tsarkar wrote:Not related, but the termites are emerging

http://www.oneindia.com/india/taxman-bi ... 62237.html

An indication how crooked the media is can be gauged by the fact that none of the larger media companies are publishing this news.New Delhi, Nov 15: The Income Tax department has slapped a penalty of Rs.57 crore on Congress leader and senior advocate Abhishek Manu Singhvi after he was unable to furnish documentary proof to back his claim of expenses. The department has rejected Singhvi's claim that a termite attack on the premises of his chartered accountant destroyed all records, said reports.

The department has also raised doubts over the advocate's claim that he purchased laptops worth Rs 5 crore for his staff, which entitled him to 30 per cent depreciation.

The Income Tax department and the Commission, had earlier, added a sum over his declared professional income of Rs. 91.95 crore over three years between 2010-11 to 2012-13 and slapped a penalty. The order was then stayed by the Rajasthan Court, said reports.

The commission has also contended Singhvi's claim that he spent Rs 35.98 crore on purchase of solar panels for his company, Rishab Enterprises. According to reports, the Jodhpur Income Tax Commissioner also came across cash ranging between Rs.7 crore to Rs. 32 crore in Singhvi's account. The Congress leader said that it was meant to pay fees of his legal assitants. Singhvi has reportedly alleged that he was being trapped in a "cat and mouse game" and argued that the Commission did not have the jurisdiction to impose penalty on him

this is also the same ahole who claimed to the IT dept that termites ate away receipts worth many tens of crores and so he was unable to produce receipts.

I doubt very much whether termites can survive such a rich diet.

all these lootyens thugs and congi "mai ke lals" were used to getting their way using a maze of cooperating baboo(n)s to cloak their shady moves and bedroom athletics.

Abhishek Singhvi in tax soup: officials reject claim that ‘termites ate vouchers,’ slap Rs 56-cr penalty

Written by Appu Esthose Suresh , Ritu Sarin | New Delhi |

November 12, 2014

Multiplying Congress leader Abhishek Manu Singhvi’s Income Tax problems, the Settlement Commission has added over Rs 91.95 crore to his declared professional income over a three-year period and slapped a penalty of Rs 56.67 crore. The order has since been stayed. He had moved the Commission on his own but a probe was launched subsequently, prompting him to describe the proceedings as a “cat and mouse game” which “trapped” him.

Citing inability to furnish documentary proof to back his expenses claim, Singhvi had told the Commission that a termite attack on the premises of his chartered accountant in December 2012 had destroyed all records and expense vouchers, documents.

The Income Tax department and the Commission also contested Singhvi’s claim that he purchased laptops worth Rs 5 crore for members of his staff over three financial years and was, therefore, entitled to 30 per cent depreciation

As first reported first by The Indian Express, Singhvi approached the Commission last year, seeking immunity from penalty and prosecution which has since been denied to him on some counts.

Singhvi moved the Jodhpur High Court which stayed a 103-page Commission order passed on September 11 this year.

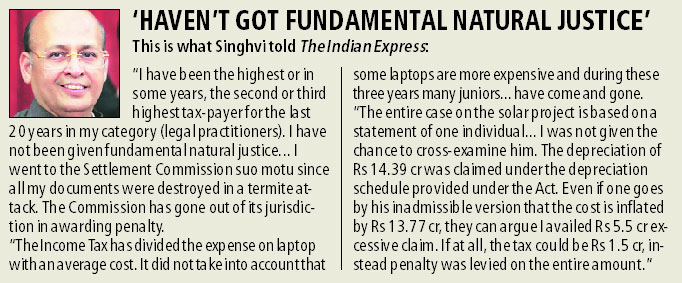

“I have been the highest tax-payer among lawyers. Even in this case, the entire income was received by cheque, so were the expenses. So it is a case of over-expenditure and the department not agreeing to it. I went to the Settlement Commission suo motu before any survey or investigation started since I could not back up my claim due to destruction of records, and the loss of which I had reported to police before the I-T probe even began,” Singhvi told The Indian Express.

The Singhvi tax case saw the Commission launching a full-fledged investigation into the expenses shown by the assessee. This is what the Commission highlighted:

> The sum has been added to Singhvi’s professional taxable income since he took the plea that a termite attack on the premises of his chartered accountant in December 2012 destroyed all his records and expense vouchers/documents. This was not accepted by the Income Tax Department (ITD) and the Commission.

> The Commission’s September order noted that since Singhvi’s salary sheet had shown that he had employed 14 advocates/professionals to assist him, he would have had to purchase 1,250 laptops (each costing Rs 40,000) to account for the amount under that head.

> The Commission also probed Singhvi’s claim that he spent Rs 35.98 crore on purchase of solar panels for his company, Rishab Enterprises. It declared that the transaction was “mainly intended at tax evasion by inflating the cost of the panels”. Of Rs 25.16 crore said to have been paid by Singhvi, the company concerned admitted it received only Rs 21.39 crore. The owner of the company which sold the solar panels, and whose premises were searched by the ITD, gave a statement admitting that the cost was “inflated” and that Rs 10 crore was to be repaid to Singhvi in the form of a loan to his sons.

Incidentally, the Commission also challenged Singhvi’s original contention — made at the first stage of his assessment — that the net income he earned from his legal practice was in the range of 55 per cent. The order noted the Income Tax contention that other equally senior Supreme Court lawyers had informed the tax department that their net income ranged between 90 per cent and 95 per cent.

The Commission also referred to the earlier probe by ITD in which several cheque payments made by Singhvi — to the tune of Rs 10.97 crore in the same three-year period — were found to be “non verifiable”. Reason: When inquiry letters were sent to 91 parties, 37 were returned.

Following the Commission order, Singhvi approached the Jodhpur High Court which granted a stay. In his writ petition, he reiterated the stand he had taken before the tax authorities: “The record of the petitioner had been destroyed on account of termite attack and could not have established existing claims by bringing on record documentary evidence.”

He said the loss of documents due to termite attack was reported to police on December 13, 2012. While contesting the I-T view, Singhvi’s petition stated: “There is absolutely no finding of the commission to the effect that termite attack, consequent destruction of records or the police report in that regard is false, misleading, lack authenticity or is legally unsustainable.”

Singhvi alleged that he had been “trapped” in a “cat and mouse game” and argued that the Commission did not have the jurisdiction to impose penalty on him. “No authority and power has been however been granted to the Settlement Commission in way of the provisions of Chapter XIX-A of the Act to impose and /or direct imposition of penalty under the provisions,” petition stated.

On the issue of the solar power company, Singhvi’s writ petition said: “No report could be furnished after 12 January 2014 being the expiry of the statutory period of 90 days for furnishing the report… DIT (Director, Income Tax investigation) Mumbai had no locus in the present proceeding… DIT Mumbai referred to ex parte enquiry conducted at Mumbai and is not tenable since the said statement was recorded under section 131 of the Act.”