to use.

It is found for 7k online. Dood comes over, setsup the machine and shows a demo. Very simple to use.

-

Marten

- BRF Oldie

- Posts: 2176

- Joined: 01 Jan 2010 21:41

- Location: Engaging Communists, Uber-Socialists, Maoists, and other pro-poverty groups in fruitful dialog.

Re: Currency Demonetisation and Future course of Indian Economy

Dipanker, if you wish to support arguments, please do so with data/information. Else, it ranks as trolling on the level of the regular AAPtards and the Lord knows there are a gazillion out there ranting and raving.Dipanker wrote:I read in one of the DeMo related article in Indian media that RBI has 20 counting machine and if all of them are operated 12 hours a day 7 days a week then it will take RBI 2 years to count the ~15 lakh crore worth returned notes.A_Gupta wrote: The interesting question is, what is the Indian RBI cash handling capacity?

I will search through the browser history to see if I can find the link.

Here's a data point: Cash Handling Machines that we envision are not the same at RBI.

https://rbi.org.in/scripts/BS_ViewTenders.aspx?Id=744

That is, the tender states a minimum of 1lac notes/hour? This is a tender for 5 such machines at different RBI offices. Followup orders for these machines would not require a retender. Only issue is that the assumption of 20 machines across all RBI offices. If that is a legit number, then a year and a half to recount everything and validate against serial numbers (which are being stored in an Oracle DB!) is a legitimate timeline.Yes. A typographical error has inadvertently appeared in the following line:

‘The capacity of each system shall be in the range of 75,000 to 90,000 bank notes per hour.’

The line is now corrected to read as under:

‘The capacity of each system shall be a minimum of 30 bank notes per second.’

As per the tender document, the bidder has to indicate whether their system can compare the serial number of note printed at two locations and sort notes that are defectively printed. If yes, the bidder may indicate the type of output the machine can produce.

To the folks quoting desktop counting machines -- there is another RBI circular that states each branch handling more than a cr must have sufficient quantities -- this mandate applies to ALL banks and branches (https://rbi.org.in/scripts/Notification ... =0&Id=5376). However, the type of FLOORTOP CVPS machine that we are talking about is a machine that can automatically sort, handle, wrap very large quantities without downtime.Page no 32, Point No 2.2 : In tender the bank has mentioned that “Each of the systems shall be so designed that it requires only one operator to handle all the operations, like feeding, programming, removing bottlenecks and taking out various outputs. Whereas the existing sites have 2 people to process cash on each machine.

It should be possible for a single operator to operate the machine. The existing staff deployment is not relevant to the tender.

Re: Currency Demonetisation and Future course of Indian Economy

if it has to compare each serial number with a database of known serials would it not slow down. better might be tag the bundle with a UID and pipe its 100 serial# into a offline huge database which is 24x7 doing the comparison job to the known data set...if a dup is found, print the UID and the offending serials# which will help to locate the stored bundle.

but since the old 500 and 1000 are going to be burned in furnace what is the value ad of this duplicate matching other than an idea just how much fake was floating around?

but since the old 500 and 1000 are going to be burned in furnace what is the value ad of this duplicate matching other than an idea just how much fake was floating around?

Re: Currency Demonetisation and Future course of Indian Economy

People may want to look at the stats here. The machines also have the job of removing soiled notes from circulation.

https://m.rbi.org.in//scripts/AnnualRep ... px?Id=1181

Any estimate of how many notes have to be counted to retire 16 billion notes per year suggests a formidable counting capacity.

https://m.rbi.org.in//scripts/AnnualRep ... px?Id=1181

Any estimate of how many notes have to be counted to retire 16 billion notes per year suggests a formidable counting capacity.

Re: Currency Demonetisation and Future course of Indian Economy

Deracinated, Indian-Traditions-Hating Bengali elite baabu, hard drinker of foreign ideological whiskies of Maoism, Marxism, Leninism, Fabian Socialism and frustrated seeing local Indian/Hindu traditions stand-up and rise in the global stage < YES / NO > ?.Dipanker wrote:Am I forcing you to believe it ?SaraLax wrote:

Why even indulging in posting the above crap and you want us to believe this "i read somewhere" stuff ?.

Do you think many of us people in this forum are wet-behind-the-ears type folks ?.

If there is no substantive link provided then it is up to reader's discretion to exercise his/her own judgement about the quality of the content.

So pause for a moment and THINK if the information provided appears reasonable or not? Because in this case whether or not you are wet-behind-the-ears, you are sounding like one.

Re: Currency Demonetisation and Future course of Indian Economy

The following link has tax-to-GDP numbers for several countriesQ: Your litmus test, you said, should be at least 1 percent more taxes. You mean 1 percent of GDP? It rises from 11-12 percent or whatever?

A: Right. At least 1 percent, otherwise I do not think the cost benefit calculus would be positive. And you must recognise that this 1 percent is on a permanent basis. It is not just this year, but every year. And of course, there will be other benefits of demonetisation like all of this black economy coming into the formal white economy and that having a multiplier effect and the digitisation, etc. and of course, corruption going down.

http://www.bloombergquint.com/opinion/2 ... al-nuances

Australia - 22.2%

Brazil - 13.1%

Canada - 11.9%

China - 9.7%

India - 11

Russia - 13.4%

Singapore - 13.9%

Sweden - 26.3%

Switzerland - 9.5%

UK - 25%

USA - 11%

Euro Area - 17.4%

Re: Currency Demonetisation and Future course of Indian Economy

http://pib.nic.in/newsite/printrelease. ... lid=157656

Print ReleasePrintXClose

Press Information Bureau

Government of India

Special Service and Features

24-January-2017 09:49 IST

India is in the midst of a major Digital Payment Movement

Shri Amitabh Kant, CEO, NITI AAYOG

*Amitabh Kant

India is making an attempt to transition to a digital payment, less cash economy. Given that only a meagre percentage of our population pays taxes, the nation’s economy also grows as more and more transactions come under banking and taxation system through digital payments. Besides, corruption in public life and governance is oiled by cash, so as we move towards a less-cash society, this anonymity which a corrupt entity enjoys by using cash goes away. Moreover, cash printing and its distribution is extremely expensive.

Individual consumers also have several benefits in going less-cash. All value of transactions, from Re. 1 to any amount, can be done digitally without carrying cash. And we can do digital transactions 24 hours even on holidays. Besides, the government has announced several incentives on digital payments which make it really cheaper as compared to cash payments for the same service.

It is not just western economies that have significant ratio of digital economy, African countries such as Kenya and Nigeria have achieved much higher adoption of digital payments even as their population is semi-literate. M-Pesa transactions account for 67% of total number of transactions under Kenya’s National Payment System. Many reports conclude that such a high rate of mobile banking has also led to increased access to financial services, reduced transaction costs and improved savings, especially by Kenyan women. India must learn from these success stories and use their experience as the India also has large young population and high mobile penetration.

Multiple initiatives

Several incentives have been announced for consumers such as discounts in fuel purchase, insurance premiums, service tax waivers and cashbacks. Revamped modes of digital payments, which are very secure, fast and customer friendly, have been launched such as BHIM app and new USSD. Large scale awareness campaigns have been launched, especially DigiDhan Melas in 100 cities, for education and handholding of public to adopt digital payments.

Several incentives and programs have been rolled out for merchants as well. Banks have been mandated to install 1 million new PoS terminals by this fiscal. Duties and taxes have been waived off on manufacture of these machines. MDR and other transaction charges on digital payments are in the process of being rationalized and soon a new regime of transaction charges will be put in place which will be based on high volume and low charges. Special care is being taken of small and rural merchants where SBI has proposed zero transaction/MDR charges on such terminals. Multiple banks are hoped to follow soon.

Solution for everyone

Given the enormous heterogeneity of India’s population and hence, government has evolved different options for different segments. Although there are more than 1 billion mobile subscriptions in the country, only 3rd of that (~370 million) use mobile internet. BHIM (UPI) and e-wallets cater to digital payments need of this segment using a smartphone (~220 million users). USSD, which can work on any mobile phone with GSM network without the need of internet, covers around 61% of population which uses only simple feature phones. Apart from these phone based solutions, we have ~78 crore debits cards in the country and ~1 billion Aadhar numbers (~40 crore bank accounts have already been seeded with Aadhaar). AEPS and PoS solutions cater to these users, with or without mobile phones, who have Aadhaar seeded bank accounts and debit/credit/prepaid cards respectively. For closer handholding to senior citizens and illiterate people, we have Banking Correspondent model which cover our rural areas where a Banking Correspondent helps in extending financial services.

BHIM app and Aadhaar Pay

Bharat Interface for Money (BHIM) is an app that lets you make easy and quick payment transactions using UPI. It's easier than wallets! You will not have to fill-out those tedious bank account details. You can easily make direct bank to bank payments and instantly collect money using just Mobile number or Payment address. This app has been launched by NPCI, the umbrella organisation for all retail payments in the country. Over 10 million BHIM App have been downloaded in last 10 days.

Aadhaar Pay is a model for merchant acceptance based on AEPS. By only installing an app on the phone and attaching a fingerprint scanner, merchants can start accepting payments from all Aadhaar seeded accounts. No card or mobile phone or PoS machine is required. Only the Aadhaar number and thumb impression is sufficient to generate and authenticate the transaction. This will enable India to achieve technological leapfrogging. My view is that by 2020 Indians will make cards and ATM’s totally redundant.

Revamped USSD

USSD is a telecom channel which lets you directly communicate from your simple phone with your bank for various transactions. It does not require internet connection. It is as easy as checking your prepaid phone balance. *99# is the standard channel which is used for communicating with all banks.

In the revamped USSD, the base layer of USSD has been integrated with UPI platform. So, now any feature phone (which is unable to install BHIM app) can also transfer or accept money from any smartphone (linked with a bank account) using BHIM app. This feature enhances the inter-operability of USSD and UPI platforms to make transactions.

Security concerns and consumer redress

Government has already formed a committee to oversee security issues in digital payments. A separate Digital Payments Division has been formed in India Computer Emergency Response Team (CERT-In). Security audit of all NPCI systems has been started to gauge needed improvements.

All the transactions done digitally are covered under Consumer Protection Act. But even before approaching the consumer forum, it is advised to approach the concerned bank for any disputes. As all digital transactions leave a record of it, it is very easy for banks to establish the veracity of such disputed transactions. Even then if the bank is not able to resolve the dispute, RBI’s institution of Banking Ombudsman can be approached by all citizens which mandates the resolution by the bank in a definite timeframe.

*****

*Author is CEO, NITI Aayog (National Institution for Transforming India) Government of India.

Print ReleasePrintXClose

Press Information Bureau

Government of India

Special Service and Features

24-January-2017 09:49 IST

India is in the midst of a major Digital Payment Movement

Shri Amitabh Kant, CEO, NITI AAYOG

*Amitabh Kant

India is making an attempt to transition to a digital payment, less cash economy. Given that only a meagre percentage of our population pays taxes, the nation’s economy also grows as more and more transactions come under banking and taxation system through digital payments. Besides, corruption in public life and governance is oiled by cash, so as we move towards a less-cash society, this anonymity which a corrupt entity enjoys by using cash goes away. Moreover, cash printing and its distribution is extremely expensive.

Individual consumers also have several benefits in going less-cash. All value of transactions, from Re. 1 to any amount, can be done digitally without carrying cash. And we can do digital transactions 24 hours even on holidays. Besides, the government has announced several incentives on digital payments which make it really cheaper as compared to cash payments for the same service.

It is not just western economies that have significant ratio of digital economy, African countries such as Kenya and Nigeria have achieved much higher adoption of digital payments even as their population is semi-literate. M-Pesa transactions account for 67% of total number of transactions under Kenya’s National Payment System. Many reports conclude that such a high rate of mobile banking has also led to increased access to financial services, reduced transaction costs and improved savings, especially by Kenyan women. India must learn from these success stories and use their experience as the India also has large young population and high mobile penetration.

Multiple initiatives

Several incentives have been announced for consumers such as discounts in fuel purchase, insurance premiums, service tax waivers and cashbacks. Revamped modes of digital payments, which are very secure, fast and customer friendly, have been launched such as BHIM app and new USSD. Large scale awareness campaigns have been launched, especially DigiDhan Melas in 100 cities, for education and handholding of public to adopt digital payments.

Several incentives and programs have been rolled out for merchants as well. Banks have been mandated to install 1 million new PoS terminals by this fiscal. Duties and taxes have been waived off on manufacture of these machines. MDR and other transaction charges on digital payments are in the process of being rationalized and soon a new regime of transaction charges will be put in place which will be based on high volume and low charges. Special care is being taken of small and rural merchants where SBI has proposed zero transaction/MDR charges on such terminals. Multiple banks are hoped to follow soon.

Solution for everyone

Given the enormous heterogeneity of India’s population and hence, government has evolved different options for different segments. Although there are more than 1 billion mobile subscriptions in the country, only 3rd of that (~370 million) use mobile internet. BHIM (UPI) and e-wallets cater to digital payments need of this segment using a smartphone (~220 million users). USSD, which can work on any mobile phone with GSM network without the need of internet, covers around 61% of population which uses only simple feature phones. Apart from these phone based solutions, we have ~78 crore debits cards in the country and ~1 billion Aadhar numbers (~40 crore bank accounts have already been seeded with Aadhaar). AEPS and PoS solutions cater to these users, with or without mobile phones, who have Aadhaar seeded bank accounts and debit/credit/prepaid cards respectively. For closer handholding to senior citizens and illiterate people, we have Banking Correspondent model which cover our rural areas where a Banking Correspondent helps in extending financial services.

BHIM app and Aadhaar Pay

Bharat Interface for Money (BHIM) is an app that lets you make easy and quick payment transactions using UPI. It's easier than wallets! You will not have to fill-out those tedious bank account details. You can easily make direct bank to bank payments and instantly collect money using just Mobile number or Payment address. This app has been launched by NPCI, the umbrella organisation for all retail payments in the country. Over 10 million BHIM App have been downloaded in last 10 days.

Aadhaar Pay is a model for merchant acceptance based on AEPS. By only installing an app on the phone and attaching a fingerprint scanner, merchants can start accepting payments from all Aadhaar seeded accounts. No card or mobile phone or PoS machine is required. Only the Aadhaar number and thumb impression is sufficient to generate and authenticate the transaction. This will enable India to achieve technological leapfrogging. My view is that by 2020 Indians will make cards and ATM’s totally redundant.

Revamped USSD

USSD is a telecom channel which lets you directly communicate from your simple phone with your bank for various transactions. It does not require internet connection. It is as easy as checking your prepaid phone balance. *99# is the standard channel which is used for communicating with all banks.

In the revamped USSD, the base layer of USSD has been integrated with UPI platform. So, now any feature phone (which is unable to install BHIM app) can also transfer or accept money from any smartphone (linked with a bank account) using BHIM app. This feature enhances the inter-operability of USSD and UPI platforms to make transactions.

Security concerns and consumer redress

Government has already formed a committee to oversee security issues in digital payments. A separate Digital Payments Division has been formed in India Computer Emergency Response Team (CERT-In). Security audit of all NPCI systems has been started to gauge needed improvements.

All the transactions done digitally are covered under Consumer Protection Act. But even before approaching the consumer forum, it is advised to approach the concerned bank for any disputes. As all digital transactions leave a record of it, it is very easy for banks to establish the veracity of such disputed transactions. Even then if the bank is not able to resolve the dispute, RBI’s institution of Banking Ombudsman can be approached by all citizens which mandates the resolution by the bank in a definite timeframe.

*****

*Author is CEO, NITI Aayog (National Institution for Transforming India) Government of India.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Currency Demonetisation and Future course of Indian Economy

check out the twitter TL of @Dipankar_cpim for some deja vu folks....

Re: Currency Demonetisation and Future course of Indian Economy

Well,done Oz. Next only to Sweden. One of the biggest ease of payment revolutions in Oz has been plastic 'tap and pay' and phone based NFC payments. Can't remember having more than $20 in my wallet and its stays in the wallet for ages.

Even a morning take away coffee is an NFC or tap and pay payment.

I really hope Aadhaar based payments take off. Let the gobermint drink it's own Kool-aid. All gobermint payments from property registrations to ration shops should be Aadhaar based. And the ridiculous stamp paper and notary business. These vendors should be mandated to also accept electronic payments as part of their licence.

Last week, I saw the first green shoot in this silly stubborn North Goa village. A small mithai shop is accepting payTM. It's the first and only among petty traders and good on him.

I have been paying sand, aggregate and stone suppliers using BHIM. I make them sit with me, ask for a copy of their passbook and xfer money in front of them. They are amazed. It's magic for them.

I think we need to spend a lot more effort on education.

Lastly, tax all cash withdrawals and transactions over Rs 5,000 ad valorem (our gobermints are ad valorem specialists). Let them produce a long winded, impossible to understand, contradictory, 500 page table of taxes to infuse mortal fear and dhoti shiver into anyone even contemplating paying by cash )

(our gobermints are ad valorem specialists). Let them produce a long winded, impossible to understand, contradictory, 500 page table of taxes to infuse mortal fear and dhoti shiver into anyone even contemplating paying by cash )

PS I am expecting some significant push on electronic payments and governance post elections.

Even a morning take away coffee is an NFC or tap and pay payment.

I really hope Aadhaar based payments take off. Let the gobermint drink it's own Kool-aid. All gobermint payments from property registrations to ration shops should be Aadhaar based. And the ridiculous stamp paper and notary business. These vendors should be mandated to also accept electronic payments as part of their licence.

Last week, I saw the first green shoot in this silly stubborn North Goa village. A small mithai shop is accepting payTM. It's the first and only among petty traders and good on him.

I have been paying sand, aggregate and stone suppliers using BHIM. I make them sit with me, ask for a copy of their passbook and xfer money in front of them. They are amazed. It's magic for them.

I think we need to spend a lot more effort on education.

Lastly, tax all cash withdrawals and transactions over Rs 5,000 ad valorem

PS I am expecting some significant push on electronic payments and governance post elections.

Re: Currency Demonetisation and Future course of Indian Economy

As I mentioned previously, counting the sum is the easy part. They need to tabulate serial numbers and check that against their master database. Each bundle takes a finite amount of time just to carry, load and unload from the machine. For a one time action like this, there are so many procedural bottlenecks to optimize, that it's quite impossible to estimate that this can be done in anything short of several months at minimum, even if you begin with the assumption that all the cash is already piled up ready for counting and all the machines and people are ready. None of this is the case in reality, and in particular, the people who feed the machines are only at work for a third of the day. Some of the workforce will be busy identifying the fakes from the bundles that were flagged, and recording all that information.Singha wrote:if it has to compare each serial number with a database of known serials would it not slow down. better might be tag the bundle with a UID and pipe its 100 serial# into a offline huge database which is 24x7 doing the comparison job to the known data set...if a dup is found, print the UID and the offending serials# which will help to locate the stored bundle.

but since the old 500 and 1000 are going to be burned in furnace what is the value ad of this duplicate matching other than an idea just how much fake was floating around?

The best way to understand the magnitude of the task is to build a workflow for all this and assign times (even if somewhat optimistic) and add all that up. There are so many notes that no matter what, the total time is a ridiculously large number. You can parallelize and optimize, and RBI is probably doing the same too. The human interface is the biggest bottleneck. They aren't equipped to do this efficiently, and in reality, no central bank has contingency plans to do anything like this quickly with so many notes.

Now with that in mind, think back to the effort it took on the part of the banks to accept and record all these notes when they were received. They came in for much criticism, but in my opinion, considering the incredible volume of notes being transacted, the banks performed extremely well. It's natural that those waiting in line may not appreciate that, but if you look at the volume of notes involved (~24 billion in all) and attempt to ascribe any sort of processing rate of your estimation, the amount of total effort that was required will be apparent.

Re: Currency Demonetisation and Future course of Indian Economy

several months? I am still curious why nobody is trolling/baiting modi/rbi over this...is it because this issue will play good for bjp in UP? that should not shut up those who are not in play in UP. heck, even congress i not in much play in UP..

Re: Currency Demonetisation and Future course of Indian Economy

It's a backend job happening in the background. Anyone expecting swift and immediate IT action on all wrong doers is being optimistic. The amount of financial data to record and process is very large, so this will play out over months or longer. The low hanging fruit can be captured quickly, but the rest will take much longer. It's not a failure, scam or anything. It's just that we're talking about Very Large Numbers.

Anyone running around screaming histrionics without bothering to do the basic math here - and it really isn't complex, just create workflow and use a calculator to add up time taken to do various things - shouldn't be taken seriously. It will be quickly apparent when you do the math that you either need a lot of time or a lot or people and resources, or both, to fit any estimated processing duration. There's no way around that when it comes to dealing with 24 billion pieces of paper.

Reminds me of an old joke about Santa Claus and delivering all presents in one night:

IS THERE A SANTA CLAUS?

No known species of reindeer can fly. BUT there are 300,000 species of living organisms yet to be classified, and while most of these are insects and germs, this does not COMPLETELY rule out flying reindeer which only Santa has ever seen.

There are 2 billion children (persons under 18) in the world. BUT since Santa doesn't (appear to) handle the Muslim, Hindu, Jewish and Buddhist children, that reduces the workload to 15% of the total - 378 million according to Population Reference Bureau. At an average (census)rate of 3.5 children per household, that's 91.8 million homes. One presumes there's at least one good child in each.

Santa has 31 hours of Christmas to work with, thanks to the different time zones and the rotation of the earth, assuming he travels east to west(which seems logical). This works out to 822.6 visits per second. This is to say that for each Christian household with good children, Santa has 1/1000th of a second to park, hop out of the sleigh, jump down the chimney, fill the stockings, distribute the remaining presents under the tree, eat whatever snacks have been left, get back up the chimney, get back into the sleigh and move on to the next house. Assuming that each of these 91.8 million stops are evenly distributed around the earth (which, of course, we know to be false but for the purposes of our calculations we will accept), we are now talking about .78 miles per household, a total trip of 75-1/2 million miles, not counting stops to do what most of us must do at least once every 31 hours, plus feeding etc.

This means that Santa's sleigh is moving at 650 miles per second, 3,000 times the speed of sound. For purposes of comparison, the fastest man- made vehicle on earth, the Ulysses space probe, moves at a poky 27.4 miles per second - a conventional reindeer can run, tops, 15 miles per hour.

The payload on the sleigh adds another interesting element. Assuming that each child gets nothing more than a medium-sized lego set (2 pounds), the sleigh is carrying 321,300 tons, not counting Santa, who is invariably described as overweight. On land, conventional reindeer can pull no more than 300 pounds. Even granting that "flying reindeer" (see point #1) could pull TEN TIMES the normal anoint, we cannot do the job with eight, or even nine. We need 214,200 reindeer. This increases the payload - not even counting the weight of the sleigh - to 353,430 tons. Again, for comparison - this is four times the weight of the Queen Elizabeth.

353,000 tons traveling at 650 miles per second creates enormous air resistance - this will heat the reindeer up in the same fashion as spacecrafts re-entering the earth's atmosphere. The lead pair of reindeer will absorb 14.3 QUINTILLION joules of energy. Per second. Each. In short, they will burst into flame almost instantaneously, exposing the reindeer behind them, and create deafening sonic booms in their wake.The entire reindeer team will be vaporized within 4.26 thousandths of a second. Santa, meanwhile, will be subjected to centrifugal forces 17,500.06 times greater than gravity. A 250-pound Santa (which seems ludicrously slim)would be pinned to the back of his sleigh by 4,315,015 pounds of force.

In conclusion -- If Santa ever DID deliver presents on Christmas Eve, he's dead now.

Anyone running around screaming histrionics without bothering to do the basic math here - and it really isn't complex, just create workflow and use a calculator to add up time taken to do various things - shouldn't be taken seriously. It will be quickly apparent when you do the math that you either need a lot of time or a lot or people and resources, or both, to fit any estimated processing duration. There's no way around that when it comes to dealing with 24 billion pieces of paper.

Reminds me of an old joke about Santa Claus and delivering all presents in one night:

IS THERE A SANTA CLAUS?

No known species of reindeer can fly. BUT there are 300,000 species of living organisms yet to be classified, and while most of these are insects and germs, this does not COMPLETELY rule out flying reindeer which only Santa has ever seen.

There are 2 billion children (persons under 18) in the world. BUT since Santa doesn't (appear to) handle the Muslim, Hindu, Jewish and Buddhist children, that reduces the workload to 15% of the total - 378 million according to Population Reference Bureau. At an average (census)rate of 3.5 children per household, that's 91.8 million homes. One presumes there's at least one good child in each.

Santa has 31 hours of Christmas to work with, thanks to the different time zones and the rotation of the earth, assuming he travels east to west(which seems logical). This works out to 822.6 visits per second. This is to say that for each Christian household with good children, Santa has 1/1000th of a second to park, hop out of the sleigh, jump down the chimney, fill the stockings, distribute the remaining presents under the tree, eat whatever snacks have been left, get back up the chimney, get back into the sleigh and move on to the next house. Assuming that each of these 91.8 million stops are evenly distributed around the earth (which, of course, we know to be false but for the purposes of our calculations we will accept), we are now talking about .78 miles per household, a total trip of 75-1/2 million miles, not counting stops to do what most of us must do at least once every 31 hours, plus feeding etc.

This means that Santa's sleigh is moving at 650 miles per second, 3,000 times the speed of sound. For purposes of comparison, the fastest man- made vehicle on earth, the Ulysses space probe, moves at a poky 27.4 miles per second - a conventional reindeer can run, tops, 15 miles per hour.

The payload on the sleigh adds another interesting element. Assuming that each child gets nothing more than a medium-sized lego set (2 pounds), the sleigh is carrying 321,300 tons, not counting Santa, who is invariably described as overweight. On land, conventional reindeer can pull no more than 300 pounds. Even granting that "flying reindeer" (see point #1) could pull TEN TIMES the normal anoint, we cannot do the job with eight, or even nine. We need 214,200 reindeer. This increases the payload - not even counting the weight of the sleigh - to 353,430 tons. Again, for comparison - this is four times the weight of the Queen Elizabeth.

353,000 tons traveling at 650 miles per second creates enormous air resistance - this will heat the reindeer up in the same fashion as spacecrafts re-entering the earth's atmosphere. The lead pair of reindeer will absorb 14.3 QUINTILLION joules of energy. Per second. Each. In short, they will burst into flame almost instantaneously, exposing the reindeer behind them, and create deafening sonic booms in their wake.The entire reindeer team will be vaporized within 4.26 thousandths of a second. Santa, meanwhile, will be subjected to centrifugal forces 17,500.06 times greater than gravity. A 250-pound Santa (which seems ludicrously slim)would be pinned to the back of his sleigh by 4,315,015 pounds of force.

In conclusion -- If Santa ever DID deliver presents on Christmas Eve, he's dead now.

Re: Currency Demonetisation and Future course of Indian Economy

Group of CMs submitted their interim report on digital payments. I guess things will move more quickly after assessing the situation.rahulm wrote: PS I am expecting some significant push on electronic payments and governance post elections.