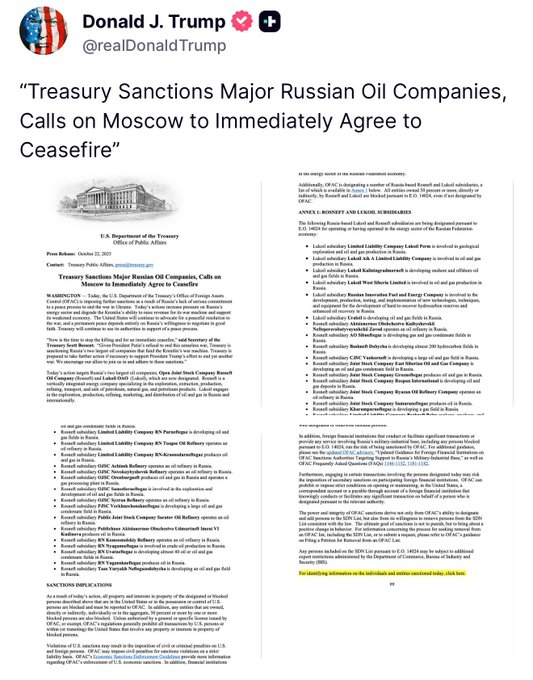

US has sanctioned Russian oil companies. When the US did so for Iran, India stopped its purchases. Why will India not do the same now?A_Gupta wrote: ↑23 Oct 2025 07:50 Via the Hindustan Times:

"US President Donald Trump appears unwilling to back down from his claim that India will soon snap its oil trade ties with Russia. Reiterating the assertion on Thursday, he added a specific figure this time: “By the end of the year, they'll be down to almost nothing, about 40 percent of the (Russian) oil.”

India-US relations: News and Discussions IV

Re: India-US relations: News and Discussions IV

Re: India-US relations: News and Discussions IV

It affects only if you are trading in US currency. India has already decided (2 weeks back) to trade with Russia using yuan.ShauryaT wrote: ↑23 Oct 2025 22:44US has sanctioned Russian oil companies. When the US did so for Iran, India stopped its purchases. Why will India not do the same now?A_Gupta wrote: ↑23 Oct 2025 07:50 Via the Hindustan Times:

"US President Donald Trump appears unwilling to back down from his claim that India will soon snap its oil trade ties with Russia. Reiterating the assertion on Thursday, he added a specific figure this time: “By the end of the year, they'll be down to almost nothing, about 40 percent of the (Russian) oil.”

Re: India-US relations: News and Discussions IV

Unlike the sanctions on Iran, which had broad international support and UN backing, the current sanctions on Russia are largely driven by the US and some of Trump's fans in Europe..(IOW The Iranian sanctions were part of a broader diplomatic effort to limit Iran's nuclear program, whereas the sanctions on Russia are basically Trump's tantrums

Re: India-US relations: News and Discussions IV

As national debt accelerates to $38 trillion, watchdog warns it's 'no way for a great nation like America to run its finances' | Fortune https://share.google/Kp9GHh3ce0Z0deCbH

Can the US just say we will pay anymore interest on the ginormous debt burden ?

Historically there is precedent when moving out of gold backed dollar !

Can the US just say we will pay anymore interest on the ginormous debt burden ?

Historically there is precedent when moving out of gold backed dollar !

Re: India-US relations: News and Discussions IV

Reuters, which has been wrong on this topic before, reports:

https://www.reuters.com/world/india/ind ... 025-10-23/

https://www.reuters.com/world/india/ind ... 025-10-23/

The Times of India says that PSUs will also move away from Rosneft and Lukoil petroleum.NEW DELHI, Oct 23 (Reuters) - Privately-owned Reliance Industries (RELI.NS), opens new tab will stop importing oil under its long-term deal to buy nearly 500,000 barrels per day of crude from Russian oil major Rosneft, after the oil producer was sanctioned by the United States, two sources with direct knowledge of the matter said on Thursday.

Re: India-US relations: News and Discussions IV

> The states: “Federal Motor Carrier Safety Administration audit had uncovered compliance irregularities in California, Colorado, Pennsylvania, South

> Dakota, Texas and Washington”. Texas and South Dakota are solidly Republican.

Sure. What is left unsaid is that California (the state with the most population, meaning it sends the most representatives to the House), CO, and Washington are all solidly democratic. PA (Which is quite populous) is Democratic-leaning. One can even make a case that PA is a solidly Democratic-leaning state.

Why is this in this thread anyways?

> Dakota, Texas and Washington”. Texas and South Dakota are solidly Republican.

Sure. What is left unsaid is that California (the state with the most population, meaning it sends the most representatives to the House), CO, and Washington are all solidly democratic. PA (Which is quite populous) is Democratic-leaning. One can even make a case that PA is a solidly Democratic-leaning state.

Why is this in this thread anyways?

Re: India-US relations: News and Discussions IV

You may be missing a "not", I guess.drnayar wrote: ↑24 Oct 2025 02:04 As national debt accelerates to $38 trillion, watchdog warns it's 'no way for a great nation like America to run its finances' | Fortune https://share.google/Kp9GHh3ce0Z0deCbH

Can the US just say we will not pay anymore interest on the ginormous debt burden ?

Historically there is precedent when moving out of gold backed dollar !

They can say it. Then what will happen to all the Treasuries held by Americans themselves (including American banks, bond funds, etc?).

Re: India-US relations: News and Discussions IV

The price is much better in this case vis a vis Iran case, perhaps? Just a WAG.ShauryaT wrote: ↑23 Oct 2025 22:44US has sanctioned Russian oil companies. When the US did so for Iran, India stopped its purchases. Why will India not do the same now?A_Gupta wrote: ↑23 Oct 2025 07:50 Via the Hindustan Times:

"US President Donald Trump appears unwilling to back down from his claim that India will soon snap its oil trade ties with Russia. Reiterating the assertion on Thursday, he added a specific figure this time: “By the end of the year, they'll be down to almost nothing, about 40 percent of the (Russian) oil.”

Re: India-US relations: News and Discussions IV

https://x.com/KanchanGupta/status/1981337585743258002

@KanchanGupta

Memo to compromised 'Hindus' who are sucking up to Jihadist Mamdani and given him free access to certain temples in New York.

https://x.com/TaliGoldsheft/status/1981089419097428188

@TaliGoldsheft

NEWS - “Over 650 rabbis from around the country signed on to an open letter on Wednesday voicing concern that, if elected New York City mayor, Zohran Mamdani would threaten “the safety and dignity of Jews in every city,” citing the Democratic nominee and frontrunner’s antagonistic views towards Israel.” Via

@J_Insider @HaleyCohen19

@KanchanGupta

Memo to compromised 'Hindus' who are sucking up to Jihadist Mamdani and given him free access to certain temples in New York.

https://x.com/TaliGoldsheft/status/1981089419097428188

@TaliGoldsheft

NEWS - “Over 650 rabbis from around the country signed on to an open letter on Wednesday voicing concern that, if elected New York City mayor, Zohran Mamdani would threaten “the safety and dignity of Jews in every city,” citing the Democratic nominee and frontrunner’s antagonistic views towards Israel.” Via

@J_Insider @HaleyCohen19

Re: India-US relations: News and Discussions IV

https://x.com/KanwalSibal/status/1981215556616540434

@KanwalSibal

The US has upped the ante.

Trump is totally unpredictable. At one moment he plans a meeting with Putin in Budapest, next he is targeting Russia’s oil sector by sanctioning two major Russian oil companies and demanding an immediate ceasefire in Ukraine.

Russia will not accept such open coercion. What next?

Problem for India. Rosneft has a major investment in Nyara.

This kind of US unilateralism is a huge problem for the international community. The US is imposing its arbitrary and capricious will on the rest of the world.

The US is in the process of destabilising the current global system. It needs reforming, but the solution does not lie in more US hegemony.

@KanwalSibal

The US has upped the ante.

Trump is totally unpredictable. At one moment he plans a meeting with Putin in Budapest, next he is targeting Russia’s oil sector by sanctioning two major Russian oil companies and demanding an immediate ceasefire in Ukraine.

Russia will not accept such open coercion. What next?

Problem for India. Rosneft has a major investment in Nyara.

This kind of US unilateralism is a huge problem for the international community. The US is imposing its arbitrary and capricious will on the rest of the world.

The US is in the process of destabilising the current global system. It needs reforming, but the solution does not lie in more US hegemony.

Re: India-US relations: News and Discussions IV

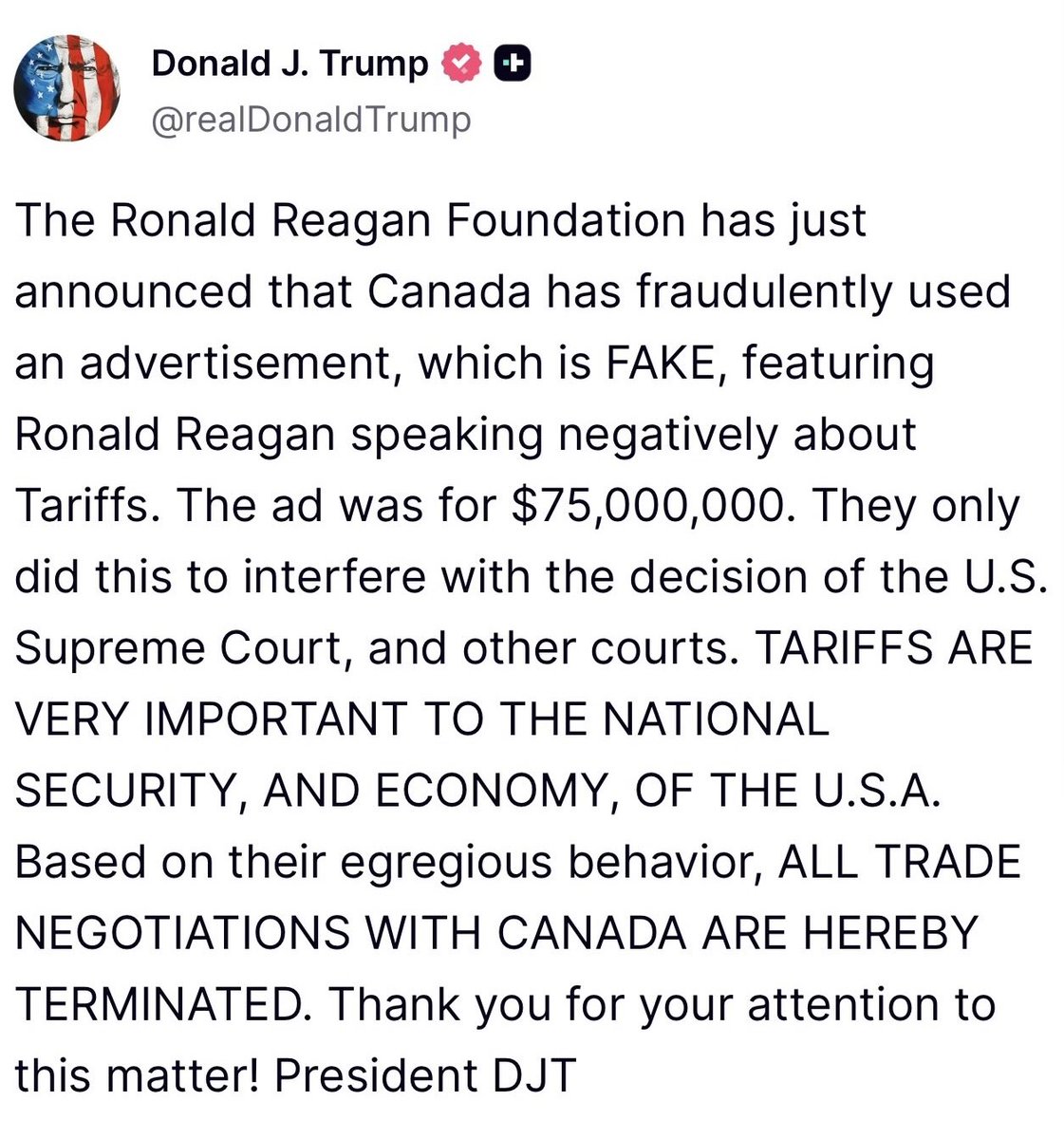

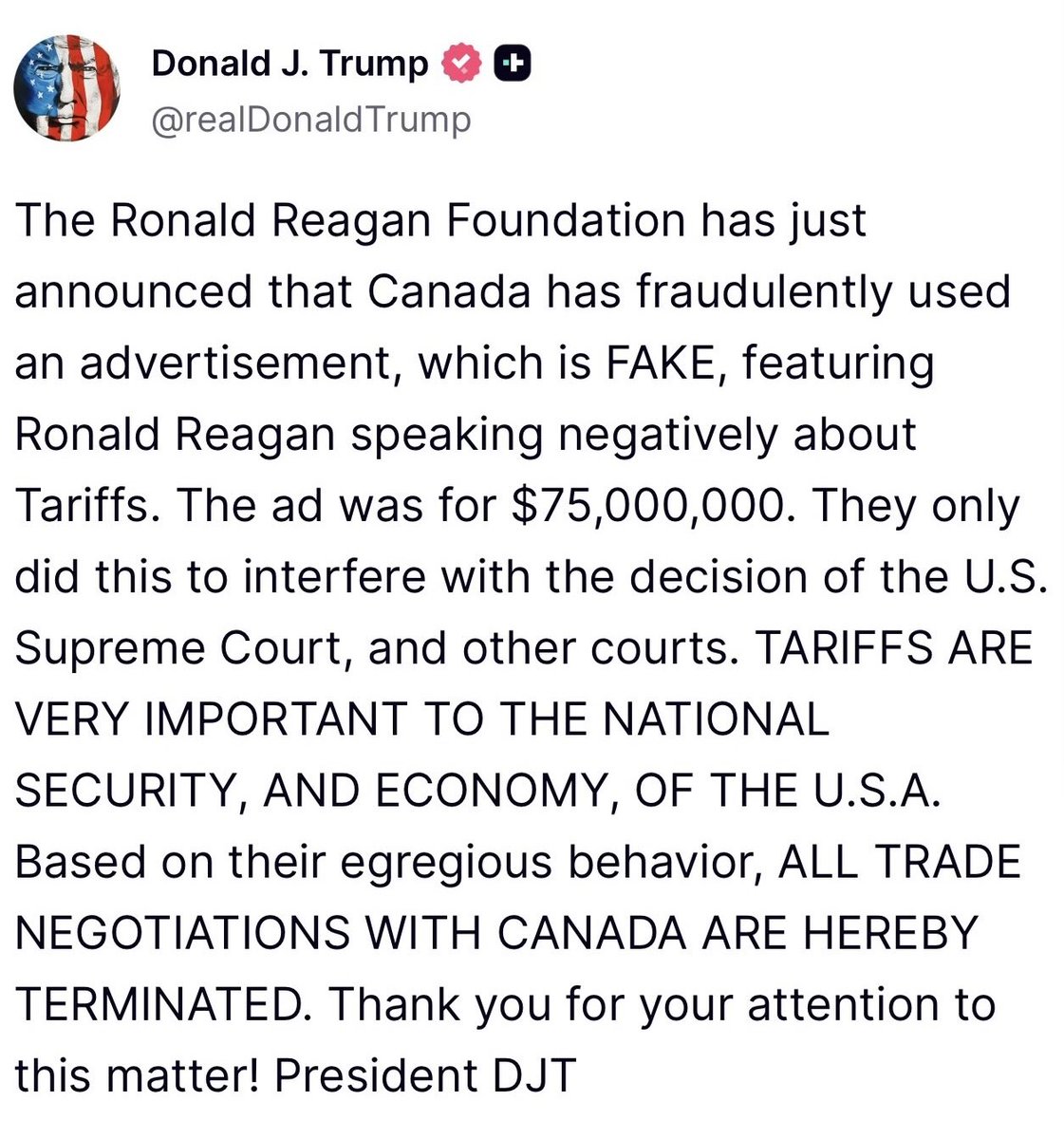

Trump announces the 'termination' of 'all trade negotiations with Canada' in a block letter on social media post, just before he goes to sleep (Washington DC, it's around midnight). Gives some idea why India is thinking ....pointless to go through all the hard negotiations only for this fellow to use some silly pretext to undo the whole thing...

Re: India-US relations: News and Discussions IV

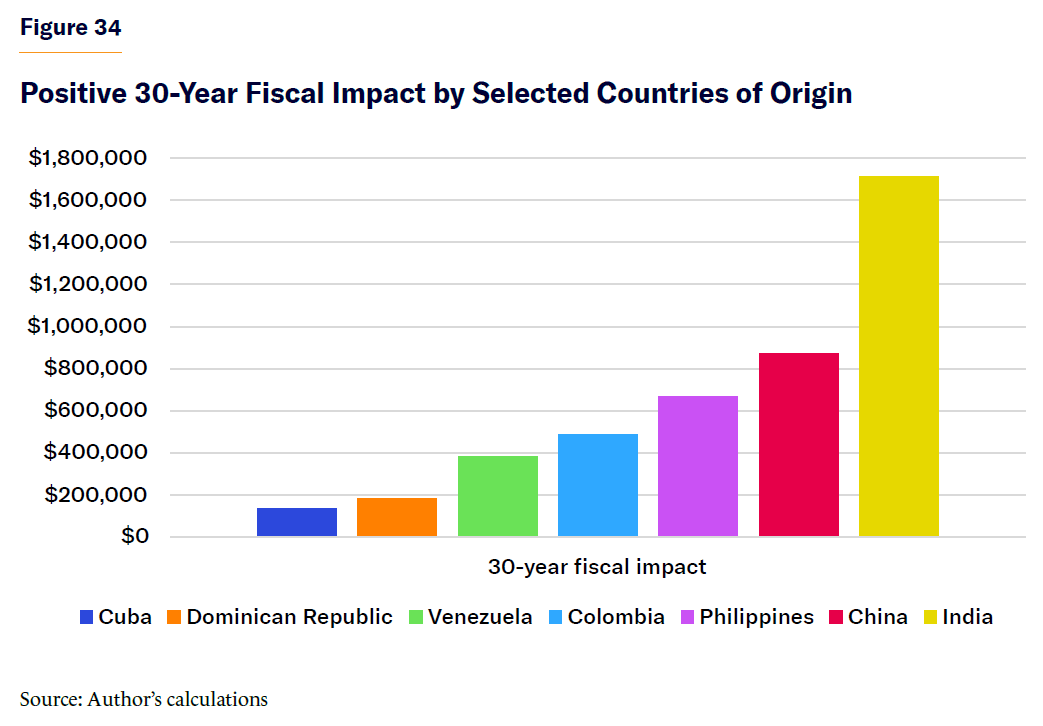

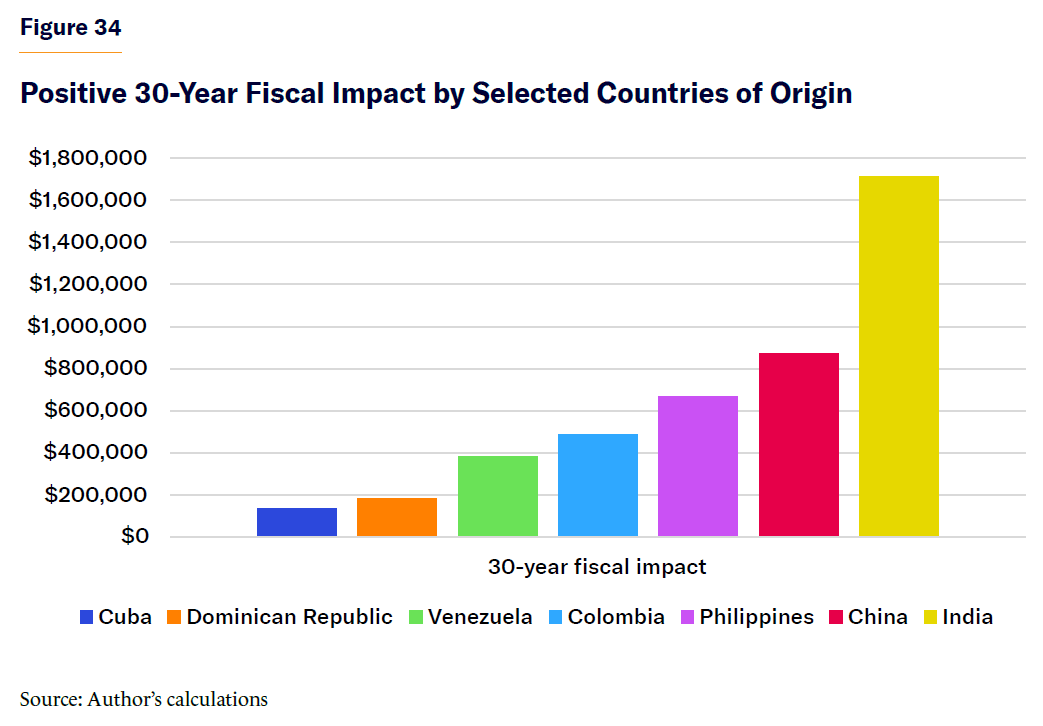

Manhattan Institute Report: Indian Immigrants Yield $1.6 Million Fiscal Surplus Each

A Manhattan Institute study by economist Daniel Di Martino, released October 23, 2025, analyzes Census data to show that Indian immigrants and their descendants generate a $1.6 million net fiscal surplus over 30 years, outpacing groups like Chinese and Filipinos while imposing costs for others like Mexicans. High-skilled H-1B visa holders in tech and STEM drive $2.3 million in savings per person, potentially cutting U.S. national debt by $4.3 trillion from 2.7 million foreign-born Indian-Americans. The report's findings contrast with rising anti-Indian sentiment on X, where critics cite job competition, cultural shifts, and $129.4 billion in 2024 remittances to India.

A Manhattan Institute study by economist Daniel Di Martino, released October 23, 2025, analyzes Census data to show that Indian immigrants and their descendants generate a $1.6 million net fiscal surplus over 30 years, outpacing groups like Chinese and Filipinos while imposing costs for others like Mexicans. High-skilled H-1B visa holders in tech and STEM drive $2.3 million in savings per person, potentially cutting U.S. national debt by $4.3 trillion from 2.7 million foreign-born Indian-Americans. The report's findings contrast with rising anti-Indian sentiment on X, where critics cite job competition, cultural shifts, and $129.4 billion in 2024 remittances to India.

Re: India-US relations: News and Discussions IV

Manhattan Institute Report: Indian Immigrants Yield $1.6 Million Fiscal Surplus Each

A Manhattan Institute study by economist Daniel Di Martino, released October 23, 2025, analyzes Census data to show that Indian immigrants and their descendants generate a $1.6 million net fiscal surplus over 30 years, outpacing groups like Chinese and Filipinos while imposing costs for others like Mexicans. High-skilled H-1B visa holders in tech and STEM drive $2.3 million in savings per person, potentially cutting U.S. national debt by $4.3 trillion from 2.7 million foreign-born Indian-Americans. The report's findings contrast with rising anti-Indian sentiment on X, where critics cite job competition, cultural shifts, and $129.4 billion in 2024 remittances to India.

A Manhattan Institute study by economist Daniel Di Martino, released October 23, 2025, analyzes Census data to show that Indian immigrants and their descendants generate a $1.6 million net fiscal surplus over 30 years, outpacing groups like Chinese and Filipinos while imposing costs for others like Mexicans. High-skilled H-1B visa holders in tech and STEM drive $2.3 million in savings per person, potentially cutting U.S. national debt by $4.3 trillion from 2.7 million foreign-born Indian-Americans. The report's findings contrast with rising anti-Indian sentiment on X, where critics cite job competition, cultural shifts, and $129.4 billion in 2024 remittances to India.

Re: India-US relations: News and Discussions IV

either that or pegging the dollar to some sort of crypto combination / revalue [ devalue the USD ] just trying to see the American game play here .. i think there is one already in motionVayutuvan wrote: ↑24 Oct 2025 06:32You may be missing a "not", I guess.drnayar wrote: ↑24 Oct 2025 02:04 As national debt accelerates to $38 trillion, watchdog warns it's 'no way for a great nation like America to run its finances' | Fortune https://share.google/Kp9GHh3ce0Z0deCbH

Can the US just say we will not pay anymore interest on the ginormous debt burden ?

Historically there is precedent when moving out of gold backed dollar !

They can say it. Then what will happen to all the Treasuries held by Americans themselves (including American banks, bond funds, etc?).

america does not care what pain other countries or even its lower class citizens have to go through

Re: India-US relations: News and Discussions IV

Currently it is not that easy. The best way to remember US Debt is 30-30-30-10 30% is held by private investors, 30% by US govt itself (social security, medicaid etc) and 30% by the foreign investors and 10% by the Fed itself to do it day to day operations. Europe owns the 40% of the foreign debt followed by Japan and China. Any change in monetary policy to compensate will tank US economy along with their friends across the Atlantic. That will be followed by USD losing its status to be a reserve currency. Fed which is managed by the bankers will not allow that to happen. All these games the current admin is playing with things like tariffs etc will only make a small dent in that debt. Moral of the story is karma will catch up and there is no way out of it.drnayar wrote: ↑24 Oct 2025 22:10either that or pegging the dollar to some sort of crypto combination / revalue [ devalue the USD ] just trying to see the American game play here .. i think there is one already in motion

america does not care what pain other countries or even its lower class citizens have to go through

Re: India-US relations: News and Discussions IV

I hope this critical topic gets more discussionwilliams wrote: ↑24 Oct 2025 22:54Currently it is not that easy. The best way to remember US Debt is 30-30-30-10 30% is held by private investors, 30% by US govt itself (social security, medicaid etc) and 30% by the foreign investors and 10% by the Fed itself to do it day to day operations. Europe owns the 40% of the foreign debt followed by Japan and China. Any change in monetary policy to compensate will tank US economy along with their friends across the Atlantic. That will be followed by USD losing its status to be a reserve currency. Fed which is managed by the bankers will not allow that to happen. All these games the current admin is playing with things like tariffs etc will only make a small dent in that debt. Moral of the story is karma will catch up and there is no way out of it.drnayar wrote: ↑24 Oct 2025 22:10

either that or pegging the dollar to some sort of crypto combination / revalue [ devalue the USD ] just trying to see the American game play here .. i think there is one already in motion

america does not care what pain other countries or even its lower class citizens have to go through

August 1971

https://www.federalreservehistory.org/e ... ility-ends

The international monetary system after World War II was dubbed the Bretton Woods system after the meeting of forty-four countries in Bretton Woods, New Hampshire, in 1944. The countries agreed to keep their currencies fixed (but adjustable in exceptional situations) to the dollar, and the dollar was fixed to gold. Since 1958, when the Bretton Woods system became operational, countries settled their international balances in dollars, and U.S. dollars were convertible to gold at a fixed exchange rate of $35 an ounce. The United States had the responsibility of keeping the dollar price of gold fixed and had to adjust the supply of dollars to maintain confidence in future gold convertibility.

In the 1960s, European and Japanese exports became more competitive with U.S. exports. The U.S. share of world output decreased and so did the need for dollars, making converting those dollars to gold more desirable. The deteriorating U.S. balance of payments, combined with military spending and foreign aid, resulted in a large supply of dollars around the world. Meanwhile, the gold supply had increased only marginally. Eventually, there were more foreign-held dollars than the United States had gold. The country was vulnerable to a run on gold and there was a loss of confidence in the U.S. government's ability to meet its obligations, thereby threatening both the dollar's position as reserve currency and the overall Bretton Woods system.

Many efforts were made to adjust the U.S. balance of payments and to uphold the Bretton Woods system, both domestically and internationally. These were meant to be "quick fixes" until the balance of payments could readjust, but they proved to be postponing the inevitable.

These efforts of the global financial community proved to be temporary fixes to a broader structural problem with the Bretton Woods system. The structural problem, which has been called the "Triffin dilemma," occurs when a country issues a global reserve currency (in this case, the United States) because of its global importance as a medium of exchange. The stability of that currency, however, comes into question when the country is persistently running current account deficits to fulfill that supply. As the current account deficits accumulate, the reserve currency becomes less desirable and its position as a reserve currency is threatened.

With inflation on the rise and a gold run looming, Nixon's administration coordinated a plan for bold action. From August 13 to 15, 1971, Nixon and fifteen advisers, including Federal Reserve Chairman Arthur Burns, Treasury Secretary John Connally, and Undersecretary for International Monetary Affairs Paul Volcker (later Federal Reserve Chairman) met at the presidential retreat at Camp David and created a new economic plan. On the evening of August 15, 1971, Nixon addressed the nation on a new economic policy that not only was intended to correct the balance of payments but also stave off inflation and lower the unemployment rate.

The first order was for the gold window to be closed. Foreign governments could no longer exchange their dollars for gold; in effect, the international monetary system turned into a fiat one. A few months later the Smithsonian agreement attempted to maintain pegged exchange rates, but the Bretton Woods system ended soon thereafter. The second order was for a 90-day freeze on wages and prices to check inflation. This marked the first time the government enacted wage and price controls outside of wartime. It was an attempt to bring down inflation without increasing the unemployment rate or slowing the economy. In addition, an import surcharge was set at 10 percent to ensure that American products would not be at a disadvantage because of exchange rates.

Re: India-US relations: News and Discussions IV

The problem with Trump's actions compared to Nixon's although Nixon's actions were fundamentally transformative and from a US perspective much needed. In comparison, Trump actions look benign. The problem with Trump is - he has not articulated a replacement order, once you break the WTO. I have a theory of Green, yellow and red zones for trade partners as the new order, but that is just me, have not seen this articulated much. US trade partners balked then as they do now but in the end reconcile, to the inherent power differential.

Re: India-US relations: News and Discussions IV

What they can easily do is to print trillions of dollars and pay their debts. Already inflation is hitting the US, but this will not harm DJT's billionaire friends. I do not even go grocery shopping now-a-days to avoid getting a heart attack.Vayutuvan wrote: ↑24 Oct 2025 06:32You may be missing a "not", I guess.drnayar wrote: ↑24 Oct 2025 02:04 As national debt accelerates to $38 trillion, watchdog warns it's 'no way for a great nation like America to run its finances' | Fortune https://share.google/Kp9GHh3ce0Z0deCbH

Can the US just say we will not pay anymore interest on the ginormous debt burden ?

Historically there is precedent when moving out of gold backed dollar !

They can say it. Then what will happen to all the Treasuries held by Americans themselves (including American banks, bond funds, etc?).

Gautam

Re: India-US relations: News and Discussions IV

This logic is no longer working with 'Global South....'!

An interesting twist to the US sanctions regarding Russian oil purchases by India. The rules are stricter for India than for Germany, for example...

An interesting twist to the US sanctions regarding Russian oil purchases by India. The rules are stricter for India than for Germany, for example...

Re: India-US relations: News and Discussions IV

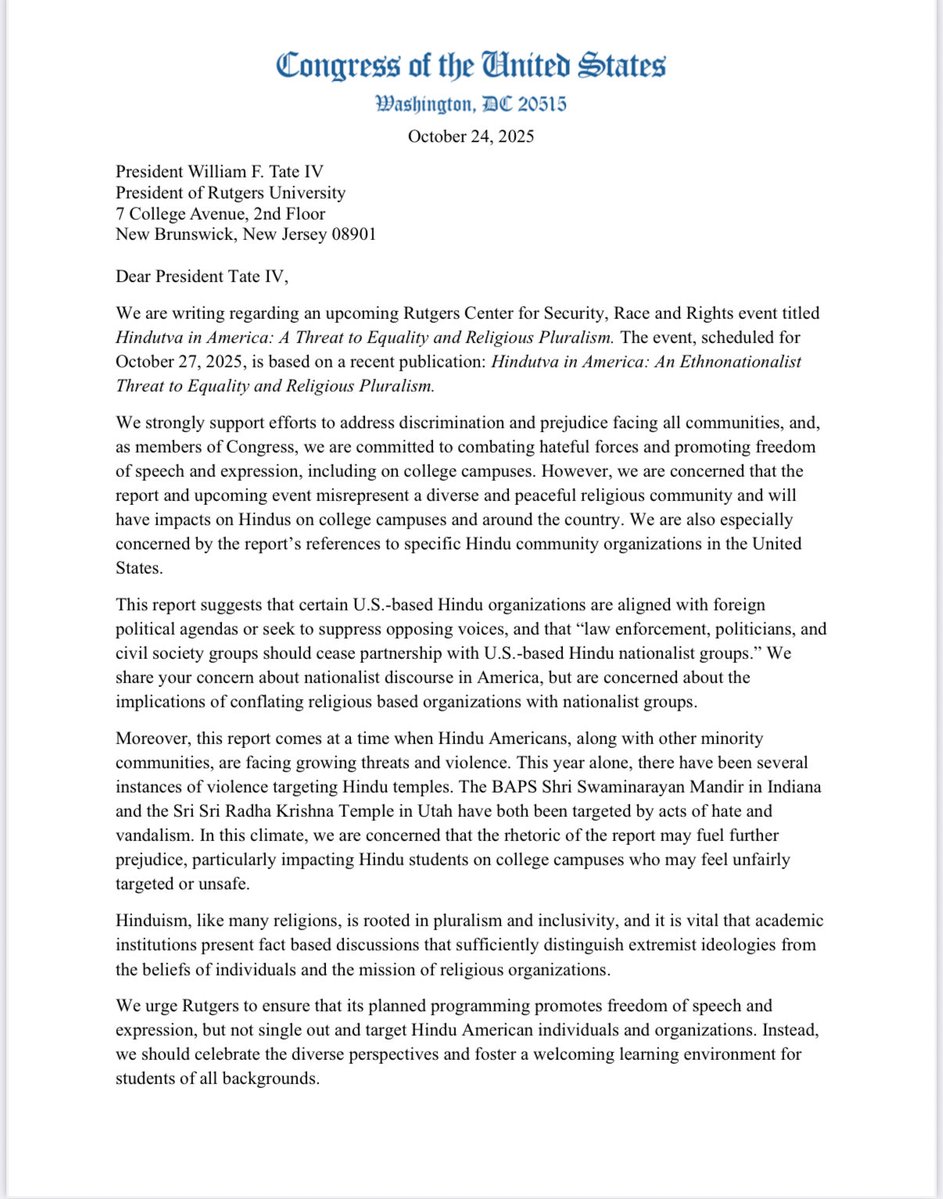

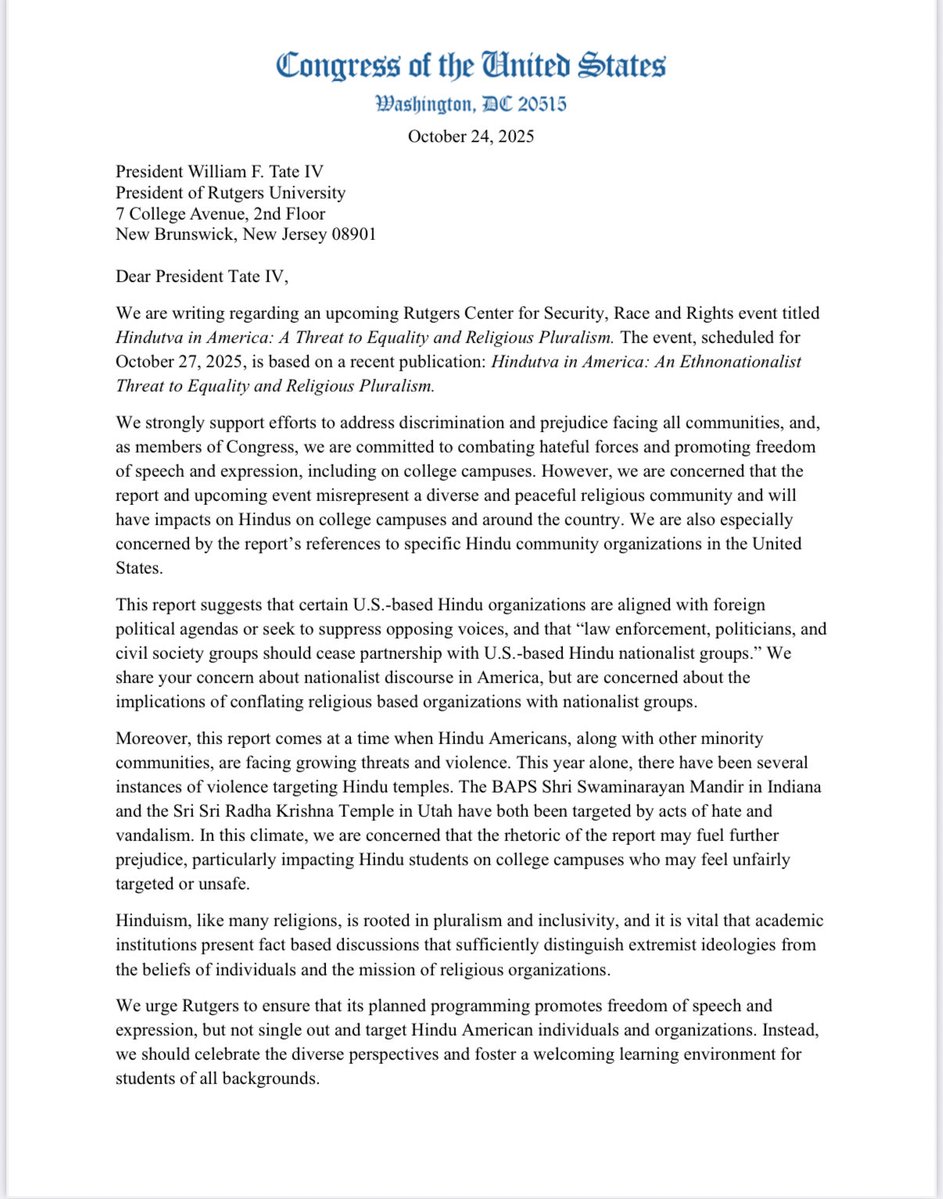

America is sick of this Hindutva tamasha...

Four bipartisan U.S. Congress members—Representatives Suhas Subramanyam, Rich McCormick, Shri Thanedar, and Sanford Bishop—sent a letter on October 24, 2025, to Rutgers University President Jonathan Holloway, urging cancellation of the October 27 event 'Hindutva in America: A Threat to Equality and Religious Pluralism.' The letter expresses fears that the event, hosted by Rutgers' Center for Security, Race and Rights, conflates Hindu nationalism with Hinduism and risks endangering Hindu students on campus. Hindu groups like CoHNA and HAF praised the action as a defense against campus Hinduphobia, while the event's organizers defend it as an examination of Hindutva's civil rights impacts.

Four bipartisan U.S. Congress members—Representatives Suhas Subramanyam, Rich McCormick, Shri Thanedar, and Sanford Bishop—sent a letter on October 24, 2025, to Rutgers University President Jonathan Holloway, urging cancellation of the October 27 event 'Hindutva in America: A Threat to Equality and Religious Pluralism.' The letter expresses fears that the event, hosted by Rutgers' Center for Security, Race and Rights, conflates Hindu nationalism with Hinduism and risks endangering Hindu students on campus. Hindu groups like CoHNA and HAF praised the action as a defense against campus Hinduphobia, while the event's organizers defend it as an examination of Hindutva's civil rights impacts.

Re: India-US relations: News and Discussions IV

https://x.com/IndiaToday/status/1982299232938688770

@IndiaToday

Wanted fugitive Lakhvinder Kumar extradited from US.

@Sreya_Chattrjee

tells you more about it

@IndiaToday

Wanted fugitive Lakhvinder Kumar extradited from US.

@Sreya_Chattrjee

tells you more about it

Re: India-US relations: News and Discussions IV

Only KhalistanI Illegals are legalized in the U.S by the Federal Govt

https://x.com/Mohansinha/status/1981810873376370902

@Mohansinha

Not South Asian, now?

@BillMelugin_

NEW: An official with the California State Transportation Agency confirms to

@FoxNews that Indian illegal alien truck driver Jashanpreet Singh’s California CDL is also a federal REAL ID, “which he was entitled to receive given the federal gov’s confirmation of his legal status.”

https://x.com/Mohansinha/status/1981810873376370902

@Mohansinha

Not South Asian, now?

@BillMelugin_

NEW: An official with the California State Transportation Agency confirms to

@FoxNews that Indian illegal alien truck driver Jashanpreet Singh’s California CDL is also a federal REAL ID, “which he was entitled to receive given the federal gov’s confirmation of his legal status.”

Re: India-US relations: News and Discussions IV

https://abcnews.go.com/US/truck-driver- ... =126804313

Truck driver in country illegally was under influence of drugs in California crash that killed 3: Police

The driver, Jashanpreet Singh, entered the U.S. illegally in 2022, DHS said.

Meredith Deliso, October 23, 2025

The driver of a semi-truck that slammed into multiple vehicles, killing three people, on a California highway was allegedly under the influence of drugs, authorities said.

The driver -- identified by authorities as 21-year-old Jashanpreet Singh -- has been charged with gross vehicular manslaughter while intoxicated and driving under the influence of a drug causing injury in connection with Tuesday's chain-reaction crash on Interstate 10 in Ontario, according to a criminal complaint.

He is in the United States illegally and an immigration detainer has also been placed on him, according to the Department of Homeland Security.

Authorities said Singh was driving a Freightliner semi-truck and failed to stop in time when traffic in his lane had slowed or stopped Tuesday afternoon. Three people were killed and at least three others injured in the multi-vehicle crash, according to the complaint.

Dash camera footage of the crash showed the truck slam into multiple vehicles in a fiery crash, then veer off into the shoulder and ram into additional vehicles before coming to a stop.

......

Gautam

Truck driver in country illegally was under influence of drugs in California crash that killed 3: Police

The driver, Jashanpreet Singh, entered the U.S. illegally in 2022, DHS said.

Meredith Deliso, October 23, 2025

The driver of a semi-truck that slammed into multiple vehicles, killing three people, on a California highway was allegedly under the influence of drugs, authorities said.

The driver -- identified by authorities as 21-year-old Jashanpreet Singh -- has been charged with gross vehicular manslaughter while intoxicated and driving under the influence of a drug causing injury in connection with Tuesday's chain-reaction crash on Interstate 10 in Ontario, according to a criminal complaint.

He is in the United States illegally and an immigration detainer has also been placed on him, according to the Department of Homeland Security.

Authorities said Singh was driving a Freightliner semi-truck and failed to stop in time when traffic in his lane had slowed or stopped Tuesday afternoon. Three people were killed and at least three others injured in the multi-vehicle crash, according to the complaint.

Dash camera footage of the crash showed the truck slam into multiple vehicles in a fiery crash, then veer off into the shoulder and ram into additional vehicles before coming to a stop.

......

Gautam

Re: India-US relations: News and Discussions IV

I think asylum seekers have the ability to get a driver's license till their asylum application is approved. Lot of Ukranian guys also doing commercial driving business.uddu wrote: ↑26 Oct 2025 10:05 Only KhalistanI Illegals are legalized in the U.S by the Federal Govt

https://x.com/Mohansinha/status/1981810873376370902

@Mohansinha

Not South Asian, now?

@BillMelugin_

NEW: An official with the California State Transportation Agency confirms to

@FoxNews that Indian illegal alien truck driver Jashanpreet Singh’s California CDL is also a federal REAL ID, “which he was entitled to receive given the federal gov’s confirmation of his legal status.”

Since he has sought asylum, India should wash it's hands off. Let him be treated to the laws of the land of milk and honey as opposed to the land from which he ran away in fear. India should also refuse to take him back when he is deported after serving out his sentence.

What is with these Khalistani guys? How come they don't seem to have a reasonable education to follow the basics of traffic rules and signs?

Re: India-US relations: News and Discussions IV

drnayar sir, can you comment more on this topic or suggest reading materials in the suitable thread? Especially on how the increase of USA debt ceiling by 5 trillion dollars by Trump and other factors will affect USA or international economy. What people want to know are the time frame of the coming events related to it. Or what will cause a point of no return etc. There are plenty of economic doomsday scenarios for USA and China but people don't know whom to trust or they are vague about the time frame.drnayar wrote: ↑25 Oct 2025 01:46I hope this critical topic gets more discussion

August 1971

https://www.federalreservehistory.org/e ... ility-ends

The international monetary system after World War II was dubbed the Bretton Woods system after the meeting of forty-four countries in Bretton Woods, New Hampshire, in 1944. [/color][/u]

Re: India-US relations: News and Discussions IV

https://x.com/Indianinfoguide/status/19 ... 3266029766

@Indianinfoguide

Zoho CEO Sridhar Vembu urges Indian immigrants to come home:says 'Why stay where you are not welcome

@Indianinfoguide

Zoho CEO Sridhar Vembu urges Indian immigrants to come home:says 'Why stay where you are not welcome

Re: India-US relations: News and Discussions IV

Trump indicates he will mediate into Pakistan, Afghanistan conflict & will "get that done quickly" since Pakistan field marshal Munir, Pak PM Sharif are "great people"

(He talks about saving millions of lives...again in all these conflicts..

PS: this will be 9th conflict Trump will resolve according to his counts, claims

Meanwhile Marco Rubio keep pointing... "Relations with Pakistan not "at the expense of a good relationship with India",... ityadi...and many other non-sense ...

But..EAM Jaishankar, US Secretary of state Marco Rubio to hold meeting in Kuala Lumper, Malaysia on the sidelines of the ASEAN summit on Monday!

(He talks about saving millions of lives...again in all these conflicts..

PS: this will be 9th conflict Trump will resolve according to his counts, claims

Meanwhile Marco Rubio keep pointing... "Relations with Pakistan not "at the expense of a good relationship with India",... ityadi...and many other non-sense ...

But..EAM Jaishankar, US Secretary of state Marco Rubio to hold meeting in Kuala Lumper, Malaysia on the sidelines of the ASEAN summit on Monday!

Re: India-US relations: News and Discussions IV

Quite right. I am not an economist by background, but there are quite a few here who can do a civilized discussion as this topic is inherently linked to Bharat's rise to the top two ranking economic powersHriday wrote: ↑26 Oct 2025 11:00drnayar sir, can you comment more on this topic or suggest reading materials in the suitable thread? Especially on how the increase of USA debt ceiling by 5 trillion dollars by Trump and other factors will affect USA or international economy. What people want to know are the time frame of the coming events related to it. Or what will cause a point of no return etc. There are plenty of economic doomsday scenarios for USA and China but people don't know whom to trust or they are vague about the time frame.drnayar wrote: ↑25 Oct 2025 01:46

I hope this critical topic gets more discussion

August 1971

https://www.federalreservehistory.org/e ... ility-ends

The international monetary system after World War II was dubbed the Bretton Woods system after the meeting of forty-four countries in Bretton Woods, New Hampshire, in 1944. [/color][/u]

America's way is might is right., so no doubt some blows will be given and taken in that process.

Re: India-US relations: News and Discussions IV

Seeing quite a few youtube and X channels harping about gold being hoarded by Indians, especially women.uddu wrote: ↑26 Oct 2025 11:08 https://x.com/Indianinfoguide/status/19 ... 3266029766

@Indianinfoguide

Zoho CEO Sridhar Vembu urges Indian immigrants to come home:says 'Why stay where you are not welcome

I fear that this is going to paint a target on their backs.

Indian folks out there better be extra careful about themselves and their surroundings.

Re: India-US relations: News and Discussions IV

As posted before: @RutgersU @RUCSRR is hosting a conference asking for Hindu American orgs to be investigated by US government.

Some orgs eg @HinduAmerican are in touch with the New Jersey Department of State, Governor’s office and members of the US Congress.

For US Citizens: we’re looking for your support to separate Rutgers from this hateful event.

Some orgs eg @HinduAmerican are in touch with the New Jersey Department of State, Governor’s office and members of the US Congress.

For US Citizens: we’re looking for your support to separate Rutgers from this hateful event.

Re: India-US relations: News and Discussions IV

All BRFites based in the US please support the petition to Rutgers at this linkAmber G. wrote: ↑26 Oct 2025 23:32 As posted before: @RutgersU @RUCSRR is hosting a conference asking for Hindu American orgs to be investigated by US government.

Some orgs eg @HinduAmerican are in touch with the New Jersey Department of State, Governor’s office and members of the US Congress.

For US Citizens: we’re looking for your support to separate Rutgers from this hateful event.

https://cohna.org/rutgers-hinduphobia/

Do it TODAY, please. The event is tomorrow (October 27th). We do not want it canceled. We only want Rutgers University administration to clearly distance themselves from giving it any official stamp of approval.

Re: India-US relations: News and Discussions IV

Done.Rudradev wrote: ↑26 Oct 2025 23:42 All BRFites based in the US please support the petition to Rutgers at this link

https://cohna.org/rutgers-hinduphobia/

Do it TODAY, please. The event is tomorrow (October 27th). We do not want it canceled. We only want Rutgers University administration to clearly distance themselves from giving it any official stamp of approval.

Re: India-US relations: News and Discussions IV

Re: India-US relations: News and Discussions IV

'Not at the expense of India', 'will not affect balance of military power between India and Pakistan', 'will ensure arms are not used in any conflict with India' are from the Cold War playbook and we shouldn't be deceived yet again.

Re: India-US relations: News and Discussions IV

Rutgers have lost all moral compass here. They have allowed the university to breed bigotry and perpetuate hate. Shameful...

Any way: an update from HAF:

Any way: an update from HAF:

In advance of the highly contested conference being held today by @RUCSRR, our ED @SuhagAShukla received the letter below from President @WFTate4

He clarifies that the conference does not represent views of @RutgersU & that bigotry & harassment will not be tolerated.

HAF staff will be present at the event, and if any statement(s) singling out and targeting Hindu American students or organizations they support are made, we will explore all options for remedy.

Re: India-US relations: News and Discussions IV

The basic thing that the Govt should publish a list of Universities that are Anti-India and those Universities must not get students from India and banks should be prevented from issuing loans to students going to such universities. There could be list that could be termed cautious list where such caution is issued to students and parents and a ban list. Indian public money should not be wasted on teaching them Anti-India hatred and Hinduphobia at western universities. I would wish them to be put in a terrorism list and treated as such.

Re: India-US relations: News and Discussions IV

sir, Audrey Tutchi is Rutger's professor. In other words, Rutgers university is actively perpetuating this anti-Hindu ideology so telling them to curtail this sentiment is of no avail.

Re: India-US relations: News and Discussions IV

Well most western universities are liberal and by definition will not tolerate assertive India. For them Hindutva means assertive India. So no use wasting our time. They are going through a slow implosion by alienating our students anyway. What we need more is chairs for more Hindu and Indian studies in the universities. We are better off focusing on that.uddu wrote: ↑28 Oct 2025 09:37 The basic thing that the Govt should publish a list of Universities that are Anti-India and those Universities must not get students from India and banks should be prevented from issuing loans to students going to such universities. There could be list that could be termed cautious list where such caution is issued to students and parents and a ban list. Indian public money should not be wasted on teaching them Anti-India hatred and Hinduphobia at western universities. I would wish them to be put in a terrorism list and treated as such.

Re: India-US relations: News and Discussions IV

Yes, No excuse in hiding behind 'freedom of speech' or' Rutgers doesn't support it'. RutgersU gave their platform for communal hate & racism targeting Hindus.

Dismantling their network is now an important thing for US based 'academics' (like us)to prevent their next filthy campaign...(There are academics in brf is Rutgers who should take (if not already doing it) some action.

Meanwhile -they chickened out- the promised live steam is NOT transmitting.

(But there are few in person - and was quite a show—as egregious as anything..

Yes, there will be a response.!