Perspectives on the global economic meltdown- (Nov 28 2010)

-

abhishek_sharma

- BRF Oldie

- Posts: 9664

- Joined: 19 Nov 2009 03:27

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown- (Nov 28 20

Illuminating only. Thanks for posting. The rot in Academic economics hasn't gone unmentioned or unnoticed, of course. The 'Inside Job' movie does its bit in bringing part of the rot into the open.abhishek_sharma wrote:Economics in Crisis: J. Bradford DeLong

http://www.project-syndicate.org/commen ... 13/English

Some notable n quotable excerpts (IMVHO):

Amen.But what astonishes me even more is the apparent failure of academic economics to take steps to prepare itself for the future. “We need to change our hiring patterns,” I expected to hear economics departments around the world say in the wake of the crisis.

The fact is that we need fewer efficient-markets theorists and more people who work on microstructure, limits to arbitrage, and cognitive biases. We need fewer equilibrium business-cycle theorists and more old-fashioned Keynesians and monetarists. We need more monetary historians and historians of economic thought and fewer model-builders. We need more Eichengreens, Shillers, Akerlofs, Reinharts, and Rogoffs – not to mention a Kindleberger, Minsky, or Bagehot.

Yet that is not what economics departments are saying nowadays.

Perhaps I am missing what is really going on. Perhaps economics departments are reorienting themselves after the Great Recession in a way similar to how they reoriented themselves in a monetarist direction after the inflation of the 1970’s. But if I am missing some big change that is taking place, I would like somebody to show it to me.

Perhaps academic economics departments will lose mindshare and influence to others – from business schools and public-policy programs to political science, psychology, and sociology departments. As university chancellors and students demand relevance and utility, perhaps these colleagues will take over teaching how the economy works and leave academic economists in a rump discipline that merely teaches the theory of logical choice.

Or perhaps economics will remain a discipline that forgets most of what it once knew and allows itself to be continually distracted, confused, and in denial. If that were that to happen, we would all be worse off.

Re: Perspectives on the global economic meltdown- (Nov 28 20

This may be needed for the health of the world economy. US dollar may have to be removed from the global currency exchanges since there is a over supply of them.paramu wrote:

It is also creating a situation that makes these countries to think about how to continue trade without using USD. If they succeed in that, it is going to be scary for the US.

Re: Perspectives on the global economic meltdown- (Nov 28 20

SwamyG:

The internet bubble did not affect the American individual too much. It was primarily a corporate recession. They had over invested heavily in technology in anticipation of the Y2K. The internet roll-out accelerated the process. As a result you had a decade of IT investment concentrated in 2-3 years which led to the boom and the subsequent bust.

There was a bubble in the stock market but the total impact of the stock bubble on the overall economy was not significant. Remember that the size of the stock market is much much smaller than the bond market. Equity markets by themselves are considered risk markets. So an up and down there is expected. The great recession was a result of the bubble in the bond market whose effects are much worse, since they affect the supposedly stable, risk-free/low risk part of the capital structure.

If 9/11 had not happened, the liquidity pump would have dried up much sooner. As a result the housing bubble would not have inflated. And that liquidity pump was the prime cause of the debt debacle and the great recession.

The internet bubble did not affect the American individual too much. It was primarily a corporate recession. They had over invested heavily in technology in anticipation of the Y2K. The internet roll-out accelerated the process. As a result you had a decade of IT investment concentrated in 2-3 years which led to the boom and the subsequent bust.

There was a bubble in the stock market but the total impact of the stock bubble on the overall economy was not significant. Remember that the size of the stock market is much much smaller than the bond market. Equity markets by themselves are considered risk markets. So an up and down there is expected. The great recession was a result of the bubble in the bond market whose effects are much worse, since they affect the supposedly stable, risk-free/low risk part of the capital structure.

If 9/11 had not happened, the liquidity pump would have dried up much sooner. As a result the housing bubble would not have inflated. And that liquidity pump was the prime cause of the debt debacle and the great recession.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Liquidity pump may have been due to global geo political change after 911 since the Arabs removed their oil dollors from US stock market. The manner in which the liquidity pump was done to fund easy loans is the problems. If it was used for funding large number of new ventures and business loans this would have changed the economy and the recovery.VikramS wrote:

If 9/11 had not happened, the liquidity pump would have dried up much sooner. As a result the housing bubble would not have inflated. And that liquidity pump was the prime cause of the debt debacle and the great recession.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Acharyaji:

Equity bubble collapse, though damaging to the psyche, do not fundamentally alter the capital system; debt bubbles can alter them.

In the early part of the decade, the pump achieved its purpose of keeping the system going post 9/11. The stock market and the economy had started the recovery by end of 2003. The stimulus should have been withdrawn by 2004. It was not and that what sent the housing market from a steep rise into a bubble. The criminal acts truly started after 2004 where NINJA, negative amortization, zero-down lending became common.

Prior to that there was a focus to make home ownership more accessible by reducing down payment requirements. The goal was to help those who had steady incomes and responsible financial habits, but were never able to save that 20% needed to buy a home. The idea was to take these reliable, permanent renters and turn them into home owners. But it got completely out of hand. And no one complained while the music was playing.

Equity bubble collapse, though damaging to the psyche, do not fundamentally alter the capital system; debt bubbles can alter them.

In the early part of the decade, the pump achieved its purpose of keeping the system going post 9/11. The stock market and the economy had started the recovery by end of 2003. The stimulus should have been withdrawn by 2004. It was not and that what sent the housing market from a steep rise into a bubble. The criminal acts truly started after 2004 where NINJA, negative amortization, zero-down lending became common.

Prior to that there was a focus to make home ownership more accessible by reducing down payment requirements. The goal was to help those who had steady incomes and responsible financial habits, but were never able to save that 20% needed to buy a home. The idea was to take these reliable, permanent renters and turn them into home owners. But it got completely out of hand. And no one complained while the music was playing.

Re: Perspectives on the global economic meltdown- (Nov 28 20

http://www.ourfuture.org/blog-entry/201 ... erred-pt-3

Who's It For?

In a way, working and middle class Americans are in a similar position to that of African Americans in 1951, when Hughes wrote "Harlem" — on the cusp between previous movements that brought better pay and working conditions that put the American Dream within reach and established institutions that made upward mobility and middle class life possible, and what may become a movement to defend and expand those hard won gains.. And though now we are encouraged believe to ourselves and our fates utterly unrelated to one another, we may yet be united by shared economic pain, to see our shared story clearly as clearly as Hughes saw it.

To sharpen the distinction, working- and middle-class Americans are challenged by an entrenched vision of who the American Dream — even America itself — is for. No, it is not the same as the discrimination black suffered for generations, denied education, economic opportunity and even citizenship itself, because of race. But, just like the viewpoints that justified the second citizenship of blacks, women, and other groups, this vision of American seeks to justify what Martin Luther King, Jr.,. called "the gulf between the haves and have-nots" rather than bridge it.

It is what President Obama called a "deeply pessimistic" vision of our future, in his speech on Wednesday.

One of the more striking characteristics of the "new" Republican agenda (or the agenda of the conservative movement, or Tea Party movement, or whatever they prefer to call themselves) is how unrelentingly negative it is. Depressingly, ploddingly negative; America is simultaneously the best and greatest country in the world, as blanket assertion, and a nation on a slow death march towards insolvency and irrelevance. America must make sacrifices, goes the refrain, but every one of the sacrifices seems to involve retracting a past long-term success; America must not (something), is the defining chant, where (something) is any number of things that other countries can successfully do and have done, but America cannot, or an even larger list of somethings that America used to do, and quite competently, but America can do no longer.

Other industrialized nations can provide their citizens with better access to healthcare; we simply cannot, and you are a fool for even bringing it up. Other nations can, say, establish warning systems for tsunamis, or volcanos, or hurricanes; America must tighten its belt, and that meager, economically trivial ounce of prevention is considered fat that should obviously be trimmed, so that America-the-entity can get back to its fighting weight. Past-America could provide at least some modest layer of security to prevent its citizens from descending into destitution in old age; we in this day cannot. Past-America could pursue scientific discoveries as a matter of national pride, even land mankind on an entirely other world; we cannot. Past-America was a haven of invention and technology that shook the world and changed the course of history countless times: whatever attributes made it such a place we cannot quite determine now, much less replicate. Public art is decadent. Public education is an infringement. Public works are for other times, never now.

...It is a staggeringly bleak vision. The notion that other free countries can do hosts of things that America, as blanket presumption, can no longer do should be the stuff of nightmares for any believer in American exceptionalism. Today believers in American exceptionalism seem to believe America is exceptional in the inverse way: America is the only country that cannot succeed at what other nations might be able to do. Healthcare, again, seems the most pressing example, though it seems Social Security is the next front on the war on past-America.

So what, then, is the national purpose? Is there such a thing? Should there be such a thing? If government cannot devote itself to bettering the life of its citizens, or rebuilding its own infrastructure, or accomplishing great and historic things, what is left? We can still wage war with aplomb, but even that is a product of our past technological prowess, and likely to be short-lived as the technological infrastructures of other nations continue to surpass our own. We are spectacular at the process of moving money around balance sheets, so long as nobody ever actually asks for it back; while such prowess has certainly built glittering edifices of private success, it is unclear what advantages it as given to our larger population.

Re: Perspectives on the global economic meltdown- (Nov 28 20

http://dollarsandsense.org/blog/2011/01 ... -1984.html

(3) Another Depressing Item: From Brave New World to 1984: While I’m making depressing comparisons between now and the Depression, it is worth mentioning a recent piece by Chris Hedges, 2011: Brave New Utopia. Hedges, whose work I’ve only recently really noticed (and I like what I see), asks whether Huxley or Orwell is the right dystopian model for our current “descent towards corporate totalitarianism.” His depressing answer–they were both right:

The two greatest visions of a future dystopia were George Orwell’s “1984” and Aldous Huxley’s “Brave New World.” The debate, between those who watched our descent towards corporate totalitarianism, was who was right. Would we be, as Orwell wrote, dominated by a repressive surveillance and security state that used crude and violent forms of control? Or would we be, as Huxley envisioned, entranced by entertainment and spectacle, captivated by technology and seduced by profligate consumption to embrace our own oppression? It turns out Orwell and Huxley were both right. Huxley saw the first stage of our enslavement. Orwell saw the second.

Re: Perspectives on the global economic meltdown- (Nov 28 20

The fuse was lit way back in the late 60s when taking debt and not repaying it seized to be a social stigma. The late 70s and 80s brought financial innovation and with it Solomon Brothers and their MBS. It was a good innovation as it mitigated the risk,attracted investment and kept the liquidity flowing. But JPM created the atomic bomb in form of synthetic derivatives. Lets accept it, even if every single sub-prime home loan (a whooping 30% of all home mortgages by 2008) would go sore in the states, it wouldn't have cost the government more than 1 trillion $. The trouble was with banks leveraged 30:1, and combined contracts almost 10 times the size of US economy.VikramS wrote:Acharyaji:

In the early part of the decade, the pump achieved its purpose of keeping the system going post 9/11. The stock market and the economy had started the recovery by end of 2003. The stimulus should have been withdrawn by 2004. It was not and that what sent the housing market from a steep rise into a bubble. The criminal acts truly started after 2004 where NINJA, negative amortization, zero-down lending became common.

Atleast those who believe some sort of a government intervention was required to stop the bleeding in 2008 think letting Lehman fail was stupidity. That triggered a collapse that forced government to bailout a whole lot of other banks and more important the 150 billion $ bailout of AIG.

Re: Perspectives on the global economic meltdown- (Nov 28 20

excellent point!!! i'm going to save this one for future reference. we keep hearing how much the mango man is responsible for the depression by taking the bad loans....but it is amazingly missed that all mango men put together only count for a paltry sum which wouldn't have made any difference to a $14 Trillion economy. it is the criminal practices of ultra high leveraging that caused the system itself to almost collapse. that is the problem here. not the mango man. the mango man issues are easy to deal with. and even if they are not dealt with, it's a little fly on a gigantic bull (RamaY ji's analogy:) ). practices associated with derivatives and "modern" finance are the problem.Lets accept it, even if every single sub-prime home loan (a whooping 30% of all home mortgages by 2008) would go sore in the states, it wouldn't have cost the government more than 1 trillion $. The trouble was with banks leveraged 30:1, and combined contracts almost 10 times the size of US economy.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Check this out devesh. I imagine you to be the guy starring as hayek in the clip.

Hari Seldon meanwhile is the fat guy singing the chorus

Hari Seldon meanwhile is the fat guy singing the chorus

Re: Perspectives on the global economic meltdown- (Nov 28 20

Ambar:

Synthetics themselves are a zero-sum game. If one party loses out the other party gains.

The problem of course is that these synthetics were given AAA rating allowing banks to ramp up the leverage and then running out of equity capital.

Synthetics themselves are a zero-sum game. If one party loses out the other party gains.

The problem of course is that these synthetics were given AAA rating allowing banks to ramp up the leverage and then running out of equity capital.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Neshant bhai, the honor of being Hayek is deserved to you alone. i wouldn't dare usurp your throne on this one.

Re: Perspectives on the global economic meltdown- (Nov 28 20

After 911 around $1T was sucked out of the equity and finance market.VikramS wrote:Acharyaji:

Equity bubble collapse, though damaging to the psyche, do not fundamentally alter the capital system; debt bubbles can alter them.

In the early part of the decade, the pump achieved its purpose of keeping the system going post 9/11. The stock market and the economy had started the recovery by end of 2003. The stimulus should have been withdrawn by 2004. It was not and that what sent the housing market from a steep rise into a bubble. The criminal acts truly started after 2004 where NINJA, negative amortization, zero-down lending became common.

Before 2003 War on Iraq another $1T was sucked out of the equity market to fund the war. This was in a report done by Stanford Uty

With low interest rate and easy loan application changed the dynamics to create a bubble. With loose regulations for hedge fund and the new fancy securites opened by legislations in 2000 this was the most freewheeling economic period in the history.

This type of thing will never be seen in history again.

Re: Perspectives on the global economic meltdown- (Nov 28 20

It is a zero-sum game had the last person holding the bag found something inside the bag! The synthetic derivatives was more like a shell game, and hence my belief that MBS served a purpose of risk mitigation and capital infusion, synthetic derivatives just gave the wall street a chance to hook in naive investors and in turn the government.VikramS wrote:Ambar:

Synthetics themselves are a zero-sum game. If one party loses out the other party gains.

The problem of course is that these synthetics were given AAA rating allowing banks to ramp up the leverage and then running out of equity capital.

@ Devesh : I wouldn't exonerate the mango abdul so easily. We are all a part of the same system. The total outstanding credit as a percentage of GDP stands at ~ 375% . How would the ABS be created without so many credit takers ? Responsibility should start at the core, and the core is the society.

-

RamaY

- BRF Oldie

- Posts: 17249

- Joined: 10 Aug 2006 21:11

- Location: http://bharata-bhuti.blogspot.com/

Re: Perspectives on the global economic meltdown- (Nov 28 20

The mango yankee didn't have much choice Amberji. He is put in that spot thru careful manipulation of tax, retirement, and education policies.Ambar wrote: @ Devesh : I wouldn't exonerate the mango abdul so easily. We are all a part of the same system. The total outstanding credit as a percentage of GDP stands at ~ 375% . How would the ABS be created without so many credit takers ? Responsibility should start at the core, and the core is the society.

Re: Perspectives on the global economic meltdown- (Nov 28 20

^^^

when there is absolutely no income growth, and especially calculated for inflation, there is income reduction for the past 40 years, how does mango American deal with ever increasing cost of living. back in the day, it used to be that high school grads in Uncle land could get good jobs that paid well. that is not the case anymore. so they need to go to college and acquire some kind of education. the fee for this education keeps increasing at a rate of 6-10% on average every year. add to that the rising costs in every other department: gas, food, etc and you have a situation where there is income loss (adjusted to inflation) and rapid rise of expenses. this has been going on for 4 decades now and only temporarily stopped in the 80's when GDP growth was abnormally high (>6%). that growth rate was only possible for short time and once that went away, the income loss returned again.

what we have seen in the US is covering up the inflationary system by fudging BLS numbers and calculation methods. mango American has no option but to be in debt. he cannot have a decent life otherwise. debt is the only recourse for him/her. to maintain a consistent standard of living, yankees have to be in debt. that is the greatest deception of American public perpetrated by their economic/business elite in cahoots with the political elite.

when there is absolutely no income growth, and especially calculated for inflation, there is income reduction for the past 40 years, how does mango American deal with ever increasing cost of living. back in the day, it used to be that high school grads in Uncle land could get good jobs that paid well. that is not the case anymore. so they need to go to college and acquire some kind of education. the fee for this education keeps increasing at a rate of 6-10% on average every year. add to that the rising costs in every other department: gas, food, etc and you have a situation where there is income loss (adjusted to inflation) and rapid rise of expenses. this has been going on for 4 decades now and only temporarily stopped in the 80's when GDP growth was abnormally high (>6%). that growth rate was only possible for short time and once that went away, the income loss returned again.

what we have seen in the US is covering up the inflationary system by fudging BLS numbers and calculation methods. mango American has no option but to be in debt. he cannot have a decent life otherwise. debt is the only recourse for him/her. to maintain a consistent standard of living, yankees have to be in debt. that is the greatest deception of American public perpetrated by their economic/business elite in cahoots with the political elite.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Vikram:

I did not say the Internet bubble alone caused the economic crisis. It is a series of events one after the other. Rampant consumerism at the cost of a family's savings and well being, Corporations going global without patriotism and loyalty to the country, Banking industry ityadi itaydi.

9/11 actually helped the country to come together and forget the slide for a brief while. I remember the Fed getting worried about how hot the economy was hurtling even in 1999.

I did not say the Internet bubble alone caused the economic crisis. It is a series of events one after the other. Rampant consumerism at the cost of a family's savings and well being, Corporations going global without patriotism and loyalty to the country, Banking industry ityadi itaydi.

9/11 actually helped the country to come together and forget the slide for a brief while. I remember the Fed getting worried about how hot the economy was hurtling even in 1999.

Re: Perspectives on the global economic meltdown- (Nov 28 20

In the course of 24hours, I heard one story about the lack of research funds in the Universities. And read two stories that talked about how University Rankings is messing up with the Education in USA. And we have people in India wanting to import US model of education into India. Sheesh, as if we do not have our own indigenous problems to begin with, we will never learn.RamaY wrote:The mango yankee didn't have much choice Amberji. He is put in that spot thru careful manipulation of tax, retirement, and education policies.

Re: Perspectives on the global economic meltdown- (Nov 28 20

SwamyG, problems are relative, and newspaper articles are about directional movement rather than absolutes. Indian universities would kill to have as "few" research funds, or to be as "messed up", as the average American university.

I'm not sure what US model of education you don't want to import into India, but Indian universities have a long way to go to be even a fraction as good as American universities.

I'm not sure what US model of education you don't want to import into India, but Indian universities have a long way to go to be even a fraction as good as American universities.

Re: Perspectives on the global economic meltdown- (Nov 28 20

The system is to keep some Uty funded and then show that all the top rankings are the same. It could be done before but not going forward.SwamyG wrote:In the course of 24hours, I heard one story about the lack of research funds in the Universities. And read two stories that talked about how University Rankings is messing up with the Education in USA. And we have people in India wanting to import US model of education into India. Sheesh, as if we do not have our own indigenous problems to begin with, we will never learn.RamaY wrote:The mango yankee didn't have much choice Amberji. He is put in that spot thru careful manipulation of tax, retirement, and education policies.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Making money at all costs, going after rankings and elite statuses; when community colleges are doing equally well when it comes to education.Abhijeet wrote:I'm not sure what US model of education you don't want to import into India, but Indian universities have a long way to go to be even a fraction as good as American universities.

Oh yeah, I forgot another thing - it was not just 3 things. I also saw Gladwell on Fareed's GPS show on CNN. See if you can find it, he rubbishes the ranking systems. So I talk to a Assistant/Associate Professors, watch a TV show, read two stories - one in NY Times and one in Local newspaper - all in 24 hours. My friends tell me that Europeans are getting more funds these days than America.

And another thing, it will do good for desh it keep furriners out of Indian Education System.

Re: Perspectives on the global economic meltdown- (Nov 28 20

What is this increase cost of living. It is about image and all the fancy first world infrastructure to compete with the other developed world. This consumption is fed by media and entertainment (Hollywood) - another corporate wing. To keep up they had no choice but go into debt.devesh wrote:^^^

when there is absolutely no income growth, and especially calculated for inflation, there is income reduction for the past 40 years, how does mango American deal with ever increasing cost of living. back in the day, it used to be that high school grads in Uncle land could get good jobs that paid well. that is not the case anymore. so they need to go to college and acquire some kind of education.

mango American has no option but to be in debt. he cannot have a decent life otherwise. debt is the only recourse for him/her. to maintain a consistent standard of living, yankees have to be in debt. that is the greatest deception of American public perpetrated by their economic/business elite in cahoots with the political elite.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Someone said that the banks had bought the sub-prime loans at ~10c/$ and expect the loans to perform normally and be paid off in normal course i.e. 30years. Most 30 year loans tend to be 3.5times the loan amount by end. By enforcing the no recourse clauses and void early payment penalty clauses, he was saying the banks will make the 3.5*10 = 35 times as if it was leveraged. Hence the reluctance to loan mod.

Re: Perspectives on the global economic meltdown- (Nov 28 20

ramana:

Sub prime loans were never designed to be paid off. They were designed to be refinanced under the assumption that once the house prices moves up by 20% the home owner will have enough equity to get a regular loan. Most of the loans were not fixed rates but floaters (ARM type loans).

On average a home owner moves once every seven years so it is very rare for a mortgage to be held for 30 years. That is one reason why 30year mortgages are linked to 10 year notes. Even if the note is held to maturity the duration is much less; the you add the chance of repayment and the realized duration is even smaller (10 years)

Sub prime loans were never designed to be paid off. They were designed to be refinanced under the assumption that once the house prices moves up by 20% the home owner will have enough equity to get a regular loan. Most of the loans were not fixed rates but floaters (ARM type loans).

On average a home owner moves once every seven years so it is very rare for a mortgage to be held for 30 years. That is one reason why 30year mortgages are linked to 10 year notes. Even if the note is held to maturity the duration is much less; the you add the chance of repayment and the realized duration is even smaller (10 years)

Re: Perspectives on the global economic meltdown- (Nov 28 20

That is not correct. 30-year mortgage roughly equals to ~13 year fixed bond and so 10-year treasury comparison is done for mortgages.VikramS wrote:ramana:

Sub prime loans were never designed to be paid off. They were designed to be refinanced under the assumption that once the house prices moves up by 20% the home owner will have enough equity to get a regular loan. Most of the loans were not fixed rates but floaters (ARM type loans).

On average a home owner moves once every seven years so it is very rare for a mortgage to be held for 30 years. That is one reason why 30year mortgages are linked to 10 year notes. Even if the note is held to maturity the duration is much less; the you add the chance of repayment and the realized duration is even smaller (10 years)

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown- (Nov 28 20

Select D&G-ish tweets from @AutomaticEarth

Chalo, dassit for today.

Really?! My, you don't say. But in 1870 they had Yindia and other colonies to milk dry now, didn't they. Who'll they milk now...The new Victorians: UK Families face biggest cash crunch since 1870 http://bit.ly/lgKkHR (New report from Deloitte)

Yawn. Debt celing will get raised as often and as high as necessary. Don;t let anyone tell ya otherwise, scripted dramas in public by 'em warring political parties not withstanding.Geithner wants to keep feeding debt addiction, says US can scrape through till Aug 2 before debt withdrawal kicks in http://bit.ly/lELYB9

Debt-Limit Deniers Don’t Buy ’Chicken Little’ Warnings http://bloom.bg/jNMvBh US has sufficient revenues to cover existing debts

Bah. So what? Wasn't Mubarak all kosher at this time of the yr, last yr?HSBC under fire over leading role in land deals for Mubarak regime http://bit.ly/kGaV9D Was the biggest European player in Egypt

So what else is new?Federal Reserve Paying Banks Interest Rate That Is Eight Times Market Rate http://bit.ly/lkeRGx $3.56 Billion in riskless money for Banks

General OT. Goes with unkil knowing a lot of things about the widespread fraud and systemic instabilities the fin sector was indulging in also since early last decade.According to the Wikileaks documents, it would seem the US knew since 2005 that OBL was living in Abbottabad http://is.gd/LtSvHC

Let ECB bail these uns out. IMF actually also sees contributions by the likes of India.Portugal agrees on a 78-billion euro EU/IMF bailout http://reut.rs/ksvTti (Left hand giving a bailout to the right hand)

Agree.U.S. Sues German giant Deutsche Bank Over Loan Practices http://nyti.ms/kgethw (Lied, will get slap on wrist)

Chalo, dassit for today.

Re: Perspectives on the global economic meltdown- (Nov 28 20

America’s Middle Class Crisis: The Sobering Facts

http://finance.yahoo.com/blogs/daily-ti ... 47274.html

Here are just some of the sobering facts:

-- There are 8.5 million people receiving unemployment insurance and over 40 million receiving food stamps.

-- At the current pace of job creation, the economy won't return to full employment until 2018.

-- Middle-income jobs are disappearing from the economy. The share of middle-income jobs in the United States has fallen from 52% in 1980 to 42% in 2010.

-- Middle-income jobs have been replaced by low-income jobs, which now make up 41% of total employment.

-- 17 million Americans with college degrees are doing jobs that require less than the skill levels associated with a bachelor's degree.

-- Over the past year, nominal wages grew only 1.7% while all consumer prices, including food and energy, increased by 2.7%.

-- Wages and salaries have fallen from 60% of personal income in 1980 to 51% in 2010. Government transfers have risen from 11.7% of personal income in 1980 to 18.4% in 2010, a post-war high.

The bottom line is simple says Schwenninger: The middle class is shrinking, which threatens the social composition and stability of the world's biggest economy. "I worry that we're becoming a barbell society - a lot of money wealth and power at the top, increasing hollowness at the center, which I think provides the stability and the heart and soul of the society... and then too many people in fear of falling down."

http://finance.yahoo.com/blogs/daily-ti ... 47274.html

Here are just some of the sobering facts:

-- There are 8.5 million people receiving unemployment insurance and over 40 million receiving food stamps.

-- At the current pace of job creation, the economy won't return to full employment until 2018.

-- Middle-income jobs are disappearing from the economy. The share of middle-income jobs in the United States has fallen from 52% in 1980 to 42% in 2010.

-- Middle-income jobs have been replaced by low-income jobs, which now make up 41% of total employment.

-- 17 million Americans with college degrees are doing jobs that require less than the skill levels associated with a bachelor's degree.

-- Over the past year, nominal wages grew only 1.7% while all consumer prices, including food and energy, increased by 2.7%.

-- Wages and salaries have fallen from 60% of personal income in 1980 to 51% in 2010. Government transfers have risen from 11.7% of personal income in 1980 to 18.4% in 2010, a post-war high.

The bottom line is simple says Schwenninger: The middle class is shrinking, which threatens the social composition and stability of the world's biggest economy. "I worry that we're becoming a barbell society - a lot of money wealth and power at the top, increasing hollowness at the center, which I think provides the stability and the heart and soul of the society... and then too many people in fear of falling down."

Re: Perspectives on the global economic meltdown- (Nov 28 20

Treasury suggests $2 trillion U.S. debt cap raise: sources

http://www.reuters.com/article/2011/05/ ... UG20110504

The Treasury has told lawmakers a roughly $2 trillion rise in the legal limit on federal debt would be needed to ensure the government can keep borrowing through the 2012 presidential election, sources with knowledge of the discussions said.

Obama administration officials have repeatedly said that it is up to Congress to decide by how much the $14.3 trillion debt limit should be raised.

But when lawmakers asked how much of an increase would be needed to meet the government's obligations into early 2013, Treasury officials floated the $2 trillion working figure, Senate and administration sources told Reuters.

Former Treasury officials have said it is routine for Congress to ask the Treasury Department for guidance. Republican leaders have asked the White House to provide the size of any proposed increase before the two sides sit down on Thursday to discuss the debt limit face-to-face.

"We have not specified an amount or a time frame. We think that should be left up to Congress," Mary Miller, Treasury's assistant secretary for financial markets, told reporters on Wednesday.

She also said it would be better to raise the debt ceiling enough so that the government does not bump up against it so frequently.

"Obviously, a longer period of time between these activities would be beneficial in terms of the work that goes into preparing for a debt limit increase. But again, you know that's not the Treasury's call," she said.

A Reuters analysis of Treasury's borrowing needs forecast Congress would have to raise the debt ceiling by more than $2 trillion to get through next year's election without having to revisit the issue. According to the Treasury, the government borrows on average about $125 billion per month.

http://www.reuters.com/article/2011/05/ ... UG20110504

The Treasury has told lawmakers a roughly $2 trillion rise in the legal limit on federal debt would be needed to ensure the government can keep borrowing through the 2012 presidential election, sources with knowledge of the discussions said.

Obama administration officials have repeatedly said that it is up to Congress to decide by how much the $14.3 trillion debt limit should be raised.

But when lawmakers asked how much of an increase would be needed to meet the government's obligations into early 2013, Treasury officials floated the $2 trillion working figure, Senate and administration sources told Reuters.

Former Treasury officials have said it is routine for Congress to ask the Treasury Department for guidance. Republican leaders have asked the White House to provide the size of any proposed increase before the two sides sit down on Thursday to discuss the debt limit face-to-face.

"We have not specified an amount or a time frame. We think that should be left up to Congress," Mary Miller, Treasury's assistant secretary for financial markets, told reporters on Wednesday.

She also said it would be better to raise the debt ceiling enough so that the government does not bump up against it so frequently.

"Obviously, a longer period of time between these activities would be beneficial in terms of the work that goes into preparing for a debt limit increase. But again, you know that's not the Treasury's call," she said.

A Reuters analysis of Treasury's borrowing needs forecast Congress would have to raise the debt ceiling by more than $2 trillion to get through next year's election without having to revisit the issue. According to the Treasury, the government borrows on average about $125 billion per month.

Re: Perspectives on the global economic meltdown- (Nov 28 20

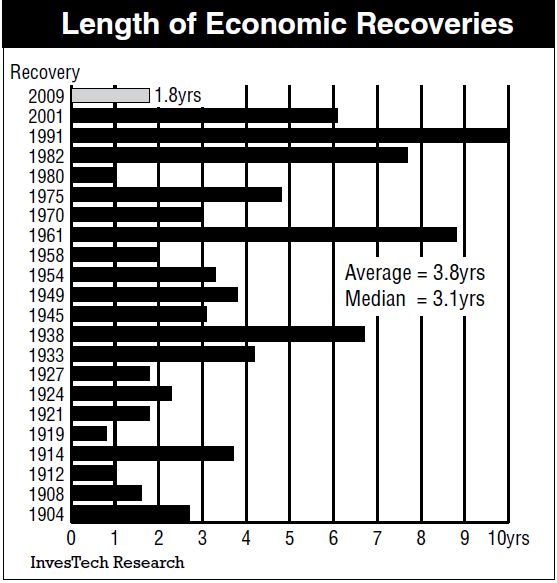

Look at the previous US recovery cycle....

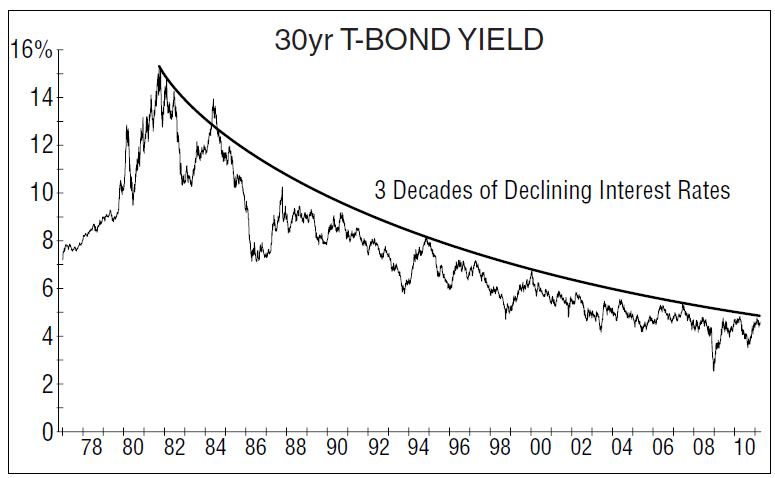

US T Bond rates...

Re: Perspectives on the global economic meltdown- (Nov 28 20

Mexican Central Bank Quietly Buys 100 Tons of Gold

Recently one of economic gurus have predicted that if any oil kingdom or Chinese purchase of 200 tonne gold as done by India previously would make gold to shoot up to $2500. Can any body predict what will be impact of economic recovery or USD future with central banks purchasing gold like never before. TIA.

Recently one of economic gurus have predicted that if any oil kingdom or Chinese purchase of 200 tonne gold as done by India previously would make gold to shoot up to $2500. Can any body predict what will be impact of economic recovery or USD future with central banks purchasing gold like never before. TIA.

-

abhischekcc

- BRF Oldie

- Posts: 4277

- Joined: 12 Jul 1999 11:31

- Location: If I can’t move the gods, I’ll stir up hell

- Contact:

Re: Perspectives on the global economic meltdown- (Nov 28 20

US has an unofficial policy of weakening the dollar, even as they publically make announcements about supporting the dollar. This is being done to reduce the burden arising from two major liabilities - pension payouts and external debt. Weak dollar also makes US products competitive in the world market with out any investments or path breaking innovation like the internet.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Diversification is all ok, but to buy something at record high is really dumb. Silver has had its biggest crash in 3 decades and has lost 30% in a mere week. The treasury auctions have been strong and looks like USD will reverse the trend and head higher now further crashing the commodities bubble.kmkraoind wrote:Mexican Central Bank Quietly Buys 100 Tons of Gold

Recently one of economic gurus have predicted that if any oil kingdom or Chinese purchase of 200 tonne gold as done by India previously would make gold to shoot up to $2500. Can any body predict what will be impact of economic recovery or USD future with central banks purchasing gold like never before. TIA.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Crash in silver prices is an engineered event.

CME Hikes Silver Margins By 17%: 4th Hike In 8 Trading Days

CME Hikes Silver Margins By 17%: 4th Hike In 8 Trading Days

Re: Perspectives on the global economic meltdown- (Nov 28 20

Did you make money?

Re: Perspectives on the global economic meltdown- (Nov 28 20

http://www.project-syndicate.org/commen ... n2/English

How Risky is the Global Economy?

Mohamed A. El-Erian

NEWPORT BEACH – Three years after the global financial crisis, the global economy remains a confusing place – and for good reasons.

Should we draw comfort from gradual healing in advanced countries and solid growth in emerging economies? Or should we seek refuge against high oil prices, geopolitical shocks in the Middle East, and continued nuclear uncertainties in Japan, the world’s third largest economy?

Many are opting for the first, more reassuring view of the world. Having overcome the worst of the global financial crisis, including a high risk of a worldwide depression, they are heartened by a widely shared sense that composure, if not confidence, has been restored.

This global view is based on multispeed growth dynamics, with the healing and healthy segments of the global economy gradually pulling up the laggards. It is composed of highly profitable multinational companies, now investing and hiring workers; advanced economies’ rescued banks paying off their emergency bailout loans; the growing middle and upper classes in emerging economies buying more goods and services; a healthier private sector paying more taxes, thereby alleviating pressure on government budgets; and Germany, Europe’s economic power, reaping the fruit of years of economic restructuring.

Much, though not all, of the recent data support this global view. Indeed, the world has embarked on a path of gradual economic recovery, albeit uneven and far less vibrant than history would have suggested. If this path is maintained, the recovery will build momentum and broaden in both scope and impact.

But “if” is where the second, less rosy view of the world comes in – a view that worries about both lower growth and higher inflation. While the obstacles are not yet sufficiently serious to derail the ongoing recovery, only a fool would gloss over them. I can think of four major issues – ranked by immediacy and relevance to the well being of the global economy – that are looming larger in importance and becoming more threatening in character.

First, and foremost, the world as a whole has yet to deal fully with the economic consequences of unrest in the Middle East and the tragedies in Japan. While ongoing for weeks or months, these events have not yet produced their full disruptive impact on the global economy. It is not often that the world finds itself facing the stagflationary risk of lower demand and lower supply at the same time. And it is even more unusual to have two distinct developments leading to such an outcome. Yet such is the case today.

The Middle Eastern uprisings have pushed oil prices higher, eating up consumer purchasing power while raising input prices for many producers. At the same time, Japan’s trifecta of calamities – the massive earthquake, devastating tsunami, and paralyzing nuclear disaster – have gutted consumer confidence and disrupted cross-border production chains (especially in technology and car factories).

The second big global risk comes from Europe, where Germany’s strong performance is coinciding with a debt crisis on the European Union’s periphery. Last week, Portugal joined Greece and Ireland in seeking an official bailout to avoid a default that would undermine Europe’s banking system. In exchange for emergency loans, all three countries have embarked on massive austerity. Yet, despite the tremendous social pain, this approach will make no dent in their large and rising debt overhang.

Meanwhile, housing in the United States is weakening again – the third large global risk. Even though home prices have already fallen sharply, there has been no meaningful rebound. Indeed, in some areas, prices are again under downward pressure, which could worsen if mortgage finance becomes less readily available and more expensive, as is possible.

With housing being such a critical driver of consumer behavior, any further substantial fall in home prices will sap confidence and lower spending. It will also make relocating even more difficult for Americans in certain parts of the country, aggravating the long-term-unemployment problem.

Finally, there is the increasingly visible fiscal predicament in the US, the world’s largest economy – and the one that provides the “global public goods” that are so critical to the healthy functioning of the world economy. Having used fiscal spending aggressively to avoid a depression, the US must now commit to a credible medium-term path of fiscal consolidation. This will involve difficult choices, delicate execution, and uncertain outcomes for both the federal government and the US Federal Reserve.

The longer the US postpones the day of reckoning, the greater the risk to the dollar’s global standing as the world’s main reserve currency, and to the attractiveness of US government bonds as the true “risk-free” financial benchmark.

The world has changed its supplier of global public goods in the past. The last time it happened, after World War II, an energized US replaced a devastated Britain. By contrast, there is no country today that is able and willing to step in should the US fail to get its act together.

These four risks are material and consequential, and each is growing in importance. Fortunately, none of them is yet transformational for the global economy, and together they do not yet constitute a disruptive critical mass. But this is not to say that the global economy is in a safe zone. On the contrary, it is caught in a duel between healing and disruptive influences, in which it can ill afford any further intensification of the latter.

Mohamed A. El-Erian is Chief Executive of PIMCO and author of When Markets Collide. This article is based on a lecture he gave at Princeton University’s Center for Economic Policy Studies.

Re: Perspectives on the global economic meltdown- (Nov 28 20

THE WORLD IN WORDS

A New World Architecture

George Soros

2009-11-04

A New World Architecture

http://www.project-syndicate.org/commen ... 52/English

NEW YORK – Twenty years after the fall of the Berlin Wall and the collapse of communism, the world is facing another stark choice between two fundamentally different forms of organization: international capitalism and state capitalism. The former, represented by the United States, has broken down, and the latter, represented by China, is on the rise. Following the path of least resistance will lead to the gradual disintegration of the international financial system. A new multilateral system based on sounder principles must be invented.

While international cooperation on regulatory reform is difficult to achieve on a piecemeal basis, it may be attainable in a grand bargain that rearranges the entire financial order. A new Bretton Woods conference, like the one that established the post-WWII international financial architecture, is needed to establish new international rules, including treatment of financial institutions that are too big to fail and the role of capital controls. It would also have to reconstitute the International Monetary Fund to reflect better the prevailing pecking order among states and to revise its methods of operation.

In addition, a new Bretton Woods would have to reform the currency system. The post-war order, which made the US more equal than others, produced dangerous imbalances. The dollar no longer enjoys the trust and confidence that it once did, yet no other currency can take its place.

The US ought not to shy away from wider use of IMF Special Drawing Rights. Because SDRs are denominated in several national currencies, no single currency would enjoy an unfair advantage.

The range of currencies included in the SDRs would have to be widened, and some of the newly added currencies, including the renminbi, may not be fully convertible. This would, however, allow the international community to press China to abandon its exchange-rate peg to the dollar and would be the best way to reduce international imbalances. And the dollar could still remain the preferred reserve currency, provided it is prudently managed.

One great advantage of SDRs is that they permit the international creation of money, which is particularly useful at times like the present. The money could be directed to where it is most needed, unlike what is happening currently. A mechanism that allows rich countries that don’t need additional reserves to transfer their allocations to those that do is readily available, using the IMF’s gold reserves.

Re: Perspectives on the global economic meltdown- (Nov 28 20

A non conmist prespective.

Just as DOW/S&P 500 gives a snapshot of the US sum total of economy, political situation etc, the ForEx market gives each country's snapshot of all indicators.

So we need to start looking at that.

Just as DOW/S&P 500 gives a snapshot of the US sum total of economy, political situation etc, the ForEx market gives each country's snapshot of all indicators.

So we need to start looking at that.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Time for a Royal Wedding ... While England Is Royally Screwed. It is one of the UK is doomed article in Newsweek. The magazine carried one in 2009 as well. Forget the Great In Britain