Perspectives on the global economic changes

Re: Perspectives on the global economic changes

A system reset is imminent. Probably even before 2020, the world’s financial system will need to find a different anchor. The dollar has been at the center of the monetary system since the Second World War, but decades of money printing have caused a gradual but relentless dollar devaluation. In a desperate attempt to maintain this dollar system, the United States has waged a secret war on gold since the 1960s. China and Russia have pierced through the American smokescreen around gold and the dollar and are no longer willing to continue lending to the United States. Both countries have been accumulating enormous amounts of gold, positioning themselves for the next phase of the global financial system.

There are only two options: a financial reset planned well in advance, or a hastily implemented one on the back of a dollar crisis. The United States, realizing the dollar will lose its prominent role, seems to be planning a monetary reset that will surprise many. It will be designed to keep the United States in the driving seat, but will include strong roles for the Euro and China’s Renminbi. And it is likely gold will be reintroduced as one of the pillars of this next phase of the global financial system. Insiders claim gold could be revalued up to $7,000 per troy ounce during this process.

The Big Reset: War on Gold and the Financial Endgame Paperback – January 15, 2014

by Willem Middelkoop

There are only two options: a financial reset planned well in advance, or a hastily implemented one on the back of a dollar crisis. The United States, realizing the dollar will lose its prominent role, seems to be planning a monetary reset that will surprise many. It will be designed to keep the United States in the driving seat, but will include strong roles for the Euro and China’s Renminbi. And it is likely gold will be reintroduced as one of the pillars of this next phase of the global financial system. Insiders claim gold could be revalued up to $7,000 per troy ounce during this process.

The Big Reset: War on Gold and the Financial Endgame Paperback – January 15, 2014

by Willem Middelkoop

Re: Perspectives on the global economic changes

Prosecution of Sarao may actually be to protect HFT or their multi Billion dollar continuing scam which will end.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

How will you position yourself prior to reset? It will have a huge effect in your purchasing power in the long term.svinayak wrote: The Big Reset: War on Gold and the Financial Endgame Paperback – January 15, 2014

by Willem Middelkoop

Well how many have the courage to do that?Hedge fund manager Stanley Druckenmiller had a private speaking gig in South Florida, the contents of which were leaked to the press. Druckenmiller made some not-so-nice comments about the Fed, which is what the stupid reporters picked up on, but he also talked about his investment philosophy, which was far more interesting.

If the best investor in the world tells you what his investment philosophy is, you should pay attention.

So Druckenmiller said he doesn’t believe in diversification. In fact, he tries to achieve the opposite of diversification—placing all his eggs in one basket. This he did with the pound sterling years ago, to great effect.

If you’re really convinced of something, why make it just 5, 10, or 20% of your portfolio? Go big. Make it 100% of your portfolio

Re: Perspectives on the global economic changes

Devaluation of currency is what most people expect.svinayak wrote:The United States, realizing the dollar will lose its prominent role, seems to be planning a monetary reset that will surprise many.

What would surprise many is the opposite of devaluation.

Also who will be trusting fiat money after a devaluation event.

Re: Perspectives on the global economic changes

Very good points and valid points.Neshant wrote:Devaluation of currency is what most people expect.svinayak wrote:The United States, realizing the dollar will lose its prominent role, seems to be planning a monetary reset that will surprise many.

What would surprise many is the opposite of devaluation.

Also who will be trusting fiat money after a devaluation event.

Read the book text from a Indian point of view.

How is India affected in the last 50 years due to this secret policies of the west.

How is Indian currency affected due to external changes

How is Indian trade affected due to global changes.

Re: Perspectives on the global economic changes

A new Documentary : Full Documentary The Truth behind the Global Economic Collapse

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

http://tinyurl.com/kc72w8tT he unfortunate consequence of not allowing the process of “creative destruction” to occur in banking and Big Business is that the historic forces behind it will seek expression elsewhere in the realm of politics and governance. The desperate antics of central banks to cover up financial failure can’t help but provoke political upheaval, including war.

It’s a worldwide phenomenon and one result will be the crackup of economic relations — thought by many to be permanent — that we call “globalism.” The USA has suffered mightily from globalism, by which a bonanza of cheap “consumer” products made by Asian factory slaves has masked the degeneration of local economic vitality, family life, behavioral norms, and social cohesion. That crackup is already underway in the currency wars aptly named by Jim Rickards, and you can bet that soon enough it will lead to the death of the 12,000-mile supply lines from China to WalMart — eventually to the death of WalMart itself (and everything like it). Another result will be the interruption of oil export supply lines.

The USA as currently engineered (no local economies, universal suburban sprawl, big box commerce, despotic agribiz) won’t survive these disruptions and one might also wonder whether our political institutions will survive. The crop of 2016 White House aspirants shows no comprehension for the play of these forces and the field is ripe for epic disruption. The prospect of another Clinton – Bush election contest is a perfect setup for the collapse of the two parties sponsoring them, ushering in a period of wild political turmoil. Just because you don’t see it this very moment, doesn’t mean it isn’t lurking on the margins.

This same moment (in history) the American thinking classes are lost in raptures of techno-wishfulness. They can imagine the glory of watching Fast and Furious 7 on a phone in a self-driving electric car, but they can’t imagine rebuilt local economies where citizens get to play both an economic and social role in their communities. They can trumpet the bionic engineering of artificial hamburger meat, but not careful, small-scale farming in which many hands can find work and meaning.

The true genius of Hillary is that she manages to epitomize every failure of our current political life: the obsessive micro-manipulation of image, the obscene moneygrubbing, the tired cronyism, the entitlement masquerading as sexual equality. Mostly, though, she has no idea where history is taking us, in case you’re wondering at the stupefying platitudes offered up as representative of her thinking. I’m not advocating for this gentleman, but it will at least be interesting to see Martin O’Malley jump into the race and call bullshit on her, which he will do, literally, because he has nothing to lose by doing it. The eunuchs on The New York Times Op Ed page certainly won’t do it.

What happens on the world financial scene will determine the flow of events up into the 2016 election. The built-up tensions and fragilities are begging for release. The defining instant might be Greece’s unwillingness to fork over another debt payment, or the death of the shale oil “miracle,” or some act by Saudi Arabia’s enemies, or some chain of exploding booby-traps in the shadow banking netherworld. The great surprise for America especially will be the recognition that our current living arrangements have no future. That’s the only thing that will prompt a new consensus to form around some alternate, more plausible future, and the emergence of a generation willing to fight for it, even if it requires some real creative destruction of the things that are killing us anyway.

Re: Perspectives on the global economic changes

Rating agencies cannot be trusted.

Private investors have to do their own due diligence.

____

Ratings agencies say no default if Greece misses ECB, IMF payments

https://ca.finance.yahoo.com/news/ratin ... iness.html

By Marc Jones

LONDON (Reuters) - Most top credit rating agencies say they would not cut Greece's rating to default if it misses a payment to the International Monetary Fund or European Central Bank, a stance that could keep vital ECB funding flowing into the financial system.

Private investors have to do their own due diligence.

____

Ratings agencies say no default if Greece misses ECB, IMF payments

https://ca.finance.yahoo.com/news/ratin ... iness.html

By Marc Jones

LONDON (Reuters) - Most top credit rating agencies say they would not cut Greece's rating to default if it misses a payment to the International Monetary Fund or European Central Bank, a stance that could keep vital ECB funding flowing into the financial system.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

Minions sacrificed at the altar.udaym wrote:Eysians = phinance = iTyvity = Bad

- Lloyd Blankfein of Goldman Sachs on reading this news.Amateurs.

Re: Perspectives on the global economic changes

Cross posting

panduranghari wrote:Will the AIIB One day matter?

Very insightful article. Highly recommended.

Touches on history showing how similar 1020 USA, 1930 Germany, 1960 USSR and 1980 Japan was to today's China. Only one succeeded in carving its niche - USA.

Also explains why RMB can never be a global reserve currency.

For me the interesting question is why it took nearly half a century after the US became the world’s largest economy for the US dollar to become an important reserve currency and whether this has implications for China. The answer may be partly because of the uncertainty surrounding the dollar, and American commitment to gold backing (in fact the Federal Reserve System was not created until 1914), and given the structure of the Chinese political system and a wide range of financial market governance issues, it is not hard to imagine reasons why the RMB might also attract uncertainty.

More relevantly, in the past century these growth miracle countries have included at least four rising powers that were expected to become the dominant geopolitical and financial power in the world – the US in the 1920s, Germany in the 1930s, the USSR in the 1950s, and Japan in the 1980s. In every case they rebelled bitterly against the existing global financial framework, complaining that it was designed to maintain the status quo and restrain their rise. Every one of these countries initiated policies aimed at transforming the world to align interests correctly and accommodate their rise to dominance. Only one of them succeeded.

Re: Perspectives on the global economic changes

The World Economic Model , Institutions like IMF , World Bank and Rating Agency is so skewed towards and controlled by West that it can get away murdering while the ROW can be hanged for petty crime.

West wont be happy with the rise of RMB or any institution supported by China or BRICS thats a given. Neither they are interested in reforming the exisiting one for the fear of loosing control.

The best bet for BRICS countries is to keep collecting Gold and let the current model implode due to its own mismanagement , post that something new would emerge or rather forced to emerge in which BRICS and other growing economies would have a much greater say if not a fair one

West wont be happy with the rise of RMB or any institution supported by China or BRICS thats a given. Neither they are interested in reforming the exisiting one for the fear of loosing control.

The best bet for BRICS countries is to keep collecting Gold and let the current model implode due to its own mismanagement , post that something new would emerge or rather forced to emerge in which BRICS and other growing economies would have a much greater say if not a fair one

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

^ Absolutely Austin saar.

As one famous economist once said - If you hate the current system, you are positively going to abhor the next one. As it stands, we are at a cusp of something eventful. The paradigm change happening in front of our eyes is hard to miss, only if we are willing to see things as they are rather than as we want it to be. Only and only physical gold will keep your purchasing power intact in this transition. All paper - stocks, bonds etc. will meet their ultimate valuation = Zero.

As one famous economist once said - If you hate the current system, you are positively going to abhor the next one. As it stands, we are at a cusp of something eventful. The paradigm change happening in front of our eyes is hard to miss, only if we are willing to see things as they are rather than as we want it to be. Only and only physical gold will keep your purchasing power intact in this transition. All paper - stocks, bonds etc. will meet their ultimate valuation = Zero.

Re: Perspectives on the global economic changes

I understand the Stock part of it but what about GOI Bonds , I mean GSEC people who have invested on GILT funds etc ?panduranghari wrote:Only and only physical gold will keep your purchasing power intact in this transition. All paper - stocks, bonds etc. will meet their ultimate valuation = Zero.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

Austin wrote: I understand the Stock part of it but what about GOI Bonds , I mean GSEC people who have invested on GILT funds etc ?

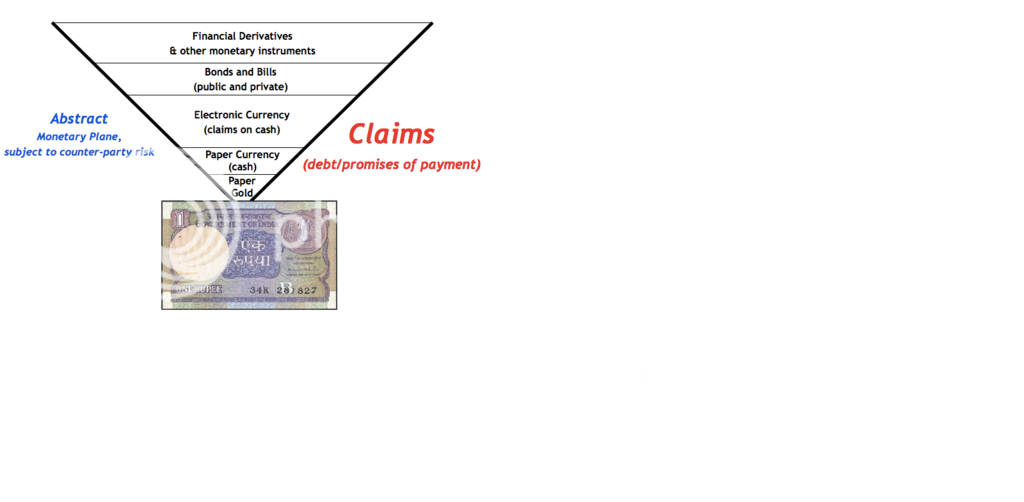

Everyone playing up in the top zone always has one eye on that single rupee note. The perceived value of that single one rupee note is imputed into every single contract in that upper pyramid. This is why everyone has their eye on it. Everyone knows it is not even worth the paper it is printed on, but they also know that as long as everyone else values it, it will hold its value which is the only thing holding up that entire top structure. This is called a network good that emerges from the network effect. Something has value only because a lot of people think it has value.

If you were to diminish the value of that single rupee by, say, 90%, then the whole top structure devalues 90% compared to the bottom pyramid instantly. No flow of funds is required. The reduced value is simply imputed to every quantum point in the pyramid. And no one would ride that devaluation out voluntarily when they could simply consolidate beforehand. So everyone is looking at that rupee thinking, believing, that they are quick enough to outrun everyone else at the first sign of trouble.

Now, in order to understand how this relates to the future economic paradigm, we need to mentally picture something resembling this upper pyramid thousands of years ago when the money concept first emerged. Money was, is, and always has been that mental concept whereby we trade real goods in their relative value implicated by conceptual units of a network good. If you owed me a cow and the going price for a cow was three ounces of gold, I'd probably just say you owed me three ounces. But that doesn't mean you'd ever pay me three ounces of gold. You might just pay me back my cow. Or perhaps you'd pay me in milk over time. If I gave you credit to buy some of my chickens you might pay me back with eggs over time. But on the books it would be recorded in gold, even though neither of us ever had any actual gold.

Can you see it? This is the concept of money. This is what money actually is. And under that upper pyramid of 2,000 years ago you'd actually see a picture of a gram of gold sitting at the bottom.

Yes, it was still a network good just like the rupee is today, but people wouldn't have to keep such a close eye on it for a couple different reasons. First of all, the upper pyramid was not so big that it actually threatened to crush its foundation. And second, there was no one aside from a few gold miners that was able to threaten the foundation by multiplying it. (Note that the monetary base at the bottom of our modern pyramid has been multiplied 650%, that's 6.5x, in the last 5 years. The gold base usually multiplies only about 6% over that same timeframe.)

Does it make sense as to why G secs or anything else is not really worth the paper it is printed on?

-

nandakumar

- BRFite

- Posts: 1688

- Joined: 10 May 2010 13:37

Re: Perspectives on the global economic changes

The bail hearing in Navinder Singh Serao, accused in the flash crash at the New York Stock Exchange in 2010, came up at a London Court today. While he is still in jail because he has been unable to come up with the 5 million Pound Sterling bail money, what came out at the hearing is that the US authorities refused to permit him withdraw the money lying in his US bank account. What that means is he has equivalent or in excess of $7.6 million in bank account in the US. He did make some money spoofing the algorithms of fatcats on wall Street.

Re: Perspectives on the global economic changes

panduranghari , Thank You for explaining in detail.

But some how I find it hard to believe GOI bond wont be worth the paper when the next global financial crisis happens , I am sure the price of Gold would shoot up but most likely GOI would raise the interest rate drastically to make investment in its bonds attractive for investors and to restore confidence.

It seems GOI itself is buying more US paper crossed $100 billion this week rather then buying Gold. Tells you lot about what their mindset is.

But some how I find it hard to believe GOI bond wont be worth the paper when the next global financial crisis happens , I am sure the price of Gold would shoot up but most likely GOI would raise the interest rate drastically to make investment in its bonds attractive for investors and to restore confidence.

It seems GOI itself is buying more US paper crossed $100 billion this week rather then buying Gold. Tells you lot about what their mindset is.

Re: Perspectives on the global economic changes

What exactly do you mean by "the rise of RMB" ?Austin wrote: West wont be happy with the rise of RMB or any institution supported by China or BRICS thats a given. Neither they are interested in reforming the exisiting one for the fear of loosing control.

Re: Perspectives on the global economic changes

Revising U.S. Grand Strategy Toward China (Carnegie Endowment)

It has become something of a cliché to say that no relationship will matter more when it comes to defining the twenty-first century than the one between the United States and China. Like many clichés, this statement is true but not terribly useful, as it tells us little or nothing about the nature of the relationship in question.

Some point to history and argue that strategic rivalry is highly likely if not inevitable between the existing major power of the day and theprincipal rising power. Others challenge such a prediction, emphasizing more the impact of domestic political, economic, and social developments within the two countries as well as the potential constructiveinfluence of diplomacy and statecraft.

...

(more)

Re: Perspectives on the global economic changes

International use of RMB and the Swap agreement that China has with many nations.KrishnaK wrote:What exactly do you mean by "the rise of RMB" ?Austin wrote: West wont be happy with the rise of RMB or any institution supported by China or BRICS thats a given. Neither they are interested in reforming the exisiting one for the fear of loosing control.

London has become intl center for RMB business

https://www.cityoflondon.gov.uk/busines ... iness.aspx

Re: Perspectives on the global economic changes

I doubt China would confer such a status on London.Austin wrote: London has become intl center for RMB business

This is a claim London is making on its own.

Re: Perspectives on the global economic changes

Its great in India that the imported gold is flowing to people rather than the govt.Austin wrote: The best bet for BRICS countries is to keep collecting Gold and let the current model implode due to its own mismanagement ,

Makes it harder for both foreign and domestic shysters to pry it from their hands.

We are blessed to have a nation of gold savers.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

More the reason why Jet Li should keep his filthy hands away from temple gold. 'Deposit gold and get interest'! What a f*****g scam.Neshant wrote: Its great in India that the imported gold is flowing to people rather than the govt.

Makes it harder for both foreign and domestic shysters to pry it from their hands.

We are blessed to have a nation of gold savers.

Re: Perspectives on the global economic changes

The tax on gold was a disincentive for import by Indians and hidden prop to US $ in terms of gold.

Re: Perspectives on the global economic changes

International use of RMB is hardly going to increase unless China starts consuming, which is held at artificially low levels by the Government of China. RMBs rise or fall is in China's hands and is not something the west controls.Austin wrote: International use of RMB and the Swap agreement that China has with many nations.

London has become intl center for RMB business

https://www.cityoflondon.gov.uk/busines ... iness.aspx

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

And who helped prop up the dollar by selling the gold leased to them by central banks? The top 8 investment banks viz.ramana wrote:The tax on gold was a disincentive for import by Indians and hidden prop to US $ in terms of gold.

1.JP Morgan

2. Goldman Sachs

3. Bank of America Merrill Lynch

4. Morgan Stanley

5. Citi

6. Deutsche Bank

7. Credit Suisse

8. Barclays Capital

The great scramble has begun. The reason why US refused the return of German gold is because its sold off as gold was considered a barbarous relic which produced no returns. Isn't modern economics simply awesome?

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

RBI raising interest rates is to ensure velocity of the money reduces so people hold their money.Austin wrote:

But some how I find it hard to believe GOI bond wont be worth the paper when the next global financial crisis happens , I am sure the price of Gold would shoot up but most likely GOI would raise the interest rate drastically to make investment in its bonds attractive for investors and to restore confidence.

It seems GOI itself is buying more US paper crossed $100 billion this week rather then buying Gold. Tells you lot about what their mindset is.

Buying forex i.e USD is to enable buying rupees overseas when rupee is depreciating abroad. you might wonder why would any sovereign country buy its own currency overseas? That is the whole reason why central banks have reserves. These reserves are to defend the currency overseas. Remember 1991. We did not have enough reserves to prevent depreciating VALUE of the rupee. So we had to pledge out assets i.e gold to get USD to defend rupee. Gold is not reserve. Gold is an asset. GOI gains nothing by buying assets. They have enough. PBoC needs to buy gold. Because they are the market and market makers. GOI/RBI are not the market. They are one of the market makers.

The mindset you talk about is perhaps not well understood. I would suggest, dont think like an individual. As an individual you will buy gold from a very specific perspective. Central banks dont think that way. Buying more USD by RBI suggests one thing. Rupee depreciation is coming. Not on its own accord. To compensate for the USD devaluation. Which will be even more painful, without reserves. See how Pakis, BDs, SLs squirm when their economies suffer. They have neither enough reserves nor enough assets.

Re: Perspectives on the global economic changes

Wrong Dhaga Baaja

Re: Perspectives on the global economic changes

These things are fine in Normal Healthy Economy Situations , I dont need to tell you we are in a midst of QE bubble created by Fed and now EU and even by Rajans own statement last year he mentioned it would burst.panduranghari wrote:RBI raising interest rates is to ensure velocity of the money reduces so people hold their money.Austin wrote:

But some how I find it hard to believe GOI bond wont be worth the paper when the next global financial crisis happens , I am sure the price of Gold would shoot up but most likely GOI would raise the interest rate drastically to make investment in its bonds attractive for investors and to restore confidence.

It seems GOI itself is buying more US paper crossed $100 billion this week rather then buying Gold. Tells you lot about what their mindset is.

Buying forex i.e USD is to enable buying rupees overseas when rupee is depreciating abroad. you might wonder why would any sovereign country buy its own currency overseas? That is the whole reason why central banks have reserves. These reserves are to defend the currency overseas. Remember 1991. We did not have enough reserves to prevent depreciating VALUE of the rupee. So we had to pledge out assets i.e gold to get USD to defend rupee. Gold is not reserve. Gold is an asset. GOI gains nothing by buying assets. They have enough. PBoC needs to buy gold. Because they are the market and market makers. GOI/RBI are not the market. They are one of the market makers.

The mindset you talk about is perhaps not well understood. I would suggest, dont think like an individual. As an individual you will buy gold from a very specific perspective. Central banks dont think that way. Buying more USD by RBI suggests one thing. Rupee depreciation is coming. Not on its own accord. To compensate for the USD devaluation. Which will be even more painful, without reserves. See how Pakis, BDs, SLs squirm when their economies suffer. They have neither enough reserves nor enough assets.

http://timesofindia.indiatimes.com/busi ... 868459.cms

So buying more Dollah is good for short term near sighted gain like preventing depreciation or perhaps what happens if they Raise Interest rates and Dollah goes back so you need more dollah to defend you rupee.

But in such situation if they raise interest rates Fed would have a much bigger problem to handle which is if they could handle it.

You see among BRICS the R and C are buying more Gold not Dollah ..... it would be more prudent to buy Gold for RBI and not just invest in Bond which may not be the worth the paper in few years from now.

Any ways we are into 7 years post 2008 crisis so we can expect more fun as the next cycle starts.

Re: Perspectives on the global economic changes

The AIIB Is Seen Very Differently in the US, Europe, and China

“A diplomatic triumph” is a phrase which is being used by Chinese media when referring to 57 nations joining the Asian Infrastructure Investment Bank (AIIB) as prospective founding members.

The signing up of the nearly sixty members from the organization’s inception was beyond the expectation of many people who participated in the establishment of the AIIB.

The AIIB is an international financial institution whose founding was proposed in 2013 by the government of China. The general purpose of this multilateral development bank is to provide finance to infrastructure projects in the Asian region.

Analysts of international affairs and finance in China, the United States, and Europe say that the unexpected success of the bank represents a major turning point in an undeclared contest for global influence between Washington and Beijing. There are many differing points of view about how the bank should function, what its role will be in the international economic system, and why China created this multilateral institution with a major focus on infrastructure in the first place. Some emphasize a desire by China to win soft power, along with financial clout. Others say that China was badly lacking in outlets for its huge financial surpluses. And others attribute China’s motives to geopolitical strategy

....

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

I do not disagree that Russia and China are buying gold hand over the fist. But they are historically not gold buying countries. That's not true for India.Austin wrote:

These things are fine in Normal Healthy Economy Situations , I dont need to tell you we are in a midst of QE bubble created by Fed and now EU and even by Rajans own statement last year he mentioned it would burst.

http://timesofindia.indiatimes.com/busi ... 868459.cms

So buying more Dollah is good for short term near sighted gain like preventing depreciation or perhaps what happens if they Raise Interest rates and Dollah goes back so you need more dollah to defend you rupee.

But in such situation if they raise interest rates Fed would have a much bigger problem to handle which is if they could handle it.

You see among BRICS the R and C are buying more Gold not Dollah ..... it would be more prudent to buy Gold for RBI and not just invest in Bond which may not be the worth the paper in few years from now.

Any ways we are into 7 years post 2008 crisis so we can expect more fun as the next cycle starts.

The RBI is also concerned about CRR and SLR.

From quora

China has Current account surplus. They are in theory not worried about what they do with the surplus funds. Russia is more or less energy independent with a sparse population. What they do should not be a guide for what RBI should. We have our own unique problems and we will deal with them in our own way.Cash Reserve Ratio (CRR): Each bank has to keep a certain percentage of its total deposits with RBI as cash reserves.

Statutory Liquidity Ratio (SLR): Amount of liquid assets such as precious metals(Gold) or other approved securities, that a financial institution must maintain as reserves other than the cash.

Formula: SLR rate = (liquid assets / (demand + time liabilities)) × 100%

Time liabilities are liabilities which the banks are liable to pay after a certain period of time. E.g. A 1 year fixed deposit

Demand liabilities are liabilities which the banks are liable to pay on being demanded by the customer. E.g. A savings account

CRR limits the ability of the banks to pump more money into the economy. SLR is used to limit the expansion of bank credit, for ensuring the solvency of banks (even if all the loans by the bank go bad, the bank can still retrieve a part of it by selling the gold/govt securities.

As of now, the CRR and SLR rates are 4% and 21.5% respectively. Hence, the bank can only use 100-4-21.5= 74.5% of its total deposits for the purpose of lending.

As bank deposit base rises with PMJDY, we need more cover to prevent sudden changes in the indices. Having the buffer of USD gives us that. This also enables us to get fuel when markets are shutting down due to paucity of USD.

U.S. is bankrupt. Only they don't know that yet. U.S. Will raise rates. When that happens look how difficult it will be to get dollars. Of course this will cause other problems but the time limit to expect these subsequent changes within US, could be a few months. Until then we will still need to hold our currency from depreciating too much. That it will is also inevitable. But fire will need to be fought with fire. Fortunately, Rajan is very knowledgeable about this and he is the best guy to have.

As they say- time will prove things.

Re: Perspectives on the global economic changes

If USA permanently looses it's manufactering industrial Eco system then even if the dollar crashes, USA will not rise back as industrial power. The only hope of USA is to force the yuan to rise or an orange revolution in China.

Re: Perspectives on the global economic changes

Central Banking is the Art of Bullsh&tting

____

Bill Bonner on Central Banking.

Bernanke trying to absolve himself of all responsibility for blowing the bubble that cause the 2008 crash. Interesting how central bankers take credit when the economy is doing well but claim they had nothing to do with it when the economy crashes.

____

Bill Bonner on Central Banking.

Bernanke trying to absolve himself of all responsibility for blowing the bubble that cause the 2008 crash. Interesting how central bankers take credit when the economy is doing well but claim they had nothing to do with it when the economy crashes.

Re: Perspectives on the global economic changes

The Keiser report is quite good indeed

Re: Perspectives on the global economic changes

The first president of the BRICS bank will be the former head of India's ICICI

РИА Новости http://ria.ru/economy/20150511/10638438 ... z3ZpCWb1rMKamath will head the Bank of the first six years, then the presidency will go to Brazil and Russia. According to the agreement, a representative of each country will be led by the bank for five years.

According to the channel, 67-year-old Kamath - one of India's most famous bankers. In April 2009, he left his post as head of the bank and took over as chairman of the board of directors without executive powers.

-

panduranghari

- BRF Oldie

- Posts: 3781

- Joined: 11 Aug 2016 06:14

Re: Perspectives on the global economic changes

^

I see this rationality trap everywhere, even on BRF. Even the very well educated suave and very intelligent people cannot see the consequences of some decisions which will have a knock on effect on their own solvency. As the author alluded to the possibility of 'immense short term costs of transition', the potential long term costs are remarkable not mentioned.So fiat money creates an attempt to control others through the political system. But at the same time, no household and no firm individually has an interest in abolishing the fiat system and putting in its place a natural monetary system. The short-term costs of such a transition would be immense. In this, we see that we are in a “rationality trap” in which one is motivated to maintain the fiat money system in spite of all its downsides, and because the culture at this point is so transformed by more than a century of easy access to fiat money.