Row 2 in the image below:

Dear Chinese, Good luck with trying to get even one OBOR project off the ground.China’s $1.7 trillion government-bond market is exhibiting a new sign of stress: The yield on longer-term debt has fallen below that on shorter-term debt—an anomaly that some traders are blaming on Beijing’s efforts to reduce financial risk.

Early on Thursday, the five-year yield /quotes/zigman/15861749/realtime BX:AMBMKRM-05Y -0.59% rose to 3.71%, breaking above the 10-year yield /quotes/zigman/15861751/realtime BX:AMBMKRM-10Y +0.15% for the first time since records began—even though the latter, at 3.68%, was near a 25-month high. Bond yields rise as their prices fall.

Such a “yield-curve inversion” defies normal market logic that bonds requiring a longer commitment should compensate investors with a higher return. It usually reflects investor pessimism about a country’s long-term growth and inflation prospects. When the U.S. Treasury /quotes/zigman/15866666/realtime BX:TMUBMUSD10Y -0.07% yield curve inverted in 2006 and 2007, most analysts cited Asian central banks’ heavy buying of longer-dated U.S. government debt.

Who's interests does the World Gold Council represent?Austin wrote:India's Working With World Gold Council to Create a Spot Exchange

https://www.bloomberg.com/news/articles ... t-exchange

They are trying that at the Shaghai gold exchange. But the dollar settlement hangover does not want to go.shyam wrote:The deal in gold futures at COMEX is that the it can settled in cash. Make them settle in physical gold, you will see price of gold changing in unexpected ways.

The Chinese Ministry of Finance criticized the decision of Moody's rating agency to lower China's long-term rating in national and foreign currency from Aa3 to A1 and change its outlook from negative to stable.

"Moody's decision to downgrade China's sovereign credit rating was made on the basis of an inappropriate method of" procyclicality, "the statement said on the agency's website said.

According to the Chinese Ministry of Finance, Moody's in its forecast overestimated the difficulties faced by China's economy and underestimated the measures to deepen the structural reform of the supply and the expansion of aggregate demand that the Chinese government is taking.

Earlier, Moody's said that this decision reflects the agency's expectation that in the coming years, China's financial opportunities will somewhat decrease, and the overall debt in the economy will continue to increase as growth slows.

Watch this video and see the patterns of Modi's decision leading to and after demonetisation. And you will understand what is being planned is not only for US, it is for India as well.Austin wrote:Jim Rickards best interview of 2017 - The Daily Reckoning - Road to Ruin

If he doesnt revel names then guys would say he is bluffing , works both ways and both has it own set of risk.shyam wrote:For some reason, I don't trust this guy. First of all he is coming from culinary institute. Second he reveals the name of all big people he met. If he reveals their names, they will stop meeting him. I am not saying he is lying, but dal meh kuch kaala hai..

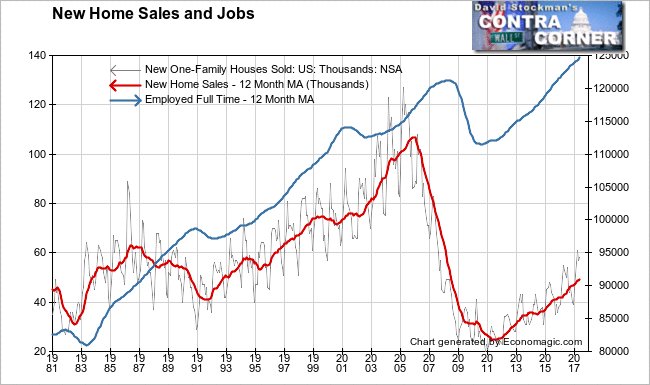

Noob question. What event can trigger a massive crash? how massive would the the "massive"..and how long will it last...Austin wrote:

Stockman Warns: S&P 500 Is Due for a Massive Crash Any Day

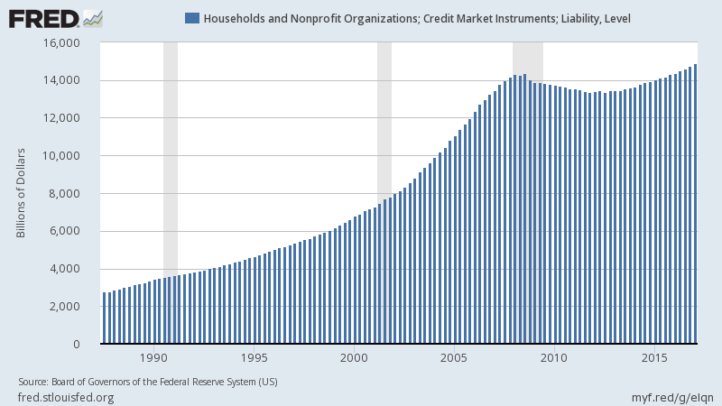

Probably because the Debt has outclass growth , Even if they pump money they are barely growing at an average of 2 % but debt has risen exponentially , Most of the money is pumped into stock market and not the real sector of economy which was meant to benefit few at the expense of most.CalvinH wrote:All this money that has printed and forced into the economy is real..what if all this is the new normal...why can't it be?

The World Bank has launched a "pandemic bond" to support an emergency financing facility intended to release money quickly to fight a major health crisis like the 2014 Ebola outbreak.

The catastrophe bond, which will pay out depending on the size of the outbreak, its growth rate and the number of countries affected, is the first of its kind for epidemics. It should mean money is disbursed much faster than during West Africa's Ebola crisis.

...