Perspectives on the global economic meltdown- (Nov 28 2010)

Re: Perspectives on the global economic meltdown- (Nov 28 20

PSU exist in China and Russia in abundance and they seem to perform well may not as great as those MNC.

PSU is not the real problem but the political patronage and appointments based on Corrupt Practices that goes on with every major and minor transfer , tendering and appointment in these organization needless to say merits have little say in such appointments. In the end leading to lower performance by these PSU.

If they can manage their PSU well they can get good results but in the end it is their own greed that brings the entire system down and see no reason why they would hurt their own personal economic interest by making PSU more efficient or dilute them for Pvt Players.

PSU is not the real problem but the political patronage and appointments based on Corrupt Practices that goes on with every major and minor transfer , tendering and appointment in these organization needless to say merits have little say in such appointments. In the end leading to lower performance by these PSU.

If they can manage their PSU well they can get good results but in the end it is their own greed that brings the entire system down and see no reason why they would hurt their own personal economic interest by making PSU more efficient or dilute them for Pvt Players.

Re: Perspectives on the global economic meltdown- (Nov 28 20

The Chinese SOE issue is a significant topic in itself. Yes, they have some really good state backed entities. But they went through a painful restructuring process in the mid 1990s, where they closed or merged several, putting millions out of until then 'safe' lifetime jobs in those SOEs.

https://www.mtholyoke.edu/courses/sgabriel/soe.htm

http://www.clb.org.hk/en/content/reform ... ises-china

Even then, the SOEs aren't paragons of excellence as a collective. To give credit where it's due, they actually did some painful reforms, though they were unconstrained by such pesky things as labor unions and voting blocs.

https://www.mtholyoke.edu/courses/sgabriel/soe.htm

http://www.clb.org.hk/en/content/reform ... ises-china

Even then, the SOEs aren't paragons of excellence as a collective. To give credit where it's due, they actually did some painful reforms, though they were unconstrained by such pesky things as labor unions and voting blocs.

Re: Perspectives on the global economic meltdown- (Nov 28 20

About UK external assets, the link lead to this link

How much of UK assets are in India? Considering 9 trillion $$ of assets outside UK it definitely does seem to be a very huge amount outside.

Also notice how the assets of UK has increased 3 times in last decade when the world is undergoing financial crisis. Any details would be relevant to the topic.

So how come UK has got such huge assets out of UK. Can another country own asset abroad like this?..

These can be viewed as the balance sheet recording the UK’s stock of foreign assets (the value of foreign investment that the UK has acquired abroad) and liabilities (investments in the UK owned by foreign companies).

..

The values of UK assets and liabilities have both increased by a factor of more than three in the decade since 1998, with total assets standing at £7,135.1 billion and total liabilities at £7,042.1 in 2008.

How much of UK assets are in India? Considering 9 trillion $$ of assets outside UK it definitely does seem to be a very huge amount outside.

Also notice how the assets of UK has increased 3 times in last decade when the world is undergoing financial crisis. Any details would be relevant to the topic.

Re: Perspectives on the global economic meltdown- (Nov 28 20

I wonder if a good deal of their "assets" are in fact their own debt (bonds).

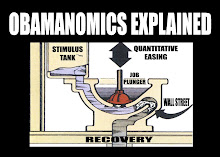

Bernanke has called purchases of US Treasury bills by the Federal Reserve as the purchases of ASSets.

Unless the population is robbed via taxation or other means of wealth confiscation down the line to repay those bonds (with interest), its not an asset but a liability.

Bernanke has called purchases of US Treasury bills by the Federal Reserve as the purchases of ASSets.

Unless the population is robbed via taxation or other means of wealth confiscation down the line to repay those bonds (with interest), its not an asset but a liability.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Suraj wrote:The savings/GDP situation in advanced countries is not pertinent to India's case at all. They have already built up infrastructure and facilities, and social support and education services upto a standard we are far from accomplishing.

Advanced countries don't save. They make third world countries do it for them by making them hold "foreign currency reserves" (namely the currency printed up by the advanced countries). If the third world countries refuse, they are subjected to an economic attack the likes which you saw in the late 90s during the "Asian financial crisis". Large western speculators & investors pulled their money rapidly out of Asian countries to instigate their collapse. This forced Asian countries to hold large amounts of "foreign reserves" to defend their economies even while advanced countries devalued and spent. I'm sure this attack is coordinated at the govt level and between govts of advanced countries. Its a kind of economic colonialism.

Fortunately for India, strong govt capital controls and a confusing array of rules made it difficult for any speculator to try to take down the market. Some speculators in fact got burned when they could not get their money out in a hurry and lost millions due to good old fashioned babu-dom of inefficiency. A rare case in which babuz & the chaos they generate actually helped the situation.

I think we will see a repeated attempt at this soon. The liquidity that has flooded into third world nations will be rapidly drained in order to instigate a collapse of economies in the East. Its a classic banking goon tactic of yelling FIRE in a theater to cause a stampede so they may pick up the pieces at a throw away price and put countries in financial chaos & debt. Then the IMF moves in for the kill the way it did in Indonesia demanding the state sell its natural resources and companies to advanced countries at rock bottom prices in exchange for loans.

The advanced countries are all in partnership on this loot.

Last edited by Neshant on 29 Jul 2013 02:19, edited 1 time in total.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Unless the details are known it would be difficult to say how are the assets leveraged by UK. Interest rate difference-internal/external is one for example. Also how UK assets increased 3 times during global recession is interesting.

Last edited by vishvak on 29 Jul 2013 02:19, edited 1 time in total.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Can Indonesia not tell IMF to take its currency- free floating or backed?!?

Re: Perspectives on the global economic meltdown- (Nov 28 20

Nope. IMF is a grouping primarily of the same advanced economies that brought down the country. The composition of the SDR is heavily weighted in terms of those country's currencies. Interestingly, the only other accepted form of debt repayment is in gold. Yet another means of draining true wealth out of third world countries to enforce the monopoly of paper monies of advanced economies.vishvak wrote:Can Indonesia not tell IMF to take its currency- free floating or backed?!?

Of course once a country is in debt to the IMF aka advanced economies, they have no intention of ever letting the third world country off the debt treadmill i.e. perpetual debt trap. Such is the fate of Africa which has to export most of its capital to keep ahead of its debt.

Advanced economies only weapon against India is oil - the payment of which is in dollars. Independent oil suppliers like Iran however can circumvent this (although even they demand dollars) which is why the advanced economies want to take down Iran, Venesuela, Libya any "non-aligned" oil supplier..etc.

The other threat comes from con artists companies like Goldman Sachs which are like a virus once they enter a third world country. A whole army of con artists soon ply their trade upon paper scams within the country and become the 5th columnist for such evil plans - both knowingly and unknowingly. Beware the banking goon.

Re: Perspectives on the global economic meltdown- (Nov 28 20

....maybe full convertibility not such a good idea says China....

http://finance.yahoo.com/news/analysis- ... 23508.html

...at least not right now.

http://finance.yahoo.com/news/analysis- ... 23508.html

...at least not right now.

In contrast, Beijing will not rush into full yuan convertibility - a part of its push to make it a global currency - by dismantling capital controls at a time when volatile capital flows in emerging markets are raising concerns about economic stability.

Re: Perspectives on the global economic meltdown- (Nov 28 20

You bet we will see many such news report on full convertibility before the events actually happens or not.

A lot of countries specially the economies of EU and US may not want China to make its currency fully convertible as they may not want to see competition specially when their economies are not doing well.

A lot of countries specially the economies of EU and US may not want China to make its currency fully convertible as they may not want to see competition specially when their economies are not doing well.

Re: Perspectives on the global economic meltdown- (Nov 28 20

China Plans Urgent Audit of Public Debt

China's gross domestic product growth slowed to 7.5% year-to-year in the second quarter of 2013 from 7.7% in the first quarter, and many economists expect it to slow further in the second half. One option for the government to prevent a sharper slide is to ratchet up public spending.

But high debt means there is a limit to the government's ability to act. China's central government debt is low—14.4% of GDP in 2012, according to the International Monetary Fund. Concern centers on rapid growth in borrowing by local governments.

The previous full audit of local-government debt in China was published in 2011 and found debts totaling 10.7 trillion yuan ($1.75 trillion) for the end of 2010. A separate audit of a subset of 36 local governments found they had outstanding debt totaling 3.85 trillion yuan in 2012, up 12.9% from 2010.

In an estimate released in July, the IMF said China's government debt totaled 46% of GDP. While lower than the debt levels of the U.S., Japan and other developed nations, that figure is considerably larger than suggested by the official data, which don't currently include borrowing by local governments.

Independent estimates often come up with public-debt levels of 60% of GDP or more, typically by ascribing a higher value to local-government debt, including that taken on by the railways ministry and policy banks such as China Development Bank that are seen as part of the government.

Re: Perspectives on the global economic meltdown- (Nov 28 20

We demanded Japanese convertibility and got it. Japan is the only one in Asia.Austin wrote:You bet we will see many such news report on full convertibility before the events actually happens or not.

A lot of countries specially the economies of EU and US may not want China to make its currency fully convertible as they may not want to see competition specially when their economies are not doing well.

It's China's turn....if they dare.

Re: Perspectives on the global economic meltdown- (Nov 28 20

May the time when US demanded their economies were not as bad as it is now and Japan is itself in a economic mess.

Today the situation is different US Economy is in bad shape and EU is in recession so if and when China makes the currency fully convertible it be a qualitatively new player in the game ..in far better shape then these economies.

This reports seems to suggest that IMF is too angry on China and more like the case of IMF pushing US agenda

IMF labels China’s economic policy ‘unsustainable’ as trade talks are suspended

Any body surprised that US being extremely disappointed with this talk which means US not getting what they want and IMF issuing sharply worded report on serious concerns of China debt is not linked.

Is IMF as seriously concerned about UK , US and other EU counties debt

Today the situation is different US Economy is in bad shape and EU is in recession so if and when China makes the currency fully convertible it be a qualitatively new player in the game ..in far better shape then these economies.

This reports seems to suggest that IMF is too angry on China and more like the case of IMF pushing US agenda

IMF labels China’s economic policy ‘unsustainable’ as trade talks are suspended

A new, sharply worded IMF report said that Chinese government debt has been growing faster than reported, and at 45 percent of annual economic output is perhaps double the officially recorded level.

Canadian WTO ambassador Jonathan Fried chaired negotiations on Wednesday and afterward suspended them indefinitely. Chinese officials in Geneva could not be reached for comment.

“The United States is extremely disappointed,” U.S. Trade Representative Mike Froman said in an e-mailed statement. “China’s current position makes progress impossible at this stage.”

Any body surprised that US being extremely disappointed with this talk which means US not getting what they want and IMF issuing sharply worded report on serious concerns of China debt is not linked.

Is IMF as seriously concerned about UK , US and other EU counties debt

Re: Perspectives on the global economic meltdown- (Nov 28 20

Our debt is in the global marketplace and our currencies are fully convertible.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Exactly the reason why you need a alternate reserve currency so that your problem does not spread out to others

Re: Perspectives on the global economic meltdown- (Nov 28 20

The US stands firm in its desire for full convertibility. Go for it.

Re: Perspectives on the global economic meltdown- (Nov 28 20

That explanation is a garbled mix of different things being conflated. Domestic savings/GDP and foreign currency reserves are not the same thing. By definition the foreign currency reserves cannot be deployed domestically - they're holdings of an external currency, often in an external entity's own banking system. They are generated through mercantile trade surpluses and inward capital flows. Domestic savings don't technically associated with any external trade, and are savings from personal and corporate sources that build the domestic capital base and provide the domestic banking sector additional capital to deploy into investment.Neshant wrote:Advanced countries don't save. They make third world countries do it for them by making them hold "foreign currency reserves" (namely the currency printed up by the advanced countries). If the third world countries refuse, they are subjected to an economic attack the likes which you saw in the late 90s during the "Asian financial crisis". Large western speculators & investors pulled their money rapidly out of Asian countries to instigate their collapse. This forced Asian countries to hold large amounts of "foreign reserves" to defend their economies even while advanced countries devalued and spent. I'm sure this attack is coordinated at the govt level and between govts of advanced countries. Its a kind of economic colonialism.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Alarming number of US citizens face poverty, 80% suffer joblessness - report

Four out of five US adults come to grips with joblessness, near-poverty or reliance on welfare for at least some parts of their lives. Over 41 percent of the nation's poor are whites, according to a new report.

In 2011, 46.2 million people in the US were living in poverty and the nation’s official poverty rate was 15 percent, up from 14.3 percent in 2009, according to the US Census Bureau. That figure appears to be the highest number seen in the 52 years for which poverty estimates have been recorded.

Although poverty rates for blacks and Hispanics are proportionately nearly three times higher, by absolute numbers the predominant face of the poor is white, the latest report shows. Economic insecurity among whites is said to be more common than is shown in the government's poverty data, engulfing over 76 percent of white adults by the time they turn 60, according to a new economic gauge being published next year by Oxford University Press.

Pessimism has been steadily growing across the country, with 63 percent of whites describing the US economy as ‘poor’ in the most recent AP-GfK poll. It’s believed that he growing gap between rich and poor and the loss of good-paying manufacturing jobs are to blame.

"If you do try to go apply for a job, they're not hiring people, and they're not paying that much to even go to work," a Buchanan County resident, 52-year-old Irene Salyers said, adding that where she lives children have "nothing better to do than to get on drugs."

Almost one out of sixteen people in the USA are living in deep poverty. The risks of poverty have been growing in recent decades, especially among people aged 35-55. For instance, people aged 35-45 had a 17 percent risk of encountering poverty during 1969-1989; the risk increased to 23 percent during the period 1989-2009.

Over 19 million whites fall below the poverty line of $23,021 for a family of four, accounting for over 41 percent of the US destitute, nearly double the number of poor blacks, according to the survey data revealed by AP. By 2030 up to 85 percent of all working-age adults in the US will experience economic insecurity.

Although by race, non-whites still have a higher risk of being economically insecure, compared with the official poverty rate, some of the biggest increases under the newer measure are among whites, with over 76 percent experiencing bouts of joblessness, life on welfare or near-poverty.

The share of children living in high-poverty neighborhoods — those with poverty rates of 30 percent or more — has increased to one in 10, putting them at higher risk of teenage pregnancy or dropping out of school. Non-Hispanic whites accounted for 17 percent of the child population in such neighborhoods, compared with 13 percent in 2000, even though the overall proportion of white children in the US has been declining.

The share of black children in high-poverty neighborhoods dropped from 43 percent to 37 percent, while the share of Latino children went from 38 percent to 39 percent.

According to the nation's leading domestic hunger-relief charity Feeding America, over 16 million children under the age of 18 (21 percent) were in poverty in 2011.

"It's time that America comes to understand that many of the nation's biggest disparities, from education and life expectancy to poverty, are increasingly due to economic class position," a Harvard professor who specializes in race and poverty William Julius Wilson told AP.

There is the real possibility that white alienation will increase if steps are not taken to highlight and address inequality on a broad front," he warned.

Re: Perspectives on the global economic meltdown- (Nov 28 20

...no 80% of america is not in poverty....

http://finance.yahoo.com/news/no-80-ame ... 52504.html

...although a job is a somtime thing. In 2002-2003, I was about 3-4 weeks being homeless (wth no unemployment insurance and no medical) until a friend recommended me for my present job. A job with benefits. Almost 18 months w/o work and a divorce on top of it. Absolutely devastating. . I am just now beginning to see the end of my credit card debt from that period and I will be able to retire debt free. (I will still have a house and car payment) I managed to avoid bankruptcy and in retrospect I should have declared it but didn't. Several of my friends have gone through bankruptcy. All professionals with degrees.

Again I must state, In America, a job is a sometime thing.

http://finance.yahoo.com/news/no-80-ame ... 52504.html

...although a job is a somtime thing. In 2002-2003, I was about 3-4 weeks being homeless (wth no unemployment insurance and no medical) until a friend recommended me for my present job. A job with benefits. Almost 18 months w/o work and a divorce on top of it. Absolutely devastating. . I am just now beginning to see the end of my credit card debt from that period and I will be able to retire debt free. (I will still have a house and car payment) I managed to avoid bankruptcy and in retrospect I should have declared it but didn't. Several of my friends have gone through bankruptcy. All professionals with degrees.

Again I must state, In America, a job is a sometime thing.

Last edited by TSJones on 30 Jul 2013 00:26, edited 1 time in total.

Re: Perspectives on the global economic meltdown- (Nov 28 20

The economic schemes in US are also planned and implemented by Harvard types. Even in India these Harvard types write plans to reduce poverty for decades and have become efficient at it.

Note how the criteria of poverty is in comparison to poor black people and poor neighborhood has had 43% black population even before economic problems.

Note how the criteria of poverty is in comparison to poor black people and poor neighborhood has had 43% black population even before economic problems.

Re: Perspectives on the global economic meltdown- (Nov 28 20

You've got lost in the banking jargon..Suraj wrote: That explanation is a garbled mix of different things being conflated. Domestic savings/GDP and foreign currency reserves are not the same thing. By definition the foreign currency reserves cannot be deployed domestically - they're holdings of an external currency, often in an external entity's own banking system. They are generated through mercantile trade surpluses and inward capital flows.

When money is printed up and spent by the country with the reserve currency, its being robbed both from domestic & foreign savings. When a country holding those foreign currency reserves is forced to draw down its reserves to defend its currency/economy, it is drawing down primarily from the stock of domestic savings to prevent having to liquidate its leveraged investments at unfavorable terms currently tied up in the market. The whole point of an economic attack is to force that liquidation of primarily domestic investments and trigger a collapse in the economy and banking system.

So who says foreign currency reserves cannot be deployed domestically?

Trying to claim there's some distinction between money being saved nationally or individually is meaningless. Ultimately the value of that money wherever it may be is being devalued and spent one end while on the other end countries/individuals are forced to save it. Worse yet, if this is not adhered to the countries are punished through economic attacks by advanced economies.

One needs a wholistic understanding of the issue and not a limited/narrow definition that comes out of a textbook.

That's the whole reason why advanced countries want to coerce the rest of the world into using their paper as a reserve currency.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Domestic savings base may be augmented by net capital inflows (which is why investment/GDP does not exactly equal savings/GDP, but is typically higher because of net capital inflows), but the relationship is not commutative - savings/GDP is not the same thing as capital inflows or foreign exchange reserves. You responded to the original post about savings/GDP with a post conflating it with forex reserves. Not the same thing. Bringing in some pet strawman like the banking system does not change that.Neshant wrote:You've got lost in the banking jargon. When money is printed up and spent by the country with the reserve currency, its being robbed both from domestic & foreign savings. So who says foreign currency reserves cannot be deployed domestically?

Feel free to look up savings/GDP on the world bank database for a country like South Korea pre and post Asian financial crisis, after which they stockpiled forex reserves - there's a trend of lower savings/GDP since the 2000s when they stockpiled reserves, not a higher one.

-

Theo_Fidel

Re: Perspectives on the global economic meltdown- (Nov 28 20

TSJ,TSJones wrote:...I am just now beginning to see the end of my credit card debt from that period and I will be able to retire debt free. (I will still have a house and car payment)

Can I just say this house payment thing is the most staggering scam I have ever encountered. This may be my 3rd world skin flint perspective but system seems to be set up to financially destroy folks and enrich bankers like no other. Think of the craziness behind the 30 year loan. All my compatriots, without exception bought their 3-4-5 th house in their mid 40’s to mid 50’s when their earning power was maximum. This means that these folks have to be working well into their 70s & 80s to pay off the note on their house! One engineer I know bought a $700,000 house at spry young age of 58. Kids have all left but he now has 6 bedrooms! On top of that he got conned into taking out a home equity loan to put in a $26,000 steel siding system. To payoff that loan, he needs to work to 88 years! I understand the logic behind selling later and all that, but you still need a place to live with low expenses in you retirement. The system is built to make sure you can never retire.

All in all, guaranteed to keep people financially distressed and 3 months from bankruptcy.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Paradoxically, the 30 year loan was created in the mid 1930s with the opposite goal in mind - enable someone to buy a home during the first one third of their working life, and have it paid off by the time they retire.

It's still a fascinating loan term - there's hardly any other nation that will agree to loan you a mortgage on that long a term on a fixed rate. It's a reflection of the long term confidence in the ability to manage growth and inflation in the US system. The US has experienced deflation, but not hyperinflation (it has encountered stagflation in the 1970s when inflation was moderately high due to the oil shock).

Any sustained period of high inflation will result in the 30-year loan going the way of the dodo, which would make the holders of those notes extremely well off because their payments are fixed, and will serve as an enormous wealth creation tool. Ditto for those who bought at the housing bottom after the 2008 crisis and refinanced down to 3.5% - they'll sit pretty for a long time.

It's still a fascinating loan term - there's hardly any other nation that will agree to loan you a mortgage on that long a term on a fixed rate. It's a reflection of the long term confidence in the ability to manage growth and inflation in the US system. The US has experienced deflation, but not hyperinflation (it has encountered stagflation in the 1970s when inflation was moderately high due to the oil shock).

Any sustained period of high inflation will result in the 30-year loan going the way of the dodo, which would make the holders of those notes extremely well off because their payments are fixed, and will serve as an enormous wealth creation tool. Ditto for those who bought at the housing bottom after the 2008 crisis and refinanced down to 3.5% - they'll sit pretty for a long time.

Re: Perspectives on the global economic meltdown- (Nov 28 20

^^^^All too true, Theo.

It is easy to get caught up in the McMansion craze. A lot of people make that mistake.

But, I would point out that it is a huge political belief in the US that home ownership is good for the US and its economy. It thas one of the highest home ownership rates per capita of any country.

However, my "mistake" was a divorce (that I did not want or deserve) and being w/o work for 18 months in 2002 and 2003.

So what to do?

I was able to find work thanks to a fellow friend/associate and keep my nose to the grind stone. My employer has a defined benefit retirement plan (which is getting rare these days for most people) and contributed my maximum. I am planning on retiring in 2 or 3 years (depending on credit card pay off schedule variable interest rates. It's vicious).

I have calculated my monthly living expenses (house payment, taxes, insurance, car, utilities, internet, house maintenace, etc.) and came up with a figure that I "must have" to pay my bills and survive.

Then I calculated a conservative estimate of my monthly retirement income including Social security, and employers pensions.

I have come up with a 60% expense ratio of my projected monthly income. That's not all that good. Most planners recommend only 50% expense ration of your retirement income. What can I say? Due to my own fault and yes, some bad luck, I am going to pay the price in reduced style of living by 10%. I would have been a lot better if my house was paid off but circumstances beyond my control prevented this.

There is one other fly in the ointment:

what happens if my employer declares banruptcy......or

Collapse of social security

...but these I have no control over so I quietly buy investment grade US silver coins when I can afford it and keep investing money in the stock market bit by bit.

It is easy to get caught up in the McMansion craze. A lot of people make that mistake.

But, I would point out that it is a huge political belief in the US that home ownership is good for the US and its economy. It thas one of the highest home ownership rates per capita of any country.

However, my "mistake" was a divorce (that I did not want or deserve) and being w/o work for 18 months in 2002 and 2003.

So what to do?

I was able to find work thanks to a fellow friend/associate and keep my nose to the grind stone. My employer has a defined benefit retirement plan (which is getting rare these days for most people) and contributed my maximum. I am planning on retiring in 2 or 3 years (depending on credit card pay off schedule variable interest rates. It's vicious).

I have calculated my monthly living expenses (house payment, taxes, insurance, car, utilities, internet, house maintenace, etc.) and came up with a figure that I "must have" to pay my bills and survive.

Then I calculated a conservative estimate of my monthly retirement income including Social security, and employers pensions.

I have come up with a 60% expense ratio of my projected monthly income. That's not all that good. Most planners recommend only 50% expense ration of your retirement income. What can I say? Due to my own fault and yes, some bad luck, I am going to pay the price in reduced style of living by 10%. I would have been a lot better if my house was paid off but circumstances beyond my control prevented this.

There is one other fly in the ointment:

what happens if my employer declares banruptcy......or

Collapse of social security

...but these I have no control over so I quietly buy investment grade US silver coins when I can afford it and keep investing money in the stock market bit by bit.

-

Theo_Fidel

Re: Perspectives on the global economic meltdown- (Nov 28 20

Don't diagree... ...multiple hits can take you down quickly... ...in mash there is this scene where colonel potter tears up the note on his house that his wife was patiently paying away. .. ..you never see that on tv anymore. truly greatest generation for all their flaws. look at meet the farqhers.. 65 years old people living on half a county... again this is hard scrabble india perspective but i hate most debt... ..i think home is your last castle and you should be completely paid off on it atleast 10 yrs to retirement. u should have the ability to drop your income to almost nothing.. i plan to be able to survive on $500 pm if necessary.... ..ofcurse if i don't escape to india...

There is book out there called anti-fragile by taleb something... ...it says that the reason the collapse devastate america was because usa lacked resilience... ..a lack of ability to return to the farm if yo will. instead we have over-weight bimbo's playing with guns pretending to surive doomsday on tv... ...shocks should make you stronger, not just survive...

If anything the last 5 years have taught me the value of governance... ..folks like you and i need to be able to drop our requirements to almost nothing so we can back stop the government... ...no government... ..no civilizaton... ..anti fragile if you will... ..must have the ability to survive on less if needed....

-----------------------

That only works if wages keep up with inflation right. recntly the wages have been behind havn't they. Bank borrows at 0%, lends t you at 3.5%. I have a sneaky suspicion someone is being had...

There is book out there called anti-fragile by taleb something... ...it says that the reason the collapse devastate america was because usa lacked resilience... ..a lack of ability to return to the farm if yo will. instead we have over-weight bimbo's playing with guns pretending to surive doomsday on tv... ...shocks should make you stronger, not just survive...

If anything the last 5 years have taught me the value of governance... ..folks like you and i need to be able to drop our requirements to almost nothing so we can back stop the government... ...no government... ..no civilizaton... ..anti fragile if you will... ..must have the ability to survive on less if needed....

-----------------------

That only works if wages keep up with inflation right. recntly the wages have been behind havn't they. Bank borrows at 0%, lends t you at 3.5%. I have a sneaky suspicion someone is being had...

Re: Perspectives on the global economic meltdown- (Nov 28 20

I think the banking crooks will ripen the system to make reverse mortgage a norm like the housing loan is today.

Re: Perspectives on the global economic meltdown- (Nov 28 20

The researchers also took an occupational approach and created an index of offshorability for hundreds of blue-collar, white-collar, and service occupations based on the degree to which the jobs required personal interaction that necessitated workers to be in close proximity to customers. It was estimated that a majority of occupations (533) and employed persons (92.6 million in 2004) are non offshorable—that is, they are completely immune to offshoring. Conversely, it's estimated that a minority of U.S. occupations (about 200) and workers (almost 30 million) fall in the highly offshorable and offshorable categories. Two categories were considered, which included 22.2% of U.S. workers in 2004, too conservative an estimate of potentially offshorable jobs in light of technological and other advances expected to arise in the coming years...and totals almost 40 million workers --- or 29% of all U.S. jobs.

http://www.economicpopulist.org/content ... utsourcing

Re: Perspectives on the global economic meltdown- (Nov 28 20

Senate Probes Banks In your Supply Chain and Holding Your Commodities in Warehouses

The Senate is opening hearings on banks buying up warehouses storing commodities and getting into the global supply chain. No doubt nothing will happen until quantitative easing is over and there is no more money to be made in manipulating these markets.

Officials in Washington opened new fronts in a probe of bank dealings in aluminum, oil and other raw materials, signaling intensifying scrutiny of possible conflicts of interest across the financial markets.

The Senate Permanent Subcommittee on Investigations has sought information in recent months from J.P. Morgan Chase & Co., Goldman Sachs Group Inc. and Morgan Stanley, people familiar with the matter said. The panel, led by Sen. Carl Levin (D., Mich.), is known for the 2010 hearings it held in a probe of Wall Street's role in the housing bust. A spokeswoman for the senator declined to comment.

The inquiry is still at an informal stage, with the committee seeking information in questionnaire form about bank participation in commodities markets and potential conflicts, one person familiar with the probe said.

Separately, Securities and Exchange Commission Chairman Mary Jo White told Senate lawmakers Tuesday that the agency is examining whether there should be greater oversight of firms that store and trade physical commodities like aluminum and oil and is looking into possible disclosure issues.

http://www.economicpopulist.org/content ... s-wipe-out

-

Christopher Sidor

- BRFite

- Posts: 1435

- Joined: 13 Jul 2010 11:02

Re: Perspectives on the global economic meltdown- (Nov 28 20

There are indications that Greece would turn the corner this year and would show some growth in 2014. Further there are indications that the recession in the euro-zone would get over this year. When this happens two biggest markets on the planet and the two biggest economies in the world would have been on the mend. That would be fantastic news. Though it remains to be seen whether these would lead to the return of the consumption patterns that we saw in the first decade of this century.

Re: Perspectives on the global economic meltdown- (Nov 28 20

And guess what...it's because of the austerity imposed by the Germans. You bite the bullet, restructure your economy, and recover. The euro will only get stronger.Christopher Sidor wrote:There are indications that Greece would turn the corner this year and would show some growth in 2014. Further there are indications that the recession in the euro-zone would get over this year. When this happens two biggest markets on the planet and the two biggest economies in the world would have been on the mend. That would be fantastic news. Though it remains to be seen whether these would lead to the return of the consumption patterns that we saw in the first decade of this century.

Re: Perspectives on the global economic meltdown- (Nov 28 20

^^^^^So what? They still got massive loan infusions and guarantees from the ECB and the EU.

The Greek economy suffered crippling unemployment, destruction of public pensions and the necessity of public soup kitchens in order to fight wholesale hunger and a banking panic.

Now they have bottomed out but who knows when the general public will completely recover?

What a victory for austerity.

And why? Because their system of taxation was corrupt and public pensions not based on any sense of reality. Not even close. The whole nation was living on a lie; their application and reporting of their financial position to join the ECB and gain access to the euro was partially fabricated in the first place. Their participation in the euro was a tissue of schemes that finally caught up with them. A nation of flim flam presenting their credentials of false integrity. And it collapsed.

They have certainly paid the price. And you say austerity worked? I say the truth was found out. My sympathies are with the innocent Greek citizens who were vicitmized by this. Some of them lost everything. The ECB will wind up making money on this as most central banks always do (and the German government) despite the German grumpiness about "paying" for Greek debt.

The Greek economy suffered crippling unemployment, destruction of public pensions and the necessity of public soup kitchens in order to fight wholesale hunger and a banking panic.

Now they have bottomed out but who knows when the general public will completely recover?

What a victory for austerity.

And why? Because their system of taxation was corrupt and public pensions not based on any sense of reality. Not even close. The whole nation was living on a lie; their application and reporting of their financial position to join the ECB and gain access to the euro was partially fabricated in the first place. Their participation in the euro was a tissue of schemes that finally caught up with them. A nation of flim flam presenting their credentials of false integrity. And it collapsed.

They have certainly paid the price. And you say austerity worked? I say the truth was found out. My sympathies are with the innocent Greek citizens who were vicitmized by this. Some of them lost everything. The ECB will wind up making money on this as most central banks always do (and the German government) despite the German grumpiness about "paying" for Greek debt.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

vic wrote:Anybody has idea about real inflation numbers in western world?

THE common error is the world goes between inflation and deflation

But the lies converge unlike the models devised by Goldman et al

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

Saar,vishvak wrote:The way Russians and Chinese are using currency for benefit, Indians should do the same for say Venezuela for oil for export market.

There is huge amount of dollars in the market and hard dollar cash is transported even in presence of electronic transfer; after some amount of hard cash was stolen from an airport this came out. More and more convertible currencies won't help huge amount of dollars perhaps.

has never been more American currency in circulation, and the amount keeps growing. And that cash moves around frequently, often carried discreetly in the belly of commercial airliners

why have these ever increasing trade deficits? Why not settle the difference every 3 months or so.

If i borrow a 1000$ from you and I promise to repay it in 2 months, will you lend me another 1000 after i have not re-payed you after 2 months? With/without interest is not a question.

So why is USA allowed to keep borrowing? Why can they not settle the debt?

The BIS understood this game and hence they invented the EURO. They are going to let USA fall on its sword and die.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

Quite right.TSJones wrote:Money is like manure, it works best when you spread it around.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic meltdown- (Nov 28 20

Neshant wrote:I wonder if a good deal of their "assets" are in fact their own debt (bonds).

Bernanke has called purchases of US Treasury bills by the Federal Reserve as the purchases of ASSets.

Unless the population is robbed via taxation or other means of wealth confiscation down the line to repay those bonds (with interest), its not an asset but a liability.

-

Christopher Sidor

- BRFite

- Posts: 1435

- Joined: 13 Jul 2010 11:02

Re: Perspectives on the global economic meltdown- (Nov 28 20

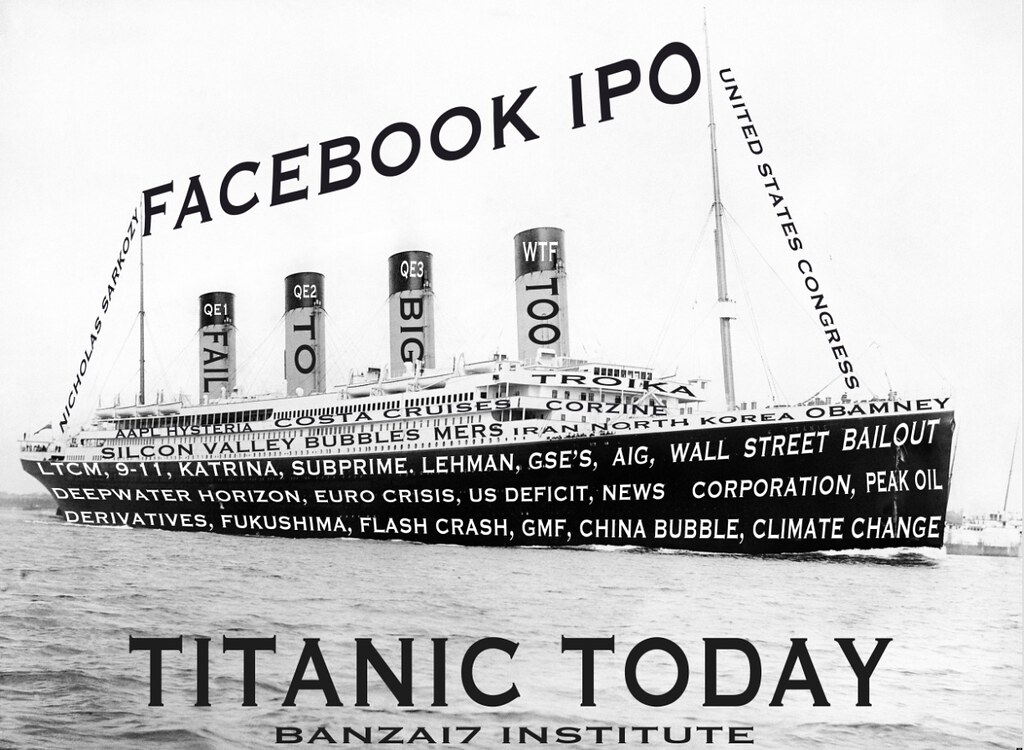

^^^^

Absolutely loved the fourth Chimney with WTF written over it.

Absolutely loved the fourth Chimney with WTF written over it.

Re: Perspectives on the global economic meltdown- (Nov 28 20

Thanks for sharing your sublime understanding of the bond marketplace.panduranghari wrote: Saar,

why have these ever increasing trade deficits? Why not settle the difference every 3 months or so.

If i borrow a 1000$ from you and I promise to repay it in 2 months, will you lend me another 1000 after i have not re-payed you after 2 months? With/without interest is not a question.

So why is USA allowed to keep borrowing? Why can they not settle the debt?

The BIS understood this game and hence they invented the EURO. They are going to let USA fall on its sword and die.