https://pib.gov.in/PressReleasePage.aspx?PRID=2022459The gross Goods and Services Tax (GST) revenue for the month of May 2024 stood at ₹1.73 lakh crore. This represents a 10% year-on-year growth, driven by a strong increase in domestic transactions (up 15.3%) and slowing of imports (down 4.3%). After accounting for refunds, the net GST revenue for May 2024 stands at ₹1.44 lakh crore, reflecting a growth of 6.9% compared to the same period last year.

Breakdown of May 2024 Collections:

Central Goods and Services Tax (CGST): ₹32,409 crore;

State Goods and Services Tax (SGST): ₹40,265 crore;

Integrated Goods and Services Tax (IGST): ₹87,781 crore, including ₹39,879 crore collected on imported goods;

Cess: ₹12,284 crore, including ₹1,076 crore collected on imported goods.

The gross GST collections in the FY 2024-25 till May 2024 stood at ₹3.83 lakh crore. This represents an impressive 11.3% year-on-year growth, driven by a strong increase in domestic transactions (up 14.2%) and marginal increase in imports (up 1.4%). After accounting for refunds, the net GST revenue in the FY 2024-25 till May 2024 stands at ₹3.36 lakh crore, reflecting a growth of 11.6% compared to the same period last year.

Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

The Indian stock market is back to its record heights once again

https://www.livemint.com/market/stock-m ... 33614.html

https://www.livemint.com/market/stock-m ... 33614.html

Stock market today: Sensex closed with a gain of 1,619 points, or 2.16 per cent, at 76,693.36, while the Nifty 50 closed at 23,290.15, up 469 points, or 2.05 per cent.

Despite a steep loss of 6 per cent on June 4, market benchmarks are up with decent gains in June so far. Sensex is up about 3.7 per cent, while the Nifty 50 has gained nearly 3.4 per cent in the first week of June.

The Sensex hit its fresh all-time high of 76,795.31 during the session before ending at 1,619 points, or 2.16 per cent, higher at 76,693.36, with all components in the green.

Nifty 50 closed 469 points, or 2.05 per cent, higher at 23,290.15, with only two stocks - SBI Life (down 1.03 per cent) and Tata Consumer (down 0.43 per cent) - in the red.

BSE Midcap index rose 1.28 per cent, while the Smallcap index ended with a gain of 2.18 per cent.

The overall market capitalisation of the firms listed on the BSE rose to nearly ₹423.4 lakh crore from nearly ₹415.9 lakh crore in the previous session, making investors richer by about ₹7.5 lakh crore in a single session.

Re: Indian Economy News & Discussion - Nov 27 2017

Somnath Mukherjee was BRF member, IIRC.vijayk wrote: ↑06 Jun 2024 22:50 [img...]https://pbs.twimg.com/media/GPXlLv1a4AA ... ame=medium[/img]

Re: Indian Economy News & Discussion - Nov 27 2017

For all those political parties moaning and groaning that petrol/diesel are not under the GST, they didn't tell you that the ball was actually in their own courts .....

https://www.youtube.com/watch?v=XtzmC2Wu1fs

Petrol and diesel to come under GST? Here's what FM Sitharaman has to say after Council meeting

The video is about 2:21 minutes long

Finance Minister Nirmala Sitharaman on Saturday said the central government's intention has always been to bring petrol and diesel under GST, and it is now up to the states to decide on the rate.

She said former Finance Minister Arun Jaitley had already made a provision by including petrol and diesel into GST law.

What remains is for the states to come together to discuss and decide on the rate of the levy.

https://www.youtube.com/watch?v=XtzmC2Wu1fs

Petrol and diesel to come under GST? Here's what FM Sitharaman has to say after Council meeting

The video is about 2:21 minutes long

Finance Minister Nirmala Sitharaman on Saturday said the central government's intention has always been to bring petrol and diesel under GST, and it is now up to the states to decide on the rate.

She said former Finance Minister Arun Jaitley had already made a provision by including petrol and diesel into GST law.

What remains is for the states to come together to discuss and decide on the rate of the levy.

Re: Indian Economy News & Discussion - Nov 27 2017

https://swarajyamag.com/news-brief/robu ... l-about-it

This growth has led to the strongest pace of job creation in over 18 years, according to a report from The Economic Times.

Significant gains in both sectors at the end of the first fiscal quarter set a strong tone for India's economy this financial year, following an 8.2 per cent expansion last year — the fastest among major countries, partly due to buoyant manufacturing.

The HSBC flash India Composite Purchasing Managers' Index (PMI), compiled by S&P Global, increased to 60.9 in June from 60.5 in May.

Maitreyi Das, a global economist at HSBC, noted that "the composite flash PMI ticked up in June, supported by rises in both the manufacturing and service sectors, with the former recording a faster pace of growth."

The manufacturing index rose to 58.5 from 57.5 in May, while the services industry's reading edged up to 60.4 from 60.2, indicating continued expansion in India despite a slowing global economy. This growth was supported by strong expansions in manufacturing output, orders, and business gains among service firms.

New export orders grew for the 22nd consecutive month in June, though the pace slightly eased after record growth in May. Robust demand led companies to hire more people, with overall employment rising at the fastest rate since April 2006, particularly in manufacturing.

Boosting jobs remains a significant challenge for Prime Minister Narendra Modi's government, which was re-elected for a rare third term earlier this month.

Meanwhile, price increases at firms have eased since May, which is positive for the outlook on retail inflation. The rise in services input costs slowed to a four-month low, while the pace of increases in prices charged to clients remained broadly unchanged.ag.com/news-brief/robust-manufacturing-and-services-drive-indias-job-growth-pace-in-june-to-record-18-year-high-heres-all-about-it

Drive India's Job Growth Pace In June To Record 18-Year High: Here's All About It

This growth has led to the strongest pace of job creation in over 18 years, according to a report from The Economic Times.

Significant gains in both sectors at the end of the first fiscal quarter set a strong tone for India's economy this financial year, following an 8.2 per cent expansion last year — the fastest among major countries, partly due to buoyant manufacturing.

The HSBC flash India Composite Purchasing Managers' Index (PMI), compiled by S&P Global, increased to 60.9 in June from 60.5 in May.

Maitreyi Das, a global economist at HSBC, noted that "the composite flash PMI ticked up in June, supported by rises in both the manufacturing and service sectors, with the former recording a faster pace of growth."

The manufacturing index rose to 58.5 from 57.5 in May, while the services industry's reading edged up to 60.4 from 60.2, indicating continued expansion in India despite a slowing global economy. This growth was supported by strong expansions in manufacturing output, orders, and business gains among service firms.

New export orders grew for the 22nd consecutive month in June, though the pace slightly eased after record growth in May. Robust demand led companies to hire more people, with overall employment rising at the fastest rate since April 2006, particularly in manufacturing.

Boosting jobs remains a significant challenge for Prime Minister Narendra Modi's government, which was re-elected for a rare third term earlier this month.

Meanwhile, price increases at firms have eased since May, which is positive for the outlook on retail inflation. The rise in services input costs slowed to a four-month low, while the pace of increases in prices charged to clients remained broadly unchanged.ag.com/news-brief/robust-manufacturing-and-services-drive-indias-job-growth-pace-in-june-to-record-18-year-high-heres-all-about-it

Drive India's Job Growth Pace In June To Record 18-Year High: Here's All About It

Re: Indian Economy News & Discussion - Nov 27 2017

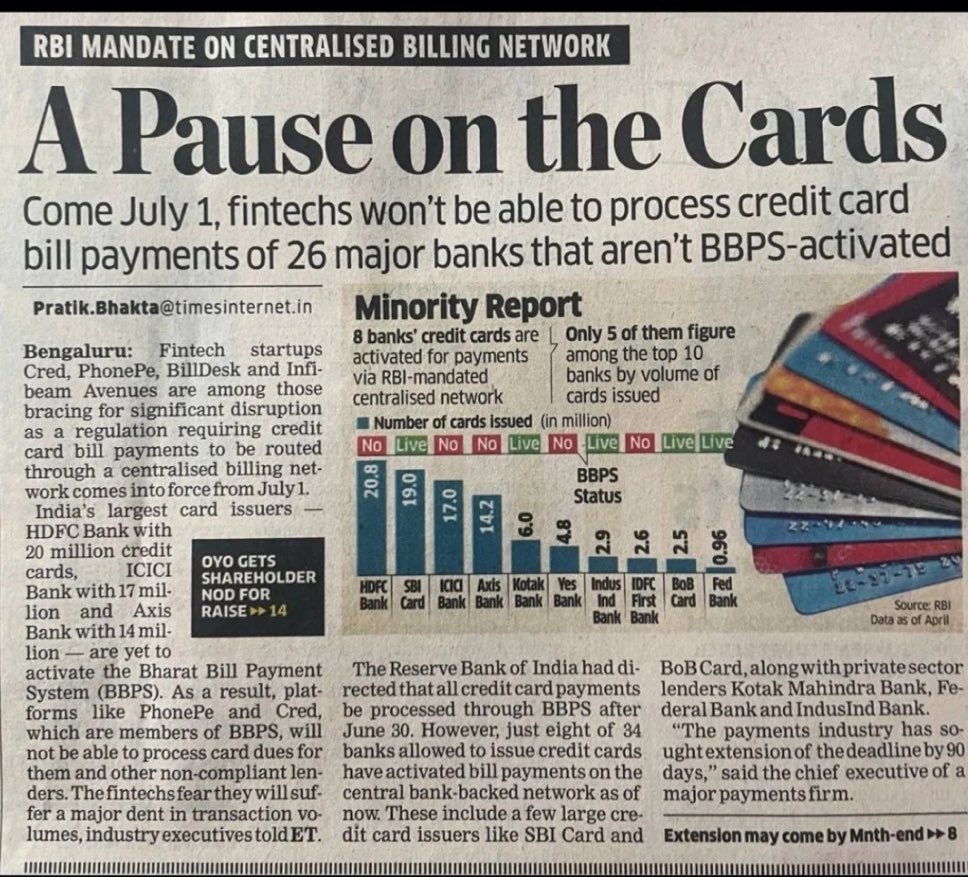

In the US there is an entity called FINRA - finance regulation agency. All transactions (cards, banks, mortgage, insurance, everything lands into FINRA) in the US end up in FINRA.

Very good move by RBI to track all transactions. Using big data processing the GOI can figure out the major payment transactions that are happening and tie them to income tax returns.

Re: Indian Economy News & Discussion - Nov 27 2017

The west realized too late, that they were betting on a gadha, in a race of ghodas

the amrikis haven't offered a PTA/FTA even to a trusted ally like the britshits, so what is their compulsion with India, or are they just hedging their bets, in view of their fast deteriorating economic outlook

garcetti is a snake oil salesman, and so, under the circumstances, can he be trusted

and meanwhile, all this huge effort seems to have gone down the drain

the amrikis haven't offered a PTA/FTA even to a trusted ally like the britshits, so what is their compulsion with India, or are they just hedging their bets, in view of their fast deteriorating economic outlook

garcetti is a snake oil salesman, and so, under the circumstances, can he be trusted

and meanwhile, all this huge effort seems to have gone down the drain

Re: Indian Economy News & Discussion - Nov 27 2017

I think the window of opportunity goes smaller each year..America does not want to end up in a situation where uk is vs Bharat !chetak wrote: ↑23 Jun 2024 12:52 The west realized too late, that they were betting on a gadha, in a race of ghodas

the amrikis haven't offered a PTA/FTA even to a trusted ally like the britshits, so what is their compulsion with India, or are they just hedging their bets, in view of their fast deteriorating economic outlook

garcetti is a snake oil salesman, and so, under the circumstances, can he be trusted

[img]https://pbs.twimg.com/media/GOzKd_gaoAA ... name=large[/img

and meanwhile, all this huge effort seems to have gone down the drain

[img]https://pbs.twimg.com/media/GOpAUN1WwAA ... ame=medium[/img

Re: Indian Economy News & Discussion - Nov 27 2017

Sanjeev Sanyal - imo important-

https://youtu.be/D25KaITZ3rM?si=PIUwhNdzYvB-wVJB

The beginning is on the three pillars of Indian macroeconomic policy, and what India hopes to achieve.

In the answer to the final question, on ESG, Sanyal exposes the deep state.

https://youtu.be/D25KaITZ3rM?si=PIUwhNdzYvB-wVJB

The beginning is on the three pillars of Indian macroeconomic policy, and what India hopes to achieve.

In the answer to the final question, on ESG, Sanyal exposes the deep state.

Re: Indian Economy News & Discussion - Nov 27 2017

From the web: "India recorded a current account surplus of $5.7 billion in the quarter ending in March of 2024, swinging from the $1.3 billion deficit in the previous three-month period, to mark the first surplus since the quarter ending in June 2021."

Re: Indian Economy News & Discussion - Nov 27 2017

Maharashtra freebies & cost:

https://www.daijiworld.com/news/newsDis ... ID=1203364

Of the above, these I would consider to be investments because they aid in present or future productivity rather than being merely consumption -

- financial assistance to 10,000 women from 17 cities to buy Pink E-rickshaws with a provision of Rs 80 crore.

- A scheme for solarisation of irrigation to achieve the goal of clean and green energy at the cost of Rs 4,200 crore was also announced.

- the government proposed free higher education for girls whereby 100 per cent reimbursement of education and examination fees will be made to Other Backward Classes and economically weaker sections with an annual family income of Rs 8 lakh. This will benefit 2,05,499 girls with an annual financial outlay of Rs 2,000 crore.

- the 'Applied Knowledge and Skill Development for Human Development', a World Bank-assisted project costing Rs 2,307 crore wherein upgradation of 500 industrial training institutes and strengthening of various other institutions will be undertaken.

- Under the 'Dnyanjyoti Savitribai Phule Aadhar Yojana', the government has proposed an increase in the accommodation allowance of the students for higher education to Rs 60,000 from the present Rs 38,000, which will benefit students from Other Backward Classes, Vimukta Jati and Nomadic Tribes, and Special Backward Classes.

This I don't like: For students from minority communities, a scholarship scheme for foreign education will be implemented, the government announced.

(a) minority rather than need focus. (b) govt sending funds to overseas institutions.

Fiscal deficit of 1 lakh crores - this is not going to be sustainable.

But if you don't do this, you get voted out of power.

This competitive freebies political nonsense will ruin the economy. Freebies are OK as long as the state can afford them, but clearly these schemes go well beyond that.

https://www.daijiworld.com/news/newsDis ... ID=1203364

Mumbai, Jun 28 (IANS): Months before the Assembly elections, Maharashtra Deputy Chief Minister Ajit Pawar, who also holds the finance and planning portfolios, presented a full budget for 2024-25 in the state Assembly on Friday with freebies and sops worth over Rs 1 lakh crore.

Pawar announced the 'Mukhyamantri Majhi Ladki Bahin Yojana' with a monthly aid of Rs 1,500 to eligible women between 21 and 60 years of age with an annual outgo of Rs 46,600 crore.

In a bid to lure the farmers of the state, who are in distress due to damage to crops and a dip in prices of agricultural produce, the government announced the 'Mukhya Mantri Baliraja Vij Savlat Yojana' to provide free electricity for running agricultural pumps of up to 7.5 horsepower capacity. This will benefit 44.06 lakh farmers with an annual subsidy of Rs 14,761 crore.

The government also proposed a Rs 5 per litre subsidy for dairy farmers.

Tabling the budget, Pawar announced the 'Mukhyamantri Annapurna Yojana' wherein three gas cylinders will be given for free per household each year. The scheme will benefit 52,16,412 families.

The government will also provide financial assistance to 10,000 women from 17 cities to buy Pink E-rickshaws with a provision of Rs 80 crore.

A scheme for solarisation of irrigation to achieve the goal of clean and green energy at the cost of Rs 4,200 crore was also announced.

Under the 'Shubhmangal Samuhik Nondanikrut Vivah' (mass marriages), the government increased the subsidy to the beneficiary girls to Rs 25,000 from Rs 10,000.

Further, the government proposed free higher education for girls whereby 100 per cent reimbursement of education and examination fees will be made to Other Backward Classes and economically weaker sections with an annual family income of Rs 8 lakh. This will benefit 2,05,499 girls with an annual financial outlay of Rs 2,000 crore.

The government also proposed the 'Punyashlok Ahilyadevi Startup Yojana' for women entrepreneurs and repayment of interest on loans up to Rs 15 lakh to small women entrepreneurs in the tourism sector under the 'Aai Yojana'. This is expected to create 10,000 jobs.

A slew of sops were also announced for the youth in the budget.

Under the 'Mukhya Mantri Yuva Karyaprashikshan Yojana' (training programme), 10 lakh youth will be given an annual stipend of up to Rs 10,000 per month. The expenditure for this scheme will be around Rs 10,000 crore annually.

Also, 50,000 youth will be imparted training each year to disseminate information about the government's schemes to the people.

The government also proposed the 'Applied Knowledge and Skill Development for Human Development', a World Bank-assisted project costing Rs 2,307 crore wherein upgradation of 500 industrial training institutes and strengthening of various other institutions will be undertaken.

For students from minority communities, a scholarship scheme for foreign education will be implemented, the government announced.

Under the 'Dnyanjyoti Savitribai Phule Aadhar Yojana', the government has proposed an increase in the accommodation allowance of the students for higher education to Rs 60,000 from the present Rs 38,000, which will benefit students from Other Backward Classes, Vimukta Jati and Nomadic Tribes, and Special Backward Classes.

Pawar estimated a revenue deficit of Rs 20,051 crore and a fiscal deficit of Rs 1,10,355 crore by the end of 2024-25, besides proposing an outlay of Rs 6,12,293 crore with revenue receipts of Rs 4,99,463 crore and revenue expenditure of Rs 5,19,514 crore.

An outlay of Rs 18,165 crore has been proposed under the 'District Annual Plan' for the year 2024-25, which is 20 per cent more than the previous year.

Further, an outlay of Rs.1.92 Lakh crore has been proposed under the scheme expenditure in the 'Annual Plan' for 2024-25. This includes an outlay of Rs 15,893 crore for the 'Scheduled Caste Plan' and Rs 15,360 crore for the 'Tribal Development Sub Plan'.

Of the above, these I would consider to be investments because they aid in present or future productivity rather than being merely consumption -

- financial assistance to 10,000 women from 17 cities to buy Pink E-rickshaws with a provision of Rs 80 crore.

- A scheme for solarisation of irrigation to achieve the goal of clean and green energy at the cost of Rs 4,200 crore was also announced.

- the government proposed free higher education for girls whereby 100 per cent reimbursement of education and examination fees will be made to Other Backward Classes and economically weaker sections with an annual family income of Rs 8 lakh. This will benefit 2,05,499 girls with an annual financial outlay of Rs 2,000 crore.

- the 'Applied Knowledge and Skill Development for Human Development', a World Bank-assisted project costing Rs 2,307 crore wherein upgradation of 500 industrial training institutes and strengthening of various other institutions will be undertaken.

- Under the 'Dnyanjyoti Savitribai Phule Aadhar Yojana', the government has proposed an increase in the accommodation allowance of the students for higher education to Rs 60,000 from the present Rs 38,000, which will benefit students from Other Backward Classes, Vimukta Jati and Nomadic Tribes, and Special Backward Classes.

This I don't like: For students from minority communities, a scholarship scheme for foreign education will be implemented, the government announced.

(a) minority rather than need focus. (b) govt sending funds to overseas institutions.

Fiscal deficit of 1 lakh crores - this is not going to be sustainable.

But if you don't do this, you get voted out of power.

This competitive freebies political nonsense will ruin the economy. Freebies are OK as long as the state can afford them, but clearly these schemes go well beyond that.

Re: Indian Economy News & Discussion - Nov 27 2017

Hindenburg is back with response to SEBI. SEBI's show cause notice has more detail of how the short operated.

Adani Update – Our Response To India’s Securities Regulator SEBI

SEBI show cause notice

Adani Update – Our Response To India’s Securities Regulator SEBI

SEBI show cause notice

Re: Indian Economy News & Discussion - Nov 27 2017

NDTV reports

GST Collection Hits ₹ 1.74 Lakh Crore In June, Monthly Data Release Stopped

The government, however, has discontinued the official release of monthly GST collection data, sources added.

GST Collection Hits ₹ 1.74 Lakh Crore In June, Monthly Data Release Stopped

The government, however, has discontinued the official release of monthly GST collection data, sources added.

Re: Indian Economy News & Discussion - Nov 27 2017

That's not transparency then. What is the logic of hiding this data.

Re: Indian Economy News & Discussion - Nov 27 2017

Blame game starts between Hindenburg and Kotak Bank: After short-seller claims Kotak created and oversaw fund to bet against Adani, Kotak denies claims

Hindenburg said that brokerage firms founded by Uday Kotak created and managed the offshore fund structure that was used by its investor partner to bet against Adani group shares.

It added that SEBI only referred to the K-India Opportunities fund and used the acronym 'KMIL' to mask the 'Kotak' name.

https://www.newindianexpress.com/busine ... ort-seller

Re: Indian Economy News & Discussion - Nov 27 2017

Not a good look for SEBI or Adani. Another shoe to drop in all likelihood. Wonder why the exchanges aren't pursuing the listing norm violation as well.

Re: Indian Economy News & Discussion - Nov 27 2017

Poverty dips to 8.5% from 21% in 2011-12, says NCAER paper

NEW DELHI: A new survey has estimated poverty to have declined to 8.5% from 21% in 2011-12 and pointed out that chronic poverty has come down but there is a significant proportion of people who can slip back into poverty due to “accident of life”.

Based on the initial findings of the just-concluded India Human Development Survey, it has estimated headcount ratios of poverty using inflation-adjusted poverty line by the Tendulkar Committee, which is used by govt to formulate and implement its schemes. This is lower than the World Bank’s $2.15 international poverty line using the 2017 purchasing power parity.

:

:

:

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.news18.com/business/indias- ... 50104.html#

Indian government bonds or government securities (G-secs) have been included in the JP Morgan-Emerging Market Bond Index. The inclusion, effective June 28, will be staggered over a 10-month period from June 28, 2024, to March 31, 2025, indicating one per cent increment on its index weight. Experts said the development will reduce borrowing cost for the government, apart from putting the Indian bond market on the radar of global bond investors.

…

Bond market experts said the inclusion of Indian bond market in the JP Morgan-EMB Index will help attract higher foreign flows, as it puts Indian bond markets on the radar of global bond investors.

It will also help bring in large passive investments from overseas, as a result of which more domestic capital would be available for industry, as crowding out would be reduced.

Currently, India carries a 1 per cent weight in the JP Morgan-Emerging Market Bond Index.

India’s weight is expected to reach the maximum threshold of 10 per cent in the GBI-EM Global Diversified, and approximately 8.7 per cent in the GBI-EM Global Index.

JP Morgan has included 29 Indian government securities under the Fully Accessible Route (FAR) in its emerging market index.

Re: Indian Economy News & Discussion - Nov 27 2017

are these bonds purchased in rupees or in USD? If in Rupees, signficant capital outflows would result in strengthening of the rupee. More companies will start allocating between 5-10% in the portfolios for India.

Re: Indian Economy News & Discussion - Nov 27 2017

Here is a URL to go through first:

https://www.tbsnews.net/bloomberg-speci ... ent-886731

Of course everything eventually will be Rupee. International retail & institutional investors will invest in their local currencies, say USD, EUR or YEN which the trading financial firm will sell in Indian market and buy rupees to purchase the bond.In more practical terms, the event means foreign investors will finally gain access to India's tightly-regulated $1.3 trillion government bond market....

In 2020, the Reserve Bank of India (RBI) opened a wide swath of its sovereign bond market to foreign investors.

JPMorgan added India to its watchlist for inclusion in the emerging market bond indexes in October 2021. But talks hit a stalemate due to New Delhi's reluctance to provide tax breaks to foreigners to trade on international platforms. What likely revived the matter was investors wanting diversification to compensate for China's economic woes and sanctions on Russia. India hasn't yielded to requests by foreign investors for tax breaks.

For this rupee stabilization is the key. A volatile rupee means most investors will shy away. For rupee to be stable, India's fiscal deficit, inflation and economy in general should be stable*

Here is how it works:

1. As a individual investor or as an institutional investment manager, you are looking at purchasing say emerging market bond fund or ETF. Examples are VEGBX or EMB or FNMIX (you can check it out on finance.yahoo.com / https://fundresearch.fidelity.com/mutua ... 315910836 )

Individual investor means you either go directly to the investment firm like JPMC or Fidelity or ETrade or Robinhood, transfer money from your bank account and purchase the bond fund or ETF. Of course you can have SIP equivalents with your own bank or your buddy who smokes weed or the local desi chaiwallah who has the best dibs on which way the Indian economy is moving (in case of bonds) and smoke a joint or two and transfer your savings.

You see you are looking for a low-volatile, stable returns for your savings. Maybe you are retired and do not want to deal with vagaries of stock market. Emerging markets bond help you beat local inflation while offering you some safety compared to stock

2. As an institutional investor, for example you are running a senior home and they have you as their financial manager. That is you are registered "BRFite Chaiwallah Investment firm" and the retirees have deposited their meagre savings to you. Including their monthly pensions. You want to make sure that it is invested and has some returns. You are an institutional investor. You contact say the "Chaddiwallah Teachers Pension Fund", who manages pensions for the teachers in the state of say Alaska or for that matter pensions for the rail road employees in Argentina or in Japan or in iceland. You get the drift. Point is you have millions of what you want to invest. Wether in dollars, yen, eur or icelandic currencies.

Key here is, you do not want to or have werewithal to open office in India and do the analysis. So you either buy FNMIX or EMB or VEGBX (or a mixture of those funds) or approach other institutions who will curate the funds for you. If you are lazy, you will just buy EMB as an institutional investor and play golf.

Your investments are tracked against an emerging bond index. That is FNMIX or VEGBX is tracked against say JPM emerging bond index. It may show returns better or worse than the index, but if it shows worst, you will try to mirror the JPM index. Even if it does better, you will still try to mirror on what did better against the benchmark index.

Since you mirror the index, you will buy into the underlying bonds that constitute the fund. And that means more money flowing into India.

Here is a breakdown of FNMIX

Mexico 6.82% Indonesia 3.57% Hungary 1.85% Sri Lanka 1.15%

Saudi Arabia 4.27% Qatar 3.41% Angola 1.77% United Kingdom 1.10%

Brazil 4.27% South Africa 3.12% Ukraine 1.59% Paraguay 1.09%

Venezuela 4.25% Chile 3.01% Romania 1.47% Other Countries 16.63%

United States 4.10% Nigeria 2.90% Ecuador 1.37% Cash & Net Other Assets 2.05%

United Arab Emirates 3.90% Egypt 2.90% Costa Rica 1.31%

Turkey 3.85% Panama 2.66% Peru 1.28%

Colombia 3.73% Argentina 2.32% Pakistan 1.18%

Dominican Republic 3.60% Oman 2.31% Guatemala 1.17%

What does that do for the Indian government? Indian government can float bullet train project from madurai to chennai and ahmedabad to delhi and issue bonds to finance it. It does not have to borrow from Bank of Baroda or SBI. Or even LIC or whatever pension plan Indians have that regularly bail out Indian government. The banks now have additional capital which can now fund expansion of say Adani enterprises or your national-pakodawalla franchise.

And for reference from above URLs

For global investors, Indian bonds offer access to a high-growth, high-yield market. According to JPMorgan, the securities have beaten their index counterparts over the past decade. Additionally, the rupee is among the least volatile emerging market currencies, which has enhanced the nation's appeal.

Since JPMorgan's September announcement, more than $10 billion has flowed into local bonds, with global funds such as BlackRock and Abrdn investing ahead of the actual inclusion. Morgan Stanley estimates that 3.6% of the total assets tracking the index are already deployed in India, reflecting a rush to gain exposure despite the elaborate documentation needed to set up onshore.

* Pappu is evil. With his Khatakat schemes, he & CONgoon wants to destabilize the Indian economy. The net result will be that foreign investment will reduce and India will find it difficult to raise capital for its growth. If you are still supporting Pappu, CONgoons or any of the dynastic parties that support CONgoons for various reasons, then you deserve nothing but hell.

Re: Indian Economy News & Discussion - Nov 27 2017

How?

Hindenburg throws $hyte on Adani. None of it sticks. And it is somehow Adani's fault? Or SEBI's fault? Please explain how logically.

*Another shoe to drop: Is a wall street cliche. It may work if there was a shoe drop earlier. Can you point to a real shoe drop other than Hindenburg's accusations?

Re: Indian Economy News & Discussion - Nov 27 2017

https://tradingeconomics.com/india/manufacturing-pmiThe HSBC India Manufacturing PMI came in at 58.3 in June 2024, up from May's 57.5 but slightly below both preliminary estimates and market forecasts of 58.5. The latest reading indicated a sharper improvement in business conditions, as strong demand conditions spurred the expansions in new orders, output and buying levels. At the same time, firms raised employment at the fastest rate seen in more than 19 years of data collection. Stocks of purchased materials also rose at a near-record pace, supported by another improvement in suppliers' delivery times. On prices, input price inflation eased in May, but was nonetheless among the highest since August 2022. As a result, companies lifted selling prices to the greatest extent since May 2022. Lastly, the outlook for the manufacturing sector remains positive, with firms expecting further improvements in demand and order book volumes in the year ahead. However, the future output index fell to a three-month low. source: S&P Global

Re: Indian Economy News & Discussion - Nov 27 2017

This bit. Don't recall seeing any explanation for the related party transactions, particularly the part where most equity was held by the family.

A bubble can inflate for quite a while, so too early to declare victory saying nothing stuck here.To This Day Adani Hasn’t Directly Addressed The Findings From Our Research Or From Dozens of Media Investigations, Instead Offering Deflections And Blanket Denials

Re: Indian Economy News & Discussion - Nov 27 2017

Let's put this thought process in motion. Let me make dozen of accusations against you. Including charges of nepotism (in your own business), charges of nepotism and spreading equity among your family members of all your holdings, unshared and shared and charges of hiding your financial assets and liabilities. The last one is very true, I do not know your financial assets and liabilities and can only speculate and since you have not been forthcoming on your financial assets, I think you are cooking the books.vera_k wrote: ↑04 Jul 2024 04:40This bit. Don't recall seeing any explanation for the related party transactions, particularly the part where most equity was held by the family.

A bubble can inflate for quite a while, so too early to declare victory saying nothing stuck here.To This Day Adani Hasn’t Directly Addressed The Findings From Our Research Or From Dozens of Media Investigations, Instead Offering Deflections And Blanket Denials

^ How will you respond? Please let us know.

---

Now can you tell us the following?

1. What are the accusations in Hindenberg report?

2. Who is Mark Kingdon?

3. What is the relation between Mark Kingdon and Kotak Mahindra International Investment Limited?

4. What is the character, composition and other details of Kotak India Opportunity Fund?

5. Who is Anla Cheng and how is the Kingdon Master fund being funded?

6. What is China Stone project?

Please answer the above first.

---

Stating "other shoe is to fall" and "a bubble can inflate for quite a while" are cliche's that make one sound profound and sanguine, but is utter wall street bull shyte.

You see on wall street (or dalal street), this maxim always holds true: Bulls make money, Bears make money, and the pigs get slaughtered.

So please explain what is a short sell and a short squeeze. In simple terms. Indians need to understand this first. Reason is the following chart:

https://finance.yahoo.com/quote/ADANIENT.NS/

Can you tell me what happened in 1st Quarter 2023 and how that chart could have immensely benefited some? And how?

And can you also explain this? https://finance.yahoo.com/news/stronger ... 00506.html

We will come to what stuck or not later. Currently whatever is stuck is only in your mind.

PS: I hope you are not a financial advisor and "stock market expert" for others. I will feel sorry for your clients.

Re: Indian Economy News & Discussion - Nov 27 2017

Within the Hindenberg report and all the hoopla arround it. Hindenberg has not made a single categorical assertion based on Indian laws or regulations. That Adani is in violation of XYZ rules or ABC regulations.

Just aspersions of wrongdoing. Without any substantiation.

Just aspersions of wrongdoing. Without any substantiation.

Re: Indian Economy News & Discussion - Nov 27 2017

Adani remains under investigation by SEBI, therefore too soon to say.

India's markets regulator puts seven Adani companies on notice for violations

However, an outfit can technically be in compliance, yet not providing accurate information. One specific allegation in the report by Hindenburg is that related parties are transacting with each other, making the business look healthier than it really is. Check Rehvar Infrastructure in the report here.

Adani report

India's markets regulator puts seven Adani companies on notice for violations

However, an outfit can technically be in compliance, yet not providing accurate information. One specific allegation in the report by Hindenburg is that related parties are transacting with each other, making the business look healthier than it really is. Check Rehvar Infrastructure in the report here.

Adani report

Re: Indian Economy News & Discussion - Nov 27 2017

Okay, and is that a violation of Indian laws or regulations?

If we know about those transactions because of Indian regulations. Then I have no concerns.

Secondly, if the business able to maintain solvency through its core business operations. Then the stock price however inflated is of no concern to anyone but holders of the stock.

Third, what is SEBI expected to show from open investigation?

What is the worst out come for the Adani group? Can you please educate US.

Because as far as I can tell, Adani group has been under investigation for nearly 15 years under different organisations and nothing has turned up.

If we know about those transactions because of Indian regulations. Then I have no concerns.

Secondly, if the business able to maintain solvency through its core business operations. Then the stock price however inflated is of no concern to anyone but holders of the stock.

Third, what is SEBI expected to show from open investigation?

What is the worst out come for the Adani group? Can you please educate US.

Because as far as I can tell, Adani group has been under investigation for nearly 15 years under different organisations and nothing has turned up.

Re: Indian Economy News & Discussion - Nov 27 2017

Common stock holders lose their investment. Bond holders don't get paid. In the best case, someone else assumes ownership of the hard infrastructure assets and operates them as usual.

Common stock equity is the cheapest money available. But In the absence of confidence, investment will be raised from other (more expensive) sources.

Re: Indian Economy News & Discussion - Nov 27 2017

Taiwan, India Threaten China’s Top Spot in EM Equity Portfolios

Thanks to record stock rallies, Taiwan and India now command more than 19% weightings each in the MSCI EM Index. That compares to China’s 22.8%, whose standing has steadily shrunk over the past few years, Bloomberg-compiled data show.

The rise of Taiwan and India is allowing investors to better diversify by betting on artificial intelligence chipmakers and the infrastructure boom coming from Modi’s programs to modernize the country. As the US rate cycle peaks out, having attractive options in emerging markets is fundamental to any pivoting of capital flows.

At its peak in 2020, China accounted for 40% of the MSCI EM Index, with investors lured by thriving e-commerce to sales of expensive liquor. That heavy weightage cost money managers dearly, with trillions of dollars wiped out as Beijing embarked on regulatory crackdowns and went on a deleveraging campaign for its indebted property sector.

If recent trends hold, Taiwan or India may catch up with China’s standing in MSCI EM this year, marking a shift into a multi-polar emerging markets world.

Re: Indian Economy News & Discussion - Nov 27 2017

Good time here to call out how emerging market funds benchmarked using MSCI EM or similar direct investment to China. For instance, take a look at this Vanguard fund -

VEMAX -

Vanguard Emerging Markets Stock Index Fund Admiral Shares

VEMAX -

Vanguard Emerging Markets Stock Index Fund Admiral Shares

Why this matter is that many times, such funds will be the only choice for emerging markets investments in workplace pension plans. Therefore, if this applies, write to your retirement plan fiduciary asking for different or more India focused fund choices.Vanguard Emerging Markets Stock Index Fund seeks to track the performance of the FTSE Emerging Markets All Cap China A Inclusion Index.

Re: Indian Economy News & Discussion - Nov 27 2017

sirji,

Adani has stuck it to the cheen in quite a few deals and they see him a major threat

Adani also is mindful of India's geopolitical/strategic interests and helps in whichever way he can to protect or advance Indian interests

That is a sore point with many BIF players and interests. Hindenberg was a major hitjob that the adanis smartly recovered from

and like the ambanis, he has almost flawless execution and management of projects, schedules with strict timelines, with on cost and on time delivery of milestones

people in the establishment who matter are well aware of the BIF threats to the adanis.

-

nandakumar

- BRFite

- Posts: 1692

- Joined: 10 May 2010 13:37

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.thehindubusinessline.com/ec ... 405679.ece

The article is behind a pay wall. The key highlight is this: The enrollment in PF employee base added 1.31 crore new members. This is more than half of 2.5 crore young Indians who would have attained 18 years of age in 23-24 as per Census data. So the formal sector alone is adding significantly to the employment numbers. If you adjust for those proceeding for higher studies and those not looking for employment especially among women, the percentage would be higher.

The article is behind a pay wall. The key highlight is this: The enrollment in PF employee base added 1.31 crore new members. This is more than half of 2.5 crore young Indians who would have attained 18 years of age in 23-24 as per Census data. So the formal sector alone is adding significantly to the employment numbers. If you adjust for those proceeding for higher studies and those not looking for employment especially among women, the percentage would be higher.

Re: Indian Economy News & Discussion - Nov 27 2017

Taiwan firms shift supply chains to India from China, trade body chief says

Taiwan firms are shifting supply chains to India from China, as Taipei and New Delhi strengthen economic ties, the head of the island's key trade body told Reuters, as global trade tension rises among major economies.

Trade conflict between the United States and China drove up Taiwan's foreign direct investment (FDI) in India to more than $665 million in the five years to 2023, said James Huang, chairman of the Taiwan External Trade Development Council.

That compared with democratically-ruled Taiwan's FDI of nearly $277 million in India during the decade from 2006 to 2017, Huang said in an interview on Monday.

"It is evident that more Taiwanese companies are moving supply chains out of China and are establishing them in India," he added.

Like most countries, India has no formal ties with Chinese-claimed Taiwan, but the two have established a close business relationship, with India keen on more investment from the major chip-producing nation to aid its efforts to boost manufacturing.

Re: Indian Economy News & Discussion - Nov 27 2017

Any analysis of the budget? I have only bits and pieces of information from WA groups.

Links from Wikipedia page https://en.wikipedia.org/wiki/Ministry_ ... ce_(India) are not working.

These links are

http://indiabudget.nic.in/budget.asp

and

http://finmin.nic.in/

I have a PDF but I am not sure of its provenance. That is why I am asking. Also why do they have only http, not https?

http websites can be spoofed and bad PDFs can be uploaded to a spoof site.

Links from Wikipedia page https://en.wikipedia.org/wiki/Ministry_ ... ce_(India) are not working.

These links are

http://indiabudget.nic.in/budget.asp

and

http://finmin.nic.in/

I have a PDF but I am not sure of its provenance. That is why I am asking. Also why do they have only http, not https?

http websites can be spoofed and bad PDFs can be uploaded to a spoof site.

Re: Indian Economy News & Discussion - Nov 27 2017

This budget is not great, just slow and steady. Indian budgets are boring stuff with nothing great to report. Bihar and AP got some support from the center. The muddle class got some minor relief at the lower end. Interest payments (on funds raised internally within India) are taking up 30% of expenditure of budget. Right there, tells you the govt borrows huge amounts and pays interests which consume almost 1/3. No movement on GST to lower rates. Only MRO aircraft has brought it down to 5% and got rid of all other slabs on GST. Nirmala announced some IT initiative for land registry throughout nation to ease the issue of land acquisition. This should help. However the GOI is so reluctant to streamline entire babucracy and judiciary and other govt systems. I don't kown why India is waiting for such stuff. We have strengths in software and the entire system can be automated, Business process mgmt, etc and we lead the world in governance by GoI like UPI, DPI etc.

The GOI is not doing anything on the import front. We are importing more from China. The banias are shutting down any effort on components, raw ingredients, etc, it is just repackaging imported stuff and selling them in the market. We see resistance to internally developed products in the military domain. Screwdrivergiri and mult-nationals palming of their products with some local bania pretending "Make in India". The entire import list of items from the commerce ministry should be targeted. Anyone creating IDDM import stuff should be given incentives like no tax, writeof of investments, etc. Each district should target 1 or more products that can be made in India and exported. UP has embarked on such a thing.

The GOI is not doing anything on the import front. We are importing more from China. The banias are shutting down any effort on components, raw ingredients, etc, it is just repackaging imported stuff and selling them in the market. We see resistance to internally developed products in the military domain. Screwdrivergiri and mult-nationals palming of their products with some local bania pretending "Make in India". The entire import list of items from the commerce ministry should be targeted. Anyone creating IDDM import stuff should be given incentives like no tax, writeof of investments, etc. Each district should target 1 or more products that can be made in India and exported. UP has embarked on such a thing.

Re: Indian Economy News & Discussion - Nov 27 2017

From that PDF I have, two flagship initiatives seem to be Agriculture and ITIs. LTCG went up both on stocks/binds as well as real estate. LTCG definition is that some body has to hold the assets for 24 months (and in some cases just 12 months) to get the lower tax rate. On the other hand, they removed indexing. If someone is holding the asset for lot longer than 24 months, they are not going to get any benefit. This might make people who are holding on to real estate (flats locked up or given on rent which wouldn't even cover the mortgage interest payments) will sell those flats. That will bring down RE prices making it attractive for first time home/flat buyers. Some of that money will come into the stock market.

Re: Indian Economy News & Discussion - Nov 27 2017

Mudra loan limit has been doubled to INR 20 lacs. Credit for MSMEs is being eased.

All in all, it is a budget to create jobs at skilled, semi-skilled, and unskilled agri sectors.

All in all, it is a budget to create jobs at skilled, semi-skilled, and unskilled agri sectors.