Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

I found this link which has links to highlights and details.

https://www.indiabudget.gov.in/index.php

Highlights PDF is here.

https://www.indiabudget.gov.in/doc/bh1.pdf

Budget at a glance: https://www.indiabudget.gov.in/doc/Budg ... glance.pdf

https://www.indiabudget.gov.in/index.php

Highlights PDF is here.

https://www.indiabudget.gov.in/doc/bh1.pdf

Budget at a glance: https://www.indiabudget.gov.in/doc/Budg ... glance.pdf

Last edited by Vayutuvan on 24 Jul 2024 10:46, edited 1 time in total.

Re: Indian Economy News & Discussion - Nov 27 2017

Not really - for such immovable assets, LTCG has come down from 20% to 12.5%. NS in her budget speech mentioned "all financial and non-financial assets" when talking about long term gains, whose tax would be 12.5%. So for properties, that would be a huge gain when selling.Vayutuvan wrote: ↑24 Jul 2024 05:49 From that PDF I have, two flagship initiatives seem to be Agriculture and ITIs. LTCG went up both on stocks/binds as well as real estate. LTCG definition is that some body has to hold the assets for 24 months (and in some cases just 12 months) to get the lower tax rate. On the other hand, they removed indexing. If someone is holding the asset for lot longer than 24 months, they are not going to get any benefit. This might make people who are holding on to real estate (flats locked up or given on rent which wouldn't even cover the mortgage interest payments) will sell those flats. That will bring down RE prices making it attractive for first time home/flat buyers. Some of that money will come into the stock market.

Re: Indian Economy News & Discussion - Nov 27 2017

वायु ji,

A tutorial on url tag. in the first tag place the link ... url=https://www.indiabudget.gov.in/doc/bh1.pdf]BH1[/url]

A tutorial on url tag. in the first tag place the link ... url=https://www.indiabudget.gov.in/doc/bh1.pdf]BH1[/url]

Re: Indian Economy News & Discussion - Nov 27 2017

@arshyam gaaru, that is what I heard from two sources. “Immovable assets” are “real estate”, I presume. What about stock holdings in Indian companies, public or private?

Re: Indian Economy News & Discussion - Nov 27 2017

That didn’t come out right.bala wrote: ↑24 Jul 2024 07:17 वायु ji,

A tutorial on url tag. in the first tag place the link ... url=https://www.indiabudget.gov.in/doc/bh1.pdf]BH1[/url]

-

Mukesh.Kumar

- BRFite

- Posts: 1441

- Joined: 06 Dec 2009 14:09

Re: Indian Economy News & Discussion - Nov 27 2017

Looks like Bala is trying out a new AI Assistant with Voice to Text ConversionVayutuvan wrote: ↑24 Jul 2024 10:45That didn’t come out right.bala wrote: ↑24 Jul 2024 07:17 वायु ji,

A tutorial on url tag. in the first tag place the link ... url=https://www.indiabudget.gov.in/doc/bh1.pdf]BH1[/url]

Re: Indian Economy News & Discussion - Nov 27 2017

वायु ji,

here is an example

budget at a glance

Mukesh ji i am not singing (no voice)!

Meanwhile Sanjay Dixit's chat on the budget is highly revealing. He says that "brilliant" budgets have mostly failed but the boring ones are to be watched since they bring out incremental changes that stick into Desh for a long time and are beneficial. India's debt ratio is not bad. He feels that Govt need not provide jobs, but proper skilling/training and enterpreunership (Mudra loans would help) would certainly increase jobs that are enduring. View YT at your leisure

https://www.youtube.com/watch?v=4x2Tk0-JQLE

here is an example

budget at a glance

Mukesh ji i am not singing (no voice)!

Meanwhile Sanjay Dixit's chat on the budget is highly revealing. He says that "brilliant" budgets have mostly failed but the boring ones are to be watched since they bring out incremental changes that stick into Desh for a long time and are beneficial. India's debt ratio is not bad. He feels that Govt need not provide jobs, but proper skilling/training and enterpreunership (Mudra loans would help) would certainly increase jobs that are enduring. View YT at your leisure

https://www.youtube.com/watch?v=4x2Tk0-JQLE

Re: Indian Economy News & Discussion - Nov 27 2017

The recent budget presented by Finance Minister Nirmala Sitharaman has brought exciting developments for the research and innovation landscape in India. The allocation of ₹1 lakh crore for private sector-driven research and innovation, along with the operationalization of the Anushandhan National Research Foundation (ANRF), is a significant boost for basic research and prototype development. Additionally, the announcement of a ₹1000 crore venture capital fund is expected to accelerate the growth of the space economy. The emphasis on R&D for small and modular nuclear reactors, clean energy technologies, and digitization of land records and geospatial data will further drive innovation and informed decision-making.

These initiatives align with the government's vision for a self-reliant and technologically advanced India, and I share Abhay Karandikar's (Secretary DST, Ex Director IIT Kanpur) enthusiasm for the potential impact of these measures on the country's development.

These initiatives align with the government's vision for a self-reliant and technologically advanced India, and I share Abhay Karandikar's (Secretary DST, Ex Director IIT Kanpur) enthusiasm for the potential impact of these measures on the country's development.

Re: Indian Economy News & Discussion - Nov 27 2017

Analysis of Defence budget / Lt. Gen P R Shankar

Re: Indian Economy News & Discussion - Nov 27 2017

I presume that is rolled up under "all financial assets". The fine print should reveal these things clearly in the next few days, let's see. I'm going by the budget speech and the annexure tabled in Parliament.

Re: Indian Economy News & Discussion - Nov 27 2017

@bala ji, I know.bala wrote: ↑24 Jul 2024 18:33 वायु ji,

here is an example

budget at a glance

Mukesh ji i am not singing (no voice)!

But I usually do url only. That way everybody can see the entire url and decide whether they trust the site etc.

Re: Indian Economy News & Discussion - Nov 27 2017

From that article:vera_k wrote: ↑24 Jul 2024 23:31

Departing from India? Clearance certificate under Black Money Act required

So only for people who are domiciled in India. Doesn't apply to OCI holders or Indian visa holding foreigners, I think.From October 1, a clearance certificate giving a clean chit under the Black Money Act will be required for persons domiciled in India, who are leaving India.

Re: Indian Economy News & Discussion - Nov 27 2017

Ahem, well, another interaction with our famed babucracy. Who is going to issue a certificate with proper sthyamp and sheal in triplicate? . The certificate to clear oneself oneself of black money has just generated another avenue to create more black money and delays, Innovative rent seeking governance., I say.Vayutuvan wrote: ↑26 Jul 2024 04:40From that article:vera_k wrote: ↑24 Jul 2024 23:31

Departing from India? Clearance certificate under Black Money Act requiredSo only for people who are domiciled in India. Doesn't apply to OCI holders or Indian visa holding foreigners, I think.From October 1, a clearance certificate giving a clean chit under the Black Money Act will be required for persons domiciled in India, who are leaving India.

Re: Indian Economy News & Discussion - Nov 27 2017

who come up with these here-brained ideas?vera_k wrote: ↑24 Jul 2024 23:31

Departing from India? Clearance certificate under Black Money Act required

Re: Indian Economy News & Discussion - Nov 27 2017

This is not some "new idea". This law exists in the Income Tax act since a very long time. DDM seems to be making a drama/sensation out of it.

Here is more detail: https://www.lexology.com/library/detail ... 540b570560

Already existing law (since 1961):

And if this proviso had previously been there and implemented properly, the likes of Mallayya, Nirav Modi, Chokshi, etc would not have been able to flee.

Here is more detail: https://www.lexology.com/library/detail ... 540b570560

Already existing law (since 1961):

Recent changes in Feb 2024, that make it more specific regarding when such a certificate would be needed:Currently, as per the first proviso to Sub-section (1A) of Section 230 of the I-T Act, a person domiciled in India at the time of his departure from India will not be permitted to leave the country without obtaining a Tax Clearance Certificate from the income tax authorities, if, in the authority’s opinion, it is necessary in light of existing circumstances. This Certificate would state that he has no liabilities under the I-T Act, or the Wealth-tax Act, 1957, or the Gift-tax Act, 1958, or the Expenditure-tax Act, 1987, or satisfactory arrangements have been made by him to pay such dues.

Under the second proviso, it is made clear that the authority would be required to a) record reasons and b) obtain prior approval of the Principal Chief Commissioner or Chief Commissioner of Income Tax.

And finally, the most recent proposal that some people are worried about. All it seems to do is add a couple more reasons for the certification, i.e. undisclosed foreign assets/black money:The circumstances in which the Tax Clearance Certificate may be required to be obtained, as delineated by the Central Board of Direct Taxes (CBDT) vide Instruction No.1/2004 dated February 5, 2024, are as follows:

Person is involved in serious financial irregularities, his presence is necessary for an investigation under the I-T Act or the Wealth-tax Act, 1957, and a tax demand will likely be raised against him; or

Direct tax arrears exceeding INR 10 lakh are outstanding against him which have not been stayed by any authority.

So, if this is properly implemented, then I am guessing many INC poltoos will find it hard to leave the country.The Finance Bill, 2024, proposes an amendment to the first proviso to Sub-section (1A) of Section 230 of the I-T Act to bridge the lacuna by inserting and including liabilities arising under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, within its ambit, for the purposes of obtaining a Tax Clearance Certificate, beginning on October 1, 2024.

And if this proviso had previously been there and implemented properly, the likes of Mallayya, Nirav Modi, Chokshi, etc would not have been able to flee.

-

nandakumar

- BRFite

- Posts: 1692

- Joined: 10 May 2010 13:37

Re: Indian Economy News & Discussion - Nov 27 2017

KL Dubey:

"So, if this is properly implemented, then I am guessing many INC poltoos will find it hard to leave the country.

And if this proviso had previously been there and implemented properly, the likes of Mallayya, Nirav Modi, Chokshi, etc would not have been able to flee."

This will surely be challenged by the likes of Singhvi, Sibal etc. The Supreme Court is sure to strike it down is an unfair restriction of Freedom of Speech/Life etc. In Menaka Gandhi case the Supreme Court held that the Right to Travel is a fundamental Right. If that doesn't work it will be struck down as violative of Basic Structure!

"So, if this is properly implemented, then I am guessing many INC poltoos will find it hard to leave the country.

And if this proviso had previously been there and implemented properly, the likes of Mallayya, Nirav Modi, Chokshi, etc would not have been able to flee."

This will surely be challenged by the likes of Singhvi, Sibal etc. The Supreme Court is sure to strike it down is an unfair restriction of Freedom of Speech/Life etc. In Menaka Gandhi case the Supreme Court held that the Right to Travel is a fundamental Right. If that doesn't work it will be struck down as violative of Basic Structure!

Re: Indian Economy News & Discussion - Nov 27 2017

Like i said this law dates from 1961...a little late to challenge it.

Right to leave the country is not a fundamental right, only the right of a citizen to return to india is a fundamental right.

The sarkar has just added "undisclosed foreign assets" to the specific reasons for requiring a leaving certificate.

Right to leave the country is not a fundamental right, only the right of a citizen to return to india is a fundamental right.

The sarkar has just added "undisclosed foreign assets" to the specific reasons for requiring a leaving certificate.

Re: Indian Economy News & Discussion - Nov 27 2017

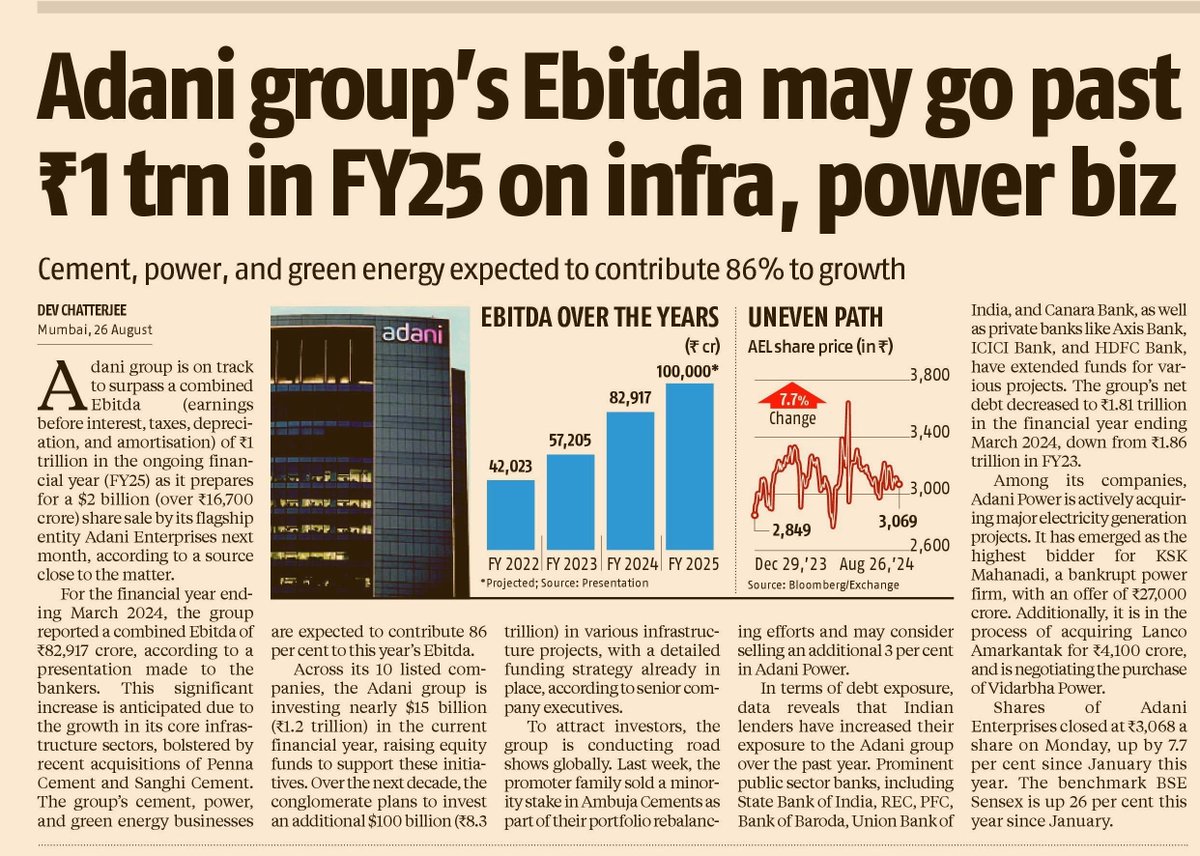

Hindenberg is planning another “expose” on India. Looks like more money is to be made on shorting..

Re: Indian Economy News & Discussion - Nov 27 2017

Is it ?

Hindenburg Made Just $4 Million From $153 Billion Adani Rout

It sounds like they don't know their place.

Re: Indian Economy News & Discussion - Nov 27 2017

They're reporting on alleged corruption in SEBI.

Whistleblower Documents Reveal SEBI’s Chairperson Had Stake In Obscure Offshore Entities Used In Adani Money Siphoning Scandal

Whistleblower Documents Reveal SEBI’s Chairperson Had Stake In Obscure Offshore Entities Used In Adani Money Siphoning Scandal

Re: Indian Economy News & Discussion - Nov 27 2017

^^ No wonder the Whites are after Adani. They don't want an Indian Rockefeller to emerge

Re: Indian Economy News & Discussion - Nov 27 2017

sanjayc ji,

not to forget the half whites

There is no other Indian conglomerate with the enormous risk appetite, the financial muscle, the project execution expertise, the adroit management मालुमात, and the corporate confidence of that caliber only comes from the inherent possession of big hairy brown ..... to consistently compete in the geopolitical and geo strategic arena

This combination of characteristics, inherent in the Adani machine, is what is actually bothering them, especially the slimy and crooked cheen and our very own manchurian candidate

Re: Indian Economy News & Discussion - Nov 27 2017

https://x.com/BesuraTaansane/status/1824428553498399009

Sameer @BesuraTaansane

Words of Deputy Managing Director of IMF, Gita Gopinath :

"Firstly India's growth did much better than we expected last fiscal year...... private consumption is expected to increase, driven by rural consumption, growth in 2 wheeler sales, FMCG"

@BJP4India

should take such clips and dub them in regional languages so that people stop believe phatichar self proclaimed economists like Dhruv Tattee !

Sameer @BesuraTaansane

Words of Deputy Managing Director of IMF, Gita Gopinath :

"Firstly India's growth did much better than we expected last fiscal year...... private consumption is expected to increase, driven by rural consumption, growth in 2 wheeler sales, FMCG"

@BJP4India

should take such clips and dub them in regional languages so that people stop believe phatichar self proclaimed economists like Dhruv Tattee !

Re: Indian Economy News & Discussion - Nov 27 2017

https://swarajyamag.com/economy/indian- ... ival-ahead

Indian Exporters Unlock New Markets Amid July Slump, Signaling Potential Revival Ahead

India's Exports Surge in Key Sectors

India's exports have shown significant growth across various sectors, with medicine exports to the US and Italy on the rise, making India the third-largest supplier of medicines to the US. The textile and apparel sector saw a 4.73% year-on-year increase in exports in July, driven by increased demand. Electronic goods exports soared by 37.31% in July, reaching $2.8 billion. Despite a slight contraction in July, Indian exporters expanded into new markets like China, Belgium, and Malaysia, indicating potential for future growth. However, Pakistan's textile group exports decreased by 3.09% in July 2024 compared to the previous year.

Indian Exporters Unlock New Markets Amid July Slump, Signaling Potential Revival Ahead

India's Exports Surge in Key Sectors

India's exports have shown significant growth across various sectors, with medicine exports to the US and Italy on the rise, making India the third-largest supplier of medicines to the US. The textile and apparel sector saw a 4.73% year-on-year increase in exports in July, driven by increased demand. Electronic goods exports soared by 37.31% in July, reaching $2.8 billion. Despite a slight contraction in July, Indian exporters expanded into new markets like China, Belgium, and Malaysia, indicating potential for future growth. However, Pakistan's textile group exports decreased by 3.09% in July 2024 compared to the previous year.

Re: Indian Economy News & Discussion - Nov 27 2017

https://x.com/dmuthuk/status/1827679794 ... Ee2Zw&s=19

I was expecting some major rural freebies in the short term. Maybe this UPS scheme will not cause major money outflow in the near future ?

D.Muthukrishnan is a certified financial planner with 536K followers in X. Can anyone comment on the new UPS scheme ? From what I had read in this forum, rural distress, very low agri growth rate, (Agniveer scheme ?) had been the main problems that caused seat losses for BJP in the last national elections.Pay commission recommendations were made keeping in mind that old pension schemes are no longer there. Now government employees would retain those extra benefits plus also get old pension benefits again. This government's decision is an economic disaster.

I was expecting some major rural freebies in the short term. Maybe this UPS scheme will not cause major money outflow in the near future ?

Re: Indian Economy News & Discussion - Nov 27 2017

RBI Governor Announces ULI, Says It Will Transform India’s Lending Ecosystem

India will formally launch its next digital financial revolution – the Unified Lending Interface (ULI). According to RBI Governor Shaktikanta Das who christened the pilot project launched last year as ULI, the interface will revolutionise the financial industry in India just like UPI – the Unified Payments Interface has done in the past few years. ULI will enable frictionless credit by cutting time taken for appraisals by lenders. It will also integrate external records such as the land records of states while ensuring total data privacy protection. The RBI Governor announced the new trinity – JAM, UPI and ULI.

// this should unleash better lending and efficiencies in the market. Usurious rates have been the bane the world over. India is reaping better technology and with a public infrastructure an even playing field is ensured. The Western model is about private companies providing the infrastructure and they make it tailored to their needs crowding out any competition. This is opposite of what is needed by the public. A public infrastructure has the backing of the Govt which is neutral and not worried about making money.

Added Later:

AI's Impact In Finance: Revolutionizing Services And Ensuring Data Privacy

At the Global Fintech Fest 2024, RBI Governor Shaktikanta Das addresses the transformative role of AI and machine learning in revolutionizing financial services. He highlights how AI algorithms are already enhancing fraud detection, while machine learning models are improving credit scoring and predictive analytics, thereby expanding access to credit. Additionally, AI-driven chatbots and virtual assistants are elevating customer service by providing personalized recommendations and resolving queries efficiently. Das emphasizes the growing potential of AI in regulatory compliance, investment advisory services, and algorithmic trading, which are set to further reshape the financial landscape. However, he also cautions about the risks associated with AI, urging a balanced and responsible adoption. He calls on financial sector players, central banks, and governments to foster the development of trustworthy AI, with a focus on data privacy, accountability, and transparency. Das suggests that governing AI technologies may be a key topic for discussion among experts at the fest.

India will formally launch its next digital financial revolution – the Unified Lending Interface (ULI). According to RBI Governor Shaktikanta Das who christened the pilot project launched last year as ULI, the interface will revolutionise the financial industry in India just like UPI – the Unified Payments Interface has done in the past few years. ULI will enable frictionless credit by cutting time taken for appraisals by lenders. It will also integrate external records such as the land records of states while ensuring total data privacy protection. The RBI Governor announced the new trinity – JAM, UPI and ULI.

// this should unleash better lending and efficiencies in the market. Usurious rates have been the bane the world over. India is reaping better technology and with a public infrastructure an even playing field is ensured. The Western model is about private companies providing the infrastructure and they make it tailored to their needs crowding out any competition. This is opposite of what is needed by the public. A public infrastructure has the backing of the Govt which is neutral and not worried about making money.

Added Later:

AI's Impact In Finance: Revolutionizing Services And Ensuring Data Privacy

At the Global Fintech Fest 2024, RBI Governor Shaktikanta Das addresses the transformative role of AI and machine learning in revolutionizing financial services. He highlights how AI algorithms are already enhancing fraud detection, while machine learning models are improving credit scoring and predictive analytics, thereby expanding access to credit. Additionally, AI-driven chatbots and virtual assistants are elevating customer service by providing personalized recommendations and resolving queries efficiently. Das emphasizes the growing potential of AI in regulatory compliance, investment advisory services, and algorithmic trading, which are set to further reshape the financial landscape. However, he also cautions about the risks associated with AI, urging a balanced and responsible adoption. He calls on financial sector players, central banks, and governments to foster the development of trustworthy AI, with a focus on data privacy, accountability, and transparency. Das suggests that governing AI technologies may be a key topic for discussion among experts at the fest.

Re: Indian Economy News & Discussion - Nov 27 2017

If you are a fintech geek this insightful session on "Finternet: Transforming Financial Services through Digital Innovation" by Nandan Nilekani will be useful.

Nandan Nilekani, Co-founder & Chairman of Infosys Technologies, will delve into how digital innovation is revolutionizing financial services. You'll gain valuable insights into enhancing financial inclusivity, streamlining operations, and creating customer-centric solutions that meet the evolving demands of today's consumers. Discover the cutting-edge trends and best practices that are shaping the future of the financial ecosystem. As digital transformation continues to impact the industry, this session will provide you with the knowledge and strategies needed to stay ahead in the rapidly evolving fintech landscape. Don’t miss this opportunity to learn from one of the industry’s leading visionaries at GFF, the world’s largest fintech conference, where thought leadership and innovation come together.

// BTW 10% of judicial cases are check bouncing cases. The above system will swat these 10% cases just like that using Finternet.

Nandan Nilekani, Co-founder & Chairman of Infosys Technologies, will delve into how digital innovation is revolutionizing financial services. You'll gain valuable insights into enhancing financial inclusivity, streamlining operations, and creating customer-centric solutions that meet the evolving demands of today's consumers. Discover the cutting-edge trends and best practices that are shaping the future of the financial ecosystem. As digital transformation continues to impact the industry, this session will provide you with the knowledge and strategies needed to stay ahead in the rapidly evolving fintech landscape. Don’t miss this opportunity to learn from one of the industry’s leading visionaries at GFF, the world’s largest fintech conference, where thought leadership and innovation come together.

// BTW 10% of judicial cases are check bouncing cases. The above system will swat these 10% cases just like that using Finternet.

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.livemint.com/news/india/10- ... 41290.html

10 Years of Jan Dhan Yojana: 53 crore accounts, ₹2.31 lakh crore deposits, PM Modi congratulates beneficiaries & more

PM Modi marked ten years of the Pradhan Mantri Jan-Dhan Yojana (PMJDY), the national mission for financial inclusion to ensure access to financial services like a basic savings and deposit account, remittance, credit, insurance, and pension in an affordable manner.

The Big Number You Won't Believe

Behind Jan Dhan Yojana

53.13 Crore Jan Dhan Account Opened

Surpassing Entire Population of The European Union

29.56 Crore Women Beneficiaries

Nearly Equal To The Entire US Population

34.14 Crore Rupay Debit Cards Issued

Combined Population Of USA and Canada

38 Lakh Crore In Direct Benefits Transferred

Amount Transferred Through DBT

◆ 2013-14: 7368 crore

◆ 2014-24: 38 Lakh Crore

Without DBT, only 15 Paise per Rupee, ₹5,70,000 crore of ₹38 lakh crore would have been reached in the hands of people.

35.37 crore Jan Dhan Accounts Empower Rural and Semi-Urban Lives

Combined Populations of Germany, France and Russia

₹2,30,000 Crore Total Deposit In Ja n Dhan Accounts

Total Economy of Mauritius, Maldives and Barbados

Growing Wealth in Every PMJDY Accounts!

◆ March 2015: ₹1065

◆ June 2024: ₹4397

In 2014, the then-NDA government launched the scheme to bring crores of Indians into the formal financial system.

Under the scheme, a basic savings bank deposit (BSBD) account can be opened in any bank branch or Business Correspondent (Bank Mitra) outlet. Benefits of the scheme are:

* There is no requirement to maintain any minimum balance in PMJDY accounts.

* Interest is earned on the deposit in PMJDY accounts.

* Rupay Debit card is provided to PMJDY account holder.

* Accident insurance cover of ₹1 lakh (enhanced to Rs. 2 lakh to new PMJDY accounts opened after 28.8.2018) is available with RuPay card issued to the PMJDY account holders.

* An overdraft (OD) facility up to Rs. 10,000 to eligible account holders is available.

* PMJDY accounts are eligible for Direct Benefit Transfer (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), Micro Units Development and Refinance Agency Bank (MUDRA) scheme.

A large number of normal saving bank accounts are also opened by banks. New measures like e-KYC and video KYC have made the account opening process paper-less, eliminating the need to visit a branch or banking correspondent for opening of bank account. PMJDY is one of the biggest financial inclusion initiatives in the world under which the total number of accounts opened crossed 53 crore.

10 Years of Jan Dhan Yojana: 53 crore accounts, ₹2.31 lakh crore deposits, PM Modi congratulates beneficiaries & more

PM Modi marked ten years of the Pradhan Mantri Jan-Dhan Yojana (PMJDY), the national mission for financial inclusion to ensure access to financial services like a basic savings and deposit account, remittance, credit, insurance, and pension in an affordable manner.

The Big Number You Won't Believe

Behind Jan Dhan Yojana

53.13 Crore Jan Dhan Account Opened

Surpassing Entire Population of The European Union

29.56 Crore Women Beneficiaries

Nearly Equal To The Entire US Population

34.14 Crore Rupay Debit Cards Issued

Combined Population Of USA and Canada

38 Lakh Crore In Direct Benefits Transferred

Amount Transferred Through DBT

◆ 2013-14: 7368 crore

◆ 2014-24: 38 Lakh Crore

Without DBT, only 15 Paise per Rupee, ₹5,70,000 crore of ₹38 lakh crore would have been reached in the hands of people.

35.37 crore Jan Dhan Accounts Empower Rural and Semi-Urban Lives

Combined Populations of Germany, France and Russia

₹2,30,000 Crore Total Deposit In Ja n Dhan Accounts

Total Economy of Mauritius, Maldives and Barbados

Growing Wealth in Every PMJDY Accounts!

◆ March 2015: ₹1065

◆ June 2024: ₹4397

In 2014, the then-NDA government launched the scheme to bring crores of Indians into the formal financial system.

Under the scheme, a basic savings bank deposit (BSBD) account can be opened in any bank branch or Business Correspondent (Bank Mitra) outlet. Benefits of the scheme are:

* There is no requirement to maintain any minimum balance in PMJDY accounts.

* Interest is earned on the deposit in PMJDY accounts.

* Rupay Debit card is provided to PMJDY account holder.

* Accident insurance cover of ₹1 lakh (enhanced to Rs. 2 lakh to new PMJDY accounts opened after 28.8.2018) is available with RuPay card issued to the PMJDY account holders.

* An overdraft (OD) facility up to Rs. 10,000 to eligible account holders is available.

* PMJDY accounts are eligible for Direct Benefit Transfer (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), Micro Units Development and Refinance Agency Bank (MUDRA) scheme.

A large number of normal saving bank accounts are also opened by banks. New measures like e-KYC and video KYC have made the account opening process paper-less, eliminating the need to visit a branch or banking correspondent for opening of bank account. PMJDY is one of the biggest financial inclusion initiatives in the world under which the total number of accounts opened crossed 53 crore.

Re: Indian Economy News & Discussion - Nov 27 2017

India to set up 12 new smart cities with a Rs 28,000 crore outlay. Details inside

https://www.google.com/amp/s/www.zeebiz ... 311343/amp

The Union Cabinet, chaired by Prime Minister Narendra Modi, on Wednesday approved 12 proposed industrial park projects worth Rs 28,602 crore under the government's National Industrial Corridor Development Programme (NICDP), in line with its 'Viksit Bharat' (Developed India) vision.

The 12 industrial parks will span across 10 states and will be strategically planned along six major corridors.

* Khurpia in Uttrakhand

* Rajpura-Patiala in Punjab

* Dighi in Maharashtra

* Palakkad in Kerela

* Agra in Uttar Pradesh

* Prayagraj in Uttar Pradesh

* Gaya in Bihar

* Zaheerabad in Telangana

* Orvakal in Andhra Pradesh

* Kopparthy in Andhra Pradesh

* Jodhpur-Pali in Rajasthan

These projects are expected to attract investment to the tune of around Rs 1.52 trillion with the potential of generating 10 lakh jobs.

■ These projects will cement India's role in global value chains with ready-to-allot land for investors.

■ The country will "soon wear a grand necklace of Industrial Smart Cities on the backbone of Golden Quadrilateral"

■ These projects are expected to attract investment from both large anchor industries and micro, small and medium enterprises to the tune of around Rs 1.52 trillion, and have an employment potential of 10 lakh direct jobs and 30 lakh indirect jobs.

■ The proposed smart cities are part of the government’s initiative to attract foreign investment, boost domestic manufacturing and spur employment generation.

■ That apart, the development of robust infrastructure aims to drive ‘balanced’ regional development.

Similar to the Integrated Industrial Township in Greater Noida, Uttar Pradesh and Special Investment Region in Gujarat’s Dholera.

■ To be developed under the National Industrial Corridor Development Programme (NICDP), these industrial nodes will function more like industrial cities, where residential and commercial setups will co-exist.

■ By positioning India as a strong player in the Global Value Chains (GVC), the NICDP will provide developed land parcels ready for immediate allotment, making it easier for domestic and international investors to set up manufacturing units in India. The projects under the NICDP are designed with a focus on sustainability, incorporating ICT-enabled utilities and green technologies to minimise environmental impact.

The government would like to develop some industrial townships and cities in partnership with other countries like Switzerland and Singapore who have expressed interest in the same.

https://www.google.com/amp/s/www.zeebiz ... 311343/amp

The Union Cabinet, chaired by Prime Minister Narendra Modi, on Wednesday approved 12 proposed industrial park projects worth Rs 28,602 crore under the government's National Industrial Corridor Development Programme (NICDP), in line with its 'Viksit Bharat' (Developed India) vision.

The 12 industrial parks will span across 10 states and will be strategically planned along six major corridors.

* Khurpia in Uttrakhand

* Rajpura-Patiala in Punjab

* Dighi in Maharashtra

* Palakkad in Kerela

* Agra in Uttar Pradesh

* Prayagraj in Uttar Pradesh

* Gaya in Bihar

* Zaheerabad in Telangana

* Orvakal in Andhra Pradesh

* Kopparthy in Andhra Pradesh

* Jodhpur-Pali in Rajasthan

These projects are expected to attract investment to the tune of around Rs 1.52 trillion with the potential of generating 10 lakh jobs.

■ These projects will cement India's role in global value chains with ready-to-allot land for investors.

■ The country will "soon wear a grand necklace of Industrial Smart Cities on the backbone of Golden Quadrilateral"

■ These projects are expected to attract investment from both large anchor industries and micro, small and medium enterprises to the tune of around Rs 1.52 trillion, and have an employment potential of 10 lakh direct jobs and 30 lakh indirect jobs.

■ The proposed smart cities are part of the government’s initiative to attract foreign investment, boost domestic manufacturing and spur employment generation.

■ That apart, the development of robust infrastructure aims to drive ‘balanced’ regional development.

Similar to the Integrated Industrial Township in Greater Noida, Uttar Pradesh and Special Investment Region in Gujarat’s Dholera.

■ To be developed under the National Industrial Corridor Development Programme (NICDP), these industrial nodes will function more like industrial cities, where residential and commercial setups will co-exist.

■ By positioning India as a strong player in the Global Value Chains (GVC), the NICDP will provide developed land parcels ready for immediate allotment, making it easier for domestic and international investors to set up manufacturing units in India. The projects under the NICDP are designed with a focus on sustainability, incorporating ICT-enabled utilities and green technologies to minimise environmental impact.

The government would like to develop some industrial townships and cities in partnership with other countries like Switzerland and Singapore who have expressed interest in the same.

Re: Indian Economy News & Discussion - Nov 27 2017

Performance of Central Banks in the World

US FED - $118 Billion LOSS

GB BoE - $86 Billion LOSS

IN RBI - $43 Billion PROFIT

This is the difference of leadership

US FED - $118 Billion LOSS

GB BoE - $86 Billion LOSS

IN RBI - $43 Billion PROFIT

This is the difference of leadership

Re: Indian Economy News & Discussion - Nov 27 2017

This is because of difference in the interest rates they receive on their asset holdings and they must pay on deposits.

QE masquerades as a monetary policy tool but it's just a way to shift the fiscal deficit off to the central bank. Tax payers ultimate nightmare!