Perspectives on the global economic meltdown (Jan 26 2010)

Re: Perspectives on the global economic meltdown (Jan 26 201

developing country needs to import lot of services and technology for building out stuff and catching up. also we import lot of crude oil.

wouldnt all these be helped by a strong rupee:dollar & rupee:euro rate?

wouldnt all these be helped by a strong rupee:dollar & rupee:euro rate?

Re: Perspectives on the global economic meltdown (Jan 26 201

yes a balanced decision is needed.

Meanwhile

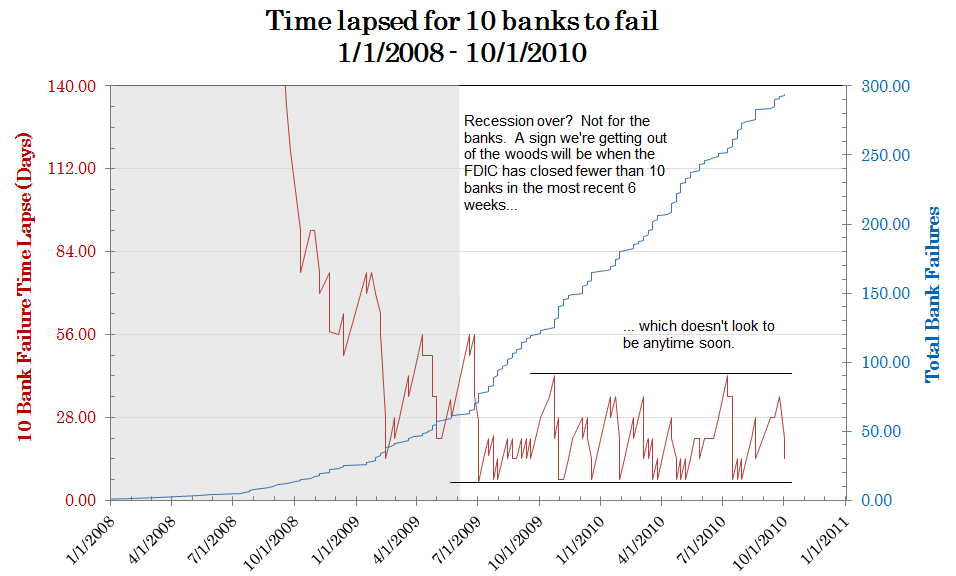

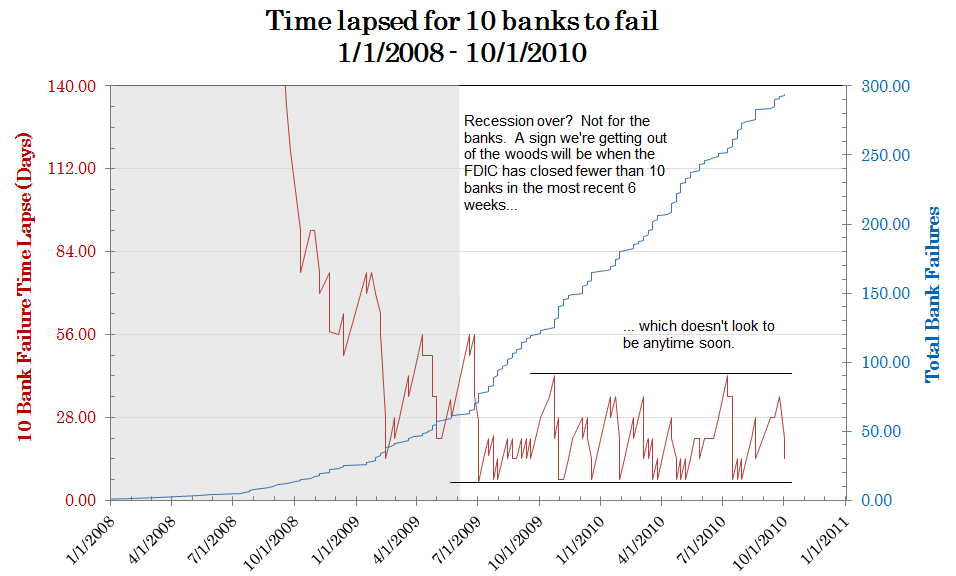

Are we heading for another Great Depression?

The graphs are tracking it to the trends. And the same politicial stalemate is seizing Washington.

Meanwhile

Are we heading for another Great Depression?

The graphs are tracking it to the trends. And the same politicial stalemate is seizing Washington.

Re: Perspectives on the global economic meltdown (Jan 26 201

There are more distressed companies out there in the world than ever before. Let rupee and stock market appreciate for a while to let Indian companies buy them, like Tata-JLR.

Re: Perspectives on the global economic meltdown (Jan 26 201

They would to some extent, but exports would be hurt. Furthermore these benefits and harms are pretty transitory, eg. as India buys more dollars to import goods, quantity of rupees on the markets increases and the rupee will decline to dollar. Stable rupee is probably best IMO.Singha wrote:developing country needs to import lot of services and technology for building out stuff and catching up. also we import lot of crude oil.

wouldnt all these be helped by a strong rupee:dollar & rupee:euro rate?

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

x-post:

Without making claims to gurudom, let me say the ekhanomist (f)article is suspect as is almost the major part of their India pronouncements. I think its beyond overdue that India and Indians take Economist like psy-ops with salt.

Also, the posters above make good points critiquing the report although their crticism may be a tad bit harsh. I hope India won't do that badly.

Point is, the recent crisis shows that complex economic systems while relatively efficient are also increasingly vulnerable to disruption. And disruption is here to stay. The 'stability' engendered in the past 30 yrs was mere illusion only. The real market forces are back. And there's little if any animal spirits (a.k.a. consumer demand) among western economies to counter them.

Economies like ours (and Russia's after the soviet collapse) are relatively primitive, sure, but are also relatively more robust to price-supply-input-quality-design-capital-funding-etc disruptions. So, yes, while growth is good and all, I continue to hope for small-scale corrections periodically every now and then so that we keep awake and alert to the dangers of mistaking complexity and efficiency for nirvana. Nope, no sir, no can do.

The economissed article ignores this angle completely. The Indian entrepreneur who survives India's business landscape is tough-as-nails. Can compete anywhere and with anyone. His one main strength is robustness, higher immunity from economic diseases. Instead, the economissed goes on and on exhorting us to become a copy of western policies and fallacies that lie brutally exposed today. OF course, how did the mighty west lose its way such that it is essentially insolvent today - unable to payback a fraction of its true (expressed and implied) liabilities (include pension, healthcare and bank liabilities here), how it lost competitiveness and robustness, how it might regain the same someday are topics for another thread, another time.

Again, IMVVHO and all that. Perhaps OT for this thread. Shall take the discussion to the perspectives thread only.

Ramana garu,ramana wrote:Amit, Hari and others gurus, Can we analyse the Economist report?

Without making claims to gurudom, let me say the ekhanomist (f)article is suspect as is almost the major part of their India pronouncements. I think its beyond overdue that India and Indians take Economist like psy-ops with salt.

Also, the posters above make good points critiquing the report although their crticism may be a tad bit harsh. I hope India won't do that badly.

Point is, the recent crisis shows that complex economic systems while relatively efficient are also increasingly vulnerable to disruption. And disruption is here to stay. The 'stability' engendered in the past 30 yrs was mere illusion only. The real market forces are back. And there's little if any animal spirits (a.k.a. consumer demand) among western economies to counter them.

Economies like ours (and Russia's after the soviet collapse) are relatively primitive, sure, but are also relatively more robust to price-supply-input-quality-design-capital-funding-etc disruptions. So, yes, while growth is good and all, I continue to hope for small-scale corrections periodically every now and then so that we keep awake and alert to the dangers of mistaking complexity and efficiency for nirvana. Nope, no sir, no can do.

The economissed article ignores this angle completely. The Indian entrepreneur who survives India's business landscape is tough-as-nails. Can compete anywhere and with anyone. His one main strength is robustness, higher immunity from economic diseases. Instead, the economissed goes on and on exhorting us to become a copy of western policies and fallacies that lie brutally exposed today. OF course, how did the mighty west lose its way such that it is essentially insolvent today - unable to payback a fraction of its true (expressed and implied) liabilities (include pension, healthcare and bank liabilities here), how it lost competitiveness and robustness, how it might regain the same someday are topics for another thread, another time.

Again, IMVVHO and all that. Perhaps OT for this thread. Shall take the discussion to the perspectives thread only.

Re: Perspectives on the global economic meltdown (Jan 26 201

Sorry ramanaji don’t agree with you. Unless one could do any of the following by looking at the graphic.

The picture is only data, what about the inference what about a little valuable insight from the poster/author, any comments context even obliquely.

I am loathe to pick on any one. A post should be informative, if not impart some language skills also relate in context, The intent is to learn from the poster what his analysis or thoughts were. We can go on cut and paste graphics, news items of no value. No?

Example what does this mean?

The picture is only data, what about the inference what about a little valuable insight from the poster/author, any comments context even obliquely.

I am loathe to pick on any one. A post should be informative, if not impart some language skills also relate in context, The intent is to learn from the poster what his analysis or thoughts were. We can go on cut and paste graphics, news items of no value. No?

Example what does this mean?

Re: Perspectives on the global economic meltdown (Jan 26 201

Remember I was saying that Indias growth of 8.5 to 9 % must be shifted to consumption and production with in the country. The Chines premier was exactly saying this his Euro zone tour. The want their factories humming by consuming in the country rather than by Walmart exports atleast the intent.

Ahh

the graphic posted by Hari saar is exactly reflecting my opinion and also the desire of Chinese premier? how so?

Look at the end of the graph the chinese fraction GDP from exports is dro(o) ping.

which means if the GDP is still growing (even if not in absolute terms but in % terms) it is from internal consumption that in turn means less dependendcy on Walmart, K mart, Home depot orders (except which are operating with in PRC including occupied tibet).

That is inference, thoughts analysis, if we dig further did indian growth of GDP as part of exports come at the expense, by looking at corresponding increase and decrease thats ananlysis.

All these are well known to Acharya ji for some reason he shy's away from giving more than pretty graphic thats my agony

Ahh

the graphic posted by Hari saar is exactly reflecting my opinion and also the desire of Chinese premier? how so?

Look at the end of the graph the chinese fraction GDP from exports is dro(o) ping.

which means if the GDP is still growing (even if not in absolute terms but in % terms) it is from internal consumption that in turn means less dependendcy on Walmart, K mart, Home depot orders (except which are operating with in PRC including occupied tibet).

That is inference, thoughts analysis, if we dig further did indian growth of GDP as part of exports come at the expense, by looking at corresponding increase and decrease thats ananlysis.

All these are well known to Acharya ji for some reason he shy's away from giving more than pretty graphic thats my agony

Last edited by ShivaS on 06 Oct 2010 22:08, edited 1 time in total.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

Aha. Bang on time, eh?

Barbarians at the gates of complexity

Book review in FT. Read in full please. Only.

Here's a tantalizing quote:

Barbarians at the gates of complexity

Book review in FT. Read in full please. Only.

Here's a tantalizing quote:

What of today’s barbarians at the gate? Trading in securities naturally invites trading in derivatives. Wherever there is a collateralised debt obligation there will soon be a CDO squared. The volume of activity, and the number of people employed in financial services, increases more rapidly than the number of people employed in the underlying trade in goods and services.

For Tainter, the fall of Rome was principally an economic phenomenon. For Gibbon, it followed the decline of civic virtue. So much changes, yet so much remains the same.

Re: Perspectives on the global economic meltdown (Jan 26 201

I too noticed the same thing. Then the question that came to my mind was, what about imports? Did that come down? If not, did Chinese forex reserve experience depletion due to sustained imports? If neither of that has happened, the graph must be shanghai statistics.ShivaS wrote:Look at the end of the graph the chinese fraction GDP from exports is dro(o) ping (:mrgreen: )

which means if the GDP is still growing (even if not in absolute terms but in % terms) it is from internal consumption that in turn means less dependendcy on Walmart, K mart, Home depot orders (except which are operating with in PRC including occupied tibet).

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

shivas regal garu,Look at the end of the graph the chinese fraction GDP from exports is dro(o) ping (:mrgreen: )

which means if the GDP is still growing (even if not in absolute terms but in % terms) it is from internal consumption that in turn means less dependendcy on Walmart, K mart, Home depot orders (except which are operating with in PRC including occupied tibet).

That is inference, thoughts analysis, if we dig further did indian growth of GDP as part of exports come at the expense, by looking at corresponding increase and decrease thats ananlysis.

While I'd normally be happy to take your perspicacious pronouncements to the ibank, in this case though, I must differ.

Sure, cheena's expolts/GDP is dropping of late but notice, (a) its trade deficit continues to balloon, (b) consumption/GDP has barely budged. What that means, again, strictly IMVVHO and all that, is that its doesmtic fixed asset (mis-)investment that largely responsible for driving the cheeni economy in the past few qtrs. Especially, that 15% stimulus/GDP figure that dwarfs even yamerika's. Most of which is mis-spent a la Japani bridges to nowhere in uneconomical projects with local gubmint debt piling up faster than even yamerika's deficits.

So no, I'd be less sanguine about cheena's soup-e-rear economic model even now. Of course, that doesn't mean cheena won;t surprise us all by pulling yet another rabbit outta its hat even now. Who knows, eh?

Jai hu and maoA.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

The costs of rising economic inequality (WaPo)

An excellent read. Americans and the GOP itself should hope Repubs don't re-take the House this year. For all their sakes.

An excellent read. Americans and the GOP itself should hope Repubs don't re-take the House this year. For all their sakes.

If you asked Americans how much of the nation's pretax income goes to the top 10 percent of households, it is unlikely they would come anywhere close to 50 percent, which is where it was just before the bubble burst in 2007.

...

Even within that top "decile," the distribution is remarkably skewed. By 2007, the top 1 percent of households took home 23 percent of the national income after a 15-year run in which they captured more than half - yes, you read that right, more than half - of the country's economic growth. As Tim Noah noted recently in a wonderful series of articles in Slate, that's the kind of income distribution you'd associate with a banana republic or a sub-Saharan kleptocracy, not the world's oldest democracy and wealthiest market economy.{Amen}

It's important to measure and track income inequality. As long as median income net of household debt is rising, real economic progress is being made and all is well. Sort of.It wasn't always that way. From World War II until 1976, considered by many as the "golden years" for the U.S. economy, the top 10 percent of the population took home less than a third of the income generated by the private economy.

In trying to figuring out who or what is responsible for rising inequality, there are lots of suspects.

...

There are a number of other culprits that come under the heading of what economists call "institutional" changes - the decline of unions, industry deregulation and the increased power of financial markets over corporate behavior. And then there is my favorite culprit: changing social norms around the issue of how much inequality is socially acceptable.

Oh, read it all. And ponder. Only.Concentrating so much income in a relatively small number of households has also led to trillions of dollars being spent and invested in ways that were spectacularly unproductive. In recent decades, the rich have used their winnings to bid up the prices of artwork and fancy cars, the tuition at prestigious private schools and universities, the services of celebrity hairdressers and interior decorators, and real estate in fashionable enclaves from Park City to Park Avenue. And what wasn't misspent was largely misinvested in hedge funds and private equity vehicles that played a pivotal role in inflating a series of speculative financial bubbles, from the junk bond bubble of the '80s to the tech and telecom bubble of the '90s to the credit bubble of the past decade.

Re: Perspectives on the global economic meltdown (Jan 26 201

Hari Seldon, The Depression historian Robert MacElvaine wrote in his book that the top 1% controlling the largest share was a feature of 1920s-1929. The crash of 1929 led to re-distribution that held on till the Reagan years. Will try to find the table at home. IOW the income distribuion is/was same as before 1929.

Re: Perspectives on the global economic meltdown (Jan 26 201

Well here are equivalent data

Wiki:

http://en.wikipedia.org/wiki/Income_ine ... ted_States

And a pdf from an UC Berkeley economist:

Incomes in US and Canada over the 20th Century

A news report dated Oct 6th

Income gap widens:Census Data

Wiki:

http://en.wikipedia.org/wiki/Income_ine ... ted_States

And a pdf from an UC Berkeley economist:

Incomes in US and Canada over the 20th Century

A news report dated Oct 6th

Income gap widens:Census Data

Re: Perspectives on the global economic meltdown (Jan 26 201

We talked about Lorenz curve,

The American dream was built on income equality via the captalism route, by building a robust middle class who could efford a certain standard of living which could be construded as luxary living vis a vis other nations. WHile the rich in the America could own more than middle class but that was not at the expense of Midlle class, which changed with reganomics of unsustainable tax cuts, increased defence spending, for some time unbriddled entitlement programs in adition to congressional pork & barell projects(bridge to know where Alaska for instance).

During the BC era Reps taking the congress and slashing of benefits and entitlements reduced the overl deficits to some extent but it also started the rot of middle class, with NAFTA (which Ross perot rightly called Shafta...) Meanwhile the opening of PRC by Crook Kissinger and Nixon duo gradually started biting into US manufacturing of ordinary goods, while Japan and Germany were exporting manufactured goods, still the picture was rosy as Iran Iraq war cost the two nations tons of money (recall Saddam borrowed money from Kuwait only to renegade and start the GW1) they tried to catch up pumping more oil and US started patrolling Gulf (having started the Gulf between Iran & Iraq) for Petrol.

The cheap money from Oil rich and the cheap goods from PRC gradually took toll on manufacturing, while our man Jack Welch was selling the concept that PRC is going to be the biggest market and all followed to put(money) plants in PRC.

In nut shell the short term vision of the leadership corroded the pillars of the greatest democracy under written (in constitution of US) by visionary leaders.

No wonder when the consumer cant consume stagnation is the fate of the nation. You have produce and consume was forgotten, not print and consume...

Revolution is preceeded by revulsion which the ruling elite thinks is illusion.

The American dream was built on income equality via the captalism route, by building a robust middle class who could efford a certain standard of living which could be construded as luxary living vis a vis other nations. WHile the rich in the America could own more than middle class but that was not at the expense of Midlle class, which changed with reganomics of unsustainable tax cuts, increased defence spending, for some time unbriddled entitlement programs in adition to congressional pork & barell projects(bridge to know where Alaska for instance).

During the BC era Reps taking the congress and slashing of benefits and entitlements reduced the overl deficits to some extent but it also started the rot of middle class, with NAFTA (which Ross perot rightly called Shafta...) Meanwhile the opening of PRC by Crook Kissinger and Nixon duo gradually started biting into US manufacturing of ordinary goods, while Japan and Germany were exporting manufactured goods, still the picture was rosy as Iran Iraq war cost the two nations tons of money (recall Saddam borrowed money from Kuwait only to renegade and start the GW1) they tried to catch up pumping more oil and US started patrolling Gulf (having started the Gulf between Iran & Iraq) for Petrol.

The cheap money from Oil rich and the cheap goods from PRC gradually took toll on manufacturing, while our man Jack Welch was selling the concept that PRC is going to be the biggest market and all followed to put(money) plants in PRC.

In nut shell the short term vision of the leadership corroded the pillars of the greatest democracy under written (in constitution of US) by visionary leaders.

No wonder when the consumer cant consume stagnation is the fate of the nation. You have produce and consume was forgotten, not print and consume...

Revolution is preceeded by revulsion which the ruling elite thinks is illusion.

Re: Perspectives on the global economic meltdown (Jan 26 201

Hari Seldon, Dont know if you have been visiting Taleb's webpage

Here is link to pdf on the technical papers of events from 2007-2010

http://www.fooledbyrandomness.com/Technicalpapers.pdf

Here is link to pdf on the technical papers of events from 2007-2010

http://www.fooledbyrandomness.com/Technicalpapers.pdf

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

^ Thx, Ramana garu. Shall go through only.

Re: Perspectives on the global economic meltdown (Jan 26 201

http://www.ritholtz.com/blog/

The actual United States wealth distribution plotted against the estimated and ideal distributions across all respondents.

The actual United States wealth distribution plotted against the estimated and ideal distributions across all respondents.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

An excellent piece by sri charles schwab in the WSJ beating an old drum - that favired by sri neshant a lot. Where's that dude disappeared to, btw??

Enough With the Low Interest Rates!

Enough With the Low Interest Rates!

Amen.Fed policy punishes savers without making credit more readily available.

Read it all only.The Federal Reserve's experiment with near-zero interest rates, which began following the credit crisis of 2008, has now become counterproductive.

As a temporary fix it served its purpose. It was an emergency antibiotic appropriate for the illness. But continuing with the experiment is disfiguring the economy and fueling doubt. Healthy economies find their own equilibrium based on market forces of supply and demand. When people don't think market forces are driving the economy and believe instead that it is being driven by excessive government intervention, they don't take the risks an economy requires.

It's time to stop the experiment and return to monetary normalcy. The negative impact of current policy is clear. The near-zero interest rate experiment is weighing on consumer and investor confidence, and the Fed signals its lack of confidence with each "extended period" proclamation. It is providing banks with low-interest financing that can be used to create modest returns through a carry-trade in U.S. Treasurys but is adding nothing to the velocity of money, which is what actually generates economic growth.

The Fed's super-loose policy has driven down the security and spending power of savers, particularly those in retirement who played by the rules during their working years and now depend on the earnings from their savings for a decent quality of life. As a result, savers and investors are being forced to take more risk with their money as they hunt for higher yields. The extreme monetary policy is also having no positive impact on the availability of consumer or business credit, job growth or consumer and business spending.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

Recommended listen only:

The reality in Japan (mp3 interview)

Just the first 10 minutes were eye-opening. Even for one as jaded as moi.

The reality in Japan (mp3 interview)

Just the first 10 minutes were eye-opening. Even for one as jaded as moi.

Re: Perspectives on the global economic meltdown (Jan 26 201

The US economy is ailing due to unhygenic post operative treatment. It is now afflicted with a super bug named after "Washington DC" this super bug has grown resistance to antibiotic called Interest rate, shows no sign of real recovery.

The interest rate hike is not going cure the malise, GOTUS has to cut massive defence budget as a first thing, get out wars overseas, cut pork and barell projects, in sequence, yes there will be social upheava but thats the cost of retaining free worl leadership!

Interest rate hike might induce capital inflows but what is important is that how you utilize the capital to be employed productively and induce large scale employment.

Unkil is now Chinese opium addict

The interest rate hike is not going cure the malise, GOTUS has to cut massive defence budget as a first thing, get out wars overseas, cut pork and barell projects, in sequence, yes there will be social upheava but thats the cost of retaining free worl leadership!

Interest rate hike might induce capital inflows but what is important is that how you utilize the capital to be employed productively and induce large scale employment.

Unkil is now Chinese opium addict

Re: Perspectives on the global economic meltdown (Jan 26 201

LOL! Its a fraud of a system man. It truly is.

---------

IMF calls for a huge new round of bank bailouts

http://blacklistednews.com/The-IMF-is-c ... 3/Y/M.html

---------

IMF calls for a huge new round of bank bailouts

http://blacklistednews.com/The-IMF-is-c ... 3/Y/M.html

Re: Perspectives on the global economic meltdown (Jan 26 201

The above quote shows the inverse condition of US economy vis a vis Indian economyto the velocity of money, which is what actually generates economic growth.

Paging vina saar: Recall in reply to Swamy G ji I had said the D Subba Rao by increasing the repo rate and other simulatneous measures was ensuring that high growth rate would not lead to high (already high due to food induced price) inflation rates.

It is not that zero rates are inhibiting the banks to lend but the real situation of banks (with NPA or write offs have never been exposed fully) nobody knows and CT senator Dodd who is bed with bankers does not want to tighten screws.

Borrowing money from feds and then lending to US govt to make money should in the first place be not allowed.

The money was intended to circulate into private ventures (not speculative) to make profits the old fashioned way.

The banks not doing so means they dont trust the US economy to recover for a very very long time. Simple and such negative feed back positively reinforces that recession is long term if not downright depression.

Re: Perspectives on the global economic meltdown (Jan 26 201

The ballooning US defense budget shows why weapons procurement should be centralized and left to the military rather than the legislature. The legislature is ultimately not the user and cannot decide what is optimal for the military and is more concerned with maximizing the ballot count in the respective electoral district.

In order to reduce the deficit the defense budget has to go down, but why be introspective when you can blame it on Barack Hussein Obama and his conspiracy to socialize America?

In order to reduce the deficit the defense budget has to go down, but why be introspective when you can blame it on Barack Hussein Obama and his conspiracy to socialize America?

Re: Perspectives on the global economic meltdown (Jan 26 201

All will change if US recognizes that Pakistan is its real enemy.

ANother alternative is equip US armed forces with Chines weapons and save a ton of money in defence procurement. Even better out source manufacturing of US weapons to China.

I think hummer plant is trans planted in China or even better copies are being made.

ANother alternative is equip US armed forces with Chines weapons and save a ton of money in defence procurement. Even better out source manufacturing of US weapons to China.

I think hummer plant is trans planted in China or even better copies are being made.

Re: Perspectives on the global economic meltdown (Jan 26 201

ShivaS wrote:We talked about Lorenz curve,

The American dream was built on income equality via the captalism route, by building a robust middle class who could efford a certain standard of living which could be construded as luxary living vis a vis other nations. WHile the rich in the America could own more than middle class but that was not at the expense of Midlle class, which changed with reganomics of unsustainable tax cuts, increased defence spending, for some time unbriddled entitlement programs in adition to congressional pork & barell projects(bridge to know where Alaska for instance).

During the BC era Reps taking the congress and slashing of benefits and entitlements reduced the overl deficits to some extent but it also started the rot of middle class, with NAFTA (which Ross perot rightly called Shafta...) Meanwhile the opening of PRC by Crook Kissinger and Nixon duo gradually started biting into US manufacturing of ordinary goods, while Japan and Germany were exporting manufactured goods, still the picture was rosy as Iran Iraq war cost the two nations tons of money (recall Saddam borrowed money from Kuwait only to renegade and start the GW1) they tried to catch up pumping more oil and US started patrolling Gulf (having started the Gulf between Iran & Iraq) for Petrol.

The cheap money from Oil rich and the cheap goods from PRC gradually took toll on manufacturing, while our man Jack Welch was selling the concept that PRC is going to be the biggest market and all followed to put(money) plants in PRC.

In nut shell the short term vision of the leadership corroded the pillars of the greatest democracy under written (in constitution of US) by visionary leaders.

No wonder when the consumer cant consume stagnation is the fate of the nation. You have produce and consume was forgotten, not print and consume...

Revolution is preceeded by revulsion which the ruling elite thinks is illusion.

I agree with you but would put in more simply. The foundation of empires since time imemorial is to import cheap Raw Materal and earn by export of Manufactured goods. Due to idiotic policies of US, they have (and are still) driving up commodity prices due to cheap dollar and driving down cost of manufactured goods due to Chinese slave labour. In the end US stands screwed.

Re: Perspectives on the global economic meltdown (Jan 26 201

There is a bear market ETF at NYSE with symbol "FAZ". Its value is supposed to go up when market goes down. People who really believe in economic collapse may use that to hedge the risk. Do this at your own risk, and BR or me are not liable if you lose money.

Re: Perspectives on the global economic meltdown (Jan 26 201

Vic>> thanks guruji I will emulate another guruji and post a graph

Re: Perspectives on the global economic meltdown (Jan 26 201

I have this conclusion that Keynesian solution of economic stimulus by govt to get the economy out of recession works for isolated non-globalized economies. Once you globalize unless there is a healthy bilatreal trade it will end up sucking away the stimulus to a far away leach economies with some sticking to the trading MNCs. And then you add currency rate shenanigans it defeats Keynesian stimulus. What is needed is a a realization of enlightened collective good. And thats asking too much when we have two-four year election cycle.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

^^^Agreed.

Question now is, where will the new equilibrium form? If janta cannot get rid of the current corrupt kleptocracy in congress the constitutional way, then the risk of constipational methods replacing the constitutional ones comes to the fore.

No, I'm not predicting pitchforks and lampbosts yet but figuratively, something will have to give. Already, dire warnings of social unrest are making the rounds in the corridors of power, it seems like.

Question now is, where will the new equilibrium form? If janta cannot get rid of the current corrupt kleptocracy in congress the constitutional way, then the risk of constipational methods replacing the constitutional ones comes to the fore.

No, I'm not predicting pitchforks and lampbosts yet but figuratively, something will have to give. Already, dire warnings of social unrest are making the rounds in the corridors of power, it seems like.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

D&G watch. TAE tweet roundup

https://twitter.com/#!/AutomaticEarth

https://twitter.com/#!/AutomaticEarth

aaj ke liye itna bas.U.S. August consumer credit is down $3.3 Bn. Consumer is 70pc+ of the economy and he's deleveraging. Recovery is out of sight, out of mind.

10 year T-Note has broken an important technical pattern, targeting sub 2pc yields now. Highly deflationary.

Stiglitz Says Fed Policy of Record-Low Rates Causing Problems http://bit.ly/cRtooD The flood of US liquidity is going abroad.

City budgets slammed by falling property taxes http://bit.ly/diK9hLCities expect property tax revenue to fall 1.8pc & sales tax down 5pc

Some 69% of municipalities are delaying or canceling capital projects, while 34% are modifying health benefits.

Nearly 75% of cities are instituting hiring freezes; 54% are mandating salary reduction or freeze; and 22% are requiring furloughs.

Nearly 8 in 10 cities are expected to eliminate staff in 2010-total of 480,000 jobs lost-on top of the 67% of cities that cut jobs last year

If the US were to pay off it's National debts, it would require every US family to pay $31,000 a year, every year for 75 years... {what can't be paid won't be paid only}

#Bernanke Tells the Truth: The United States is on the Brink of Financial Disaster http://bit.ly/9iUD9q Truthiness {yawn}

UK house prices fall by record 3.6pc in a month http://bit.ly/d7l6Br Down £6,000 in September alone.

Food stamp use reached a record high (again) in July, with 41.8 Million people on the program. Up 18pc YoY. Target by end of year is 43.3 Mn

Re: Perspectives on the global economic meltdown (Jan 26 201

Hari, We have cut up most of the cards and cancelled the accounts and reduced to bare minimum. Only essentials like Iphone are bought for cash! SHQ is very nervous. No frivoulous/discretionary expenditures at all.

-

Also CATO has a handbook on Social Scurity which shows what a scam it is for the workers.

If born before 1955 one has to live ~89 years to recover what one puts in. If one retires at 65 they live 82 to 86 based on male or female. For those born later its even worse!

-

Also CATO has a handbook on Social Scurity which shows what a scam it is for the workers.

If born before 1955 one has to live ~89 years to recover what one puts in. If one retires at 65 they live 82 to 86 based on male or female. For those born later its even worse!

-

Satya_anveshi

- BRF Oldie

- Posts: 3532

- Joined: 08 Jan 2007 02:37

Re: Perspectives on the global economic meltdown (Jan 26 201

ramana wrote:Only essentials like Iphone are bought for cash!

-

akashganga

- BRFite

- Posts: 374

- Joined: 17 Mar 2010 04:12

Re: Perspectives on the global economic meltdown (Jan 26 201

Ron Paul: End the Fed, Legalize Competing Currencies

http://www.youtube.com/watch?v=moROt9yoQl8

http://www.youtube.com/watch?v=moROt9yoQl8

Re: Perspectives on the global economic meltdown (Jan 26 201

There lies the benefit of getting a govt job and joining a public sector union.ramana wrote: Also CATO has a handbook on Social Scurity which shows what a scam it is for the workers.

If born before 1955 one has to live ~89 years to recover what one puts in. If one retires at 65 they live 82 to 86 based on male or female. For those born later its even worse!

You get to retire early, get a gold plated pension plan indexed to inflation, get the taxpayer in the private sector (with no pension himself) to pay for all gambling losses on the stock market by your pension fund, plus job security, benefits and other goodies - which keep getting better as political crooks you vote into office keep on raising the pension payouts.

Unfortunately the private sector is collapsing now as parasites from the banking & financing 'industry' drain them dry. So I expect a pension crisis soon since there are just not enough suckers around.

Re: Perspectives on the global economic meltdown (Jan 26 201

That made me laugh as wellSatya_anveshi wrote:ramana wrote:Only essentials like Iphone are bought for cash!

Re: Perspectives on the global economic meltdown (Jan 26 201

IPhone is an essential item for a person like Ramana-ji to read BR from anywhere...

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

x-posting from Ind Econ dhaga.

What we call capital is the lifeblood of business. Sure, no disputing that. Working capital often takes the form of Credit. Terms of credit and thereby availability of capital is crucial to the birth, survival and health of businesses. In some sense. Now let's take a look at the conditions governing capital formation contrasted with capital availability for businesses including startups and SMEs in Desh.

In the rurals, the do-gooder samaritan microfinance guys charge 24-30% p.a. interest. Fact. Boink. Local moneylenders start at 36% and reports suggest go all the way to 60%. In the urbans, those with access to bank credit start off somewhere at 12% for risky business startup loans and 18% is like, more typical, am told for certain forms of emergency credit extension facilities.

Even half this level would be considered usurious in most of the tfta emerged khanomic world. ZIRP is the mantra there because their current debt levels, already unrepayable in full will simply go belly up should rates move up by even a few 100 basis points. The farthest extreme case is that of Japan, that paragon of JIT-efficiency-physical infrastructure, which as a nation with 190% debt/GDP will see almost 60% of its tax revenue go into interest payments should rates rise even 100 basis points. Digest that a sec. 60% of its tax revenues. Any wonder they're sh1t scared at the prospect of any rise in rates? They're stubbornly hugging 0% as far as can be conceived only.

Western rating agencies despite India's stellar repayment record rated us below greece and Ireland all this while. It pushed up our borrowing costs. But thanks to robust savings -> capital formation within the country, we managed somehow. Now, we don't need the rating agencies and their fancy ratings so much anymore so much, do we? LOL. We have to develop our debt markets with depth ourselves. Phoren capital is welcome, on our terms, to play by our rules and regulations. And these should be strict to weed out speculative hot money.

Now Desi entrepreneurs who had access to certain community forms of lending and credit - think of the marwari business community that provided credit access at very attractive rates within the community - did exceedingly well as is known. Others however, and there're 10s of millions of small businesses - from daily wage labor to artisans and craftsmen to small shopkeepers and so on supporting families with their businesses for whom capital and credit have been hard to come by. That they have evolved, after the weakest died off, to survive and thrive in the current competitive Indian market is tribute to robustness.

Sure, it would always help to have better public infrastructure and less corruption and all that. But given that all Indian firms face roughly similar levels of these obstacles, what they have done so far is awesome. Nothing less. Sure, we can all always do better. So let us.

Again, inchoate thoughts. Still evolving. Critiques and additions welcome. Jai ho.

paramu wrote:You get the environment you described when you have access to cheap credit that grows in tree - err thin air or may be on paper or electronic digits. When that dries away, you will see the ugly face of professionalism and efficiency. Who can survive in such environment? That will be "Jugad"!Gus wrote:But I would rather be in a place where efficiency, professionalism and predictability are more prevalent than 'jugaad to circumvent obstacles' type environment.

But there is scope to move it to the next level that doesn't require cheap money.

Awrite, been thinking this thing through a bit and time to flesh the inchoate thoughts out a little more perhaps.Hari Seldon wrote:^ paramu saar,

+1 only. 'scarcity' was the human condition for over 99% of its existence on the planet. And except for the past few decades of post-modern neoclassical/monetarist economics when money could be created out of nothing, it was the defining paradigm. I do get the sense that the old, 'real' market forces are back.

What we call capital is the lifeblood of business. Sure, no disputing that. Working capital often takes the form of Credit. Terms of credit and thereby availability of capital is crucial to the birth, survival and health of businesses. In some sense. Now let's take a look at the conditions governing capital formation contrasted with capital availability for businesses including startups and SMEs in Desh.

In the rurals, the do-gooder samaritan microfinance guys charge 24-30% p.a. interest. Fact. Boink. Local moneylenders start at 36% and reports suggest go all the way to 60%. In the urbans, those with access to bank credit start off somewhere at 12% for risky business startup loans and 18% is like, more typical, am told for certain forms of emergency credit extension facilities.

Even half this level would be considered usurious in most of the tfta emerged khanomic world. ZIRP is the mantra there because their current debt levels, already unrepayable in full will simply go belly up should rates move up by even a few 100 basis points. The farthest extreme case is that of Japan, that paragon of JIT-efficiency-physical infrastructure, which as a nation with 190% debt/GDP will see almost 60% of its tax revenue go into interest payments should rates rise even 100 basis points. Digest that a sec. 60% of its tax revenues. Any wonder they're sh1t scared at the prospect of any rise in rates? They're stubbornly hugging 0% as far as can be conceived only.

Western rating agencies despite India's stellar repayment record rated us below greece and Ireland all this while. It pushed up our borrowing costs. But thanks to robust savings -> capital formation within the country, we managed somehow. Now, we don't need the rating agencies and their fancy ratings so much anymore so much, do we? LOL. We have to develop our debt markets with depth ourselves. Phoren capital is welcome, on our terms, to play by our rules and regulations. And these should be strict to weed out speculative hot money.

Now Desi entrepreneurs who had access to certain community forms of lending and credit - think of the marwari business community that provided credit access at very attractive rates within the community - did exceedingly well as is known. Others however, and there're 10s of millions of small businesses - from daily wage labor to artisans and craftsmen to small shopkeepers and so on supporting families with their businesses for whom capital and credit have been hard to come by. That they have evolved, after the weakest died off, to survive and thrive in the current competitive Indian market is tribute to robustness.

Sure, it would always help to have better public infrastructure and less corruption and all that. But given that all Indian firms face roughly similar levels of these obstacles, what they have done so far is awesome. Nothing less. Sure, we can all always do better. So let us.

Again, inchoate thoughts. Still evolving. Critiques and additions welcome. Jai ho.