hanumadu wrote:So how are indirect taxes much greater than direct taxes in India?

They are. Historically indirect taxes receipts were much higher than direct taxes . It was only as recent as 2007 or so when the direct taxes collected by the Central Govt inched up above that collected by the Central Govt and are roughly similar.

However, if you include the taxes the states get where the indirect taxes split is like 90% and included in total taxes collected, yes, Indrect taxes will be much greater than direct taxes.

34% increase till november (and not 38% as you claim it to be) is over last fiscal and not what is projected in budget. The budget already projected ~19 increase. So its only 15% surprise on the up side for indirect taxes.

You seem to have a penchant to shoot and scoot every so often on this thread.

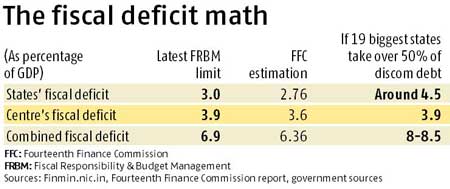

But look at the bonanza they got from oil. Huge increase in indirect taxes AND a massive compression in subsidy outgo from what they would have budgeted for with oil at $50. Despite that, the borrowing is at what they budgeted for and they are struggling to meet the fiscal deficit.

The one thing that DIDNT happen were divestments (some Rs20,000 crore or so budgeted iirc?), and of course direct taxes fell a wee bit short.

And now they are saying that they are going to defer fiscal consolidation and let the deficit rise the next year ! Why, coz they dont have the one time oil bonanza? What if oil rises next year ? No buffer in the fiscal system and the country is royally SCROOD.

If the Kangress ran amok with fiscal profilgacy and ran huge deficits and funny math with Pranab Mukherjee's budgets and took inflation to 10% for 5 years under UPA II, Jaitely seems to be set on the Pranab Mukerjee esque path for NDA under Modi.

I frankly have not been able to decipher WHERE TF has the spending been going. There have been little or nothing by way of structural reforms other than unclogging the project piplines. At least under Vajpayee, Arun Shourie went about selling white elephants and got the millstones one by one off our necks (he unfortunately was prevented from selling off Air India, oh, what a missed opportunity).

Given the luck they got with the oil, they could have passed through lot more of oil price cuts, compressed fiscal deficit further and cut back borrowing to allow bond yields to fall in line with RBI's 125bps cuts . These two would have kick started spending and also tamed inflation by cutting costs for everyone .

But no, the Govt had to go on a tax, borrow and spend binge, driving up actual interest rates for everyone else , crowding out private borrowing in pursuit of some Keynesian nonsense.