Perspectives on the global economic meltdown- (Nov 28 2010)

Re: Perspectives on the global economic meltdown- (Nov 28 20

Rats are all jumping ship on the Federal Reserve.

They don't want their names associated with a major crash because that's exactly wha'ts coming down the pike.

------------------

3 Rats have fled the sinking ship

The Federal Reserve said D. Nathan Sheets quit as the central bank’s chief international economic adviser after almost four years in the position and a day before policy makers meet.

The Fed, in a statement today in Washington, didn’t say why Sheets, 46, is leaving the institution. As director of the Division of International Finance, Sheets briefed Chairman Ben S. Bernanke and other officials on economic developments outside the U.S. and represented the Fed at international meetings.

...The departure means all three of Bernanke’s top staff advisers have left their positions or announced their departures in the last 13 months. Brian Madigan, former director of the Division of Monetary Affairs, retired last year, while the Fed said in May that David Stockton, director of the Division of Research and Statistics, is retiring Sept. 30.

http://www.bloomberg.com/news/2011-08-0 ... viser.html

They don't want their names associated with a major crash because that's exactly wha'ts coming down the pike.

------------------

3 Rats have fled the sinking ship

The Federal Reserve said D. Nathan Sheets quit as the central bank’s chief international economic adviser after almost four years in the position and a day before policy makers meet.

The Fed, in a statement today in Washington, didn’t say why Sheets, 46, is leaving the institution. As director of the Division of International Finance, Sheets briefed Chairman Ben S. Bernanke and other officials on economic developments outside the U.S. and represented the Fed at international meetings.

...The departure means all three of Bernanke’s top staff advisers have left their positions or announced their departures in the last 13 months. Brian Madigan, former director of the Division of Monetary Affairs, retired last year, while the Fed said in May that David Stockton, director of the Division of Research and Statistics, is retiring Sept. 30.

http://www.bloomberg.com/news/2011-08-0 ... viser.html

Re: Perspectives on the global economic meltdown- (Nov 28 20

Nikkei 225 seems to have staged a come back.

Re: Perspectives on the global economic meltdown- (Nov 28 20

This is where the genius of our forefathers comes into place. For centuries Indian insistence of owning gold is coming full circle. 70% of all gold ever to come out of earth is in India. Romans, arab, chinese, british came and went but we kept our focus on gold.yogi wrote:Gold Emerging as an Alternative Currency (for black money & corruption)

Indian gold may not lie in Governement coffers, but it's safe in millions of Godrej cupboards across India. If indeed Dollars fails, and gold value zooms, Indian Middle class will be the biggest beneficiary as the world's largest repository of gold.

Gold value goes up, our families stand to gain the most. At last Bharat's days are coming.

-

Dileep

- BRF Oldie

- Posts: 5891

- Joined: 04 Apr 2005 08:17

- Location: Dera Mahab Ali धरा महाबलिस्याः درا مهاب الي

Re: Perspectives on the global economic meltdown- (Nov 28 20

Sri, don't forget the poor "father of the bride" folk here.

Gold in the family is NOT an asset, because:

1. You can't sell it. Period. End of Discussion, and a week in doghouse!

2. Its value depreciates faster than the prime real estate in Kraachi. Every time you visit Bhima Jewels, good old Bhima Bhattar eats up 20% of the value.

Gold in the family is NOT an asset, because:

1. You can't sell it. Period. End of Discussion, and a week in doghouse!

2. Its value depreciates faster than the prime real estate in Kraachi. Every time you visit Bhima Jewels, good old Bhima Bhattar eats up 20% of the value.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Dileep, I agree with you.

But Gold has come out to be the safest way preserving wealth. Push comes to shove it will play a huge role. As they say it for a purpose our forefathers considered it something u hold on to, much like RIL share in India. When price is right everything is up for grabs also ur own situation plays a big role. If gold does become more and more instrument of choice to store wealth it will become critical. How do you explain the slew of Pawn shops in Sahukarpet?

But Gold has come out to be the safest way preserving wealth. Push comes to shove it will play a huge role. As they say it for a purpose our forefathers considered it something u hold on to, much like RIL share in India. When price is right everything is up for grabs also ur own situation plays a big role. If gold does become more and more instrument of choice to store wealth it will become critical. How do you explain the slew of Pawn shops in Sahukarpet?

Re: Perspectives on the global economic meltdown- (Nov 28 20

Dileep,

I understand that selling gold in family is not easy. But it is the last resort.

personal Example: When my grand mom became sick my dad had to sell all the gold including my moms to finance the cancer treatment. This was in 1980's. SOme of that gold was bought in 60's and

70's at negligible rates. My mom still feels bad if she has that gold now, it would be worth so much

I think because of lack of structures like Medicare and Medicaid, gold acts as a final back up of some sort. Gold is not some thing we trade with (buy sell and Buy sell), but a Safe haven.

I think the average Indian has become intelligent enough to buy gold in forms where making loss is low. A lot of people are buying gold coins, where there are no gold making charges of the order of 16-20%

I understand that selling gold in family is not easy. But it is the last resort.

personal Example: When my grand mom became sick my dad had to sell all the gold including my moms to finance the cancer treatment. This was in 1980's. SOme of that gold was bought in 60's and

70's at negligible rates. My mom still feels bad if she has that gold now, it would be worth so much

I think because of lack of structures like Medicare and Medicaid, gold acts as a final back up of some sort. Gold is not some thing we trade with (buy sell and Buy sell), but a Safe haven.

I think the average Indian has become intelligent enough to buy gold in forms where making loss is low. A lot of people are buying gold coins, where there are no gold making charges of the order of 16-20%

Re: Perspectives on the global economic meltdown- (Nov 28 20

After the Chinese aggression, there was drive to ask for donating gold for the service. My mom gave up 100 tolas of her gold for the fear of the PLA and the abject performance at the border with Brig level officers being taken prisoner.

We dont regret it one bit.

However when we hear of Defence scams blood boils.

We dont regret it one bit.

However when we hear of Defence scams blood boils.

Re: Perspectives on the global economic meltdown- (Nov 28 20

In keeping with the thread title, check out the documentary, Inside Job.

It's a "Must See" for a very intelligent and incisive look at the current financial crisis in the US and some western countries. It shows the insidious nexus between the US Government, Wall Street and Academia... and how the same individuals who brought on the calamity are still running the show.

It's a "Must See" for a very intelligent and incisive look at the current financial crisis in the US and some western countries. It shows the insidious nexus between the US Government, Wall Street and Academia... and how the same individuals who brought on the calamity are still running the show.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Gold in Pureland.

http://www.rferl.org/content/pakistan_m ... 88564.html

In Pakistan, High Gold Prices Taking Luster Off Marital Tradition

August 06, 2011

By Farangis Najibullah, Maliha Amirzada

"Far from the busy floors of the world's major commodity-trading centers, rising gold prices are taking their toll on marital tradition in Pakistan.

As gold hits record highs, some couples are being forced to postpone -- or even cancel -- their weddings because their families cannot piece together a suitable dowry.

And in places like Kanju, in the country's southwestern Swat Valley -- no gold means no wedding, because this is a place where tradition trumps all.

"My two brothers are engaged to marry, but we have to postpone both weddings because of the incredibly high price of gold," says Shahnaz Bibi, a resident of the village. "My cousin's wedding is also off for this reason."

The price of gold has soared on global markets, rising beyond $1,630 per troy ounce. In Pakistan, where precious metals are measured in Pakistani tolas (.44 troy ounce), one tola of gold currently costs more than $620.

Tradition dictates that families should buy several tolas of gold for their children's wedding, but with average salaries hovering around $150 a month, even middle-income families like Shahnaz Bibi's are finding the costs too steep......."

Gautam

http://www.rferl.org/content/pakistan_m ... 88564.html

In Pakistan, High Gold Prices Taking Luster Off Marital Tradition

August 06, 2011

By Farangis Najibullah, Maliha Amirzada

"Far from the busy floors of the world's major commodity-trading centers, rising gold prices are taking their toll on marital tradition in Pakistan.

As gold hits record highs, some couples are being forced to postpone -- or even cancel -- their weddings because their families cannot piece together a suitable dowry.

And in places like Kanju, in the country's southwestern Swat Valley -- no gold means no wedding, because this is a place where tradition trumps all.

"My two brothers are engaged to marry, but we have to postpone both weddings because of the incredibly high price of gold," says Shahnaz Bibi, a resident of the village. "My cousin's wedding is also off for this reason."

The price of gold has soared on global markets, rising beyond $1,630 per troy ounce. In Pakistan, where precious metals are measured in Pakistani tolas (.44 troy ounce), one tola of gold currently costs more than $620.

Tradition dictates that families should buy several tolas of gold for their children's wedding, but with average salaries hovering around $150 a month, even middle-income families like Shahnaz Bibi's are finding the costs too steep......."

Gautam

Re: Perspectives on the global economic meltdown- (Nov 28 20

Feds to keep interest rates low thru 2013. Dow takes another 130 points hit thus reversing any gains early in the day.

The sentiment is they didnt know the economy was so bad that rates need to be kept low for that long!

The sentiment is they didnt know the economy was so bad that rates need to be kept low for that long!

-

Bade

- BRF Oldie

- Posts: 7212

- Joined: 23 May 2002 11:31

- Location: badenberg in US administered part of America

Re: Perspectives on the global economic meltdown- (Nov 28 20

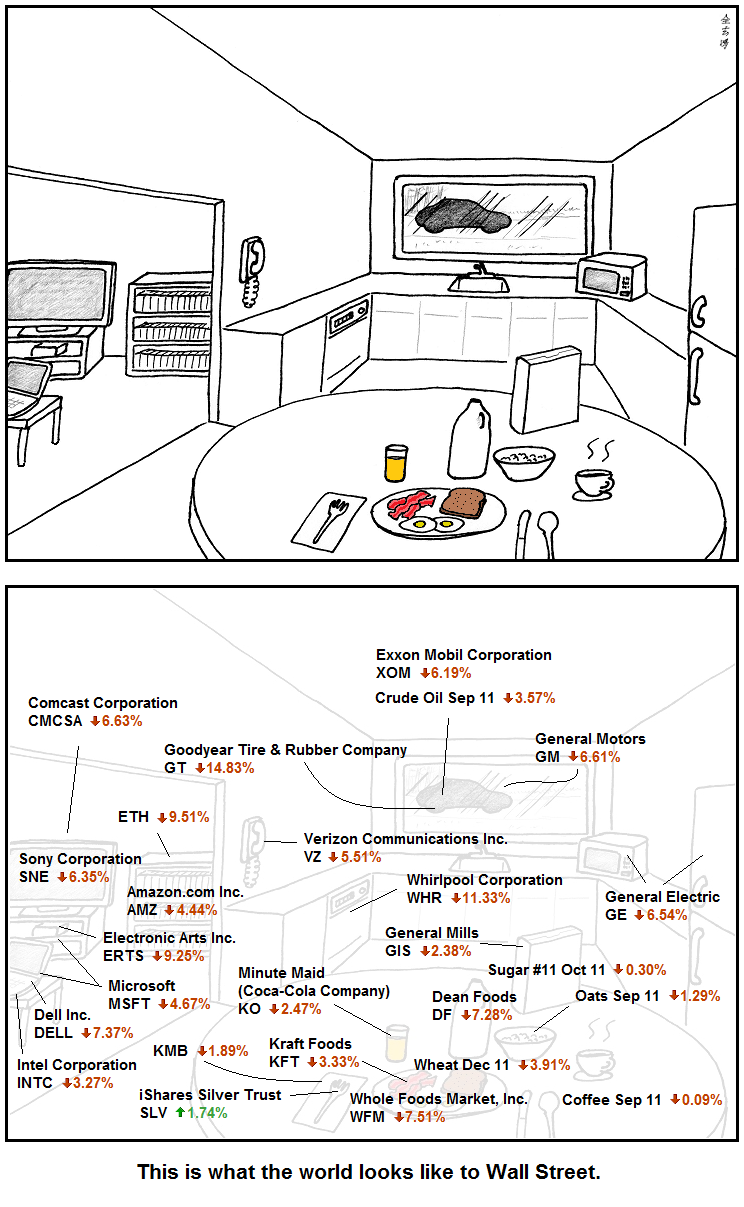

So $2 trillion and change was lost in stocks from investors (citizens) trying to fix the $2 trillion and change in entitlement cuts that was not in place.

I think would it not have been far better to default instead and still lose the $2trillion in stock value.

After all this pundits from industry come on shows and say nothing is fundamentally wrong with the US industry indicators, and people should keep vested.

I think all this stocks drama-baazi is just siphoning money out of gullible investors and those who have little choice but to join a 401k plan.

I think would it not have been far better to default instead and still lose the $2trillion in stock value.

After all this pundits from industry come on shows and say nothing is fundamentally wrong with the US industry indicators, and people should keep vested.

I think all this stocks drama-baazi is just siphoning money out of gullible investors and those who have little choice but to join a 401k plan.

Re: Perspectives on the global economic meltdown- (Nov 28 20

401K is not gold, it can vanish into thin air too. The "Defined Contribution" vs "Defined Benefits" battle is an old one, and the "DC" folks won that battle. The expectation was like the housing sector, everybody thought the housing prices will continue to climb; nobody talked about the hype or that there would be burst; including moi. Similarly the DC folks had ample reasons to show how DC will benefit, until the whole edifice came crushing on us. In a matter of few years, life shows how life on this planet is all fickle and should not be taken for granted.

http://www.watsonwyatt.com/us/pubs/insi ... leID=19148

If anyone put all their money in stocks, then I do feel sorry for them. They were caught in the hype and did not balance their risk (a.k.a putting all eggs in one basket)

http://www.watsonwyatt.com/us/pubs/insi ... leID=19148

If anyone put all their money in stocks, then I do feel sorry for them. They were caught in the hype and did not balance their risk (a.k.a putting all eggs in one basket)

-

Bade

- BRF Oldie

- Posts: 7212

- Joined: 23 May 2002 11:31

- Location: badenberg in US administered part of America

Re: Perspectives on the global economic meltdown- (Nov 28 20

SwamyG, I believe in the secular long term trend for the stock market, except for wars and the destruction it brings about or a random wild act of nature. All else is just part of financial engineering to achieve certain goals. Look at the wild swings in the later half of the day today. There is no hype, just manipulation to gain.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Bade wrote:SwamyG, I believe in the secular long term trend for the stock market, except for wars and the destruction it brings about or a random wild act of nature. All else is just part of financial engineering to achieve certain goals. Look at the wild swings in the later half of the day today. There is no hype, just manipulation to gain.

Dont panic, never act in haste and wait. Never shall thou invest which you cant afford to loose for it will provide great timely leverage for eventual gain.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Markets reversed to close almost 4.75% up on S&P. Two positive signs : 1) It was a rally based on strong volume. b) It was a rally despite the absence of much anticipated QE3 by the feds. Ofcourse, we can easily give away today's rally in the days to come, but atleast i'm glad it did not take another bond buying program to rally the markets.ramana wrote:Feds to keep interest rates low thru 2013. Dow takes another 130 points hit thus reversing any gains early in the day.

The sentiment is they didnt know the economy was so bad that rates need to be kept low for that long!

Re: Perspectives on the global economic meltdown- (Nov 28 20

http://www.boston.com/business/articles ... and_china/

Toyota looks to India and China

Toyota looks to India and China

TOKYO - Toyota Motor Corp., which has sunk to number three in global vehicle sales, is counting on emerging markets to revive its fortunes.That put it behind General Motors Co. and Volkswagen AG. Toyota has been the top-selling automaker in annual sales for the past three years.Sandeep Singh, deputy managing director at Toyota’s joint venture in India, said growth in India is so solid for Toyota that he is confident the company is headed in the right direction.

Singh said the difficulties from the disaster are temporary, and Toyota’s vision for growth remains unchanged.“The targets we have been given, we are on track for that,’’ he said of India’s part of the plan.Toyota’s sales in India jumped 53 percent this year to 53,100 for the first half, and the growth is expected to continue because of production capacity boosts, Singh said.Toyota, number five in India in market share, is pushing the made-for-India Etios small sedan to attract an emerging middle class.And Toyota is expecting to sell 900,000 vehicles in

Re: Perspectives on the global economic meltdown- (Nov 28 20

That is the single greatest mantra of investment. Rest pale into insignificance. That is the first thing I tell anyone who asks me about investment tips.Prem wrote: Dont panic, never act in haste and wait. Never shall thou invest which you cant afford to loose for it will provide great timely leverage for eventual gain.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Ambar, ramana:

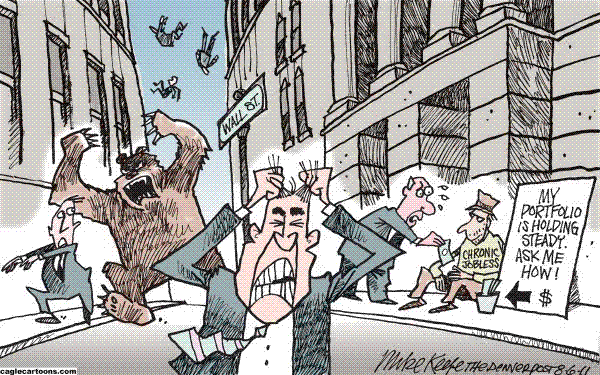

It is very likely that a new bear market has started. Bear markets are characterized by extreme moves on both sides. You have plunges when bids disappear and wild and quick rallies when too many people get short at extremes. So take all rallies with a pinch of salt.

The market is heavily oversold; many technical indicators are a historic oversold levels or levels seen in 2008-2009. Markets act like rubber-bands and the size of the move is often a function of the preceding move. The markets also move very fast with most of the trading dominated by computers which primarily focus on short term trend following.

ramana: The market moves did not have much to do with the feeling that the economy was poor (everyone knows that). Market was ready for a bounce and it got one in the morning as many shorts covered prior to the Fed. However once the Fed notes came out it was something that most equity traders did not understand. There was no bond buying but the 21st century version of Operation Twist AND there was dissent. The dissent helped the bond market since it lowers the threat of inflation. The bond market saw what the Fed was doing and rallied.

The HFT computers saw that and started selling equities. The market had not tested the 1100 area during the day in the ES and that is what they targetted. They got to 1100, bounced once, went down again broke 1100 BUT that did not lead to more initiative selling (either stops of longs or new shorts). Once the break did not have a follow-through, the low was in, and it rallied 80 handles after that, as computers reversed and decided to run in the other direction. The market is controlled by algorithms and is very very technical these days.

So if you are investing, think in terms of trades, not buy and hold.

It is very likely that a new bear market has started. Bear markets are characterized by extreme moves on both sides. You have plunges when bids disappear and wild and quick rallies when too many people get short at extremes. So take all rallies with a pinch of salt.

The market is heavily oversold; many technical indicators are a historic oversold levels or levels seen in 2008-2009. Markets act like rubber-bands and the size of the move is often a function of the preceding move. The markets also move very fast with most of the trading dominated by computers which primarily focus on short term trend following.

ramana: The market moves did not have much to do with the feeling that the economy was poor (everyone knows that). Market was ready for a bounce and it got one in the morning as many shorts covered prior to the Fed. However once the Fed notes came out it was something that most equity traders did not understand. There was no bond buying but the 21st century version of Operation Twist AND there was dissent. The dissent helped the bond market since it lowers the threat of inflation. The bond market saw what the Fed was doing and rallied.

The HFT computers saw that and started selling equities. The market had not tested the 1100 area during the day in the ES and that is what they targetted. They got to 1100, bounced once, went down again broke 1100 BUT that did not lead to more initiative selling (either stops of longs or new shorts). Once the break did not have a follow-through, the low was in, and it rallied 80 handles after that, as computers reversed and decided to run in the other direction. The market is controlled by algorithms and is very very technical these days.

So if you are investing, think in terms of trades, not buy and hold.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Nice post VikramS. Please xpost in the investing thread too. Buy and hold works well in secular bull markets onlee. In range bound and bear markets it's better to be aware of buy and sell signals to shift allocations accordingly.

Re: Perspectives on the global economic meltdown- (Nov 28 20

I believe the Fed and US Govt should explicitly enable and encourage homeowners to refinance into 1 year ARMs. That will let consumers save a lot on interest costs and give a boost to the economy.

They should have done this a long time ago. The tea leaves could be read as far back as the 2nd half of 2007. With rates being low from 2008-2013 at the minimum, and perhaps further out if they start cutting into the deficit, it is a lost opportunity to provide some cheap stimulus at the expense of the rest of the world, which anyway doesn't have anything better to do with its money than to buy US treasuries.

They should have done this a long time ago. The tea leaves could be read as far back as the 2nd half of 2007. With rates being low from 2008-2013 at the minimum, and perhaps further out if they start cutting into the deficit, it is a lost opportunity to provide some cheap stimulus at the expense of the rest of the world, which anyway doesn't have anything better to do with its money than to buy US treasuries.

Re: Perspectives on the global economic meltdown- (Nov 28 20

I bet if people could exchange a gold coin or bangle for a house, they would sell it. Its not being sold now only because that psychological limit has not been hit. There's a price for everything.Dileep wrote: Gold in the family is NOT an asset, because:

1. You can't sell it. Period. End of Discussion, and a week in doghouse!.

If that's the case, I need to setup a Cash-4-Gold outlet in India. There are lots of cash-4-gold type outfits in the US that are really just dens for shysters. They try to lowball the ignorant & desparate on the price of gold. One strategy I've heard is to quote the price of gold per gram. Since most of the poor don't know how many grams there are in an ounce, they just say yes. However much of that easy gold has been cleaned out.Dileep wrote: 2. Its value depreciates faster than the prime real estate in Kraachi. Every time you visit Bhima Jewels, good old Bhima Bhattar eats up 20% of the value.

The next scam coming down the pike will be from banking & financing crooks - namely the so called gold ETFs. Investors will come to find out what they were buying was paper instead of gold.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Any attempt by the govt to lower expenses for one party means the money has to be taken from some other party. So I fail to see how it will save anything unless that money is taken on as debt from overseas investors - who no doubt will be defaulted on in the future.vera_k wrote:I believe the Fed and US Govt should explicitly enable and encourage homeowners to refinance into 1 year ARMs. That will let consumers save a lot on interest

-

RamaY

- BRF Oldie

- Posts: 17249

- Joined: 10 Aug 2006 21:11

- Location: http://bharata-bhuti.blogspot.com/

Re: Perspectives on the global economic meltdown- (Nov 28 20

I moved my little 401k money into stocks yesterday. Lost 4% value alreadySwamyG wrote:

If anyone put all their money in stocks, then I do feel sorry for them. They were caught in the hype and did not balance their risk (a.k.a putting all eggs in one basket)

Re: Perspectives on the global economic meltdown- (Nov 28 20

[/quote]Prem wrote:.Toyota, number five in India in market share, is pushing the made-for-India Etios small sedan to attract an emerging middle class.And Toyota is expecting to sell 900,000 vehicles in

I wonder what are we getting out of Japan if they are getting all this out of us.

There's damn near nothing we are exporting to them unlike China.

Its time to discuss this issue with them before India lands itself in the position of US - just importing tons of crap and increasing indebtedness.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Trading in these markets could result in loss of undies and lungees if one does not have a good pulse and timing. Even market experts do not stick their necks too far out. It is tough to predict how long the current conditions will hold. Market is looking for confidence from all quarters of the World and especially USA. European countries are yet to come out their troubles. Trade only if you are ready to lose the money.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Good old stock market rigging to pump the market up yet again ?

http://www.zerohedge.com/news/volume-sp ... umes-againThe levitation resumes. And as expected, the second this happens the volume divergence from average goes red. Good to see that no matter how big of a beating they experience, the robots will always be here, apocalypse or shine. In the meantime, the carbon-based whales are sitting on the sidelines until 2:15 pm. Anything less than the expected from the gospel of St. Chairsatan will promptly push the volume bar from red to green, and the direction of stocks (inversely) appropriately.

Re: Perspectives on the global economic meltdown- (Nov 28 20

More even distribution of the benefit. Plus given the liquidity trap that's coming into focus now, the US government is awash in money both from domestic and foreign investors, who can't seem to take a risk. Best way out is to get consumption going again, which can happen if people get more money they can go out and spend or use to retire debt (which will let them spend eventually).Neshant wrote:Any attempt by the govt to lower expenses for one party means the money has to be taken from some other party. So I fail to see how it will save anything unless that money is taken on as debt from overseas investors - who no doubt will be defaulted on in the future.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Mr. Magoo is going more senile by the minute.

Printing money to pay off debts is a default. Next to bernanke, he's the primary reason for the disaster and yet he continues giving economic analysis.

----

No Chance of Default, US Can Print Money: Greenspan

Former Federal Reserve Chairman Alan Greenspan on Sunday ruled out the chance of a US default following S&P's decision to downgrade America's credit rating.

"The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default" said Greenspan on NBC's Meet the Press.

http://www.cnbc.com/id/44051683/

Printing money to pay off debts is a default. Next to bernanke, he's the primary reason for the disaster and yet he continues giving economic analysis.

----

No Chance of Default, US Can Print Money: Greenspan

Former Federal Reserve Chairman Alan Greenspan on Sunday ruled out the chance of a US default following S&P's decision to downgrade America's credit rating.

"The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default" said Greenspan on NBC's Meet the Press.

http://www.cnbc.com/id/44051683/

Re: Perspectives on the global economic meltdown- (Nov 28 20

The last thing that's needed are more bright ideas from the useless middleman sector known as banking & financing on how to go on a wreckless spending spree and rob peter for paul to revive the economy. The entire profession of economics is looking more & more like saucery these days.vera_k wrote:More even distribution of the benefit. Plus given the liquidity trap that's coming into focus now, the US government is awash in money both from domestic and foreign investors, who can't seem to take a risk. Best way out is to get consumption going again, which can happen if people get more money they can go out and spend or use to retire debt (which will let them spend eventually).

Back in 2002, the same silly notion was put forward by these same clueless economists and we found out where that road leads! Its no coincidence that the banking & financing "industry" expanded vastly to accomodate the fraud of spending without producing even while the real (productive) economy shrank. I'm sure it works well for them as they get to profit off the wreckless spending by shuffling paper & robbing savers even if its ruinious for the real productive economy.

The govt should get out of the business of trying to get anything going as more often than not, its just wasting money of taxpayers and destroying the wealth of the few who are producers.

What's needed is not more wreckless spending ideas but SAVINGS, production of goods the world needs and exports thereof. If nothing else, the hoard of shysters working in banking & financing need to get real jobs. Shrinking the useless middleman sector might just be the relief the economy needs to start growing.

Last edited by Neshant on 10 Aug 2011 08:14, edited 1 time in total.

-

Theo_Fidel

Re: Perspectives on the global economic meltdown- (Nov 28 20

Arn't we already in a bear market. Technically the market peaked at DOW 14,000 in 2007-2008. We are a long ways of that already. Had a couple of patriotic desi friends invested in IFN at $100, and told them to diversify immediately but they held on and got wiped out. IFN still sucks big time. I thought diversify is the big lesson of bear markets.

--------------------------------------------------

Vikram,

Don't understand how repeated trading can possibly get a better return. Too much like timing the market, which never works, right. IMHO that only locks in your losses.

Re-balancing I understand, I have a 40% Desh, 40% Int & 20% USA exposure. I'm also one of those sad saps with 20% siting in Treasury Bill's, mostly 2 year note and mostly for tax purposes. Right now desh has increased to 44% while USA is down to 17%. So Will be liquidating desh to buy Unkil and re-balance once the hoo-haa dies down a bit.

--------------------------------------------------

Vikram,

Don't understand how repeated trading can possibly get a better return. Too much like timing the market, which never works, right. IMHO that only locks in your losses.

Re-balancing I understand, I have a 40% Desh, 40% Int & 20% USA exposure. I'm also one of those sad saps with 20% siting in Treasury Bill's, mostly 2 year note and mostly for tax purposes. Right now desh has increased to 44% while USA is down to 17%. So Will be liquidating desh to buy Unkil and re-balance once the hoo-haa dies down a bit.

Last edited by Theo_Fidel on 10 Aug 2011 08:17, edited 2 times in total.

-

abhishek_sharma

- BRF Oldie

- Posts: 9664

- Joined: 19 Nov 2009 03:27

Re: Perspectives on the global economic meltdown- (Nov 28 20

gold retail price in india is 26000 per tola today in news report.

back in 2004 when I was r2i, had suggested to my wife that we buy a couple of certified gold bars from there and bring it back. the price was around 7000 iirc back then....wife said why do we need so much gold, we onlee have a son.

well now we also have a daughter but gold is 26k. lol.

back in 2004 when I was r2i, had suggested to my wife that we buy a couple of certified gold bars from there and bring it back. the price was around 7000 iirc back then....wife said why do we need so much gold, we onlee have a son.

well now we also have a daughter but gold is 26k. lol.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Indians holding gold from the great great grandparents time have seen their net value trippling , quadarupling. If total indian holding is more than 40kT, it roughly translate into 2 Trillion$ of which 1.5 was added in last 2-3 years or so. best part is , This came on top of double digit economic addition in the yconomy.Singha wrote:gold retail price in india is 26000 per tola today in news report.

back in 2004 when I was r2i, had suggested to my wife that we buy a couple of certified gold bars from there and bring it back. the price was around 7000 iirc back then....wife said why do we need so much gold, we onlee have a son.

.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Theo:

Very simple measures like oversold, overbought on market breadth oscillators can help you avoid big draw-downs. Reduce when this indicator goes about 70. Then wait for a turn before buying.

http://stockcharts.com/h-sc/ui?s=$NAMO& ... 2849086498

http://stockcharts.com/h-sc/ui?s=$NYMO& ... 7515696771

====

It is very hard to call a market with a 100% gain a bear market! All these talks about cyclical rally in a secular bear is meaningless.

Right now yield curves are inverted (or almost inverted) in many emerging markets. Many indices have fallen 20% (brazil, Russell 2000 etc.) which is the formal definition of a bear market. And the kind of rally we had today has only happened before in the 2008-2009 big bear!

Very simple measures like oversold, overbought on market breadth oscillators can help you avoid big draw-downs. Reduce when this indicator goes about 70. Then wait for a turn before buying.

http://stockcharts.com/h-sc/ui?s=$NAMO& ... 2849086498

http://stockcharts.com/h-sc/ui?s=$NYMO& ... 7515696771

====

It is very hard to call a market with a 100% gain a bear market! All these talks about cyclical rally in a secular bear is meaningless.

Right now yield curves are inverted (or almost inverted) in many emerging markets. Many indices have fallen 20% (brazil, Russell 2000 etc.) which is the formal definition of a bear market. And the kind of rally we had today has only happened before in the 2008-2009 big bear!

Re: Perspectives on the global economic meltdown- (Nov 28 20

In my reckoning, the Fed and the continued piling of money into US treasuries has set us up for a massive stock market rally over the next year. They have removed all uncertainty around what borrowing costs will be for 2 years.

I have ARMs resetting in October based on the weekly average this week, and so far this should be the lowest ever they have gone.

I have ARMs resetting in October based on the weekly average this week, and so far this should be the lowest ever they have gone.

-

Dileep

- BRF Oldie

- Posts: 5891

- Joined: 04 Apr 2005 08:17

- Location: Dera Mahab Ali धरा महाबलिस्याः درا مهاب الي

Re: Perspectives on the global economic meltdown- (Nov 28 20

Got to clarify the points about gold.

Gold ornaments are normally 916 hallmarked. They are marked up 15-20% as making charges. When you sell, you will get the gold price back. The problem with ornaments is, women tend to exchange them. Every exchange drops 20% of the value. SHQ had some 80 soverigns when we got married. I bought at least 30 sovereigns, but now she has only 60. Rest Bhima Bhattar took with all those 'exchanges'

Gold bars sold by banks and other such institutions are marked up 10-15%, and you will get it discounted down to 5% if you are a good customer. When you sell, you will get the gold price.

Gold bars from jewellers are marked up 2-5%. If you can buy from a gold refiner, you can get it at 1-2% markup. There is one in DMA from whom I bought some.

Gold ornaments are normally 916 hallmarked. They are marked up 15-20% as making charges. When you sell, you will get the gold price back. The problem with ornaments is, women tend to exchange them. Every exchange drops 20% of the value. SHQ had some 80 soverigns when we got married. I bought at least 30 sovereigns, but now she has only 60. Rest Bhima Bhattar took with all those 'exchanges'

Gold bars sold by banks and other such institutions are marked up 10-15%, and you will get it discounted down to 5% if you are a good customer. When you sell, you will get the gold price.

Gold bars from jewellers are marked up 2-5%. If you can buy from a gold refiner, you can get it at 1-2% markup. There is one in DMA from whom I bought some.

-

nandakumar

- BRFite

- Posts: 1687

- Joined: 10 May 2010 13:37

Re: Perspectives on the global economic meltdown- (Nov 28 20

Dileep, I am not sure banks are permitted to buy back gold even from those who bought it from the bank in the first place. There are some RBI constraints on this.Dileep wrote:Got to clarify the points about gold.

Gold bars sold by banks and other such institutions are marked up 10-15%, and you will get it discounted down to 5% if you are a good customer. When you sell, you will get the gold price.

Now, if you take it to a jeweller he discounts it for some reason - a sort of a disloyalty penalty for not coming to him in the first place- the discounts I am told are typically 10 per cent. So gold has to generate a nominal 20 per cent return (10 per centage points for wastage like penalty and 10 per centage points in actual return) to make it even comparable to fixed deposits in banks. That is where the catch is. Historically gold has not generated that kind of return over extended periods. The last five years has been an exception with a mouth watering 24 per cent annualised return. Will it be so now in the light of the global uncertainties? Hard to say. But there it is.