Perspectives on the global economic meltdown- (Nov 28 2010)

Re: Perspectives on the global economic meltdown- (Nov 28 20

Few weeks back there was a discussion about billionnair's fears. Something in those lines...

The Other Barbarians at the Gates

The Other Barbarians at the Gates

It’s strange to imagine someone like Greene, who counts Mike Tyson as a close friend, and who has a streak that caused the L.A. party girls to refer to him as �Mean Jeff Greene,� feeling vulnerable. It’s hard to think of any superrich person as vulnerable, just as it’s hard to think that a bear with outstretched claws and giant teeth is more afraid than you are. But over the past few months, it’s become clear that rich people are very, very afraid. Sometimes it feels like this was the main accomplishment of Occupy Wall Street: a whole lot of tightened sphincters. It’s not a stretch to say many residents of Park Avenue harbor vivid fears of a populist revolt like the one seen in The Dark Knight Rises, in which they cower miserably under their sideboards while ragged hordes plunder the silver.

�This is my fear, and it’s a real, legitimate fear,� Greene says, revving up the engine. �You have this huge, huge class of people who are impoverished. If we keep doing what we’re doing, we will build a class of poor people that will take over this country, and the country will not look like what it does today. It will be a different economy, rights, all that stuff will be different.

Re: Perspectives on the global economic meltdown- (Nov 28 20

The above article focuses on shale gas economics from EU standpoint. This does not mean that shale will not be of economic value to US/China/Argentina etc. At-least it changes equation somewhat as far as energy sources are concerned where till recently we did not have choice except few authoritarian regimes. Some optimism is better then none.

Re: Perspectives on the global economic meltdown- (Nov 28 20

^^ There are just two major challenges to Shale if it can be overcome then it will be major source of energy.

1. High extraction cost making it expensive fuel over natural gas unless heavily subsidised by government.

2. Risk of Ground water contamination specially for countries that rely on ground water as source of supply.

3. Last but not the least no one know how fracking or if fracking has long term geological impact.

1. High extraction cost making it expensive fuel over natural gas unless heavily subsidised by government.

2. Risk of Ground water contamination specially for countries that rely on ground water as source of supply.

3. Last but not the least no one know how fracking or if fracking has long term geological impact.

Re: Perspectives on the global economic meltdown- (Nov 28 20

http://www.firstpost.com/investing/pimc ... 02529.html

pimco's gross says equities/bonds will give very low returns going forward.

pimco's gross says equities/bonds will give very low returns going forward.

Re: Perspectives on the global economic meltdown- (Nov 28 20

http://www.blogging4jobs.com/work/baby- ... workforce/

The Generations and Change in our WorkplaceBrace yourself, HR — a big shift in the workforce is coming. You are facing a talent gap like never before seen, and the only way to overcome this gap is to find, attract, and engage the talent your organizations’ need to sustain their operations and grow their business. But before we get into what needs to done, let’s address what’s happening.

In the past, general population trends have also been reflected in the working population and the generations. As Tammy Erickson pointed out in a recent article, we have lived in a pyramid structure. The pyramid’s base included the biggest and youngest set of working people, the narrowing middle and top sections progressed from middle aged to older working class.

With the large population of 81 million Baby Boomers in the workforce and their desire to continue in their jobs and careers for various reasons, an inverted pyramid structure is forming.

However, two other major classes are influencing the shape of the current workforce. Gen Xers totaling 46 million are mid-way through their careers and Geneneration Y, or Millennials, comprising 85 million are entering their careers, so instead of reflecting an inverted pyramid, the population and workforce in general is more of an hourglass shape.

Baby Boomer’s at Work

Aside from the obvious Baby Boomer phenomenon and the population expansion giving rise to the huge population of Millennials, the recession of 2007-08 and lingering economic stresses have influenced the formation of this new workforce. Baby Boomers are now looking to stay in the workforce past their retirement age. In fact, one in four Baby Boomers polled claimed they will never retire from work. Many lost pensions, retirement savings, and investments during the financial crisis…and they now must continue working because they have to. Others are simply still working because they can and they still want to!

Baby Boomers weren’t the only ones affected in the recession. Companies were also fighting financial cuts and constraints while still striving to achieve the bottom line. The line item with the most significant impact on a company’s profit had to be reduced. Mass layoffs and consolidation of positions were implemented in an effort to preserve growth. Everyone has been affected, and the Millennials are feeling the effects now in a big way. Though unemployment is at its highest rate in years, and with approximately 3.7 million open, advertised positions, companies are still being increasingly, impossibly, selective in their searches. They want to recruit only the already employed who have the required experience to perform incredibly challenging roles — leaving experienced but currently unemployed and entry-level potential candidates out of the running for many positions.

With Baby Boomers having no place outside the workforce and Millennials not having a place in the workforce, how does HR address this current polarizing trend?

Solutions to Generational & Workforce Staffing

The solution is addressing the needs of the entire organization in your talent selection, workforce staffing, and training regardless of generation or generational influences. While you may never be able to satisfy everyone in their roles, it is leadership’s imperative to find the right people for the company and fit them into the best roles. When you have the right people with the right skills, train them. Don’t neglect the induction process. Match them to experienced individuals and include them on project teams to immerse them into the company culture, processes, and systems.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown- (Nov 28 20

Raúl Ilargi Meijer: The Central Libor Question: Do We Want to Save Our Banks or Our Societies?

Worthwhile read. Sample this...

Worthwhile read. Sample this...

The last line sounds very much like our uber sekular pols and their media pals in Des.There is no segment of private industry that has grabbed more power than the banking industry… Banks will offer up individual traders as lambs for the sacrificial chopping block, and lawmakers will declare that justice has been done. The traders can protest as much as they want that they were not operating in a vacuum, and that their superiors were very much aware of their machinations, if not outright demanding them, but it will make no difference. Bob Diamond was thrown to the wolves so Mervyn King could stay where he is. King himself made sure of it …

The underlying idea for Libor was always: “by the bankers, for the bankers”. And if anyone involved in setting up Libor back in 1985 now wishes to claim that they had no idea that allowing banks to make up the rates at which they borrowed out of thin air created scope for manipulation, that would insult everyone’s intelligence including yours and mine. The problem is that in today’s climate, this doesn’t keep them from making precisely such claims. And that is very much part of a trend. It has increasingly become acceptable for bankers and politicians alike to deny anything flat out and see what happens, knowing their friends have their backs.

Re: Perspectives on the global economic meltdown- (Nov 28 20

More on International western first wold standards:

After HSBC (per earlier post), now it appears that Standard Chartered 'hid' thousands of transactions over 10 years worth about $$ 250 Billions (only?) on oil trade with Iran.

Standard Chartered Iran allegations another blow for banking

Hidden in the report

After HSBC (per earlier post), now it appears that Standard Chartered 'hid' thousands of transactions over 10 years worth about $$ 250 Billions (only?) on oil trade with Iran.

Standard Chartered Iran allegations another blow for banking

Systematically disguised but first world banking so what to do?In the latest US move against foreign banks dealing with Iran, the New York State Department of Financial Services (DFS) threatened London-based Standard Chartered with fines and the suspension of its licence.

Regulators accused the group of hiding more than $250 billion in illegal transactions for almost a decade, alleging it systematically disguised foreign exchange deals with Iran that potentially opened the US banking system to terrorists and criminals.

Standard Chartered said it "strongly rejects ... the portrayal of facts as set out"

Hidden in the report

In this back and forth of charges and rejection of charges, Standard Chartered rejects US Iran transaction claimsMeanwhile the notorious Libor rate-rigging affair has rocked Britain's Barclays bank and threatens to spread to financial institutions worldwide.

So while India has to cut back supplies of oil from Iran to avoid sanctions on oil firms, first world international western banks as usual just got to 'hide' transactions, for later trade off between a little penalty and may be some PR exercises.insisting that "99.9pc of the transactions" complied with regulations.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Fed should buy as many bonds as necessary: Fed Officer - Moneycontrol

It seems QE3 is coming, and expecting QE4 and QE5. The reason is as long as western economies are down, and if still China holds it USD reserves, Western nations are fearing that it crown jewels like GE, financial and commodities or nerve points like consumer goods companies will be in Chinese hands. The only option left for western economies, either drag Chinese economy down and make sure its USD reserves are worthless or evaporated, till that time expect QEx and European bailouts regularly. The Chinese drag-down may come in geopolitical heat up (sanctions) or spectacular Chinese breakdown, in which I favor former, because Chinese are behaving arrogantly with all their neighbors. JMT.

It seems QE3 is coming, and expecting QE4 and QE5. The reason is as long as western economies are down, and if still China holds it USD reserves, Western nations are fearing that it crown jewels like GE, financial and commodities or nerve points like consumer goods companies will be in Chinese hands. The only option left for western economies, either drag Chinese economy down and make sure its USD reserves are worthless or evaporated, till that time expect QEx and European bailouts regularly. The Chinese drag-down may come in geopolitical heat up (sanctions) or spectacular Chinese breakdown, in which I favor former, because Chinese are behaving arrogantly with all their neighbors. JMT.

Re: Perspectives on the global economic meltdown- (Nov 28 20

I remember that some one named John Snow (a long back) mentioned about deliberate attempts by Feds and GOTUS to pump money as much as possible to devalue the holdings of PRC, Russia( oil revenues), (basically BRICS). That same person also predicted that relative to US currency to keep parity all other exporting countries to US will allow their currencies to devalue. This can be evidenced by the devaluation INR visa vis USD and as far as the PRC goes it will pump its investments of Dollars where it will get the max Bang and also assures captive consumption of its goods.

And where does such market exist? of course in Africa that's why PRC will go aggressive in Mineral rich SA, Namibia, Dem Rep of Congo, Nigeria Kenya Mozambique etc.

Most of the food in France, Netherlands Belgium England comes from Africa The vegetables Fruits legumes and fresh cut flowers of course clementine and citrus fruit also comes from Israel

The New Kids on the block will all be from Africa both as consumers and producers of Mineral and natural resources.

If I was younger I would start in Africa some industry and even Agriculture

And where does such market exist? of course in Africa that's why PRC will go aggressive in Mineral rich SA, Namibia, Dem Rep of Congo, Nigeria Kenya Mozambique etc.

Most of the food in France, Netherlands Belgium England comes from Africa The vegetables Fruits legumes and fresh cut flowers of course clementine and citrus fruit also comes from Israel

The New Kids on the block will all be from Africa both as consumers and producers of Mineral and natural resources.

If I was younger I would start in Africa some industry and even Agriculture

Re: Perspectives on the global economic meltdown- (Nov 28 20

A form of "civil disobedience" protest is developing in LA area. The person who started this is an artist named Alex Schaefer, inspired by Max Keiser. Looks like more people are joining.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Looks like Germany is preparing to handle any civil unrest that may occur due to economic uncertainties.

German army's crisis role widened

German army's crisis role widened

The German military will in future be able to use its weapons on German streets in an extreme situation, the Federal Constitutional Court says.

The ruling says the armed forces can be deployed only if Germany faces an assault of "catastrophic proportions", but not to control demonstrations.

The decision to deploy forces must be approved by the federal government.

Severe restrictions on military deployments were set down in the German constitution after Nazi-era abuses.

The court says the military still cannot shoot down a hijacked passenger plane - fighter jets would have to intercept the plane and fire warning shots to force it to land.

After World War II the new constitution ruled that soldiers could not be deployed with guns at the ready on German soil, the BBC's Stephen Evans reports from Berlin.

The court has now changed that, saying troops could be used to tackle an assault that threatens scores of casualties.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Preparations of the inevitable

Re: Perspectives on the global economic meltdown- (Nov 28 20

most of these nations have a high police:civilian ratio anyway. much higher than india atleast.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Soros unloads all finance stocks and loads up gold

Gurus .. getting a lot of gloom and doom emails in my mailbox these days. The sentiment seems to turning bearesh these days with a section of folks wanting to move to gold due to US printing paper dollars.

Yet hyper inflation is not yet with us. So my question is what is the opposite argument - why is inflation in the US not yet reached crisis proportions? Is it that the productivity of US labor is at all time high (wringing blood out of stone)? Or the low interest rates also putting a clamp on this ? Most of us think of ourselfs as a middle of the road kind of a guys (working stiffs) when it comes to D&G scenarios but dont want to be left in the dust either when it happens again as it did with the housing bust (still digging out of that one..)

Gurus .. getting a lot of gloom and doom emails in my mailbox these days. The sentiment seems to turning bearesh these days with a section of folks wanting to move to gold due to US printing paper dollars.

Yet hyper inflation is not yet with us. So my question is what is the opposite argument - why is inflation in the US not yet reached crisis proportions? Is it that the productivity of US labor is at all time high (wringing blood out of stone)? Or the low interest rates also putting a clamp on this ? Most of us think of ourselfs as a middle of the road kind of a guys (working stiffs) when it comes to D&G scenarios but dont want to be left in the dust either when it happens again as it did with the housing bust (still digging out of that one..)

Re: Perspectives on the global economic meltdown- (Nov 28 20

Soros does a lot of disinformation too.

As long as new round of QE is not announced, I think cash is king. Question is how do you preserve the cash and you don't know which bank is going to crash next.

As long as new round of QE is not announced, I think cash is king. Question is how do you preserve the cash and you don't know which bank is going to crash next.

In spite of this, why does Germany need army inside the borders? May be, they expect things to turn much ugly.Singha wrote:most of these nations have a high police:civilian ratio anyway. much higher than india atleast.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Things are turning ugly

Germany may be the country that brings the euro crashing down

Germany may be the country that brings the euro crashing down

http://www.telegraph.co.uk/comment/9484 ... -down.htmlReported daily in such papers as Die Welt, Handelsblatt and Der Spiegel, a succession of politicians, financiers and commentators have concluded that, with Greece about to go bankrupt and Spain and Italy to follow, enough is enough. Certainly, they argue, Greece must be allowed to leave the euro. But so, many add, must Spain, Italy and others. Indeed, so dire has this crisis become – with one senior politician estimating Germany’s potential liability at more than $1 trillion – that voices are now being raised to say that the only practical solution to this mess would be for Germany itself to abandon the euro. The rest of the eurozone could thus be left to sink or swim with a currency which, without Germany’s backing, would face a massive devaluation.

Re: Perspectives on the global economic meltdown- (Nov 28 20

^ More detail in reports today. From reuters link

ECB denies taking decisions per mandate, but few details are reported link

Does a little slowdown in Germany look temporary since costs incurred from aid for euro zone rescues is not periodic?The Bundesbank remains critical of the purchase of euro system sovereign bonds, which comes with considerable risks for stability

..

The Bundesbank retains substantial influence within Germany and across financial markets due to its inflation fighting credentials, but it is unlikely it could scupper Draghi's plan, given the German central bank is only one of 17 constituents at the ECB.

..

As a pre-requisite for any ECB bond buying to help a troubled euro zone state, the central bank wants the government concerned to request aid from the bloc's bailout funds and to fulfill the economic conditions attached to any help.

..

The Bundesbank on Monday also warned that Germany's economy, which has remained resilient through most of the euro zone's debt crisis and posted solid growth, could suffer more in the second half of this year.

...

While the (German) economy put in a strong performance in the first three months of this year, growth slowed to 0.3 percent in the second quarter and recent data have shown manufacturing orders, industrial output, imports and exports all dropping.

..

"The trust in German state finances is an important stabilizing factor in the current crisis but is not unshakeable," the Bundesbank wrote.

..

But the Bundesbank said rising tax revenues, lower interest rates on German debt and lower expenses on unemployment could not offset costs incurred from aid for euro zone rescues and the liquidation of state-backed lender WestLB. WDLG.UL

ECB denies taking decisions per mandate, but few details are reported link

Germany's Der Spiegel magazine reported in its Monday edition that the ECB was considering setting interest rate thresholds for each of the euro-zone's 17 countries for the future purchase of government bonds, a move that would be aimed at preventing borrowing costs of high-debt countries such as Spain and Italy from spiraling to unsustainable levels.

..

The note also responded to a call by Spanish Finance Minister Luis de Guindos that the ECB commit to massive, open-ended purchases of Spanish government bonds to support the market.

"As far as recent statements by government officials are concerned, it is also wrong to speculate on the shape of future ECB interventions," the email said.

..

The Spiegel report on possible ECB interest-rate caps caused Italian and Spanish bond yields early Monday to fall to their lowest levels in a month, while haven German Bunds dived. The ECB's clarifying statement later in the morning checked the move, also triggering a new drop in the euro against major trading currencies.

-

abhischekcc

- BRF Oldie

- Posts: 4277

- Joined: 12 Jul 1999 11:31

- Location: If I can’t move the gods, I’ll stir up hell

- Contact:

Re: Perspectives on the global economic meltdown- (Nov 28 20

Right now, all of that money is being absorbed into supporting the derivatives trade. If that 780 trillion dollar mountain of speculation had unwinded, ALL of west would have become bankrupt.Jayram wrote:Soros unloads all finance stocks and loads up gold

Gurus .. getting a lot of gloom and doom emails in my mailbox these days. The sentiment seems to turning bearesh these days with a section of folks wanting to move to gold due to US printing paper dollars.

Yet hyper inflation is not yet with us. So my question is what is the opposite argument - why is inflation in the US not yet reached crisis proportions? Is it that the productivity of US labor is at all time high (wringing blood out of stone)? Or the low interest rates also putting a clamp on this ? Most of us think of ourselfs as a middle of the road kind of a guys (working stiffs) when it comes to D&G scenarios but dont want to be left in the dust either when it happens again as it did with the housing bust (still digging out of that one..)

Once all of the bets made in that trade has been secured with US gobermint money, the tide will reverse and if the Fed is not careful, hyperinflation will hit US and global economy like a bullet train at peak speed. Hyperinflation will mean that the US has unofficially defaulted on its USD 65 million (total value at current prices) liability in the form of foreign debts, pensions to be paid, etc. So, hyperinflation will NOT be bad for the US elites.

Re: Perspectives on the global economic meltdown- (Nov 28 20

May be, this has to be in IT thread....

Just a perspective....

After Selling His Startup For $1.2 Billion, Yammer CEO Calls The End Of Silicon Valley

Just a perspective....

After Selling His Startup For $1.2 Billion, Yammer CEO Calls The End Of Silicon Valley

-

brihaspati

- BRF Oldie

- Posts: 12410

- Joined: 19 Nov 2008 03:25

Re: Perspectives on the global economic meltdown- (Nov 28 20

The greenback is delinked form geld since Nixon. Without being tied up to a scarce resource, money and speculative value perhaps cannot be separated anymore from product supported value. The US economy is in the exact same dynamics that the Japanese have been stretching out from late 70's. Controlled paperization postpones the inevitable.abhischekcc wrote:Right now, all of that money is being absorbed into supporting the derivatives trade. If that 780 trillion dollar mountain of speculation had unwinded, ALL of west would have become bankrupt.Jayram wrote:Soros unloads all finance stocks and loads up gold

Gurus .. getting a lot of gloom and doom emails in my mailbox these days. The sentiment seems to turning bearesh these days with a section of folks wanting to move to gold due to US printing paper dollars.

Yet hyper inflation is not yet with us. So my question is what is the opposite argument - why is inflation in the US not yet reached crisis proportions? Is it that the productivity of US labor is at all time high (wringing blood out of stone)? Or the low interest rates also putting a clamp on this ? Most of us think of ourselfs as a middle of the road kind of a guys (working stiffs) when it comes to D&G scenarios but dont want to be left in the dust either when it happens again as it did with the housing bust (still digging out of that one..)

Once all of the bets made in that trade has been secured with US gobermint money, the tide will reverse and if the Fed is not careful, hyperinflation will hit US and global economy like a bullet train at peak speed. Hyperinflation will mean that the US has unofficially defaulted on its USD 65 million (total value at current prices) liability in the form of foreign debts, pensions to be paid, etc. So, hyperinflation will NOT be bad for the US elites.

-

brihaspati

- BRF Oldie

- Posts: 12410

- Joined: 19 Nov 2008 03:25

Re: Perspectives on the global economic meltdown- (Nov 28 20

Comparing this with the Indian economy dhaaga - a puchh : all that is being lamented here for the "west", came long after all sorts of reforms in the west that we want desperately for the Indian economy. How do people reconcile the two?

Re: Perspectives on the global economic meltdown- (Nov 28 20

Theoretically the situation propelling the out come of Japan of 1970s and 1980s could be true to current US situation but the parameters are vastly different to predict the outcomes

1) Japan physical size and natural resource are minuscule compared US

2) Yen was never a currency of world trade where as USD is

3) Japan's consumption of economic resources is minuscule compared to US

Most importantly US will go not any length to enforce supremacy of USD including regime change, subversion, covert or overt wars

So even the huge printing presses in Canada which prints USD currency can not change the dynamic so easily also there is a world wide vested interest in making USD buoyant even if it's sinking. Shall we call this vested interest

1) Japan physical size and natural resource are minuscule compared US

2) Yen was never a currency of world trade where as USD is

3) Japan's consumption of economic resources is minuscule compared to US

Most importantly US will go not any length to enforce supremacy of USD including regime change, subversion, covert or overt wars

So even the huge printing presses in Canada which prints USD currency can not change the dynamic so easily also there is a world wide vested interest in making USD buoyant even if it's sinking. Shall we call this vested interest

-

Theo_Fidel

Re: Perspectives on the global economic meltdown- (Nov 28 20

Bji,

I would put it this way.

The USA is a horrible system for ordinary folks. Except all the other systems are worse. From Indias perspective we need a good safety net certainly better than USA as we gradually follow their example.

The unrelated point is the debt crisis is complex. There are 2 sets of countries.

Folks like Greece and Ireland have no business pretending to have a higher income than Germany.

The second set USA, Germany, France , etc are essentially solvent. The fight is over a refusal to pay their debts. The USA would rather spend $60 Billion on dog/cat food than pay $50 billion to guarantee healthcare to all the old folks.

I would put it this way.

The USA is a horrible system for ordinary folks. Except all the other systems are worse. From Indias perspective we need a good safety net certainly better than USA as we gradually follow their example.

The unrelated point is the debt crisis is complex. There are 2 sets of countries.

Folks like Greece and Ireland have no business pretending to have a higher income than Germany.

The second set USA, Germany, France , etc are essentially solvent. The fight is over a refusal to pay their debts. The USA would rather spend $60 Billion on dog/cat food than pay $50 billion to guarantee healthcare to all the old folks.

Re: Perspectives on the global economic meltdown- (Nov 28 20

I am no economics expert but I have observed that Americans spend a lot on medical insurance but are stubborn to pay less money for universal healthcare. No wonder the system fleeces them so efficiently.

Hope India makes better rules where the poor can enjoy healthcare without paying exhorbitant prices. So far India has done well in keeping drug costs low making it a global hub for pharmaceuticals.

Multinational systems like NATO, EU work only when bigger nations are able to pull smaller nations out of trouble. When the strain becomes too large for the powerful nations to handle, the system collapses. This might happen if Germany fails to pay for others' mistakes.

Hope India makes better rules where the poor can enjoy healthcare without paying exhorbitant prices. So far India has done well in keeping drug costs low making it a global hub for pharmaceuticals.

Multinational systems like NATO, EU work only when bigger nations are able to pull smaller nations out of trouble. When the strain becomes too large for the powerful nations to handle, the system collapses. This might happen if Germany fails to pay for others' mistakes.

-

brihaspati

- BRF Oldie

- Posts: 12410

- Joined: 19 Nov 2008 03:25

Re: Perspectives on the global economic meltdown- (Nov 28 20

If you take all those arguments together about relative sizes and currency ownership impact, it makes it even more problematic for USA. Beyond a certain point, unless you deflate you cannot sustain speculative paper money. The larger the size of the unsupported money - the more difficult it is.pentaiah wrote:Theoretically the situation propelling the out come of Japan of 1970s and 1980s could be true to current US situation but the parameters are vastly different to predict the outcomes

1) Japan physical size and natural resource are minuscule compared US

2) Yen was never a currency of world trade where as USD is

3) Japan's consumption of economic resources is minuscule compared to US

Most importantly US will go not any length to enforce supremacy of USD including regime change, subversion, covert or overt wars

So even the huge printing presses in Canada which prints USD currency can not change the dynamic so easily also there is a world wide vested interest in making USD buoyant even if it's sinking. Shall we call this vested interest

-

brihaspati

- BRF Oldie

- Posts: 12410

- Joined: 19 Nov 2008 03:25

Re: Perspectives on the global economic meltdown- (Nov 28 20

I would not be so sure. The debt they hold is against unpayable resources. The reason they invested in those stuff that became debts - was because their own growth factors were falling. The fall could be related to a host of factors, some demographic, some political - but most of it a financial compulsion for profitability no longer sustainable within Europe. There you have the results of whole-sale skills-tech-education upgradation result. No not being sarcastic. Just asking to have a pause and think of the consequences of our decisions in a mad rush to copy propaganda solutions.Theo_Fidel wrote:Bji,

I would put it this way.

The USA is a horrible system for ordinary folks. Except all the other systems are worse. From Indias perspective we need a good safety net certainly better than USA as we gradually follow their example.

The unrelated point is the debt crisis is complex. There are 2 sets of countries.

Folks like Greece and Ireland have no business pretending to have a higher income than Germany.

The second set USA, Germany, France , etc are essentially solvent. The fight is over a refusal to pay their debts. The USA would rather spend $60 Billion on dog/cat food than pay $50 billion to guarantee healthcare to all the old folks.

Re: Perspectives on the global economic meltdown- (Nov 28 20

BJi

Deflate against what?

It's already happened

Gold was $285 per Troy oz in 1996 today it's at $1500.00 plus and going higher

Oil in 1996 was at $18 per barrel it's now hovering $95 plus

Milk was 0.87 per gallon

I repeat there is no intrinsic value in dollar ( at the current rate)

To be in the race all currencies are sliding down relative to USD

Hence the commodities will go up to point

But as long as US remains the largest consumer of resources, the dollar relative to other currencies will be priced higher, even though in absolute terms it's value is and will remain lower than yesterday's dollar, as long as the Canadian printing presses are busy and free availability of dollars worl wide continues.

Deflate against what?

It's already happened

Gold was $285 per Troy oz in 1996 today it's at $1500.00 plus and going higher

Oil in 1996 was at $18 per barrel it's now hovering $95 plus

Milk was 0.87 per gallon

I repeat there is no intrinsic value in dollar ( at the current rate)

To be in the race all currencies are sliding down relative to USD

Hence the commodities will go up to point

But as long as US remains the largest consumer of resources, the dollar relative to other currencies will be priced higher, even though in absolute terms it's value is and will remain lower than yesterday's dollar, as long as the Canadian printing presses are busy and free availability of dollars worl wide continues.

-

Theo_Fidel

Re: Perspectives on the global economic meltdown- (Nov 28 20

I'm not so sure the growth factors are falling, esp. in USA & Germany type economies. Take a look at this chart below. USA GDP today is higher than 2008. The real problem is that more of the wealth is being confiscated by the rich so the poor are forced into financial games to pay the bills. The economy itself however is productive and wealthy enough to pay the bills. It is the refusal to pay for your commitments that cause all these battles.brihaspati wrote:was because their own growth factors were falling. The fall could be related to a host of factors, some demographic, some political - but most of it a financial compulsion for profitability no longer sustainable within Europe. There you have the results of whole-sale skills-tech-education upgradation result. No not being sarcastic. Just asking to have a pause and think of the consequences of our decisions in a mad rush to copy propaganda solutions.

AFA India goes, we are committed bhai. There was a time we wiffled and waffled but now we are all in. Our die was cast the moment we allowed cable TV/Star Channels and Rupert Murdoch into nadu in 1990. Everyone has a new aspiration since then. Everyone wants to live like dilli billi. All we can do is clear the direction appropriately. My opinion is get the safety net in right now, it will get much harder later.

Re: Perspectives on the global economic meltdown- (Nov 28 20

One problem above graph doesn't show is that after 2008, US economy grew average at around 1%, but budget deficit grew at 10% every year. That is, had the government not borrowed 10% of GDP, it would have shrank 9%, at least!!! The 10% budget deficit is still going strong with no end in sight. This is unsustainable and could even enter a dangerous territory.

Biggest mistake people who always talk about GDP growth make is not talking about debt growth. Anybody can appear rich by taking more debt.

Biggest mistake people who always talk about GDP growth make is not talking about debt growth. Anybody can appear rich by taking more debt.

-

brihaspati

- BRF Oldie

- Posts: 12410

- Joined: 19 Nov 2008 03:25

Re: Perspectives on the global economic meltdown- (Nov 28 20

Theo ji,

had no intention to go technical. It would just take up too much space. Just wanted to say that the overall growth has to be discounted by the borrowings not based on current transient assessment. Sometimes, current borrowings are redeemed in the future - like a properly repaid bank-loan - sort of. Problem becomes when the foreseeable time horizon, and the projected internal growth scenario does not add up to the forecast growth over the time span of repayment.

Europe's profitability had begun to decline from the early 90's - masked to a great extent by the Euro transition process, and heavy capital transfers into the peripheral economies, that fueled excessive heating up. But there was a reason that the capital flowed into such non-basic sectors of the economy such as real estate speculations. Europes main industries were losing out on internal profitability - partly due to a shrinking of the internal market - which in turn shrank because of a demographic downturn in natives and political pressures against immigration of the wrong colour or ideology as well as keeping up wages of natives, and partly because of the fact that higher efficiency was achieved at the cost replacement of labour, even high skilled labour.

This makes the European model hostage to cheap energy and investments in less "educated" economies with cheaper labour and less "high skills". If those strategies do not work out - speculative profit hunting is the onlee way left.

had no intention to go technical. It would just take up too much space. Just wanted to say that the overall growth has to be discounted by the borrowings not based on current transient assessment. Sometimes, current borrowings are redeemed in the future - like a properly repaid bank-loan - sort of. Problem becomes when the foreseeable time horizon, and the projected internal growth scenario does not add up to the forecast growth over the time span of repayment.

Europe's profitability had begun to decline from the early 90's - masked to a great extent by the Euro transition process, and heavy capital transfers into the peripheral economies, that fueled excessive heating up. But there was a reason that the capital flowed into such non-basic sectors of the economy such as real estate speculations. Europes main industries were losing out on internal profitability - partly due to a shrinking of the internal market - which in turn shrank because of a demographic downturn in natives and political pressures against immigration of the wrong colour or ideology as well as keeping up wages of natives, and partly because of the fact that higher efficiency was achieved at the cost replacement of labour, even high skilled labour.

This makes the European model hostage to cheap energy and investments in less "educated" economies with cheaper labour and less "high skills". If those strategies do not work out - speculative profit hunting is the onlee way left.

-

member_20292

- BRF Oldie

- Posts: 2059

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

^^^ Theo fidel jee, and B-jis and all the other bade bhaiyya jees.

Some economic questions need answering.

Tell me one thing. The Indian economy is growing at 5-6% per annum and has earlier grown at 8-9% p/a depending upon how good the global economy was at that point of time.

Comparing the US and the EU, why is the US that much better in economic terms than the EU?

Their gdp per capita is better. They work longer hours, more days, pay more per person on health care, as well as have worse health on an average. Is that the reason in simple terms?

Another question. Why is the current account deficit so important to us. Why do we care that we import more than we export ?

My personal belief is that the best government is one that stays the heck out of the hair of its subjects.

If that's the case, then how can the GOI get in place mechanisms that will allow the common citizenry of India to take care of the roads in their own cities? Toll booths are painful, as the one on the NH 8 shows me daily.

One tech enabled mechanism could be that a chip is affixed to most cars and the distance that the car travels, is subtracted from the chip. The chip is an ordinary prepaid GSM chip which allows for balance to be deducted from it per use.

Thoughts?

Some economic questions need answering.

Tell me one thing. The Indian economy is growing at 5-6% per annum and has earlier grown at 8-9% p/a depending upon how good the global economy was at that point of time.

Comparing the US and the EU, why is the US that much better in economic terms than the EU?

Their gdp per capita is better. They work longer hours, more days, pay more per person on health care, as well as have worse health on an average. Is that the reason in simple terms?

Another question. Why is the current account deficit so important to us. Why do we care that we import more than we export ?

My personal belief is that the best government is one that stays the heck out of the hair of its subjects.

If that's the case, then how can the GOI get in place mechanisms that will allow the common citizenry of India to take care of the roads in their own cities? Toll booths are painful, as the one on the NH 8 shows me daily.

One tech enabled mechanism could be that a chip is affixed to most cars and the distance that the car travels, is subtracted from the chip. The chip is an ordinary prepaid GSM chip which allows for balance to be deducted from it per use.

Thoughts?

-

Theo_Fidel

Re: Perspectives on the global economic meltdown- (Nov 28 20

Folks should not fall for Faux News propaganda onlee...

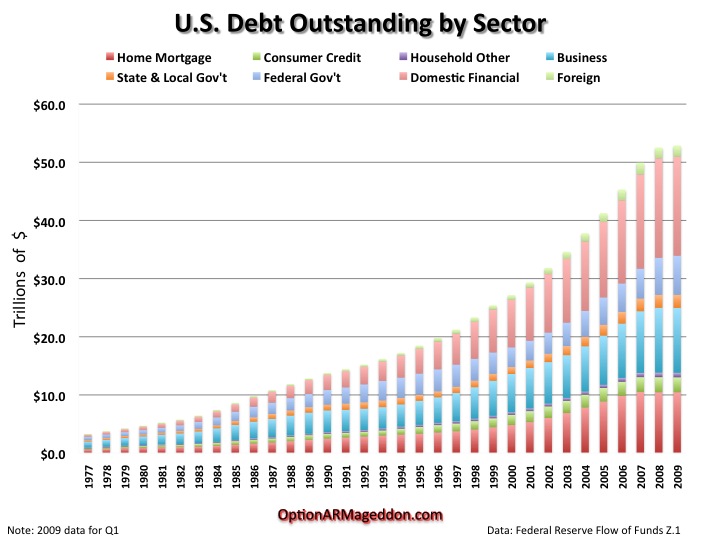

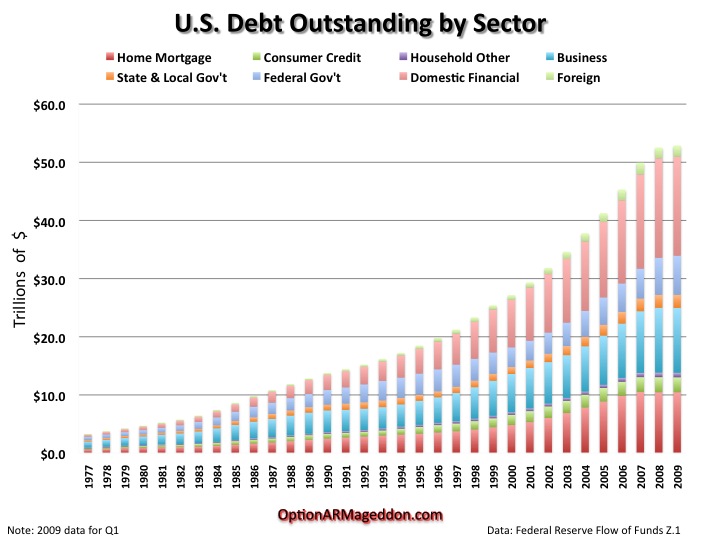

What matters is not Public debt but total debt.

See the chart below.

As GOTUS has taken on debt all other sectors of USA have cut debt. In effect the USA has the capacity to service its debts and this capacity has improved as the total outstanding debt has actually come down since 2008. The years massive debt growth were from 1980 Reagan to Bush 1 to Clinton to Bush 2. Since then total debt has been quite stable and even declined a bit.

The problem is a complete unwillingness to take responsibility, cut back on spas/massages, cruise vacations and palace construction by those who have money in the USA, meaning the top 5%. This is what people mean when they say the USA is morally bankrupt and in decline. This is what the Roman empire turned into, bread and circuses, remember....

There was a statistic some where that just the Caribbean cruise industry is enough to make Medicare solvent. The problem is the rich refuse to take responsibility for the country. They want all the benefits but none of the liabilities of being USA citizen. Right now the USA has a presidential candidate who made his millions in USA and then promptly shifted his money out of country to avoid paying for his liabilities. He is proud of paying 13% in taxes when this tax rate is not enough to even pay for the military and the wars!

What matters is not Public debt but total debt.

See the chart below.

As GOTUS has taken on debt all other sectors of USA have cut debt. In effect the USA has the capacity to service its debts and this capacity has improved as the total outstanding debt has actually come down since 2008. The years massive debt growth were from 1980 Reagan to Bush 1 to Clinton to Bush 2. Since then total debt has been quite stable and even declined a bit.

The problem is a complete unwillingness to take responsibility, cut back on spas/massages, cruise vacations and palace construction by those who have money in the USA, meaning the top 5%. This is what people mean when they say the USA is morally bankrupt and in decline. This is what the Roman empire turned into, bread and circuses, remember....

There was a statistic some where that just the Caribbean cruise industry is enough to make Medicare solvent. The problem is the rich refuse to take responsibility for the country. They want all the benefits but none of the liabilities of being USA citizen. Right now the USA has a presidential candidate who made his millions in USA and then promptly shifted his money out of country to avoid paying for his liabilities. He is proud of paying 13% in taxes when this tax rate is not enough to even pay for the military and the wars!

-

member_20292

- BRF Oldie

- Posts: 2059

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

^^^ home financial debt and the home mortgage debts are the largest in that image.

Wonder how the graph for China looks like? India?

Wonder how the graph for China looks like? India?

Re: Perspectives on the global economic meltdown- (Nov 28 20

The above graph by Theo shows that great GDP growth is actually provided by equally great growth in total debt.

Private debt is what created the financial crisis of 2008. As sovereign debt is growing now, it will have its own consequence in future.

Private debt is what created the financial crisis of 2008. As sovereign debt is growing now, it will have its own consequence in future.

-

Theo_Fidel

Re: Perspectives on the global economic meltdown- (Nov 28 20

Another data point...

http://www.google.com/hostednews/ap/art ... e623c3b662

http://www.google.com/hostednews/ap/art ... e623c3b662

In 1970, the share of U.S. income that went to the middle class was 62 percent, while wealthier Americans received just 29 percent. But by 2010, the middle class garnered 45 percent of the nation's income, tying a low first reached in 2006, compared to 46 percent for upper-income Americans.

Since 2000, the median income for America's middle class has fallen from $72,956 to $69,487.

—Who's to blame: Of the self-described middle-class Americans who say it is more difficult now than it was a decade ago to maintain a standard of living, 62 percent say "a lot" of the blame lies with Congress. About 54 percent say the same about banks and financial institutions, while 47 percent say large corporations, 44 percent point to the Bush administration, 39 percent cite foreign competition and 34 percent find fault with the Obama administration. About 8 percent say the middle class itself deserves a lot of the blame.