There is a pattern. We need more research data to support it but there is a pattern. Unless curtailed, once settled, it's going to look like a feudal society.A_Gupta wrote:http://www.counterpunch.org/2015/04/07/ ... servitude/

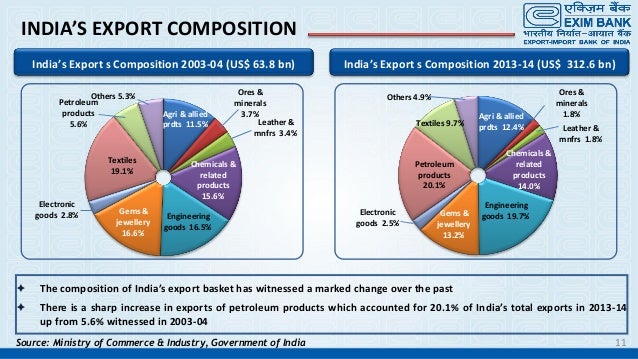

The thrust of the article is that corporations are taking over India andAcross the globe, powerful corporations and their compliant politicians seek to sweep away peoples and their indigenous knowledge and culture in the chase for profit and control. They call this ‘development’. They will allow nothing and no one to stand in their way.

- Marriages between political & industrial families

- Progeny going to Ivy Leagues

- Corporations as new form of feudal economy

- Huge land allocations for these companies

- Company employees as vote banks

- These vote banks in turn sustain the business-political enterprise