Looks like to you western banks is US banks. I am assuming you are talking about too big to fail banks that caused the financial crises and the US government had to bail them out as allowing them to shut down will cause far more loss to the economy.Neshant wrote:Note I'm not against the elimination of BM attained through corruption.

I am against the creation of an even bigger robbery scheme setup under the guise of "eliminating BM".

If BM from corruption is bad, then institutionalized robbery through the fraud of private banks insisting on control over the earnings & savings of people is worse. If the former is BM, the latter is super-BM.

But do you even understand the above? If the answer is no, there is no point discussing it any further.

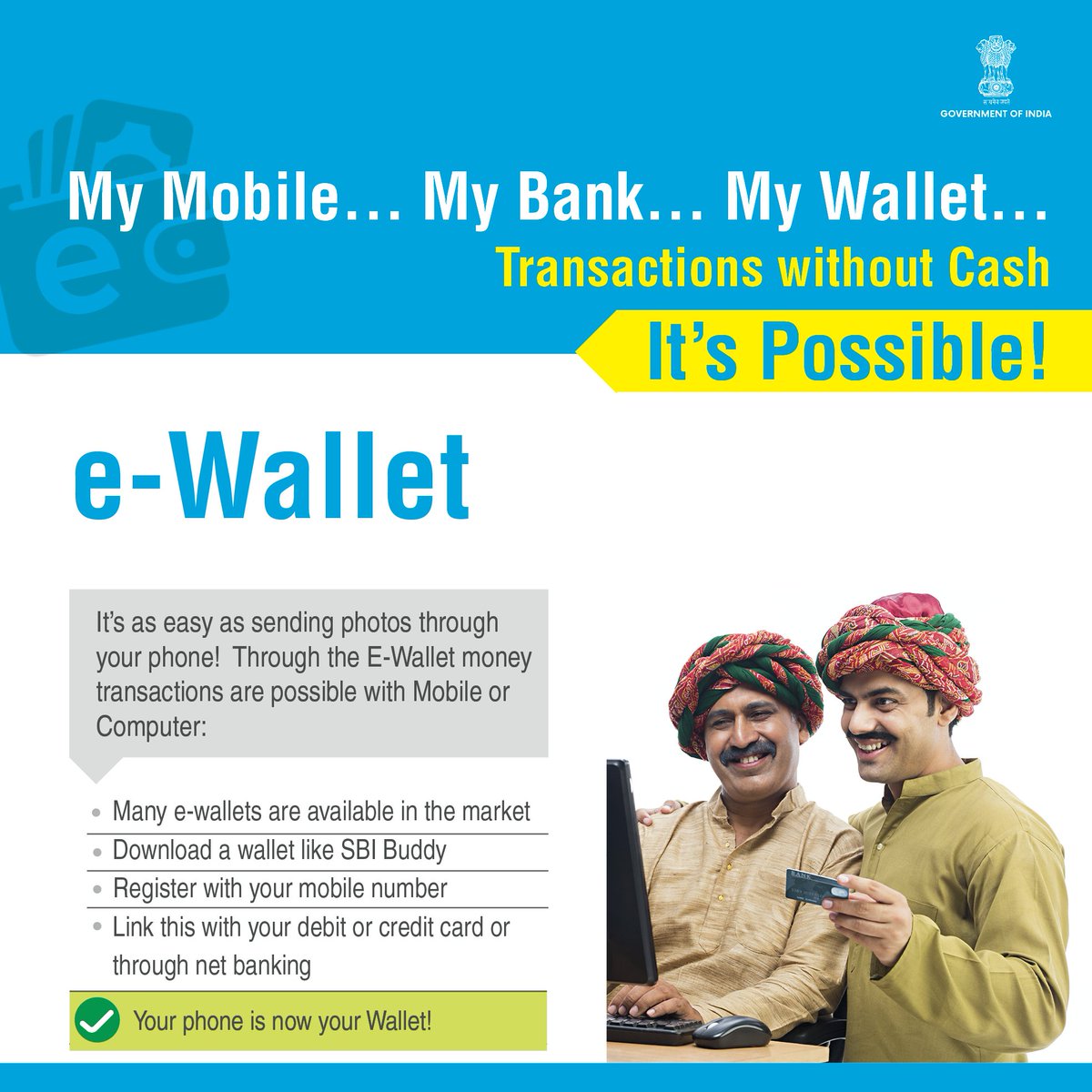

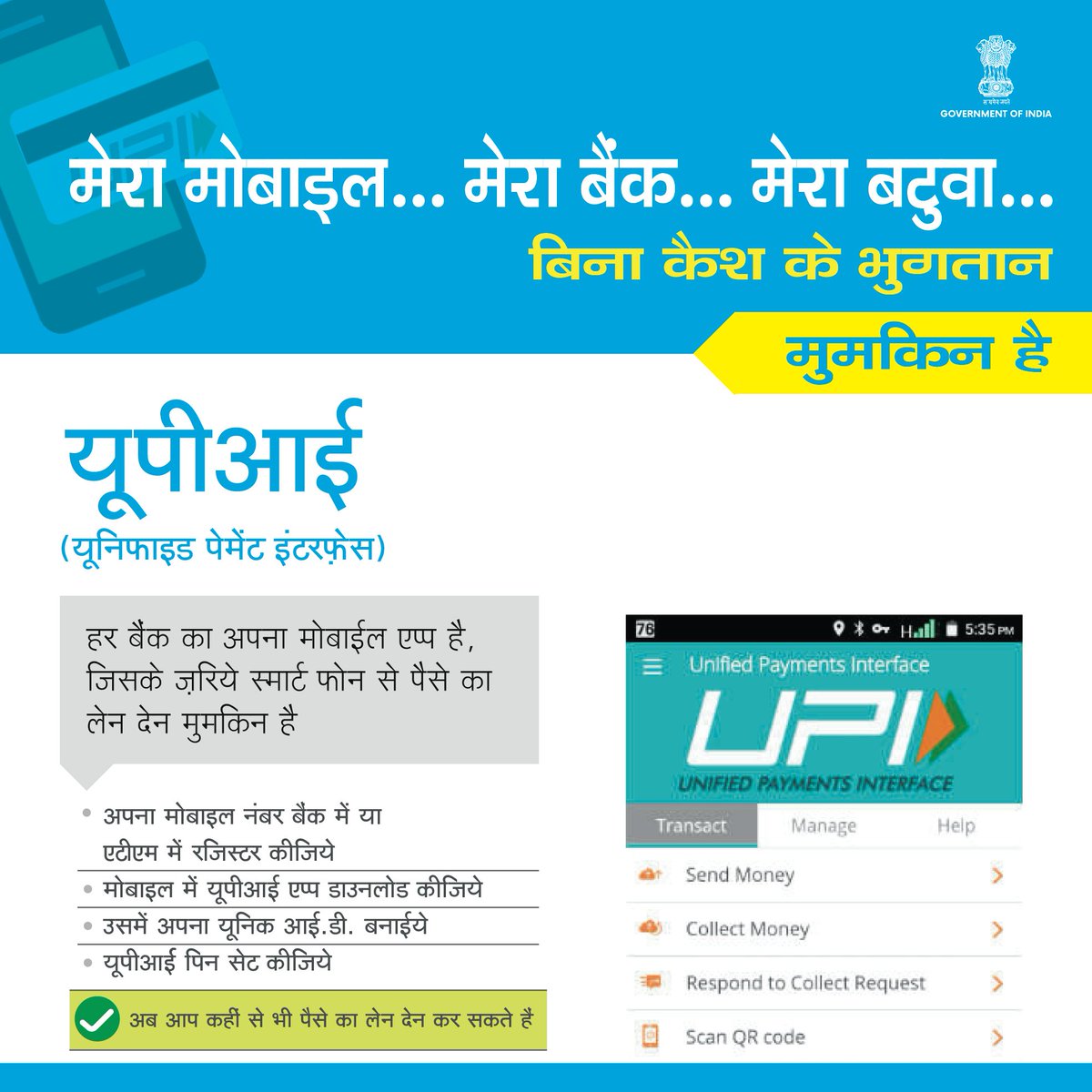

The assumption is that govt will control the digital currency and that control will not gravitate into the hands of private banksters. The history of how central banks (aka proxies for private banks) came into existence in the western world suggest that is the EXACT mechanism through which illegal & monopolistic control over society is attained by banksters.

Once private banksters gain control over the nation's monetary system and people have no exit from it, the people are little more than serfs.

Under all circumstances, the people who earn the wealth should choose the monetary system. Not "wise men" at the top claiming to be acting in the best interest of the people by forcing them to hand over control of their wealth to banksters as custodians. That is the objective of govt (and soon bankster) controlled digital currencies launched under the guise of preventing crime when in fact its objective is crime.

If your source of misgivings to what's happening in India now is solely based on how banks performed in the US, you need to understand the basic difference between the economies and culture of two countries. They are market based and credit taking society, ours is opposite to that. Ours is banking and savings based societies. If customers of private banks come to know that their banks are investing their savings in stock markets, I bet the bank will lose many of its customers. If you want to take example of western banks, you can take a look at Japanese and German banks. Again the only banks in these countries that was affected during the financial crisis were the banks that were involved with the markets.