must be a different world where buying a tea or a breakfast costs rs 2000 and if it doesnt everyone has change handy..Rishi Verma wrote:I simply don't understand why in a city like Bangaluru, Kerala a Rs2000 note is that difficult to use. Here in UP I have used it for petrol, groceries, and for many other small purchases. Not a single person hesitated to accept it.

Currency Demonetisation and Future course of Indian Economy

Re: Currency Demonetisation and Future course of Indian Economy

Re: Currency Demonetisation and Future course of Indian Economy

yes, completely agreeBart S wrote:An SBI account is useful to have, but for day to day banking the private banks are much better. SBI is useful really when you want a car loan or a home loan - they are much more fair and have better rates than private banks for those.

Re: Currency Demonetisation and Future course of Indian Economy

I see many pensioners and old folks (70+ age group) who are hugely inconvenienced by the demonetization angle. they simply arent clued into the digital world and were and are used to making regular trip to local bank and dealing with everyone using cash. the la-di-da type (not you) who dont even reside in india can make sarcastic comments about bangalore etc and brag but reality is there is a huge undercurrent of concern about cash availability in the smaller denominations (100, 10, 50 etc) and not everyone has kids/family who can chip in. i hope things improve in the next few weeks. btw my sbi cards havent been replaced, have to check on an axis one.Bart S wrote:The new committee under Kant will identify and operationalise in the earliest possible timeframe user-friendly digital payment options in all sectors of the economy, an official statement said.

The old adage that a camel is a horse designed by committee comes to mind. By the time these fuddy duddies come up with a plan the world would have moved on and we would have lost what is a very real first mover advantage and opportunity.

They should just assemble the fintech brains from the industry, including representation from all the major banks, tell them what the requirements are and let them build and implement it.

Re: Currency Demonetisation and Future course of Indian Economy

@Rishi VermaKaran M wrote:must be a different world where buying a tea or a breakfast costs rs 2000 and if it doesnt everyone has change handy..Rishi Verma wrote:I simply don't understand why in a city like Bangaluru, Kerala a Rs2000 note is that difficult to use. Here in UP I have used it for petrol, groceries, and for many other small purchases. Not a single person hesitated to accept it.

Even earlier, small veggie vendors would not be able to break a 500 Rs note and return change after you made a purchase of say, Rs 40 and paid with a Rs 500 note.

The larger kirana shops and dept stores may be able to do it but if you act smart and expect change of Rs 1960 after you have made a token purchase of Rs 40 and paid with a spanking new Rs 2000 note, why should they bother?? Small change is a critical commodity today and is being hoarded and dealt out in dribs and drabs because small change is what helps them sell through the day.

Re: Currency Demonetisation and Future course of Indian Economy

Cashless is not a new concept at all. Indians have forgotten that bankers cheques were the original route to cashless economy. But because cheques bounced - even government cheques regularly bounced cheques simply went out of fashion in India. For years I have been surprised at anyone who agreed to accept a cheque - including my kids schools.

In the 1980s when I lived in the UK, the credit worthiness of a cheque was guaranteed by what was called a "cheque guarantee card". This was a bit painful. It meant writing out a cheque - (often at a supermarket queue) and then showing your card and its number would either be written down, or the card itself would be run through a manual stamping machine (faster then writing). Cheque guarantee cards were a bank guarantee that they would honour a certain amount - usually a maximum of 50 Pounds Sterling on that cheque. I spent years doing that and I rarely had even 10 Pounds cash in my wallet - they were huge ungainly notes those days - you could stitch a pair of undies with them. Amounts more than 50 Pounds could be paid by more than 1 cheque. Of course credit cards were there but I made the error of getting Amex which was mostly not accepted anywhere back then. I got Visa much later.

Incidentally ATMs back then almost always had queues in the UK - as in the image below. At least one BRFite will recognize one person in that image - a classmate of his

In the 1980s when I lived in the UK, the credit worthiness of a cheque was guaranteed by what was called a "cheque guarantee card". This was a bit painful. It meant writing out a cheque - (often at a supermarket queue) and then showing your card and its number would either be written down, or the card itself would be run through a manual stamping machine (faster then writing). Cheque guarantee cards were a bank guarantee that they would honour a certain amount - usually a maximum of 50 Pounds Sterling on that cheque. I spent years doing that and I rarely had even 10 Pounds cash in my wallet - they were huge ungainly notes those days - you could stitch a pair of undies with them. Amounts more than 50 Pounds could be paid by more than 1 cheque. Of course credit cards were there but I made the error of getting Amex which was mostly not accepted anywhere back then. I got Visa much later.

Incidentally ATMs back then almost always had queues in the UK - as in the image below. At least one BRFite will recognize one person in that image - a classmate of his

Re: Currency Demonetisation and Future course of Indian Economy

Lot of my work is involved in such fields and secure protocols. Hence, I have brought up such concerns. For example, I am in US and know that pretty much all my transactions are backed up by banks and credit card companies if through personal accounts. Even then, I do not keep debit card or use cell phone to do any transactions or have any financial app in general on my phone. Sometimes you are just afraid of finding someone like you on the other side.ShauryaT wrote:darshan wrote:Some days back many debit card accounts were compromised and cards were reissued./quote] Anything that touches your bank account electronically in real time has a perceived level of high risk. In the place we live in, although debit cards are widely accepted, most consumers prefer the user of credit cards. It is my understanding that Debit card fraud is not as protected as credit card. Almost everyone I know of has faced some type of credit/debit card fraud. So, yes a serious issue and having a buffer like a credit card between your bank and the retail PoS is a good conventional idea. Maybe the younger generation feels otherwise.

Re: Currency Demonetisation and Future course of Indian Economy

I know before the demonetization and even before the introduction of 1000 and 500 Rs. note., carrying cash was the safest option. And life was so easy.

Like if I had to distribute monthly salary of 4k to 9 employees., I had to go to bank., and present a cheque to the banker. The banker will queue up the cheque., and go for a coffee break. Then come back and tally the cheque with the account and do the necessary credit on the ledger (which itself was a book weighing few kilos). Then would issue me a brass token with a number on it. The brass token was cool. I would then go and have my coffee break. Coming back will still find the cheque on the sr. banker who would then tally the ledger and initial and then some note will be sent to the cashier. There will be a bunch of people waiting at the cashier. Based on the queue, one has to decide if one can take a lunch break or not.

Okay your number gets called and show up with a suitcase and a pouch. 36000 Rs in 100 Rs note was never possible. You would get maybe a single bundle of 100 Rs or if lucky get two bundles of 100 Rs. Anyway., you stuff the wads of cash in the pouch and make a motion that the money actually went in the suitcase. Keep the dirty looking pouch with you. Then begins your journey.You have to assume that you will be mugg'ed or knife'd at any point and your suitcase will be snatched from you. *will* since it was snatched from me. Thankfully not at knife point.

Anyway., point is taking wads of cash around is so so so much safer. All this cashless transactions., the big bad banks are going to snoop on it and take your money away one day. So my suggestion is do not go cashless.

Cash is king. Carry lots of wads around. Do put in suitcase or in pouches. With inflation., the amount you have to give out will not be 36k but more than that! I think it will easily be around 90k. Maybe you will be lucky and get 9 bundles of 100 Rs. each.

Again Cash is king.

Like if I had to distribute monthly salary of 4k to 9 employees., I had to go to bank., and present a cheque to the banker. The banker will queue up the cheque., and go for a coffee break. Then come back and tally the cheque with the account and do the necessary credit on the ledger (which itself was a book weighing few kilos). Then would issue me a brass token with a number on it. The brass token was cool. I would then go and have my coffee break. Coming back will still find the cheque on the sr. banker who would then tally the ledger and initial and then some note will be sent to the cashier. There will be a bunch of people waiting at the cashier. Based on the queue, one has to decide if one can take a lunch break or not.

Okay your number gets called and show up with a suitcase and a pouch. 36000 Rs in 100 Rs note was never possible. You would get maybe a single bundle of 100 Rs or if lucky get two bundles of 100 Rs. Anyway., you stuff the wads of cash in the pouch and make a motion that the money actually went in the suitcase. Keep the dirty looking pouch with you. Then begins your journey.You have to assume that you will be mugg'ed or knife'd at any point and your suitcase will be snatched from you. *will* since it was snatched from me. Thankfully not at knife point.

Anyway., point is taking wads of cash around is so so so much safer. All this cashless transactions., the big bad banks are going to snoop on it and take your money away one day. So my suggestion is do not go cashless.

Cash is king. Carry lots of wads around. Do put in suitcase or in pouches. With inflation., the amount you have to give out will not be 36k but more than that! I think it will easily be around 90k. Maybe you will be lucky and get 9 bundles of 100 Rs. each.

Again Cash is king.

Re: Currency Demonetisation and Future course of Indian Economy

Such ridiculous conspiracy theories against cashless system.

Not even worth debating.

And cashless doesn't necessarily mean credit/debit cards.

PayTM, UPI and the good old drafts and cheques are all examples of cashless.

India doesn't have to ape the West; it is resourceful enough to design solutions that work for its people.

Not even worth debating.

And cashless doesn't necessarily mean credit/debit cards.

PayTM, UPI and the good old drafts and cheques are all examples of cashless.

India doesn't have to ape the West; it is resourceful enough to design solutions that work for its people.

Re: Currency Demonetisation and Future course of Indian Economy

United Payments Interface: Post-dream launch, just Rs 3.5 crore daily volumes

http://www.financialexpress.com/opinion ... MM.twitter

http://www.financialexpress.com/opinion ... MM.twitter

Yet, as NPCI managing director AP Hota said on Tuesday, there are just about 10,000 daily transactions on UPI with an average value of around Rs 3,600. To be sure, the first few months were used in the banks testing the app and it was only this week that SBI got on to the platform—HDFC Bank joined a few weeks ago—but there is little doubt the pace of adoption is very slow, especially given that PayTM is at 5 million daily transactions and is talking of being on track to get Rs 24,000 crore of transactions this financial year.

While few doubt the simplicity-plus-security of the UPI interface, getting people to make payments through it and vendors to accept them requires tremendous marketing effort, and funds. Not only is a lot of advertising required, generous cash-backs are required and other incentives are required to convince vendors. NPCI, which has done a great technical job in the payments space from IMPS to RuPay, however, does not have such deep pockets as the non-bank wallets seem to have. So, apart from the few advertisements it has put so far, or the three minutes of television time economic affairs secretary Shaktikanta Das gave UPI in his morning briefing on Tuesday, there is little UPI can do to actively canvass users. It is then up to the banks to push UPI but there is no certainty banks will push it given most have wallets which are competing products.

Re: Currency Demonetisation and Future course of Indian Economy

There were virtually no ATMs in India in the early 90s

Even the 500 Rupee note had arrived just before that (1987), and 1000 notes reappeared in 2000. It was the proliferation of ATMs after Y2K or so that made it easier to transact in cash - but as dish pointed out above cash transactions were decidedly not convenient even up to the 1990s. It was usuall "Bank Draft" for anything serious. You pay by bank draft (if you did not have cash). Even if you had cash you might have to worry.

I never grew up in a cash carrying household and I remember being greatly anxious carrying Rs 10,000 for the first time in my life in the 1980s.

So the "cash economy" is hardly an "Indian tradition" as people might be tempted to claim. Cash transactions in India for the majority of people till 20 -25 years ago were usually small transactions

I also must point out that my earliest salaries in India did not cross Rs 1000 in the early 1980s. We doctors used to be jealous of Engineers whom we were told used to get 4000. In those days (I can't recall the exact values) a VCR was Rs 40,000. A TV or a fridge were about 5-8000. The question of paying amounts that were half one's annual salary or more in cash simply did not occur. Yes groceries food, movies etc were paid for in cash- also train tickets. Air Tickets would be a bank draft or a cheque - the latter would mean a delay

The "cash economy" really exploded after the 1990s and the number and value of black money transactions I am sure increased exponentially.

Even the 500 Rupee note had arrived just before that (1987), and 1000 notes reappeared in 2000. It was the proliferation of ATMs after Y2K or so that made it easier to transact in cash - but as dish pointed out above cash transactions were decidedly not convenient even up to the 1990s. It was usuall "Bank Draft" for anything serious. You pay by bank draft (if you did not have cash). Even if you had cash you might have to worry.

I never grew up in a cash carrying household and I remember being greatly anxious carrying Rs 10,000 for the first time in my life in the 1980s.

So the "cash economy" is hardly an "Indian tradition" as people might be tempted to claim. Cash transactions in India for the majority of people till 20 -25 years ago were usually small transactions

I also must point out that my earliest salaries in India did not cross Rs 1000 in the early 1980s. We doctors used to be jealous of Engineers whom we were told used to get 4000. In those days (I can't recall the exact values) a VCR was Rs 40,000. A TV or a fridge were about 5-8000. The question of paying amounts that were half one's annual salary or more in cash simply did not occur. Yes groceries food, movies etc were paid for in cash- also train tickets. Air Tickets would be a bank draft or a cheque - the latter would mean a delay

The "cash economy" really exploded after the 1990s and the number and value of black money transactions I am sure increased exponentially.

Re: Currency Demonetisation and Future course of Indian Economy

I didn't have a personal experience with debit card fraud but just last week had a big fraud transaction on my credit card, which my CC provider alerted me to after a couple of days. After the usual clarifications and declarations, the CC company asked for a police complaint, apparently as part of RBI regulations. Turns out bank fraud is deemed "special crime" and is dealt with centrally (at a Central Crime Branch in COP HQ in Chennai) and not at the local PS's. This process took almost a whole day and will take another day as well by the time the CCB is done with it. There were a dozen others with similar credit/debit card fraud when I was there. Many had anywhere from 20/25K to 80/90K lost and some were in confusion if they ever will see their money back or if the bank staff themselves may have been complicit etc.darshan wrote:Some days back many debit card accounts were compromised and cards were reissued. It would be informative if anyone over here who may have been affected by fraud through that and can describe how the whole incident was handled by bank authorities. For example, let us say one ended up seeing few thousands in fraudulent charges due to this, did this person get the money back immediately? was there any run around or hold up of money for awhile?

I am not sure yet how far the CCB will investigate to catch the fraudsters on a case-by-case basis especially if they are out-of-state/country but may, in the long run, follow broad patterns to catch some. Also, not sure yet how long the CC providers will take to close these cases or with what resolution. This is my first time. Overall I would say, it might involve a bit of running around and waiting for a few weeks at least before finding out resolution.

Re: Currency Demonetisation and Future course of Indian Economy

No one really means cashless will be totally digital system. What we are going to have a system wherein most fo the transactions are done online, mobile banking or by card and all cash transactions are very rare. Now it is the another way around.

Too much traffic in here due to Akrosh divas and Bandh.

Too much traffic in here due to Akrosh divas and Bandh.

Re: Currency Demonetisation and Future course of Indian Economy

http://swarajyamag.com/economics/heres- ... tion-drive

Here’s What These 5 Ex-RBI Governors Have To Say About Modi’s Demonetisation Drive

Arihant Pawariya - November 25, 2016,

Here’s What These 5 Ex-RBI Governors Have To Say About Modi’s Demonetisation Drive

1) Y.V. Reddy who served as the governor of the Reserve Bank Of India from 2003-2008, when economy saw a massive boom, has endorsed the decision taken by the Modi government. Mr. Reddy termed the timing of the move “perfect” as it comes right before the Goods and Services Tax (GST) is all set to be implemented.

It is a historic moment. There is bound to be paradigm shift in the economic and political system. With the GST on the anvil, the system is ripe for a change. However, to take it forward, contract enforcement and judicial processes will have to play active role. It is impossible to have a big change without some inconvenience and some temporary disruptions.

The Economic Times

2) C. Rangarajan served as governor of the RBI in the post-liberalisation era from 1992-1997. He called the demonetisation move a “standard prescription” that was tried in the past, however, he added, that this time the government was targeting those who accumulated money, who issue fake currency and those financing terrorism. Mr. Rangarajan has also called for measures so that black money doesn’t get generated in future.

The government’s move to withdraw Rs 500 and Rs 1,000 notes is a standard prescription in extinguishing unaccounted money. This has been tried in the past. But the government (this time) had three targets: those who accumulated money, who issue fake currency and those financing terrorism, the last two being of different nature. But as far as black money is concerned, this measure is a step towards reducing black money or unaccounted money from the system. It will affect the retail trade as most of the transactions are done using cash. There are some other sectors in the economy like real estate, jewellery where cash has become a major player for transaction. Those will undergo a fundamental change.

3) D. Subbarao, who was at the helm at the RBI post 2008 financial crisis, has said that positives of the current demonetization drive outweighed the negatives. However, he cautioned the RBI against treating the money not returned during the current drive as profit and handing over it to the government.

If you ride out the short-term pain, the positives will be substantial, be in terms of attracting investments, and also getting people to move from physical cash to electronic transactions. The money being deposited in the banks, as against having it in the pocket, or under the pillow, was good for the economy.Banks will multiply the money when it is with them. It will encourage banks to get lending rates down, even if the RBI does not ease any further…. demonetization will also help improve financial inclusion... banks will be able to give out more credit and all this will have a multiplier effect.

Livemint

4) Dr. Raghuram Rajan, the previous RBI governor, hasn’t commented on the current drive. But on an earlier occasion, he had raised doubts about the effectiveness of demonetisation as a way of cleaning the financial system of black money. Rajan had suggested that it is better to focus on making improvements in tracking tax data and ramping up tax administration.

In the past demonetisation has been thought off as a way of getting black money out of circulation. Because people then have to come and say “how do I have this ten crores in cash sitting in my safe” and they have to explain where they got the money from. It is often cited as a solution. Unfortunately, my sense is the clever find ways around it.They find ways to divide up their hoard in to many smaller pieces. You do find that people who haven’t thought of a way to convert black to white, throw it into the Hundi in some temples. I think there are ways around demonetization. It is not that easy to flush out the black money.

The Huffington Post

5) Bimal Jalan, served from 1997-2003, overseeing the transition of the RBI from 20th century to 21st. He has termed the demonetisation drive as positive and good “in terms of what the intention is.” When asked whether the scheme will achieve its purpose, Mr Jalan said that ‘it would take three-four months to see how it works.’

It is very positive and good for us in terms of what the intention is. And over a period of time as I think he also mentioned that it will be easy to see what else needs to be done to make it available, make it accessible to the people who do not have bank account and let us hope it works out. The most crucial issue at the moment is how to increase the spread in the banking system that is the most crucial issue. The second related most important issue is that in rural areas or in semi-urban area where there are no banks accounts for the poor or for the agriculturists and, then what is to be done with their notes if they do not have a bank account.

The Economic Times

Re: Currency Demonetisation and Future course of Indian Economy

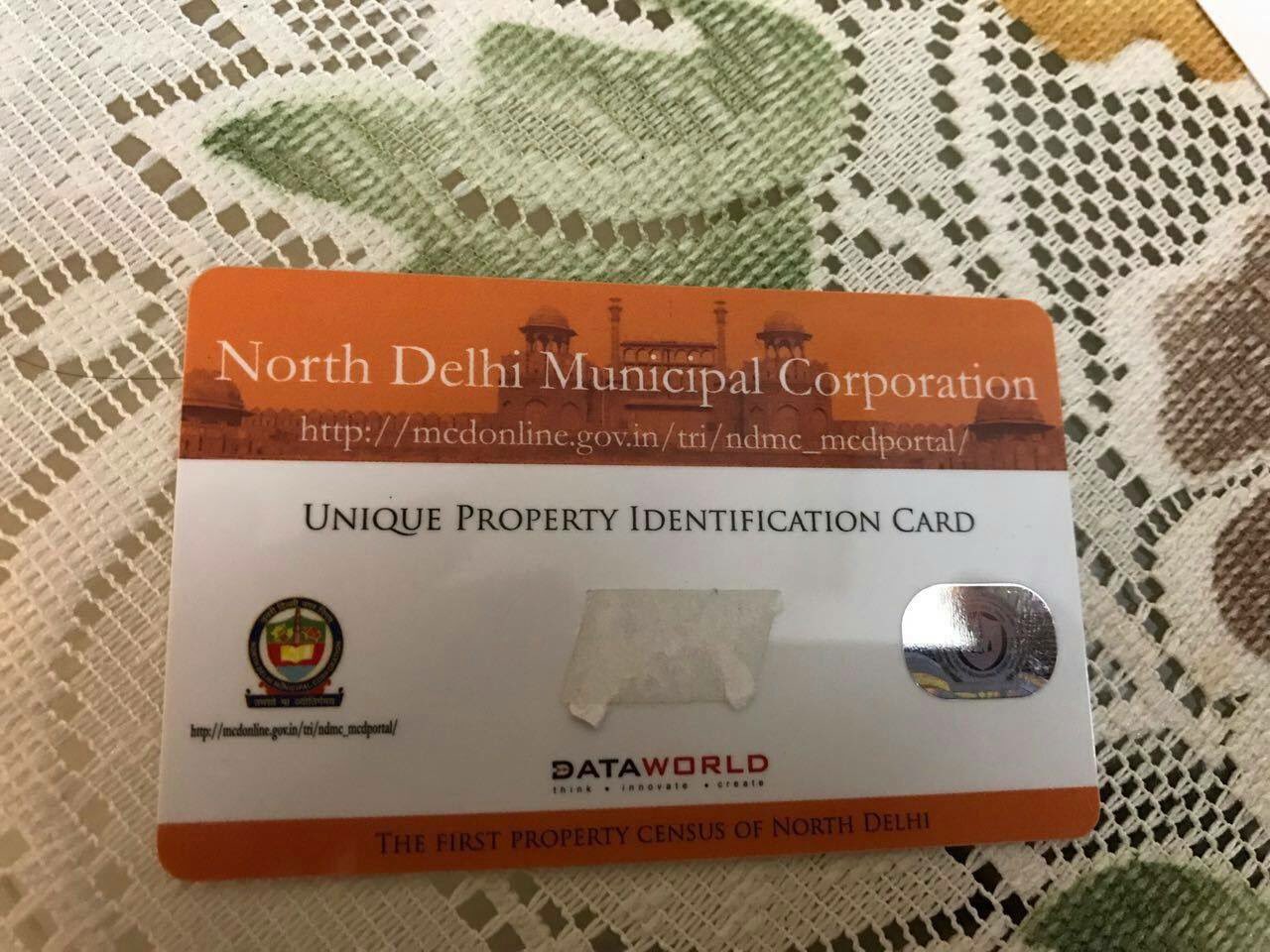

Renuka Jain @RenukaJain6

Property ID card Next BOMB ready. Via FB. @narendramodi throwing bouncers. to tale Enders

Hope it becomes a norm for all lands in India, within a few years. Bye bye to goondas, benamies and govt land encroaches.

-

Marten

- BRF Oldie

- Posts: 2176

- Joined: 01 Jan 2010 21:41

- Location: Engaging Communists, Uber-Socialists, Maoists, and other pro-poverty groups in fruitful dialog.

Re: Currency Demonetisation and Future course of Indian Economy

This is goin to hurt the RE market for a few years. And hurt incomes at various courts where cases have been running for decades.

Re: Currency Demonetisation and Future course of Indian Economy

Currency crisis: Kerala witness exodus of migrant workers.....

The report tries to paint a picture that, because of non availability of cash, these laborers who were called on a daily wage basis are now left unemployed. Because no one has money to pay them. One thing which is not mentioned is that the migrant workers are heavily engaged in the real estate sector in Kerala. Real Estate sector is already not in a good shape, and the drive against black money would have messed up things even further. Construction activity seems to have taken a serious hit in the communist heaven.

The report tries to paint a picture that, because of non availability of cash, these laborers who were called on a daily wage basis are now left unemployed. Because no one has money to pay them. One thing which is not mentioned is that the migrant workers are heavily engaged in the real estate sector in Kerala. Real Estate sector is already not in a good shape, and the drive against black money would have messed up things even further. Construction activity seems to have taken a serious hit in the communist heaven.

-

putnanja

- BRF Oldie

- Posts: 4765

- Joined: 26 Mar 2002 12:31

- Location: searching for the next al-qaida #3

Re: Currency Demonetisation and Future course of Indian Economy

View: Cash is risky after demonetisation, can't say what Modi will do next

...

Those whose black wealth comes are a separate class but as far as real business-owners are concerned, their response is different. Over the last fortnight, I've interacted with a large number whom I know and they've all said that they are converting their businesses to all white. Not a single one has had any moral epiphany; they're not doing this because it's the right thing. Instead, they've all said that cash is just too risky now because you don't know what Modi could do next. If you are doing business in cash, you can feel the fear in your heart that here's a determined, dangerous and unpredictable opponent who has shown that there is no limit to how far he is willing to go.

And that's the real determinant of what the economic impact of demonetisation will be.

...

Re: Currency Demonetisation and Future course of Indian Economy

No Smartphone? You Can Still Transfer Money Using A Basic Mobile Phone

http://swarajyamag.com/technology/no-sm ... bile-phone

http://swarajyamag.com/technology/no-sm ... bile-phone

Re: Currency Demonetisation and Future course of Indian Economy

http://economictimes.indiatimes.com/mar ... 658151.cms

On the retail side, India has this tremendous advantage because RBI has had the foresight to work with the banks through NPCI to develop the backbone that has allowed the launch of UPI technology.This jump that is happening right now of bypassing debit cards and credit cards, these are now redundant technology, you just use mobile phone to make payments. In fact, we are launching UPI technology for our corporate clients, that's already in pilot phase and we will be following soon on the retail ..

Re: Currency Demonetisation and Future course of Indian Economy

I have lost $3000 via debit card fraud a decade and half ago. Simply put, I used a debit card at a public bus/metro station without connecting another event which I noticed but didn't suspect anything at that time, that a small distance away the cables linking the ATM machines were disconnected and someone's briefcase was nearby.

Unlike credit card, in Debit card once you lost money, it is done and lost forever. Unless someone is priority customer with a bank etc. The bank gave me back $500 as a goodwill gesture.

Unlike credit card, in Debit card once you lost money, it is done and lost forever. Unless someone is priority customer with a bank etc. The bank gave me back $500 as a goodwill gesture.

Last edited by habal on 28 Nov 2016 12:41, edited 1 time in total.

Re: Currency Demonetisation and Future course of Indian Economy

https://www.valueresearchonline.com/sto ... n=fundline

The real impact of demonetisation

Don't pay any attention to estimates of GDP impact--the real effect will come from future behaviour change

By Dhirendra Kumar | Nov 28, 2016

The real impact of demonetisation

While demonetisation moves along, warts and all, the side game of guess-the-GDP has started in earnest. Normally a dull activity, with little to interest the ordinary saver and investor, the GDP game is sure to bring thrill to the life of economists in the coming months. As we all know, the economists' profession is a notoriously dull one, with very little excitement in their lives, apart from the tweets of Nassim Nicholas Taleb. Demonetisation is an unexpected bonanza for them. There will now be months of estimations and counter-estimations, there will be magical numbers that people will just pull out of somewhere, there will be accusations (or innuendo) of political bias, articles and papers and counter-papers will have to be written and so on and so forth.

Already, estimates of the GDP impact range from -0.25 per cent to -3.5 per cent. So the low, middle and high ground are all taken. Based on the results obtained by various players who have entered the game so far, the best way to get into the media in a big way is to try and be outlandish while still sounding sane. In my opinion, whoever did that -3.5 per cent nailed it in that respect. There's a lot of PR value in being the first with an extravagant claim. The winner of the next round will have to do the same at the other end, i.e., claim that GDP growth will immediately see a huge uptick.

But here's the thing. If you are a saver and an investor, or just someone who is worried about what the impact of demonetisation will be like, don't pay any attention to any of these predictions. At this point of time, there is literally no way to have more than a vague idea of what the impact of demonetisation on GDP will be. Those who have come out with precise numbers--some had done so within a day or so of the initial announcement--are doing so for many reasons, but actual discovery of truth is not one of them. People talking about investments often talk about GDP as if they are the cause of something. However, let's not forget that they are a measurement of economic activity.

In this case, not only is that economic activity that is yet to take place, but one that will comprise of crores of people responding in their own way to a fundamental economic event that is unique in their lifetime. For anyone to claim that can already distill all that into a number, and then (as many brokerages and analysts are doing) ask investors to act upon that number is not very honest. Of course, since we already have numbers across a large range, someone or the other will turn out have guessed right, but that's irrelevant for you.

Moreover, there will be many positives, even immediate ones. I have already seen, first-hand, a sharp shift in previously cash-based businesses to above-board, tax-paid transactions. The real success of demonetisation, and the majority of its economic impact, will come not from the 'unearthing' of stocked black money, but from a change in future behaviour. People work in cash, earn profits in cash and accumulate wealth in black because so far, this has been effectively a riskless option. This is no longer true--and that's the real change. For the first time, there is real danger and real unpredictability in continuing to do so.

Those whose black wealth comes from bribery and other crimes are a separate class but as far as real business-owners are concerned, their response is very different. Over the last fortnight, I've personally interacted with a large number who I know personally and they've all said that they are converting their businesses to all white. Not a single one has had any moral epiphany, they're not doing this because it's the right thing. Instead, they've all said that cash is just too risky now because you don't know what Modi could do next. If you are doing business in cash, you can feel the fear in your heart that here's a determined, dangerous and unpredictable opponent who has shown that there is no limit to how far he is willing to go. And that's the real determinant of what the economic impact of demonetisation will be.

-

Rishi Verma

- BRFite

- Posts: 1019

- Joined: 28 Oct 2016 13:08

Re: Currency Demonetisation and Future course of Indian Economy

So bringing respect for the law instead of system of goonda-giri and lawlessness should not be tried?Marten wrote:This is goin to hurt the RE market for a few years. And hurt incomes at various courts where cases have been running for decades.

Indian society (micro to macro) has a fashion of nay-saying whenever someone suggests trying a better alternative. If I tell my obese aunty to lose weight, five other relatives will chime in against the suggestion without a rhyme or reason, we are like that onlee.

Last edited by Rishi Verma on 28 Nov 2016 13:01, edited 1 time in total.

-

Manish_Sharma

- BRF Oldie

- Posts: 5142

- Joined: 07 Sep 2009 16:17

Re: Currency Demonetisation and Future course of Indian Economy

Habal jee, why is it so? Would be great if you can explain for my understanding.habal wrote: Unlike credit card, in Debit card once you lost money, it is done and lost forever. Unless someone is priority customer with a bank etc. The bank gave me back $500 as a goodwill gesture.

Re: Currency Demonetisation and Future course of Indian Economy

http://www.dnaindia.com/money/report-tr ... es-2277631

Trucks ply faster as govt lifts toll gates

The suspension of toll payments has reduced the overall turnaround time by one-and-a-half days (Mumbai-Delhi), resulting in a savings of Rs 3,000 per day per truck.

This has led to the revival of their old proposal for annual toll permit instead of the manual payment or ETC tag.

"Earlier when toll was being collected, the average distance covered daily was just over 250 km, now with toll exemptions we are able to cover 400 km per day. This has meant faster movements of goods," said Gurvinder Grewal, vice-president of Bombay Goods Transport Association, told DNA Money.

The truckers have also made a proposal to the government for make toll payment an annual affair and cashless, instead of collecting it manual or by way of Electronic Toll Collection (ETC). This will help reduce time wasted at toll nakas and fuel.

ETC tags have their own drawback of only one or two dedicated lanes that are equipped with the tag reading instrument. On several occasions, such lanes are kept open for even cash payment, resulting in traffic snarls at toll plazas, defeating the very purpose of cashless transactions and faster movement of vehicles.

"On the basis of a report, frequent stoppages made at the toll barriers result into loss of man hours and fuel worth Rs 145,905 crore combined. This is much higher to the toll revenues collected during the year 2014-15 at Rs 14,717 crore (as per NHAI's website)," said Bal Malkit Singh, advisor to All India Motor Transport Congress (AIMTC).

Trucks ply faster as govt lifts toll gates

The suspension of toll payments has reduced the overall turnaround time by one-and-a-half days (Mumbai-Delhi), resulting in a savings of Rs 3,000 per day per truck.

This has led to the revival of their old proposal for annual toll permit instead of the manual payment or ETC tag.

"Earlier when toll was being collected, the average distance covered daily was just over 250 km, now with toll exemptions we are able to cover 400 km per day. This has meant faster movements of goods," said Gurvinder Grewal, vice-president of Bombay Goods Transport Association, told DNA Money.

The truckers have also made a proposal to the government for make toll payment an annual affair and cashless, instead of collecting it manual or by way of Electronic Toll Collection (ETC). This will help reduce time wasted at toll nakas and fuel.

ETC tags have their own drawback of only one or two dedicated lanes that are equipped with the tag reading instrument. On several occasions, such lanes are kept open for even cash payment, resulting in traffic snarls at toll plazas, defeating the very purpose of cashless transactions and faster movement of vehicles.

"On the basis of a report, frequent stoppages made at the toll barriers result into loss of man hours and fuel worth Rs 145,905 crore combined. This is much higher to the toll revenues collected during the year 2014-15 at Rs 14,717 crore (as per NHAI's website)," said Bal Malkit Singh, advisor to All India Motor Transport Congress (AIMTC).

Re: Currency Demonetisation and Future course of Indian Economy

boss, banks can always say,

(at least this is what they implied in my case, since as luck would have it ATM thief struck my wallet just the day before Christmas and as you may know in dollar-land, the next 2 weeks are holidays)

"hey kashtmar", you got drunk, had sex with someobody or a wild night and gave out your card and password to somebody". It's all your fault.

Onus is then on customer to dispute this claim by approaching a banking ombudsman. I have to prove there that it was not my fault and bank is neglecting its liability and fraud.

(at least this is what they implied in my case, since as luck would have it ATM thief struck my wallet just the day before Christmas and as you may know in dollar-land, the next 2 weeks are holidays)

"hey kashtmar", you got drunk, had sex with someobody or a wild night and gave out your card and password to somebody". It's all your fault.

Onus is then on customer to dispute this claim by approaching a banking ombudsman. I have to prove there that it was not my fault and bank is neglecting its liability and fraud.

Re: Currency Demonetisation and Future course of Indian Economy

Debit card compromised: Should you be worried?

http://www.livemint.com/Industry/yFVhPU ... rried.html

http://www.livemint.com/Industry/yFVhPU ... rried.html

Plus when we use our debit card online, there is a 2 step authentication. 2nd being the one time password we recieve on our registered mobile.Should you worry?

All the recently reported debit card data breaches have happened at the bank level. According to Reserve Bank of India (RBI), banks are responsible for security of the debit cards they issue. “Hence, in case of any monetary loss on account of breach of security or failure of the security, the bank is liable to bear the loss,” RBI says in a circular on debit cards.

The bank is liable if there has been a failure of its systems and infrastructure resulting in fraud. According to the RBI, if a transaction has taken place without the additional factor of authentication and a customer has complained that the transaction was not effected by her, the issuer bank will reimburse the customer.

What do you do if your money is missing?

If you have lost any money, there is no need to panic. You need to immediately inform the bank about the loss. If you don’t inform the bank about the loss or theft, the bank cannot be held liable. You can report the fraud at any time of the day but immediately after you come to know about it. Once you report the loss, it is the bank’s responsibility to stop further use of the card. If the cardholder is found to have been negligent, she will have to bear the liability.

In a recent draft circular on customer protection, RBI said a customer will not be liable where fraud or negligence is on the part of the bank or for a third-party breach where the customer notifies the bank within three working days of receiving a communication from the bank on any unauthorized transaction. “Where customer’s own involvement is not clearly established, customer liability will be limited to a maximum of Rs5,000 if she reports within 4 to 7 working days and if customer reports beyond 7 working days, customer liability will be determined based on bank’s Board approved policy,” RBI said in the circular.

Re: Currency Demonetisation and Future course of Indian Economy

'We cannot imagine China carrying out demonetisation' says Chinese media

http://indiatoday.intoday.in/story/chin ... 20318.html

http://indiatoday.intoday.in/story/chin ... 20318.html

Re: Currency Demonetisation and Future course of Indian Economy

My intl. credit cards have been hacked a few times in the past.Had to prove I wasn't abroad at the time.The banks took the hits. Started using debit cards.Xtra transaction charge,plus vulnerability again.Using a multiple card protection scheme,but "cash is till king".Now,with bank interest rates dropping like the Paki army sh*tting bricks on the LOC,of what value is your money in a bank deposit where you get peanuts?

Money lenders...sorry,"financiers",make much more by "leasing" money to those who need it fast and quick.They serve a vital part of the Indian economy,and have new safeguards tx to the F.Min. directives.With financiers,there's little need to produce multiple forms,tax returns,etc.,etc. except for strong guarantors or collateral. So more people will look towards getting larger returns from their moolah from such avenues,esp. the ":cash and carry" biz,rather than go in for Mr.Modi's heavily promoted "cashless" economy. In a country so diverse and varied as India,a veritable EU of South Asia,with such disparity between the obscenely rich, disgustingly rich,filthy rich,rich,upper muddle class,middle muddle class,lower muddle class,poor,pretty poor,even poorer,poorest of the poor,below poverty line,on-the-street poor,he is barking up the wrong tree,chasing the wrong cat,hunting with the wrong hound and like Don Quixote and his Sancho Panza RBI chef,dreaming the "impossible dream".

PS:"Black Money" is merely the symptom of the disease called "Corruption".As long as politicians and govt. servants ask for bribes ...and they're now doing so wanting new notes and gold coins,this entire fiasco will result in an unmitigated disaster ,impoverisihing India to a significant extent. The Rupee-Dollar rate is expected by financial analysts to cross 75 next year.Unemployment will abound,with less crops,veggies,etc.,inflation will rise.The Chinese must be laughing all the way to the bank.

Money lenders...sorry,"financiers",make much more by "leasing" money to those who need it fast and quick.They serve a vital part of the Indian economy,and have new safeguards tx to the F.Min. directives.With financiers,there's little need to produce multiple forms,tax returns,etc.,etc. except for strong guarantors or collateral. So more people will look towards getting larger returns from their moolah from such avenues,esp. the ":cash and carry" biz,rather than go in for Mr.Modi's heavily promoted "cashless" economy. In a country so diverse and varied as India,a veritable EU of South Asia,with such disparity between the obscenely rich, disgustingly rich,filthy rich,rich,upper muddle class,middle muddle class,lower muddle class,poor,pretty poor,even poorer,poorest of the poor,below poverty line,on-the-street poor,he is barking up the wrong tree,chasing the wrong cat,hunting with the wrong hound and like Don Quixote and his Sancho Panza RBI chef,dreaming the "impossible dream".

PS:"Black Money" is merely the symptom of the disease called "Corruption".As long as politicians and govt. servants ask for bribes ...and they're now doing so wanting new notes and gold coins,this entire fiasco will result in an unmitigated disaster ,impoverisihing India to a significant extent. The Rupee-Dollar rate is expected by financial analysts to cross 75 next year.Unemployment will abound,with less crops,veggies,etc.,inflation will rise.The Chinese must be laughing all the way to the bank.

-

Mukesh.Kumar

- BRFite

- Posts: 1440

- Joined: 06 Dec 2009 14:09

Re: Currency Demonetisation and Future course of Indian Economy

Guys what is the update on Bharat Bandh?

I hope junta and specially bank unions are against it

I hope junta and specially bank unions are against it

Re: Currency Demonetisation and Future course of Indian Economy

OK brother - I will take your word on this. Best to stop squabbling before others in the forum fall into a comaSuraj wrote: No, YOU haven't understood the question here. You're talking ridiculously small sums. Who cares about small sums ? There's 14 lakh crore of cash involved in the demonetization business. You're arguing about the status of a few thousands in the hands of a guy who was in coma ? Unless half the population of India went into coma overnight, something like that is irrelevant. The question is, why are you even bothering coming up with such case examples of non-existent importance when you look at the total money involved ? It's like talking about a multi-lakh purchase and talking about how 1-2 paise could be saved through interesting tricks.

Once the demonetization exercise is complete, the amount of cash that did not get deposited/exchanged will be in >10k crore to lakh crores. There aren't enough people going into coma to make that little parlor trick work. You need about 1 crore people to plan on going into coma right away to make it under the 2.5lakh reporting limit per person.

Also found this piece authored by an ex-RBI type: http://www.thehindubusinessline.com/opi ... 378641.ece

-

prasannasimha

- Forum Moderator

- Posts: 1219

- Joined: 15 Aug 2016 00:22

prasannasimha

Busy. Nothing abnormal in Bangalore.

Re: Currency Demonetisation and Future course of Indian Economy

Nothing almost everywhere except Tripura and Kerala.

Re: Currency Demonetisation and Future course of Indian Economy

Bharath Bandh has become a Kerala & Tripura Bandh. Looks like the huge population of this country has completely ignored the pleas of the commies and going on with their business.Mukesh.Kumar wrote:Guys what is the update on Bharat Bandh?

Re: Currency Demonetisation and Future course of Indian Economy

Make that "parts of Kerala". Like 1 km radius of AKG center here and probably Alappuzha markets and party villages of Kannur. There were so many

Just back home from a trip. People were plying trips with an "Airport Service" printout on the windscreen. Milkman apparently came, but garbage-auto could not, since it is part of the whole Kudumbashree network. Folks in scooters are doing good

the online troll community is having a field day about "Bharat bandh" pretensions

Just back home from a trip. People were plying trips with an "Airport Service" printout on the windscreen. Milkman apparently came, but garbage-auto could not, since it is part of the whole Kudumbashree network. Folks in scooters are doing good

the online troll community is having a field day about "Bharat bandh" pretensions

Re: Currency Demonetisation and Future course of Indian Economy

And in Kerala and Tripura also only because of commie goonda muscle power and the associated threat of violence. In Kerala there is a good chance that even police will not come to your assistance if your vehicle is stopped and you are beaten up by commie goondas since they are in power now. In every other place where people have a choice they have rejected this ridiculous bandh.Sachin wrote:Bharath Bandh has become a Kerala & Tripura Bandh. Looks like the huge population of this country has completely ignored the pleas of the commies and going on with their business.Mukesh.Kumar wrote:Guys what is the update on Bharat Bandh?

Re: Currency Demonetisation and Future course of Indian Economy

Gautamhttp://www.financialexpress.com/economy ... on/457671/

In strategic push Narendra Modi government using note ban to boost financial inclusion

The Centre is using demonetisation as an opportunity to push its financial inclusion initiative. In two separate communications on November 25, top central government officials asked states, banks and employers to open bank accounts for even temporary workers belonging to unorganised sector.

The Centre is using demonetisation as an opportunity to push its financial inclusion initiative. In two separate communications on November 25, top central government officials asked states, banks and employers to open bank accounts for even temporary workers belonging to unorganised sector. Employers were “advised” to pay wages or salary to even contract and casual workers “only through bank accounts”.

In a joint letter to chief secretaries of various states, labour secretary M Sathiyavathy and financial services secretary Anjuly Chib Duggal said: “In order to facilitate financial inclusion of workers and to ensure timely payment of their wages, it has been decided to launch a campaign to open bank accounts in respect of those workers of organised and unorganised sectors who do not have their own bank accounts even now.”

In a separate letter to all deputy chief labour commissioners, chief labour commissioner AK Nayak said: “…all principal employers and contractors should be advised to ensure payment of wages to all employees, including contract workers, only through bank accounts.”

“For financial inclusion of workers, it has become necessary to ensure payment of wages to workers through bank accounts. Accordingly, you are advised to take up with all major employers to get bank accounts opened in respect of each worker/employee, if not already opened, especially in respect of contract and casual workers. This may be accorded top priority as payment has to be made for the current month by the end of this month or by the first week of the following month,” the letter said.

Re: Currency Demonetisation and Future course of Indian Economy

shiv wrote:

Incidentally ATMs back then almost always had queues in the UK - as in the image below. At least one BRFite will recognize one person in that image - a classmate of his

And often, to pass the time there was a lot of 'public display of affection' going on in them queues! My desi sensibilities would get a rude shock.

-

Rishi Verma

- BRFite

- Posts: 1019

- Joined: 28 Oct 2016 13:08

Re: Currency Demonetisation and Future course of Indian Economy

I had predicted this, corrupt bank officials hand in glove with crooks. Biggest fear is banks laundering money in strongholds of politicians like mayawati, Mulayam, etc etc... Good thing is in this case they were caught. Which probably means that the software trigger to alert the IT guys is just coming online.

40Cr Found in Delhi Bank Acc

40Cr Found in Delhi Bank Acc

Re: Currency Demonetisation and Future course of Indian Economy

Lets see what this gent has to say.parashara wrote:OK brother - I will take your word on this. Best to stop squabbling before others in the forum fall into a coma

Also found this piece authored by an ex-RBI type: http://www.thehindubusinessline.com/opi ... 378641.ece

------>

On January 16, 1978, demonetisation of ₹1,000, ₹5,000 and ₹10,000 notes was announced through an ordinance. The conversion of old notes was kept open till 1981. The value of banned currency notes was only ₹1.46 billion, about 1.7 per cent of the total value of currency in circulation (₹85 billion). Initially, about 68 per cent of invalid notes were withdrawn in 1978. By August 1981, about 86 per cent of such notes returned to the banking system. The value such notes that did not return to the RBI was hardly about ₹210 million. This liability does not exist in the RBI book. The amount was so small that transfer of such liability to the Government did not evoke any debate.

<-------

1. Liability on the RBI books vanished (sub: any other word that better describes the situation) to the extent the notes that where not returned/recycled.

2. The resultant gain (Loss of liability) to the RBI was transferred to the GOI.

That settles it then. If it has happened in the past then surely there is no *legal* issue in executing a similar transfer this time around. Inline with the majority views on this forum.

There might be other consideration that may influence what happens this time around BUT there is no bar.

Last edited by pankajs on 28 Nov 2016 16:32, edited 1 time in total.

Re: Currency Demonetisation and Future course of Indian Economy

Former RBI Governer D. Subbarao has warned against transferring the profit to govt in haste. I wonder what could be the problems?