% of Indians pay tax - 4%

% of Indians upset over new tax slabs - 90%

IMO India does not have the infra/process setup to grow north of 10% yet.Rahulsidhu wrote:I think reactions to the budget probably reflect expectations different people had from it.

If you think (like the policy-making team) that GDP growth at 5% going on to 6-6.5% next year is "good", then it makes sense. The budget does nothing major to alter this trend.

OTOH if you REALLY believe in the potential of the Indian economy which should be growing north of 10%, then you should be disappointed because this budget does nothing to take us from there to there.

On the contrary, the lack of infra means that India can absorb HUGE investments in infra alone to take growth > 10% for several years.V_Raman wrote:IMO India does not have the infra/process setup to grow north of 10% yet.Rahulsidhu wrote:I think reactions to the budget probably reflect expectations different people had from it.

If you think (like the policy-making team) that GDP growth at 5% going on to 6-6.5% next year is "good", then it makes sense. The budget does nothing major to alter this trend.

OTOH if you REALLY believe in the potential of the Indian economy which should be growing north of 10%, then you should be disappointed because this budget does nothing to take us from there to there.

Please don't bring political diatribes (not yours, the quoted person's) here. It detracts from the purpose of this thread.Arun.prabhu wrote:Growth is bad. Social justice and the parasites that live off it is good. Better to roll In mud forever than to try to stand on one’s feet:

https://www.thehindu.com/news/national/ ... 720952.ece

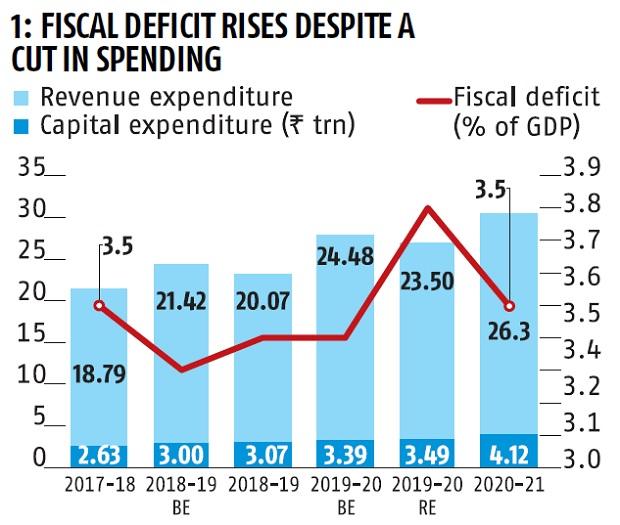

The budget for 2020-21 was expected to meet two or three important criteria. One was that it should enhance transparency and improve the credibility of its numbers. By expanding the scope of a key data tableand presenting details of fully-serviced government bonds and loans availed from the National Small Savings Fund (NSSF), not just for 2019-20 and 2020-21, but for the past four years, the government has taken giant strides towards reporting its off-budget borrowing. Equally importantly, it has pencilled in a much smaller increase on this score for 2020-21, signalling that it would like to freeze its recourse to off-budget borrowings, which had ballooned in 2018-19 and in 2019-20. It has made it a lot easier for many to report the “true" fiscal deficit.

Second, the government was expected to put money in the hands of the public. The number of tax slabs might have increased now, but the substantially lower tax rates with zero exemptions is a big move forward in putting more money in the hands of people and in making filing tax returns a less stressful exercise. That said, easing business and living conditions remains an urgent priority for state and local governments. Formalization of micro and small businesses remains a herculean task. That is why many give up growth aspirations and operate below the radar. The key to unlocking productivity gains lies in easing local and state-level compliance and regulatory requirements.

Third, the government was expected to raise more money by selling its assets. It has signalled its intent by budgeting a large sum on this score. It also needs luck in the form of better market sentiment next year, not just in India but globally. Other positives include the treatment of employee stock options in startups, liberalized conditions on the exemption of startup profits, the far-sighted decision to provide exemption from tax on dividends in the hands of sovereign wealth funds for investments made in India up to 2024, and the taxpayers’ charter.

CNBC-TV18

@CNBCTV18Live

IHS Markit India Manufacturing PMI rises to 55.3 in January from 52.7 in December, its highest level in just under eight years

Kiran Mudlagiri

@KiranMudlagiri

Green shoots of economy visible. Industries expanding their production capacities, more hiring in manufacturing and other industries. Positive signs showing up. #EkBharathShresthBharath

Spaminder Bharti Retweeted

Aashish Chandorkar

@c_aashish

Services PMI at 7-year high

Manufacturing PMI at 8-year high

Composite PMI at 7-year high

So are we back in the game?January GST collection was Rs 1,10,828 crore which is the second highest since launch of GST.

The 3-month trend definitely supports expansion:Suraj wrote:PMI figures for a single month are too noisy to be useful indicators. Same for IIP, CPI etc. For quite some time, I'd posted 3- and 6-month averaged IIP data on this thread to offer greater insight. However I've not done so for PMI and I don't know of anyone else who has.

The government will sanction the entire 1.12 crore houses under the Pradhan Mantri Awas Yojana (PMAY) by next month, Union Housing and Urban Affairs Minister Hardeep Singh Puri said in Rajya Sabha on Wednesday.

“A revised demand assessment was made and now the demand is for 1.12 crore houses. I am sure we can meet that in terms of sanctioning in the next month or so,” he said during the Question Hour in the Upper House.

Russia's Rosneft keen to bid for BPCL

Russia's largest oil producer Rosneft is keen to bid for acquisition of BPCL, sources said.

Feb 06, 2020

NEW DELHI: Russia's largest oil producer Rosneft is keen to bid for acquisition of Bharat Petroleum Corp Ltd (BPCL), sources said after the Russian firm's CEO Igor Sechin met Oil Minister Dharmendra Pradhan on Wednesday.

Rosneft, which is the majority owner of India's second-biggest private oil refinery, is keen to expand in the world's third-largest and the fastest-growing energy market.

Sechin first met Pradhan over breakfast, and then in delegation-level talks expressed interest in bidding for the acquisition of government stake in Bharat Petroleum Corp Ltd (BPCL), officials privy to the discussions said.

The government is selling all of its 53 per cent stake in BPCL in the country's biggest privatisation plan.

Officials said national oil companies from the Middle East, such as Aramco of Saudi Arabia and ADNOC of UAE, have also been primed for bidding for BPCL.

Sechin, who was here to witness the signing of the first deal with Indian state-owned refinery for supplying crude oil a fixed-term basis, expressed interest in investing more in India, they said.

On November 20, 2019, the Cabinet headed by Prime Minister Narendra Modi had decided to privatise BPCL by selling the government's entire 52.98 per cent stake to a strategic investor along with management control.

Rosneft owns a 49.13 per cent Nayara Energy Limited (formerly Essar Oil Limited). Nayara owns and operates 20 million tonnes per year refinery at Vadinar in Gujarat and also owns 5,628 petrol pumps in the country.

It is keen on expanding the fuel retailing network and BPCL would get it ready access to close to one-fourth of 67,440 petrol pumps in the country.

BPCL operates four refineries in Mumbai, Kochi (Kerala), Bina (Madhya Pradesh) and Numaligarh (Assam) with a combined capacity of 38.3 million tonnes per annum, which is 15 per cent of India's total refining capacity of 249.4 million tonnes.

After removing three million tonnes of the capacity of the Numaligarh refinery, which will be sold to a public sector unit, the new buyer will get 35.3 million tonnes of refining capacity.

BPCL owns 15,177 petrol pumps and 6,011 LPG distributor agencies in the country. Besides, it has 51 liquefied petroleum gas (LPG) bottling plants.

The company distributed 21 per cent of petroleum products consumed in the country by volume as of March last year and has more than a fifth of the 250 aviation fuel stations in the country.

The government is keen to get international energy majors such as Saudi Aramco, Total SA of France and ExxonMobil to operate in the downstream fuel marketing business so as to bring in greater competition.

Currently, 95 per cent of retail petrol and diesel sales and near 100 per cent of cooking gas (LPG) and kerosene sales are controlled by the public sector units.

As on March 31, BPCL reported cash and cash equivalents of around Rs 5,300 crore, against Rs 10,900 crore of debt maturing over the next 15 months.

Officials said Indian Oil Corp (IOC) signed a term contract to import up to 2 million tonnes of Russian grade Urals oil from Rosneft in 2020.

This is the first time a state-owned firm has signed a term import deal with Russia as they look to diversify sourcing of oil beyond their traditional suppliers in the Middle East. State-run firms have started importing significant volumes from the US as part of this strategy.

At current prices, the government stake in BPCL is worth just over Rs 53,000 crore. The acquirer will have to make an open offer for buying an additional 26 per cent stake from other shareholders of BPCL.

The stake sale is critical for the government to meet its disinvestment target of Rs 2.10 lakh crore set for the coming financial year starting April 1.

Perhaps for the first time in the history of India’s health policymaking, multiple agencies are moving in a closely coordinated manner, towards common policy goals. We see unprecedented expansion of government medical colleges across the country, particularly in districts where none existed. A centrally sponsored scheme for establishment of new government medical colleges is upgrading 157 existing district hospitals across India’s most underserved areas.

As a result, there has been a 47% rise in the number of government medical colleges between 2014 and 19, compared to a 33% increase in the total number of medical colleges in the past five years, from 404 to 539. The number of undergraduate medical seats has seen a jump of 48%, from 54,348 in 2014-15 to 80,312 in the academic year 2019-20. Government is aggressively trying to expand medical seats leveraging the private sector as well, with an aim to overcome bottlenecks in terms of personnel as well as healthcare delivery.

The High Level Group on the Health Sector constituted by the government submitted its recommendation to the Fifteenth Finance Commission that in the coming five years, 3000 to 5000 hospitals (200 beds) needs to be created across the country.

That would be very unfair for small traders and Amazon will take over the entire market. Currently the products may shift hands 4 to 5 times before it is finally sold.tandav wrote:Time has come to pull the plug on GST and move to a transaction tax system. That way only when a transaction is made there will be tax collected by govt. It will greatly simplify ease of business.

Far too simplistic and meaningless. Don't conflate political reasons with economic ones.tandav wrote:Time has come to pull the plug on GST and move to a transaction tax system. That way only when a transaction is made there will be tax collected by govt. It will greatly simplify ease of business.

As of date there is a huge number of folks who should have been able to bill very large amounts to their clients but can't since they would need to pay GST and there is no way to ensure they get paid. Tax should not be collected unless vendor is paid.Rishirishi wrote:That would be very unfair for small traders and Amazon will take over the entire market. Currently the products may shift hands 4 to 5 times before it is finally sold.tandav wrote:Time has come to pull the plug on GST and move to a transaction tax system. That way only when a transaction is made there will be tax collected by govt. It will greatly simplify ease of business.

All advanced countries have GST and it is working. It will take some time to settle.

Yagnasri wrote:We need to look for new direct taxation areas wherein people with means will pay more and not any indirect tax which is paid at the same rate by everyone. We already have property tax at local admin level which due to political and pressures is very low % of the actual value of the property. If that can be made say 0.25% to 1.0% of the value of the property in all urban areas and reduce the funding of the municipality and Municipal Corporations to the extant of that new amount we may have very good collection of funds. Funds can be used to local education, health and other social infra which is badly needed in most of Bharat.

Raoul and Robert pvt limited is a resident Indian company. If that company manufactures Maruti cars designed and patented by Uncle Sanjay Gandhi and make profits then those profits will be taxed at Indian rates because the business has an 'Indian connection'. There is relief for Mongolian shareholders of Raoul and Robert through DTAA on the dividend distributed by the company. But since Abdul has by now become a resident he will have to pay tax at Indian rates on all incomes wherever received/earned.UlanBatori wrote:A pooch for the experts. I was looking up the definition of Foreign Direct Investment.

The RBI page says it is investment by a person RESIDENT OUTSIDE India. So if Abdul Bin Kabul were to come stay in India for 130 days a year for 3 years, he becomes Resident. Then he can invest all he wants, no restriction at all?

Plus it says nothing about the investment having to come from a halal phoren institution etc.

Could someone shed light on this please?

**Disclosure** My real intent is to see if the following scam works. An OhSeeEye has only 3 years to repatriate phoren $$$ to desh ("rejident but naat aardinarily rejident") b4 the money being repatriated is considered to be "Income", taxed at Indian rates. This can be very steep.

OTOH, suppose same Oh See Eye (Abdul) settles in desh. Then forms a company in Mongolia, Kublai Khan Inc, office address PO Box 6661313, Ulan Bator.

Said company gets money invested by Abdul from funds drawn out of his EyeArrAay (tax due to Mongolia at that point). The money is then funnelled as FDI by this phoren entity to buy shares of say, Raoul and Robert Pvt Ltd. Saves the difference between Mongolian and Indian tax rates, which is significant.

Why doesn't this work? {Hmmm.. I suspect because desh hits Abdul with the diff. between tax paid to Mongolia and tax due to desh, under DTAA. There goes another bright idea.

}

So an EnnArrEye can bring their retirement funds into India paying only Mongolian tax rate, but same abdul if resident in India, gets hit with higher desh tax? UNPHAIR!!!!

Trouble is that this dictates to Abdul to do scorched-earth and withdraw $$ at high rate inside the 3 years and pump it into desh before the Resident But Not Ordinarily Resident window closes. That hurts!!

Only saving scenario there, is if exchange rate moves in favor of INR. That of course is a game-changer.