Currency Demonetisation and Future course of Indian Economy

Re: Currency Demonetisation and Future course of Indian Economy

Looks like in addition to the Kashmiri terrorirists, Maoists, BD 420s the kerala CPM network will be a collateral damage in the demonetization drive.

Re: Currency Demonetisation and Future course of Indian Economy

the construction work on a building opposite my house has stopped ...all labour is in the Q's changing money for the owners !!

Re: Currency Demonetisation and Future course of Indian Economy

Sent the below to PMO today

==================================

Registration Number : PMOPG/E/2016/047XXXX

Name Of Complainant : XXXXXXXXXXX

Date of Receipt : 17 Nov 2016

Received by : Prime Ministers Office

Officer name : Shri Ambuj XXXXX

Officer Designation : Under Secretary (Public)

Contact Address : Public Wing

5th Floor, Rail Bhawan

New Delhi110011

Contact Number : 011-2338XXXX

e-mail : [email protected]

Grievance Description : I support this move of demonitization unconditionally. Now that the situation is better, a few points that could have been done without tampering with secrecy.It may not be too late and still can be done.

1. UPI apps for all mobile OS and not just android, released beforehand to public.

2. Youtube video demo of upi app usage, both as buyer and seller, in regional language, for all mobile OS published with much media fan fare, released beforehand to public and same videos in national and regional DD channels at least. Audio ad in regional languages in AIR about UPI and how to use the same as buyer and seller.

3. Permanent banning of Rs 500, 1000 and 2000 notes to ensure no storage of black money via cash.

4. PAN card verification mandatory for any cash transaction above Rs 500.

5. Completely ban of cash transaction above Rs 5000

6. Complete ban of cash transaction on certain categories like air travel, vehicle, land building registraion, hospital bill settlement on costly procedures etc

Current Status : RECEIVED THE GRIEVANCE

==================================

Registration Number : PMOPG/E/2016/047XXXX

Name Of Complainant : XXXXXXXXXXX

Date of Receipt : 17 Nov 2016

Received by : Prime Ministers Office

Officer name : Shri Ambuj XXXXX

Officer Designation : Under Secretary (Public)

Contact Address : Public Wing

5th Floor, Rail Bhawan

New Delhi110011

Contact Number : 011-2338XXXX

e-mail : [email protected]

Grievance Description : I support this move of demonitization unconditionally. Now that the situation is better, a few points that could have been done without tampering with secrecy.It may not be too late and still can be done.

1. UPI apps for all mobile OS and not just android, released beforehand to public.

2. Youtube video demo of upi app usage, both as buyer and seller, in regional language, for all mobile OS published with much media fan fare, released beforehand to public and same videos in national and regional DD channels at least. Audio ad in regional languages in AIR about UPI and how to use the same as buyer and seller.

3. Permanent banning of Rs 500, 1000 and 2000 notes to ensure no storage of black money via cash.

4. PAN card verification mandatory for any cash transaction above Rs 500.

5. Completely ban of cash transaction above Rs 5000

6. Complete ban of cash transaction on certain categories like air travel, vehicle, land building registraion, hospital bill settlement on costly procedures etc

Current Status : RECEIVED THE GRIEVANCE

Re: Currency Demonetisation and Future course of Indian Economy

Perhaps Mody realised that India's swiss banks are not in Switzerland but in these co.op banks in "God's own country"?Paul wrote:Looks like in addition to the Kashmiri terrorirists, Maoists, BD 420s the kerala CPM network will be a collateral damage in the demonetization drive.

Re: Currency Demonetisation and Future course of Indian Economy

They are not collateral damages, they are the damage that was partly intended when this ModiJi announced demonetisation last week. Collateral damages are those by and large honest people who had just sold their land/property to fund their daughter's marriage and had a pile of cash which turned worthless overnight until exchanged in the bank.Paul wrote:Looks like in addition to the Kashmiri terrorirists, Maoists, BD 420s the kerala CPM network will be a collateral damage in the demonetization drive.

Re: Currency Demonetisation and Future course of Indian Economy

^^yes, situation in other state cooperative banks will equally bad. However, Kerala network be first on hit list for obvious reasons

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Currency Demonetisation and Future course of Indian Economy

IMPS/NEFT has a max limit of 2L . The activation is immediate (atleast with my bank, with the OAC coming via sms instantaneously) and from right then, you get a limit of Rs 30,000, until the next day , where you can do upto Rs 2L.sum wrote: For any e-payment, we have to add a benificiary and wait 30 mins for activation and 1st 2 days, have to wait for 50k max limit....how is this usually worked around if we want to make a instant payment for some dealing and they cannot wait 2-3 days for the cool-off period of NEFT/IMPS/RTGS.

It is only RTGS where, you have a wait. But note. You can go to the bank branch and fill in the form and ask THEM to do an RTGS if you want a high value transaction immediately. There is no wait/activation for that.

So really this traders / organized guys whining doesnt hold true. Okay. The Mandi traders can now withdraw Rs 50,000 daily. But note, they first have to deposit the old cash! Or they will be only drawing down their balance. The unaccountable cash in their hand is now toast. The banks should stop accepting deposits of new Rs 2000 and Rs 500 notes and accept only old ones until Dec 30th so that everyone can find out exactly how much cash got deposited by account (and hence PAN number) system wide and go after them if above a trigger limit.

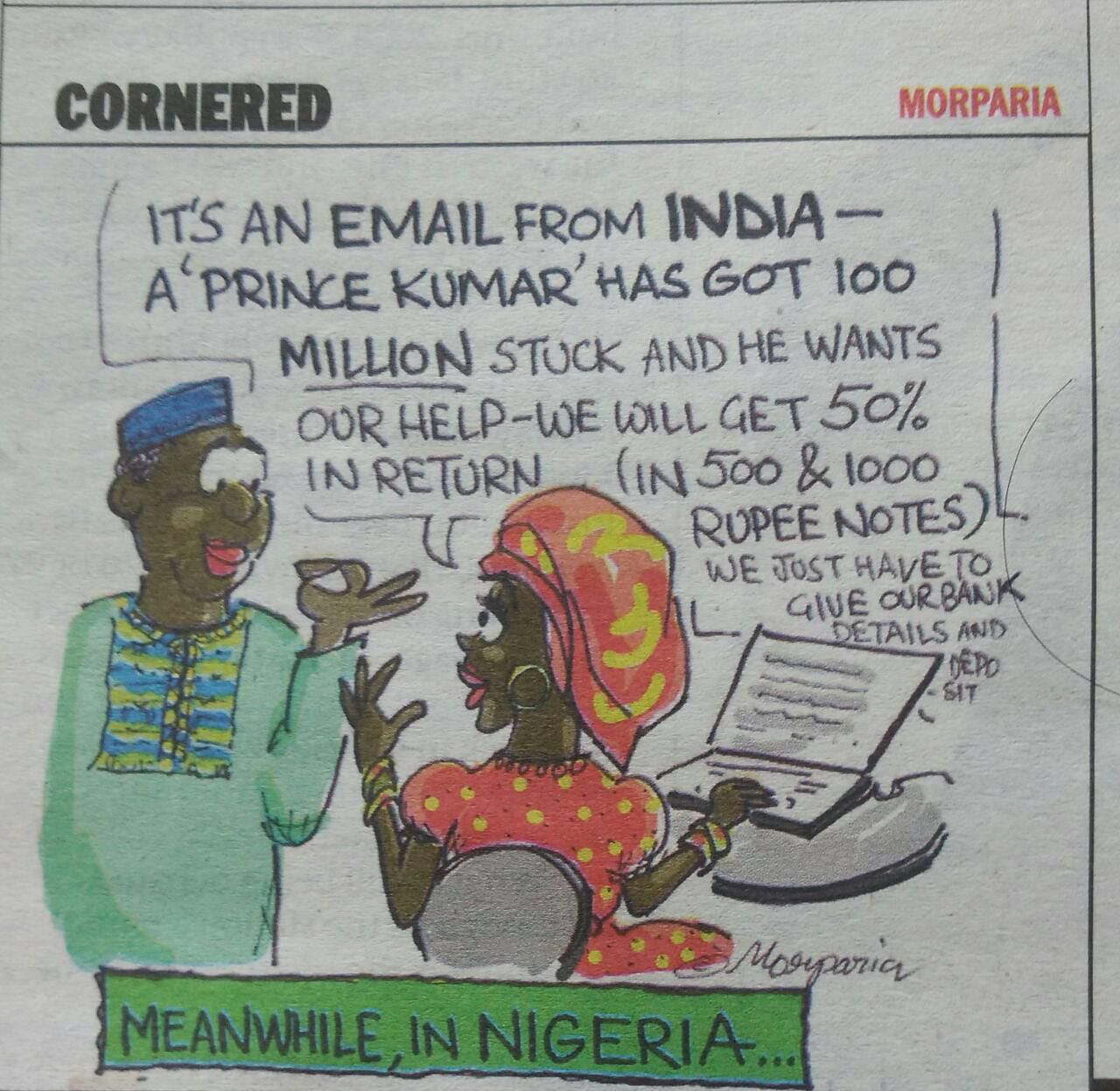

And this reduction of exchange limit to Rs 2000 from Rs 4500 per day is fabulous. This will immediately slow down the "organised" exchange wallahs guys. Sure even with 20 guys you can exchange Rs 40,000 Rs in say 4 hrs. Difficult to do. Atleast the large metros and large cash withdrawal branches would have got the indelible ink. Now you need to go to small branches in tier 2 and 3 places, where anyways the cash will be limited. Now rented queue guy will be scared. He has to exchange HIS cash first! You will soon run out of bodies.

In a three or 4 more days the ATMs will be full up and running. The crowds in the branches will start thinning out.

Last edited by vina on 17 Nov 2016 12:16, edited 1 time in total.

Re: Currency Demonetisation and Future course of Indian Economy

many coop banks have shadily given out back dated FD's, demand drafts and what not. There is a very large loophole here.Sachin wrote:Perhaps Mody realised that India's swiss banks are not in Switzerland but in these co.op banks in "God's own country"?Paul wrote:Looks like in addition to the Kashmiri terrorirists, Maoists, BD 420s the kerala CPM network will be a collateral damage in the demonetization drive.. But from what I hear such banks in other states are also not very different. Now all of them are trying to join hands to become a unified force and approach the RBI and Fin.Min.

-

Manish_Sharma

- BRF Oldie

- Posts: 5133

- Joined: 07 Sep 2009 16:17

Re: Currency Demonetisation and Future course of Indian Economy

Zee News is showing that people at kejri420's rally are cursing and abusing him, they are praising Modi and saying look kejri is chor all his black money is destroyed, hence he is protesting.

-

Manish_Sharma

- BRF Oldie

- Posts: 5133

- Joined: 07 Sep 2009 16:17

Re: Currency Demonetisation and Future course of Indian Economy

Please spread far and wide :

Re: Currency Demonetisation and Future course of Indian Economy

Why notes? Let there be Rs. 100 coins. Lasts longer and more inconvenient to store away. Cannot be melted away for value either since the metal is not worth much.Chandragupta wrote:They should flush the market with Rs.100 notes and eliminate all other higher notes.

Re: Currency Demonetisation and Future course of Indian Economy

I saw a jawan standing in line trying to get some cash , he was saying that he got limited time off in a day and how difficult it was to get cash

I wish the govt can make sufficient cash available to our armed forces and open special bank counters etc within army bases to distribute cash on an expedited basis

I wish the govt can make sufficient cash available to our armed forces and open special bank counters etc within army bases to distribute cash on an expedited basis

Re: Currency Demonetisation and Future course of Indian Economy

^^ I remember visiting a cantonment once..there are some areas that are off limits to all but those with clearance or appointment within. I remember seeing at least two PSU bank branches and ATMs in that "restricted" area accessible to none but armed forces personnel only.

Re: Currency Demonetisation and Future course of Indian Economy

I have a strong feeling the Big fish are watching the scenary from behind the tall grass with beady eyes and waiting to see if the situation changes by Dec 30. They are waiting to see if Didi's/AK420 etc.'s muhim pays off and changes something by Dec 30.

The big money is yet to be reeled in.

The big money is yet to be reeled in.

Re: Currency Demonetisation and Future course of Indian Economy

^

Right. Most of the big fish will wait till the last week and there will be a last minute rush by *some* to get in.

Right. Most of the big fish will wait till the last week and there will be a last minute rush by *some* to get in.

Re: Currency Demonetisation and Future course of Indian Economy

[quote="Manish_Sharma"]Please spread far and wide :

Image

^^^Will happily spread far and wide if assisted with translation, please.

Image

^^^Will happily spread far and wide if assisted with translation, please.

Re: Currency Demonetisation and Future course of Indian Economy

The big fish got caught by NaMO and are being reeled in.

They cant reel jack shiite now. There is literally no way out other than seceding from the union or the other eqally dangerous option. Good luck to anyone who even dreams of it (and may you rot in hell if you do)

They cant reel jack shiite now. There is literally no way out other than seceding from the union or the other eqally dangerous option. Good luck to anyone who even dreams of it (and may you rot in hell if you do)

Re: Currency Demonetisation and Future course of Indian Economy

From what I saw on my way to office - the queues in front of banks have halved.

I seriously pray that the ATM situation gets better soon. Its still bad.

But more or less - its normal life in my corner of Kolkata.

BTW - rubbing off indelible ink used to be an old trick. I have not heard it happening over the last two elections any more. I guess they have changed the composition. Also mandatory voter card and has stopped election frauds to a big extent.

I seriously pray that the ATM situation gets better soon. Its still bad.

But more or less - its normal life in my corner of Kolkata.

BTW - rubbing off indelible ink used to be an old trick. I have not heard it happening over the last two elections any more. I guess they have changed the composition. Also mandatory voter card and has stopped election frauds to a big extent.

Re: Currency Demonetisation and Future course of Indian Economy

Just one hypothetical pooch:

For any e-payment, we have to add a benificiary and wait 30 mins for activation and 1st 2 days, have to wait for 50k max limit....how is this usually worked around if we want to make a instant payment for some dealing and they cannot wait 2-3 days for the cool-off period of NEFT/IMPS/RTGS.[/quote]

Sirji,

One doesn't need cooling period for rtgs payment.

Actually only high value payments are made through it.

Regards

For any e-payment, we have to add a benificiary and wait 30 mins for activation and 1st 2 days, have to wait for 50k max limit....how is this usually worked around if we want to make a instant payment for some dealing and they cannot wait 2-3 days for the cool-off period of NEFT/IMPS/RTGS.[/quote]

Sirji,

One doesn't need cooling period for rtgs payment.

Actually only high value payments are made through it.

Regards

Re: Currency Demonetisation and Future course of Indian Economy

SBI deposits at 1.14 lakh crores - which means about 5 lakh crore has come back.

-

Shaktimaan

- BRFite

- Posts: 534

- Joined: 11 Aug 2016 06:14

Re: Currency Demonetisation and Future course of Indian Economy

Farmers, people with weddings in their homes can withdraw up to Rs.250,000. Agro traders registered in APMCs can withdraw rs.50K per week.

Cash exchange limit lowered from Rs 4500 to Rs 2000.

Cash exchange limit lowered from Rs 4500 to Rs 2000.

Re: Currency Demonetisation and Future course of Indian Economy

I am not sure how practical this is nor you understand the grass-root issues. few points, some we all know.Picklu wrote: Grievance Description : I support this move of demonitization unconditionally. Now that the situation is better, a few points that could have been done without tampering with secrecy.It may not be too late and still can be done.

1. UPI apps for all mobile OS and not just android, released beforehand to public.

2. Youtube video demo of upi app usage, both as buyer and seller, in regional language, for all mobile OS published with much media fan fare, released beforehand to public and same videos in national and regional DD channels at least. Audio ad in regional languages in AIR about UPI and how to use the same as buyer and seller.

3. Permanent banning of Rs 500, 1000 and 2000 notes to ensure no storage of black money via cash.

4. PAN card verification mandatory for any cash transaction above Rs 500.

5. Completely ban of cash transaction above Rs 5000

6. Complete ban of cash transaction on certain categories like air travel, vehicle, land building registraion, hospital bill settlement on costly procedures etc

1- not everyone has PAN #. indelible ink should gave been thought through. But the cashier now has to receive check, count cash, put indelible ink, then hand over money. What ever success this project had, was primarily due to the great work the bank employees did. They help correct many of the flaws in implementation. Last thing govt should do is to add more work.

2- Lot of fans for the cashless society. Please think through this. If you have Rs 10,000 you will only spend max 10,000. But instead you have plastic money, there is no limit literally. This is exactly what is happening in US and among many desi youngsters today. Too much credit card debt. So cashless society does not necessarily mean better. I would say cash one is better to keep debt at bay at all levels. May be a good mix of both, like in your point #6

3- this black money that everyone is howling at the top of voice is only a certain percentage. I think govt has over-estimated it. Much of the country runs on liquid money. Money that kept moving unlike the un-productive black money. This liquid money runs the economy, bring food and medicine to the local stores, helps farmers buy food, sow, reap, and repeat. Asking illiterate farmer, loom worker, construction worker etc to use ATM is impossible. Go stand in front of a chinese ATM. Can you find your way through? that is the same effect those souls have. Also each bank ATM is different.

4- when you replace 85% of the currency in circulation, how can RBI expect to run the economy on rest 15% ?. If they can print Rs2000 and Rs500 notes in secrecy, they can print Rs 100 also in secrecy. But they just failed. They mis-calculated the size of the liquid economy. about 2 days ago 90% of the interstate trucks had stopped. This is where the planning and execution failure happened. Now they are chasing a fast moving target. Daily changes to rules.

I think we really need to be more prudent in our thoughts rather than say cashless, PAN card, ban this, ban that..

Last edited by GeorgeM on 17 Nov 2016 14:38, edited 1 time in total.

Re: Currency Demonetisation and Future course of Indian Economy

How does this affect DMK/AIDMK looted wealth? Is that all stashed in Switzerland?Paul wrote:I have a strong feeling the Big fish are watching the scenary from behind the tall grass with beady eyes and waiting to see if the situation changes by Dec 30. They are waiting to see if Didi's/AK420 etc.'s muhim pays off and changes something by Dec 30.

The big money is yet to be reeled in.

Re: Currency Demonetisation and Future course of Indian Economy

From the shrill cry I hear from across the political spectrum (except BJP) in Kerala, if cooperative banks gets audited chances of having a Rohit Vemula, or Gajendra or the ex-Soldier Sarpanch in Kerala is very very high!! The politicos in Kerala have still not been able to give a valid reason on why they could not give the list of people who had more than Rs.100,000 in their accounts.Paul wrote:^^yes, situation in other state cooperative banks will equally bad. However, Kerala network be first on hit list for obvious reasons

Re: Currency Demonetisation and Future course of Indian Economy

OT alert. I just made my first pay TM payment.

-

Rishi Verma

- BRFite

- Posts: 1019

- Joined: 28 Oct 2016 13:08

Re: Currency Demonetisation and Future course of Indian Economy

....जब राहुल गांधी ने पूछा

2000 के नोट की चिप में गाने भरवा सकते हैं क्या ??????

2000 के नोट की चिप में गाने भरवा सकते हैं क्या ??????

-

Akshay Kapoor

- Forum Moderator

- Posts: 1643

- Joined: 03 May 2011 11:15

Re: Currency Demonetisation and Future course of Indian Economy

You are right that it's bank employees who are doing heroic work in implementing this. Why - they are the common Indian and if they get good leadership and a good cause they will by and large perform. Checking indelible ink takes 1 second.Sidharth wrote:I am not sure how practical this is nor you understand the grass-root issues. few points, some we all know.Picklu wrote: Grievance Description : I support this move of demonitization unconditionally. Now that the situation is better, a few points that could have been done without tampering with secrecy.It may not be too late and still can be done.

1. UPI apps for all mobile OS and not just android, released beforehand to public.

2. Youtube video demo of upi app usage, both as buyer and seller, in regional language, for all mobile OS published with much media fan fare, released beforehand to public and same videos in national and regional DD channels at least. Audio ad in regional languages in AIR about UPI and how to use the same as buyer and seller.

3. Permanent banning of Rs 500, 1000 and 2000 notes to ensure no storage of black money via cash.

4. PAN card verification mandatory for any cash transaction above Rs 500.

5. Completely ban of cash transaction above Rs 5000

6. Complete ban of cash transaction on certain categories like air travel, vehicle, land building registraion, hospital bill settlement on costly procedures etc

1- not everyone has PAN #. indelible ink should gave been thought through. But the cashier now has to receive check, count cash, put indelible ink, then hand over money. What ever success this project had, was primarily due to the great work the bank employees did. They help correct many of the flaws in implementation. Last thing govt should do is to add more work.

2- Lot of fans for the cashless society. Please think through this. If you have Rs 10,000 you will only spend max 10,000. But instead you have plastic money, there is no limit literally. This is exactly what is happening in US and among many desi youngsters today. Too much credit card debt. So cashless society does not necessarily mean better. I would say cash one is better to keep debt at bay at all levels. May be a good mix of both, like in your point #6

3- this black money that everyone is howling at the top of voice is only a certain percentage. I think govt has over-estimated it. Much of the country runs on liquid money. Money that kept moving unlike the un-productive black money. This liquid money runs the economy, bring food and medicine to the local stores, helps farmers buy food, sow, reap, and repeat. Asking illiterate farmer, loom worker, construction worker etc to use ATM is impossible. Go stand in front of a chinese ATM. Can you find your way through? that is the same effect those souls have. Also each bank ATM is different.

4- when you replace 85% of the currency in circulation, how can RBI expect to run the economy on rest 15% ?. If they can print Rs2000 and Rs500 notes in secrecy, they can print Rs 100 also in secrecy. But they just failed. They mis-calculated the size of the liquid economy. about 2 days ago 90% of the interstate trucks had stopped. This is where the planning and execution failure happened. Now they are chasing a fast moving target. Daily changes to rules.

I think we really need to be more prudent in our thoughts rather than say cashless, PAN card, ban this, ban that..

You are completely wrong about black money size. My cousin is an IAS officer and my uncle was in IPS. He worked in enforcement directorate. Govt own secret estimate in MMS times was 50 pct bare minimum. IAS and IPS grapevine estimates are 100 pct. You have no clue about the scale of wealth transfer that has happened since late 90s into babu, political and crony capitalist hands. Literally all national resources - agri land, minerals , spectrum has been converted to cash (on back of industrialisation) and vast percentages have found their way to the new elite. this has all been skimmed off the common man. And they know it. That is why despite 'inconvenience' they are supporting the move.

Your points about poor people and ATM are correct at the margin i.e. in extreme cases. My anecdotal eveidmexe says that there is not as big an issue as is being made out. Your point about constantly changing rules etc make sense. Crisis management war room, dedicated officers managing this and following through on a wat footing is needed. May already be happening. We don't know.

-

Akshay Kapoor

- Forum Moderator

- Posts: 1643

- Joined: 03 May 2011 11:15

Re: Currency Demonetisation and Future course of Indian Economy

Question for Suraj,

Is there any estimate of how much new 500 and 2000 notes will be printed. What are the ways BM can get their hands on this and revert to their old ways ? BM can withdraw any amount from my bank via check right ? Just because paper trail is there doesn't necessarily mean that IT scryituny will happen. And when it does what about paying off the IT officer , court cases etc.

Is there any estimate of how much new 500 and 2000 notes will be printed. What are the ways BM can get their hands on this and revert to their old ways ? BM can withdraw any amount from my bank via check right ? Just because paper trail is there doesn't necessarily mean that IT scryituny will happen. And when it does what about paying off the IT officer , court cases etc.

Re: Currency Demonetisation and Future course of Indian Economy

Cashless economy is not equal to more credit cards. Spending from saving account using debit card is also plastic money. As such Indians did not need credit cards to come to India from West to teach us how to operate Credit system based economy. We have always had monthly credit system for almost all essential things e.g. Kirana would be totally on monthly credit.Sidharth wrote:

2- Lot of fans for the cashless society. Please think through this. If you have Rs 10,000 you will only spend max 10,000. But instead you have plastic money, there is no limit literally. This is exactly what is happening in US and among many desi youngsters today. Too much credit card debt. So cashless society does not necessarily mean better. I would say cash one is better to keep debt at bay at all levels. May be a good mix of both, like in your point #6

Re: Currency Demonetisation and Future course of Indian Economy

Most poor who have seen price of a idly and dosa rise know that it is inflation in last ten years and connect it to BM generation and hoarding. People do notice who is getting ostensibly wealthy over the years and connect it to possible shady activities and tax evasion etc.

The ones cribbing most are the ones who always complain about any line - the middle class who cannot afford to hire somebody else for menial work and needs those hours to be on the treadmill of monthly budget balancing.

The ones cribbing most are the ones who always complain about any line - the middle class who cannot afford to hire somebody else for menial work and needs those hours to be on the treadmill of monthly budget balancing.

Re: Currency Demonetisation and Future course of Indian Economy

With the anti black money environment, Modi ji can just give a war cry for every indian and share the IT helpline to report any mass cash found or any body demanding bribe. There will definitely be a revolution since i can feel it in the public in bank branches or in ATM.

Re: Currency Demonetisation and Future course of Indian Economy

So has these really large BM come out??Akshay Kapoor wrote:

You are completely wrong about black money size. My cousin is an IAS officer and my uncle was in IPS. He worked in enforcement directorate. Govt own secret estimate in MMS times was 50 pct bare minimum. IAS and IPS grapevine estimates are 100 pct. You have no clue about the scale of wealth transfer that has happened since late 90s into babu, political and crony capitalist hands. Literally all national resources - agri land, minerals , spectrum has been converted to cash (on back of industrialisation) and vast percentages have found their way to the new elite. this has all been skimmed off the common man. And they know it. That is why despite 'inconvenience' they are supporting the move.

I think that is hiding in the $1.4 trillion in Swiss accounts. $1.4 trillion is 92 lac crore. We have collected a minuscule 5 lac crore so far and is decreasing daily. That is about 5% of Swiss accounts

Let us not confuse the issue. Yes the big fish has some really big BM. That is now either in large tracts of land or in gold or in Swiss accounts. What we are catching today is mostly the liquid money that kept the machinery running. Or in other words, the catch today has both Liquid Money and BM. We have just put brakes to the economy. If we had caught only BM, the economy will not come to a halt, as BM is idle money with no contribution to growth.

People are confusing the large BM with Liquid Money. We have just burned down the house to catch that pesky mouse.

Re: Currency Demonetisation and Future course of Indian Economy

some darlings of the commie naxal gang like @pbmehta are continuing to lie through their black teeth.

Why does @pbmehta repeat this falsehood? Indelible ink is for exchanges not deposit or withdrawal. Disappointing.

Re: Currency Demonetisation and Future course of Indian Economy

Did the Kirana guy take debit card at the end of the month to settle account?JayS wrote:

Cashless economy is not equal to more credit cards. Spending from saving account using debit card is also plastic money. As such Indians did not need credit cards to come to India from West to teach us how to operate Credit system based economy. We have always had monthly credit system for almost all essential things e.g. Kirana would be totally on monthly credit.

Or you still had to pay cash. Else he will make your life miserable. Credit card.. you can still get away.

Yes debit card is better than credit, but it still makes you spend more as when you loose cash out of your wallet, you feel it, though your fingers. Any card, debit or credit, is just swiping. Much less pain or may be no pain.

Cashless is great for big transactions. But for daily home running, cash is the best to keep out of debt.

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Currency Demonetisation and Future course of Indian Economy

Every Kirana wala will soon have a swipe machine. Whether you choose to pay with credit or debit is upto you. I would recommend credit card. Helps in emergenices, has reward points, allows you to contest wrong billing, has insurance protection etc.. etc..Sidharth wrote:Did the Kirana guy take debit card at the end of the month to settle account?

Or you still had to pay cash.

That is so much psycho babble . Massaging that kind of pyscho / neurosis with cash is what leads this country into the unaccounted money, lowers tax base and yes, keeps you poor with terrible infra and huge underinvestment. That kind of neuroses has had fatal effects. Time to cure it and cleanse it. Another "Swacch Bharat" . Cleaning out the garbage (that is a genearational and 25 year effort) and also the corruption and black money!Yes debit card is better than credit, but it still makes you spend more as when you loose cash out of your wallet, you feel it, though your fingers. Any card, debit or credit, is just swiping. Much less pain or may be no pain.

Cashless is great for big transactions. But for daily home running, cash is the best to keep out of debt.

Re: Currency Demonetisation and Future course of Indian Economy

I would suggest you read previous posts, particularly those by Suraj. These things are discussed already. No, not all BM is in liquid cash, most is locked in RE/Gold within the country. But over the time, the valuation of those things will fall. Also not all BM is idle money, some of it comes out as consumption. So we should see reduction in consumption in short terms.Sidharth wrote:So has these really large BM come out??Akshay Kapoor wrote:

You are completely wrong about black money size. My cousin is an IAS officer and my uncle was in IPS. He worked in enforcement directorate. Govt own secret estimate in MMS times was 50 pct bare minimum. IAS and IPS grapevine estimates are 100 pct. You have no clue about the scale of wealth transfer that has happened since late 90s into babu, political and crony capitalist hands. Literally all national resources - agri land, minerals , spectrum has been converted to cash (on back of industrialisation) and vast percentages have found their way to the new elite. this has all been skimmed off the common man. And they know it. That is why despite 'inconvenience' they are supporting the move.

I think that is hiding in the $1.4 trillion in Swiss accounts. $1.4 trillion is 92 lac crore. We have collected a minuscule 5 lac crore so far and is decreasing daily. That is about 5% of Swiss accounts

Let us not confuse the issue. Yes the big fish has some really big BM. That is now either in large tracts of land or in gold or in Swiss accounts. What we are catching today is mostly the liquid money that kept the machinery running. Or in other words, the catch today has both Liquid Money and BM. We have just put brakes to the economy. If we had caught only BM, the economy will not come to a halt, as BM is idle money with no contribution to growth.

People are confusing the large BM with Liquid Money. We have just burned down the house to catch that pesky mouse.

Next hammer might fall on Benami properties, which will unlock more BM from RM or that which is hidden in books of benami companies. YOu can imagine the consequences.

For overseas BM, nationalisation of those assets can be done once GOI is confident enough that they have done the homework. Surely they are doing it, if you have observed over last two years, in the form of amended tax treaties with tax havens, data sharing treaties with many countries. It has to start from somewhere. This is where it is starting from, where GOI finds itself in full control. Bringing in money from outside is not totally under GOI control. But it could happen one day, who knows.

Re: Currency Demonetisation and Future course of Indian Economy

Essentials will not see much compression in demands. Other demand like house/Jewelery/Cars/Clothes/Other non-essentials and Luxury items will just shift to a future period. Some loss will occur on the periphery in time-barred demand like Airlines ticket/Hotel rooms/Theaters seats.

Once upon the wisdom was that most BM is tied down in Swiss accounts. In the last five years that changed to most is tied in RE and to a little extent in Gold. And Swiss have declared that they do NOT have much money from Indian passport holders as deposits.

Once upon the wisdom was that most BM is tied down in Swiss accounts. In the last five years that changed to most is tied in RE and to a little extent in Gold. And Swiss have declared that they do NOT have much money from Indian passport holders as deposits.

Re: Currency Demonetisation and Future course of Indian Economy

Did Kirana guy accepted Debit cards - stupid question, since there were hardly any debit cards until some 10yrs back. Only in recent time debit card has become a default with saving bank account.Sidharth wrote:Did the Kirana guy take debit card at the end of the month to settle account?JayS wrote:

Cashless economy is not equal to more credit cards. Spending from saving account using debit card is also plastic money. As such Indians did not need credit cards to come to India from West to teach us how to operate Credit system based economy. We have always had monthly credit system for almost all essential things e.g. Kirana would be totally on monthly credit.

Or you still had to pay cash. Else he will make your life miserable. Credit card.. you can still get away.

Yes debit card is better than credit, but it still makes you spend more as when you loose cash out of your wallet, you feel it, though your fingers. Any card, debit or credit, is just swiping. Much less pain or may be no pain.

Cashless is great for big transactions. But for daily home running, cash is the best to keep out of debt.

Last I checked GOI hasn't banned Currency notes totally. Only exchange of large denomination is happening. And this premise that plastic money will make people spend more, it totally baseless. Perhaps true for some people, but certainly not a general phenomenon. I do not have credit card, and I almost never use cash for transaction of 100+ rupees. Sorry but I never felt the compulsion to spend more just because its less painful to pay. And from where I come from, people have not started spending like crazy after they got hooked on to debit or credit cards.

FYI lot of small shop owners in BLR do accept cards, its just matter of change of mindset. If it can happen in BLR, it can happen in rest of the India.

Last edited by JayS on 17 Nov 2016 15:41, edited 1 time in total.