Indian Economy: News and Discussion (Jan 1 2010)

Re: Indian Economy: News and Discussion (Jan 1 2010)

Those who follow this thread might remember that there was a blip in the November IIP figures, and commentary at the time claimed a slowdown. As I pointed out then, it was most likely a blip, considering the accelerating growth rate in December. 3Q GDP numbers should still come out nicely.

-

amit

- BRF Oldie

- Posts: 4325

- Joined: 30 Aug 2007 18:28

- Location: The Restaurant at the End of the Universe

Re: Indian Economy: News and Discussion (Jan 1 2010)

Yes I remember reading your post. Kudos boss!Suraj wrote:Those who follow this thread might remember that there was a blip in the November IIP figures, and commentary at the time claimed a slowdown. As I pointed out then, it was most likely a blip, considering the accelerating growth rate in December. 3Q GDP numbers should still come out nicely.

Re: Indian Economy: News and Discussion (Jan 1 2010)

GDP grew faster at 8% last fiscal

INDIA’S economy grew at a faster pace in fiscal 2009-10 than estimated earlier, the government said on Monday.

The gross domestic product (GDP) grew at the rate of 8% as against 7.4% estimated in May last year. The upward revision is based on the quick estimates of national income for the year, the Central Statistical Office (CSO) said.

Re: Indian Economy: News and Discussion (Jan 1 2010)

There was an article in Dec in TOI editorial about challenge of resources for India and its population

can somebody get this out. thx in advance

can somebody get this out. thx in advance

Re: Indian Economy: News and Discussion (Jan 1 2010)

yup, that's why I trust your analysis on these things over many eggspurts.Suraj wrote:Those who follow this thread might remember that there was a blip in the November IIP figures, and commentary at the time claimed a slowdown. As I pointed out then, it was most likely a blip, considering the accelerating growth rate in December. 3Q GDP numbers should still come out nicely.

Re: Indian Economy: News and Discussion (Jan 1 2010)

http://economictimes.indiatimes.com/new ... 403759.cms

India model of development is worth emulating, says US

India model of development is worth emulating, says US

WASHINGTON: The Indian model of growth, based largely on local consumption and innovation and enterprise, which has unleashed the true potential of its billion plus people in the last two decades is worth emulating globally, a top Obama Administration official has said. "The India model is really one based largely on local consumption and innovation and enterprise because of the changes and the reforms that have taken place in the Indian economy over the last ten years and twenty years, that were started by the current Prime Minister when he was finance minister in 1990," said Assistant Secretary of State for South and Central Asia Robert Blake ."That in itself is a great story, and it's in very sharp contrast to the more export-oriented model of China which is much more devoted to, and their prosperity is based on the continued success of their exports. Whereas India is much more internally driven and therefore quite an important model," Blake said, according to the transcripts of the interview released by the State Department.

In his remarks before the Syracuse University , Blake said it is not only the pace of India's growth, but how India is growing - India has not followed the typical pattern of economic growth, from agrarian-to-industrialized-to-services economy. "Instead, its recent economic development has been driven by a technologically-advanced services sector, driven by innovation, education and free markets," he said. "India is the world's second fastest-growing major economy today and is projected to become the world's third largest economy in the year 2025. It will also soon be the world's most populous country. And it is a young country. At a time when much of the industrialized world faces rapidly declining birthrates, half of India's population is under the age of 25," he said.

Re: Indian Economy: News and Discussion (Jan 1 2010)

Prem wrote:"India is the world's second fastest-growing major economy today and is projected to become the world's third largest economy in the year 2025. It will also soon be the world's most populous country. And it is a young country. At a time when much of the industrialized world faces rapidly declining birthrates, half of India's population is under the age of 25," he said.

Today in an event a leading guy said India population will exceed China 2020. He said this will change the growth and economy and per capita

He was leading the audience to start seeing India now. China bubble will burn the finger who linger longer

Re: Indian Economy: News and Discussion (Jan 1 2010)

Should India give its peoples data to foreign companies and govts like this.

http://www.economist.com/node/18010459? ... eh/indians

Identifying a billion Indians

http://www.economist.com/node/18010459? ... eh/indians

Identifying a billion Indians

Even with strict controls for privacy, the UID scheme will help companies understand more about the population they serve. “It would be fantastic for just about any business,” predicts Mr Singh. There is a caveat, of course: the scheme must work. Britain has put off plans for biometric identity cards partly because of worries about soaring costs and technical snafus. Building and running India’s database is a challenge as gargantuan as India itself.

Re: Indian Economy: News and Discussion (Jan 1 2010)

The bigger issue has not been settled - that of mining policy...Minerals are state/society's assets..Not a provate company's...Iron ore royalty is currently fixed at 27 rupees/ton, when the market price is 1300-1400 dollars..(While a proposal to hike it to 10% ad valorem was approved by CCEA, it hasnt been implemented AFAIK)...Suraj wrote:Finally! Great news to start the week

Hopefully the Arcelor-Mittal Jharkhand plant will get its clearance next.

POSCO, Arcelor or Tata Steel - they should pay for extraction..Today its windfall profits!

Re: Indian Economy: News and Discussion (Jan 1 2010)

^^

This is correct. Otherwise, it is simple exploitation of national resources, and privatization of a public commodity.

This is correct. Otherwise, it is simple exploitation of national resources, and privatization of a public commodity.

-

Theo_Fidel

Re: Indian Economy: News and Discussion (Jan 1 2010)

In any case we the consumer will be paying for this as well anyway. Companies never absorb such costs.

http://www.bloomberg.com/apps/news?pid= ... sQ0QreW3Y0

http://www.bloomberg.com/apps/news?pid= ... sQ0QreW3Y0

August 17, 2009 India increased the royalty it charges from mining companies on iron ore to 10 percent to help the nation’s states earn more revenue.

-

Raghavendra

- BRFite

- Posts: 1252

- Joined: 11 Mar 2008 19:07

- Location: Fishing in Sadhanakere

Re: Indian Economy: News and Discussion (Jan 1 2010)

Change archaic labour laws to boost economy http://www.deccanherald.com/content/133 ... boost.html

Amitava Ghosh

The oldest labour laws, enacted under British rule, continue to govern the industry that now faces a global scenario

The fact that recent World Bank studies have rated India as the most rigid country in the matter of labour laws certainly does not augur well for industries, both domestic and multinational that propose to set up shop here. While liberalisation of the economy has been welcomed with open arms, with an all out effort to bring in foreign investment, the laws which could scuttle such efforts continue to remain.

Though recognition is there from the government on the need for flexibility in the labour market, the inadequate social security and unemployment insurance services in the country have prevented enacting legislations, permitting termination of labour services based on performance. Indeed, there have been structural reforms in labour laws designed to benefit workers. Yet, amendments to enable industry to move to a high trajectory of growth leading to a higher employment potential is unfortunately not forthcoming.

In India, economic growth is directly linked with industrial growth. Industrial growth is invariably dependent on the relationship existing with the labour force. A suffocating set of labour laws that are tuned to benefit solely the labour force rather than the interests of the industry is bound to throw up road blocks that can impact steady growth. Indian labour laws presently remain defensive, governing minute activities, incorporating cumbersome procedures that serve to impair the smooth working of the industry.

Interestingly, the oldest Indian Labour laws, enacted under the British rule, continue to govern the industry that now faces a global scenario. Some of these laws and provisions are so archaic, they bear no relevance to the present day world. There is no attempt to change these laws to suit the new industries, particularly in the banking & financial sectors and the IT industry.

Industrialists have so far been vociferous in their call for labour reforms and a re-look at such archaic laws that not only bear no relevance in a global scenario, but fail to serve the requirements of emerging industries in the IT and ITES sector. While accelerated growth in such industries is deeply impacted by such laws, it also dilutes foreign investment by forcing multinational companies to do a rethinking on investment.

Besides serving as a source of irritant for the setting up of new industries, these antiquated laws also slow down the pace at which new skills can be formed and prevent industries from moving on to a cost cutting mode in times of recession.

Sadly, a point that is missed here is the fact that, pertinent amendments to obsolete laws could in the long run increase the number of legitimately hired workforce, permitting better working conditions, welfare, safety as well as training opportunities that would ultimately help create a more productive workforce.

Essentially, structural changes to labour laws rely on four important stake holders, viz, the trade unions, industry, national and regional political parties and eventually the government. Currently, given the diametrically opposite interests of the industry and trade unions, any proposed change in an outdated law is met with stiff resistance from the unions.

Trade unions typically battle for job security and any move to dilute this can lead to unrest. With trade unions forming the backbone of any election scene, it is but inevitable for any elected government or political party to indulge in humouring this vote bank rather than push for reforms to boost industry.

The question then arises, is the industry in the country to remain under the stranglehold of laws that have now not only become irrelevant but they also impede growth. Is accelerated growth which can translate as more employment opportunities and better working and training conditions for the same labour that these laws are trying to protect, to be sacrificed because of a lack of will to push for reforms?

A quick look at some of the key labour laws and issues governing the country would make the dire nature of legislative scenario, clearly evident.

Industrial Dispute Act

The Industrial Dispute Act, 1947 is all pervasive, governing literally all issues concerning disputes in an industry. Thus, strikes, lock-outs, lay-offs, retrenchment and any dispute concerning labour come under its purview. The provision under Chapter V-B of the Act makes it mandatory for any industry employing more than 100 workers to seek permission before lay-off, retrenchment as well as closure.

It is to be noted here that this figure of 100 was stipulated in the year 1947, at a time when the labour size of individual industries were relatively small. Only select industries came under the control of the Act. The scene is totally different now. The figure of 100 is too small a number and hence makes the Act too pervasive, causing unnecessary delays, driving up the cost of industrial houses that are relatively insignificant in size.

There is thus an urgent need to take a serious look at this figure, whereby the limit could be raised to over a 1000 employees. This would enable industrial houses to increase the size while retaining their flexibility. Besides reducing the number of legal battles, such a reform would ensure effective management. The current opposition from trade unions to such a revision needs to be overlooked as the resistance stems from a mistaken impression of increased job losses.

Besides the Chapter V-B, Section 9-A of the Act too needs rethinking and amendment. Presently, under Section 9-A of the Act, any decision, however minor, that might impact the labour in the industry, requires 21 days advance notification to the government. In the present fast paced world where timely decisions prove crucial in determining the survival of industry, 21 days notification is not only outdated, it can in a crisis situation lead to an industry’s collapse.

Contract Labour regulation

The Contract Labour Regulation and Abolition, CLRA Act 1970 is another classic example of an obsolete legislation governing industrial bodies. Under this Act, the industry has to apply for a licence to hire labour. Besides, records have to be meticulously maintained in hard copy under the Act, failure of which amounts to a criminal offence.

This Act bore relevance at a time when contract labour was a small number, confined to ports, mines and plantations. With the current trend of outsourcing pervading the global market and having more than a significant presence in Indian industry, contract labour is a massive body, too extensive to allow such records in hard copies or applications for licences.

Social Security

Yet another issue affecting the smooth working of industry is the social security laws in practice. Our present social security laws require a part of the salary to be deposited in the provident fund, with an equal contribution from the employer. While the concept in essence ensures a certain level of financial security to the employee, the portion of the employer’s contribution to the pension fund does raise many questions.

Currently, 12% of the employee’s remuneration is contributed to provident fund. An equal amount is contributed by the employer, of which 3.67% goes into the provident fund and the remaining 8.33% is deposited into the public pension fund. Though the amount deposited into the public pension fund does have a ceiling of Rs 541, this sum can prove to be large in a lower income bracket.

At the end of the tenure of a lower income employee, this pension fund accumulates to a sizeable amount, providing a secure retirement benefit. However, the manner in which these funds are used by the government and their accessibility to the employee at the time of retirement continues to be debatable.

For instance, the 8th Valuation Report of 2004 estimated the shortfall of funds at the end of the year to be over Rs 22000 crores. Besides lack of sufficient information on the nature of utilisation of the funds, it is unclear as to how such a shortfall would be made good. Interestingly, over the years, this figure has been on the rise.

To make matters worse, a sizeable number of employees have either no clue as to how to claim the amount due to them or give up their claim given the laborious and time consuming procedures involved.

If industry in the country is to grow at an unhindered pace, it is critical that such obsolete laws are reviewed and amended to reflect the needs of a changing world. Precious time and money could then be saved and diverted to productive avenues which will not only increase revenue but also employment.

-

Theo_Fidel

Re: Indian Economy: News and Discussion (Jan 1 2010)

I don't find anything archaic about requiring a contribution to a provident fund. Sure the paperwork could be easier but that is a procedures thing. The law itself is fine.

-

RamaY

- BRF Oldie

- Posts: 17249

- Joined: 10 Aug 2006 21:11

- Location: http://bharata-bhuti.blogspot.com/

Re: Indian Economy: News and Discussion (Jan 1 2010)

http://www.indexmundi.com/commodities/? ... &months=60somnath wrote: The bigger issue has not been settled - that of mining policy...Minerals are state/society's assets..Not a provate company's...Iron ore royalty is currently fixed at 27 rupees/ton, when the market price is 1300-1400 dollars..(While a proposal to hike it to 10% ad valorem was approved by CCEA, it hasnt been implemented AFAIK)...

POSCO, Arcelor or Tata Steel - they should pay for extraction..Today its windfall profits!

In December 2010, market price of Iron ore is $1.82 per metric ton.

Re: Indian Economy: News and Discussion (Jan 1 2010)

Its aboutn130-140.. Mistake...RamaY wrote:In December 2010, market price of Iron ore is $1.82 per metric ton.

http://www.reuters.com/article/2011/02/ ... 7520110203

Re: Indian Economy: News and Discussion (Jan 1 2010)

Theo,Suraj,Vina and others who follow Indian economy closely ,i have a couple of questions :

a) I met this gentleman from India this evening who's visiting states for a month. He says India no longer follows 'bottom up' approach (family credit) when it comes to loans but a 'top down' approach (through banks) just like US/western economies. And that home equity is now below 20% compared to 75-80% a couple of decades ago.And banks dont require counter-signing or surety for issuing loans.

If what he says is true,then our housing market looks just as bad as the US housing market. Agreed,the economy today is robust but do we have a calamity on our hands if we see a major slowdown in emerging economies? How will banks ever recuperate 80% on what are already over-priced properties?

Then i take a look at graphs posted by Theo a couple of months ago :

Personal loans/Service loans do not make up a significant portion of our total credit market.So where does this 80% /90% loan on homes go into ?

Do we have a graph that can show the housing loans as a percentage of total GDP?

b) While looking up Theo's graphs, the below chart caught my eye :

Look at the commodity imports : Why such a spike in bulk conumption goods? This makes me question are we making the same mistake as the west of living beyond our means and borrowing for our consumption?

Thanks.

a) I met this gentleman from India this evening who's visiting states for a month. He says India no longer follows 'bottom up' approach (family credit) when it comes to loans but a 'top down' approach (through banks) just like US/western economies. And that home equity is now below 20% compared to 75-80% a couple of decades ago.And banks dont require counter-signing or surety for issuing loans.

If what he says is true,then our housing market looks just as bad as the US housing market. Agreed,the economy today is robust but do we have a calamity on our hands if we see a major slowdown in emerging economies? How will banks ever recuperate 80% on what are already over-priced properties?

Then i take a look at graphs posted by Theo a couple of months ago :

Personal loans/Service loans do not make up a significant portion of our total credit market.So where does this 80% /90% loan on homes go into ?

Do we have a graph that can show the housing loans as a percentage of total GDP?

b) While looking up Theo's graphs, the below chart caught my eye :

Look at the commodity imports : Why such a spike in bulk conumption goods? This makes me question are we making the same mistake as the west of living beyond our means and borrowing for our consumption?

Thanks.

Re: Indian Economy: News and Discussion (Jan 1 2010)

^ Retail loan portfolio of Indian banks comprises around 20% of their total advances, of which around half is in housing loans. Total housing loan stock stands at ~7% of the GDP.

Re: Indian Economy: News and Discussion (Jan 1 2010)

India's mortgage penetation is still very very low...At a macro level, equity will be much higher than 20% of home stock..

Outstanding mortgages is still difficult to exactly pin down, as a large part of the market is still unorgansied, but the estimates run between 2-5% of GDP, which is really low..

http://www.financialnewsagency.org/mort ... 56809.html

Really, the issue with the US mortgages was not about delinquencies per se...A vanilla mortgage is a standard loan with risk weightages of 100-200% in the bank's books...In normal course of business, the bank would be required to provide for enough capital to absorb fairly large delinquencies without ramming the sysytem...The problem was securitisation of the loan books...It is usually a good tool for risk management, but it created its own dynamics...So a bank securitises part of its loan book and sells it off to, say a money market fund..This means that the "risk" is off the bank's books and hence not provided for...The money market fund on the other hand, is not required to provide any "reserves" or capital for its investments...It however might buy "insurance" or "credit protetion" on the issuer of the MBS from another bank...Typically, protection on another institution would require capitaal at much lower levels than a mortgage loan..Because the going was good, loan origination teams in the US were under pressure to build up more and more of those loans so that they could be securitised off for a fee...

Problem started when the loans started going bad...The originating bank provided no capital (it wasnt required to)...The money market fundsuddenly saw its ivnestments sink to 60 cents to the dollar...And as the orginating bank ran into trouble to provide liquidity support to the MBS, the seller of the credit protection saw his "position" on the CDS side suffer large MTM losses as the originating bank's CDS spread ballooned up...

The problem was exaccerbated as mortgage was a VERY LARGE part of Us (and UK and a lot of other palces') GDP..

In India, RBI does a splendid job of regulating the market...And our sizes are also much less, in relative terms...On this account at least, don t worry, have curry!

Outstanding mortgages is still difficult to exactly pin down, as a large part of the market is still unorgansied, but the estimates run between 2-5% of GDP, which is really low..

http://www.financialnewsagency.org/mort ... 56809.html

Really, the issue with the US mortgages was not about delinquencies per se...A vanilla mortgage is a standard loan with risk weightages of 100-200% in the bank's books...In normal course of business, the bank would be required to provide for enough capital to absorb fairly large delinquencies without ramming the sysytem...The problem was securitisation of the loan books...It is usually a good tool for risk management, but it created its own dynamics...So a bank securitises part of its loan book and sells it off to, say a money market fund..This means that the "risk" is off the bank's books and hence not provided for...The money market fund on the other hand, is not required to provide any "reserves" or capital for its investments...It however might buy "insurance" or "credit protetion" on the issuer of the MBS from another bank...Typically, protection on another institution would require capitaal at much lower levels than a mortgage loan..Because the going was good, loan origination teams in the US were under pressure to build up more and more of those loans so that they could be securitised off for a fee...

Problem started when the loans started going bad...The originating bank provided no capital (it wasnt required to)...The money market fundsuddenly saw its ivnestments sink to 60 cents to the dollar...And as the orginating bank ran into trouble to provide liquidity support to the MBS, the seller of the credit protection saw his "position" on the CDS side suffer large MTM losses as the originating bank's CDS spread ballooned up...

The problem was exaccerbated as mortgage was a VERY LARGE part of Us (and UK and a lot of other palces') GDP..

In India, RBI does a splendid job of regulating the market...And our sizes are also much less, in relative terms...On this account at least, don t worry, have curry!

Re: Indian Economy: News and Discussion (Jan 1 2010)

It was estimated at 2.5% in 2001, but over the last decade it has climbed up to reach 7%. That's the figure used in all research reports as of 2009 and '10.somnath wrote:Outstanding mortgages is still difficult to exactly pin down, as a large part of the market is still unorgansied, but the estimates run between 2-5% of GDP, which is really low..

Also industry average LTV (loan to house value ratio) is 67% in India, though top credits can get 80%.

Last edited by Arjun on 03 Feb 2011 17:54, edited 1 time in total.

Re: Indian Economy: News and Discussion (Jan 1 2010)

From the link Nihat posted.

The Centre's fiscal deficit narrowed by 44.75 per cent year-on-year to Rs 1.71 lakh crore during the first three quarters of the current fiscal on the back of better-than-expected revenue from the sale of spectrum and robust tax collections.

Expenditure by the central government rose by 11.21 per cent during the period to Rs 7.86 lakh crore from Rs 7.07 lakh crore in the year-ago period.

So reasons for reduction in deficit are:The sharp fall in the Centre's fiscal deficit was also due to the fact that despite the enhanced flows to the central exchequer, there was not a commensurate increase in government's expenditure and the RBI has blamed this for the present cash crunch in the system

1) UPA- II Government is unable to do an encore of UPA-1 in spectrum sale, this shows the 2G spectrum Sale was nothing But Daylight Robbery. We probably woundnt have had such a High Public Debt and Bearing Interest costs if 2G Spectrum alone ( forget the other corruption happening) was done properly

2) Better than expected growth in Automotive Sales and Manufacturing sector performance leading to Higher Indrect Taxes, fat cats are still not paying thier Direct Taxes propelry. If not for unsual performance of Automative and certain other sectors contributing to Indirect taxes, we'd be in soupe.

3) Govt has still not been able to tighten its belt, Expenditure up by 11.21%. If not for intervenion by RBI, this would have ballonned further with the sqaundering of Public money.

Re: Indian Economy: News and Discussion (Jan 1 2010)

Planning commission has launched an online forum for getting feedback and suggestions for developing an approach to the 12th 5 year plan.

http://www.12thplan.gov.in/hss/index.php

http://www.12thplan.gov.in/hss/index.php

-

Theo_Fidel

Re: Indian Economy: News and Discussion (Jan 1 2010)

Ambar,

WRT to mortgages, the real problem in the US system was the disconnection of risk from mortgage issue. The banks developed a system to sell on the mortgages which allowed them to increase the number of mortgages they could issue and there by pocket the lucrative origination fees. The banks became dependent on the profit from the fees with the result that the sub-prime market became overly dominant.

Nothing like this sell on system exists in India. The risk is still assumed by the banks and in fact by individual bank branches and managers. While there could be a bad actor or two this is not betting the entire bank as the US did.

Also the 20% collateral required is very high by world standards. And it is only for new loans. Nothing like reverse mortgage exists for instance. To my mind the next scam that will wash over the US banking system. There is nothing inherently wrong in a mortgage system where risk & reward remain closely coupled.

WRT to the bulk commodities refer to the RBI chart below. The spike is probably due to the recovery after the 2008 crash.

http://rbidocs.rbi.org.in/rdocs/Publica ... 200910.pdf

90% of them are industrial raw materials. Unfortunately there are consequences to a fast growing India not getting steel mills of real capacity like POSCO going ASAP. We now import well over $10 Billion worth of Steel alone. Probably in the 20 million ton range of all categories, esp. specialized! Most unfortunate! As recently as 2002 our steel import was $ 1 Billion. This is also a consequence of our Dinosaur PSU's.

Most unfortunate! As recently as 2002 our steel import was $ 1 Billion. This is also a consequence of our Dinosaur PSU's.

WRT to mortgages, the real problem in the US system was the disconnection of risk from mortgage issue. The banks developed a system to sell on the mortgages which allowed them to increase the number of mortgages they could issue and there by pocket the lucrative origination fees. The banks became dependent on the profit from the fees with the result that the sub-prime market became overly dominant.

Nothing like this sell on system exists in India. The risk is still assumed by the banks and in fact by individual bank branches and managers. While there could be a bad actor or two this is not betting the entire bank as the US did.

Also the 20% collateral required is very high by world standards. And it is only for new loans. Nothing like reverse mortgage exists for instance. To my mind the next scam that will wash over the US banking system. There is nothing inherently wrong in a mortgage system where risk & reward remain closely coupled.

WRT to the bulk commodities refer to the RBI chart below. The spike is probably due to the recovery after the 2008 crash.

http://rbidocs.rbi.org.in/rdocs/Publica ... 200910.pdf

90% of them are industrial raw materials. Unfortunately there are consequences to a fast growing India not getting steel mills of real capacity like POSCO going ASAP. We now import well over $10 Billion worth of Steel alone. Probably in the 20 million ton range of all categories, esp. specialized!

Re: Indian Economy: News and Discussion (Jan 1 2010)

Thanks guys.

Re: Indian Economy: News and Discussion (Jan 1 2010)

There's a small but growing market for reverse mortgages in India. A few PSU banks offer the product and LIC has announced plans to enter into reverse mortgages in a big way.Theo_Fidel wrote: Nothing like reverse mortgage exists for instance.

Re: Indian Economy: News and Discussion (Jan 1 2010)

Deleted

Last edited by Suraj on 04 Feb 2011 12:11, edited 1 time in total.

Reason: Please don't post unintelligible spam

Reason: Please don't post unintelligible spam

-

Theo_Fidel

Re: Indian Economy: News and Discussion (Jan 1 2010)

Acharya,

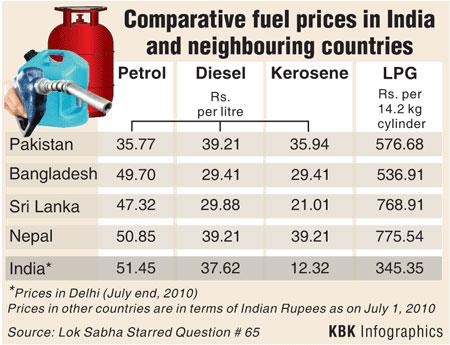

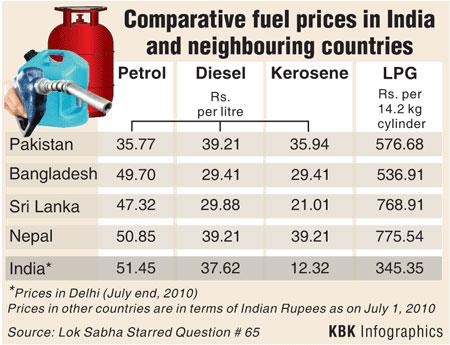

The price difference is a sole function of currency valuation. The Indian rupee is much stronger. This is a real situation guys. Not Acharya's usual conspiratorial leaning.

Here is the comparative chart from Rediff. A bit dated.

I'm very conflicted by this. One reason those countries suffer currency devaluation is precisely this refusal to properly price and tax fuel. Their governments cover this subsidy through printing money which causes their currency to devalue further, triggering even more inflation. Esp. as oil has to be paid w/ foreign currency. We have not seen anything like the 20%+ inflation Pakistan has suffered for the past 3-4 years for instance. This bankrupts the oil companies and leaves them without the savings needed for investment.

A month or two ago Suraj & I were discussing the drop in Public investment in 2007-2008 that triggered our mild slow down in 2008-2009. Suraj thought that it was caused by the spike in the price of Oil and the resulting massive subsidy. Just to give people an idea, Public sector saving dropped from ~ 6% of GDP to ~2% of GDP.

Ah! here's the image. Look at the purple bar on the left.

While the pain is real, for the economy its is better we keep the bottom line in the black and hence hold on to the investment rate. It would be interesting to hear other comments.

The price difference is a sole function of currency valuation. The Indian rupee is much stronger. This is a real situation guys. Not Acharya's usual conspiratorial leaning.

Here is the comparative chart from Rediff. A bit dated.

I'm very conflicted by this. One reason those countries suffer currency devaluation is precisely this refusal to properly price and tax fuel. Their governments cover this subsidy through printing money which causes their currency to devalue further, triggering even more inflation. Esp. as oil has to be paid w/ foreign currency. We have not seen anything like the 20%+ inflation Pakistan has suffered for the past 3-4 years for instance. This bankrupts the oil companies and leaves them without the savings needed for investment.

A month or two ago Suraj & I were discussing the drop in Public investment in 2007-2008 that triggered our mild slow down in 2008-2009. Suraj thought that it was caused by the spike in the price of Oil and the resulting massive subsidy. Just to give people an idea, Public sector saving dropped from ~ 6% of GDP to ~2% of GDP.

Ah! here's the image. Look at the purple bar on the left.

While the pain is real, for the economy its is better we keep the bottom line in the black and hence hold on to the investment rate. It would be interesting to hear other comments.

Re: Indian Economy: News and Discussion (Jan 1 2010)

I find it a little hard to believe that the 6.9% real GDP growth for '09 was solely on account of the subsidies due to oil price surge of '08, and had nothing to do with the global recession.

If I look at the graph on the right, the GCF for public sector does not seem to be very different from '08 to '09, however the private sector one does show a marked fall. Possibly the private sector, sensing the recessionary climes and being more sensitive to it, put the brakes on investment? Could that be an alternate explanation?

This is not to discount the importance of removing the subsidies from the POV of containing fiscal deficit - which is a different issue altogether.

If I look at the graph on the right, the GCF for public sector does not seem to be very different from '08 to '09, however the private sector one does show a marked fall. Possibly the private sector, sensing the recessionary climes and being more sensitive to it, put the brakes on investment? Could that be an alternate explanation?

This is not to discount the importance of removing the subsidies from the POV of containing fiscal deficit - which is a different issue altogether.

Re: Indian Economy: News and Discussion (Jan 1 2010)

The number for 09-10 was 7.4%, and now has been revised now upwards to 8%..So it wasnt bad at all..And of course the financial crisis had an impact...On reduced private sector investments, on reduced exports (a lot of people dont realise how important exports are now to manufacturing growth), and on a reduction in foreign investment flows...Arjun wrote:I find it a little hard to believe that the 6.9% real GDP growth for '09 was solely on account of the subsidies due to oil price surge of '08, and had nothing to do with the global recession

Simple, the Indian govt DOES NOT print money to cover its deficits!Theo_Fidel wrote:I'm very conflicted by this. One reason those countries suffer currency devaluation is precisely this refusal to properly price and tax fuel. Their governments cover this subsidy through printing money which causes their currency to devalue further, triggering even more inflation. Esp. as oil has to be paid w/ foreign currency. We have not seen anything like the 20%+ inflation Pakistan has suffered for the past 3-4 years for instance. This bankrupts the oil companies and leaves them without the savings needed for investment

-

Theo_Fidel

Re: Indian Economy: News and Discussion (Jan 1 2010)

In India private sector spending declines when the government needs to raise additional money due to dis-savings. Subsidies directly correlate to the private sector getting crowded out. If the savings are there investment would continue in some form or the other.

Re: Indian Economy: News and Discussion (Jan 1 2010)

Indian Black Money: The Swindler’s List

1. Manoj Dhupelia

2. Rupal Dhupelia

3. Mohan Dhupelia

4. Hasmukh Gandhi

5. Chintan Gandhi

6. Dilip Mehta

7. Arun Mehta

8. Arun Kochar

9. Gunwanti Mehta

10. Rajnikant Mehta

11. Prabodh Mehta

12. Ashok Jaipuria

13. Raj Foundation

14. Urvashi Foundation

15. Ambrunova Trust

The three trusts in this list are registered outside India.

1. Manoj Dhupelia

2. Rupal Dhupelia

3. Mohan Dhupelia

4. Hasmukh Gandhi

5. Chintan Gandhi

6. Dilip Mehta

7. Arun Mehta

8. Arun Kochar

9. Gunwanti Mehta

10. Rajnikant Mehta

11. Prabodh Mehta

12. Ashok Jaipuria

13. Raj Foundation

14. Urvashi Foundation

15. Ambrunova Trust

The three trusts in this list are registered outside India.

Re: Indian Economy: News and Discussion (Jan 1 2010)

http://www.seasonalmagazine.com/2011/02 ... ecret.html

Indian Economy’s Dirty Little Secret - Inflation is Here by Design

Indian Economy’s Dirty Little Secret - Inflation is Here by Design

Despite repeated efforts to deflate, prices are getting inflated. Either it shows the incompetence of leaders like Dr. Manmohan Singh, Pranab Mukherjee, & P Chidambaram, as the Opposition says, or there is something else to the economy, something that remains hidden to most of us.The secret might well be this - nobody in central policy-making really cares a damn about inflation. But not necessarily because of apathy or ignorance. With almost half gone from its second-term, and considering the time taken to turn around economics, UPA clearly cannot afford apathy. And anyone who knows the rudiments of economics knows that inflation can very well be tamed by cutting down on government spending, or specifically in the post-2008 context, rolling back the fiscal stimulus.But the central policy makers aren’t willing to even consider these steps. Why? Because, they really don’t care a damn about inflation.

Just recall what the other Singh told press recently, “Inflation is one thing I am least worried about…” And it is not just Montek Singh Ahluwalia's take on this. Kaushik Basu, FinMin’s Chief Economic Advisor recently said, “We want to take steps to bring down inflation but we do not want to be so single minded in bringing down inflation…”The political leadership, on the other hand, can’t be as clear as bureaucrats. But the intentions should be clear to all. Now only the question of ‘why’ remains, given the stark unpopularity of inflation.

Chances are that this team, led by Dr. Manmohan Singh, want to go down in history as the men who finally guided India into the right economic track that a developing nation should take to become a developed nation

Re: Indian Economy: News and Discussion (Jan 1 2010)

Can you explain what is the usual thing here.Theo_Fidel wrote:A Not Acharya's usual conspiratorial leaning.

-

joshvajohn

- BRFite

- Posts: 1516

- Joined: 09 Nov 2006 03:27

Re: Indian Economy: News and Discussion (Jan 1 2010)

Why India sees red over black money

By Kuldip Nayar, Special to Gulf News

http://gulfnews.com/opinions/columnists ... y-1.757034

Congress teaches workers to counter dirty money talk

http://timesofindia.indiatimes.com/indi ... 386075.cms

`22.5 lakh crore loot from India

By Balbir K Punj

http://www.organiser.org/dynamic/module ... 383&page=2

Black money funds political parties: Rahul Bajaj

http://timesofindia.indiatimes.com/indi ... 426970.cms

Black Money Everywhere

http://www.centralchronicle.com/viewnew ... leID=56474

Laundering black money

By Kuldip Nayar

Indian black money in Swiss banks, according to Swiss Banking Association report, 2006, was the highest — as much as $1456 billion.

http://www.deccanherald.com/content/134 ... money.html

whose heads are going to roll if black money list is ? some political allies in UPA and also in NDA are in danger of being black listed by Supreme court if the list is out. What if a party supremo's account or his or her relationship to an account is revealed?!

Possibly an amnesty can be given if they put their investment in rural educational instutions such as medical colleges or universities or in medical hospitals and social care centres or in charities or even investment in solar electricity units or windmills or in recycling units or an ambulance service to all over India or some sort of investment that would also give them some money back as interest or service rent or profit. This amnesty should be given for a month or two as it was done for Gold when P Chidambaram was FM.

By Kuldip Nayar, Special to Gulf News

http://gulfnews.com/opinions/columnists ... y-1.757034

Congress teaches workers to counter dirty money talk

http://timesofindia.indiatimes.com/indi ... 386075.cms

`22.5 lakh crore loot from India

By Balbir K Punj

http://www.organiser.org/dynamic/module ... 383&page=2

Black money funds political parties: Rahul Bajaj

http://timesofindia.indiatimes.com/indi ... 426970.cms

Black Money Everywhere

http://www.centralchronicle.com/viewnew ... leID=56474

Laundering black money

By Kuldip Nayar

Indian black money in Swiss banks, according to Swiss Banking Association report, 2006, was the highest — as much as $1456 billion.

http://www.deccanherald.com/content/134 ... money.html

whose heads are going to roll if black money list is ? some political allies in UPA and also in NDA are in danger of being black listed by Supreme court if the list is out. What if a party supremo's account or his or her relationship to an account is revealed?!

Possibly an amnesty can be given if they put their investment in rural educational instutions such as medical colleges or universities or in medical hospitals and social care centres or in charities or even investment in solar electricity units or windmills or in recycling units or an ambulance service to all over India or some sort of investment that would also give them some money back as interest or service rent or profit. This amnesty should be given for a month or two as it was done for Gold when P Chidambaram was FM.

Re: Indian Economy: News and Discussion (Jan 1 2010)

From the article:Prem wrote:http://www.seasonalmagazine.com/2011/02 ... ecret.html

Indian Economy’s Dirty Little Secret - Inflation is Here by Design

This is a misguided article ... inflation happens when production fails to keep up with the money-printing.To give just a glimpse of this pain, it is enough to realize that there is still room for more inflation. Because, for all of India’s high inflation rates now, realize once and for all that the cost-of-living index in USA (computed as consumer prices including rent) is still 177% higher than in India. In UK, it is 236% higher than in India!

Of course, Indians and Americans don’t earn equally. But not only is this difference smaller, but it is getting smaller by the year. For example, the local purchasing power of Americans is now only 98% higher than Indians. And in the case of Englishmen, local purchasing power index is even smaller - only 57% higher than in India now. These numbers are even more significant, taking into account the better savings culture of Indians vis-à-vis Westerners.

Clearly, room for further inflation is there if we want to end up as a developed nation. And the only thing that can offset inflation is earnings growth, and if earnings - of individuals, families, companies, governments, and ultimately of the nation - doesn’t keep pace, any and all of these social units will be in deep trouble.

And for earnings to grow, productivity should grow, and that is why the team led by Dr. Manmohan Singh is madly after GDP growth. That is how USA grew itself in the post-WW2 era, always striving to keep annual GDP at high single digits, if not low double digits, and suffering high inflation as the outcome. And now, with USA and other developed countries growing at low single digits, Dr. Singh and his team rightly thinks that if we continually grow at high single digits, we can successfully play catch up.

In contrast, if growth is slowed down, inflation will in no doubt come down, but so will employment rate, and so will APL percentage. In fact, studies have shown that with each declining growth percentage (that will tame inflation), the country will see unemployment levels inching towards 20%, and the failure to raise another 100 million people from BPL status.

Also, the statistics seem to be incorrect ... In India, about 80% of the population lives on about Rs 50 per day or thereabouts, and have no livable housing, water supply or toilets. They wear tattered clothes and hardly get any education worth the name. If they happen to fall sick, they can count on having back-breaking bribes extorted from them at the primary health centers.

The article also fails to mention the primary cause for this bone-crushing poverty - namely the money being looted hand over fist, in lakhs of crores, by the 2G family and other political elites.

Re: Indian Economy: News and Discussion (Jan 1 2010)

The purchasing power of Americans is less than double that of Indians? What fantasy world is this author living in? That is laughable.

Re: Indian Economy: News and Discussion (Jan 1 2010)

Thats the usual "crowding out" theory..Doesnt pan out in India...If you plot the fiscal deficit numbers along with investment/GDP and GDP growth rate, there is no statistically significant issue of crowding out in India...When I studied economics first (15 years backTheo_Fidel wrote:In India private sector spending declines when the government needs to raise additional money due to dis-savings. Subsidies directly correlate to the private sector getting crowded out. If the savings are there investment would continue in some form or the other.

The article seems strange, no doubt..But about the stats, this whole business of 77% of the population living below poverty line (Arjun Sengupta estimates) is a bit of an ideological stretch...Surjit Bhalla has written extensively on how the statistics actually point out to much better numbers..And quite frankly, going by asset ownership patterns (mobiles phones, two wheelers, TVs etc), the numbers DO seem to be much better than that...Pranav wrote:Also, the statistics seem to be incorrect ... In India, about 80% of the population lives on about Rs 50 per day or thereabouts, and have no livable housing, water supply or toilets. They wear tattered clothes and hardly get any education worth the name